Tax Relief Form Templates

Documents:

240

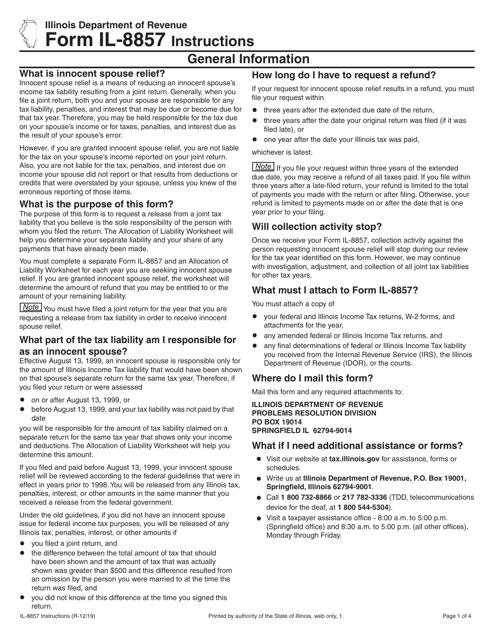

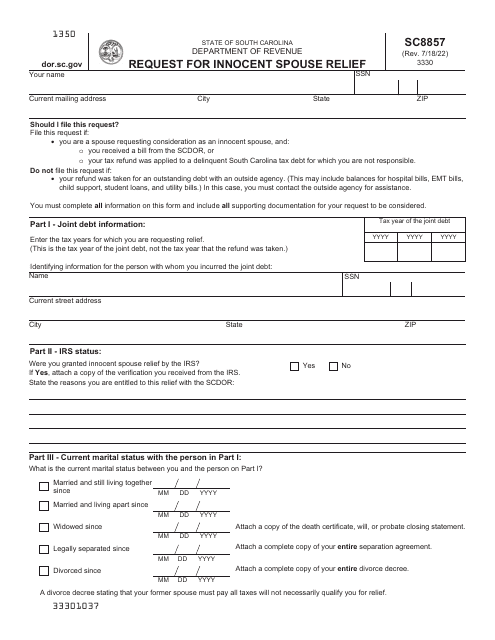

This form is used for requesting innocent spouse relief in the state of Illinois.

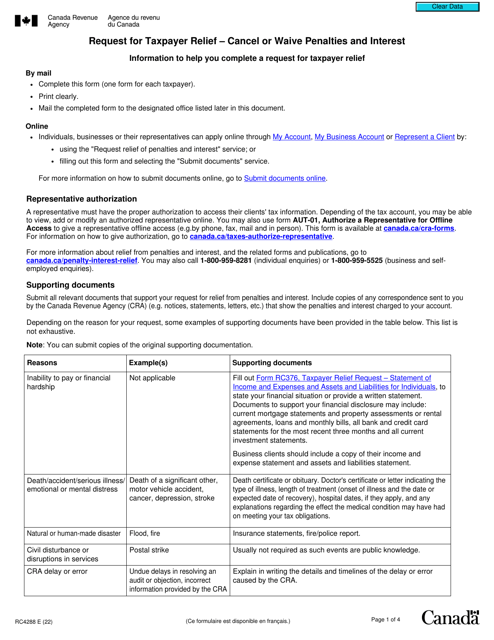

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

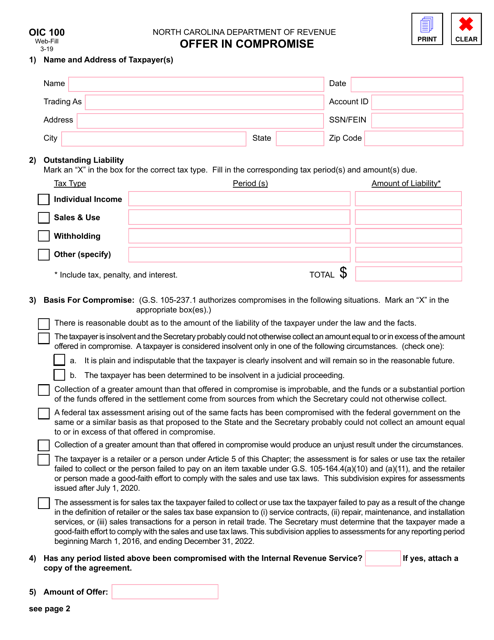

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

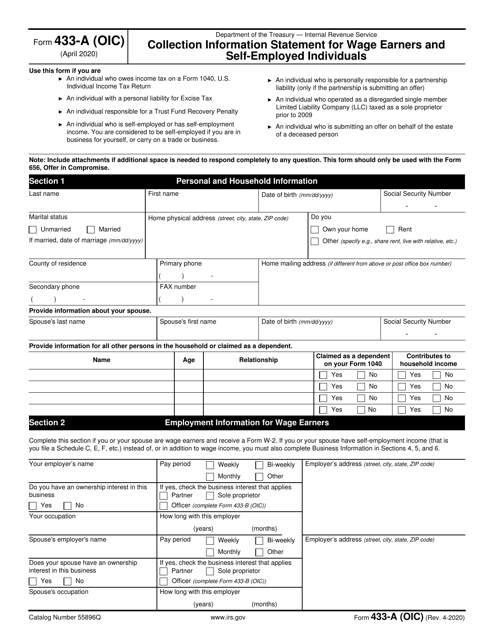

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

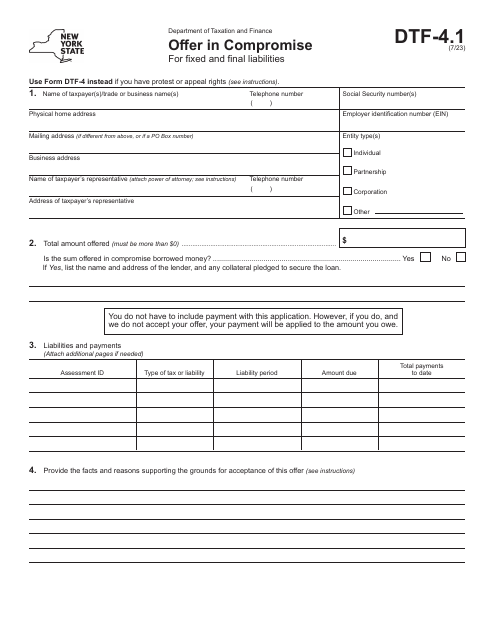

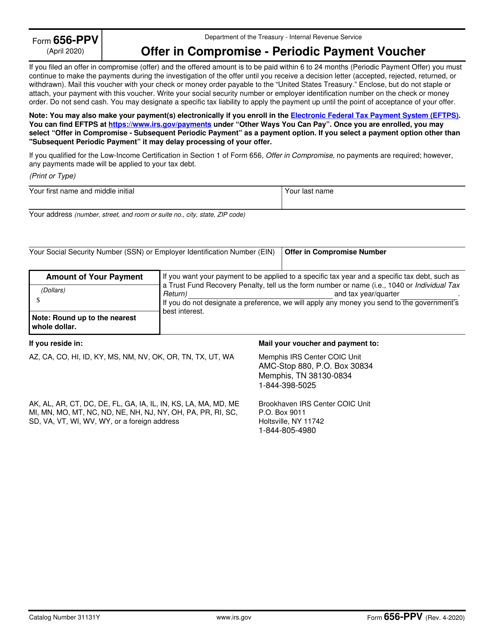

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

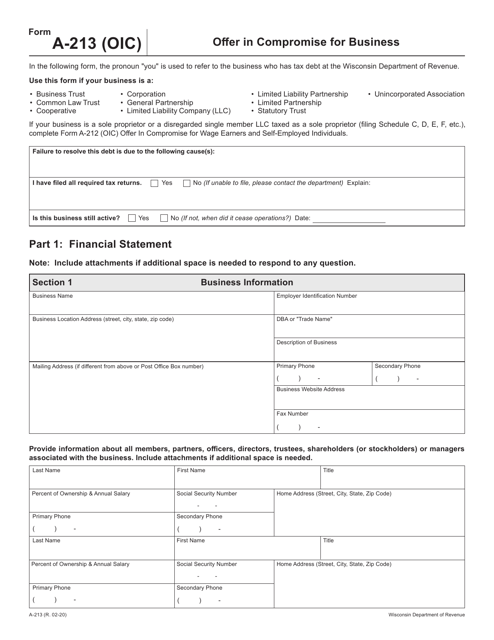

This form is used for making an offer in compromise for a business located in Wisconsin.

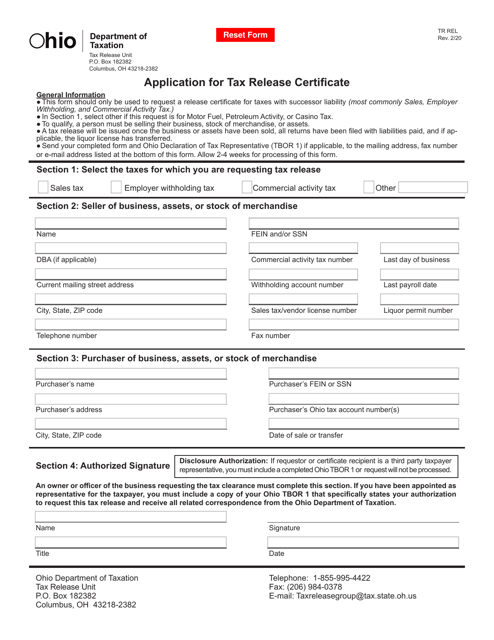

This form is used for acquiring a tax release certificate in Ohio. It helps individuals to request the release of their tax liabilities.

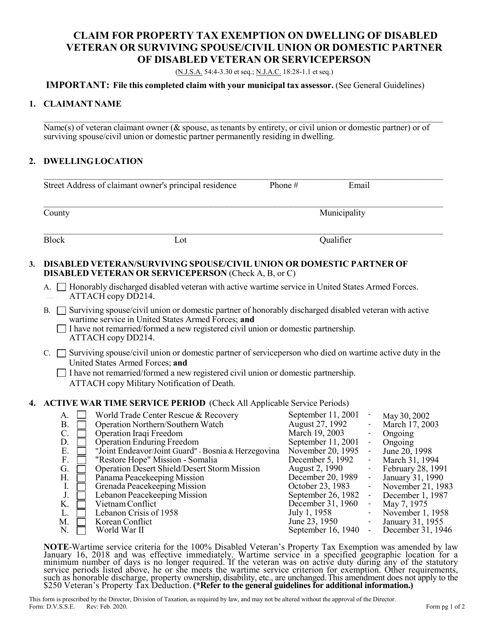

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

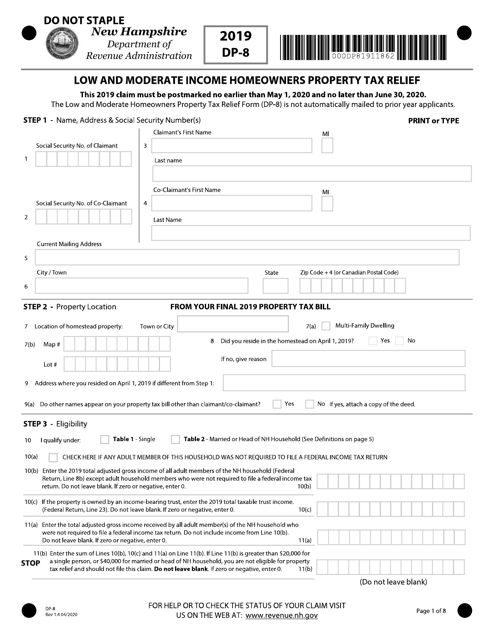

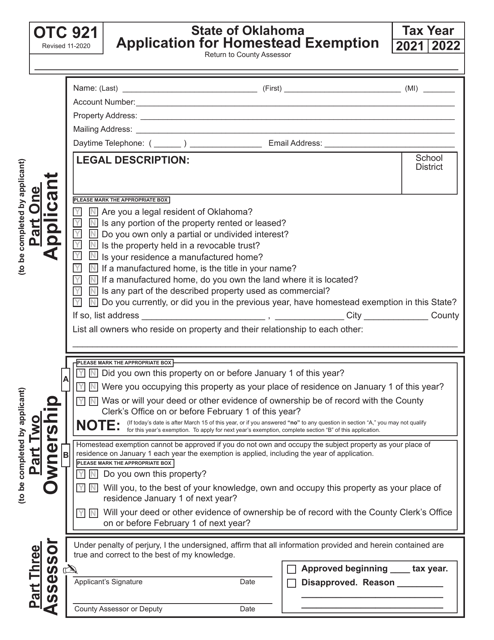

This form is used for applying for low and moderate income homeowners property tax relief in the state of New Hampshire.

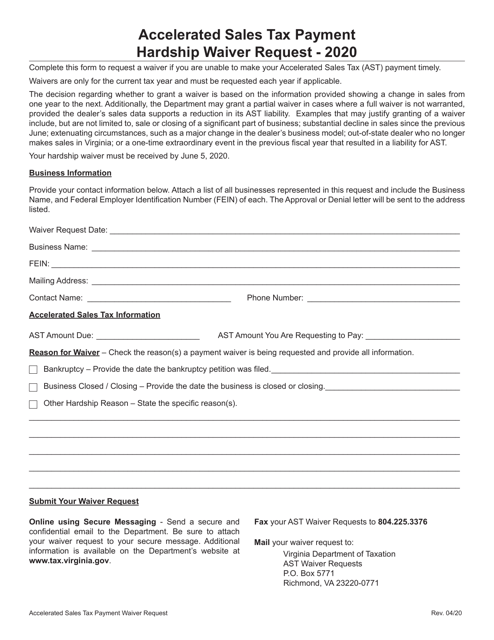

This form is used in Virginia to request a hardship waiver for the accelerated sales tax payment. It is meant for individuals or businesses facing financial difficulties that make it difficult to make the tax payment on time.

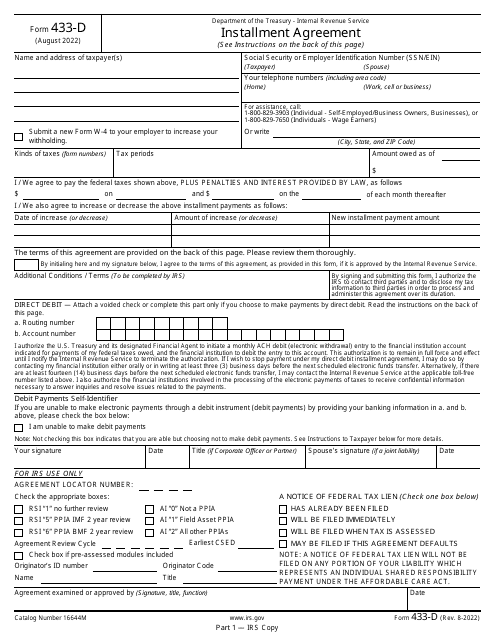

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

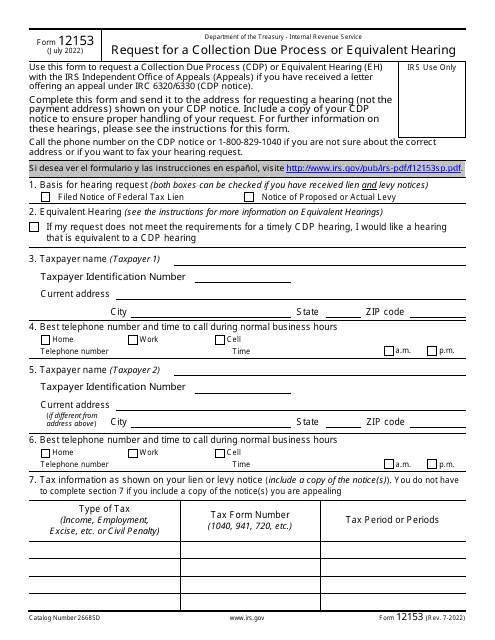

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

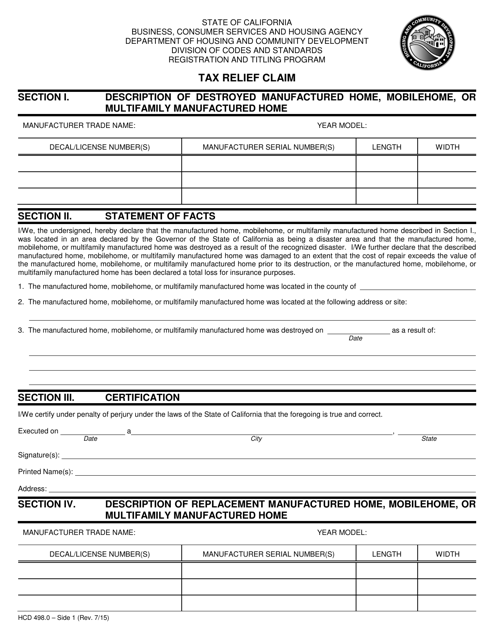

This form is used for claiming tax relief in the state of California.

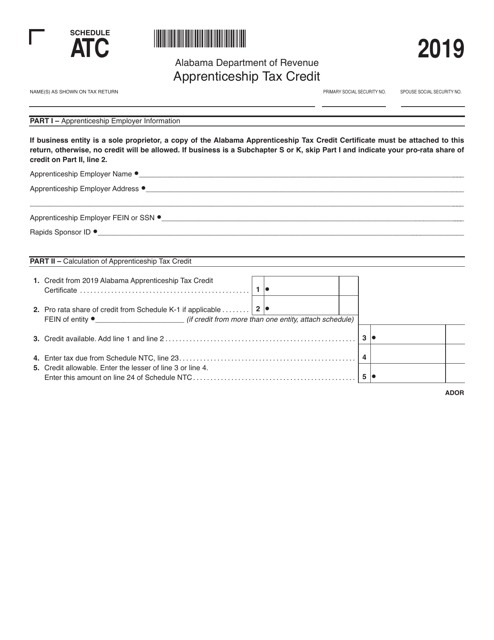

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

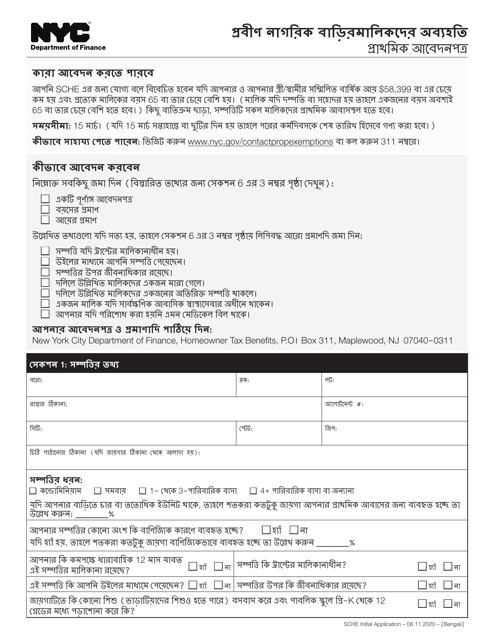

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

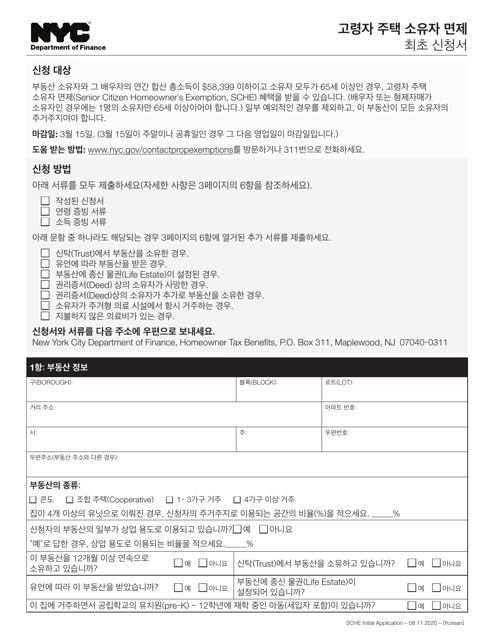

This document is for senior citizens in New York City who want to apply for the initial homeowners' exemption. It is available in Korean.

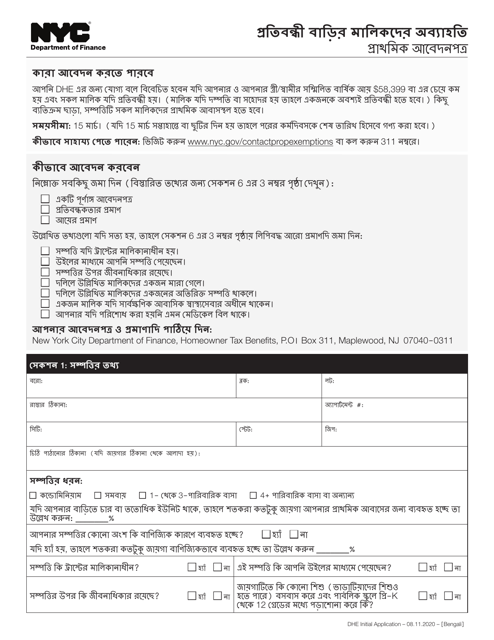

This document is for disabled homeowners in New York City who want to apply for an initial exemption. It is available in Bengali.

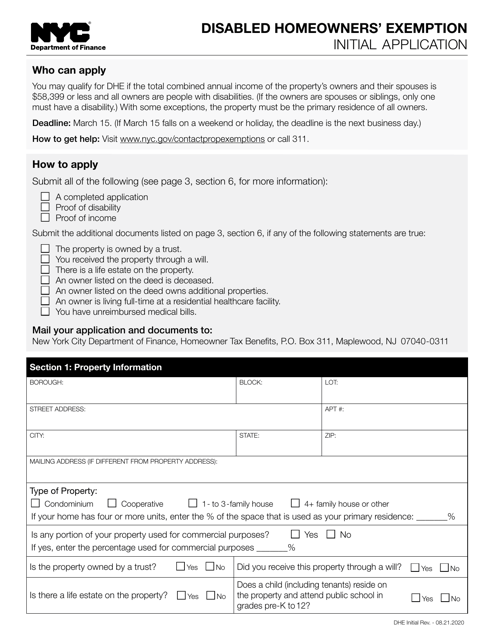

This document is for disabled homeowners in New York City who are applying for the initial exemption.