Tax Assessment Form Templates

Documents:

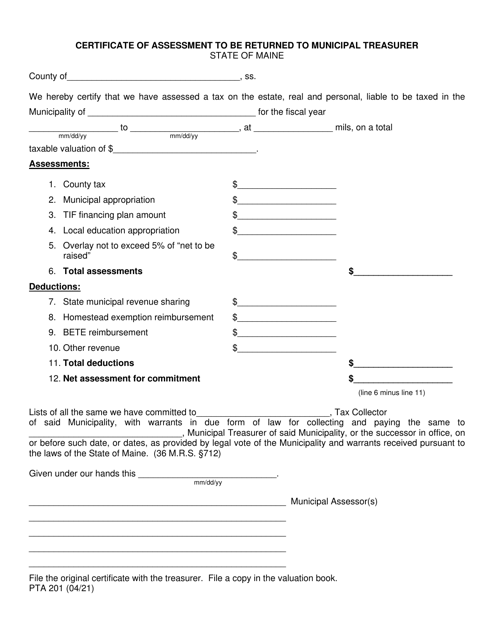

197

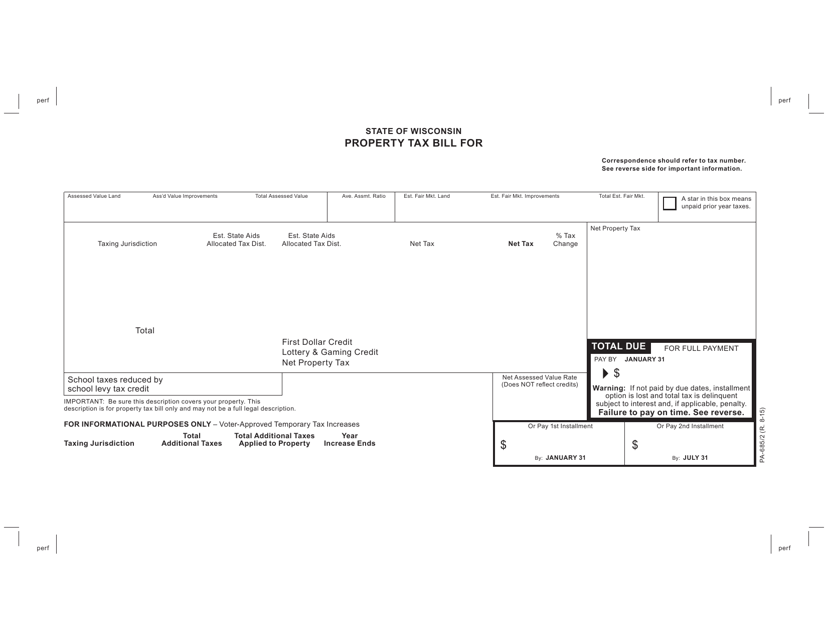

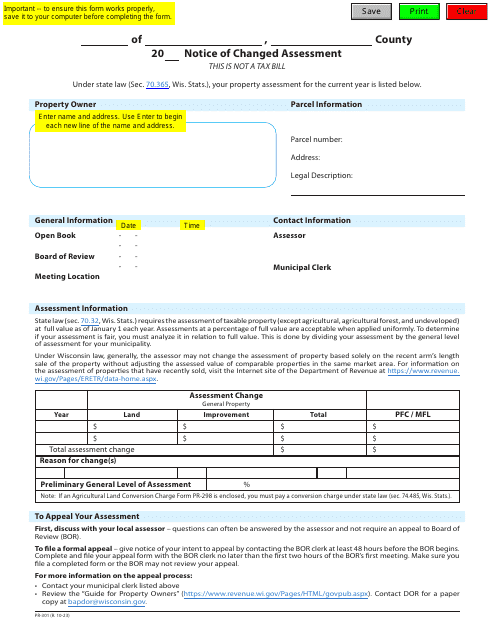

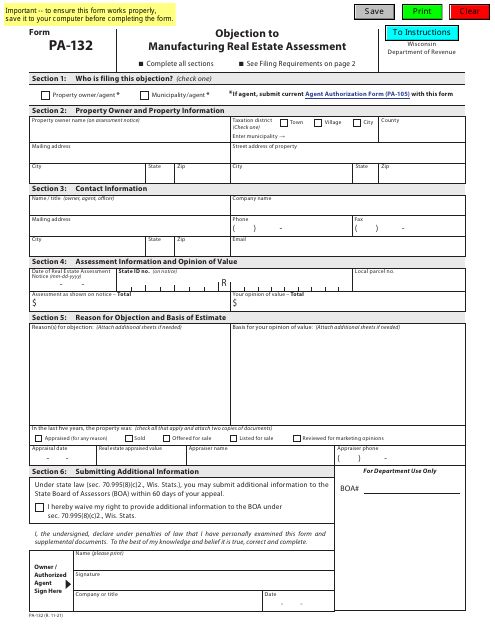

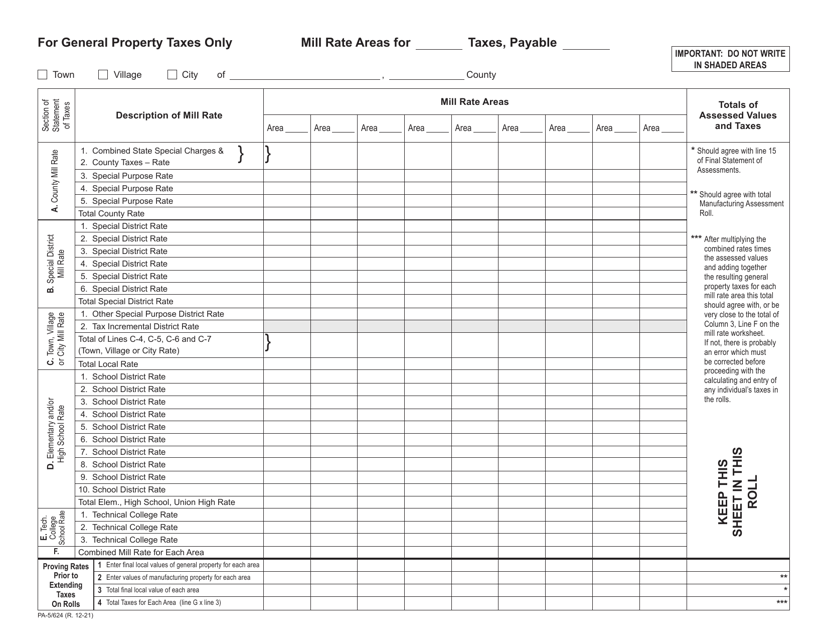

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

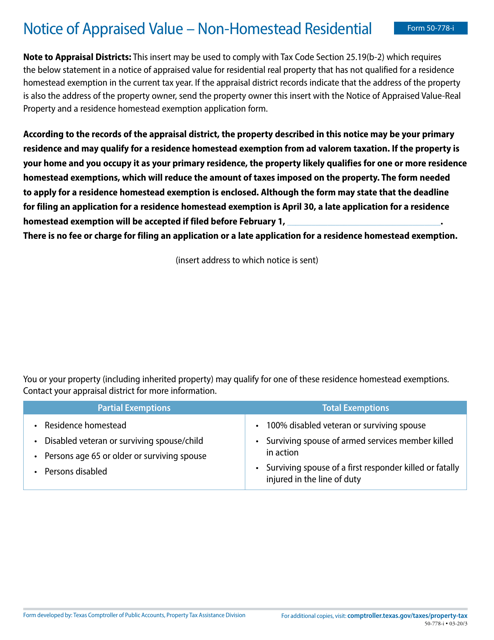

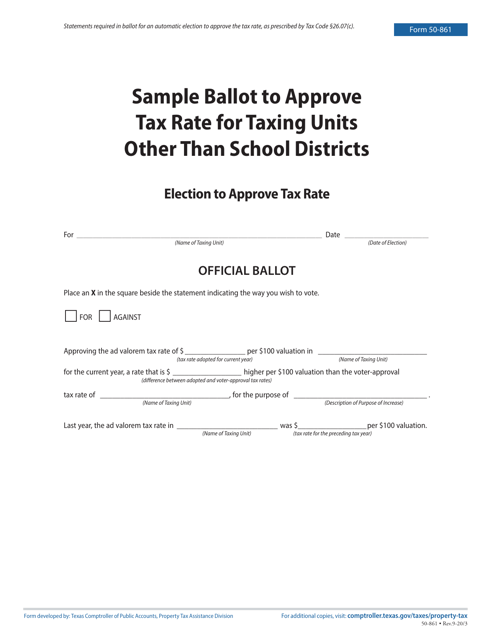

This Form is used for notifying property owners in Texas about the appraised value of their non-homestead residential property.

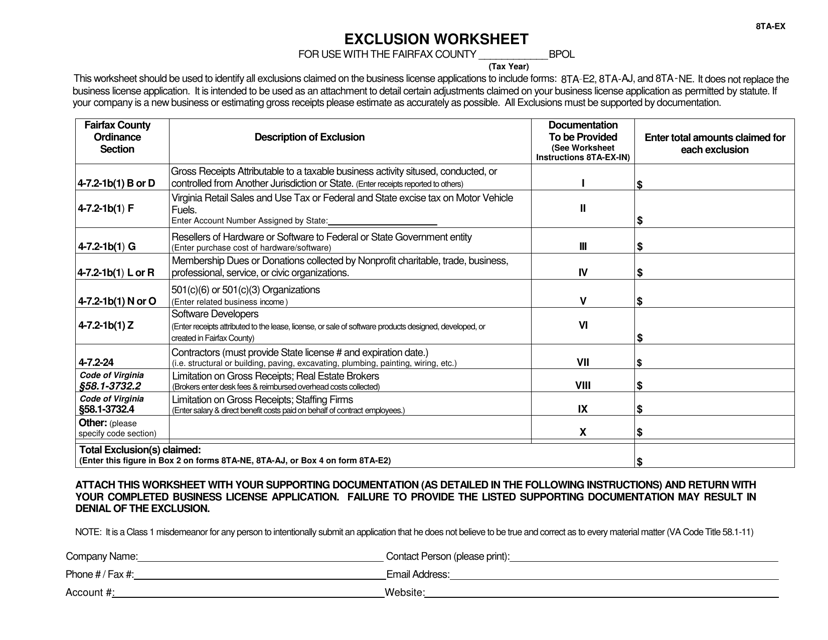

This form is used for calculating exclusions on real property taxes in Fairfax County, Virginia.

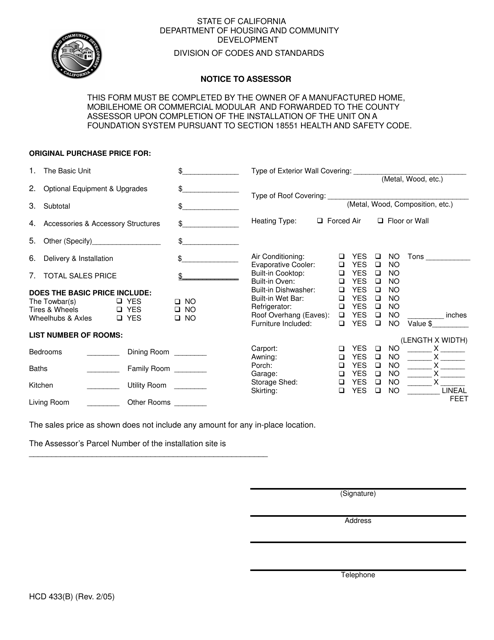

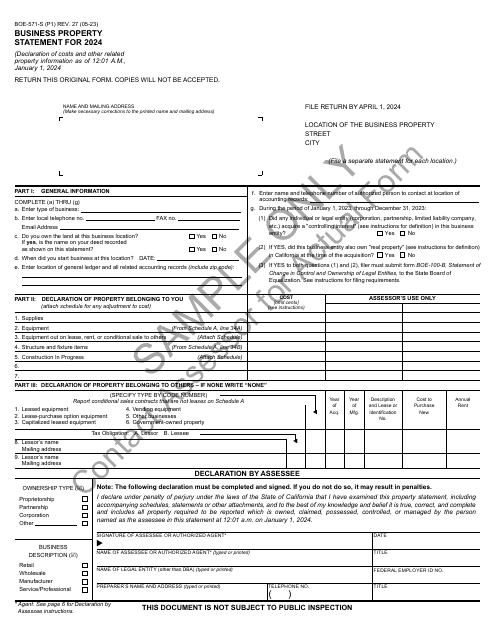

This form is used for notifying the assessor in California about certain changes or updates related to property assessment.

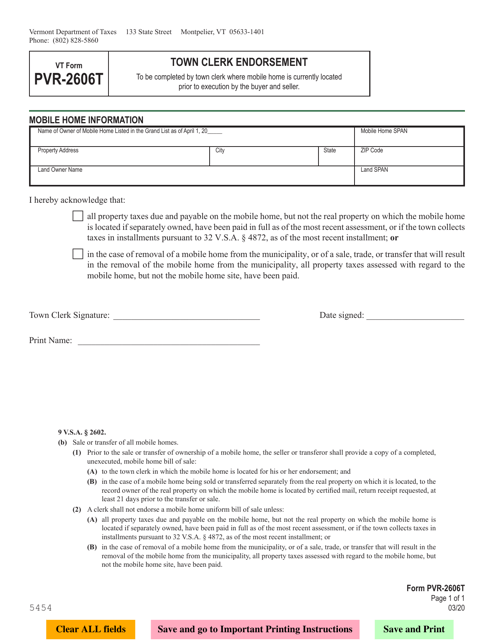

This form is used for obtaining the Town Clerk Endorsement in Vermont.

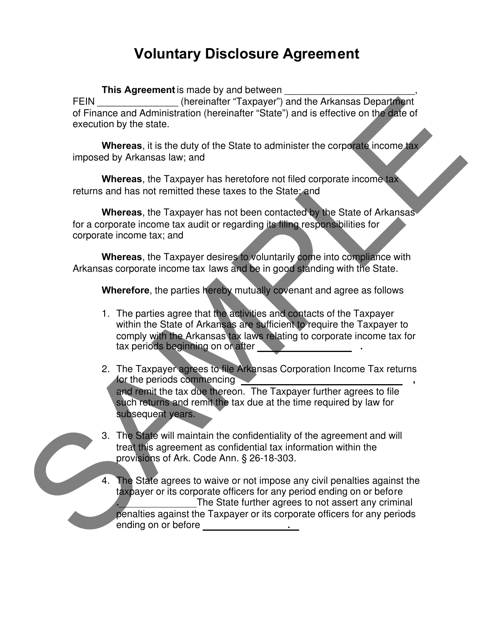

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

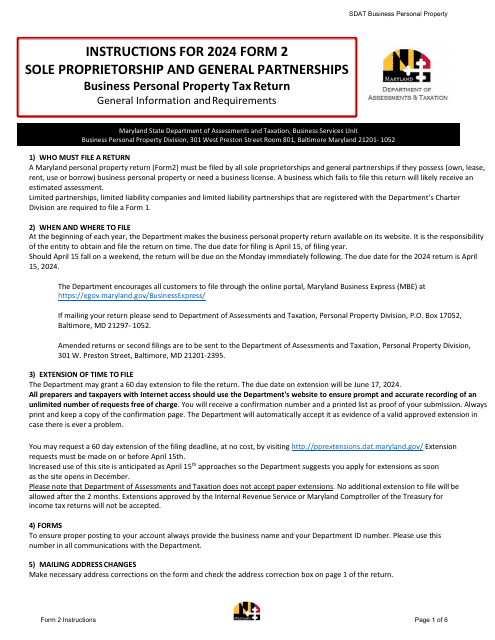

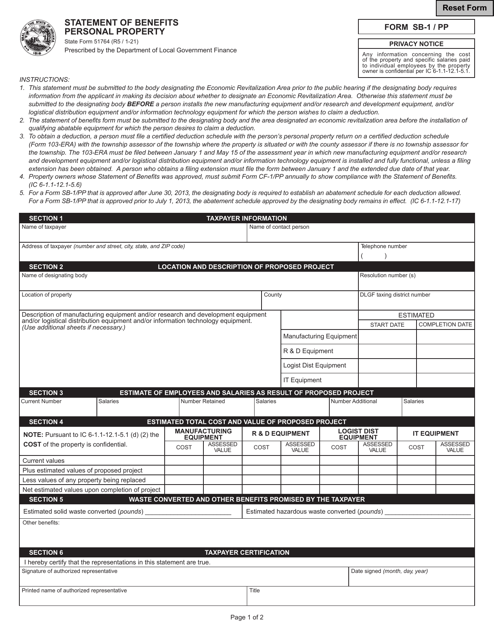

This Form is used for reporting personal property benefits in the state of Indiana.

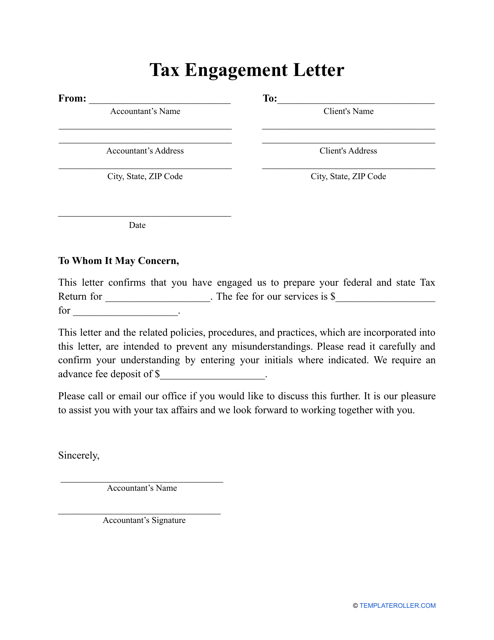

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

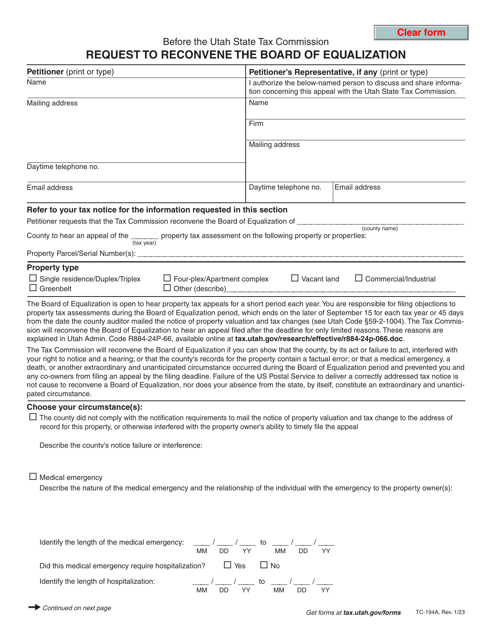

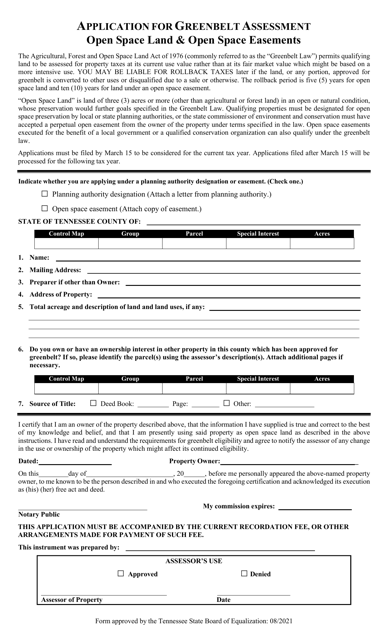

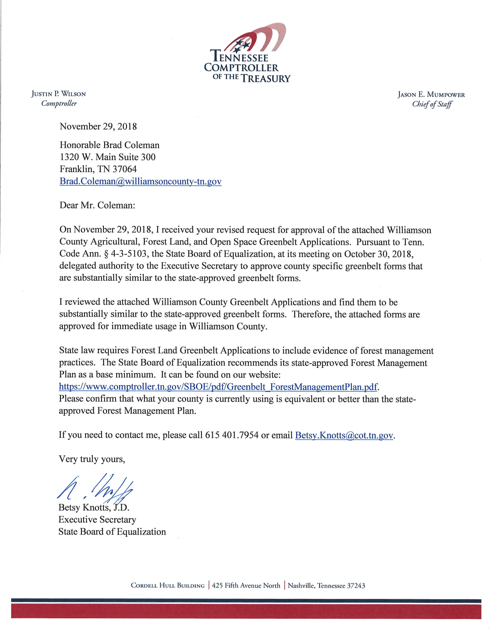

This document is used for applying for a Greenbelt Assessment in Williamson County, Tennessee.

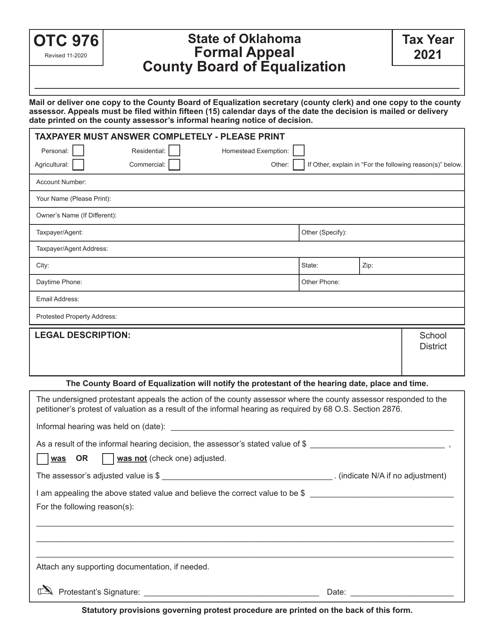

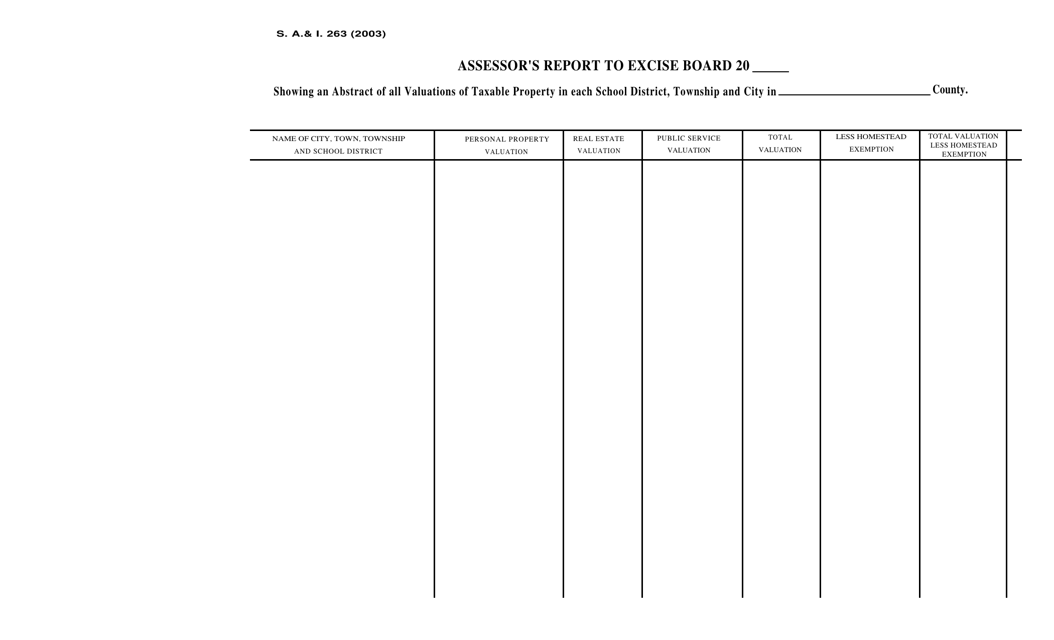

This type of document is used for submitting an Assessor's Report to the Excise Board in Oklahoma.

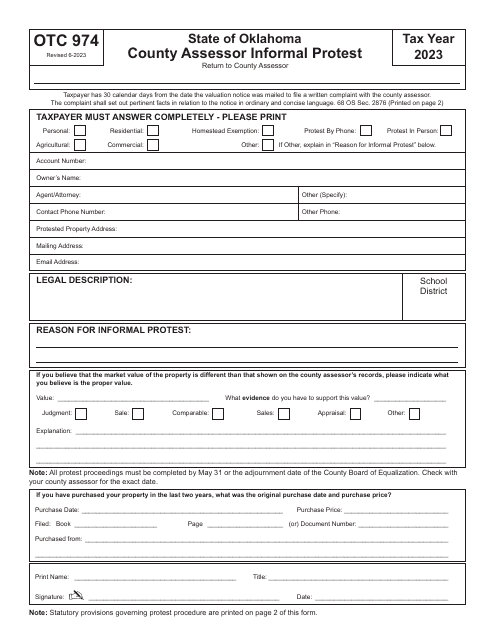

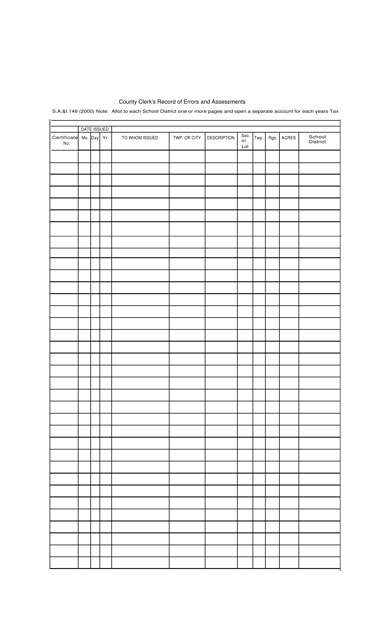

This document is used for recording errors and assessments made by the County Clerk in Oklahoma. It helps maintain accurate records of any discrepancies or changes in property assessments.

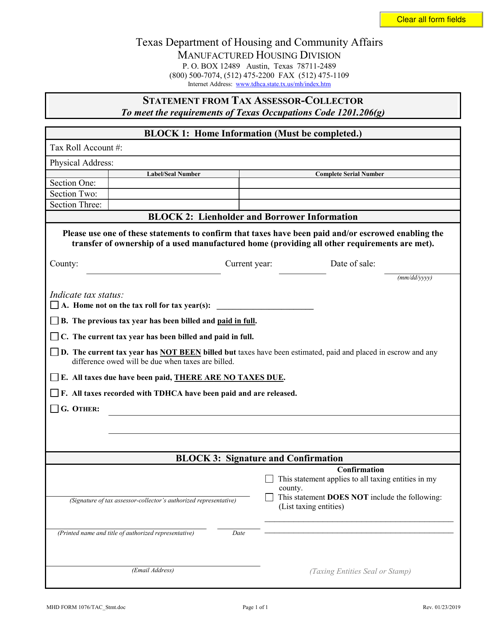

This Form is used for tax assessors and collectors in Texas to provide a statement of their taxes.

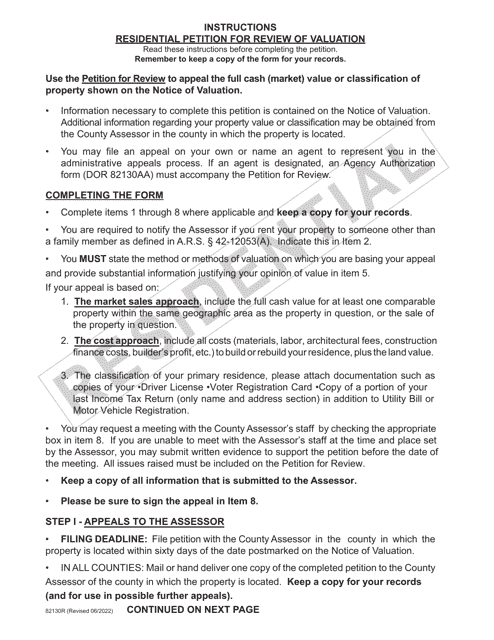

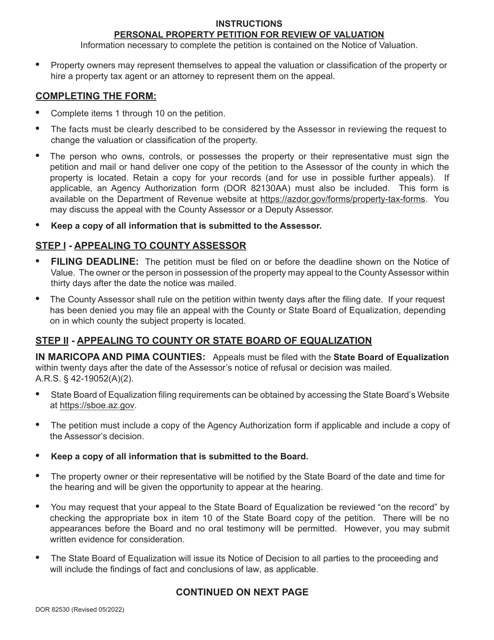

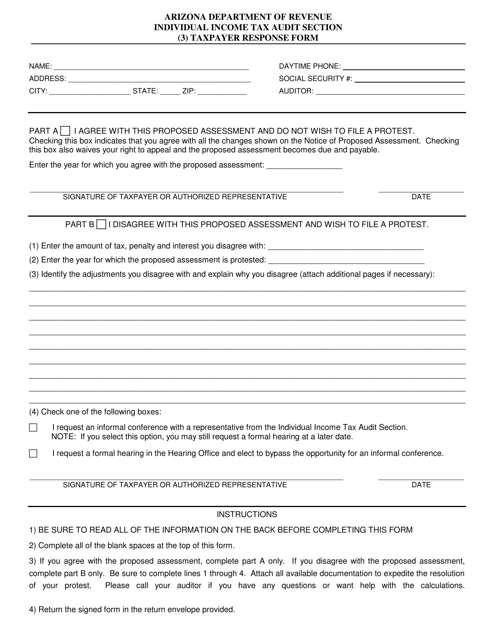

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

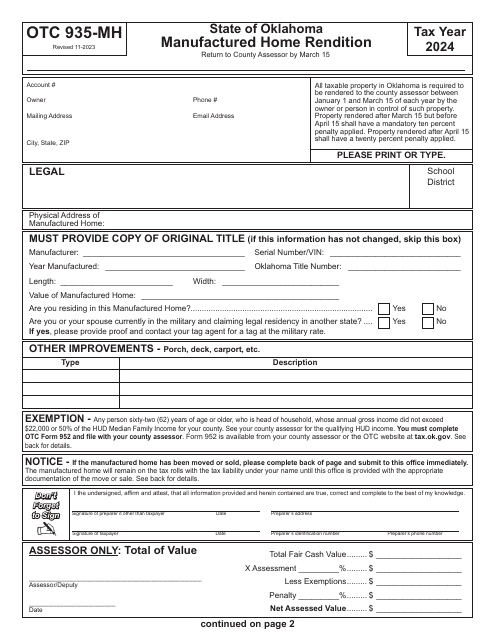

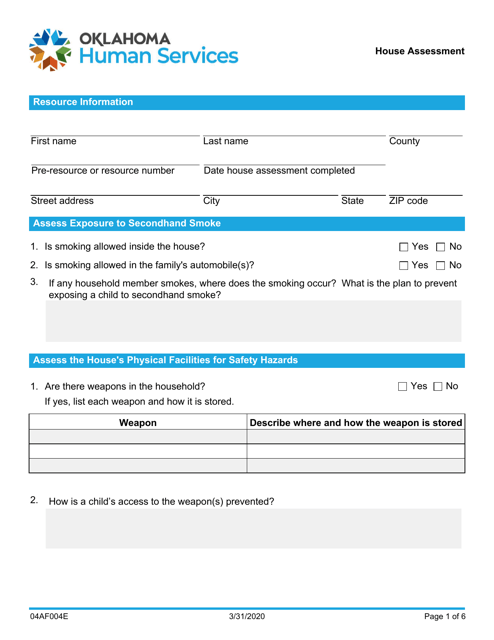

This Form is used for assessing houses in Oklahoma. It helps determine the value and tax assessment of residential properties in the state.

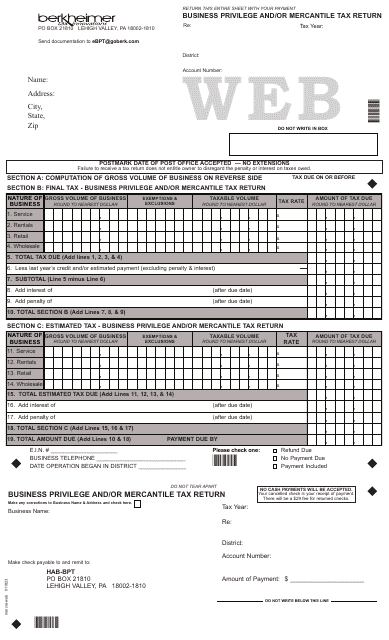

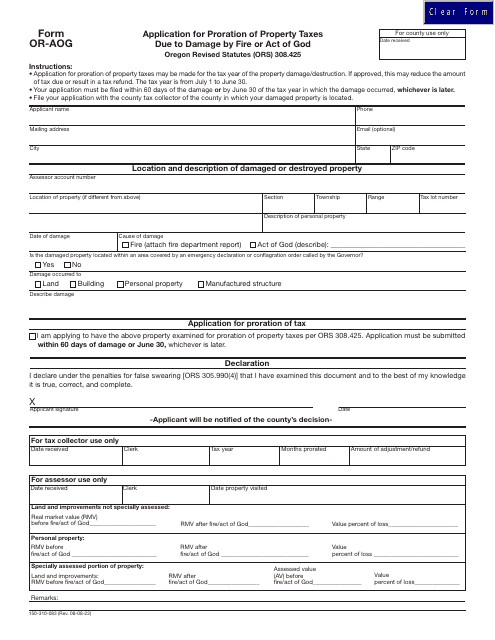

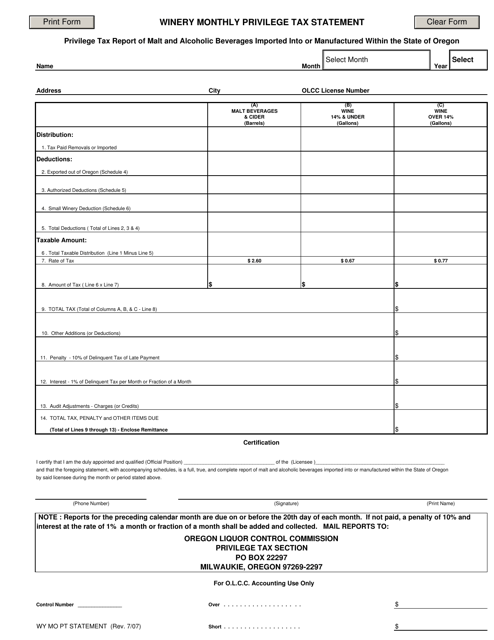

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

This Form is used for applying for a tax abatement on real property in Washington, D.C.