Tax Refund Form Templates

Documents:

569

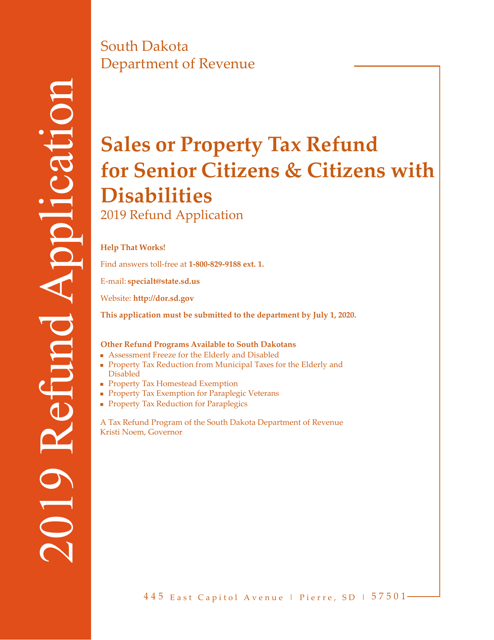

This document for senior citizens and citizens with disabilities in South Dakota who want to claim a refund for sales or property tax.

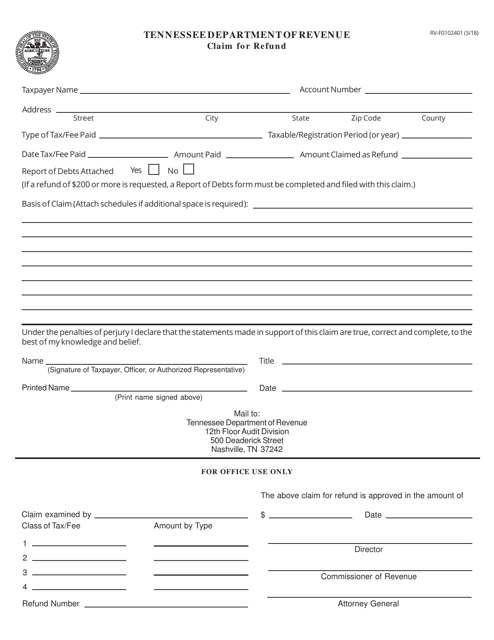

This form is used for claiming a refund in the state of Tennessee.

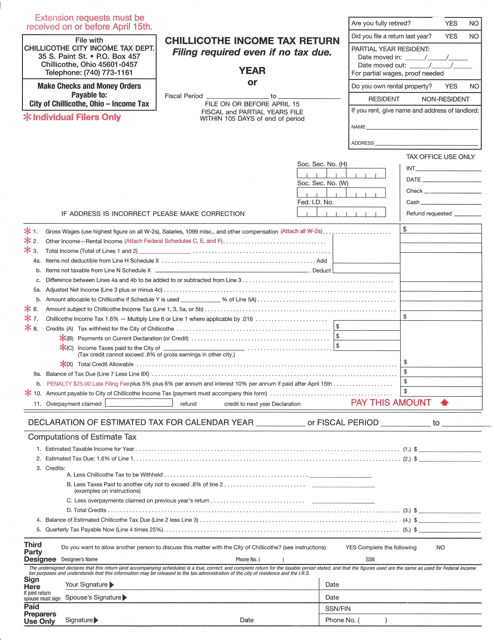

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

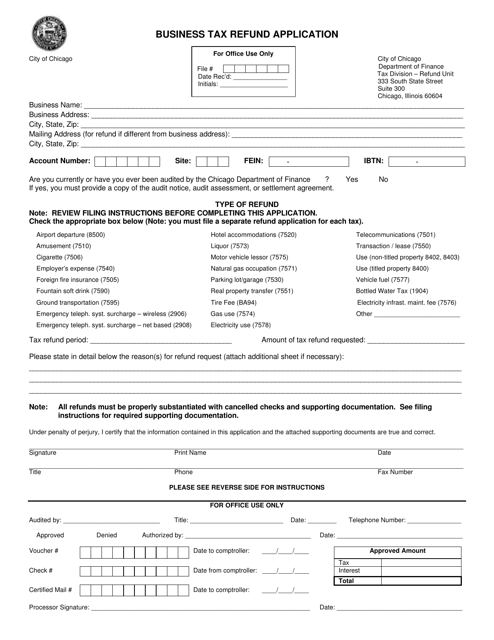

This form is used for applying for a tax refund for businesses located in the City of Chicago, Illinois.

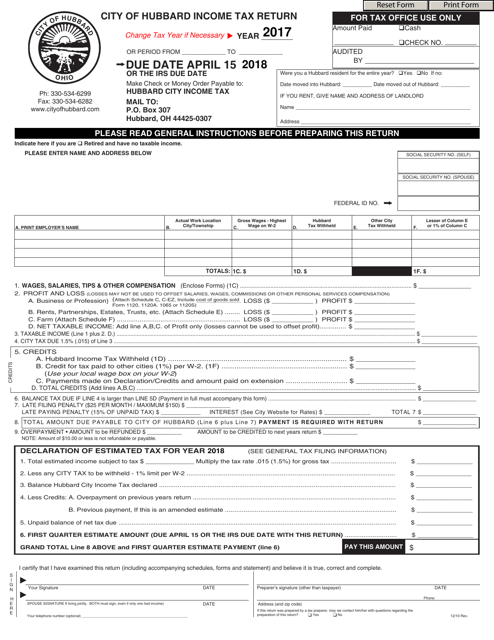

This document is used for filing income tax returns in the City of Hubbard, Ohio.

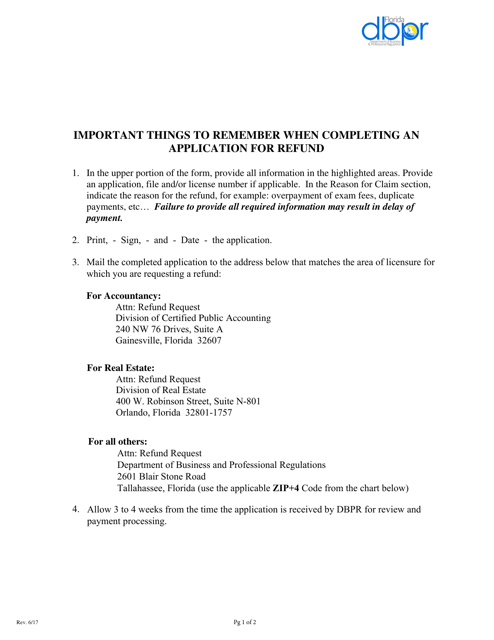

This form is used for applying for a refund in the state of Florida.

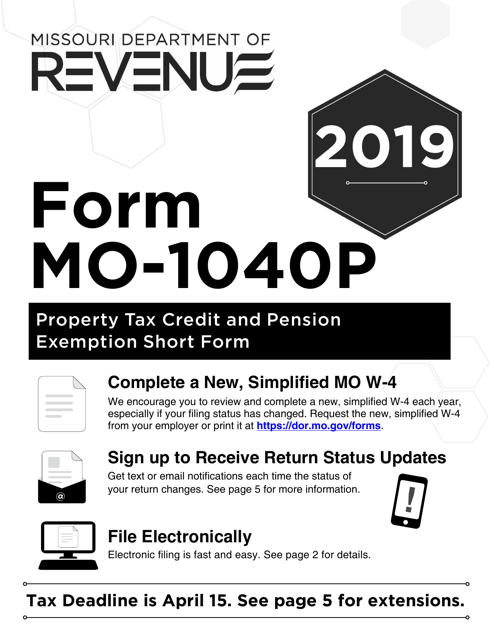

This Form is used for filing the individual income tax return and claiming property tax credit or pension exemption in Missouri.

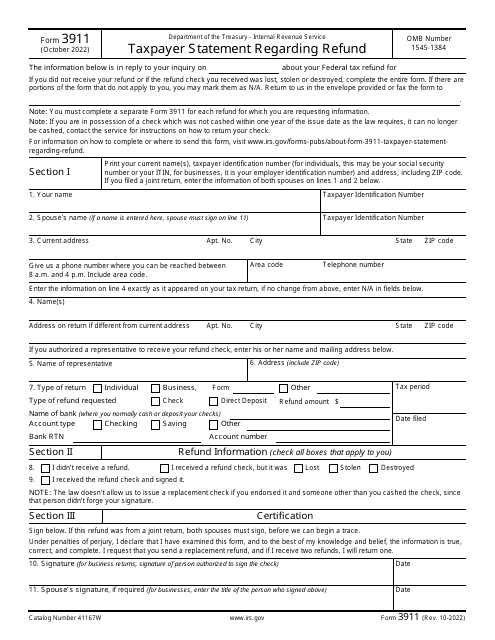

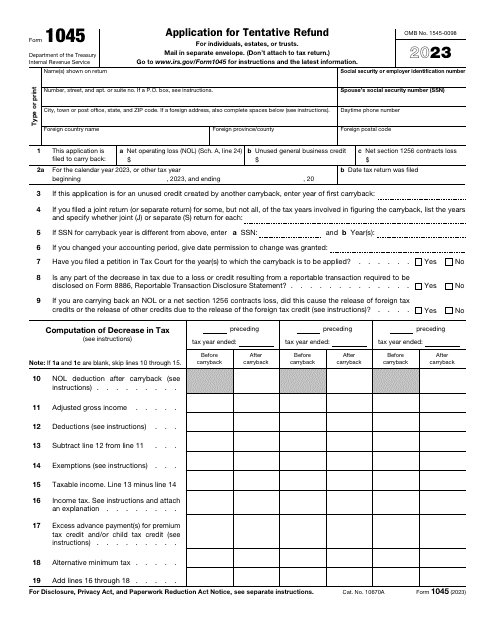

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

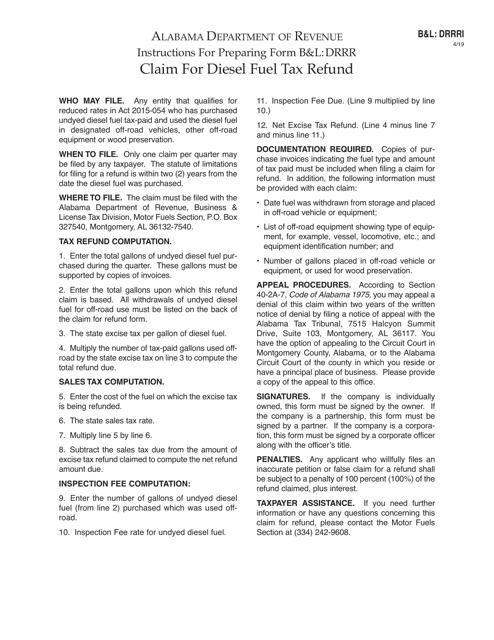

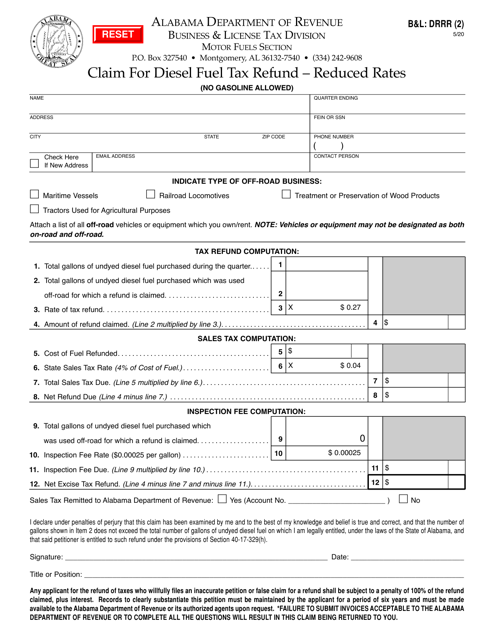

This Form is used for claiming a refund of diesel fuel tax in the state of Alabama. Follow the instructions to file your claim accurately.

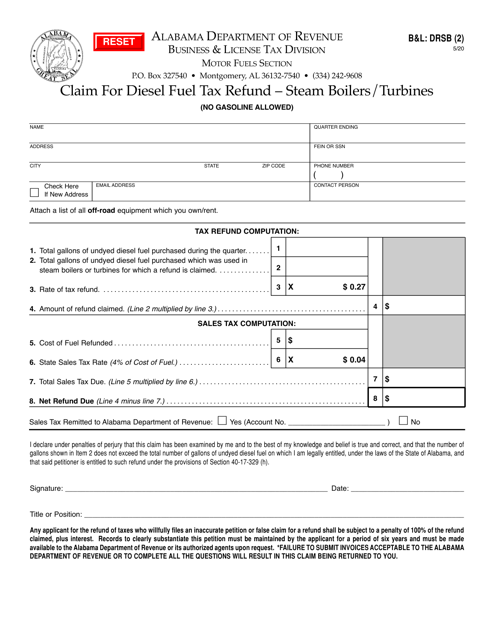

This form is used for claiming a refund on diesel fuel tax for steam boilers and turbines in Alabama.

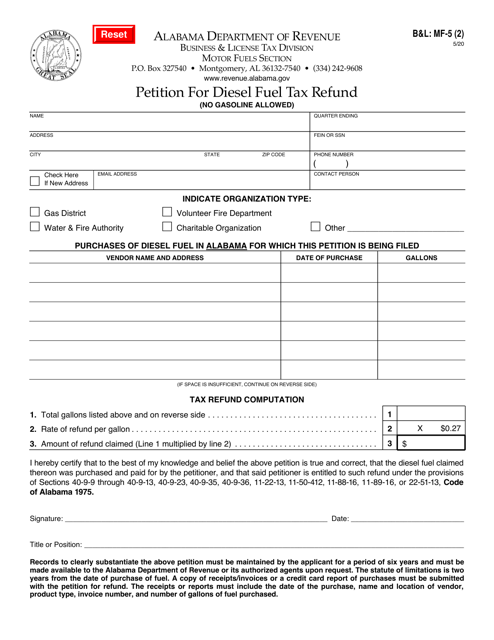

This form is used for filing a petition to request a refund of diesel fuel tax paid in the state of Alabama.

This form is used for claiming a refund on diesel fuel tax at reduced rates in Alabama.

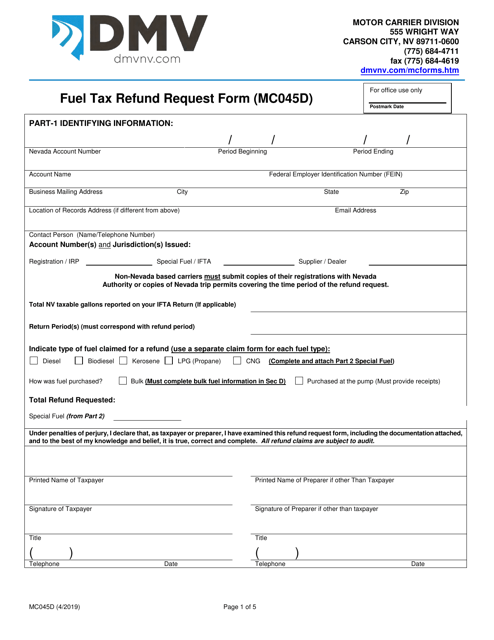

This Form is used for requesting a fuel tax refund in the state of Nevada.

This Form B-A-102R is used for applying for a Vapor Products Excise Tax Refund in North Carolina. It specifically applies to tax-paid vapor products that have been returned to the manufacturer in the state of North Carolina.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

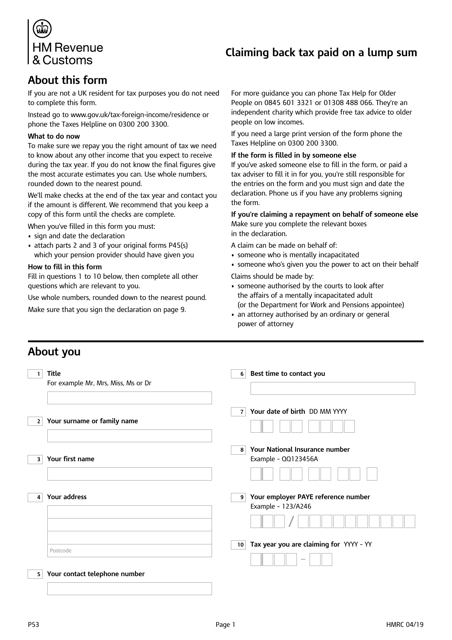

Individuals that reside in the United Kingdom may use this form when they want to claim back tax the government owes them on a lump sum they have obtained.

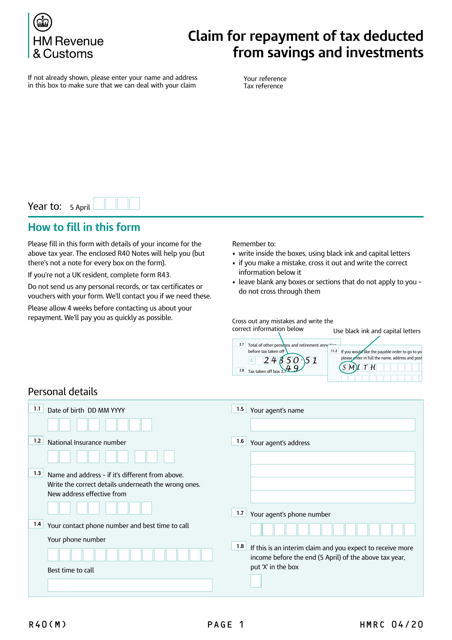

This is a document that may be used when an individual wants to claim a repayment of tax on their savings interest.

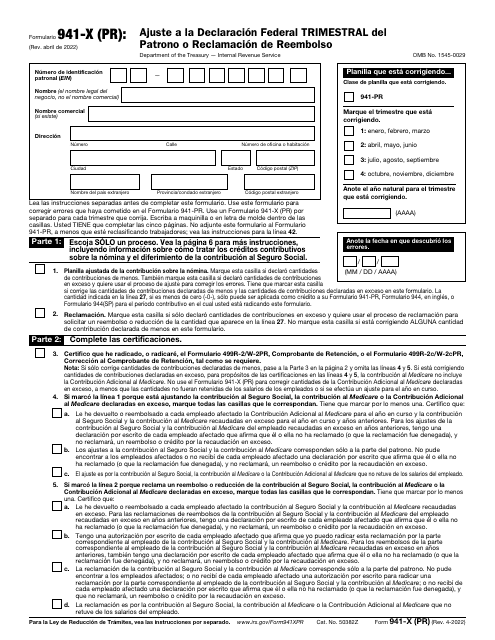

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.