Tax Refund Form Templates

Documents:

569

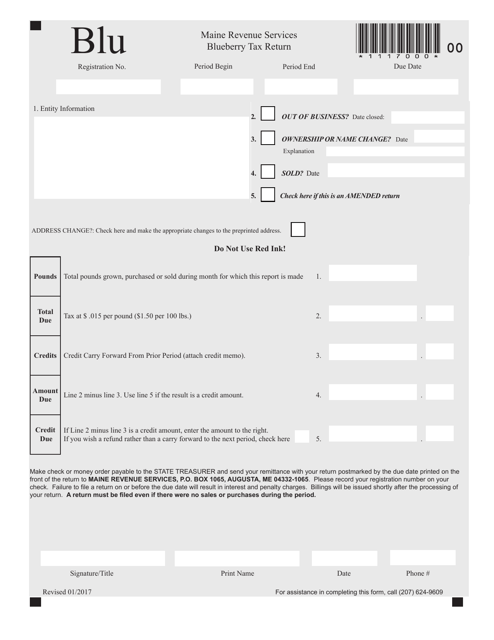

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

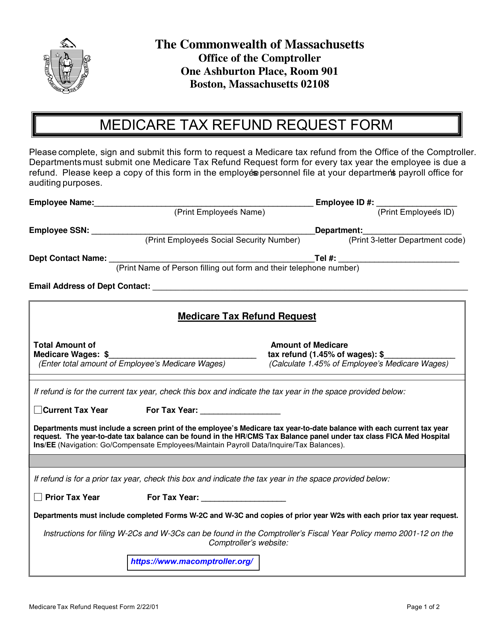

This form is used for requesting a refund of Medicare taxes paid to the state of Massachusetts.

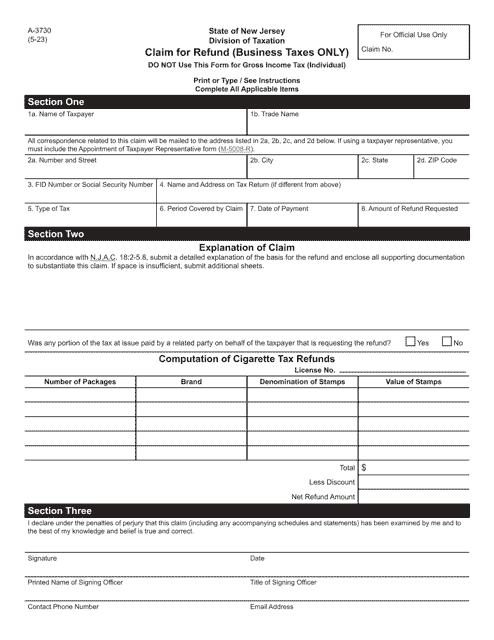

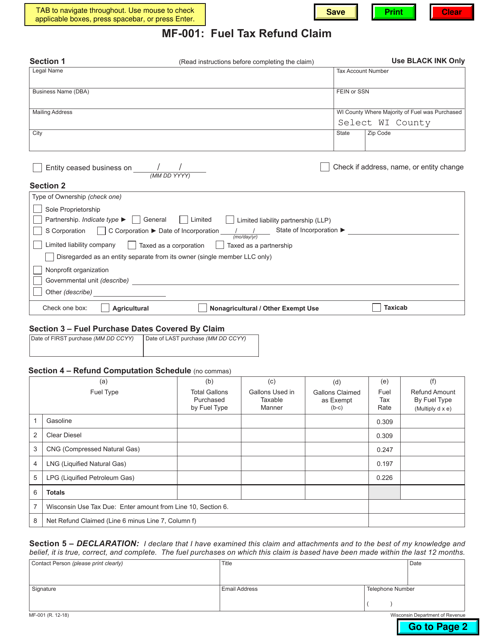

This Form is used for requesting a tax refund or adjustment in the state of Virginia.

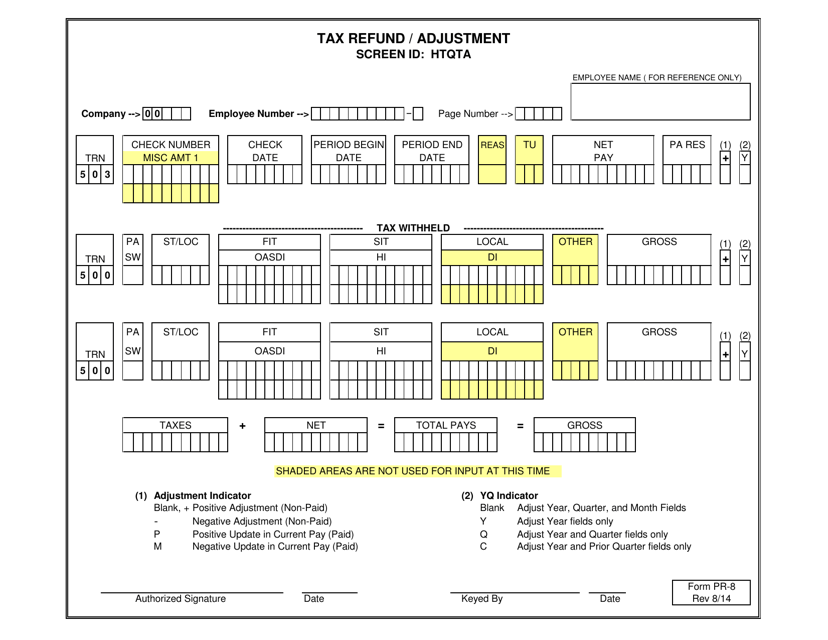

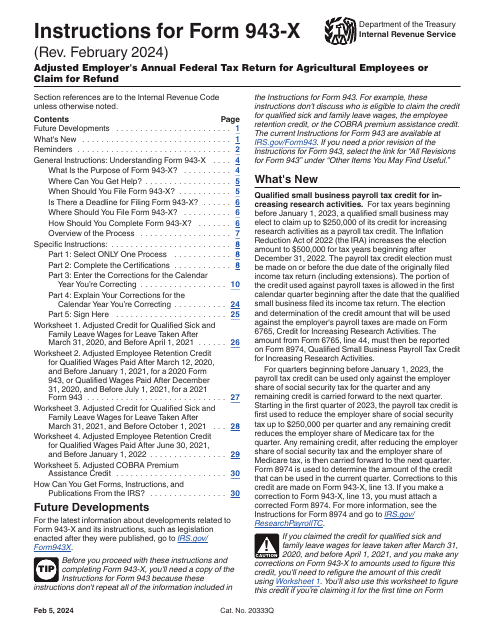

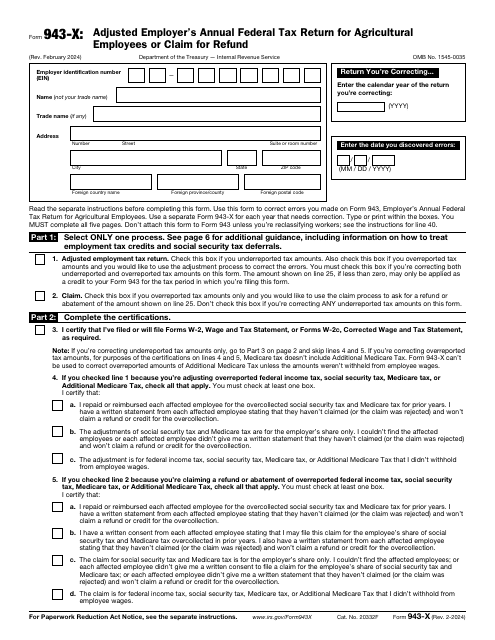

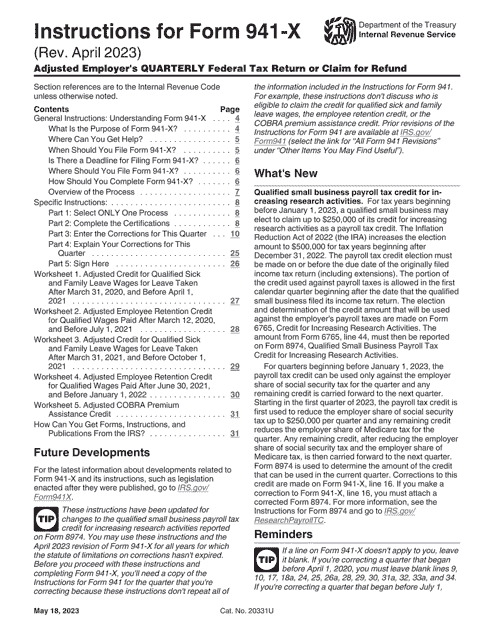

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

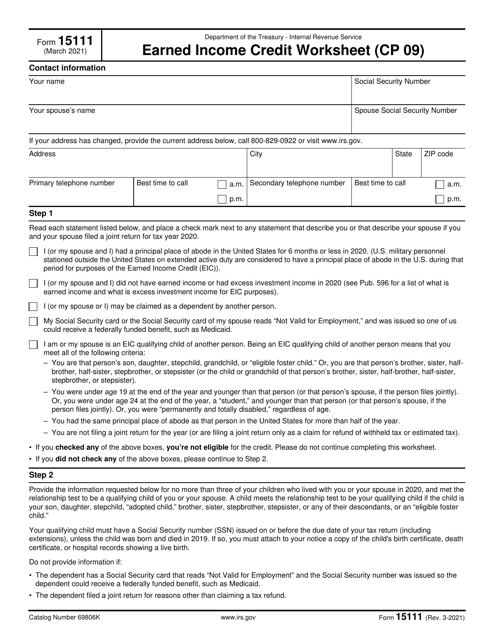

This form is used to calculate the Earned Income Credit for eligible taxpayers.

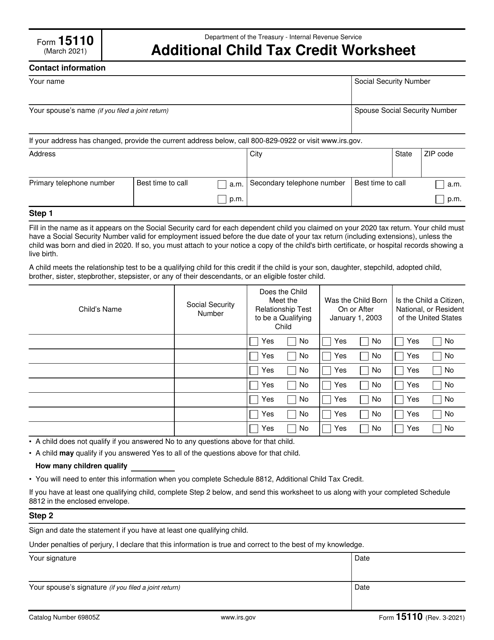

This form is used for calculating the additional child tax credit.

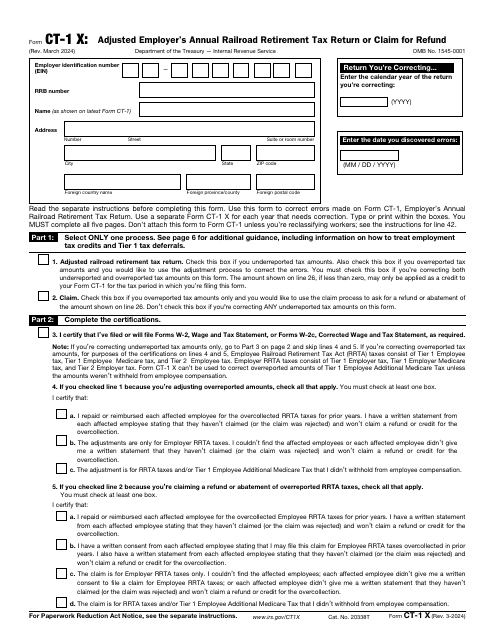

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

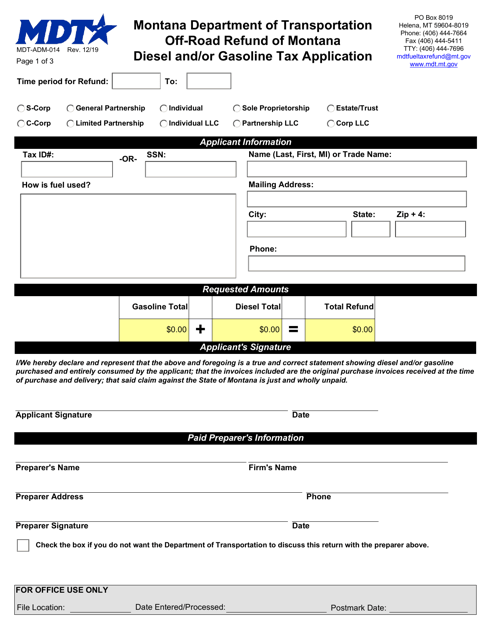

This form is used for applying for a refund of Montana diesel and/or gasoline tax for off-road use.

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

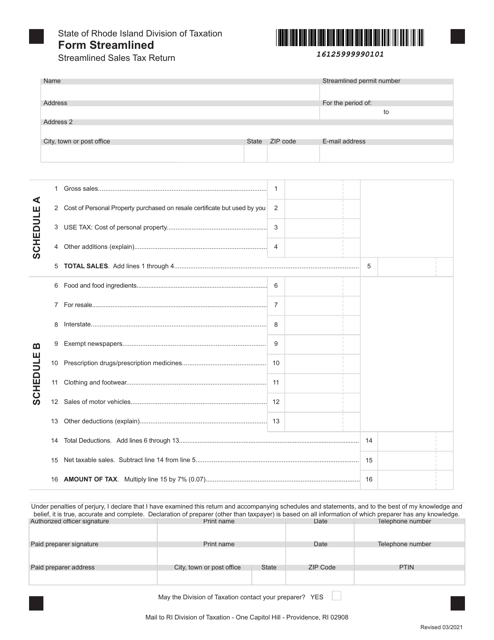

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

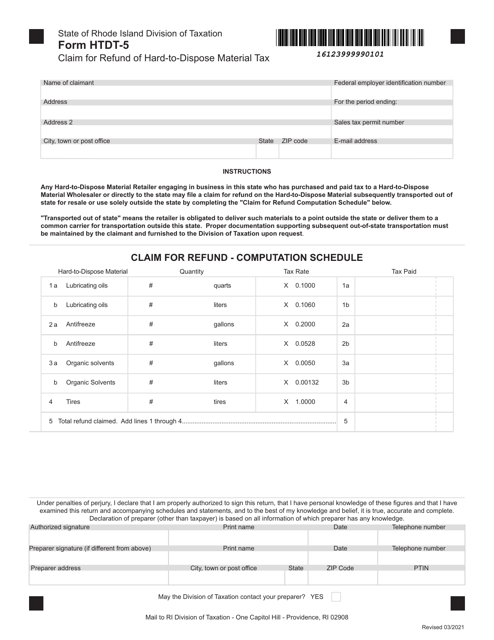

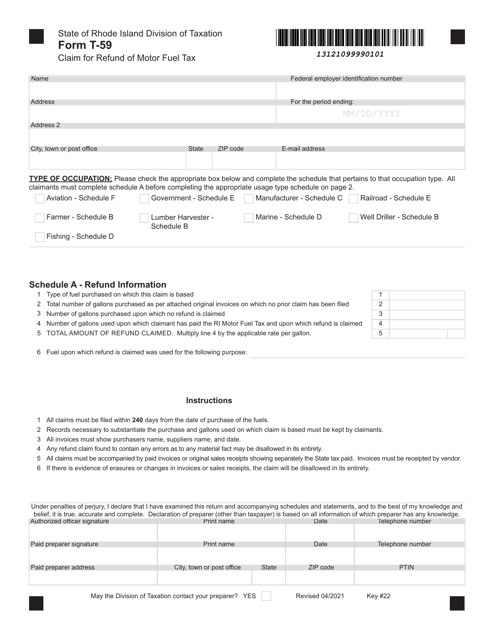

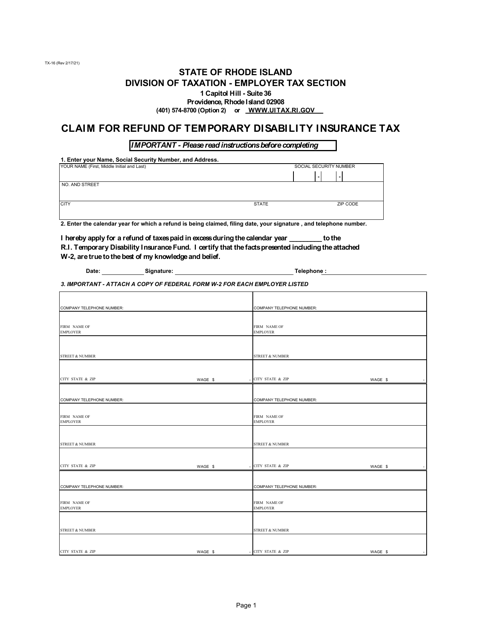

This form is used for claiming a refund of temporary disability insurance tax paid in Rhode Island.

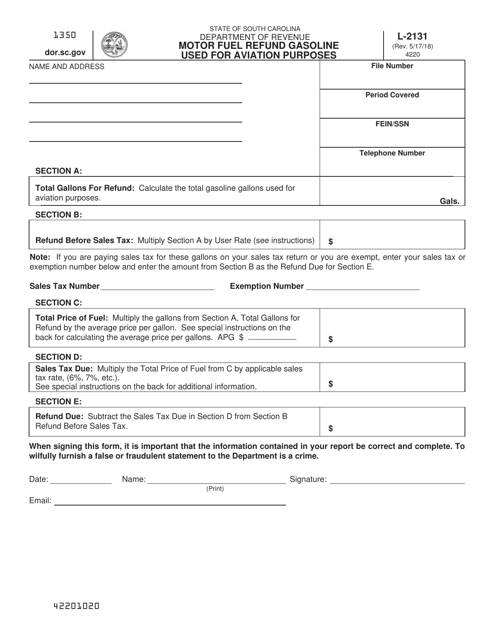

This form is used for claiming a refund for gasoline used for aviation purposes in South Carolina.

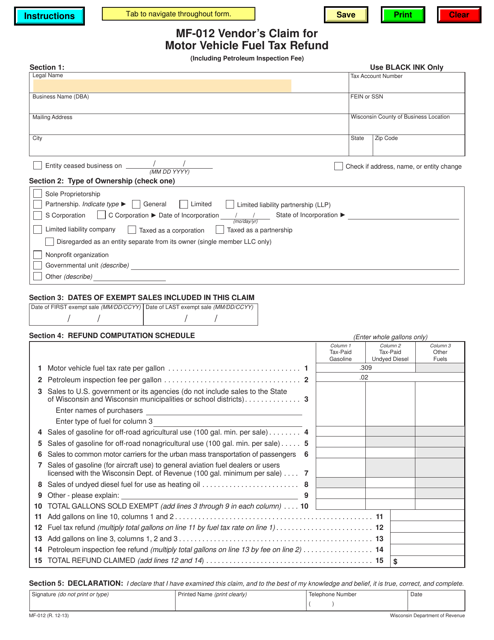

This Form is used for vendors in Wisconsin to claim a refund on motor vehicle fuel tax.

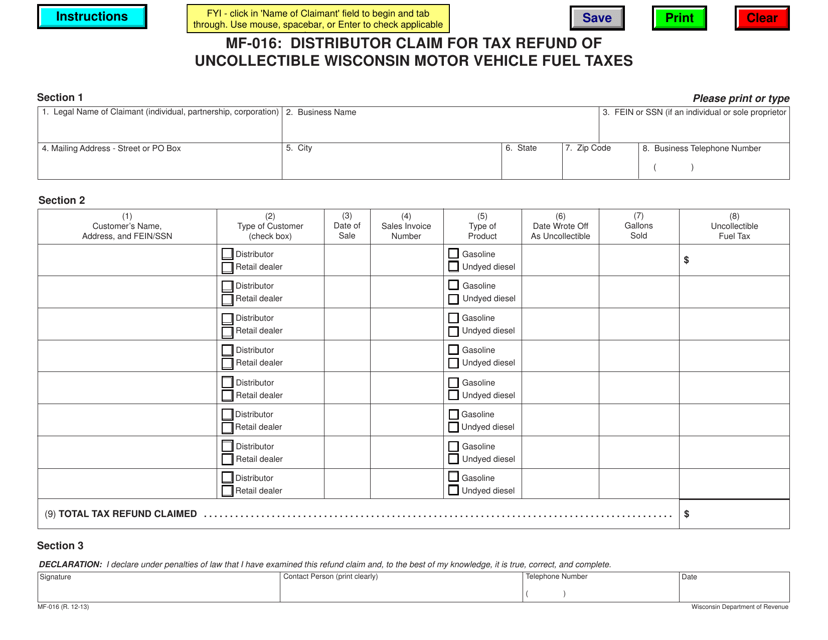

This form is used for distributors in Wisconsin to claim a tax refund for uncollectible motor vehicle fuel taxes.

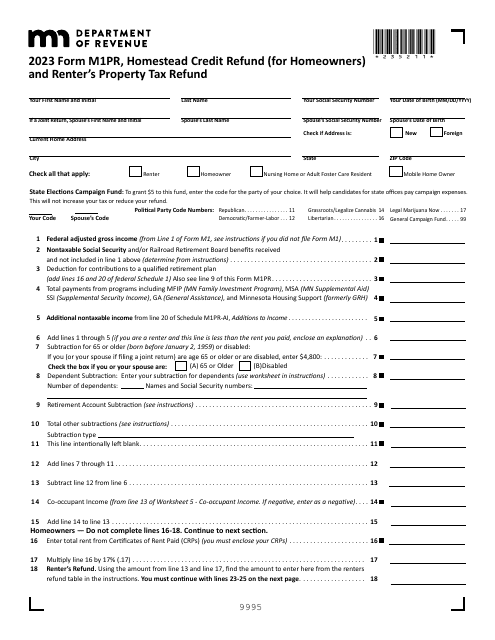

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.

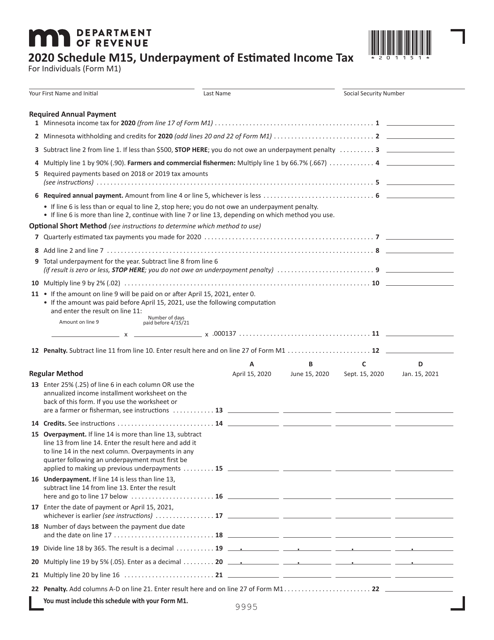

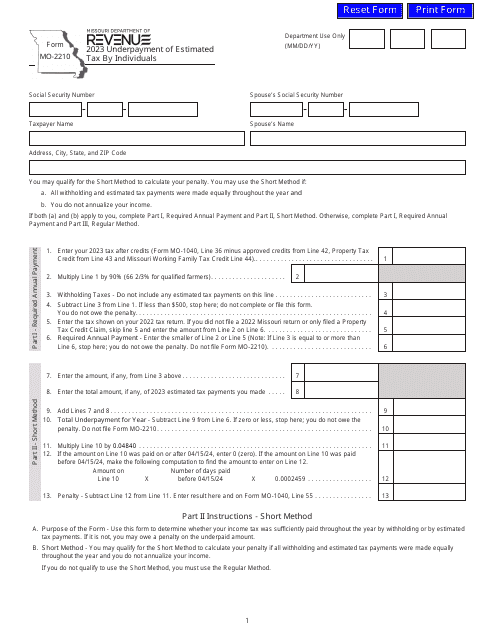

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

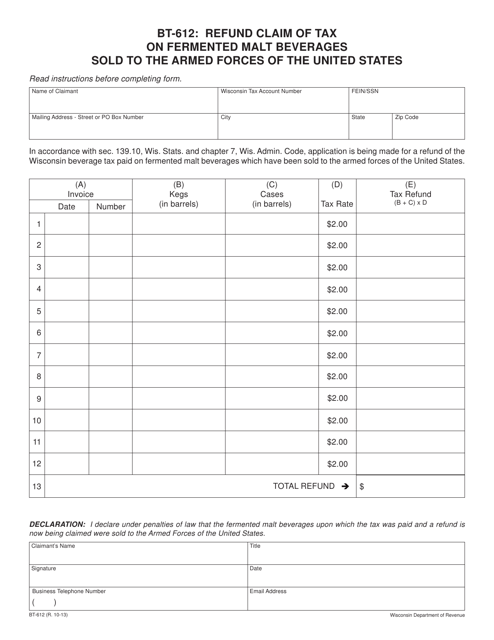

This Form is used for claiming a refund of tax on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

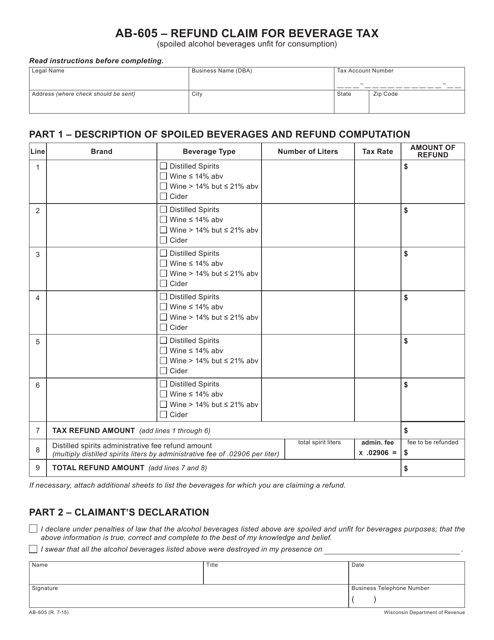

This form is used for claiming a refund of beverage tax in the state of Wisconsin.

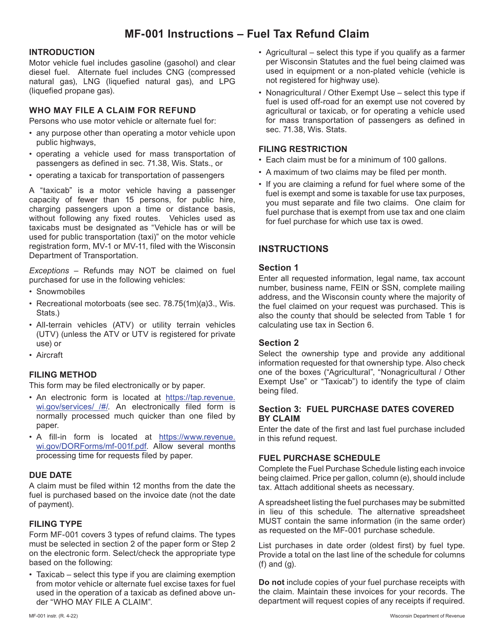

This form is used for claiming a refund on fuel taxes paid in the state of Wisconsin.

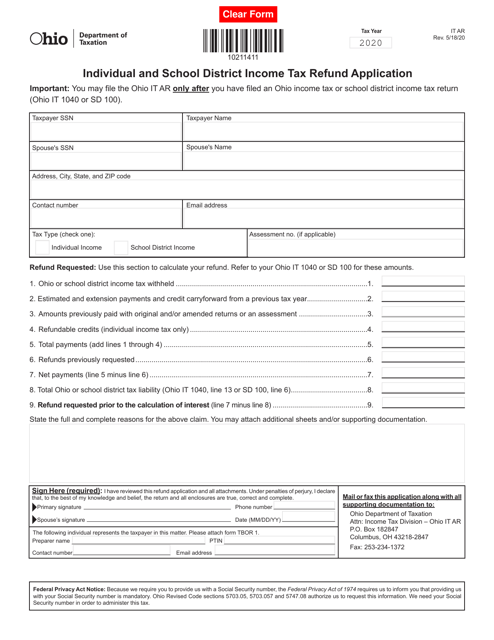

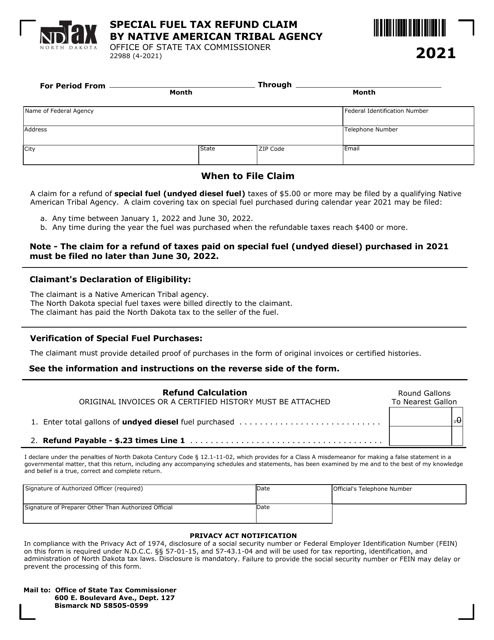

This form is used by Native American tribal agencies in North Dakota to claim a refund on special fuel taxes.

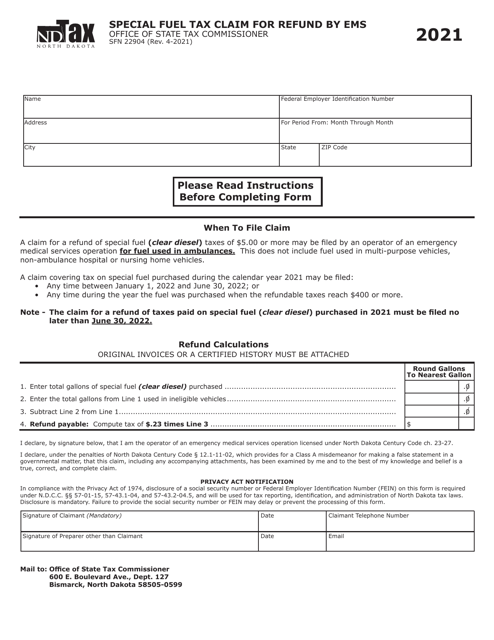

This form is used for claiming a refund of special fuel tax paid by EMS (Emergency Medical Services) in North Dakota.