Tax Assessment Form Templates

Documents:

197

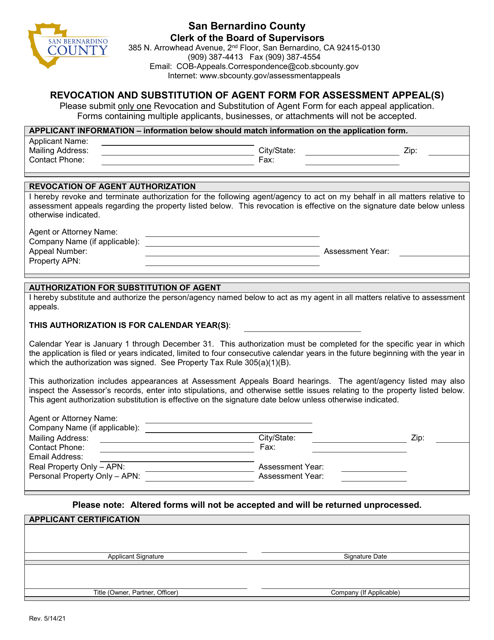

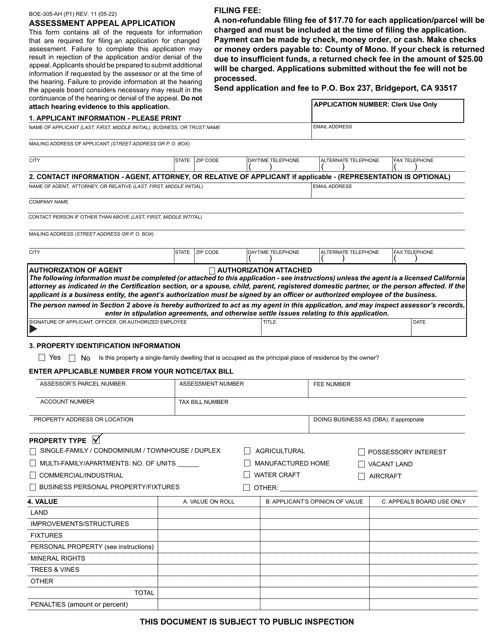

This document is used for revoking and substituting an agent for assessment appeals in the County of San Bernardino, California.

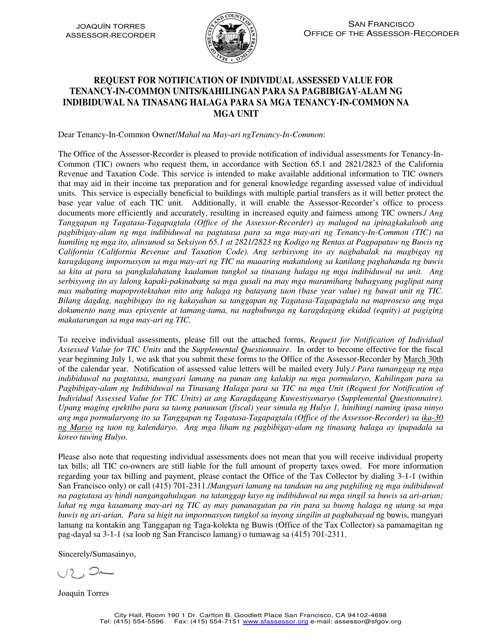

This document is a request form for receiving notifications about the assessed value of individual Tic units in the City and County of San Francisco, California. Available in English and Tagalog.

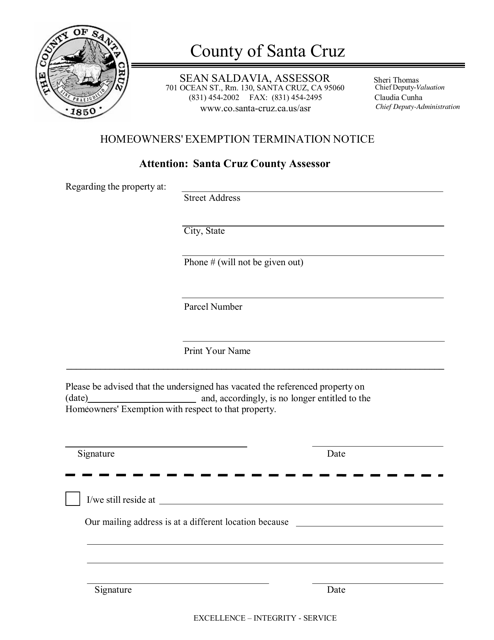

This document is a notice that informs homeowners in Santa Cruz County, California about the termination of their homeowners' exemption.

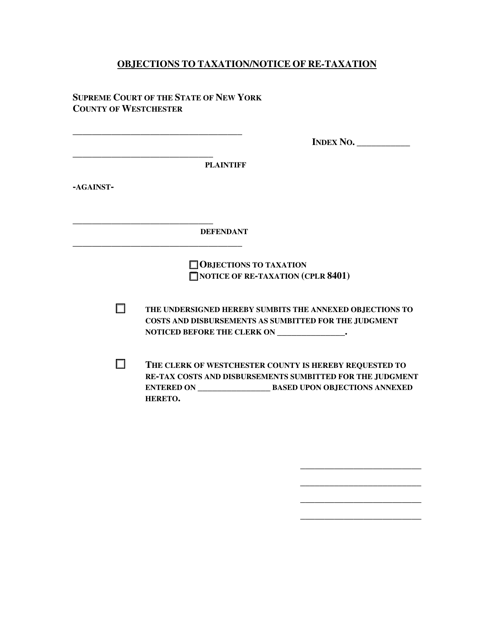

This document is for objecting to taxation or notifying about re-taxation in Westchester County, New York. It allows residents to voice their concerns or request a review of their property taxes.

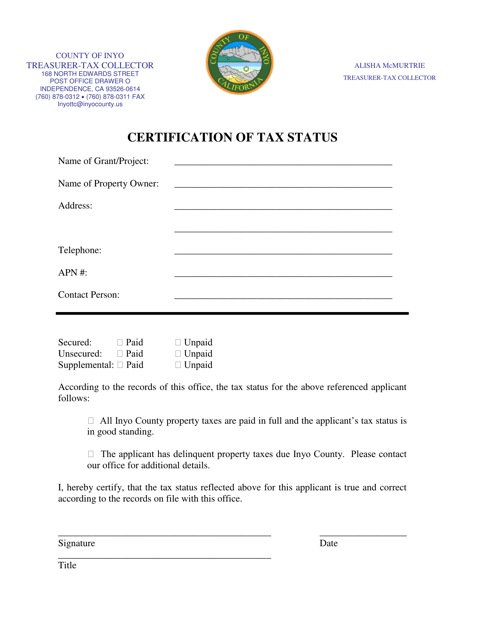

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

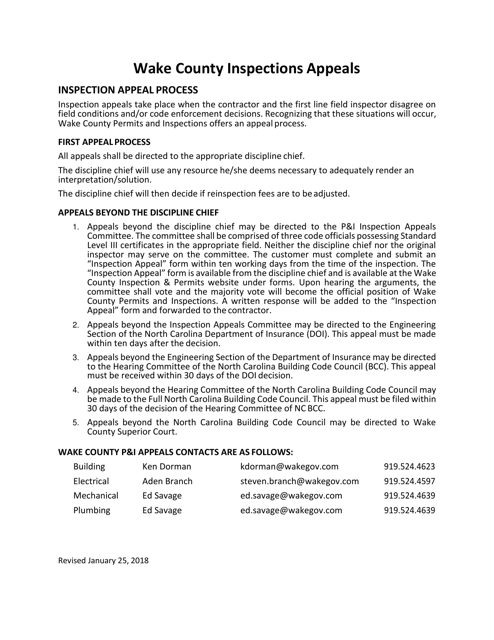

This document is used for appealing the results of an inspection in Wake County, North Carolina.

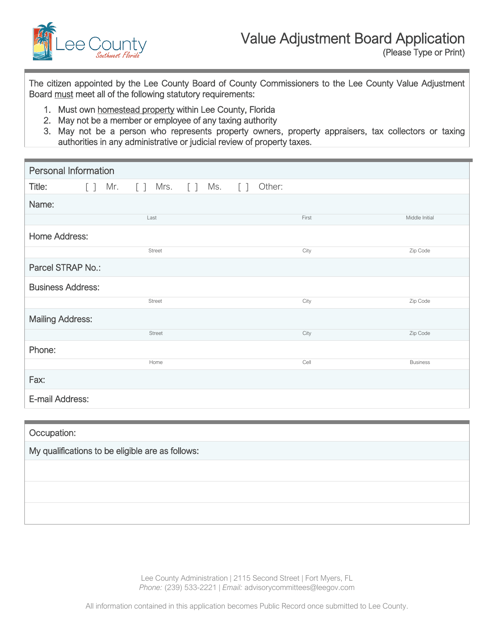

This document is for applying to the Value Adjustment Board in Lee County, Florida.

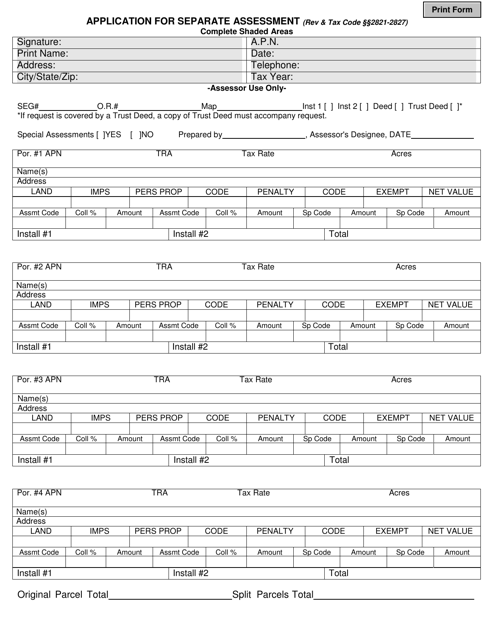

This type of document is used for applying for separate assessment in Shasta County, California. Separate assessment refers to the process of assessing property or land separately from adjacent parcels.

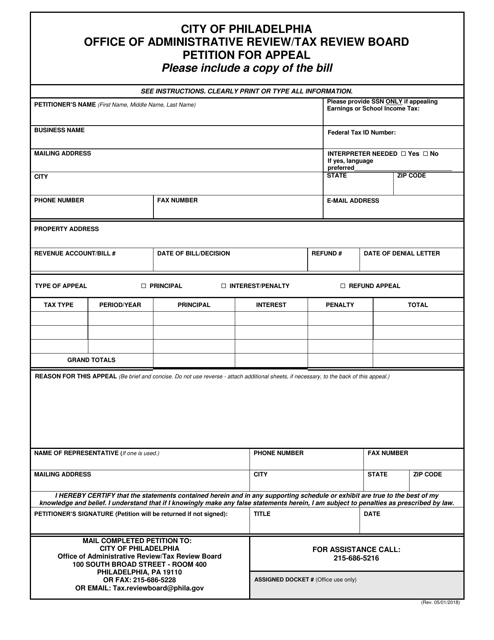

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

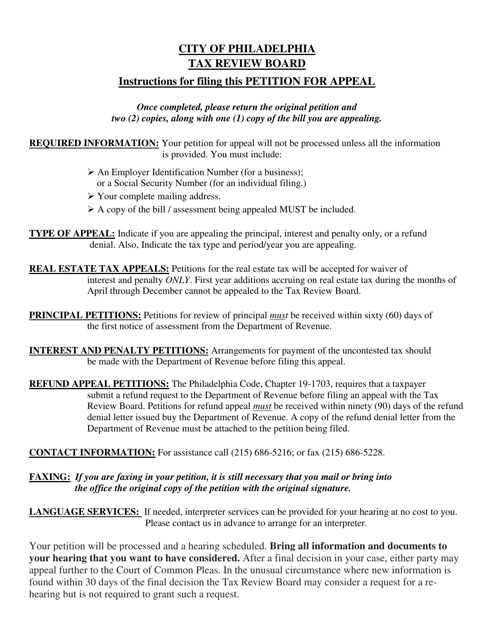

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.

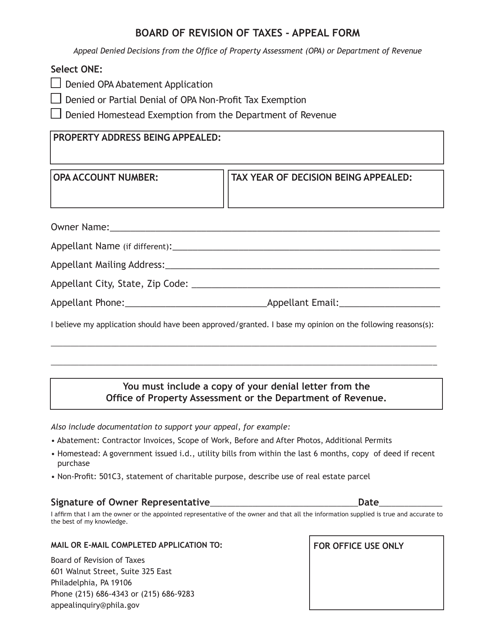

This Form is used for appealing a denied abatement or exemption in the City of Philadelphia, Pennsylvania.

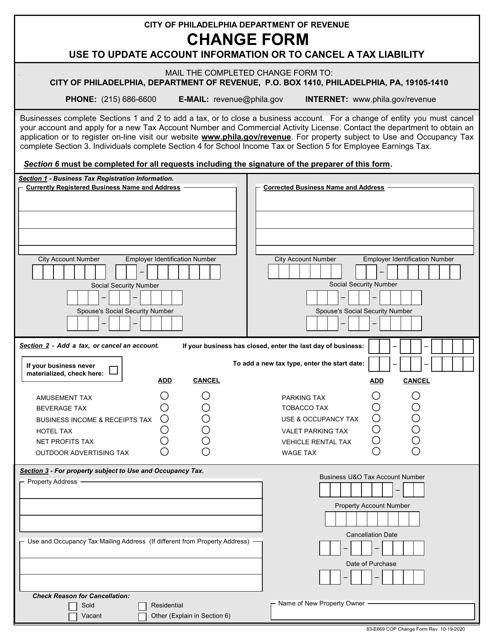

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

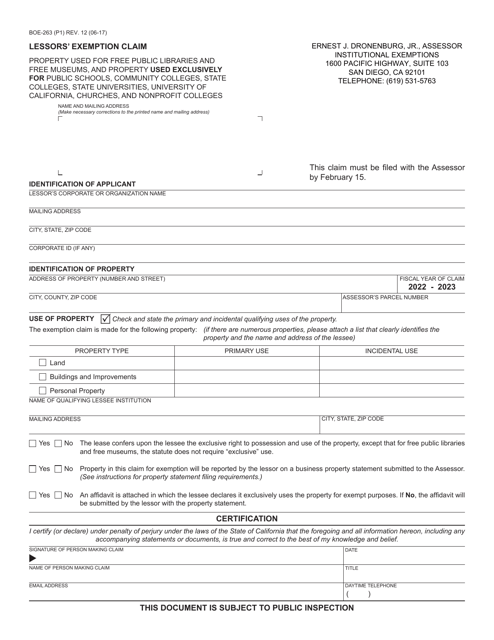

This form is used for claiming a lessors' exemption in San Diego County, California.

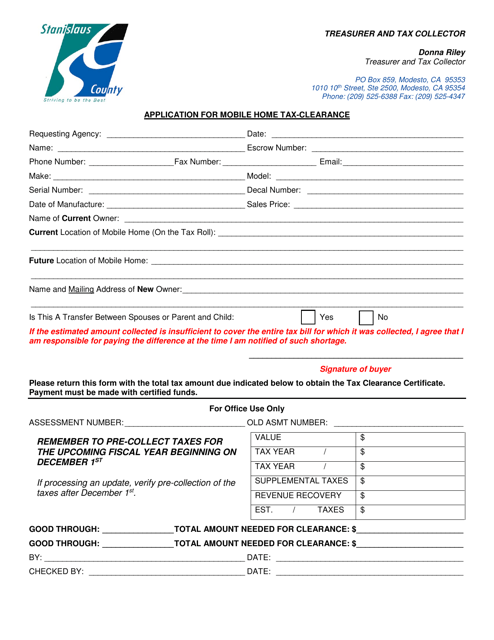

This document is used for applying for a tax-clearance for a mobile home in Stanislaus County, California.

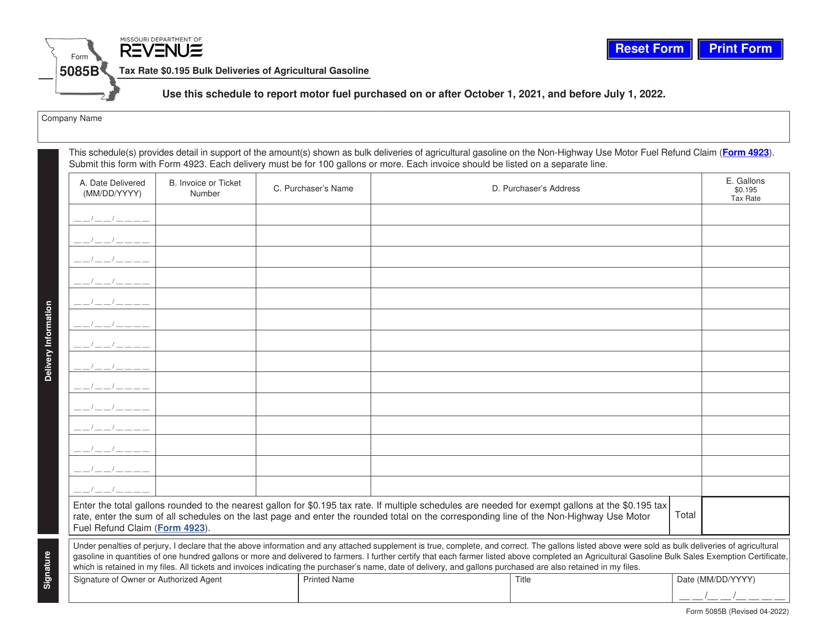

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

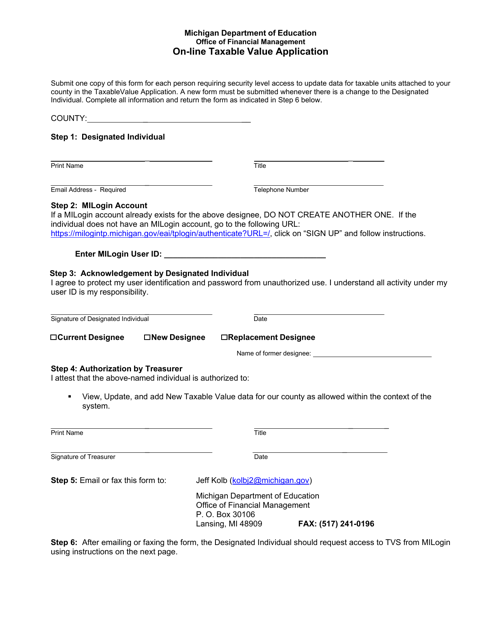

This document allows residents of Michigan to apply for the on-line taxable value of their property for tax purposes.

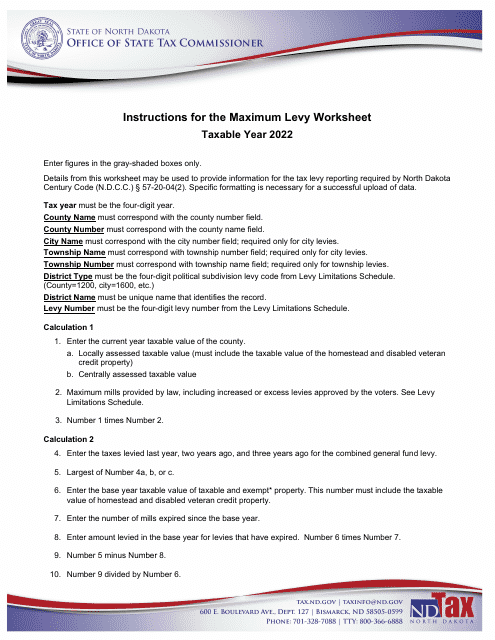

This document provides instructions for completing the Maximum Levy Worksheet in North Dakota. The worksheet helps determine the maximum amount of money that can be levied or collected for various purposes, such as taxes or funding for specific projects, within the state.

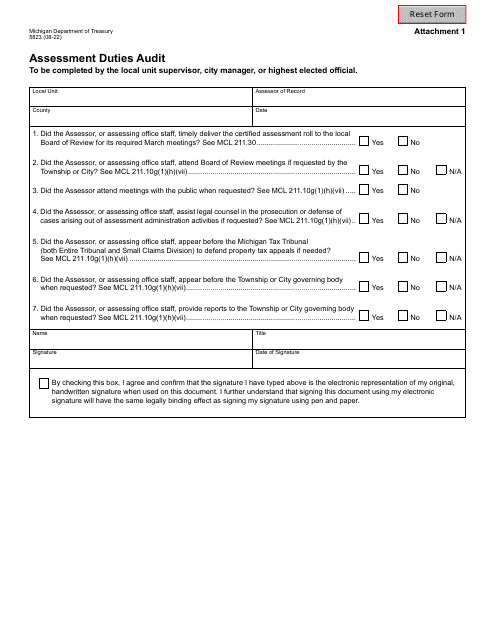

This form is used for conducting an assessment duties audit in the state of Michigan. It helps to ensure compliance and accuracy in assessing taxes and duties.

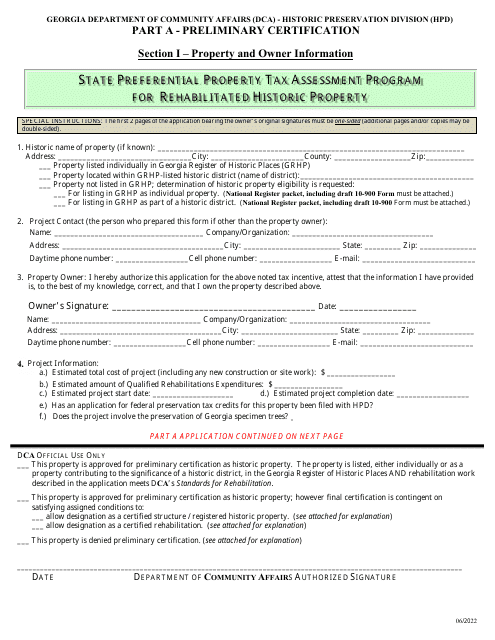

This document certifies that a historic property in Georgia is eligible for preferential property tax assessment. It is part of the state's program to encourage the rehabilitation of historic properties.

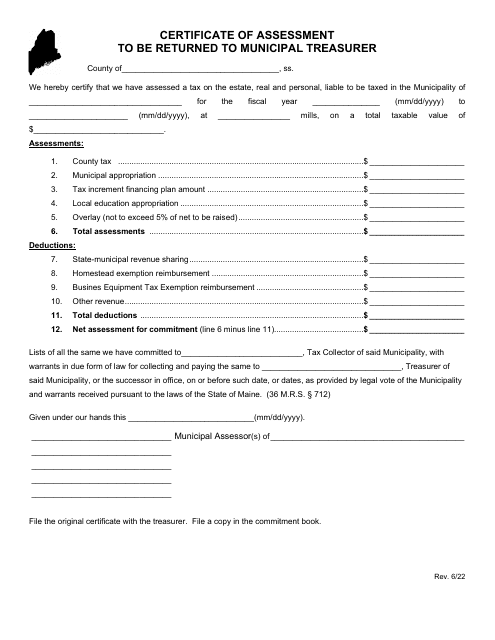

This document is for the return of a Certificate of Assessment to the Municipal Treasurer in the state of Maine. It is used to update and provide accurate information about the assessed value of a property for tax purposes.

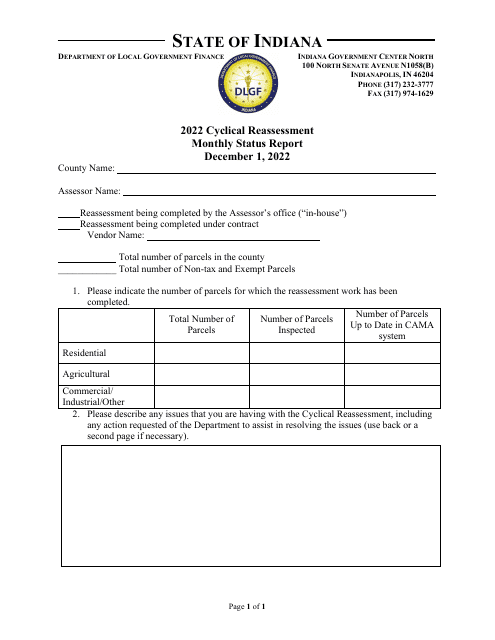

This document provides a monthly status report for the cyclical reassessment process in Indiana for the month of December.