Tax Refund Form Templates

Documents:

569

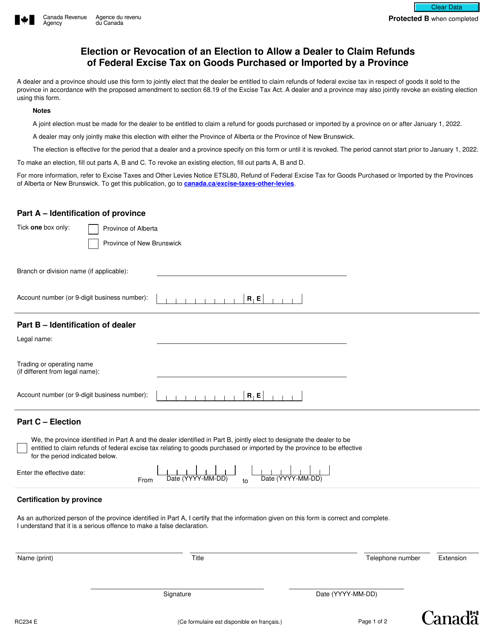

This form is used for electing or revoking an election to allow a dealer in Canada to claim refunds of federal excise tax on goods purchased or imported by a province.

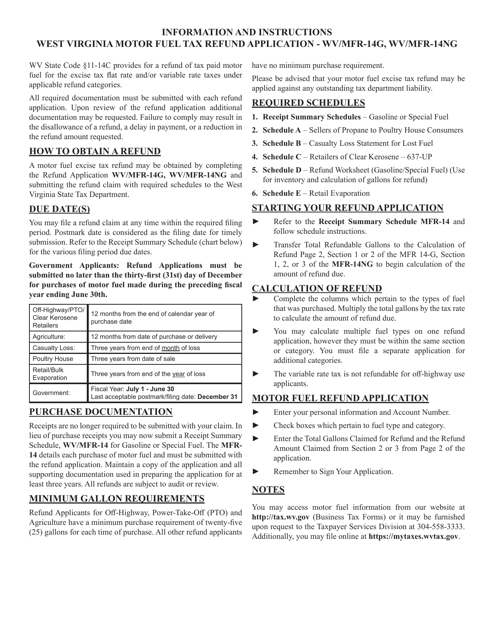

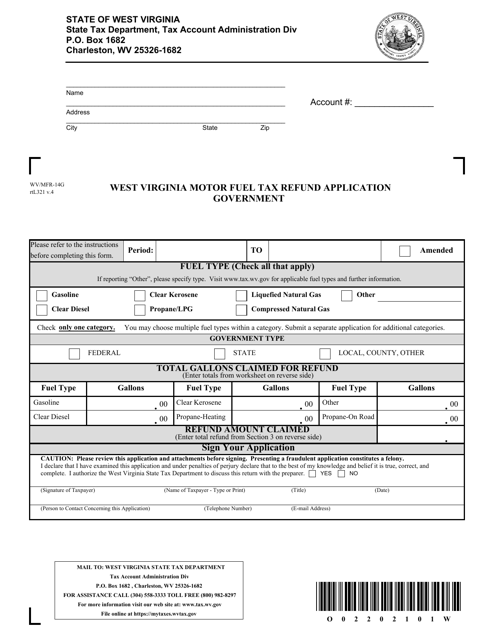

This document is used for applying for a motor fuel tax refund in West Virginia. It provides instructions on how to complete Form WV/MFR-14G or WV/MFR-14NG.

This Form is used for applying for a motor fuel tax refund in West Virginia. Motor fuel vendors and distributors can use this form to claim a refund on taxes paid on motor fuel.

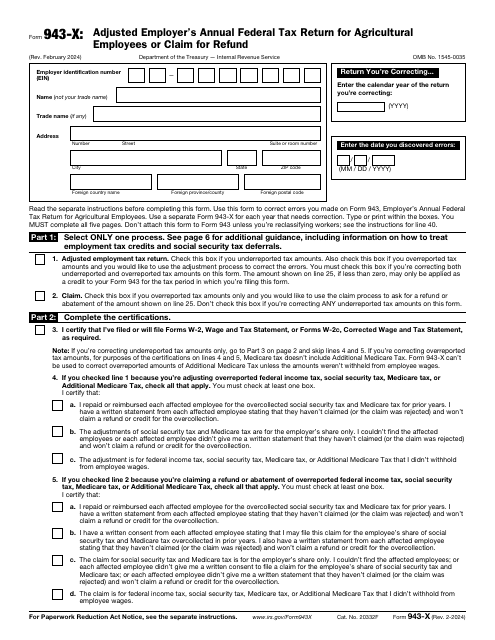

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

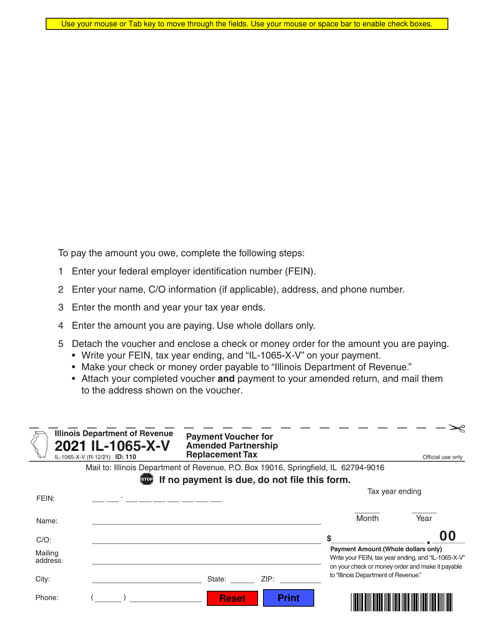

Form IL-1065-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

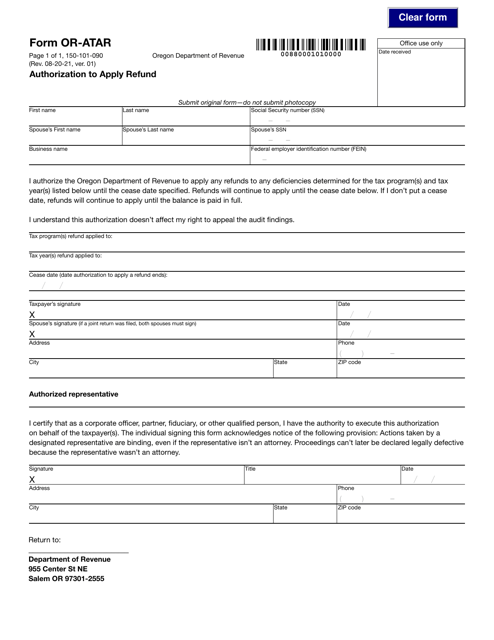

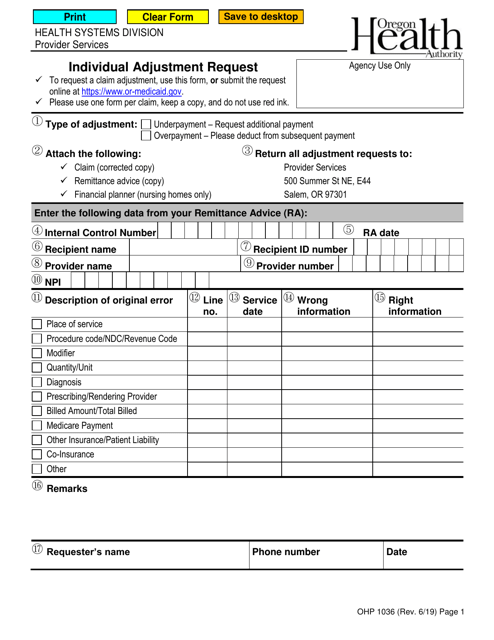

This Form is used for individuals in Oregon to request an adjustment to their taxes or other financial matters. It allows individuals to make changes or corrections to information previously reported to the Oregon Department of Revenue.

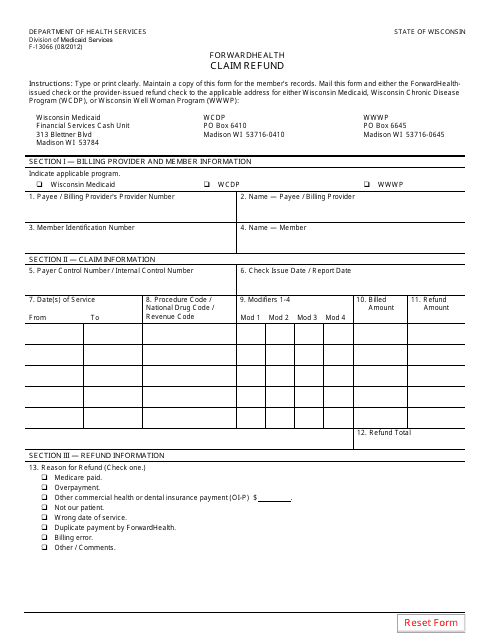

This Form is used for claiming a refund in the state of Wisconsin.

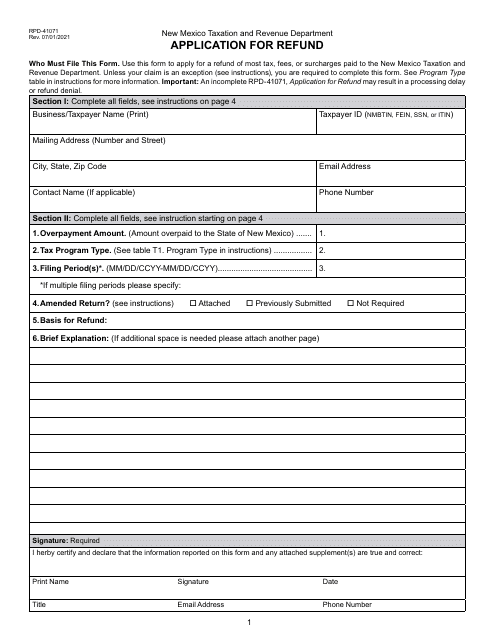

This form is used for applying for a refund in the state of New Mexico.

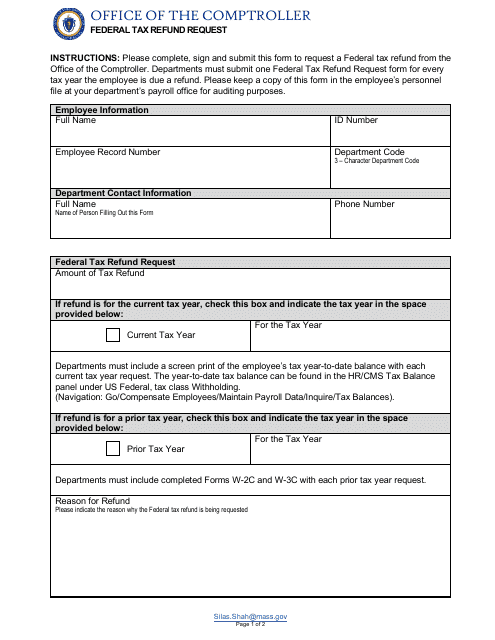

This document is used to request a federal tax refund in the state of Massachusetts.

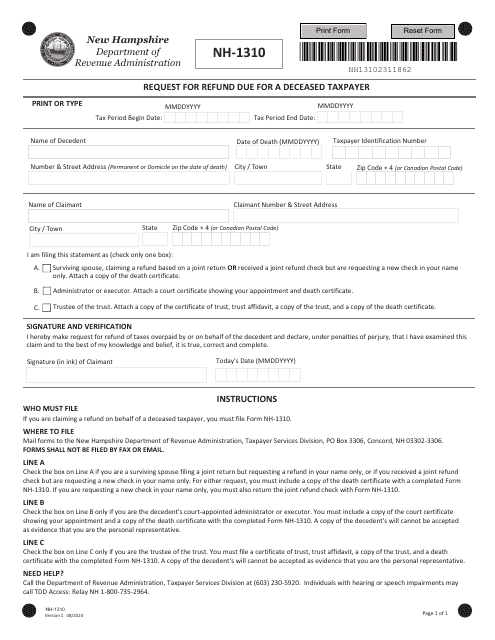

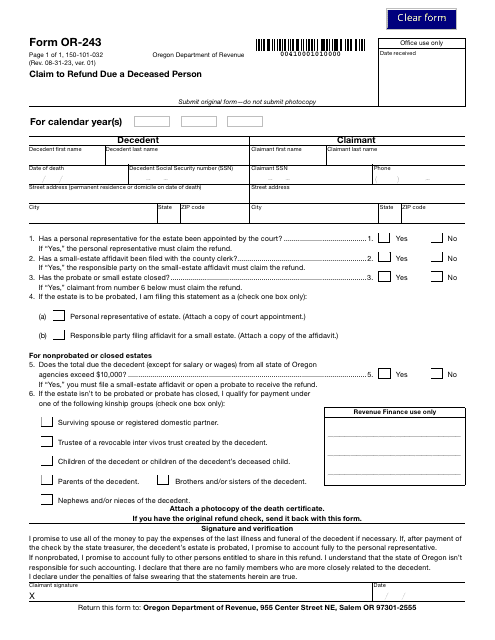

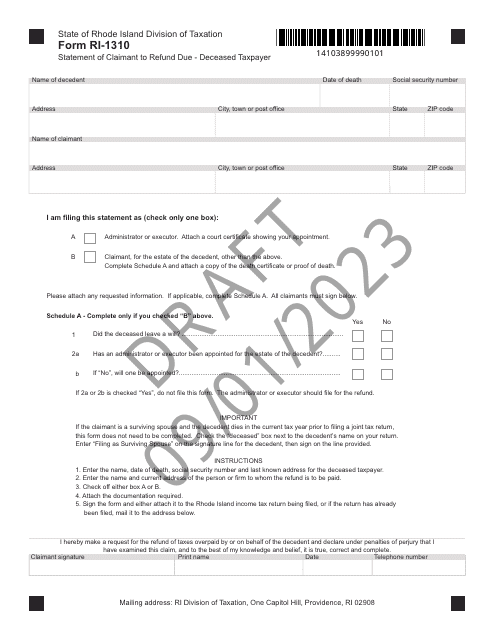

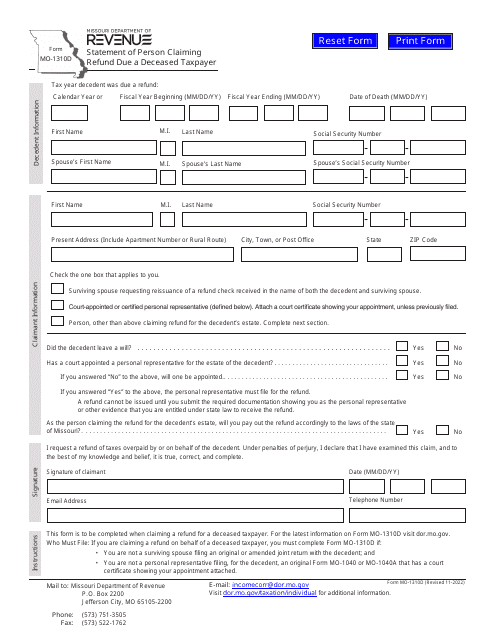

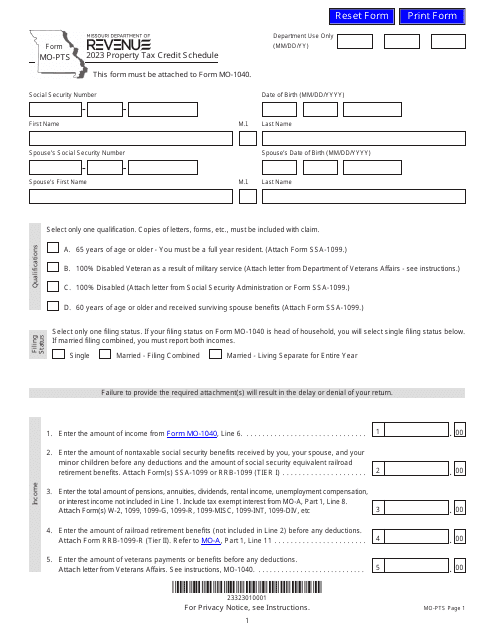

This Form is used for claiming a refund on behalf of a deceased taxpayer in the state of Missouri.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

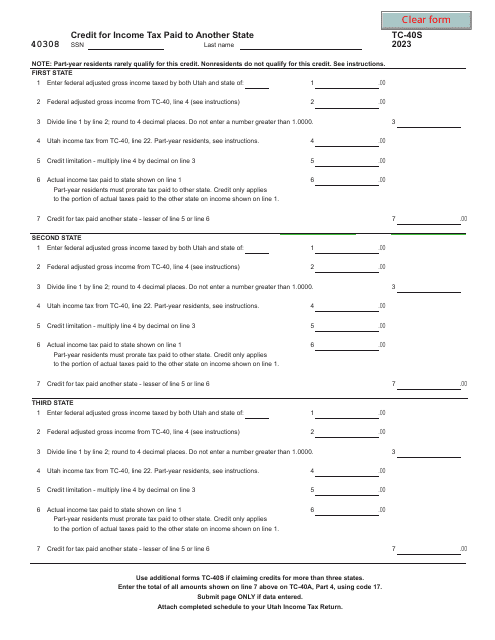

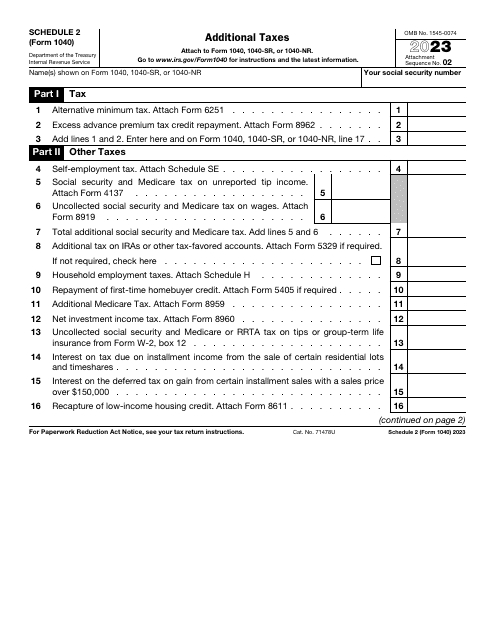

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

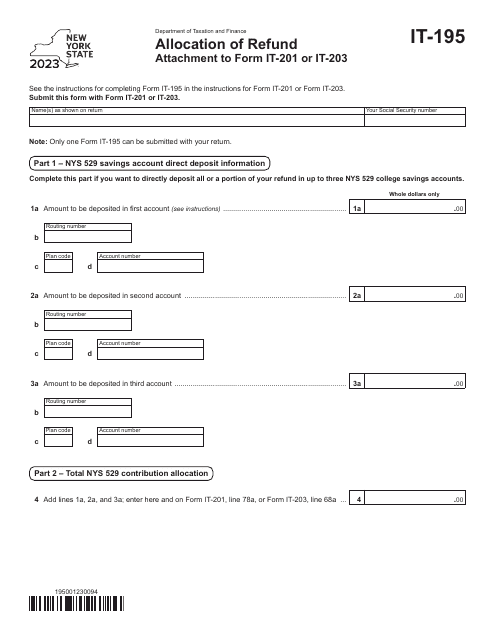

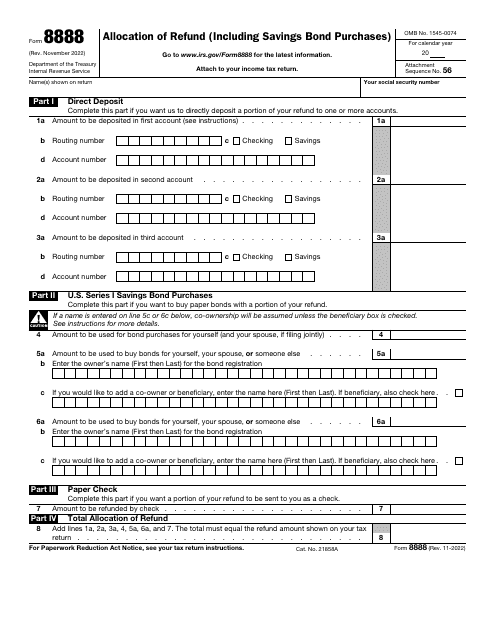

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

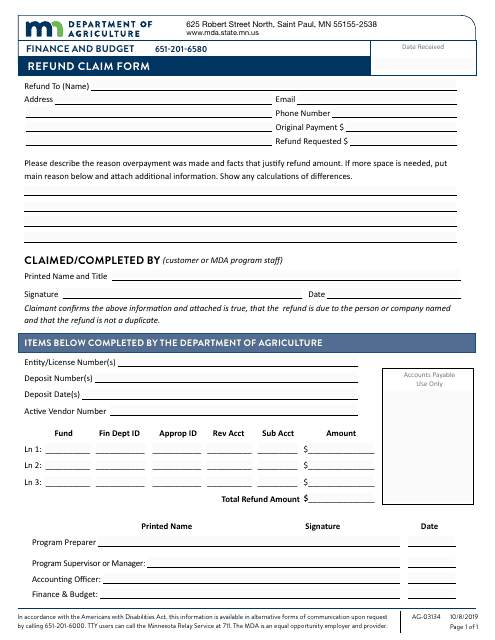

This form is used for claiming a refund in Minnesota.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.