Business Tax Documents Templates

Documents:

611

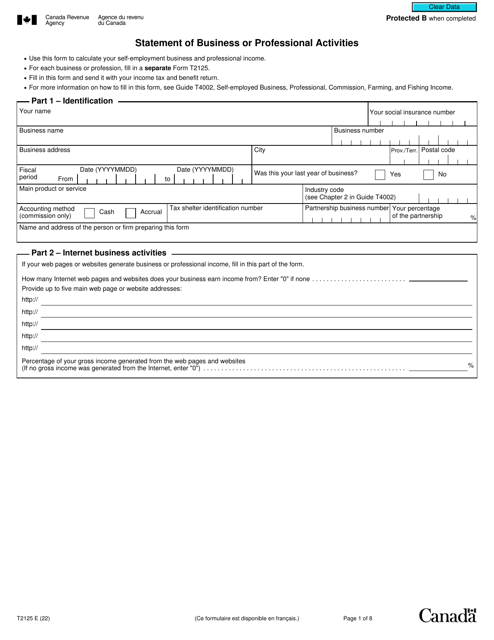

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

This form is used for filing the Business Development Corporation Tax Return in Kentucky.

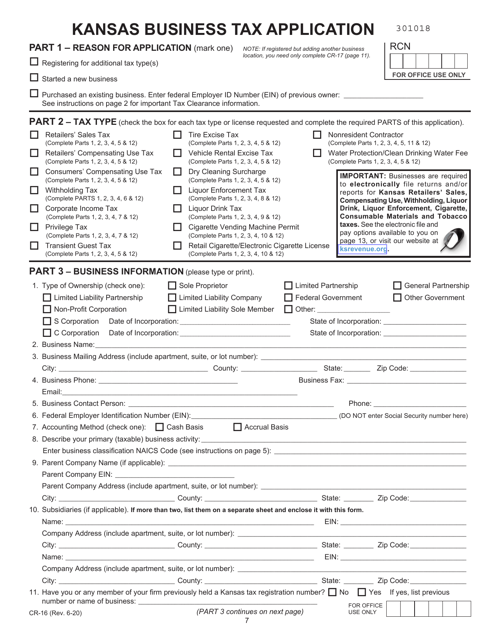

This form is used for submitting a business tax application in the state of Kansas. It is important for businesses to accurately complete and submit this form to ensure compliance with state tax laws.

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.

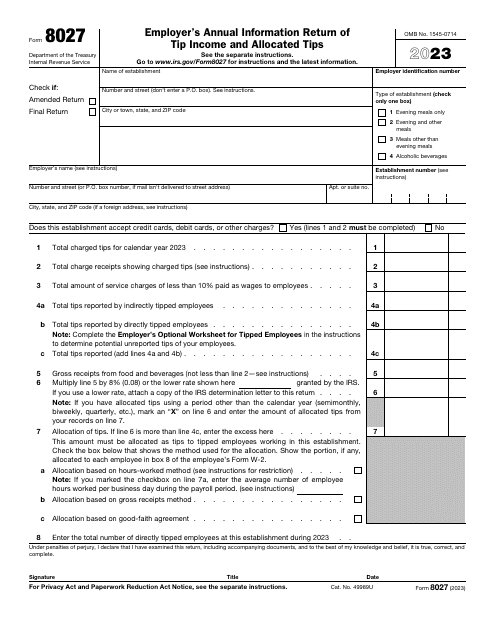

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

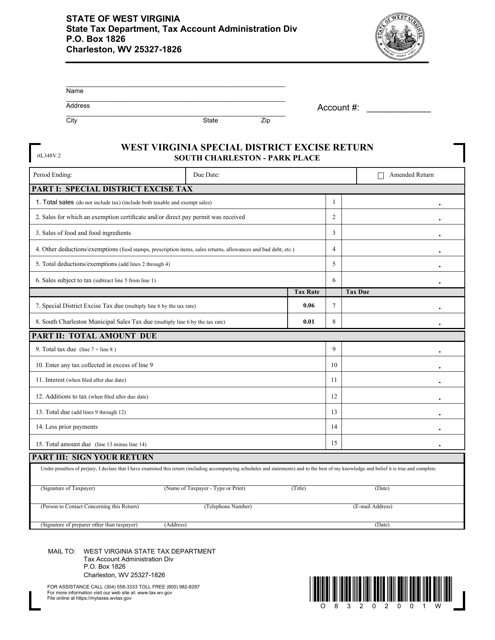

This form is used for filing the West Virginia Special District Excise Return for businesses located in South Charleston - Park Place area of South Charleston, West Virginia.

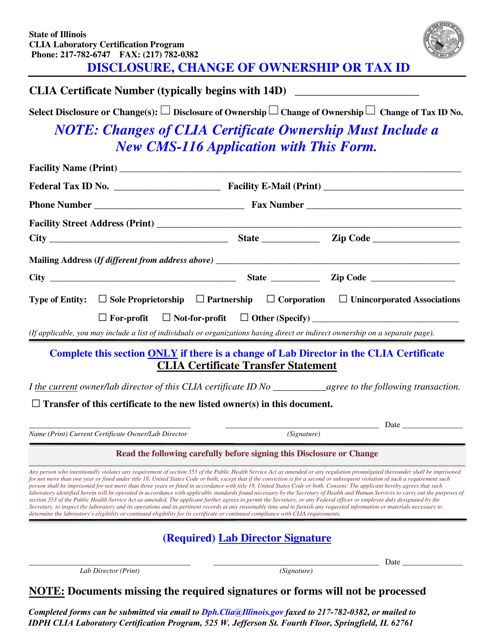

This document is used for disclosing a change of ownership or tax identification in the state of Illinois. It is important to update this information accurately to comply with state laws and regulations.

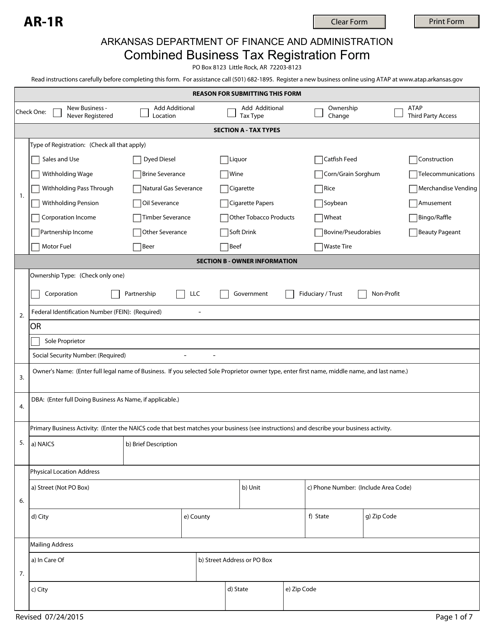

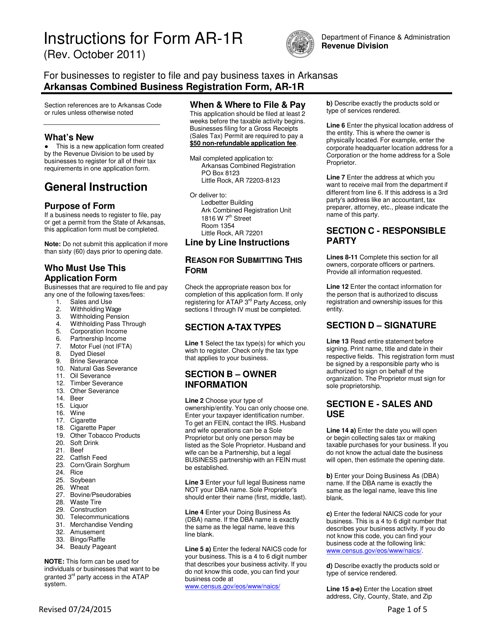

This Form is used for registering a business for tax purposes in Arkansas.

This Form is used for combined business tax registration in the state of Arkansas. It provides instructions on how to complete Form AR-1R to register your business for various taxes.

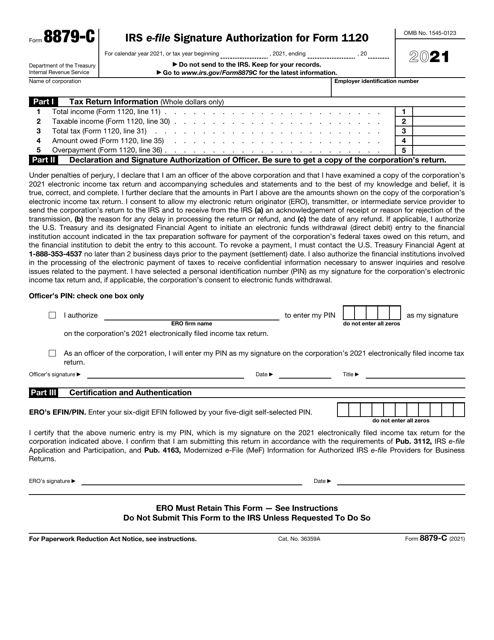

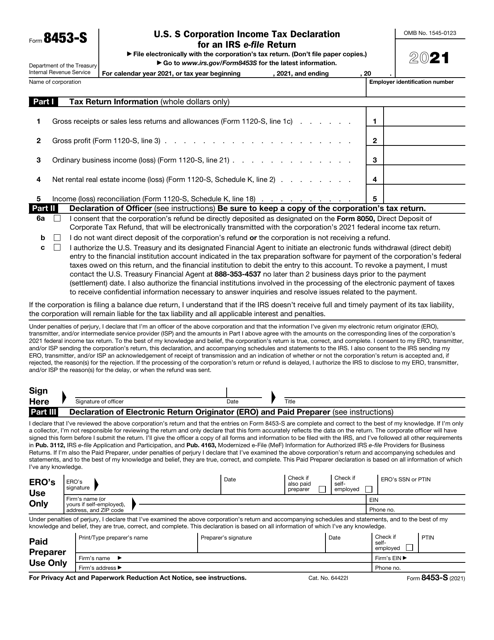

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

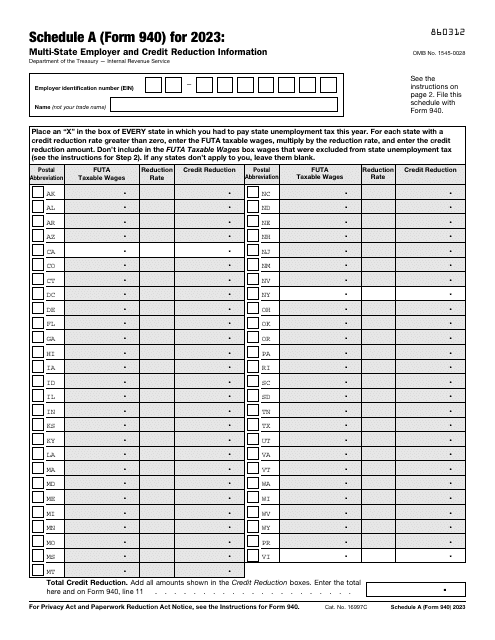

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

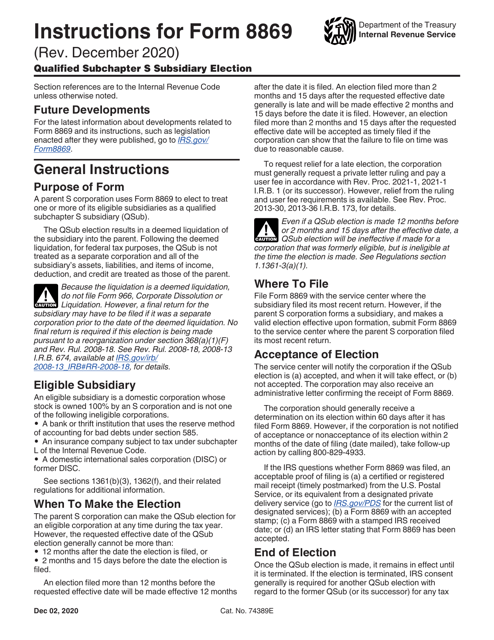

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

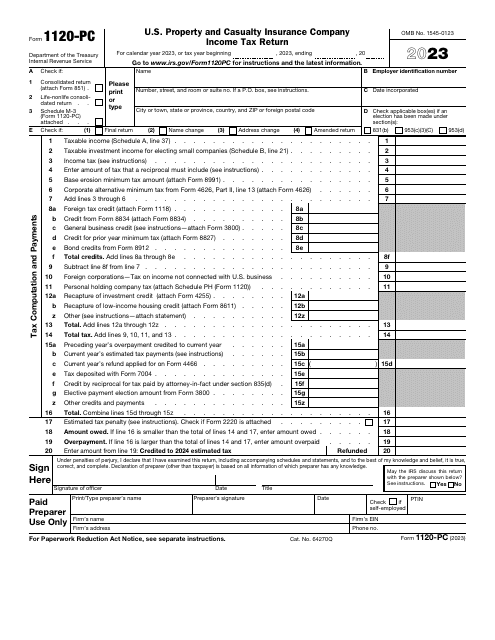

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

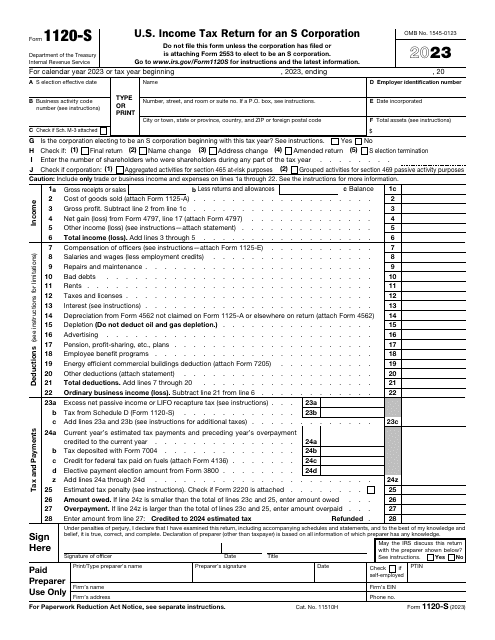

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).