Tax Relief Form Templates

Documents:

240

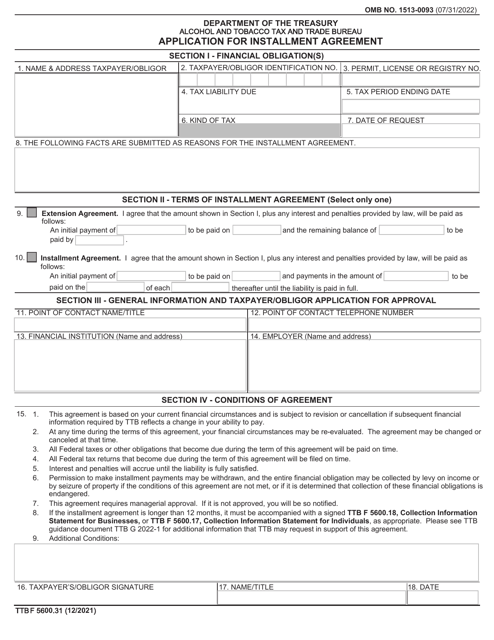

This Form is used for applying for an installment agreement with the Alcohol and Tobacco Tax and Trade Bureau (TTB). It is for businesses that owe excise taxes on alcohol, tobacco, and firearms and need to make payments in smaller, manageable installments.

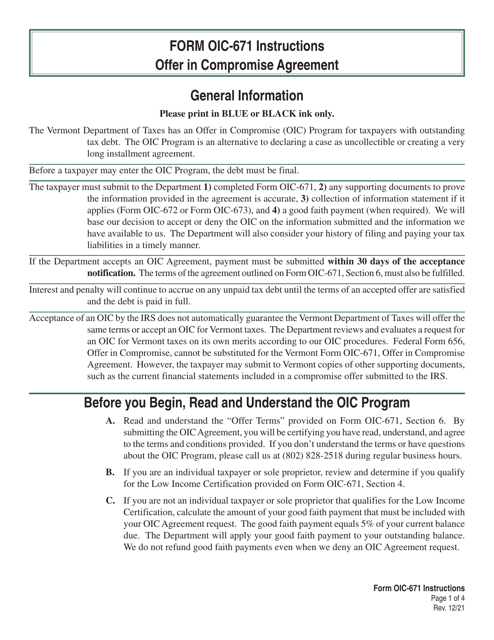

This Form is used for submitting an Offer in Compromise Agreement in the state of Vermont. It is a document that allows taxpayers to propose a settlement amount to the Vermont Department of Taxes in order to resolve their tax debt.

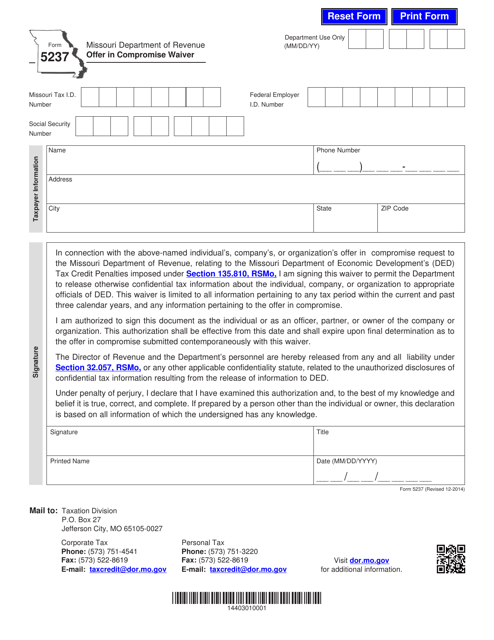

This form is used for applying for an offer in compromise waiver in the state of Missouri.

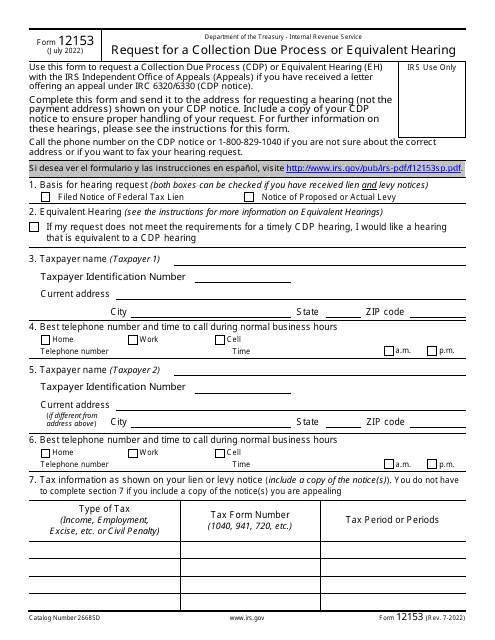

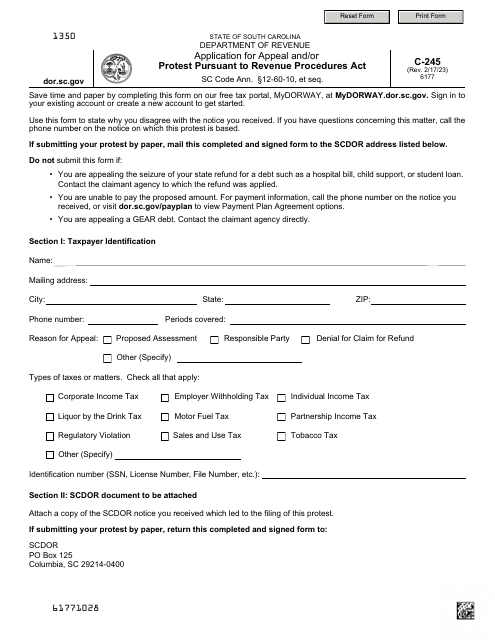

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

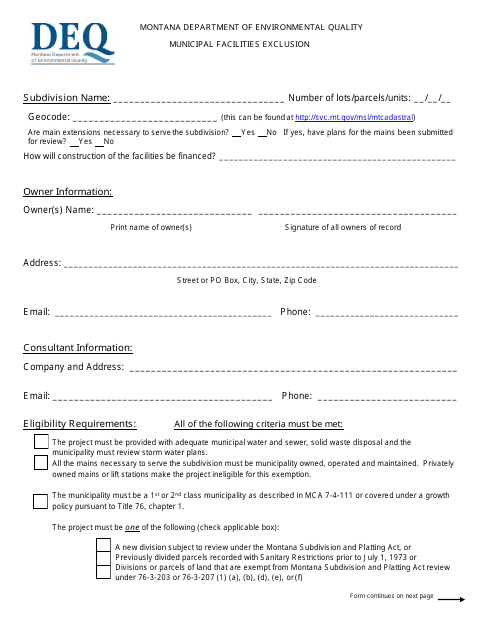

This document provides information about the Municipal Facilities Exclusion in Montana.

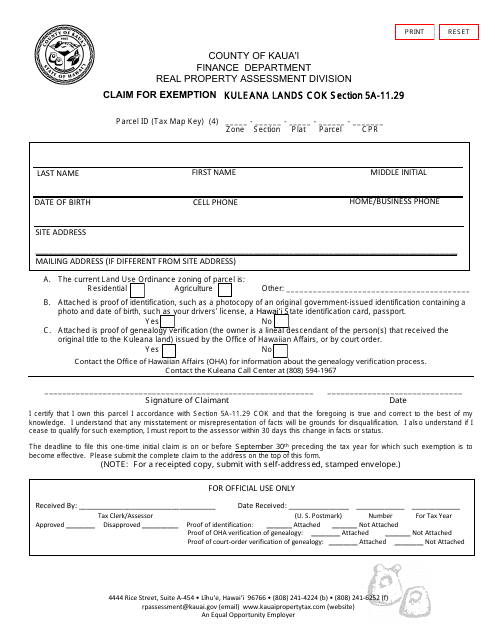

This document is used for claiming exemption for Kuleana Lands Cok Section 5a-11.29 in the County of Kauai, Hawaii.

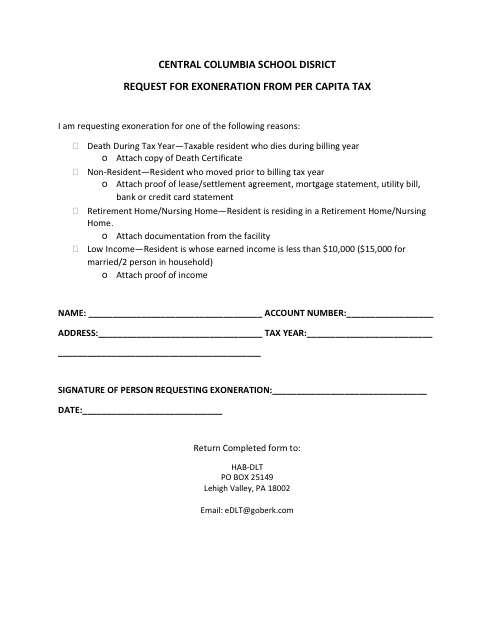

This document is a Request for Exoneration From Per Capita Tax specific to the Central Columbia School District in Pennsylvania. It is used by residents in the school district to request an exemption from paying the per capita tax.

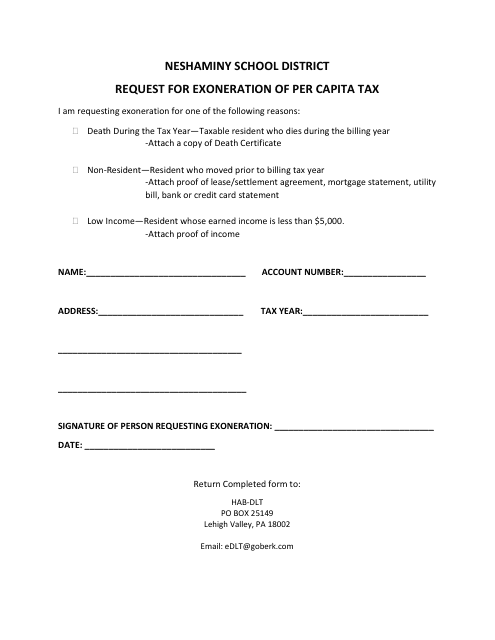

This document is a request to be exempted from paying the per capita tax in the Neshaminy School District in Pennsylvania.

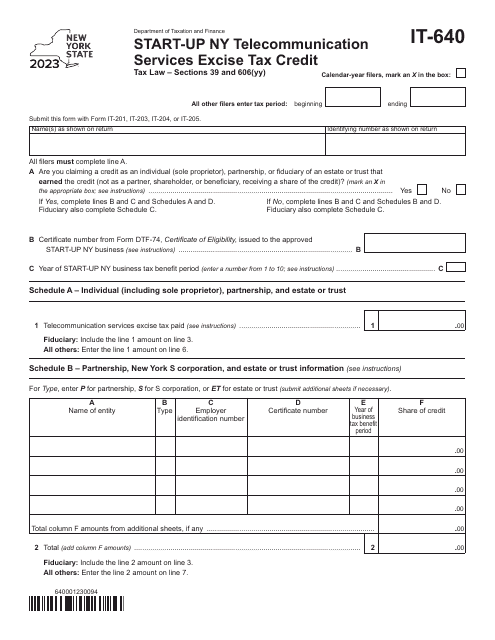

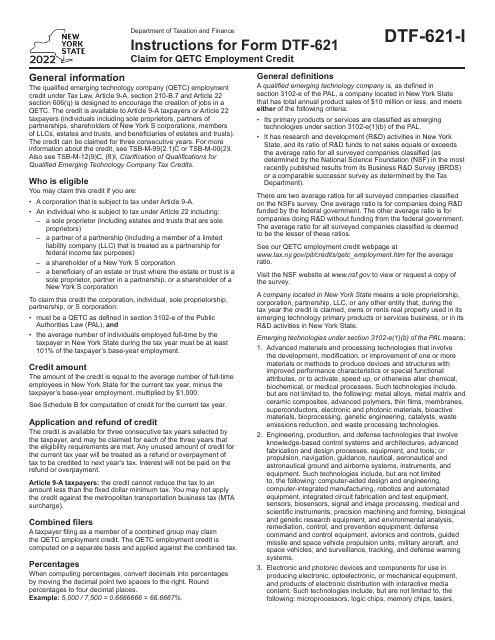

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.

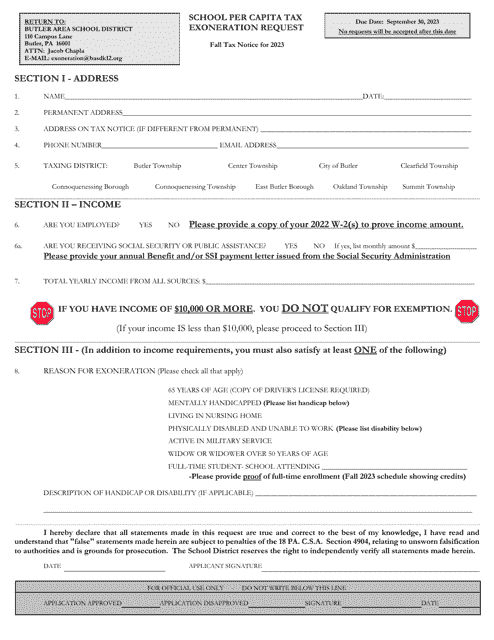

This document is a Per Capita Tax Exoneration Request for the Butler Area School District located in Pennsylvania.

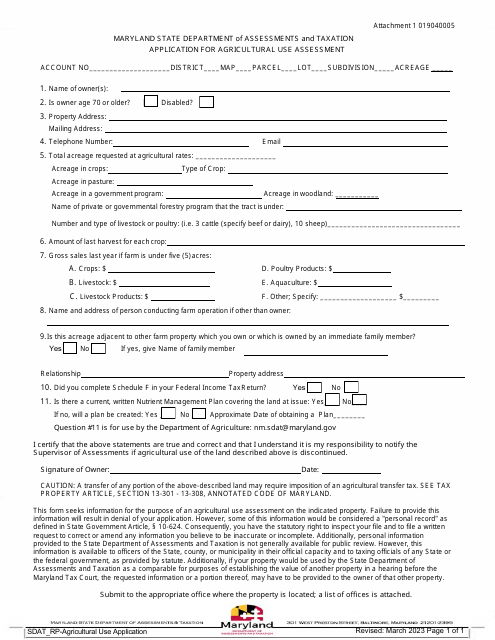

This document is used for applying for agricultural use assessment in the state of Maryland.

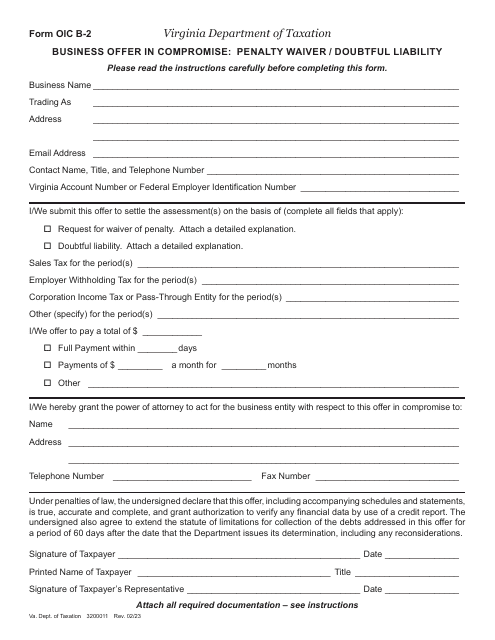

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.