State Tax Forms and Templates

Documents:

933

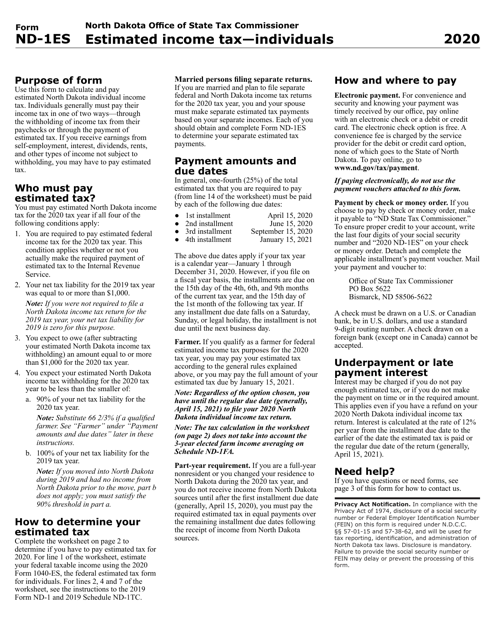

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.

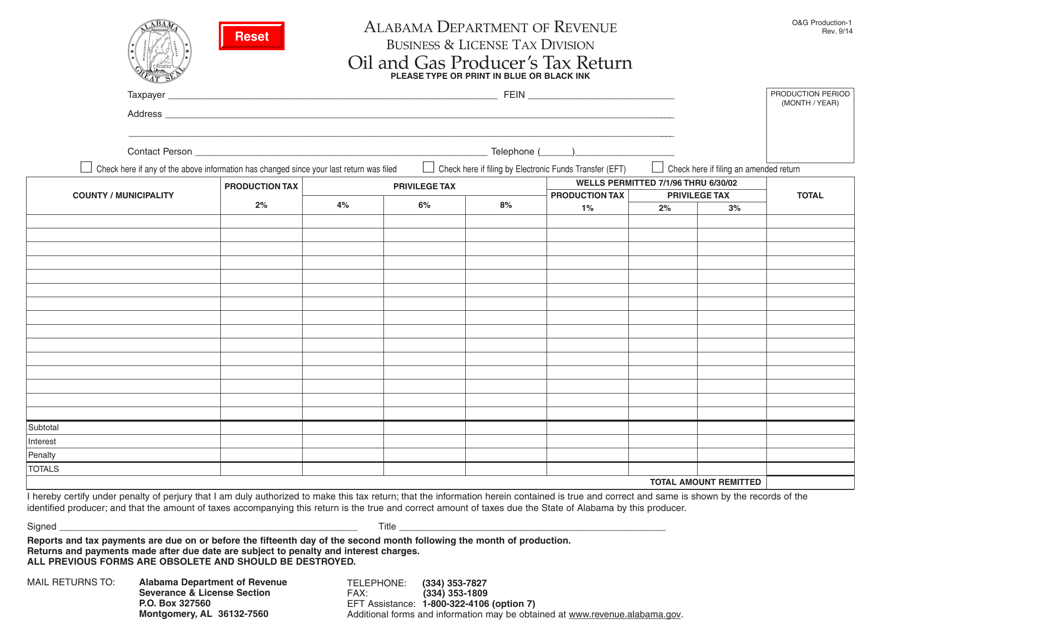

This Form is used for filing the Oil and Gas Producer's Tax Return in Alabama. It is for producers in the oil and gas industry to report their production and calculate the taxes owed to the state.

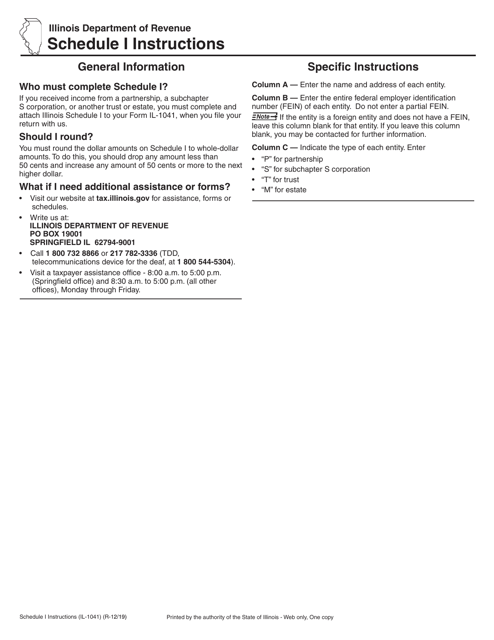

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

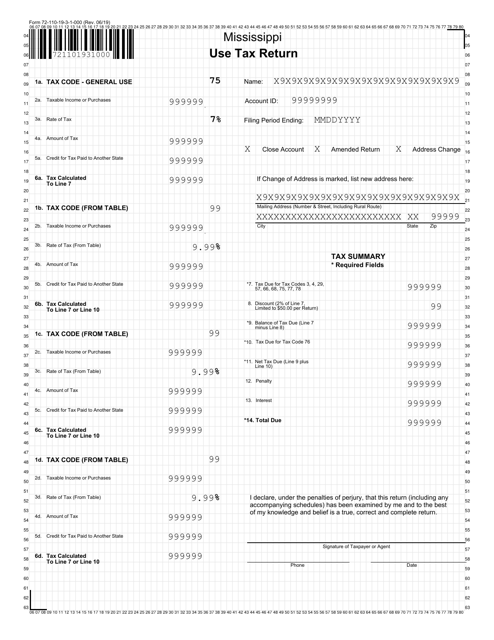

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

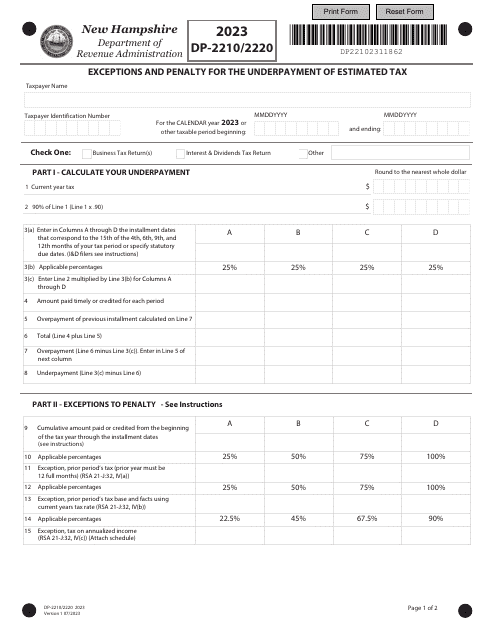

Form DP-2210/2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire, 2023