Tax Relief Form Templates

Documents:

240

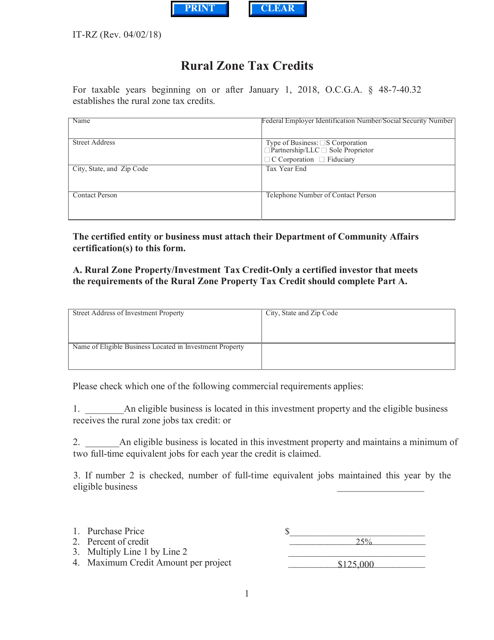

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

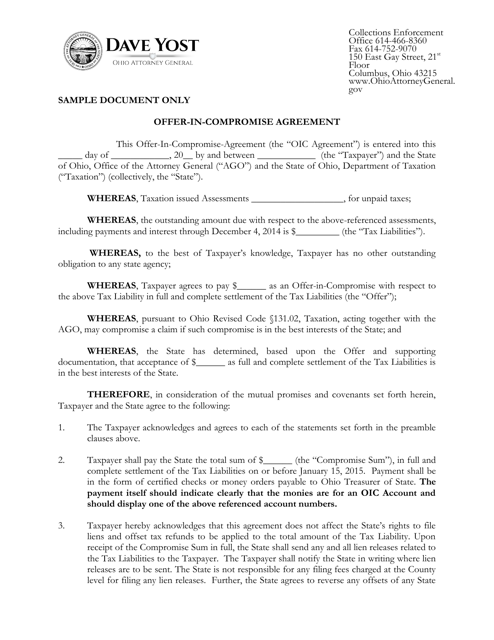

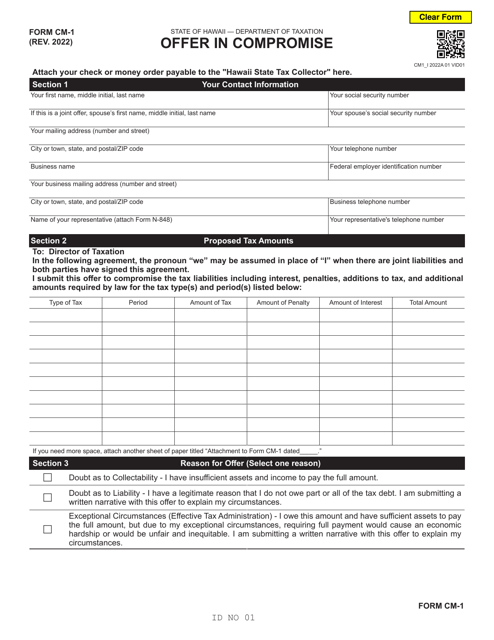

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

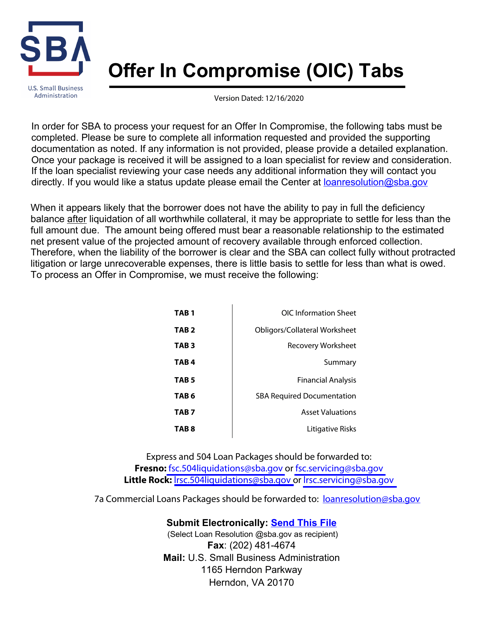

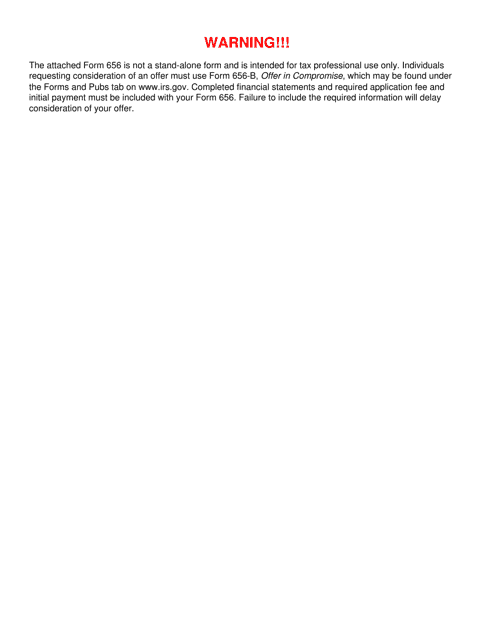

This form is used for making an offer in compromise to the Internal Revenue Service (IRS) in Washington, D.C. It allows taxpayers to settle their tax debt for less than the full amount owed.

This document is used for applying for the Annual Tax Credit under the Enhanced Enterprise Zone Tax Credit Program in Missouri.

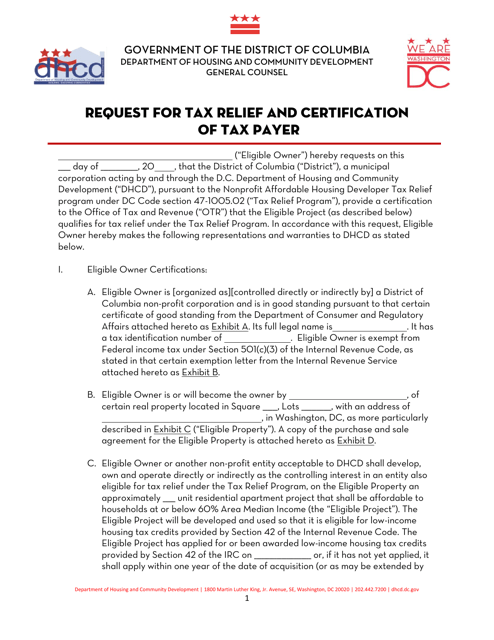

This document certifies eligibility for tax relief in Washington, D.C. It helps residents apply for and receive tax relief benefits.

This document is used for requesting tax relief and obtaining certification as a taxpayer in Washington, D.C.

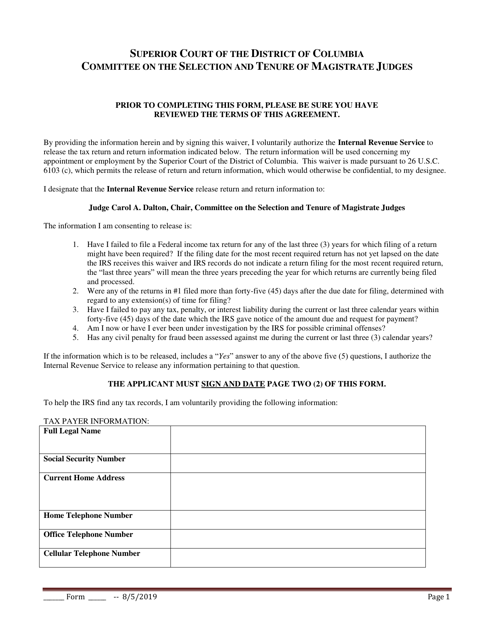

This document is used for requesting a waiver of taxes in Washington, D.C.

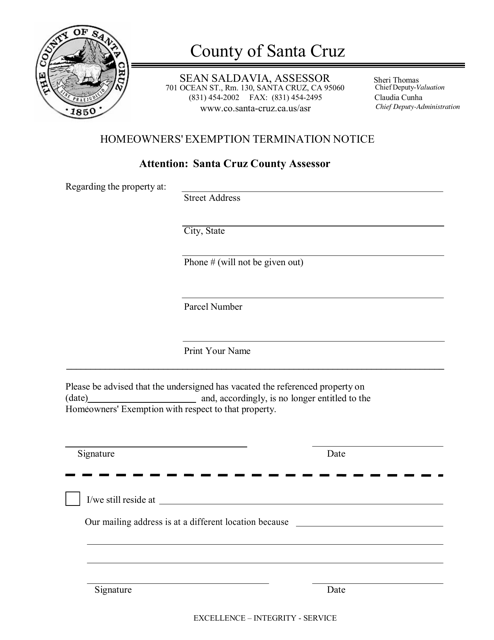

This document is a notice that informs homeowners in Santa Cruz County, California about the termination of their homeowners' exemption.

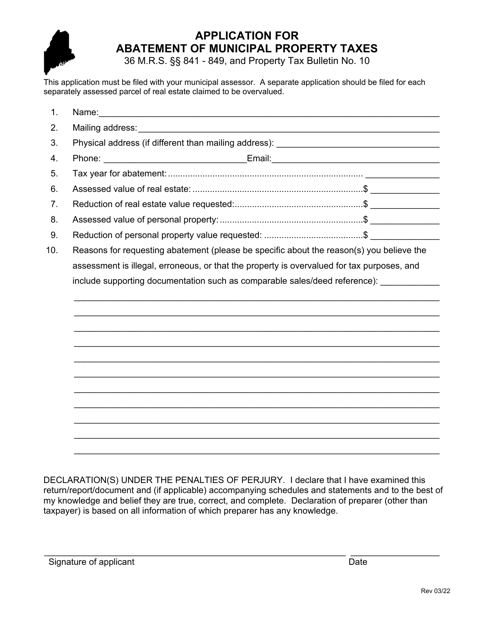

This form is used for requesting a reduction or elimination of municipal property taxes in the state of Maine. It allows property owners to seek relief from excessive tax payments.

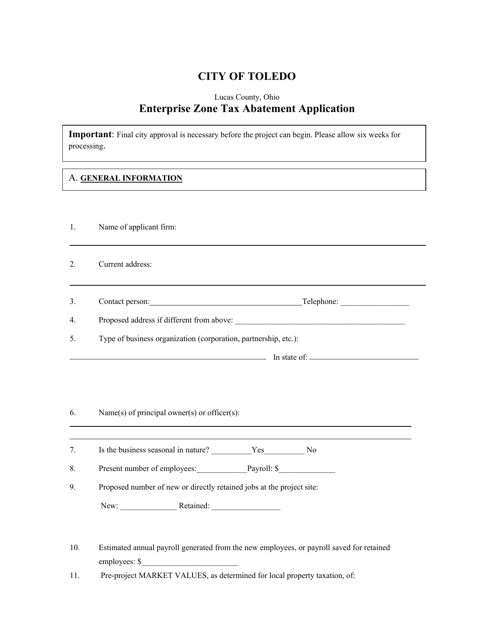

This document is an application for a tax abatement in the Enterprise Zone in Toledo, Ohio. The tax abatement is a program that allows businesses to receive a reduction or exemption from certain taxes for a specified period of time in order to promote economic development in the designated area.

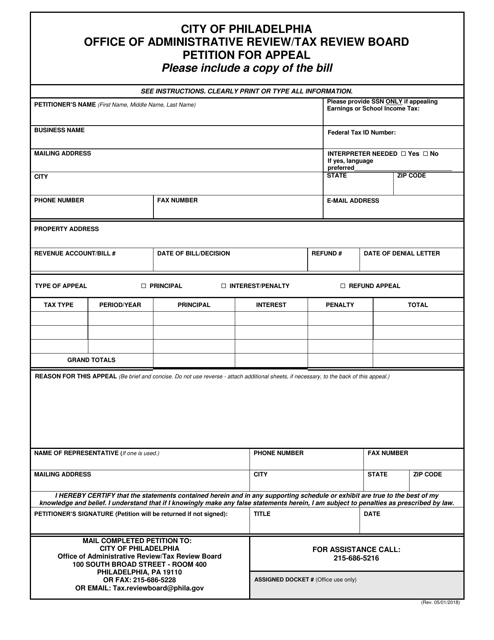

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

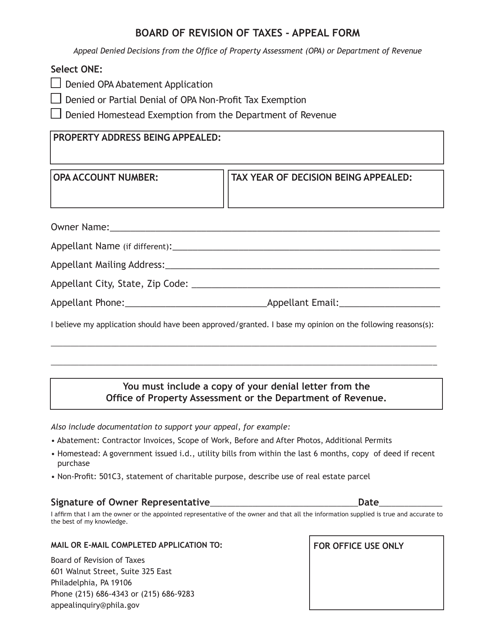

This Form is used for appealing a denied abatement or exemption in the City of Philadelphia, Pennsylvania.

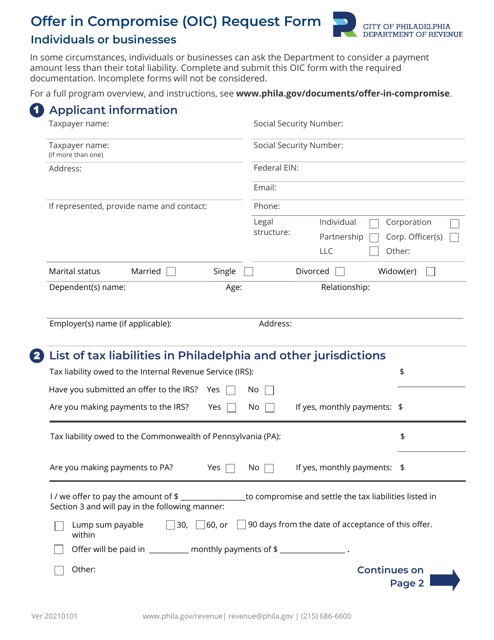

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

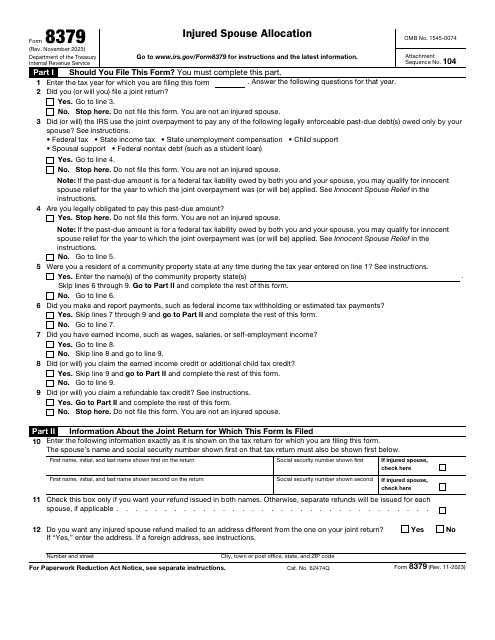

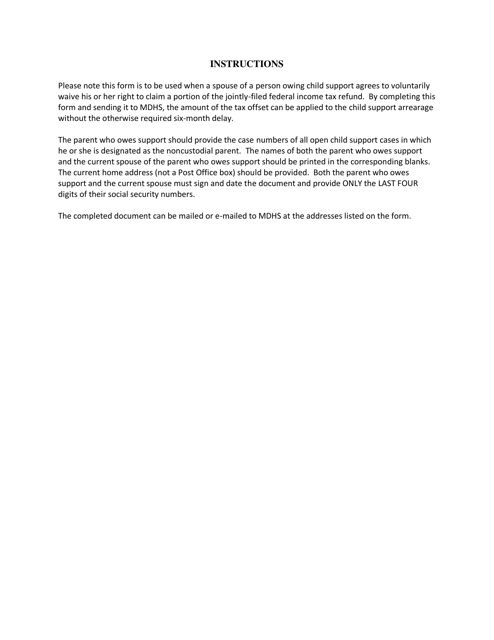

This document is a request form used in Mississippi to request the release of a joint tax refund by the IRS for an injured spouse.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

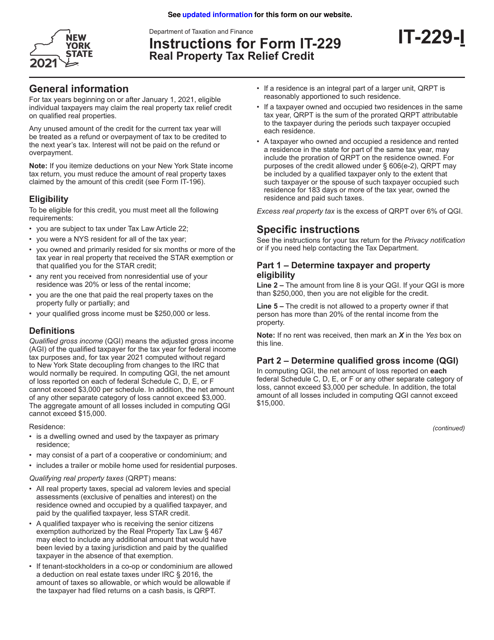

This document is used to provide instructions for Form IT-229 Real Property Tax Relief Credit in the state of New York. It helps taxpayers understand how to claim a credit for property taxes paid on their primary residence.