Tax Refund Form Templates

Documents:

569

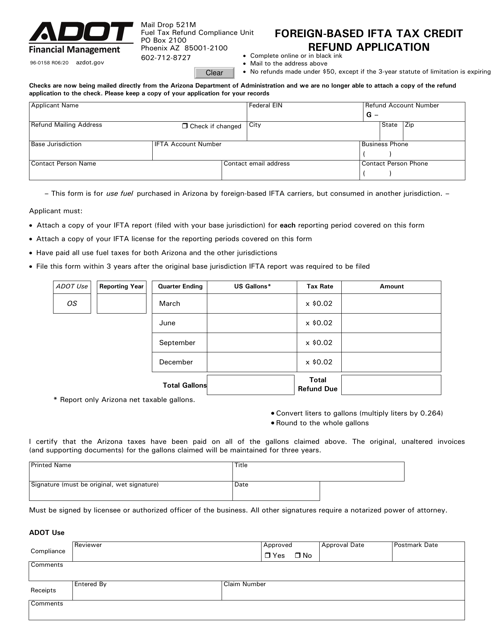

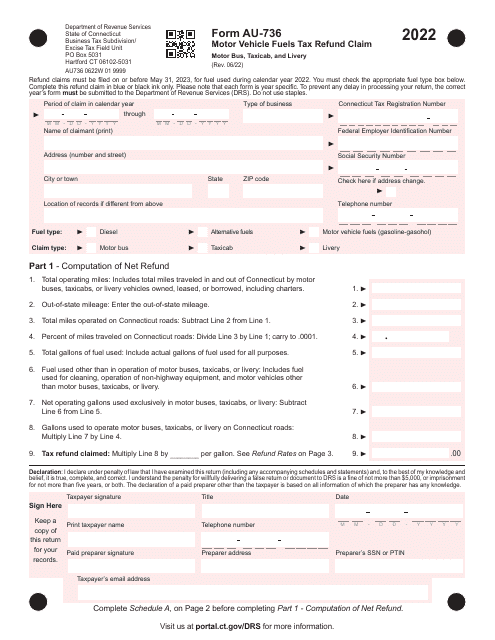

This form is used for foreign-based IFTA tax credit refund application in the state of Arizona.

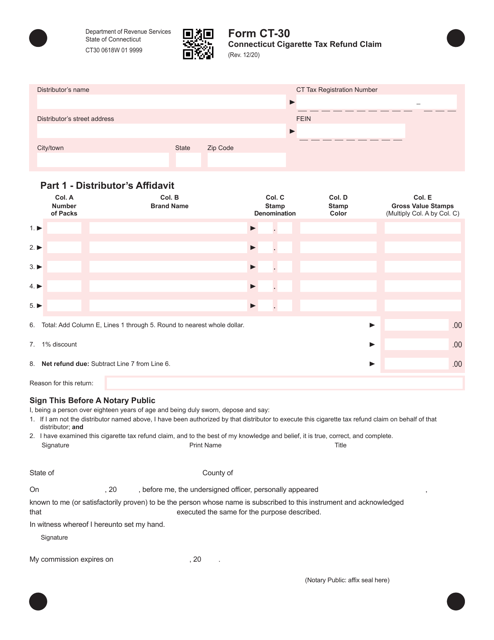

This form is used for claiming a refund of cigarette taxes paid in the state of Connecticut.

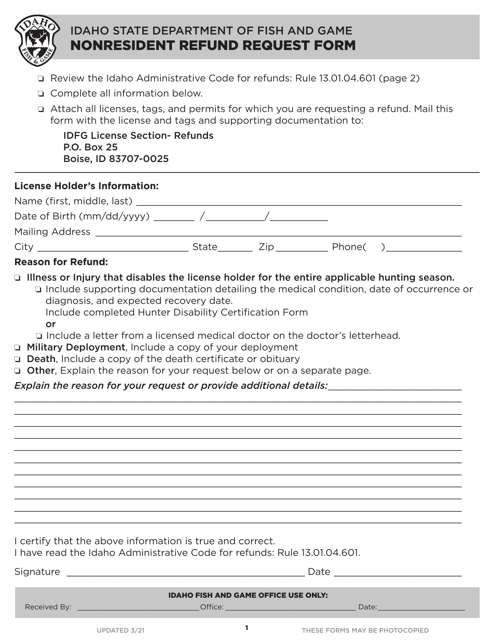

This form is used for nonresidents to request a refund in the state of Idaho.

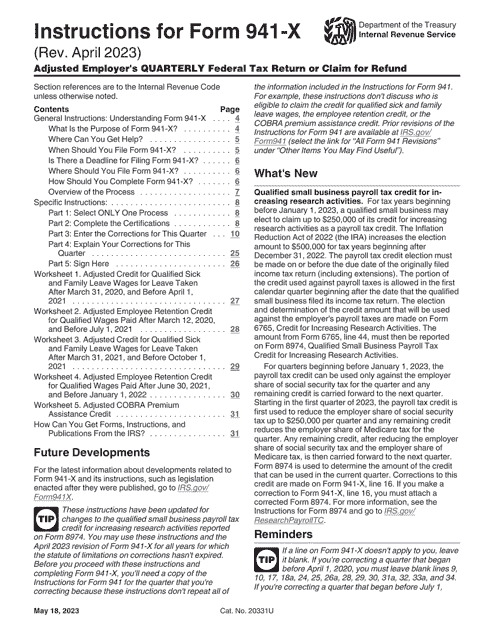

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

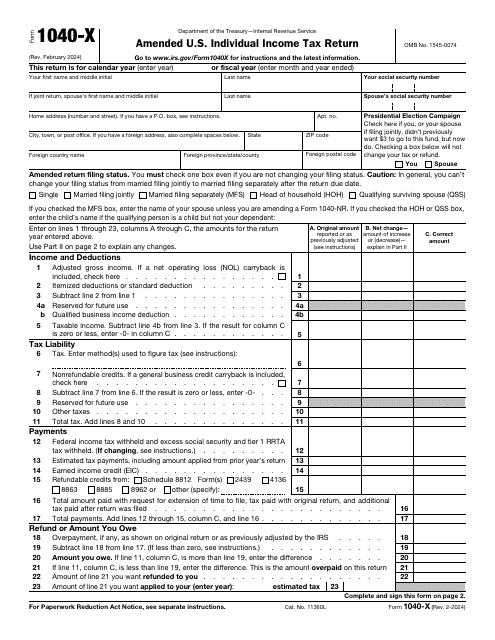

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

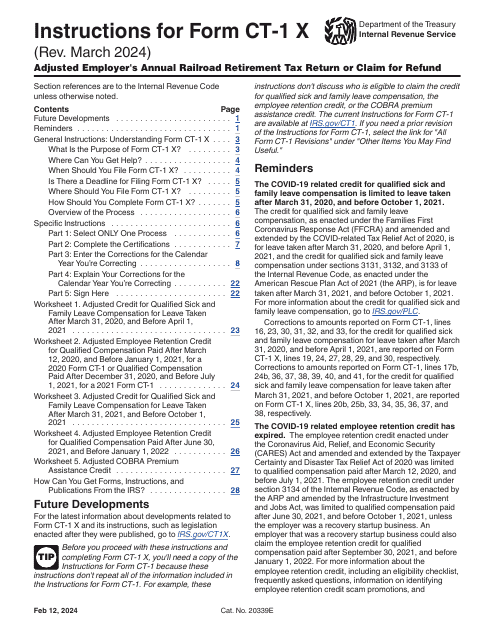

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

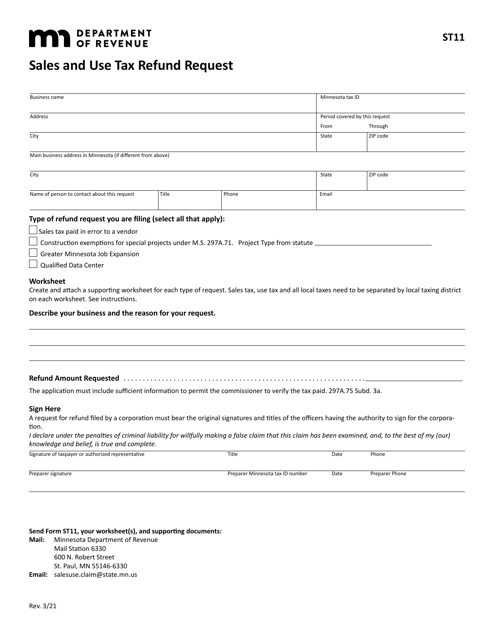

This form is used for requesting a refund of sales and use tax in the state of Minnesota.

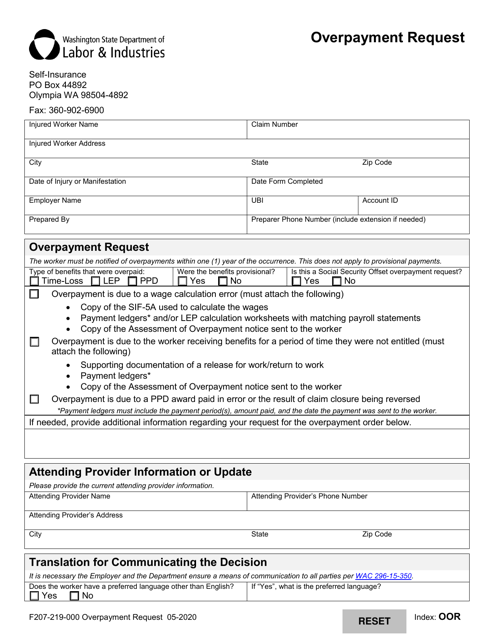

This Form is used for requesting overpayment refunds in Washington state.

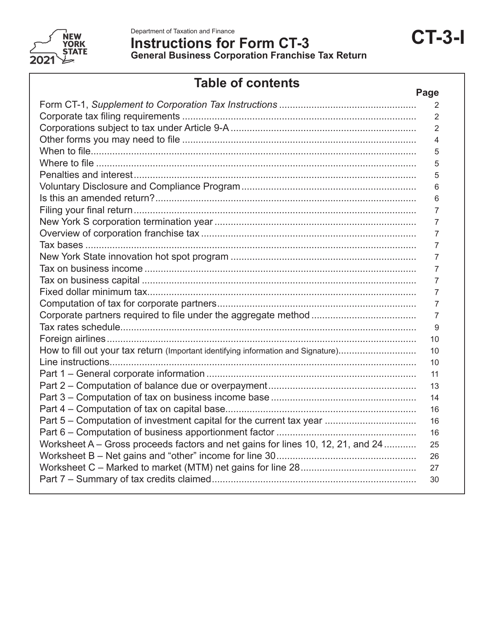

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

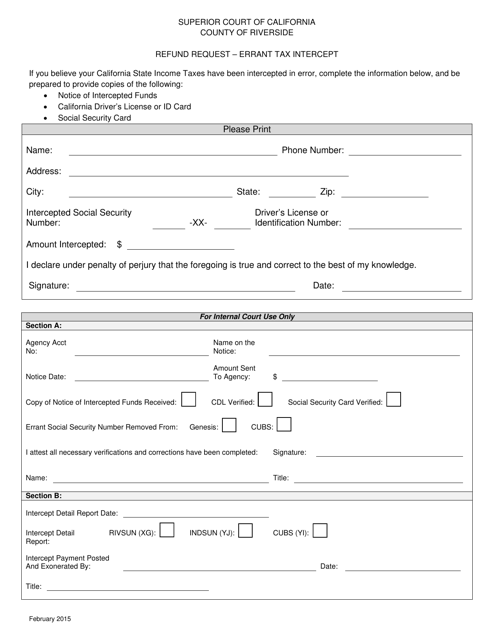

This document is used for submitting a refund request for an erroneous tax intercept in Riverside County, California.

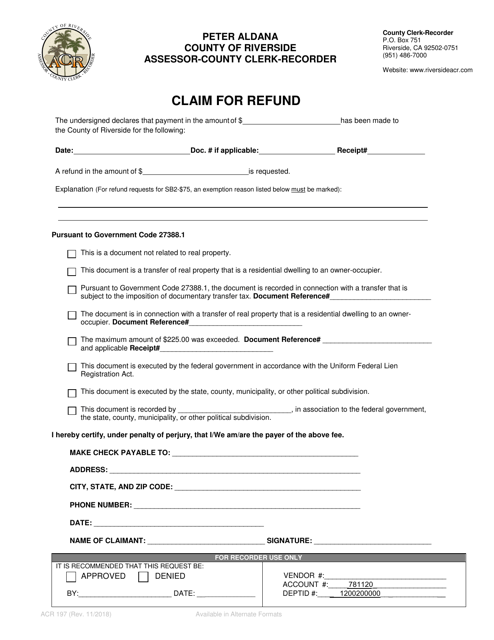

This document is used for claiming a refund in the County of Riverside, California.

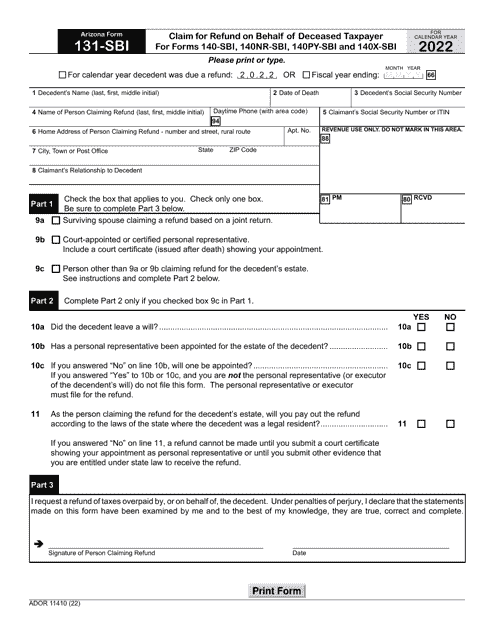

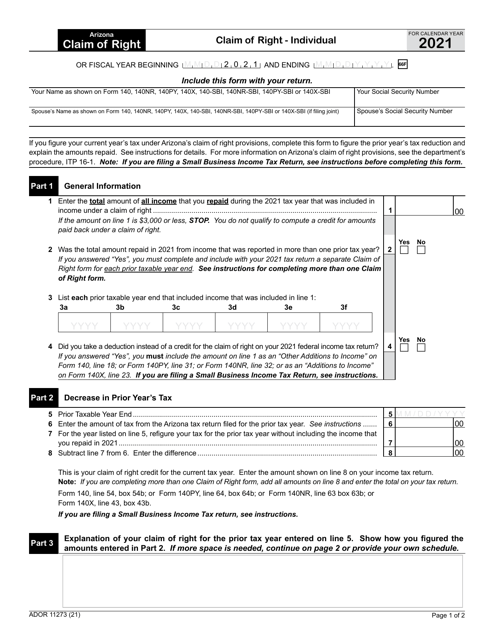

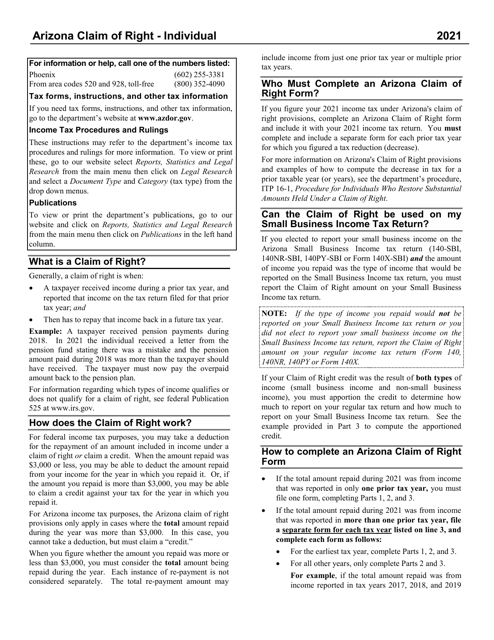

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

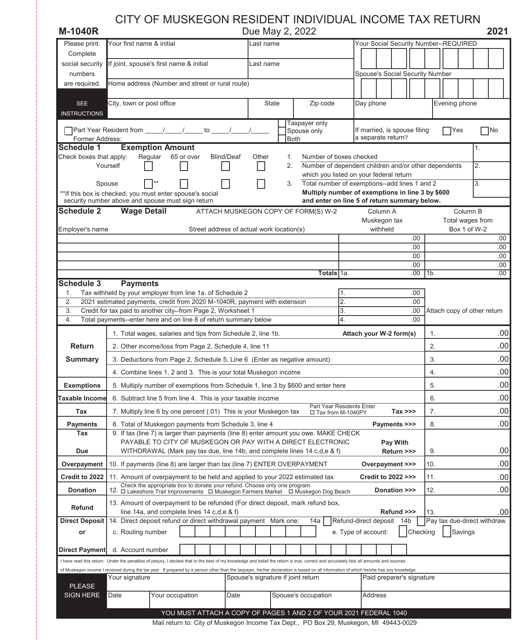

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.