Business Tax Documents Templates

Documents:

611

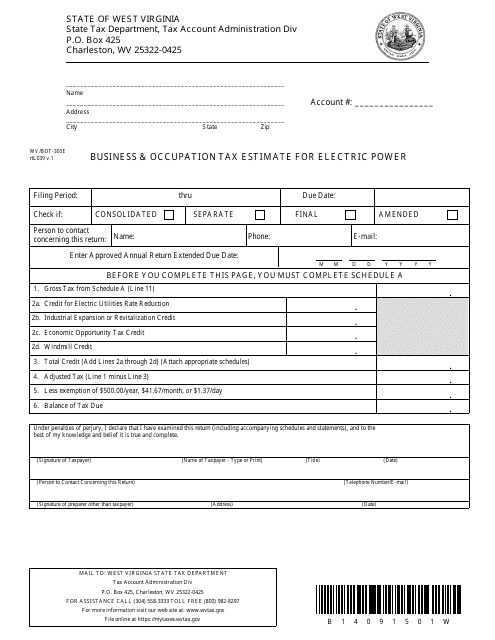

This form is used for estimating the business and occupation tax for electric power in West Virginia.

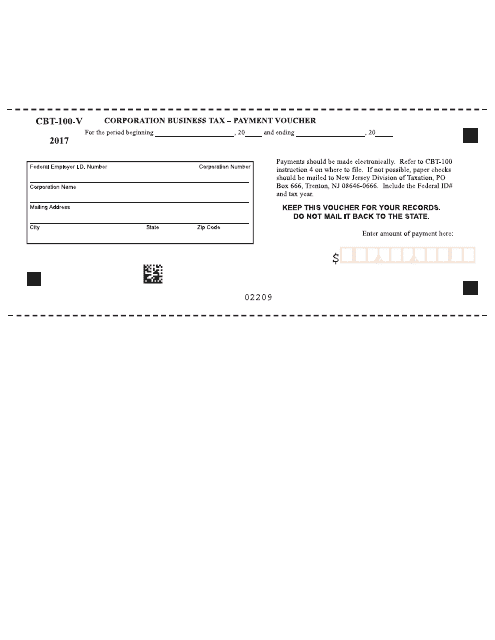

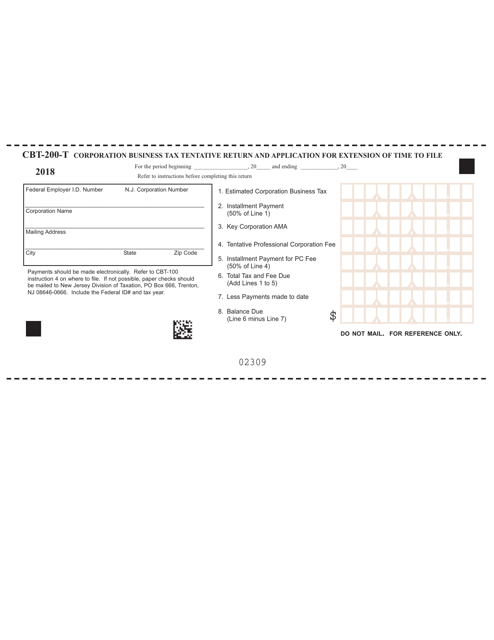

This document is a payment voucher for corporations to pay their business tax in the state of New Jersey.

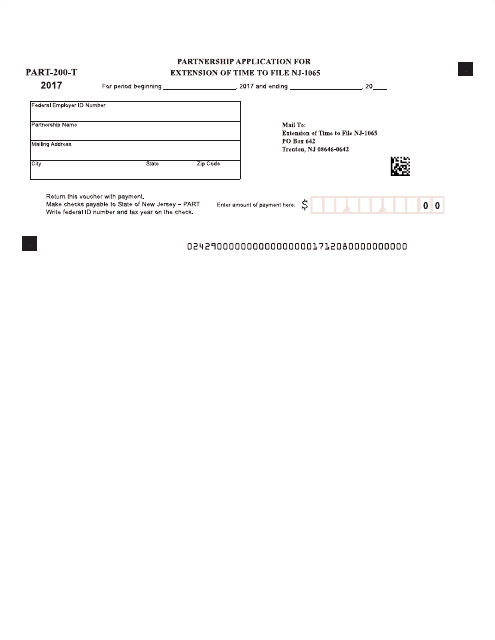

This Form is used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

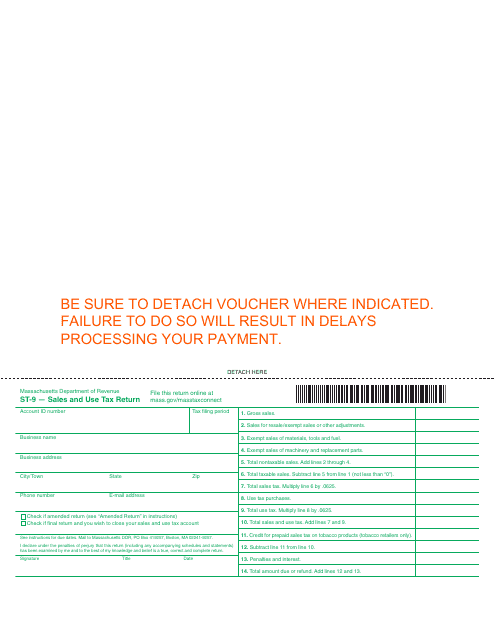

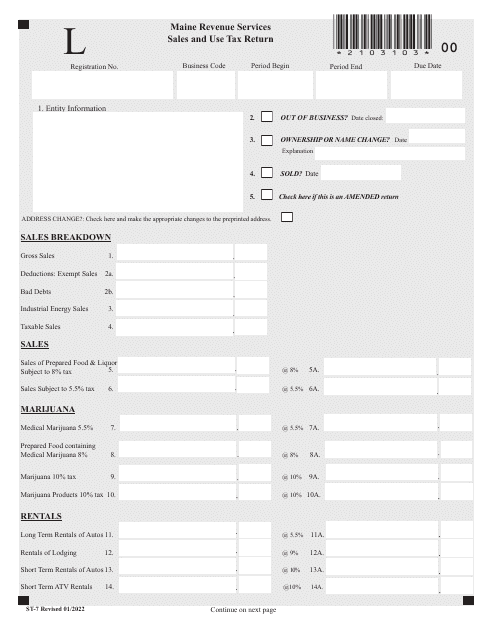

This Form is used for filing sales and use tax returns in the state of Massachusetts. It is used by businesses and individuals to report and remit taxes on sales and purchases made within the state.

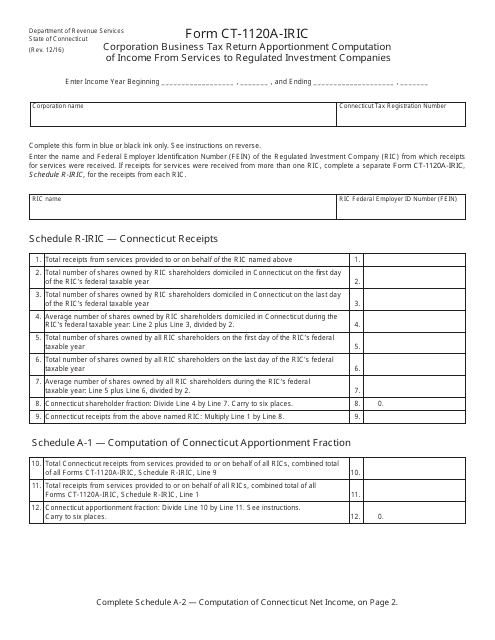

This form is used by corporations in Connecticut to calculate the apportionment of income from services to regulated investment companies for the purpose of filing their business tax return.

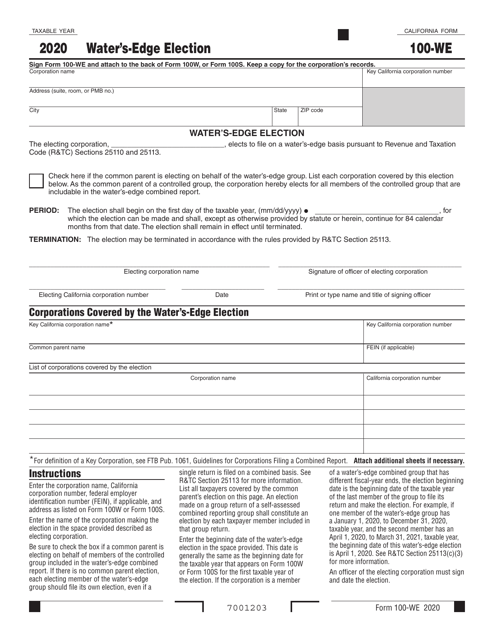

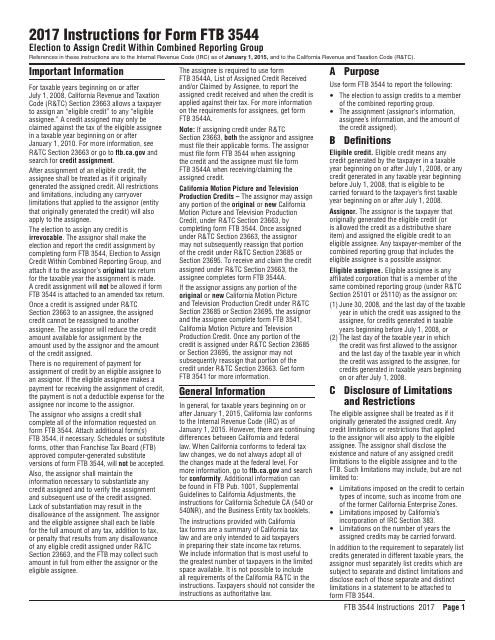

This Form is used for making an election to assign credit within a combined reporting group in California. The form provides instructions on how to complete the election process.

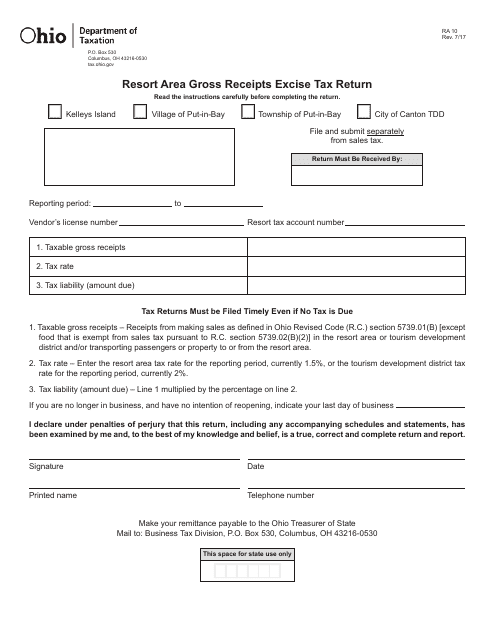

This form is used for reporting and paying the Resort Area Gross Receipts Excise Tax in Ohio.

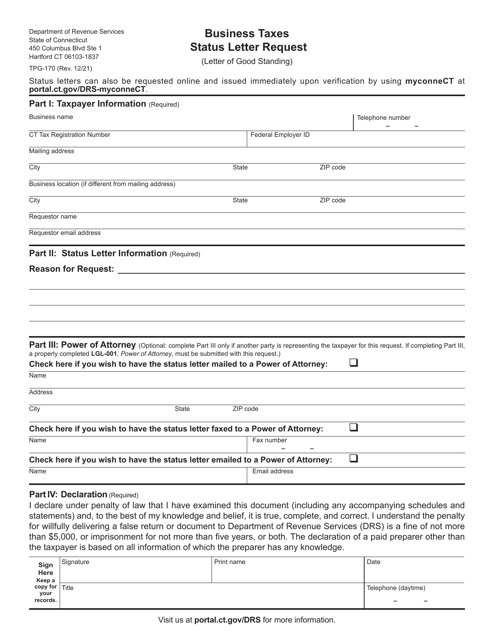

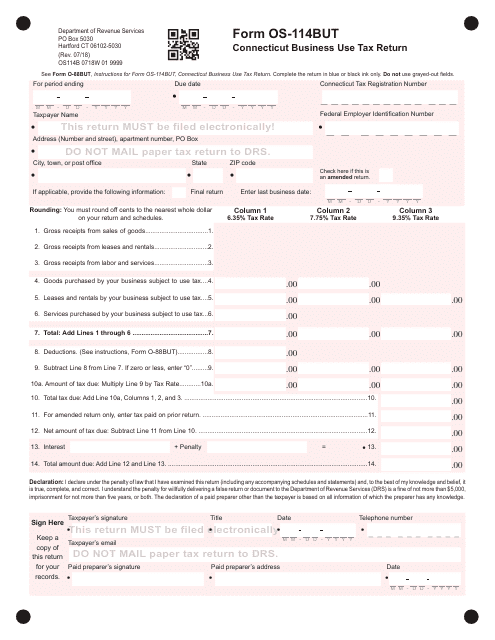

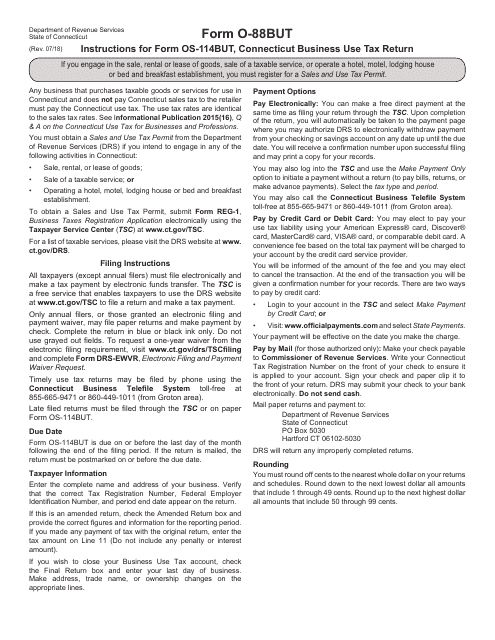

This form is used for reporting and paying business use tax in the state of Connecticut. Businesses are required to file this return if they have made purchases from out-of-state retailers and have not paid sales tax on those purchases.

This Form is used for reporting and paying business use tax in the state of Connecticut. It is required for businesses that have made out-of-state purchases or rentals of tangible personal property for use within Connecticut.

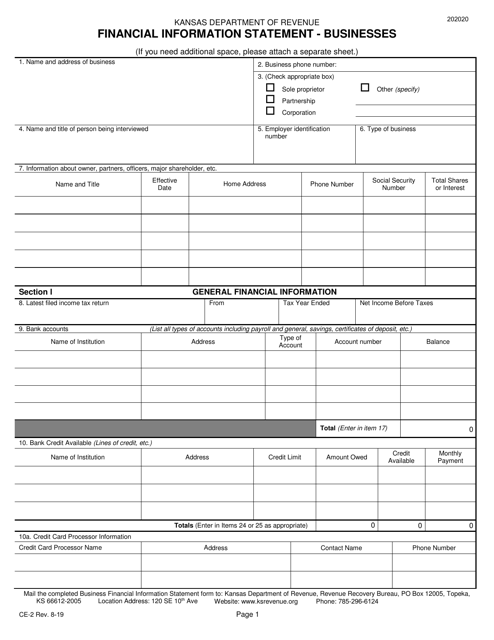

This Form is used for applying for business tax in the state of Kansas.

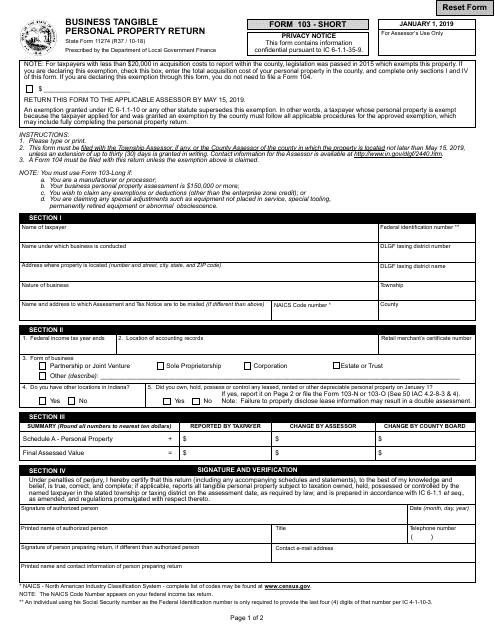

This form is used for reporting and assessing the value of tangible personal property owned by businesses in the state of Indiana.

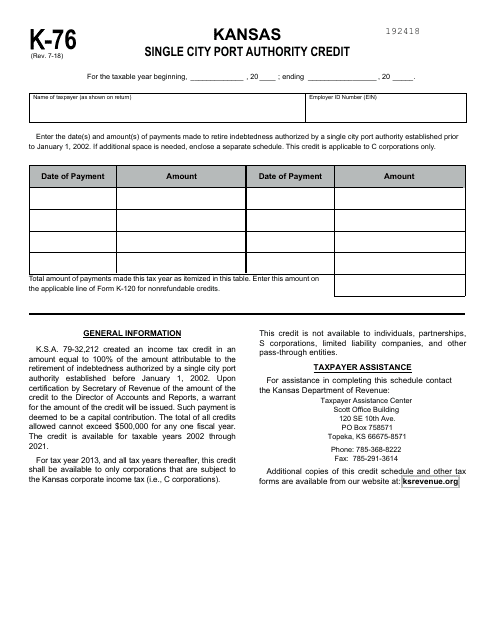

This Form is used for claiming a tax credit related to the operations of a single city port authority in Kansas.

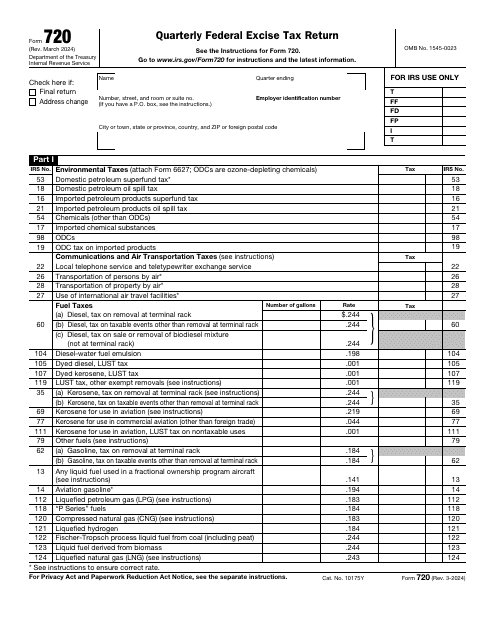

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.