Business Tax Documents Templates

Documents:

611

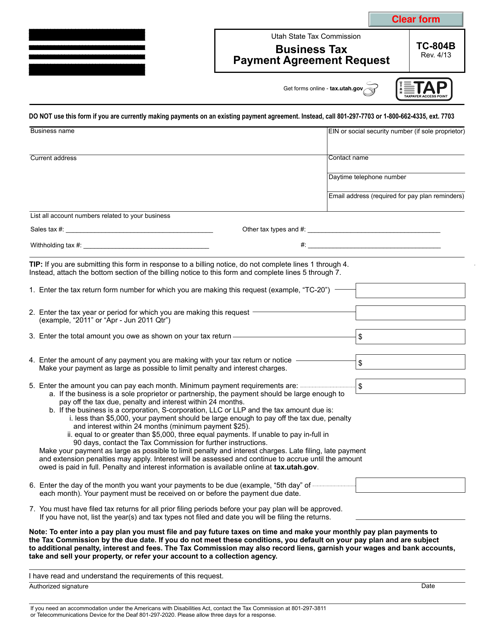

This Form is used for requesting a tax payment agreement for businesses in Utah. It allows businesses to set up a plan to pay their taxes over time.

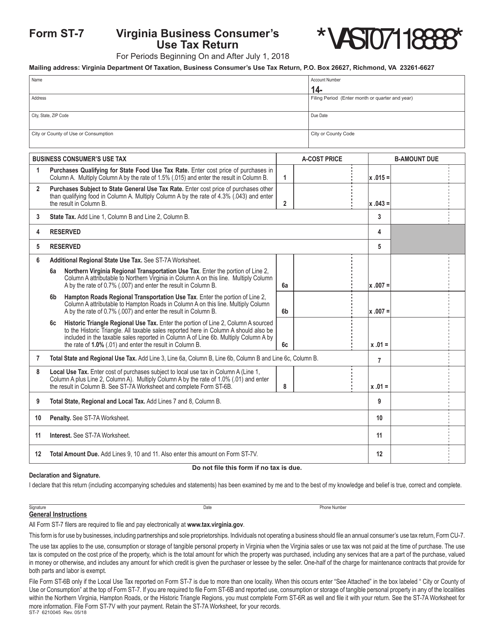

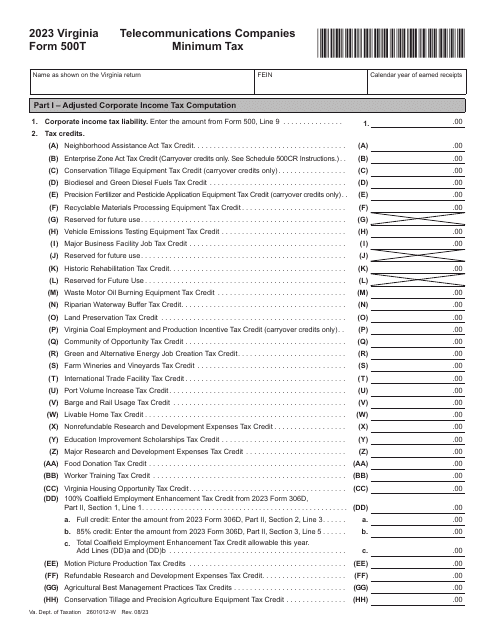

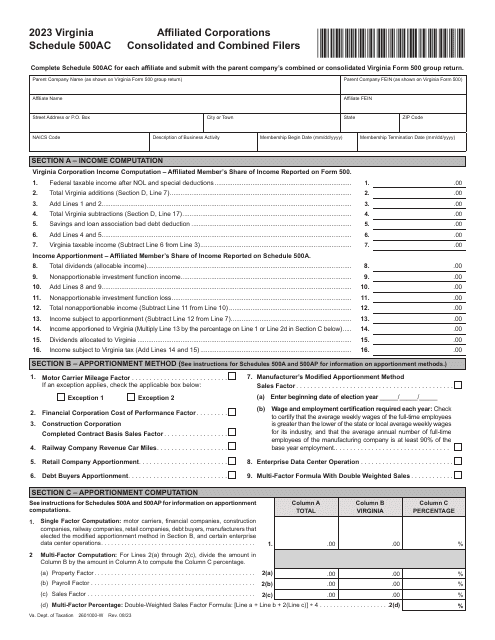

This Form is used for reporting and paying business consumer's use tax in the state of Virginia.

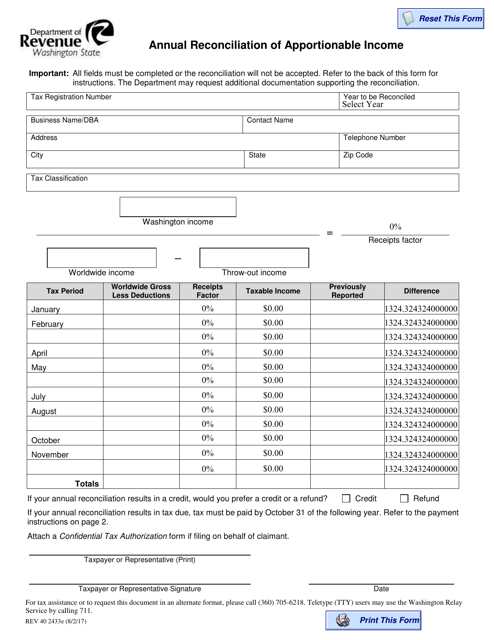

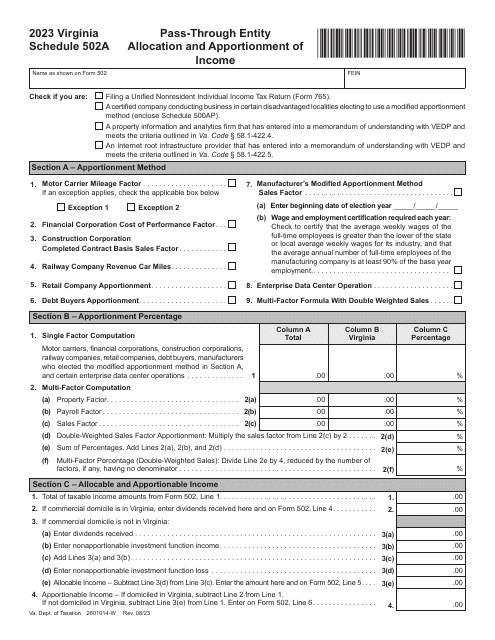

This form is used for the annual reconciliation of apportionable income in the state of Washington. It is used to determine the amount of income that is subject to taxation in the state.

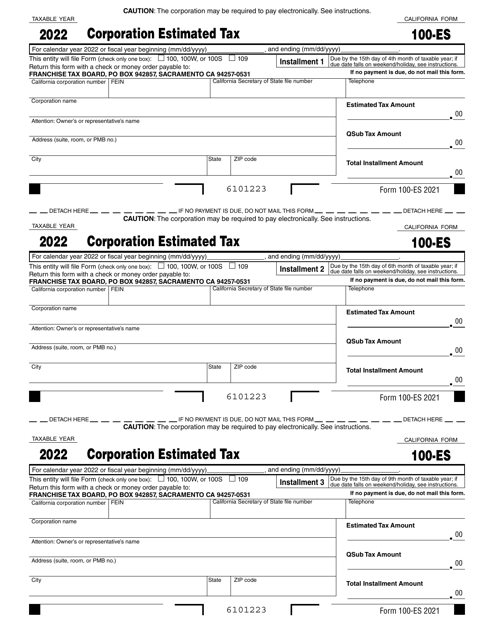

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

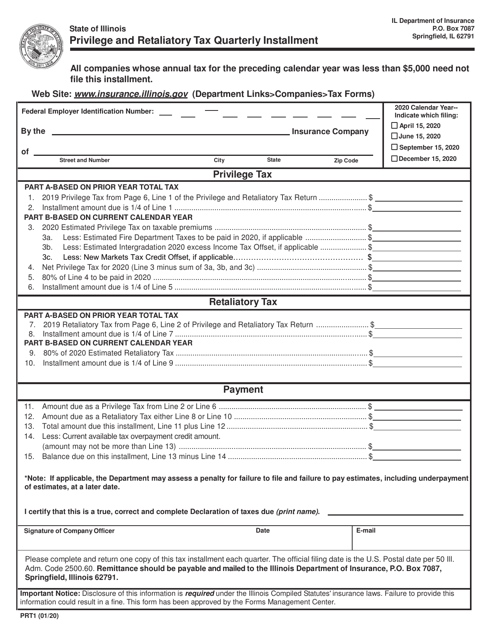

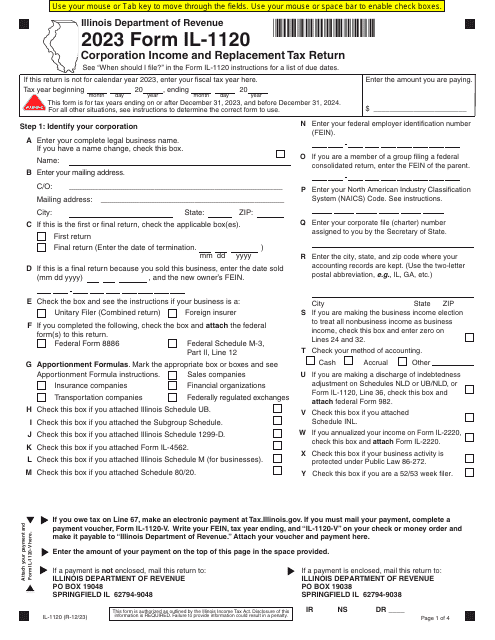

This Form is used for submitting quarterly installment payments for Privilege and Retaliatory Taxes in the state of Illinois.

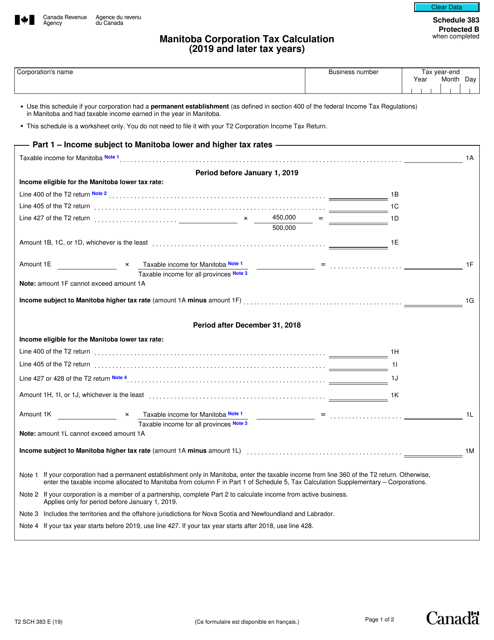

This form is used for calculating the Manitoba Corporation Tax for corporations in the province of Manitoba, Canada.

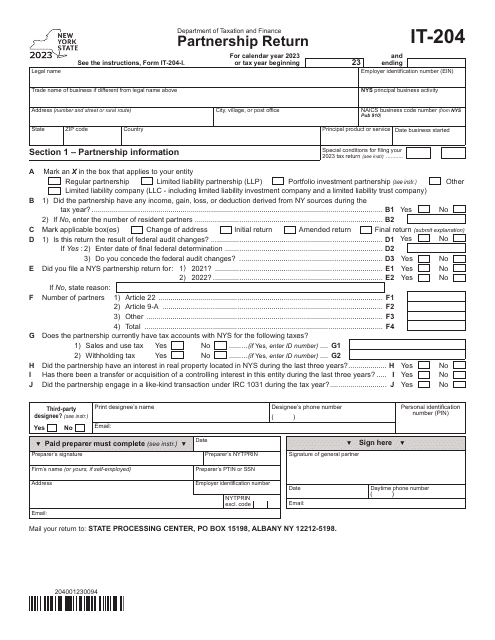

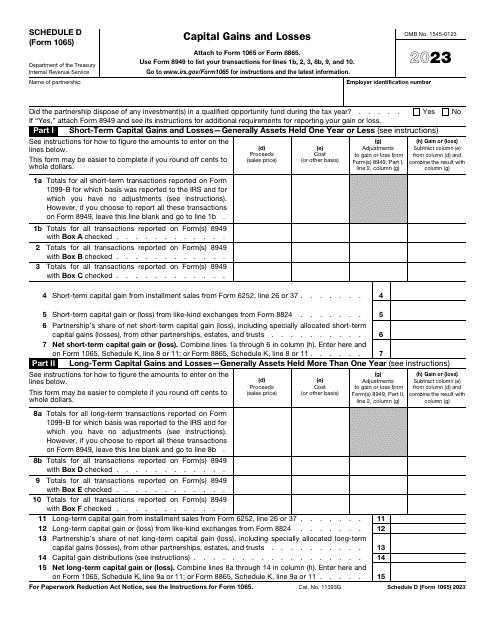

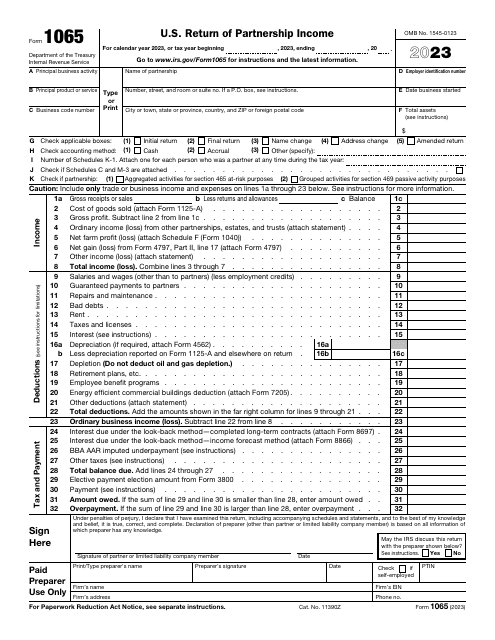

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

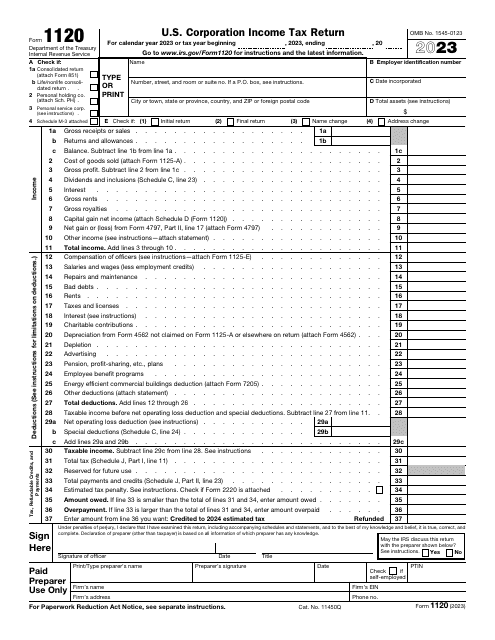

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

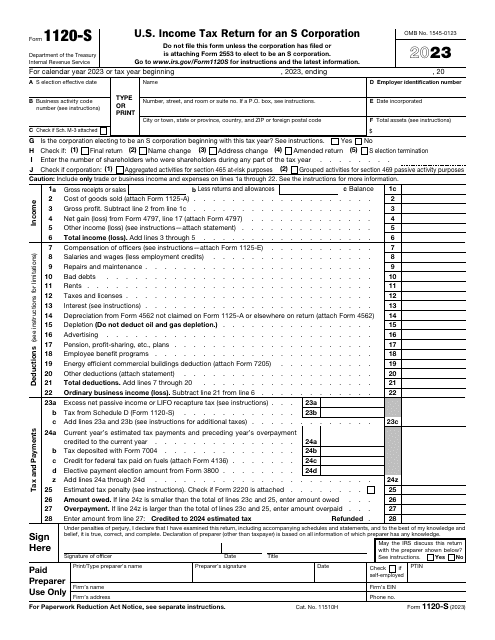

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

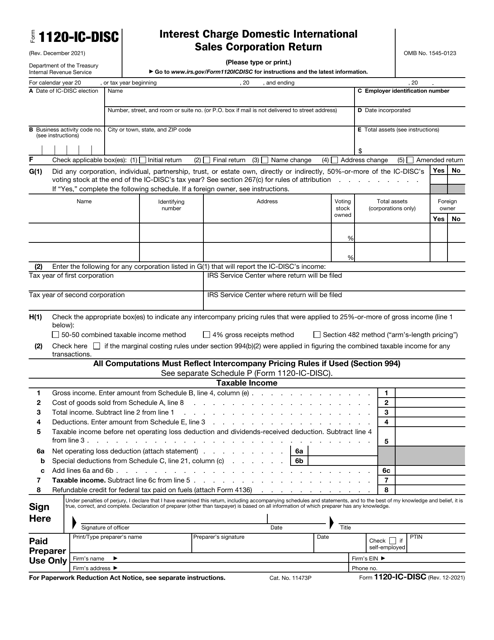

This form is also called the IC-DISC tax return. It is a form used by corporations as an information return reported to the Internal Revenue Service (IRS). A list of available Schedules is presented in the form description.