Tax Refund Form Templates

Documents:

569

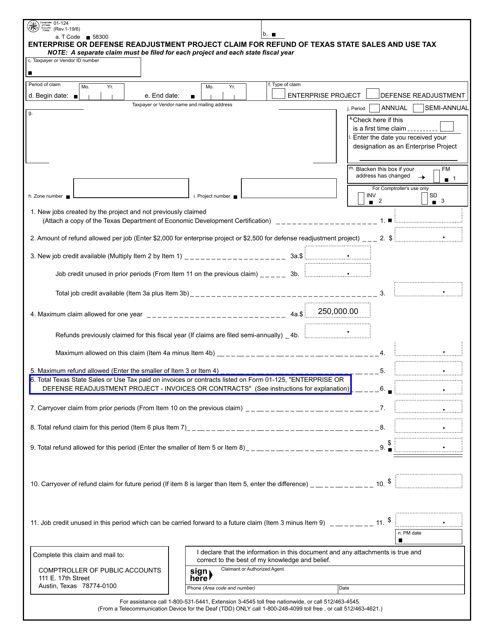

This form is used for claiming a refund of Texas State Sales and Use Tax for enterprise or defense readjustment projects in Texas.

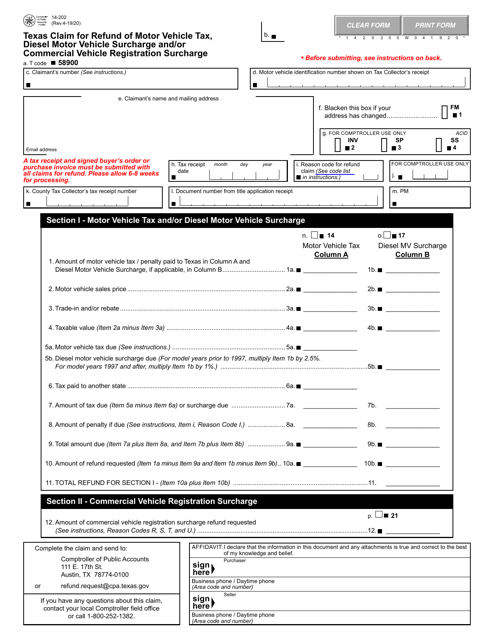

This Form is used for claiming a refund of motor vehicle tax, diesel motor vehicle surcharge and/or commercial vehicle registration surcharge in the state of Texas.

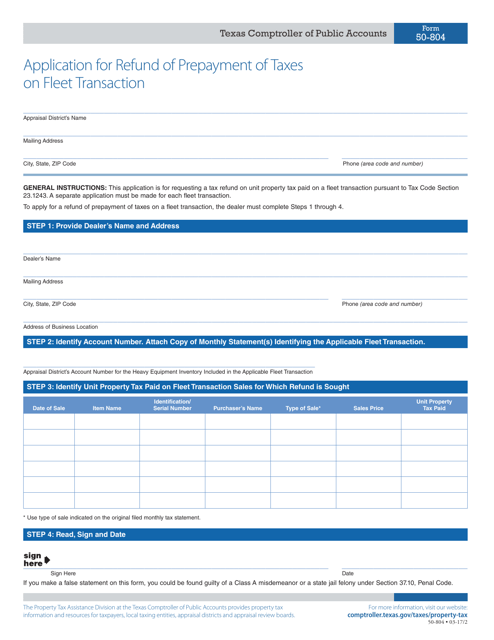

This Form is used for requesting a refund of prepayment of taxes on fleet transactions in the state of Texas.

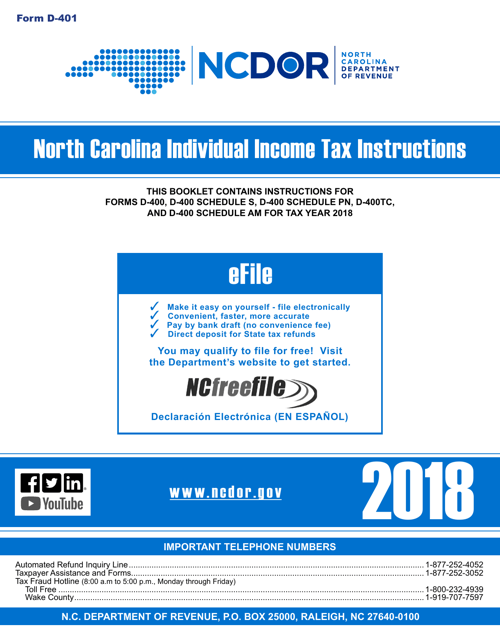

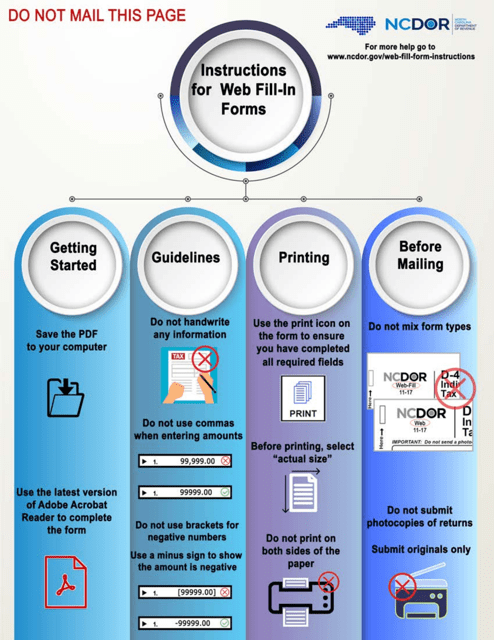

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

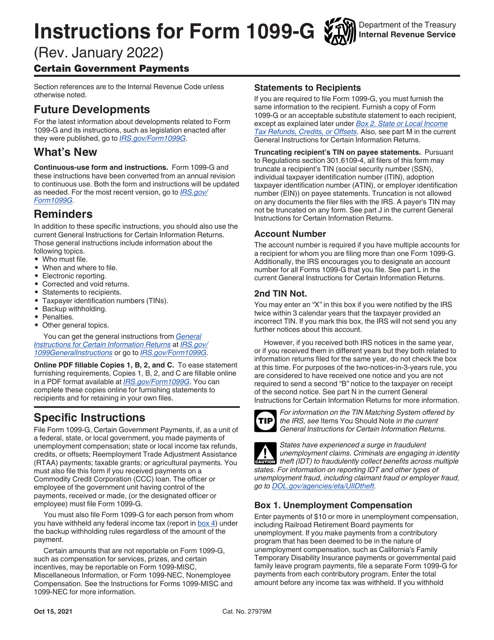

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

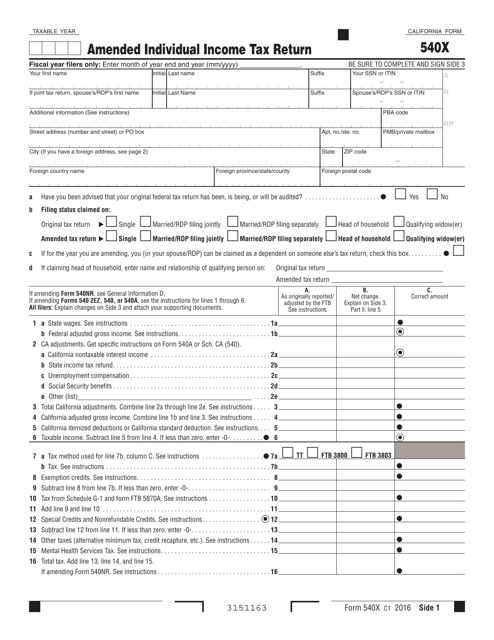

This form is used for making amendments to your individual income tax return in California.

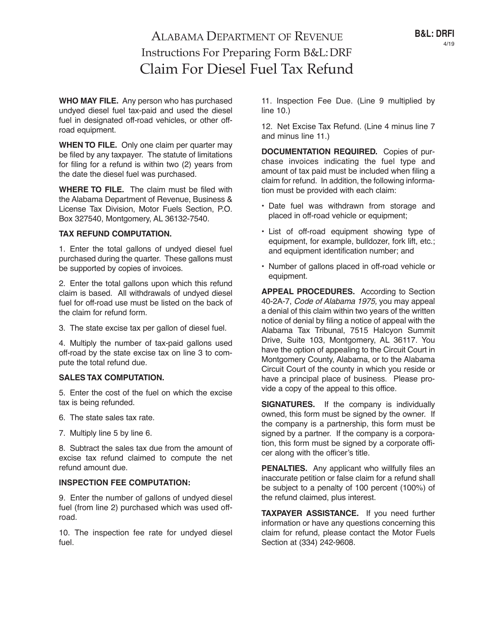

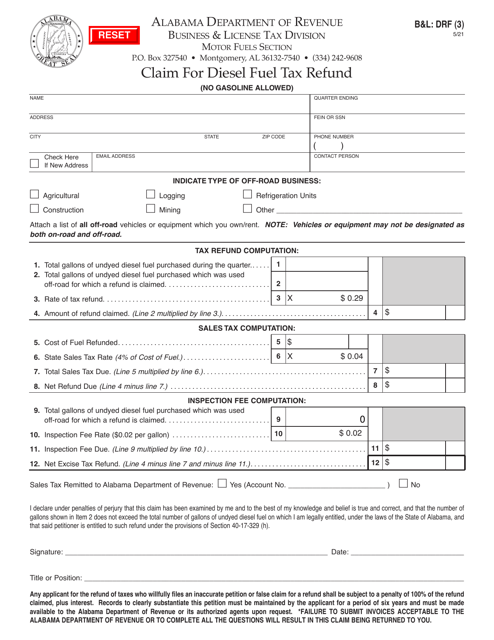

This type of document is used for claiming a refund on diesel fuel taxes in Alabama. It provides instructions on how to fill out Form B&L: DRF Claim for Diesel Fuel Tax Refund.

This form is used for claiming a refund of motor vehicle lease or subscription taxes in the state of North Carolina.

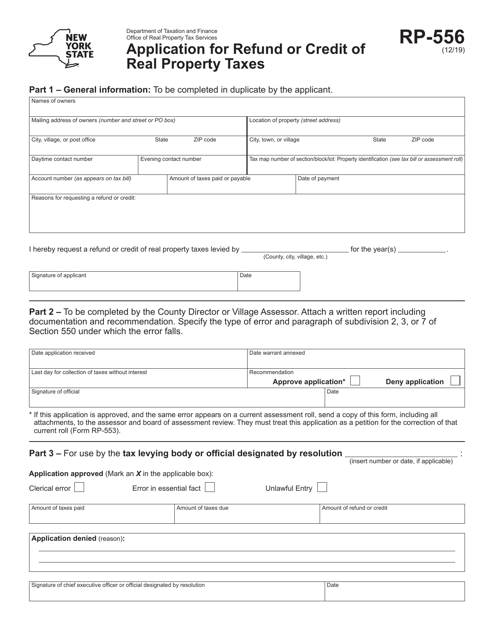

This form is used for applying for a refund or credit for the payment of real property taxes in the state of New York.

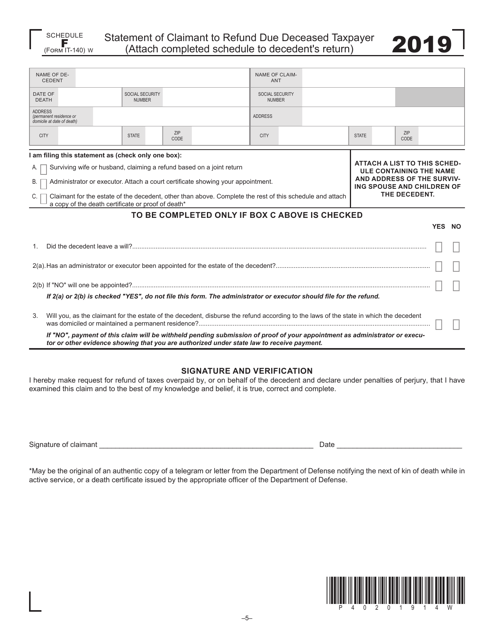

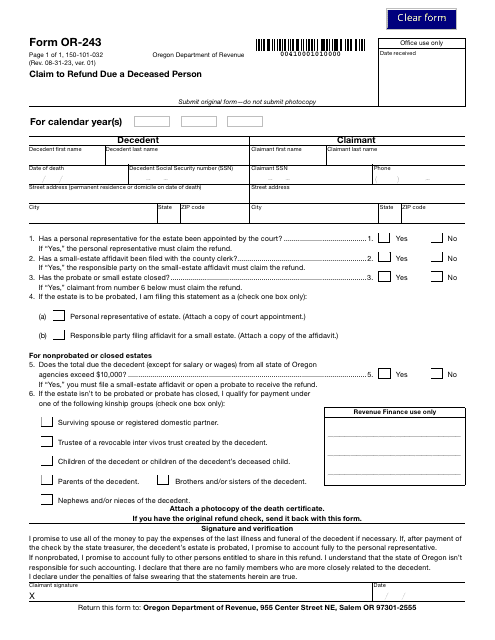

This Form is used for claiming a refund on behalf of a deceased taxpayer in West Virginia.

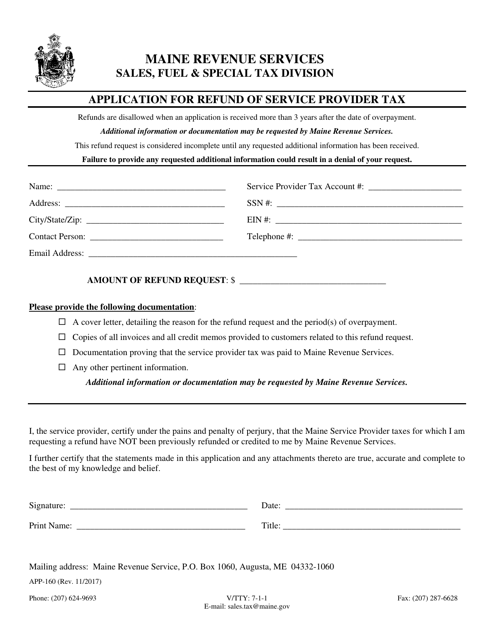

This form is used for applying for a refund of service provider tax in Maine.

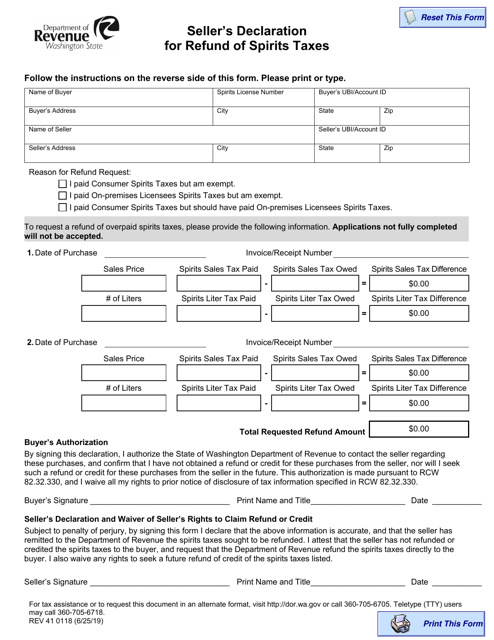

This Form is used for sellers in Washington to declare refund of spirits taxes.

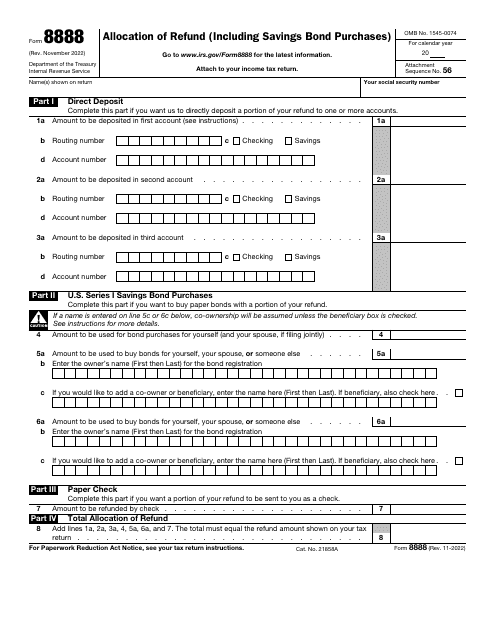

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

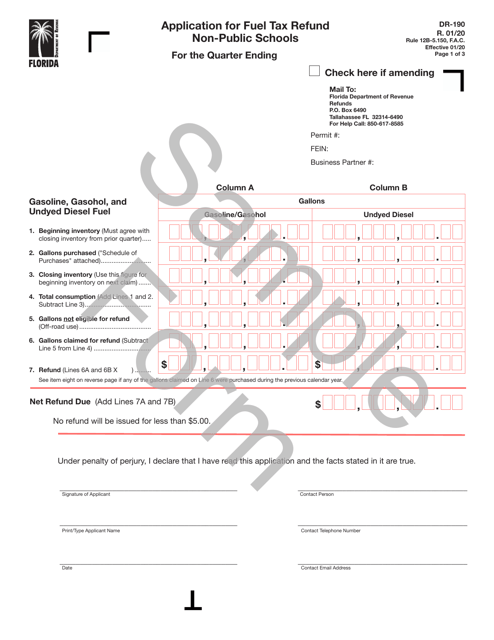

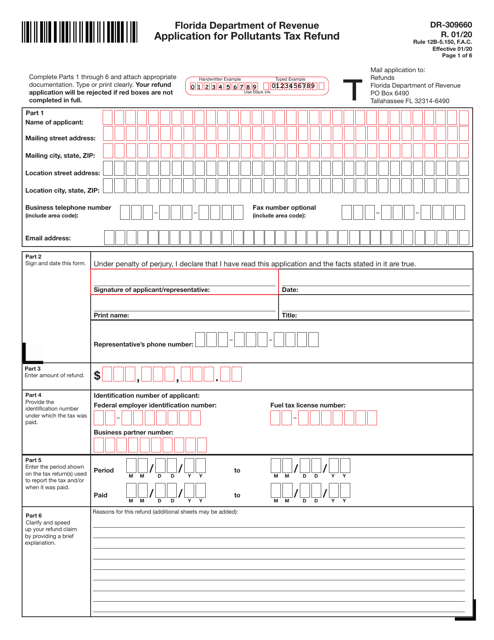

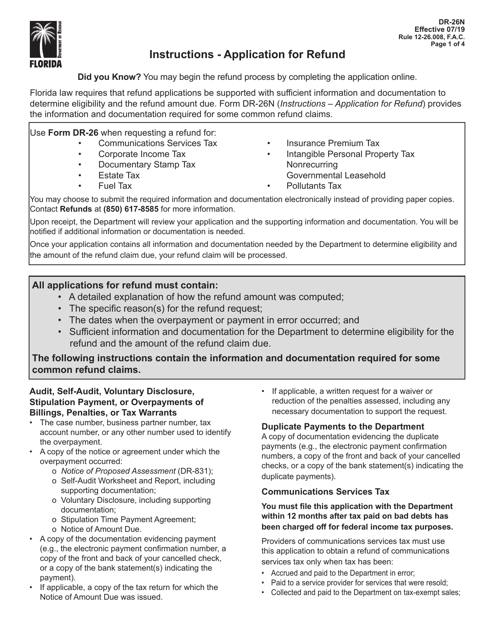

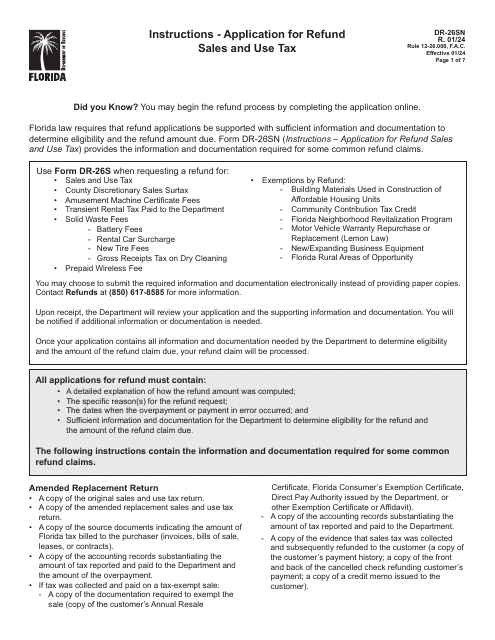

This Form is used for applying for a refund in the state of Florida. It provides instructions on how to fill out Form DR-26 to claim a refund.

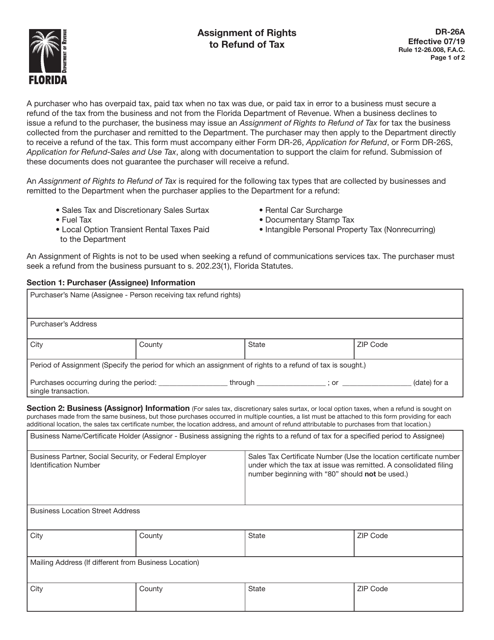

This form is used for assigning the rights to a tax refund in the state of Florida.

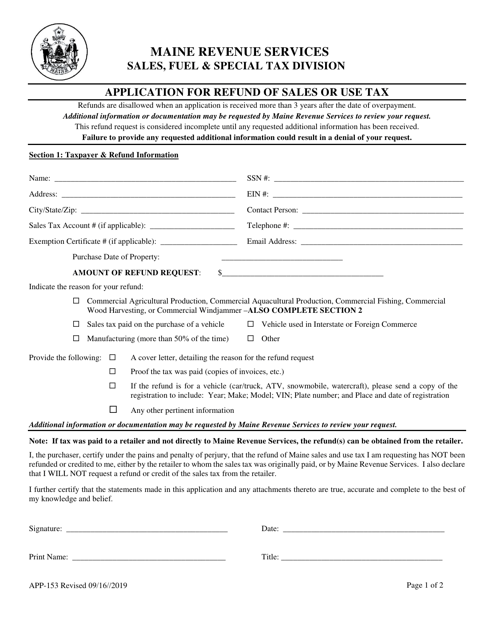

This Form is used for applying for a refund of sales or use tax in the state of Maine.