Business Tax Documents Templates

Documents:

611

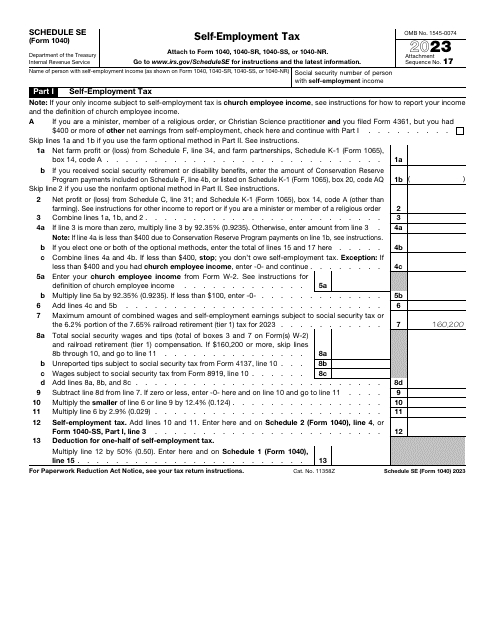

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

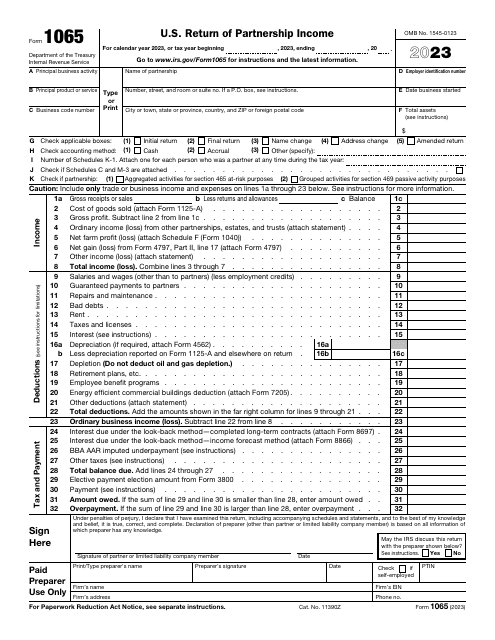

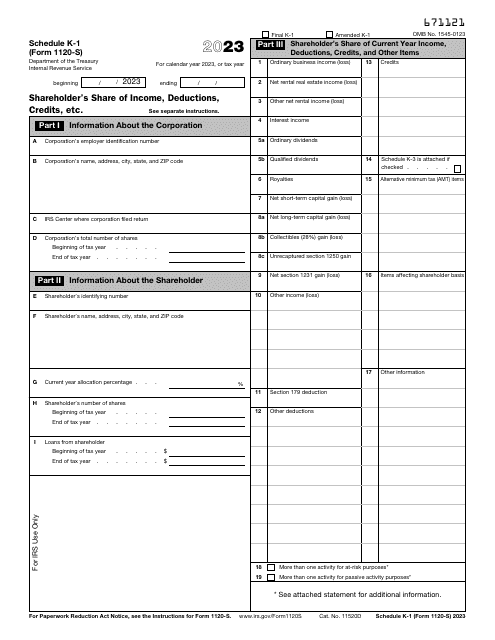

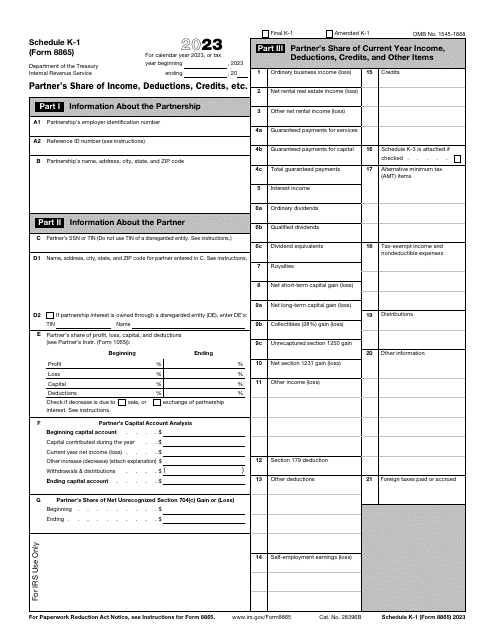

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

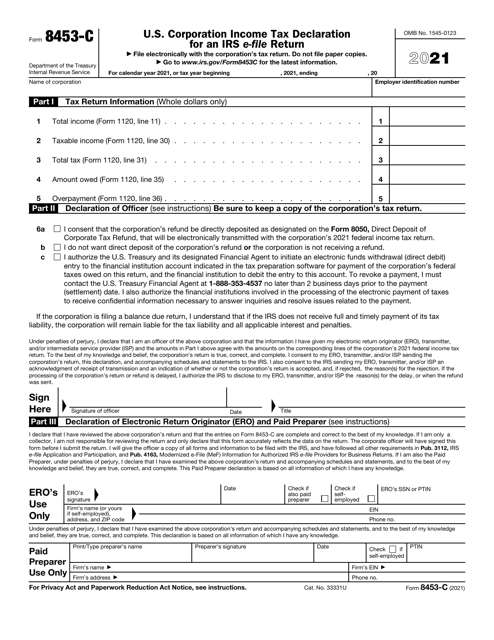

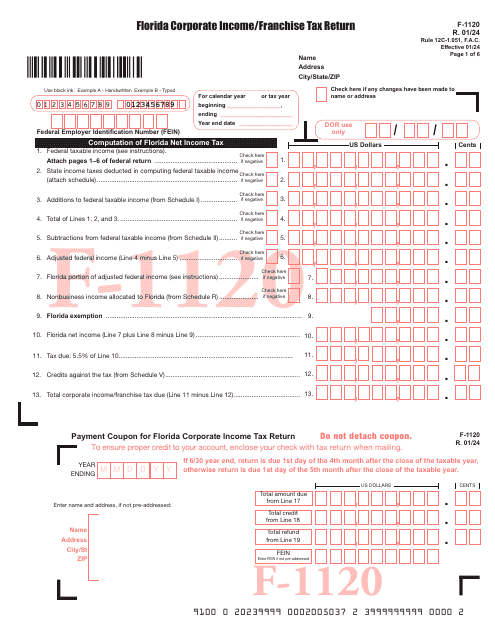

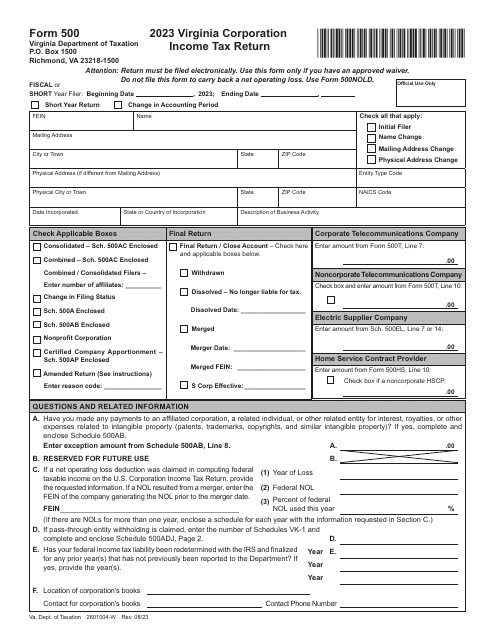

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

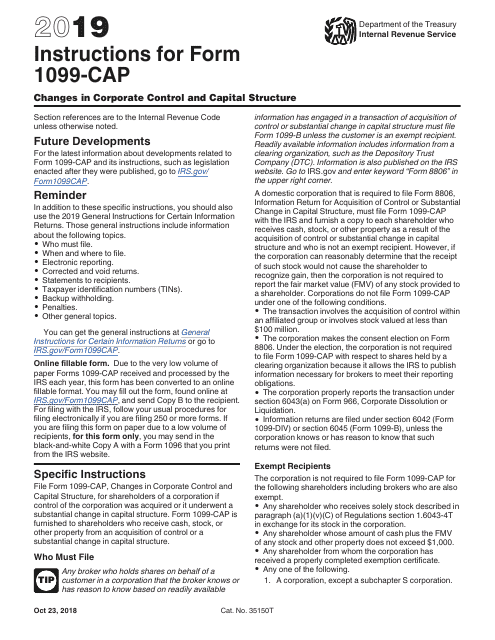

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

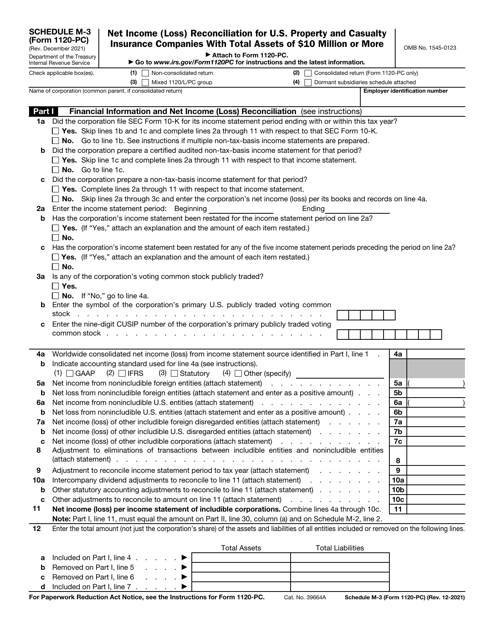

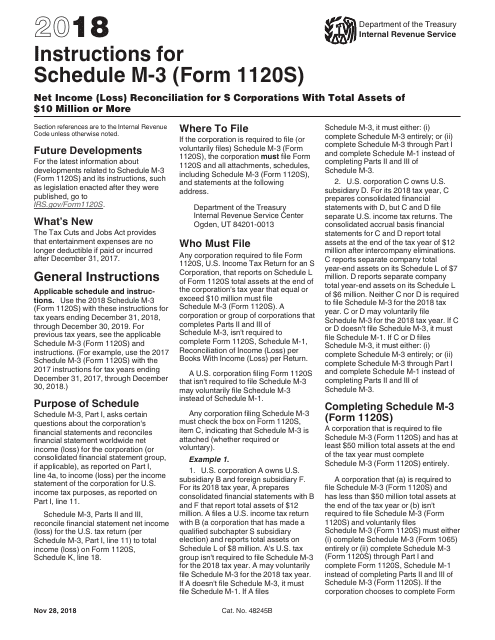

This form is used for reconciling the net income (or loss) of S Corporations with total assets of $10 million or more on Form 1120S. It provides detailed instructions for completing the Schedule M-3 section.

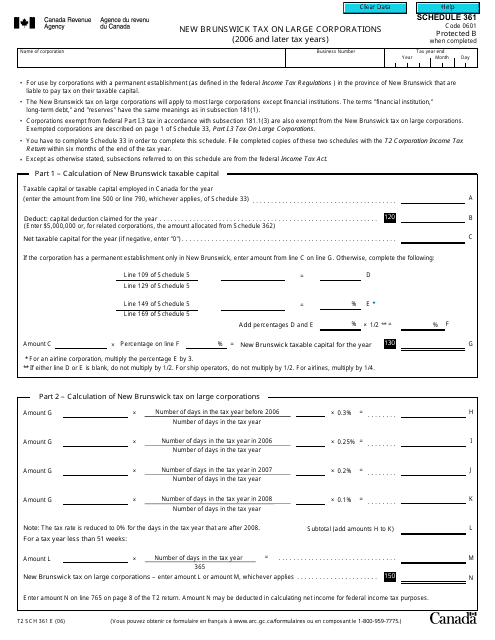

This form is used for calculating and reporting the New Brunswick tax on large corporations for the tax years 2006 and later in Canada.

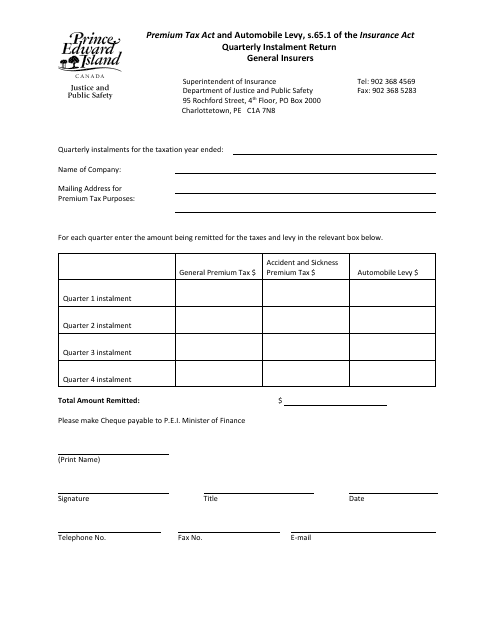

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

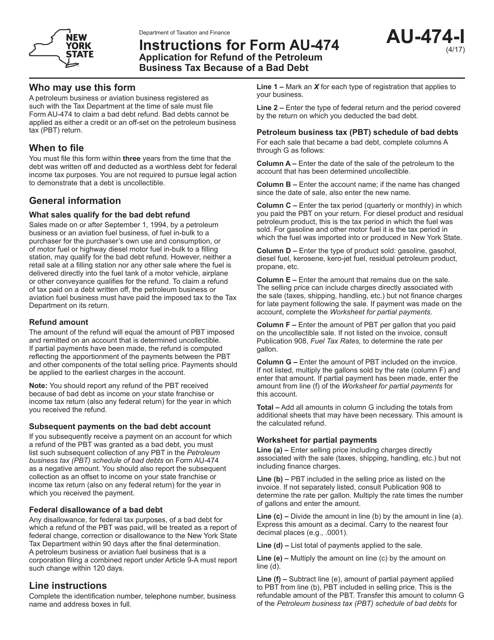

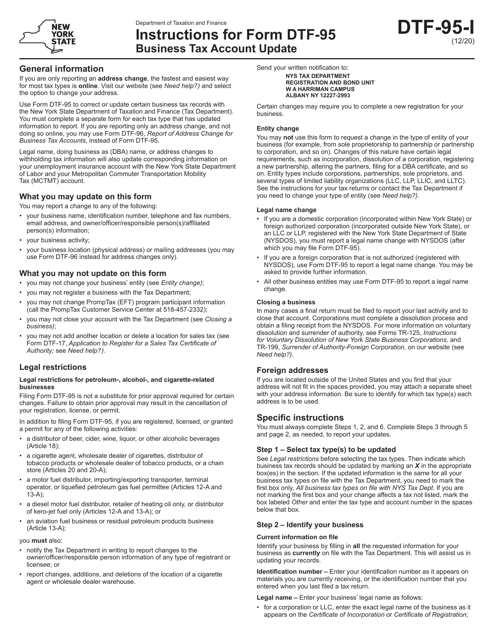

This form is used for filing an application for a refund of the petroleum business tax in New York due to a bad debt. It provides instructions on how to complete the form and apply for the refund.

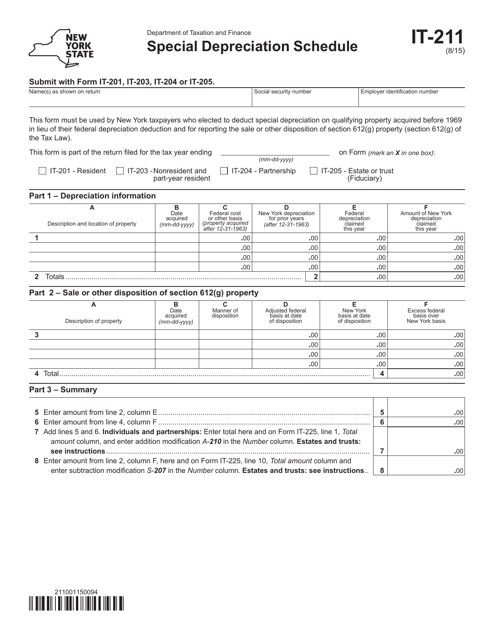

This form is used for reporting special depreciation for businesses in New York. It helps businesses calculate and claim deductions for depreciating assets.

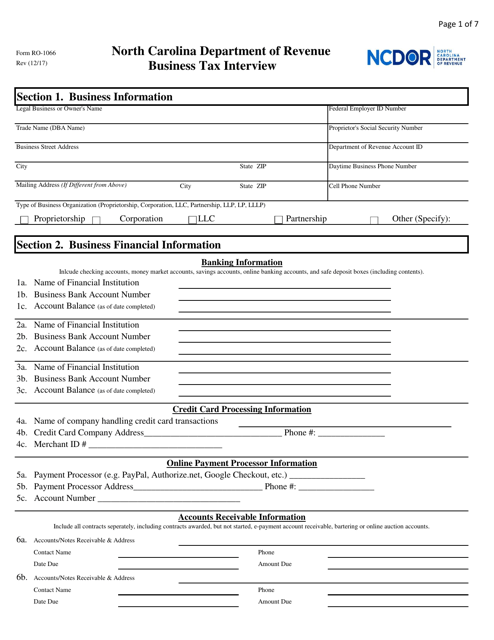

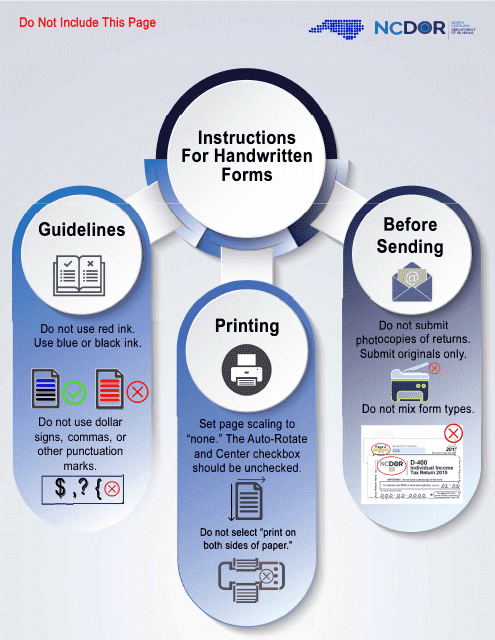

This form is used for conducting a business tax interview in North Carolina. It helps gather information related to business taxes and is an important step in the tax filing process for businesses in the state.

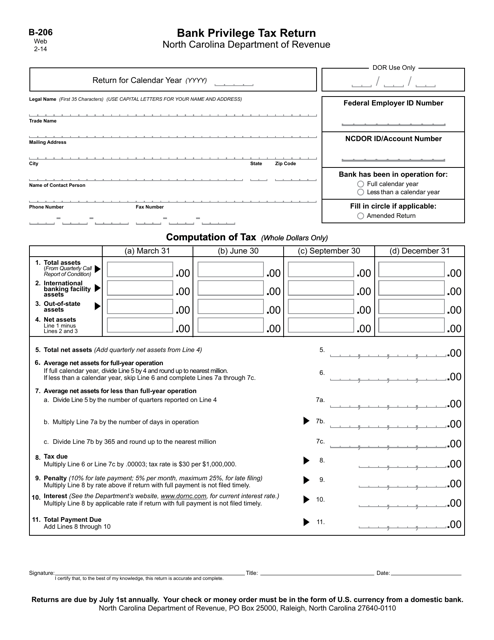

This Form is used for filing the Bank Privilege Tax Return in the state of North Carolina. The Bank Privilege Tax is a tax imposed on banks for the privilege of doing business in the state.

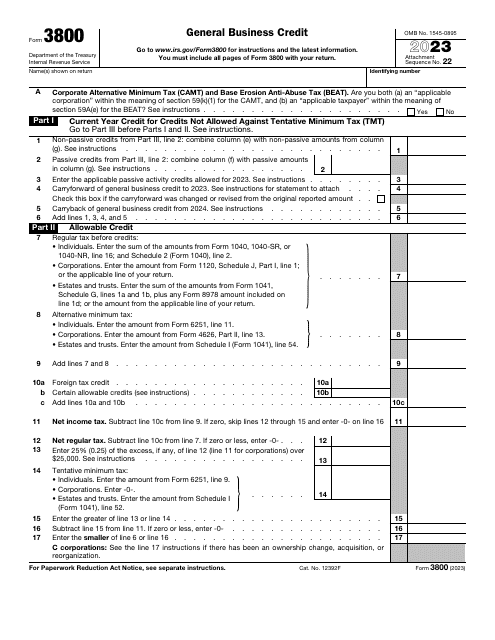

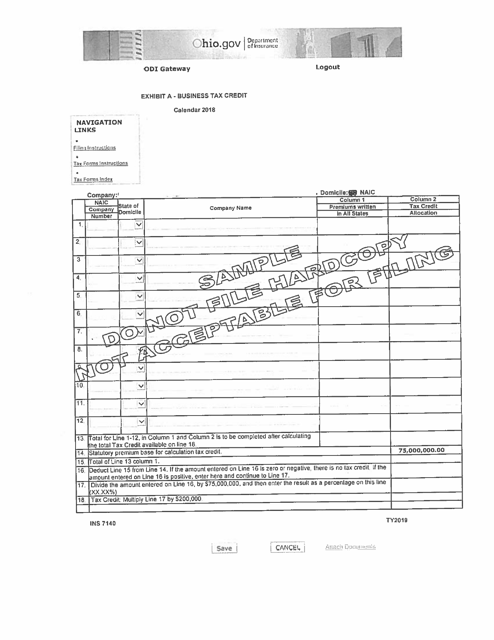

This form is used for claiming a business tax credit in the state of Ohio.

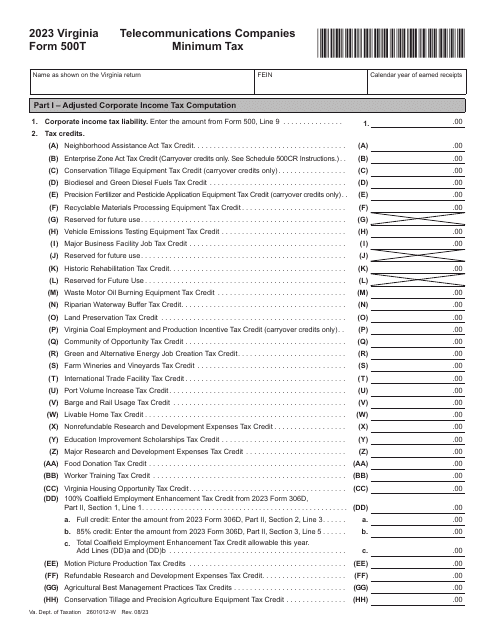

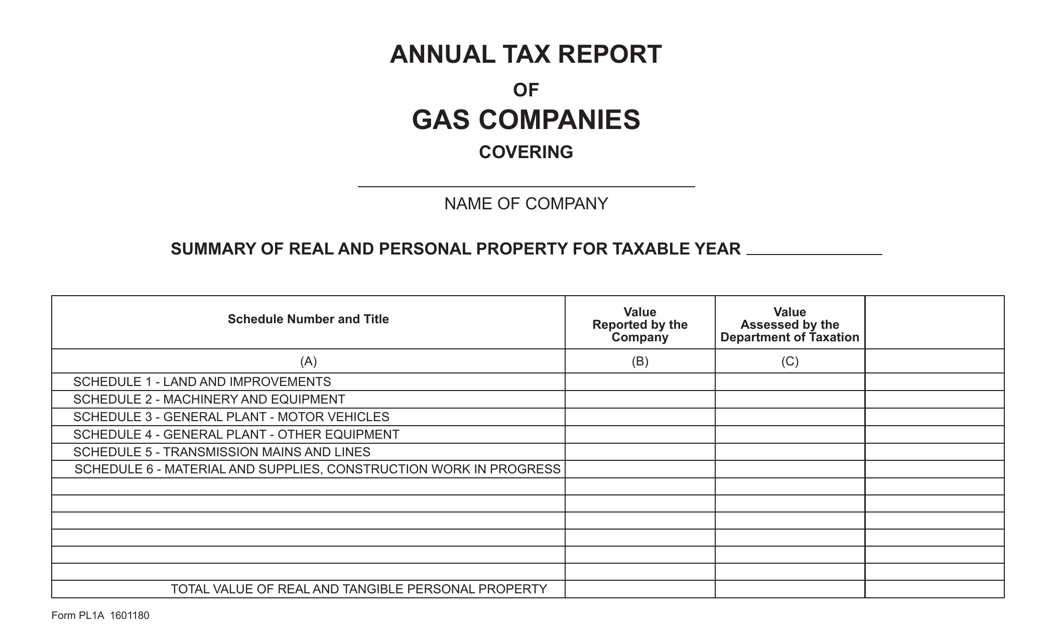

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

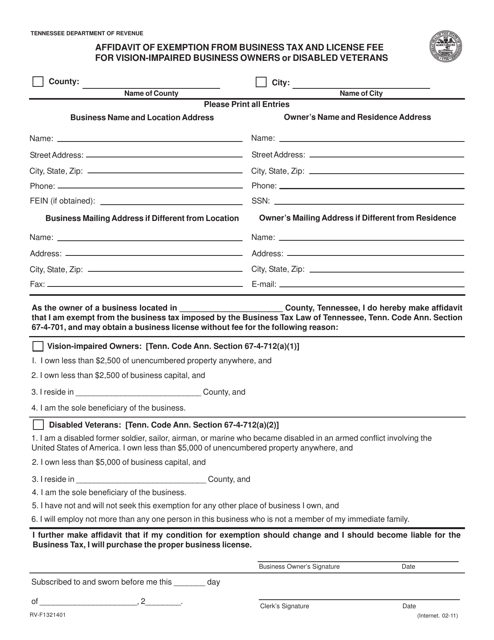

This form is used for vision-impaired business owners or disabled veterans in Tennessee to apply for an exemption from business tax and license fees.