Income Tax Form Templates

Documents:

2505

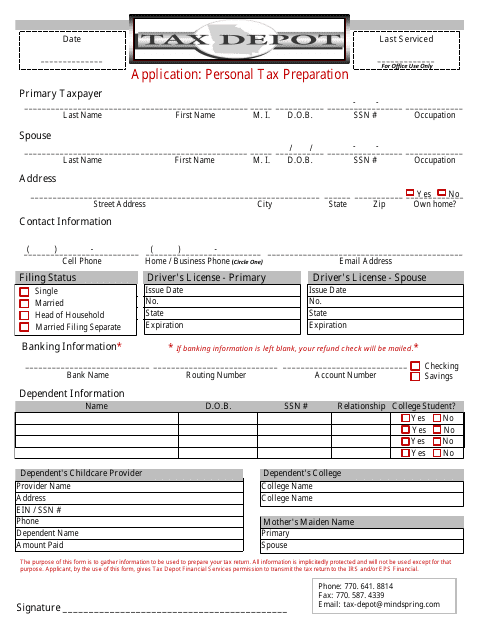

This Form is used for applying for a personal tax preparation application through Tax Depot.

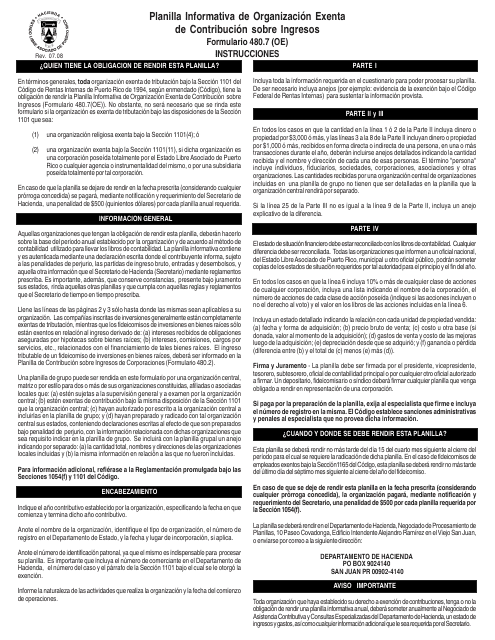

This form is used for individuals in India to declare their eligibility for a tax exemption on interest income or income from units without deduction of tax.

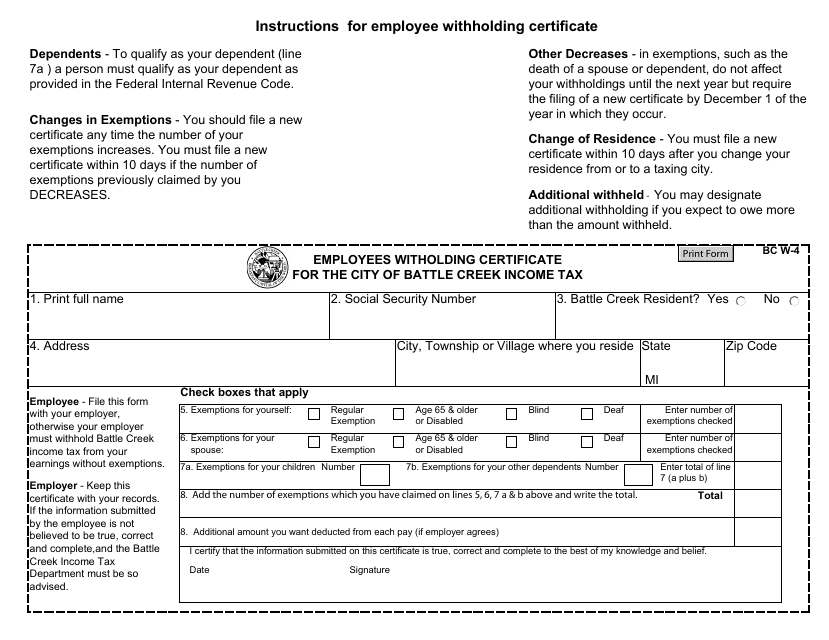

This form is used for employees in Battle Creek, Michigan to declare their withholding for the City of Battle Creek Income Tax.

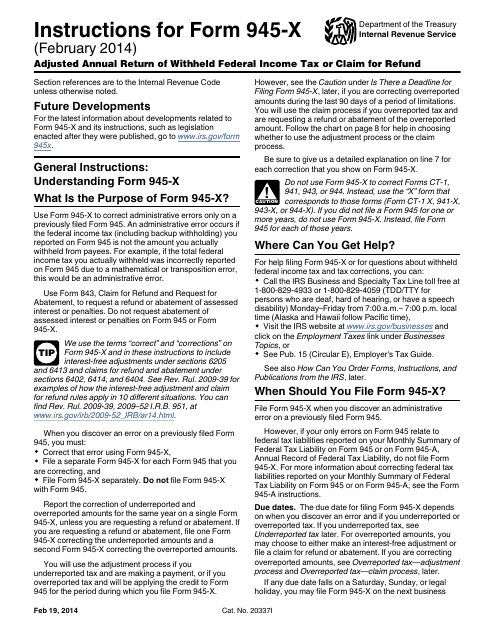

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

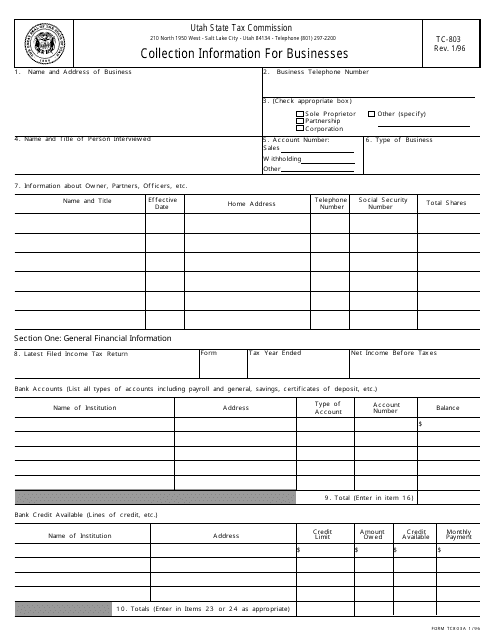

This form is used for businesses in Utah to provide collection information.

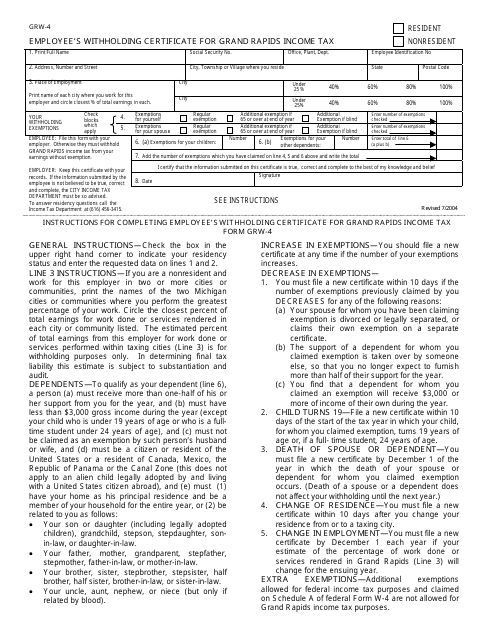

This form is used for employees in Grand Rapids, Michigan to declare their withholding certificate for Grand Rapids income tax.

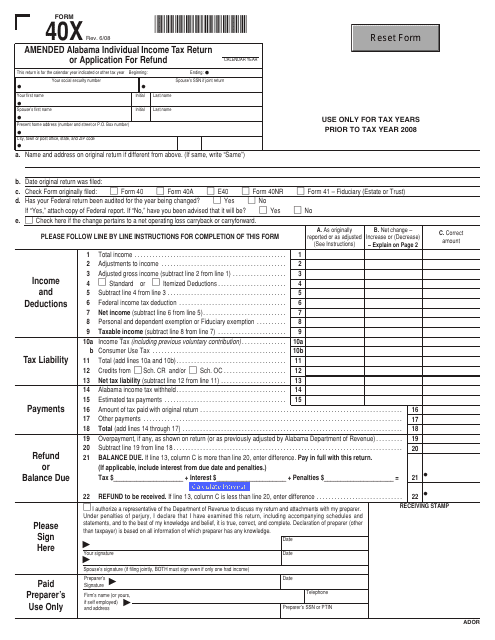

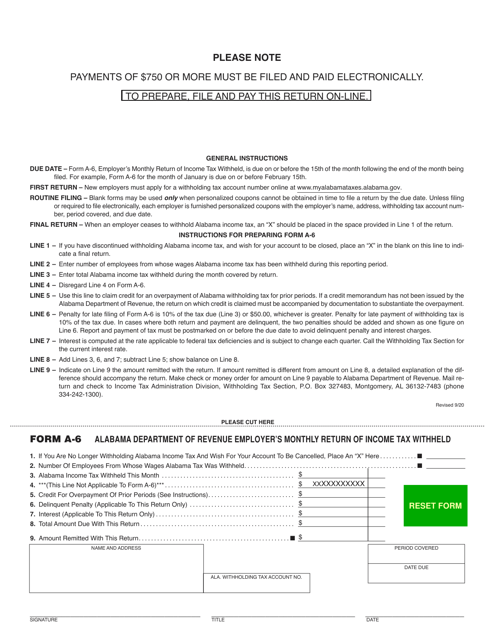

This form is used for filing an amended Alabama Individual Income Tax Return or applying for a refund in the state of Alabama.

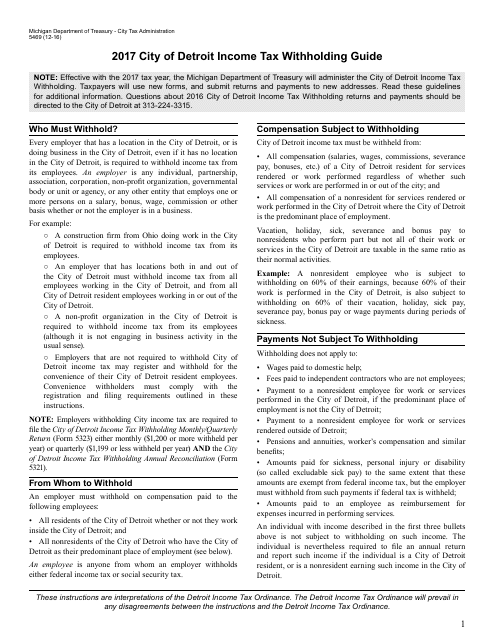

This Form is used for withholding income tax in the City of Detroit, Michigan. It provides instructions on how to correctly complete Form 5489 and comply with the city's tax regulations.

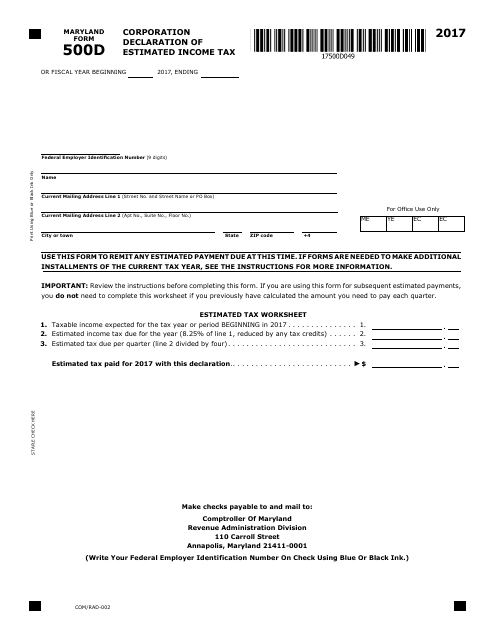

This form is used for Maryland corporations to declare their estimated income tax for the year.

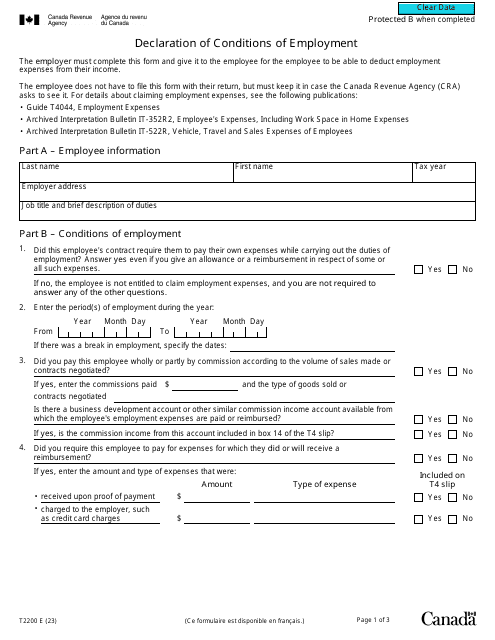

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.

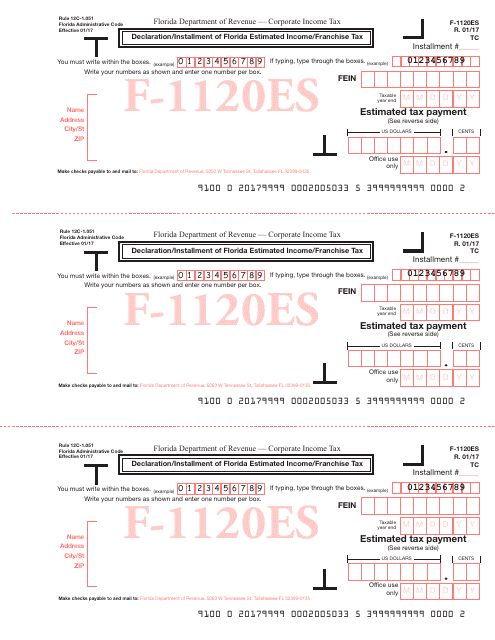

This Form is used for declaring and making installment payments of estimated income/franchise tax in Florida.

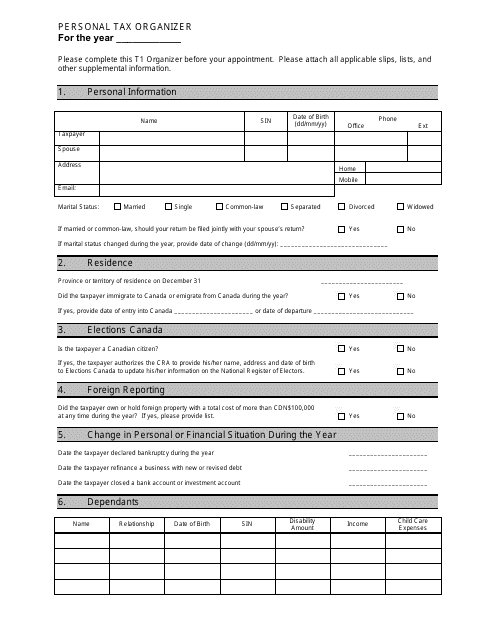

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

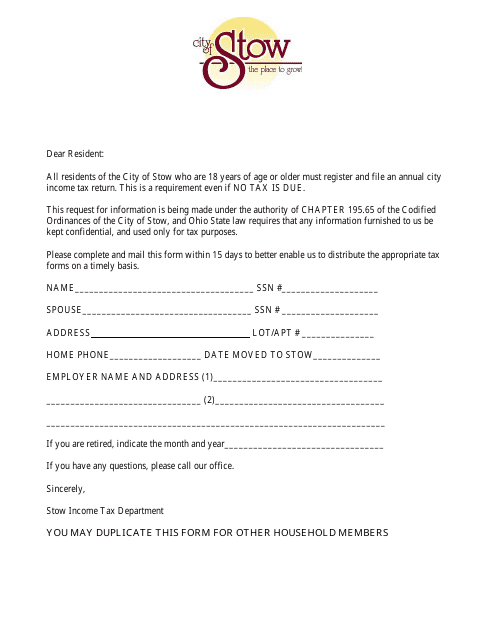

This Form is used for filing your income tax return in the City of Stow, Ohio.

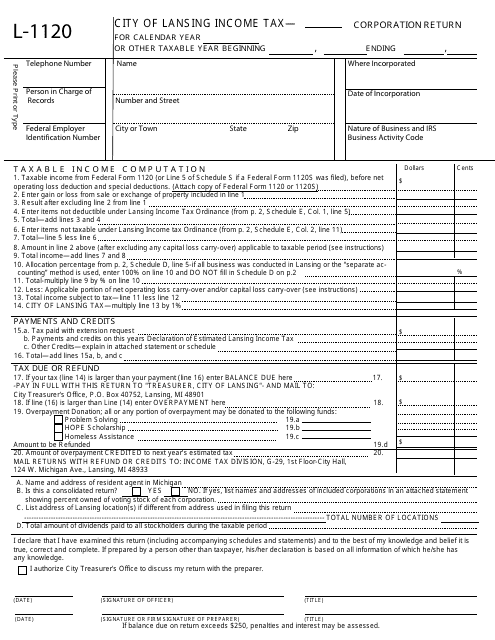

This form is used for filing the income tax corporation return specifically for businesses located in the City of Lansing, Michigan.

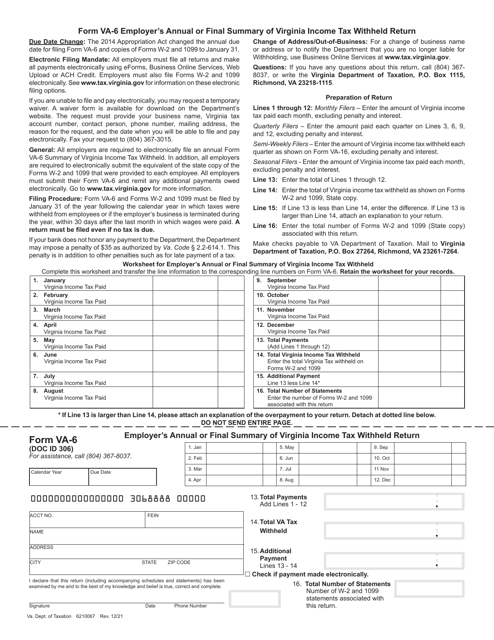

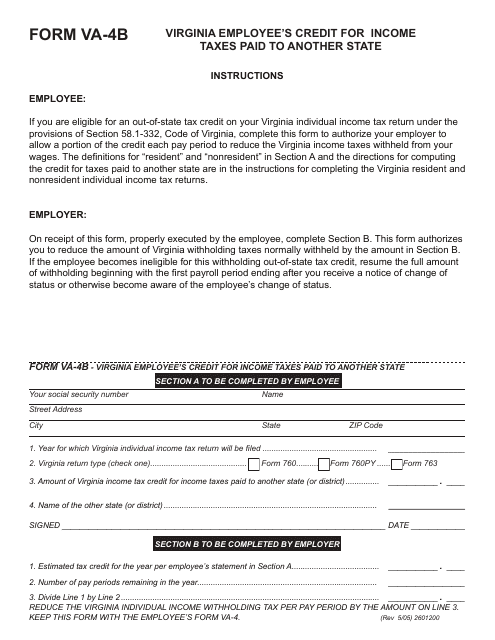

This form allows Virginia employees to claim a credit for income taxes paid to another state.

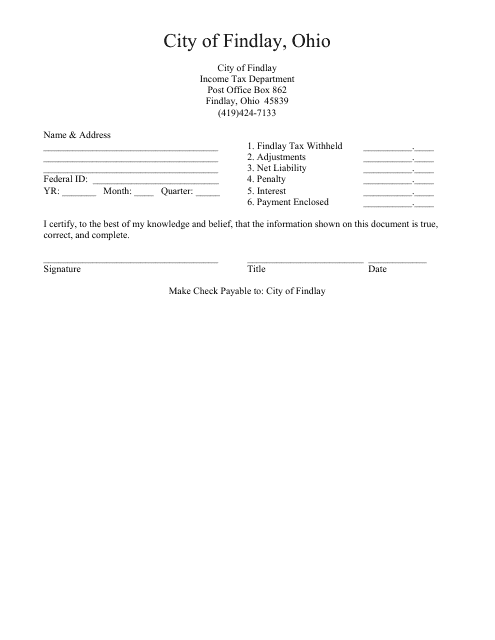

This tax form is used for filing taxes with the City of Findlay, Ohio. It is specific to residents and businesses located in Findlay and must be completed accurately and submitted by the designated deadline.

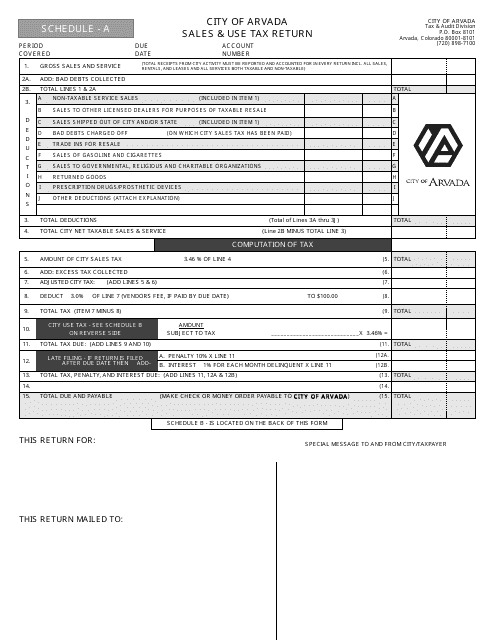

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

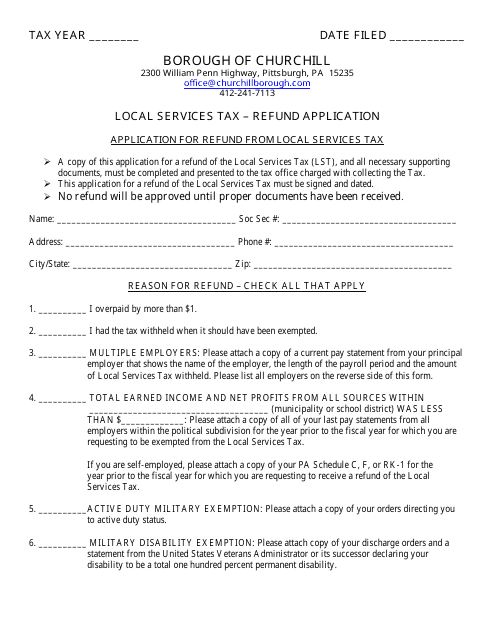

This Form is used for applying for a refund of local services tax paid to the Borough of Churchill, Pennsylvania.

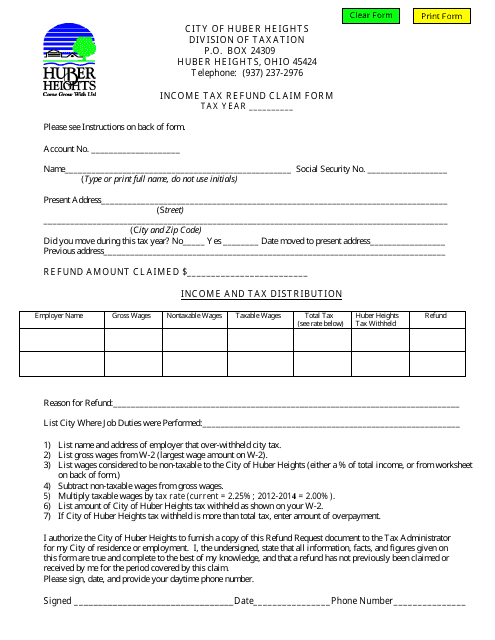

This form is used for claiming an income tax refund in Huber Heights, Ohio.

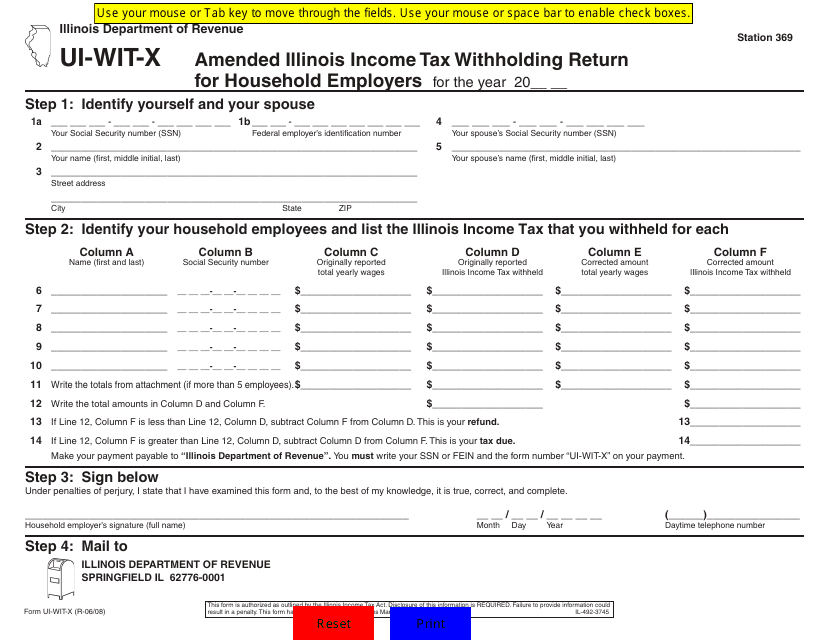

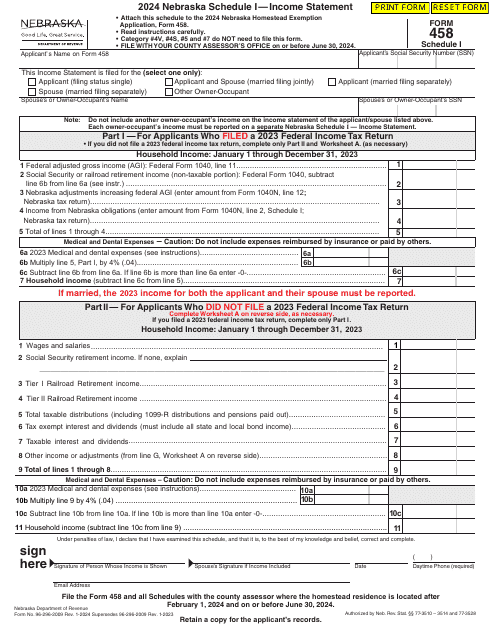

This form is used for Illinois household employers to amend their income tax withholding return for household employees.

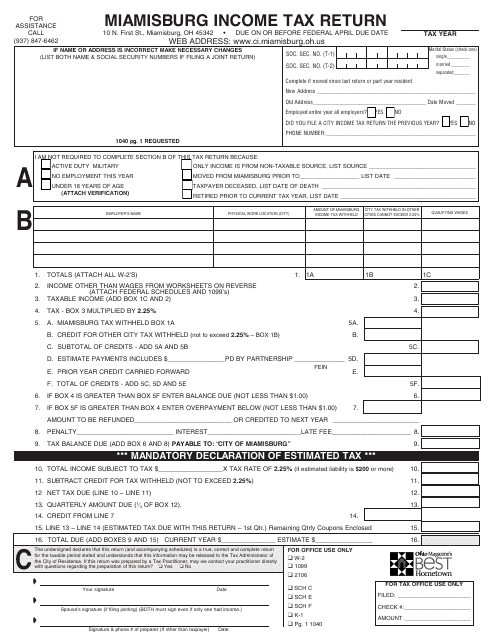

This form is used for filing the income tax return specifically for residents of the city of Miamisburg, Ohio.

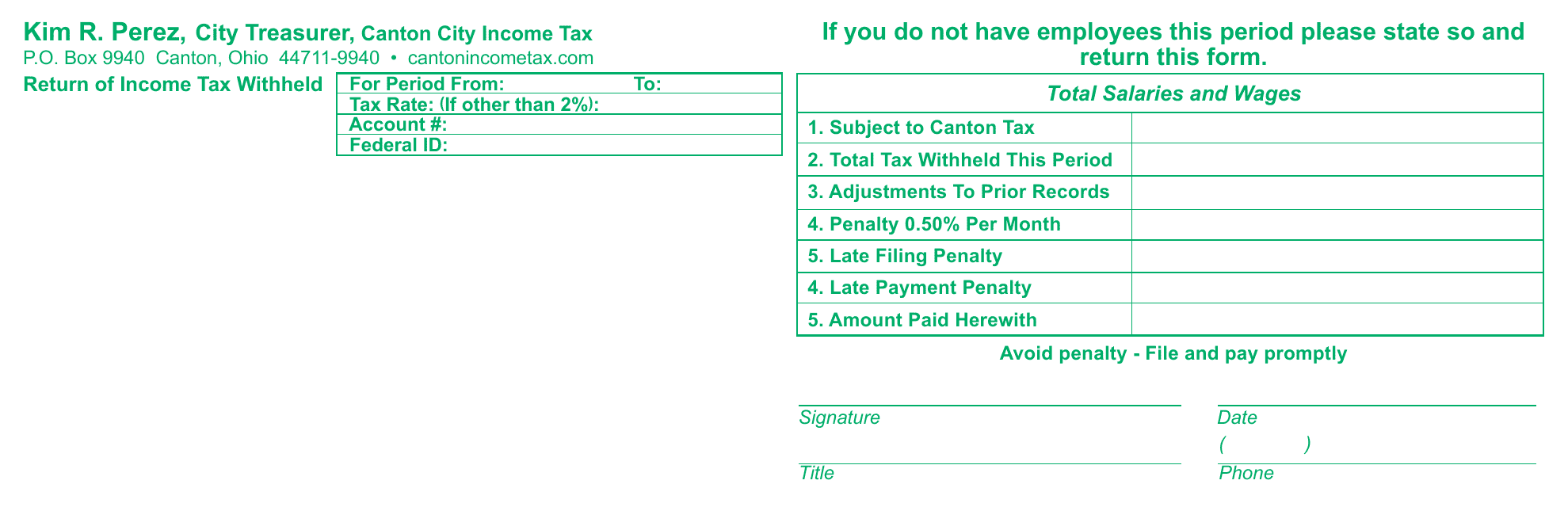

This Form is used for obtaining a withholding coupon from the City of Canton, Ohio.

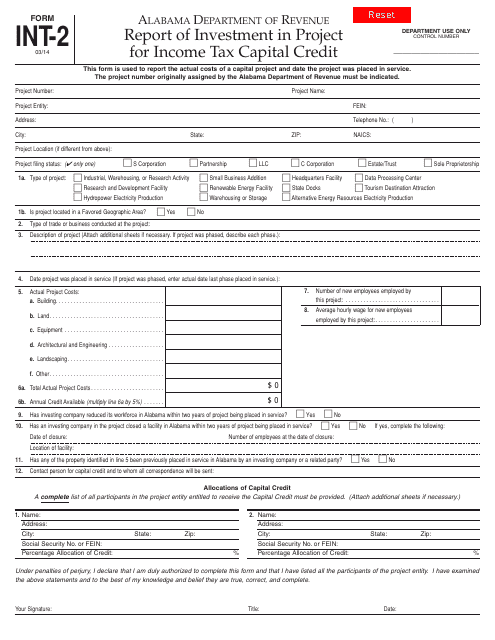

This form is used for reporting investments made in a project to claim income tax capital credit in Alabama.

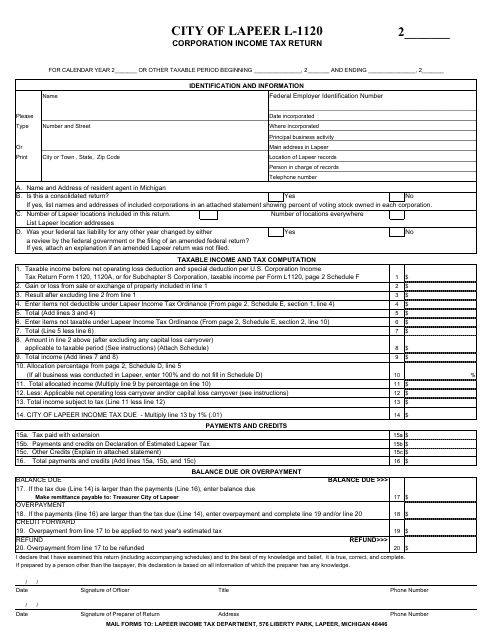

This form is used for filing corporation income tax return specifically for businesses located in the City of Lapeer, Michigan.

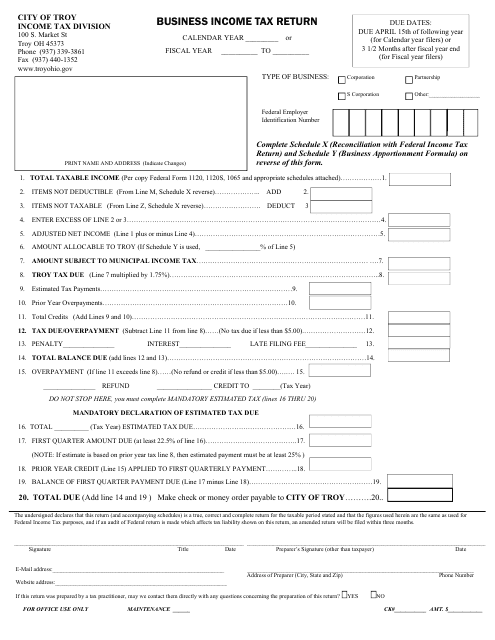

This document is used for filing your business income tax return specifically for the City of Troy, Ohio. It is required for businesses operating within the city to report their income and pay the appropriate taxes.

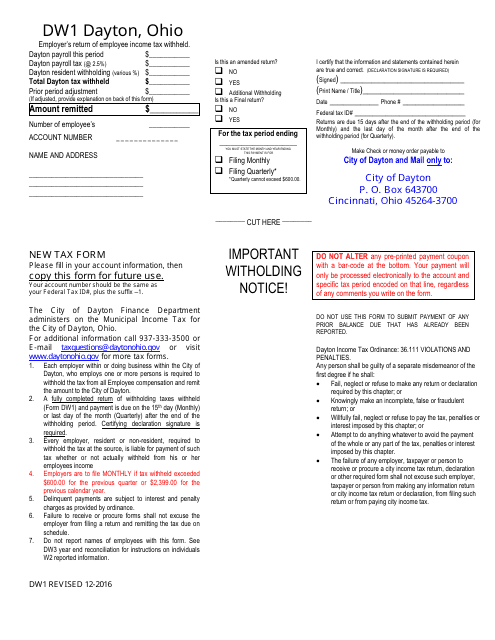

This form is used for employers in the City of Dayton, Ohio to report the income tax withheld from their employees' paychecks.

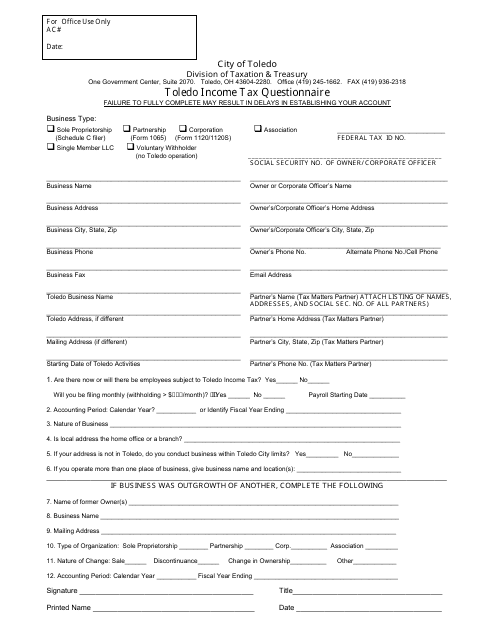

This Form is used for completing the Toledo Income Tax Questionnaire for residents of Toledo, Ohio.

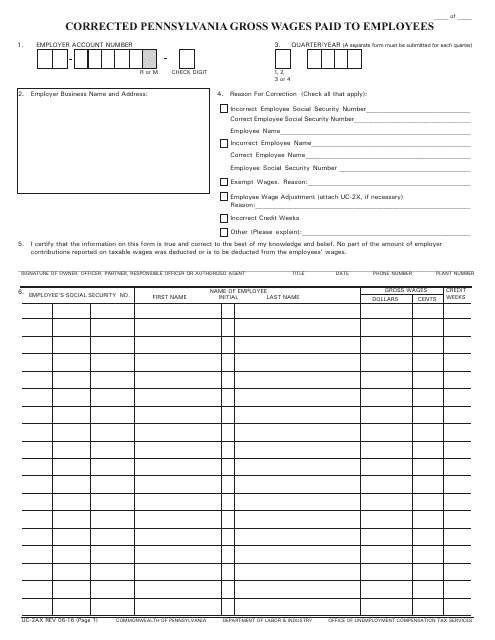

This form is used for reporting corrected gross wages paid to employees in Pennsylvania. It helps to ensure accurate reporting for tax purposes.

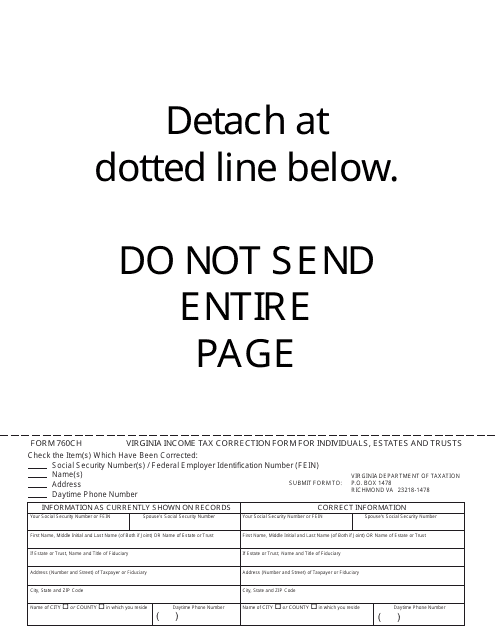

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

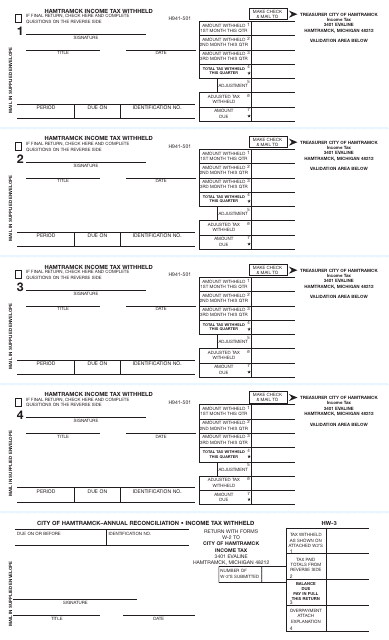

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

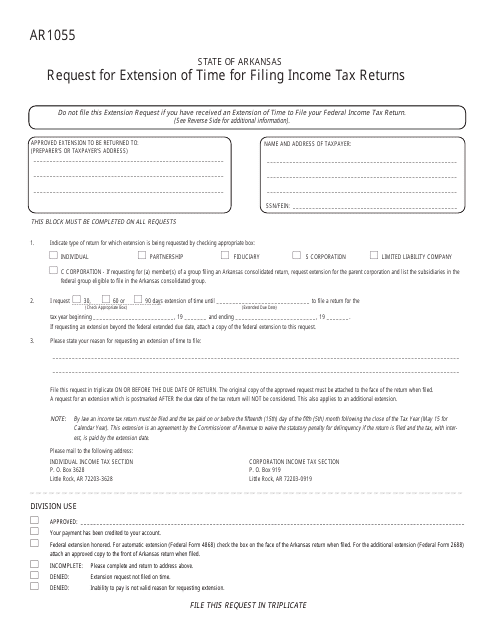

This form is used for requesting an extension of time to file income tax returns in Arkansas.

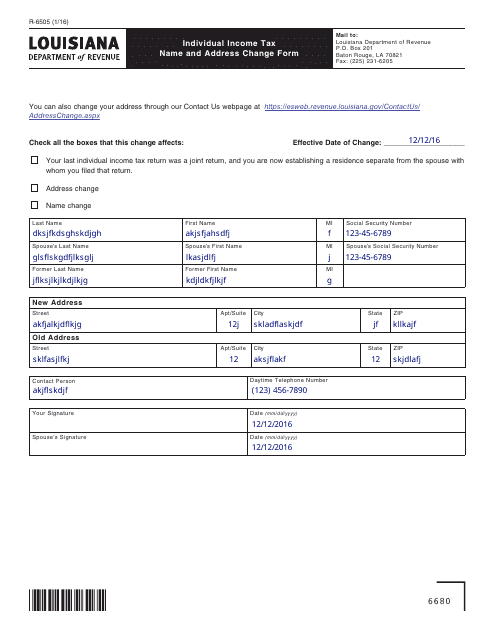

This form is used for individuals in Louisiana who need to update their name and address information for their income tax records.

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India](https://data.templateroller.com/pdf_docs_html/32/322/32275/form-15h-declaration-under-section-197a-1a-the-income-tax-act-1961-to-be-made-by-a-persons-not-being-a-company-or-a-firm-claiming-receipt-interest-other-than-interest-on-securities-or-income-in-respect-units-without-deduction-tax-india_big.png)