Tax Relief Form Templates

Documents:

240

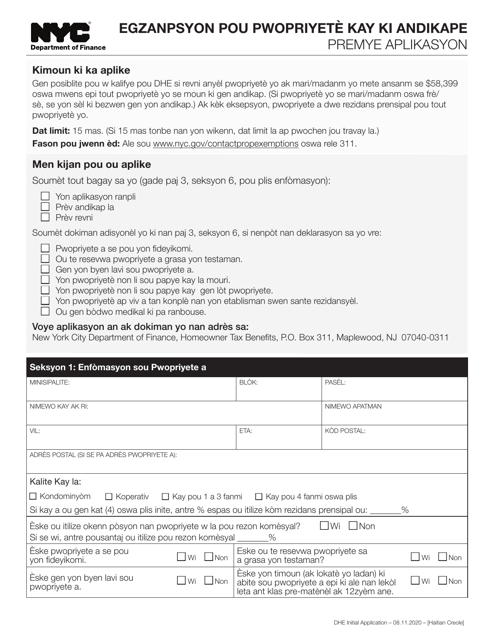

This type of document is used for disabled homeowners in New York City who are applying for the initial exemption. It is available in Haitian Creole language.

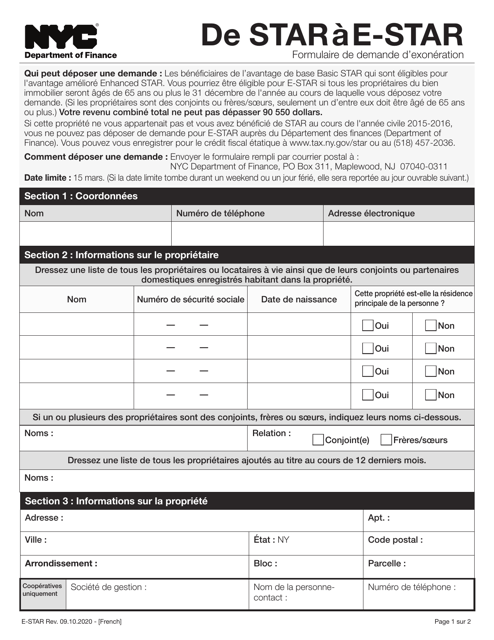

This document is for applying for the Star to E-Star exemption in New York City. It is available in French.

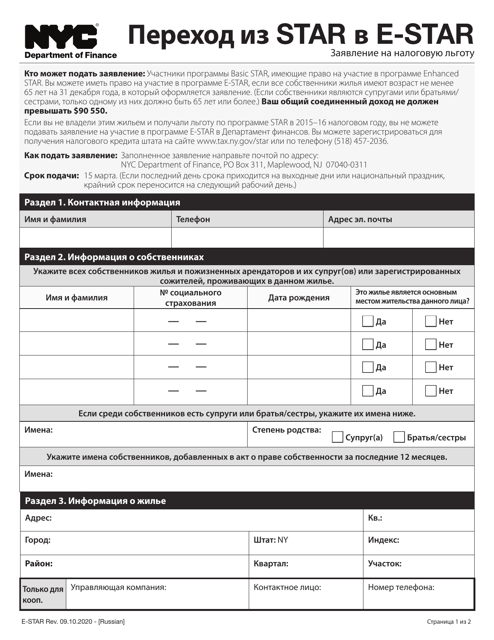

This document is an application for the Star to E-Star exemption in New York City, written in Russian.

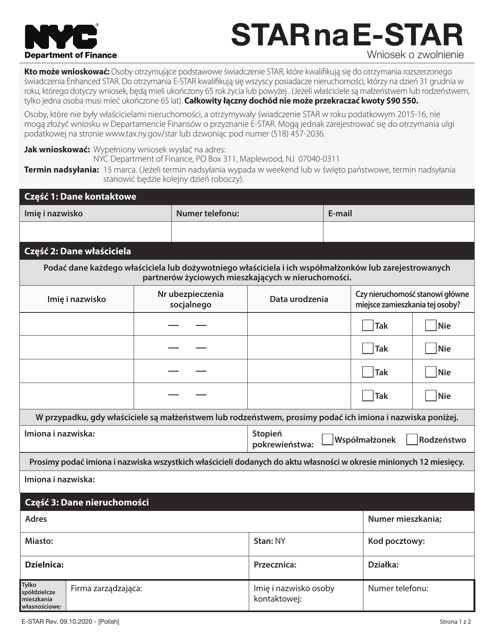

This Form is used for applying for the Star to E-Star Exemption in New York City for Polish-speaking residents.

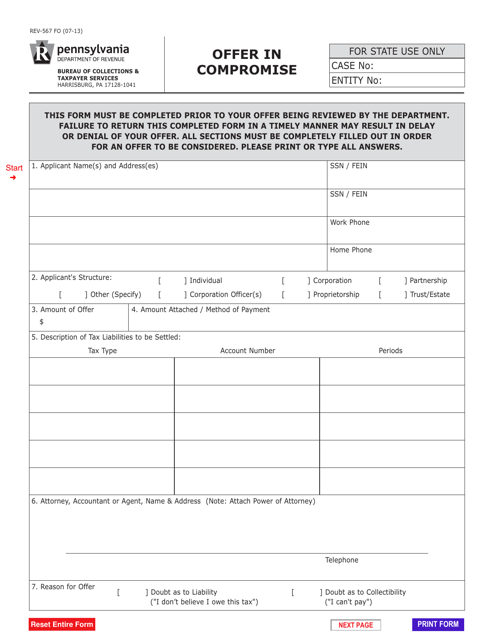

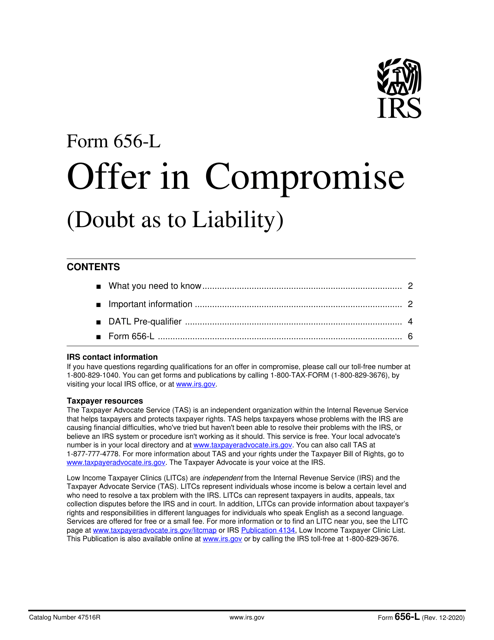

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

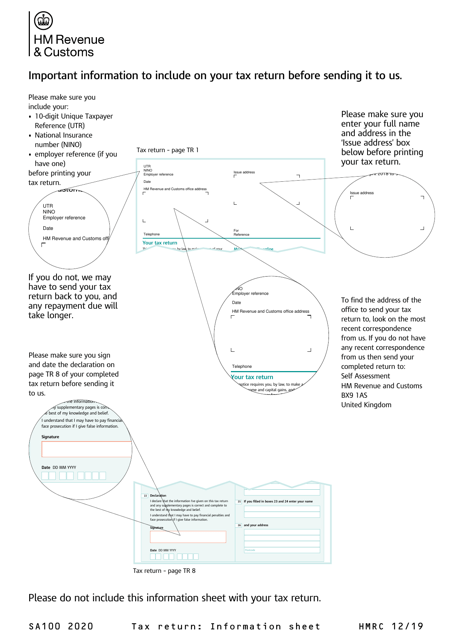

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.

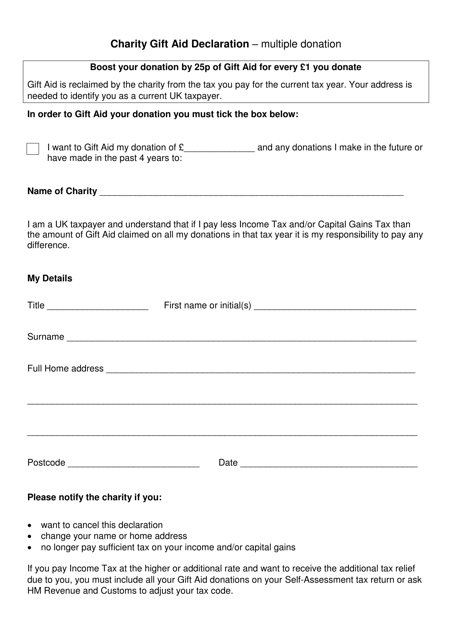

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

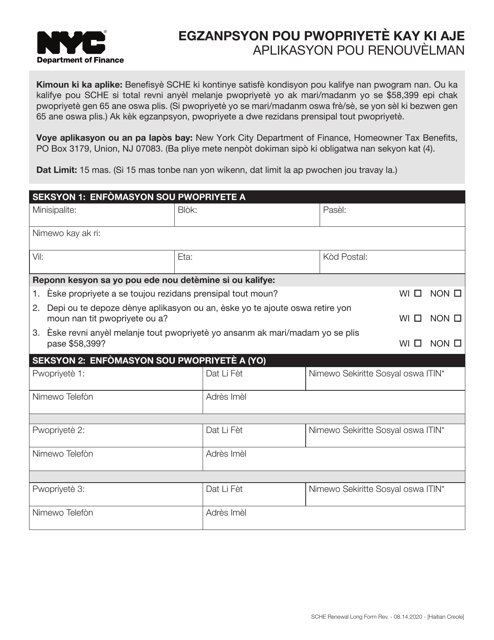

This Form is used for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Haitian Creole language.

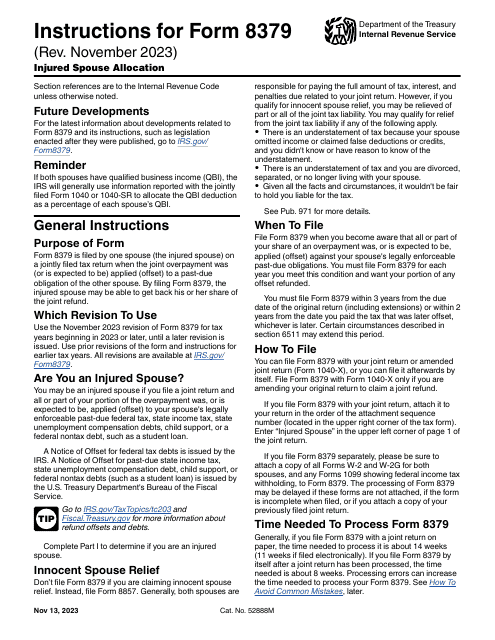

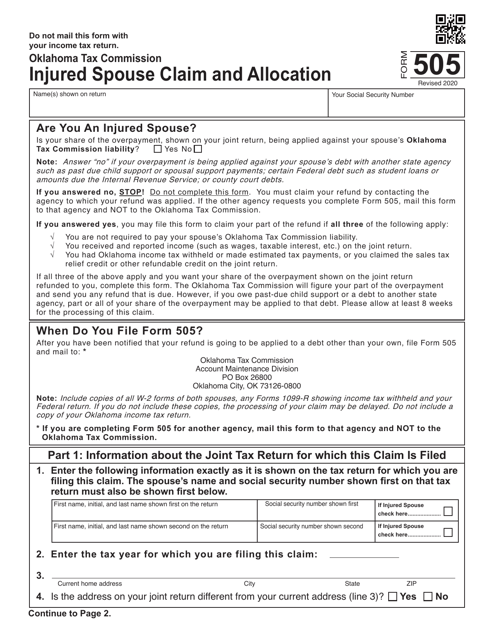

This Form is used for Oklahoma residents who are filing an injured spouse claim and allocation.

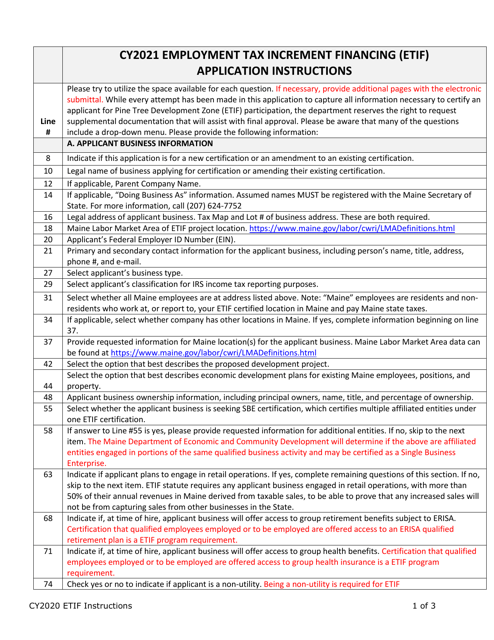

This form is used for applying for the Employment Tax Increment Financing (ETIF) Program Business Certification in Maine. It provides instructions and guidelines for businesses to complete the application process.

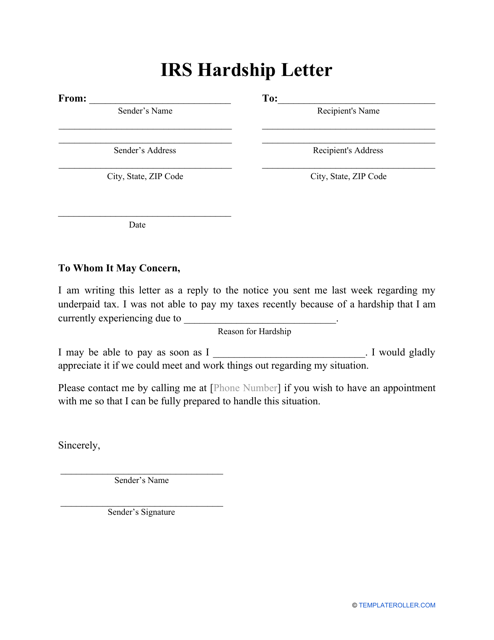

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

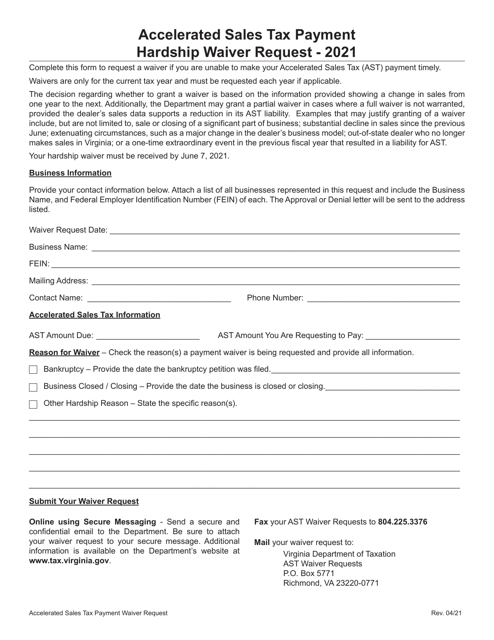

This document is a request to waive the hardship requirement for accelerated sales tax payment in Virginia.

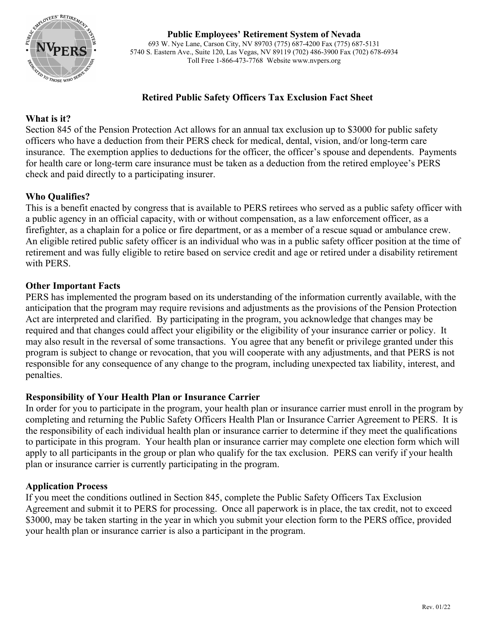

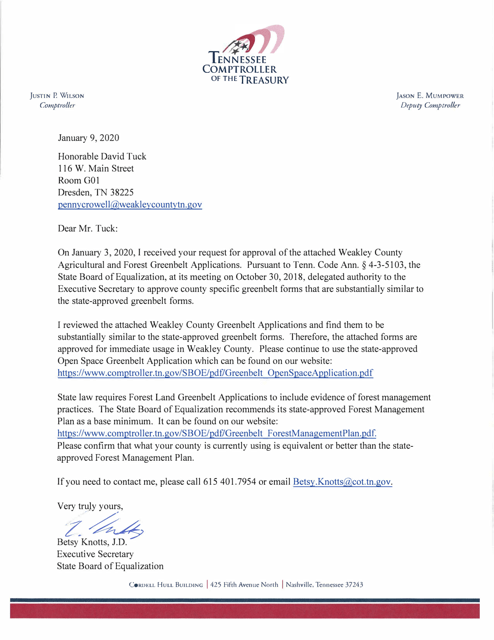

This document is for applying for a Greenbelt assessment in Weakley County, Tennessee. Greenbelt assessment is a program that aims to provide property tax relief for landowners who maintain their land in agricultural or forestry use. This application allows landowners to be considered for reduced property taxes based on the greenbelt assessment criteria.

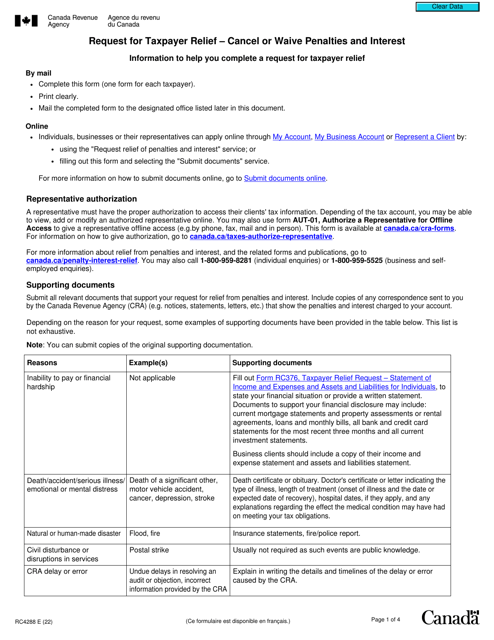

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

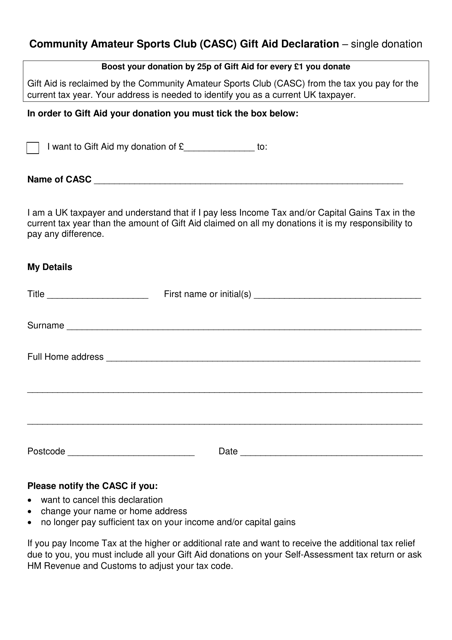

This document is a gift aid declaration specifically for single donations made to a Community Amateur Sports Club (CASC) in the United Kingdom. It enables the CASC to claim gift aid on the donation, which provides financial benefits to the club.

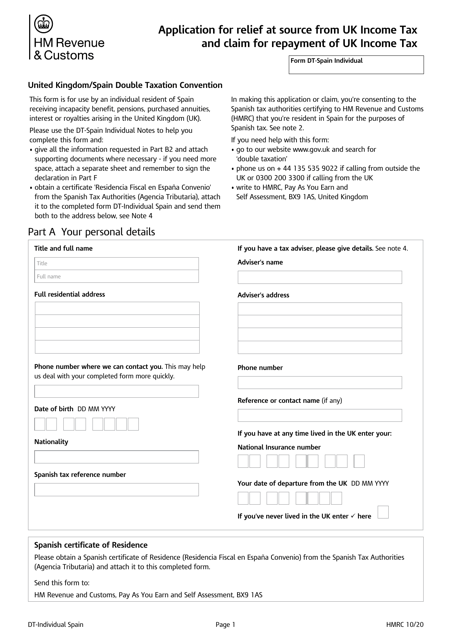

This form is used by individuals residing in Spain to apply for relief at source from UK income tax and claim for repayment of UK income tax.

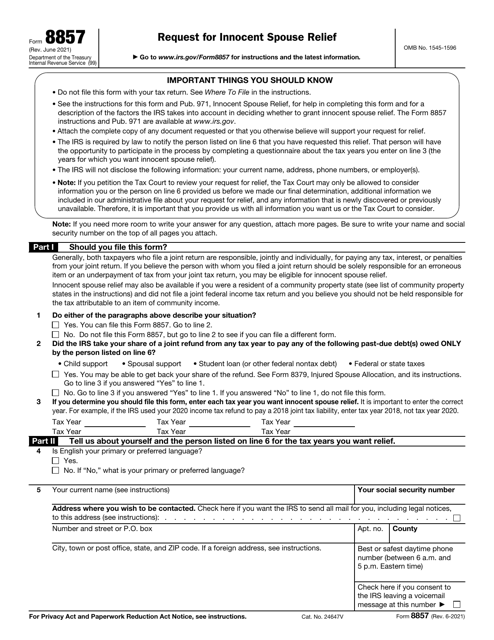

This Form is used for requesting Innocent Spouse Relief from the Internal Revenue Service (IRS). It is intended for individuals who believe they should not be held responsible for the tax liability owed by their spouse or former spouse.

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.