State Tax Forms and Templates

Documents:

933

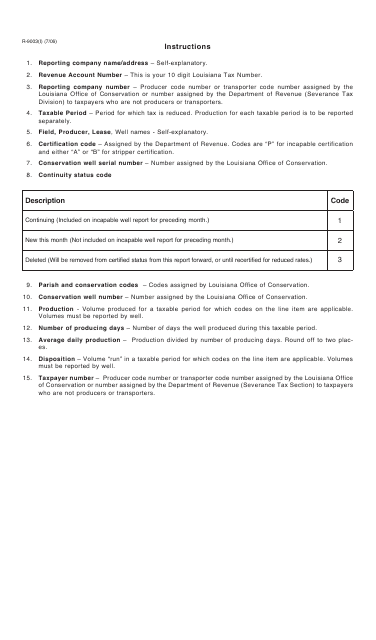

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

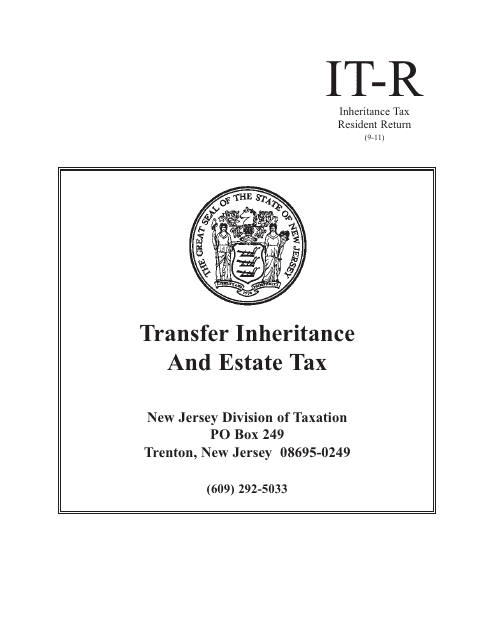

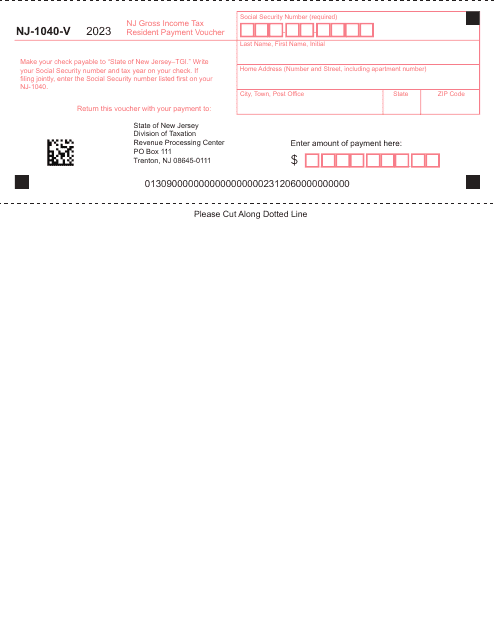

This form is used for reporting and paying inheritance tax for residents of New Jersey.

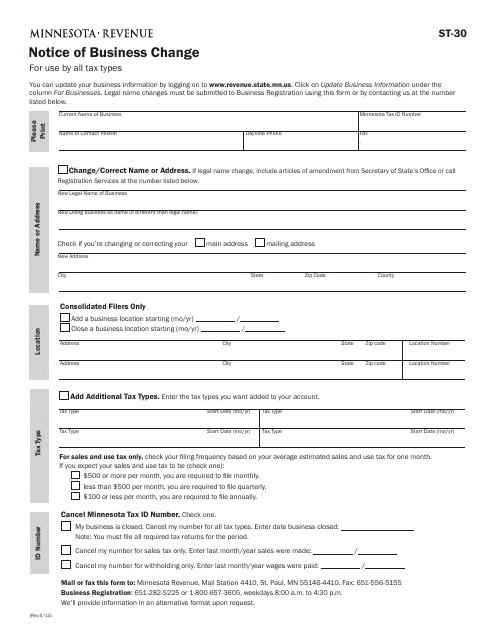

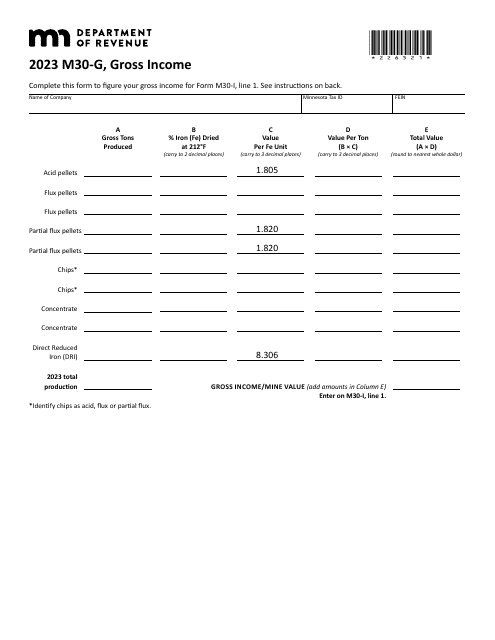

This Form is used for notifying the state of Minnesota about changes in business information. It helps businesses update their records with the state.

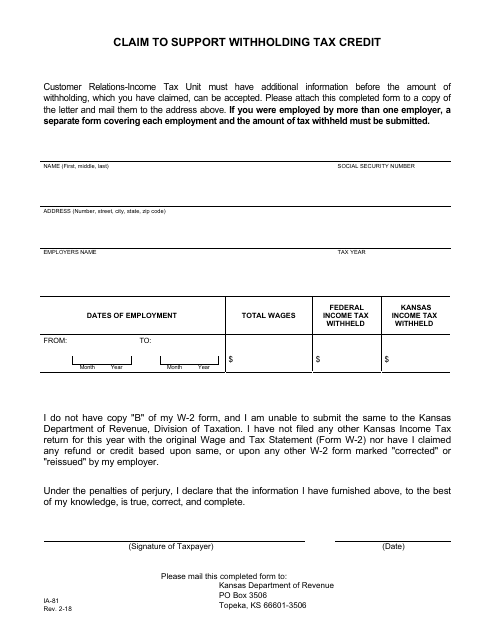

This Form is used for residents of Kansas to claim a withholding tax credit.

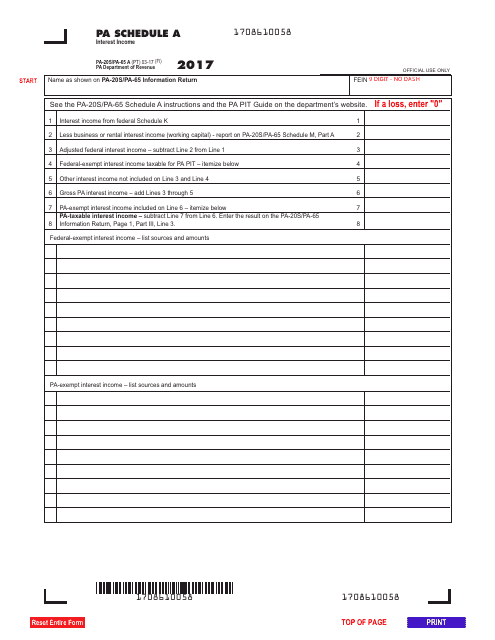

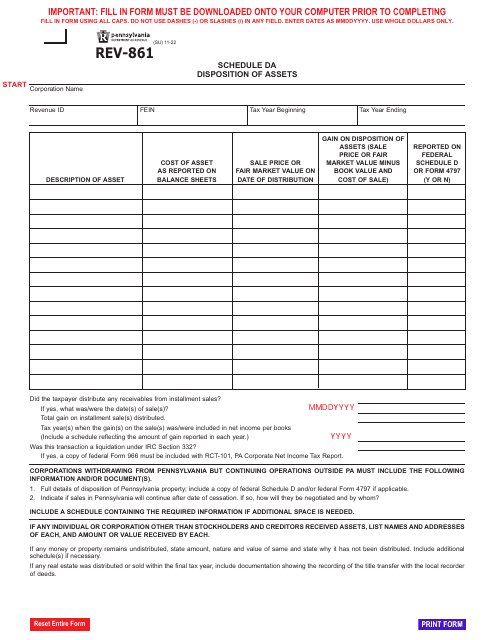

This form is used for reporting interest income in the state of Pennsylvania.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

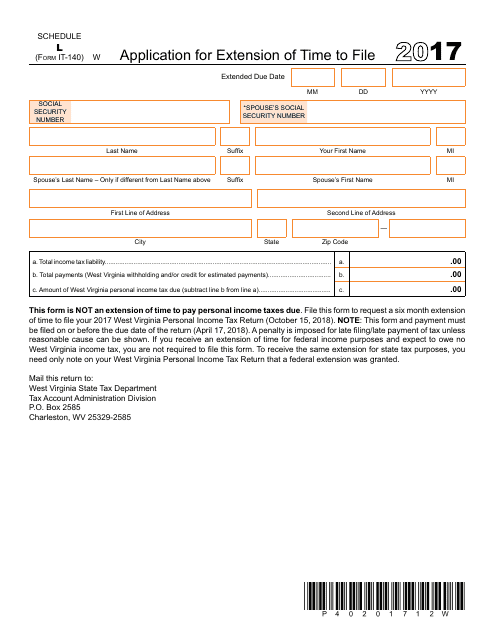

This form is used for applying for an extension of time to file your West Virginia state income tax return, Form IT-140.

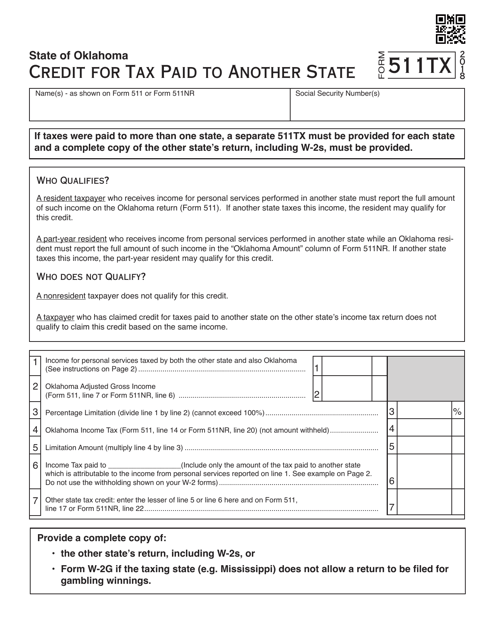

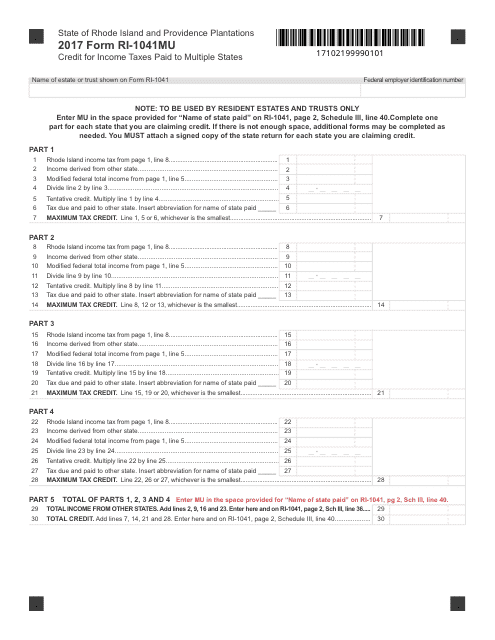

This form is used for claiming a credit for income taxes paid to multiple states when filing taxes in Rhode Island.

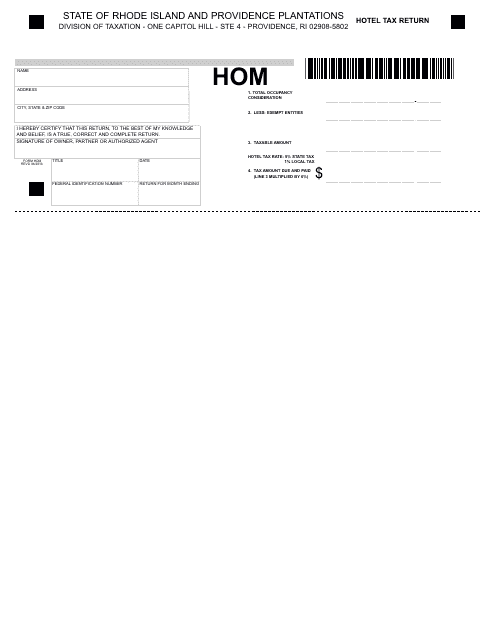

This form is used for reporting and paying hotel taxes in Rhode Island. Hotel owners and operators must complete this return to ensure compliance with tax regulations.

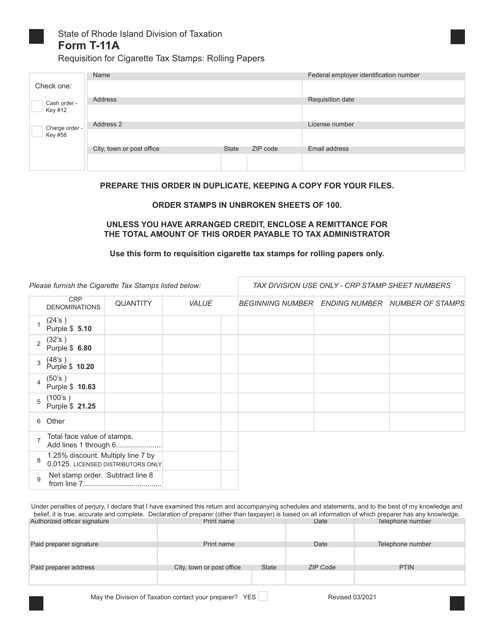

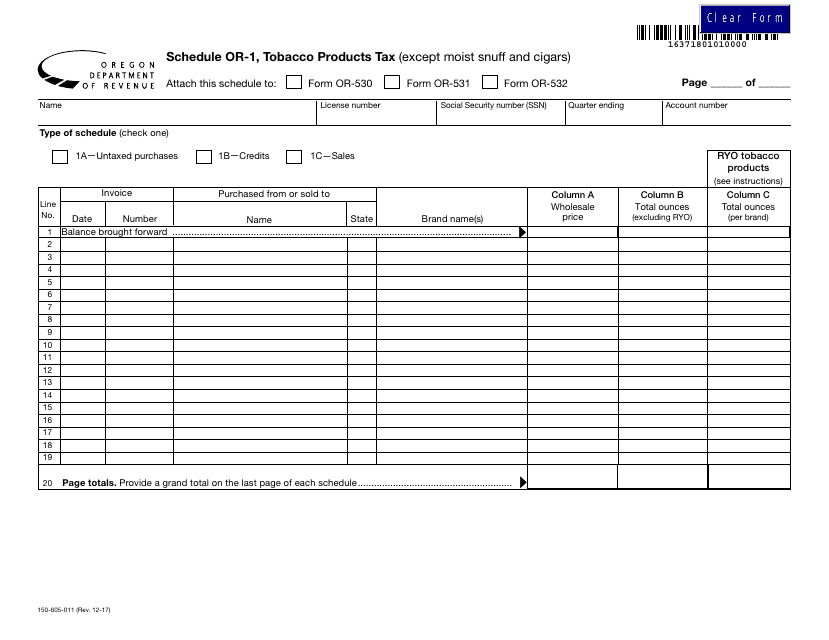

This Form is used for reporting and paying taxes on tobacco products, excluding moist snuff and cigars, in the state of Oregon.

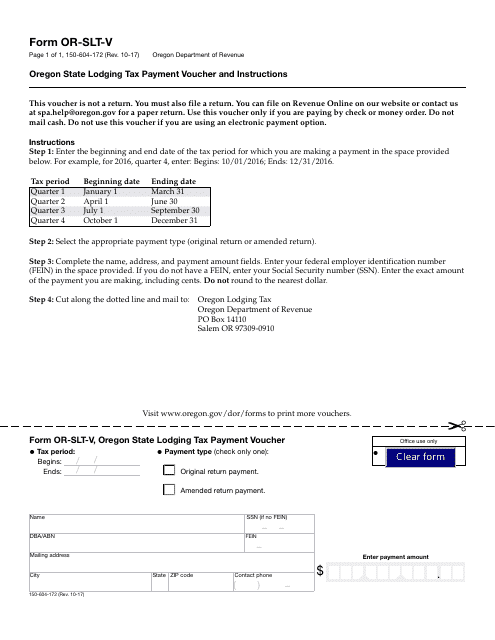

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

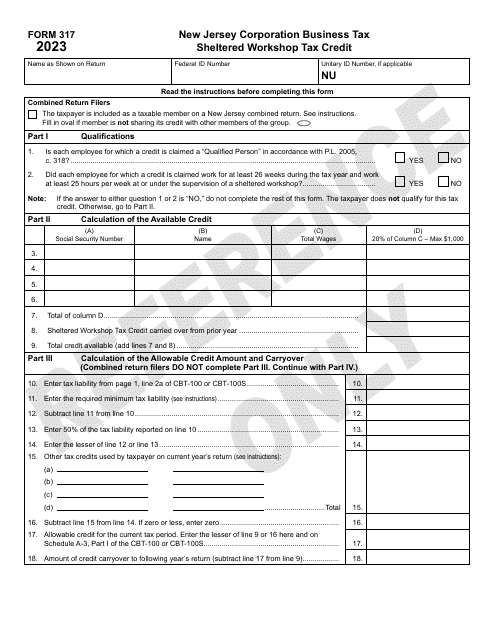

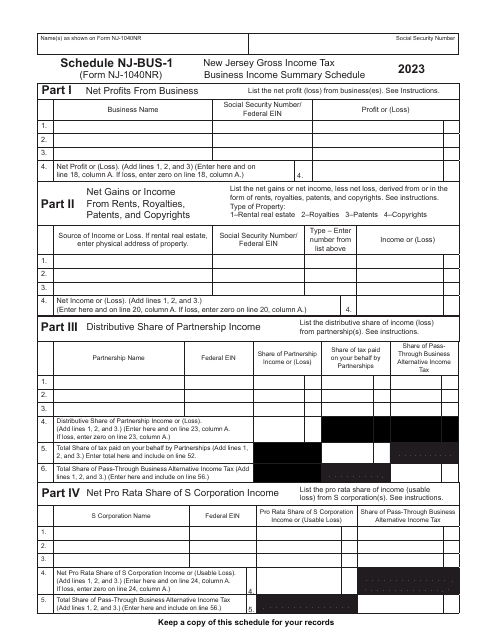

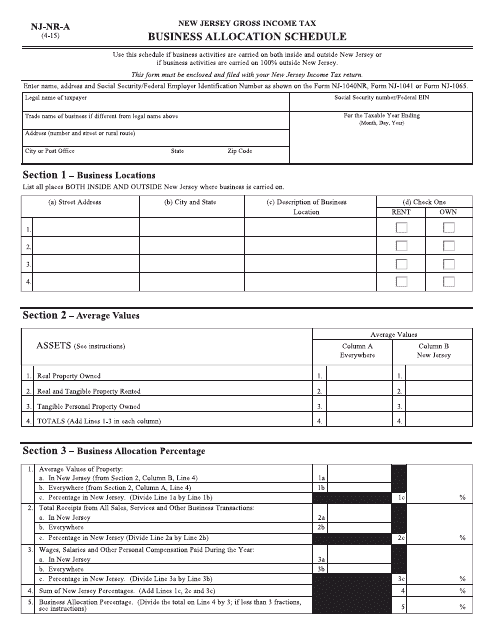

This form is used for business owners to allocate their income and expenses for tax purposes in the state of New Jersey.

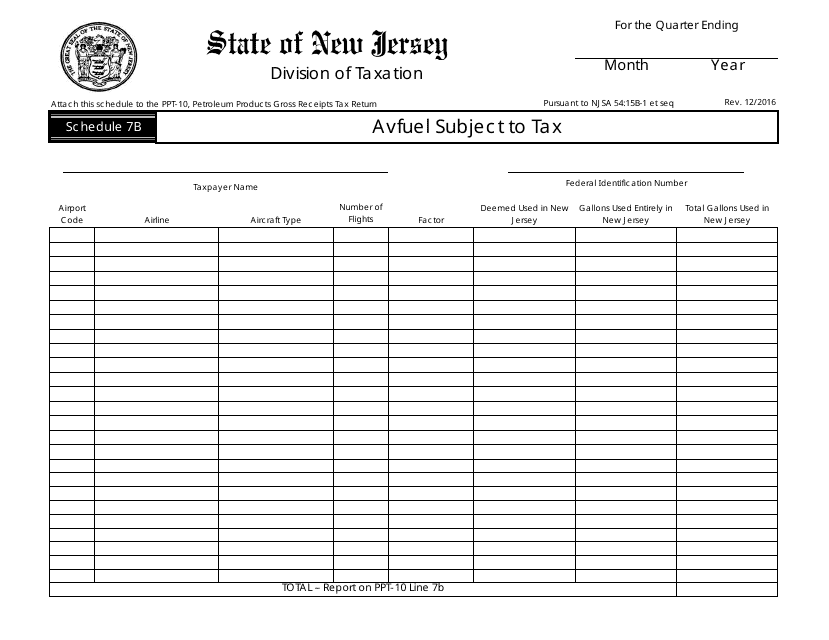

This Form is used for reporting Avfuel subject to tax in New Jersey.

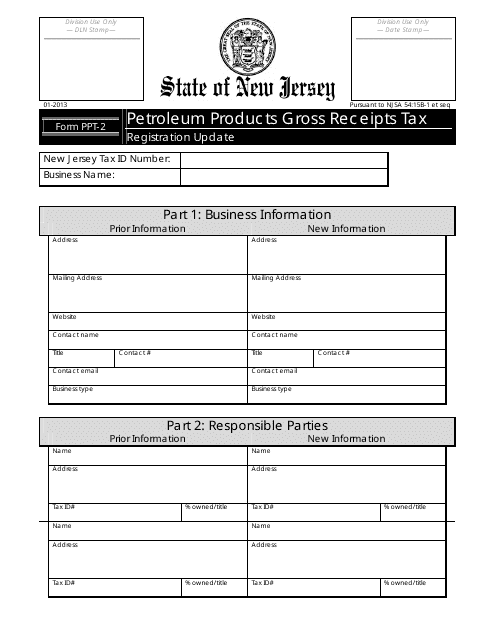

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

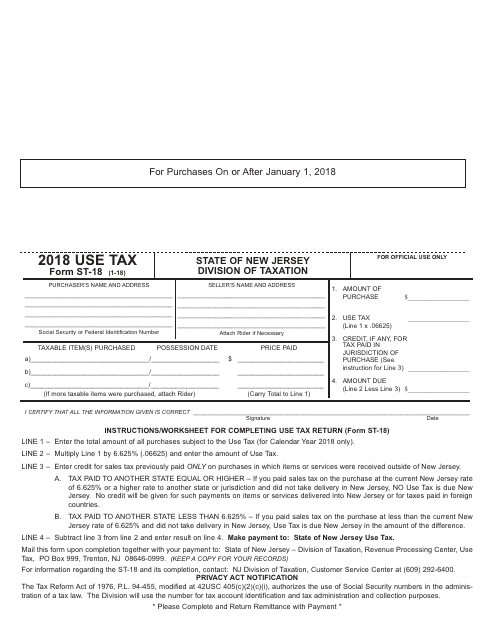

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on goods purchased out-of-state and used within New Jersey. Use this form to calculate and remit the appropriate tax amount.

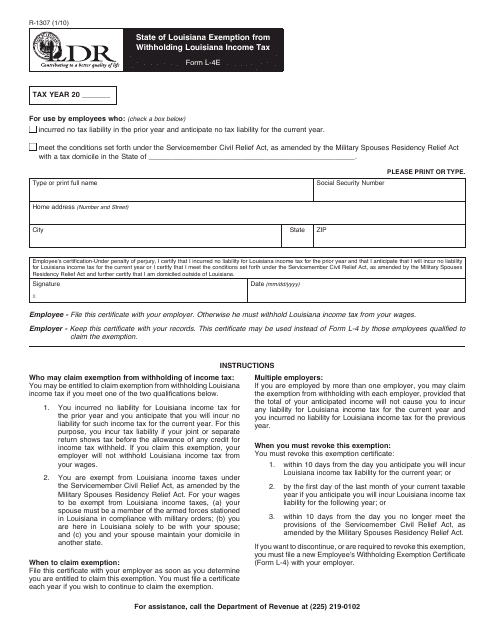

This form is used for individuals in Louisiana to claim an exemption from withholding Louisiana income tax.