Tax Refund Form Templates

Documents:

569

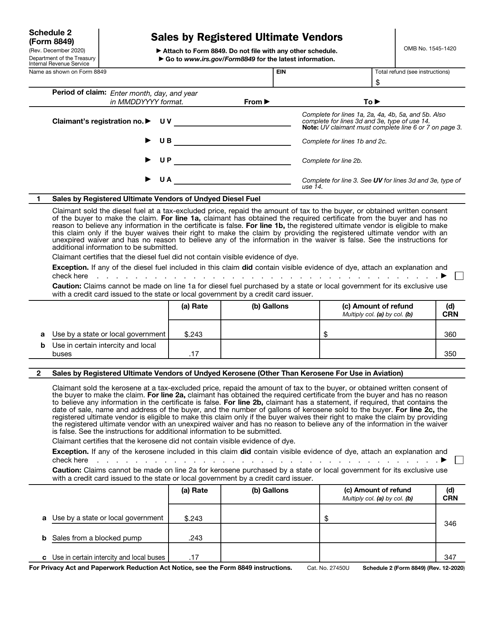

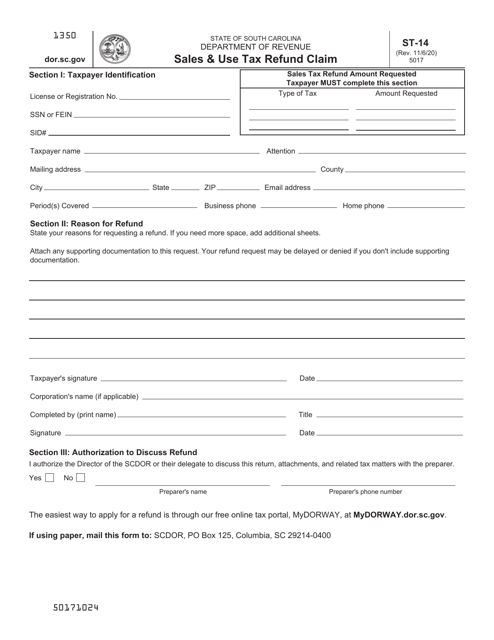

This Form is used for reporting sales made by registered ultimate vendors to claim a credit or refund.

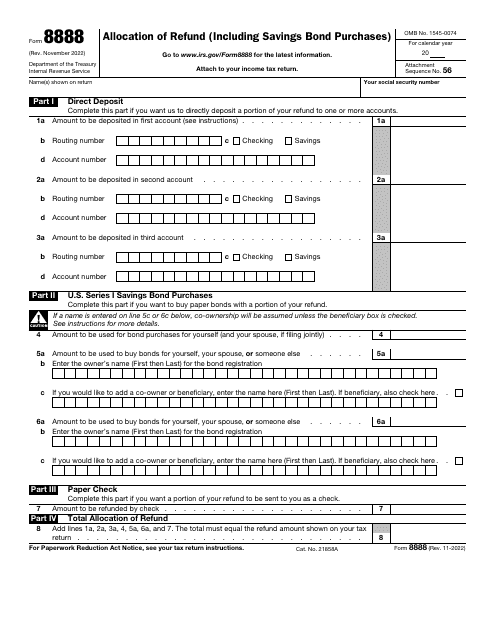

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

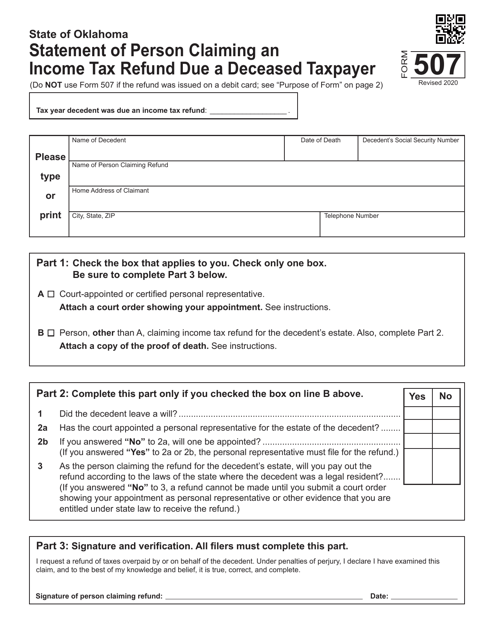

This form is used for making a statement to claim an income tax refund on behalf of a deceased taxpayer in Oklahoma.

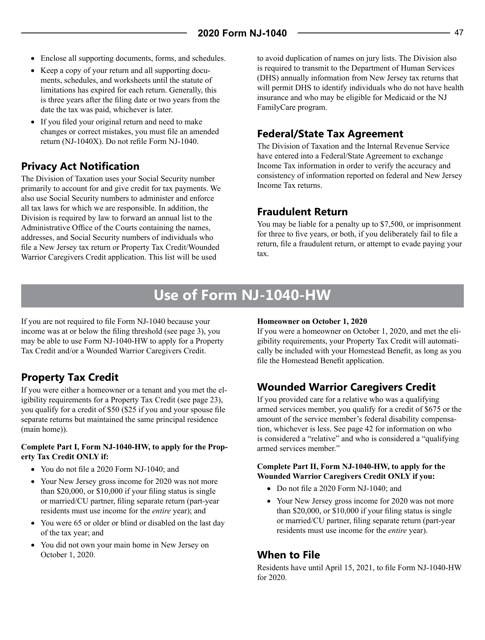

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

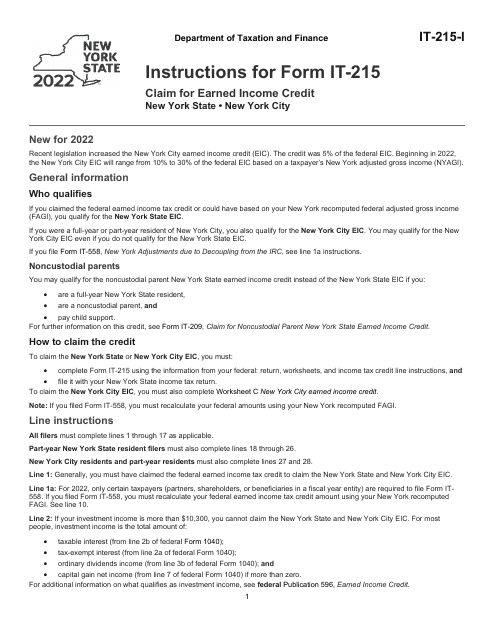

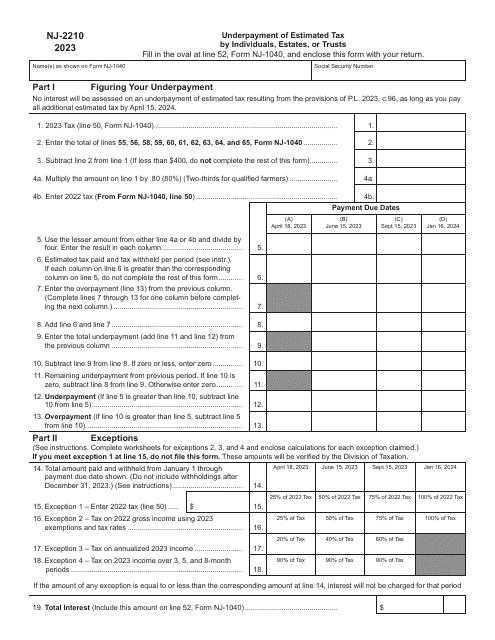

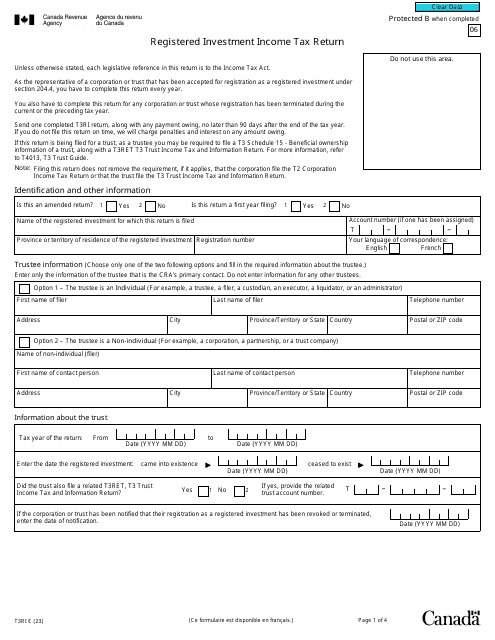

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

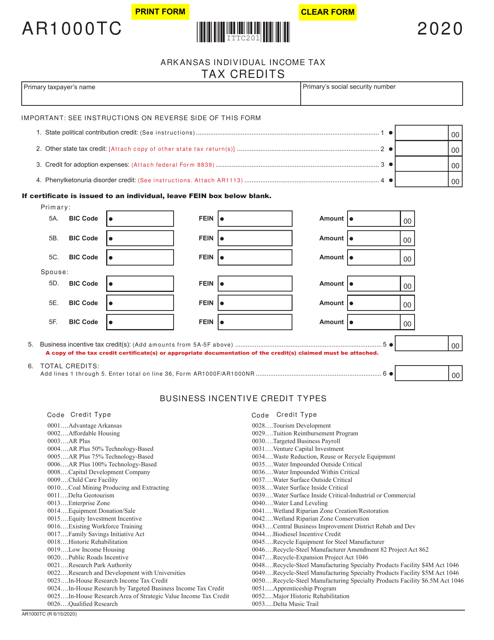

This Form is used for claiming tax credits on your Arkansas state taxes. It allows you to reduce the amount of tax you owe or increase your tax refund.

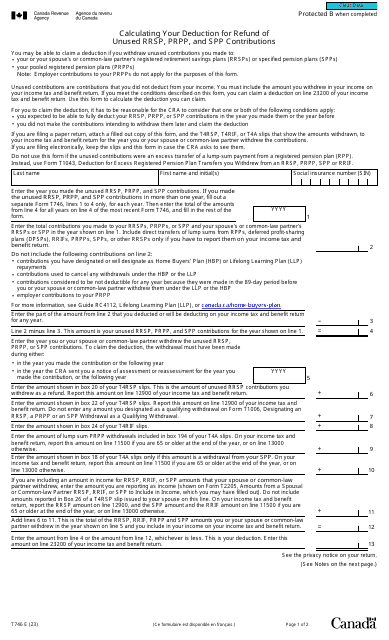

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada

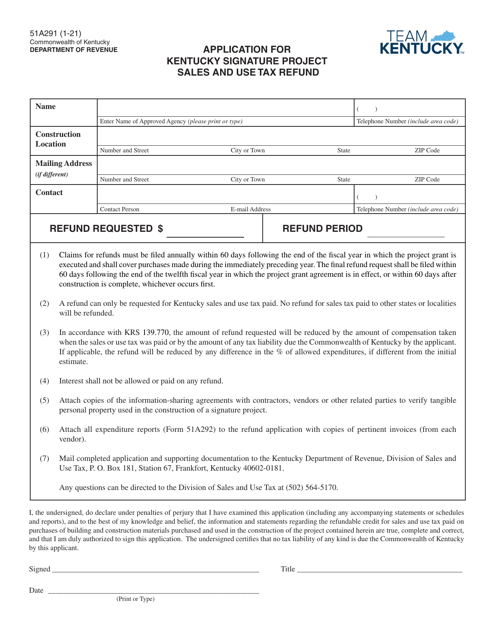

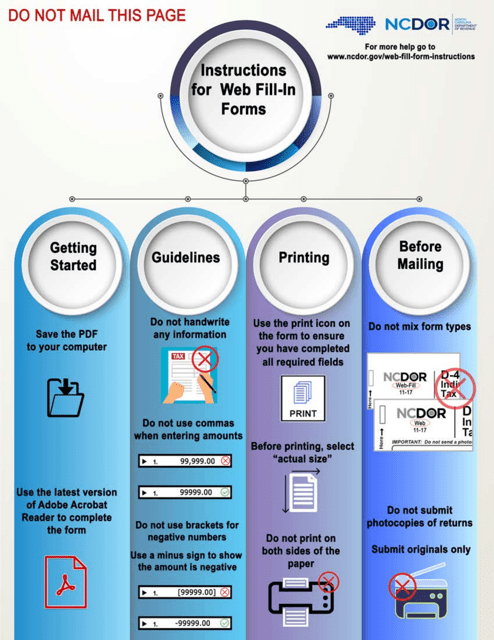

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

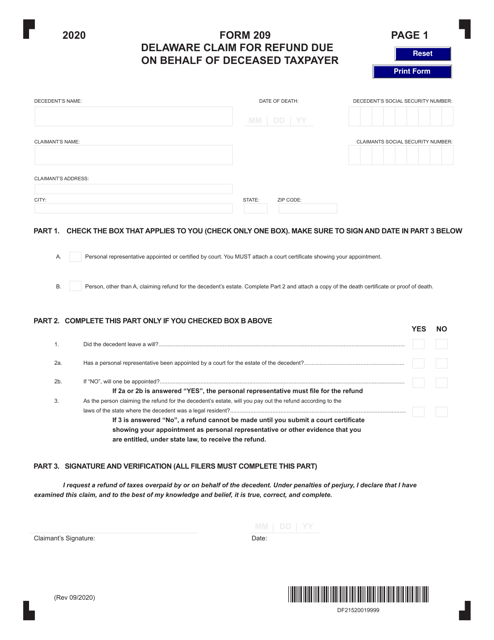

This Form is used for claiming a refund on behalf of a deceased taxpayer in the state of Delaware.

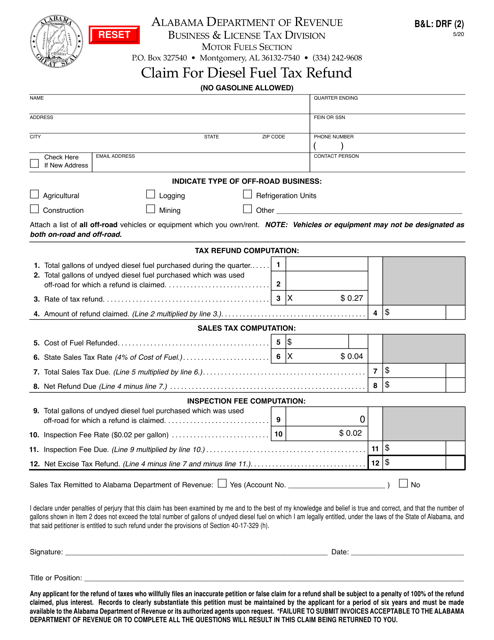

This form is used for claiming a refund on diesel fuel tax paid in the state of Alabama.

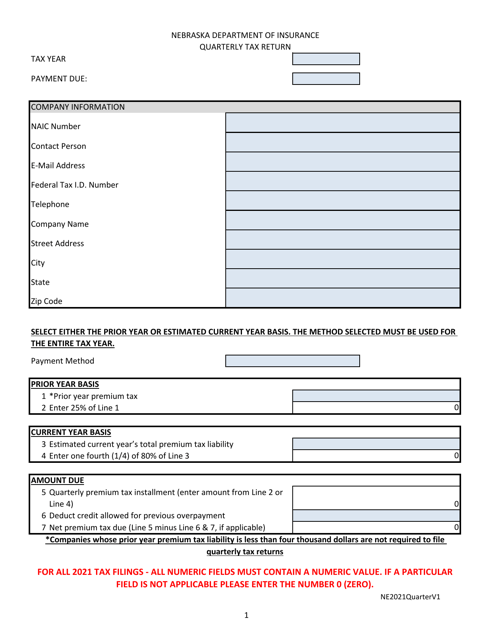

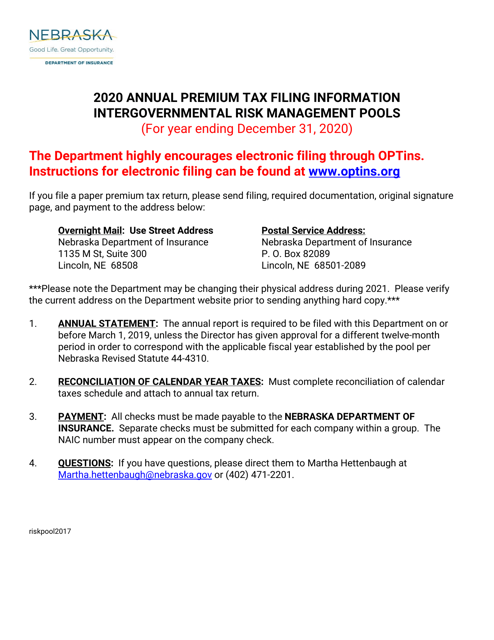

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

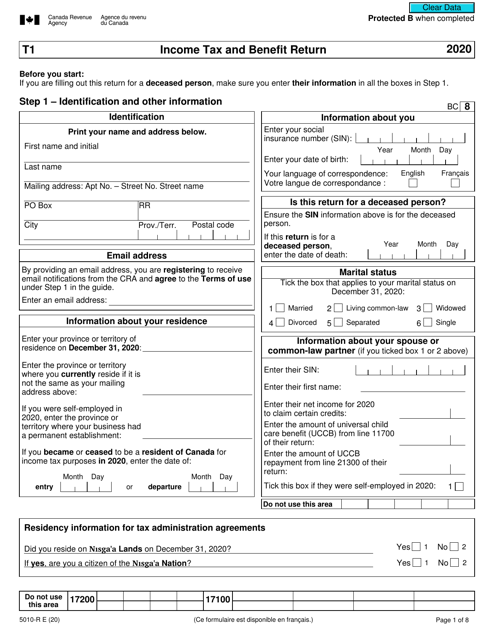

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.