Income Tax Form Templates

Documents:

2505

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

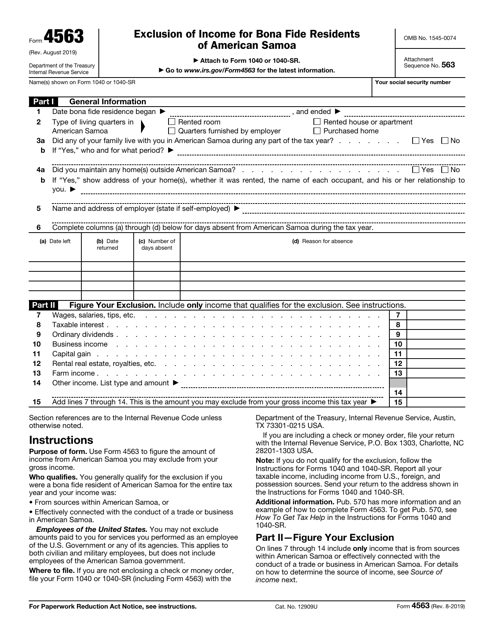

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

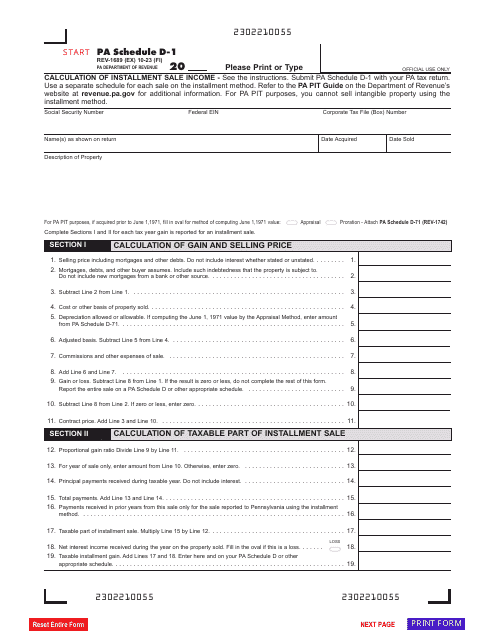

This is an IRS form that includes the details of an installment sale.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

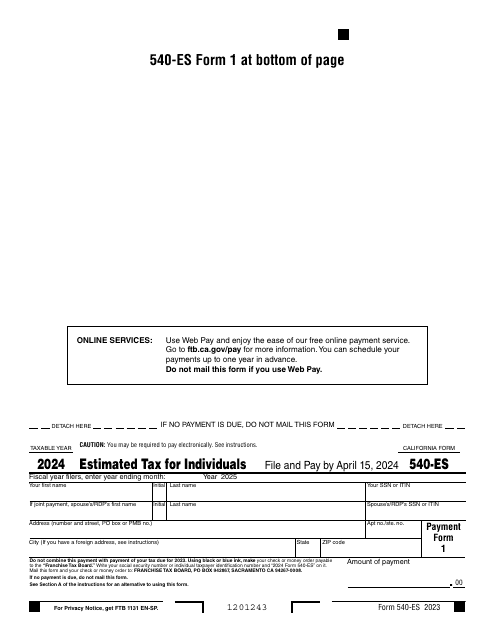

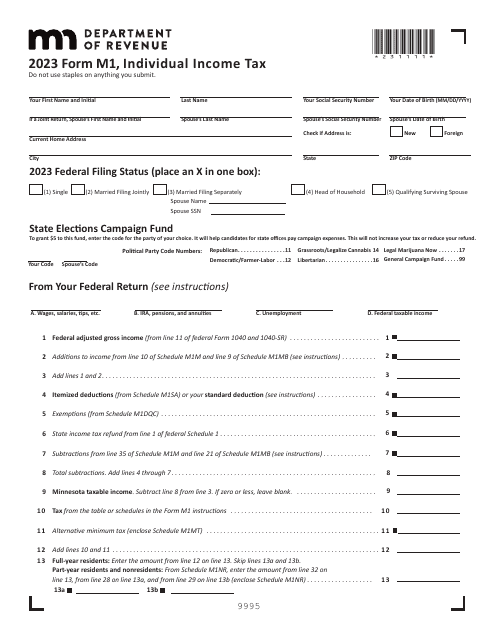

Fill out this form over the course of a year to pay your taxes in the state of California.

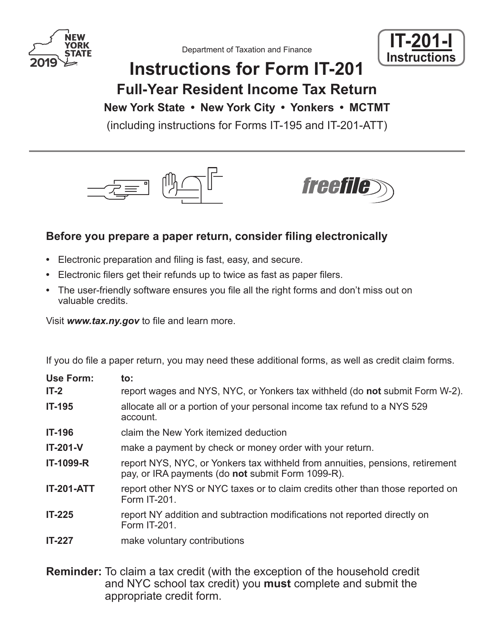

This form contains official instructions for Form IT-201, along with Forms IT-195 and IT-201-ATT.

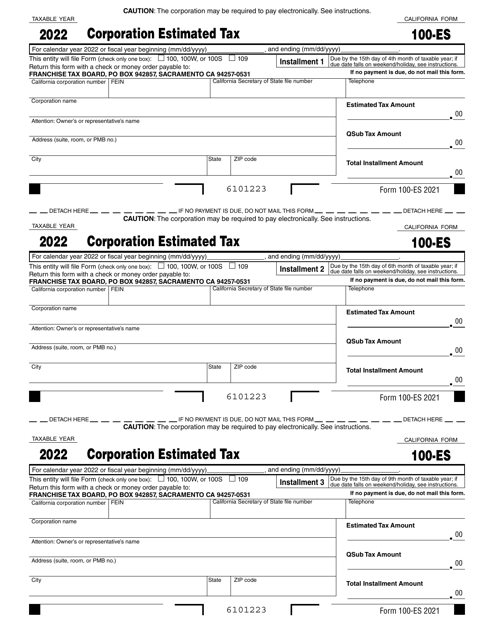

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

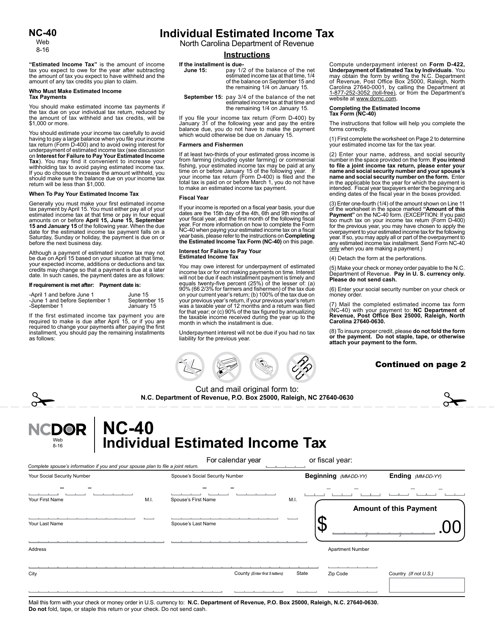

This Form is used for filing individual estimated income tax payments in the state of North Carolina.

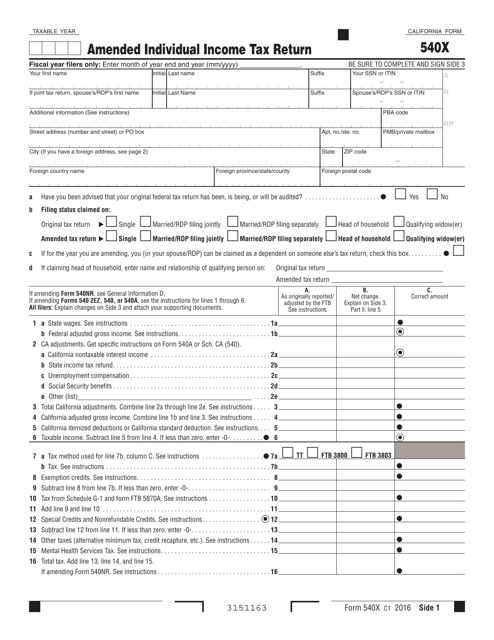

This form is used for making amendments to your individual income tax return in California.

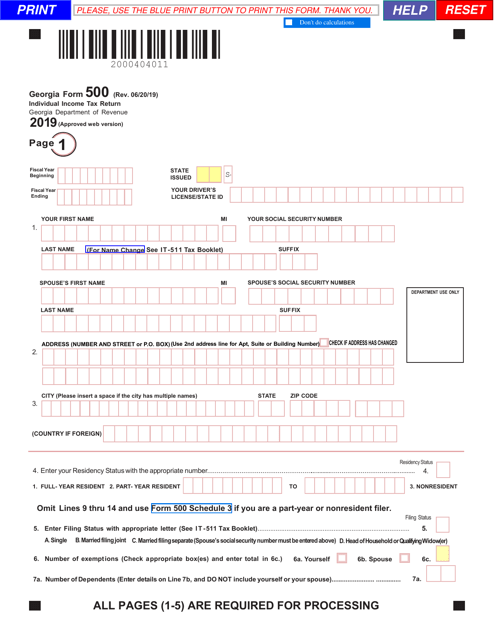

This Form is used for filing individual income tax returns in the state of Georgia.

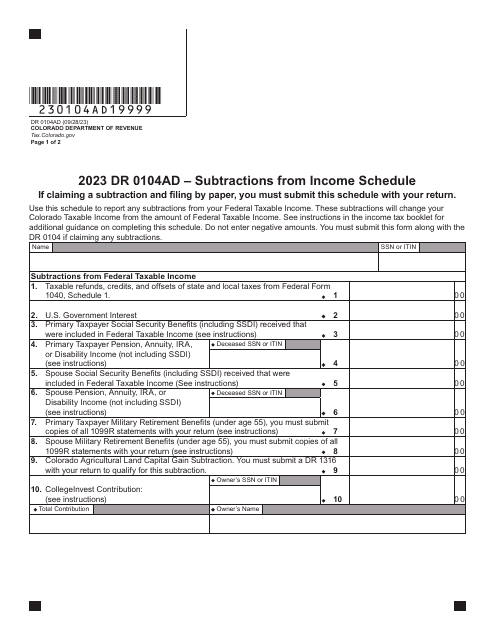

This is an application developed by the Colorado Department of Revenue. The form is used to report subtractions from Federal Taxable Income.

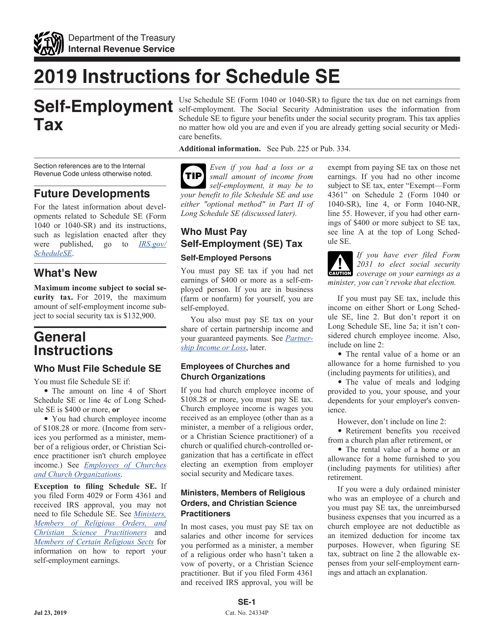

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

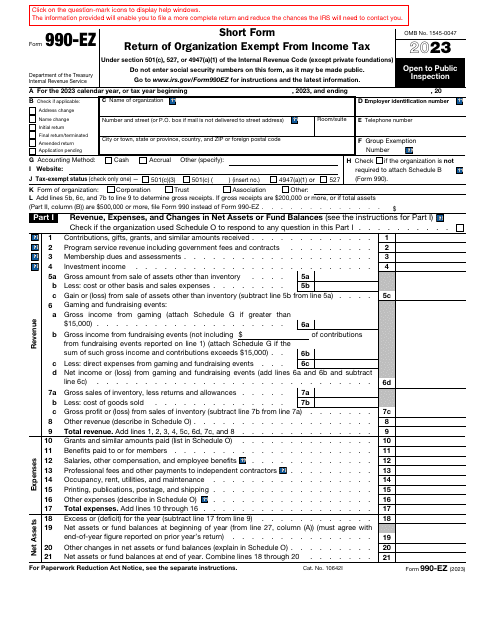

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

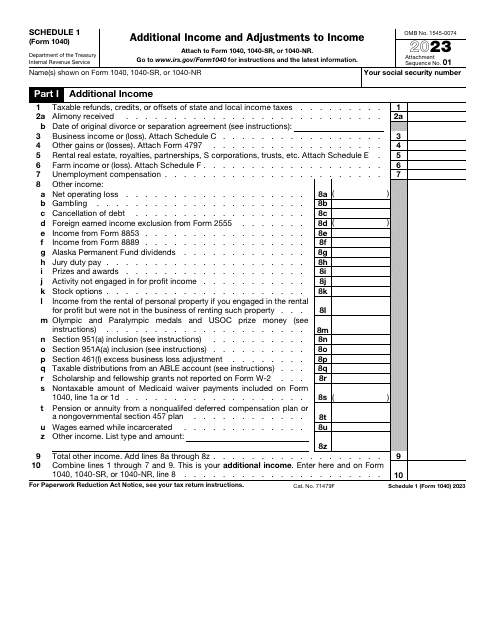

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

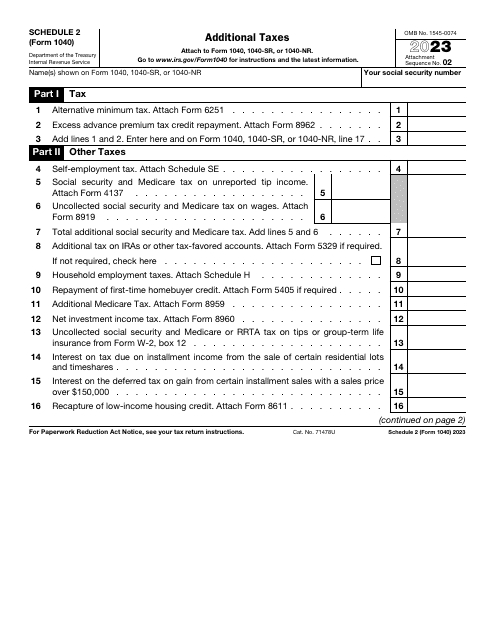

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

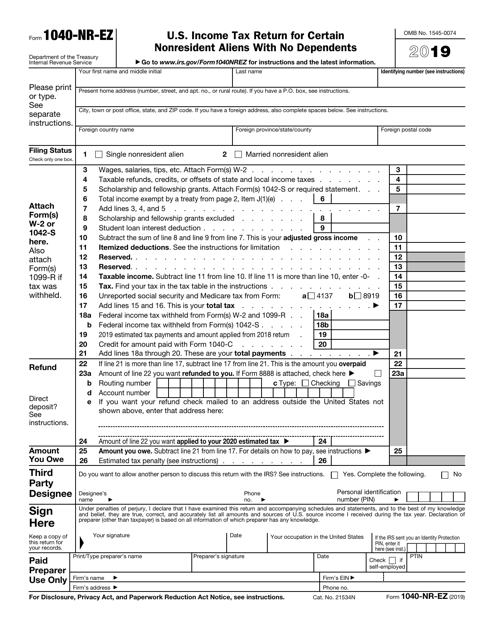

Use this form if you are a non-resident alien (non-United States citizen who has not passed the green card or the substantial presence test) and claim no dependents. This form was issued by the Internal Revenue Service (IRS).

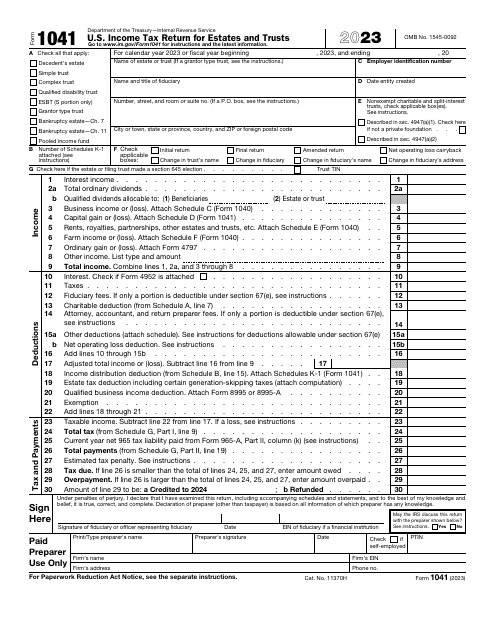

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

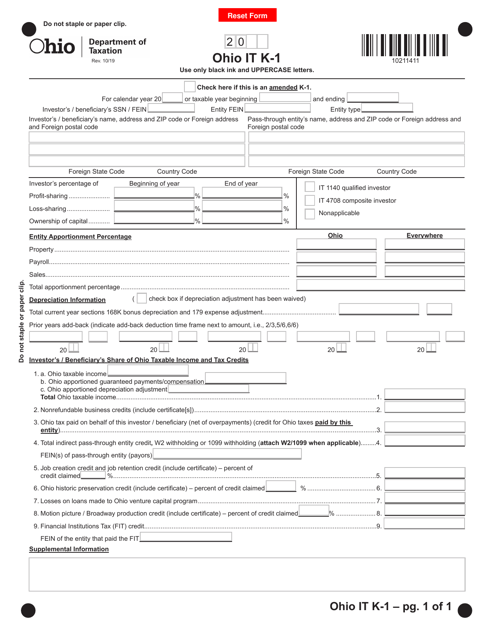

This form is used for reporting income from partnerships in the state of Ohio. It is used by individuals who are partners in a partnership and need to report their share of income, deductions, and credits on their personal tax return.