Tax Assessment Form Templates

Documents:

197

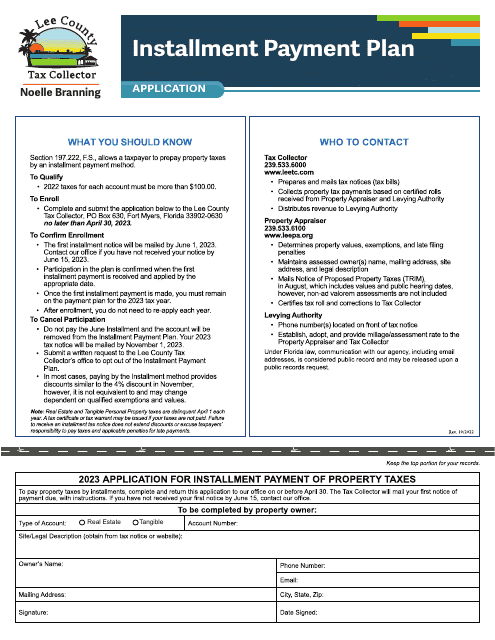

This document is for residents of Lee County, Florida who want to apply for an installment payment plan for their property taxes.

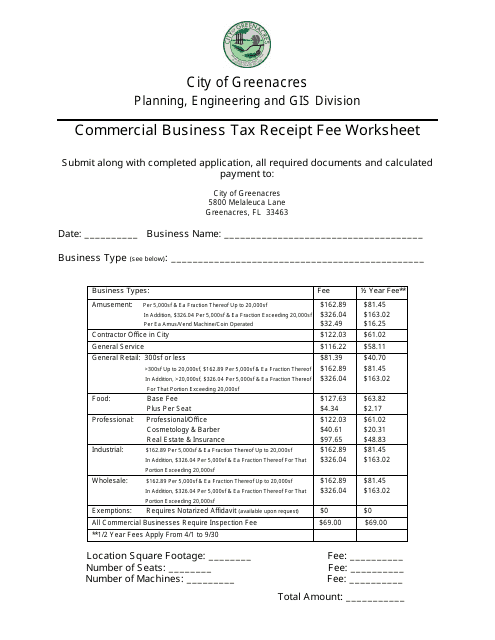

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.

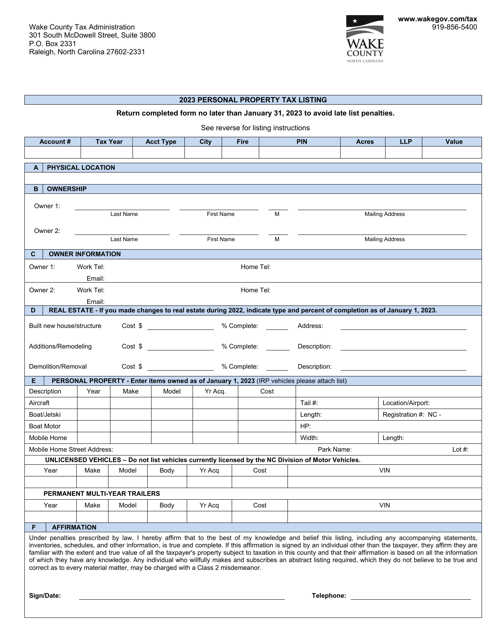

This document is used for listing personal property taxable in North Carolina. It provides a detailed record of personal property that is subject to tax in the state.

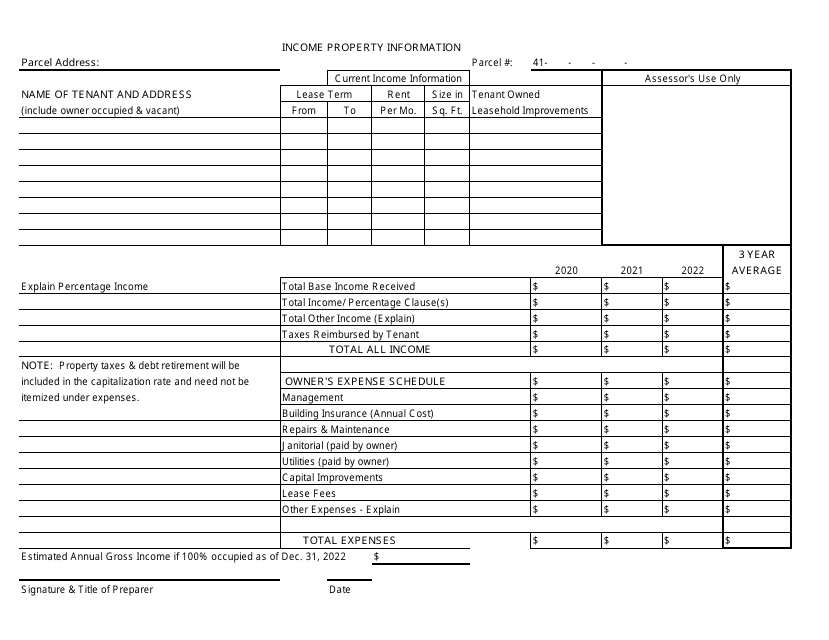

This document is used for reporting income and expenses related to a property in Grand Rapids, Michigan. It is used for assessment purposes by the city's assessor.

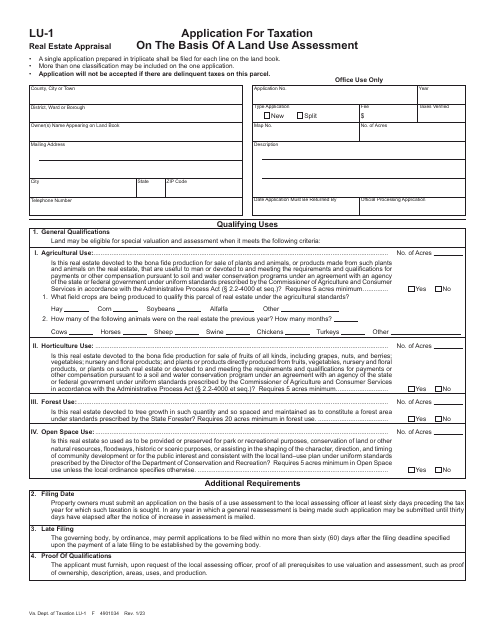

This Form is used for applying for taxation based on land use assessment in Virginia.

This document is used for filing personal property taxes on business assets in DeKalb County, Georgia.

This document is used for applying for a homestead exemption in the city of Philadelphia, Pennsylvania. It is available in English and Spanish.

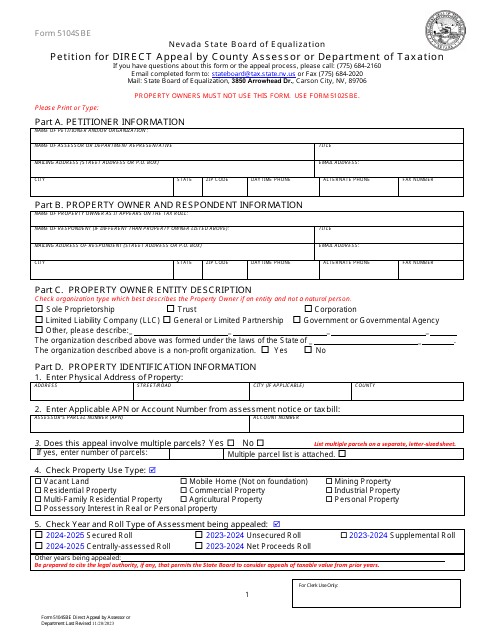

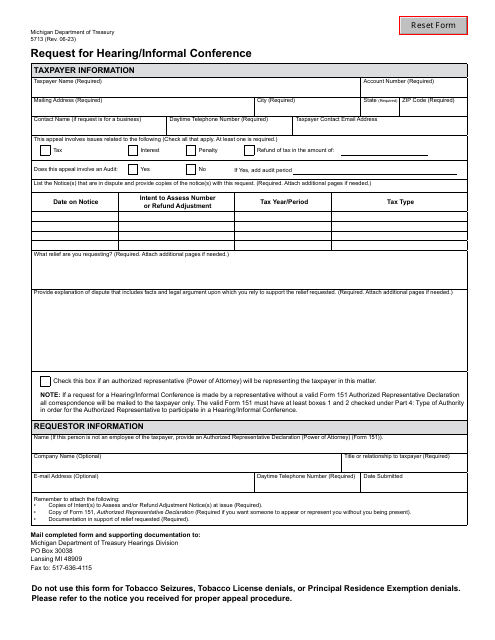

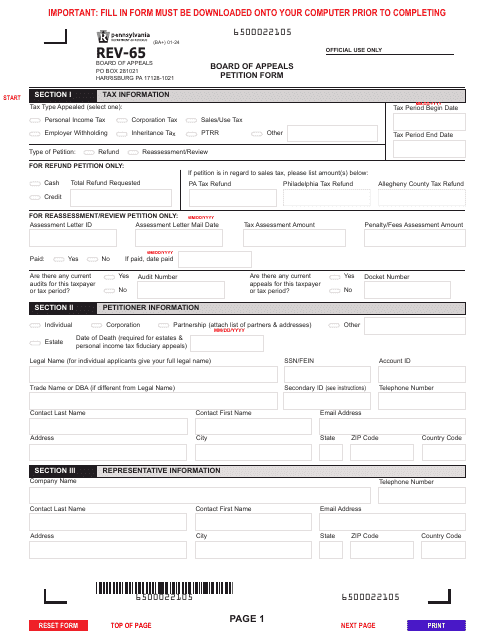

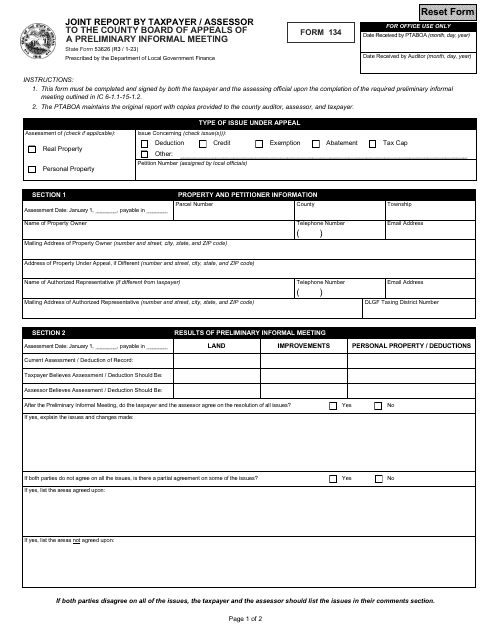

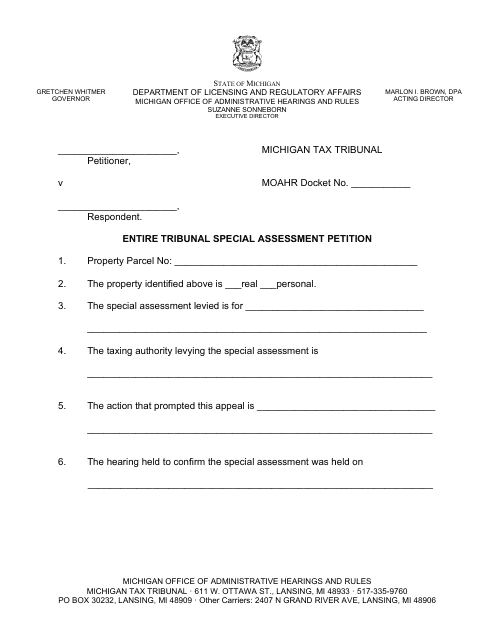

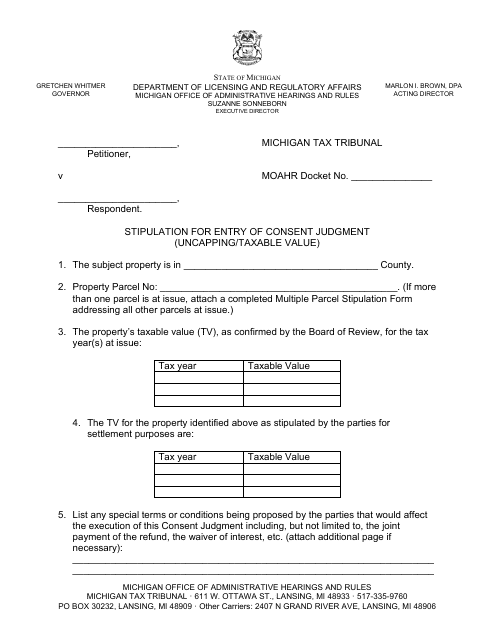

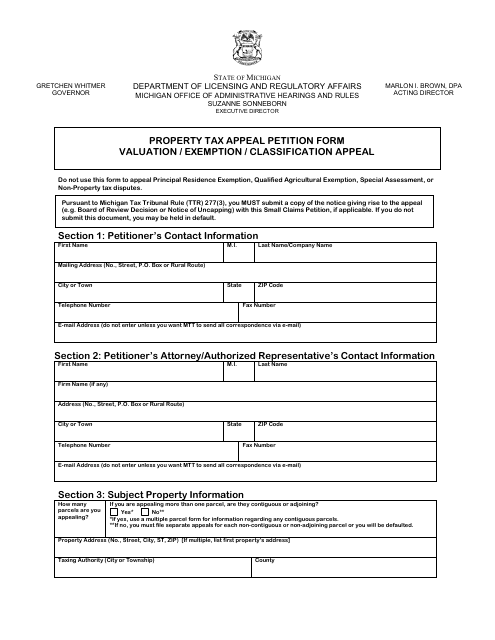

This document is used for filing a petition related to property tax assessment in Michigan. It allows taxpayers to contest their property tax assessment before the Tribunal.

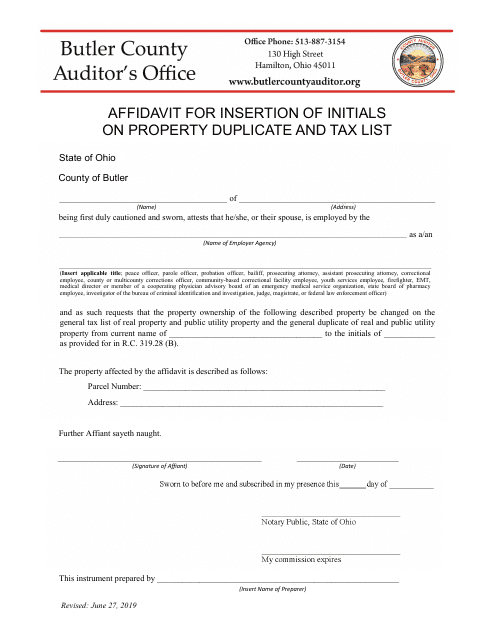

This document is used for requesting the insertion of initials on a property duplicate and tax list in Butler County, Ohio.

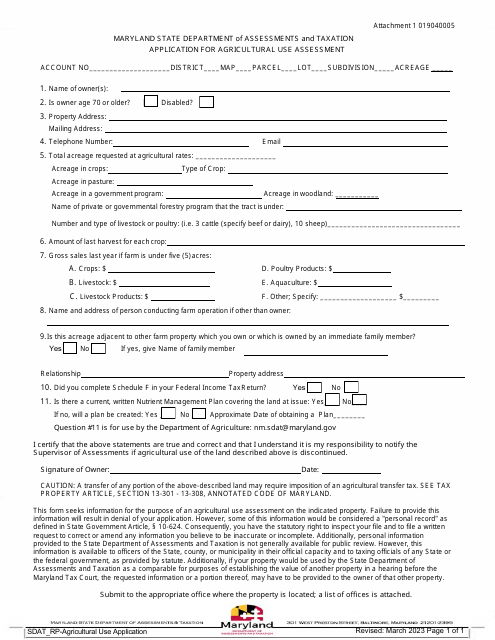

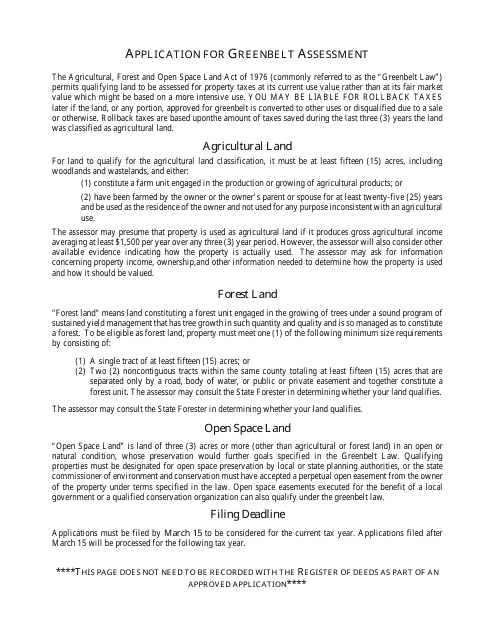

This document is used for applying for agricultural use assessment in the state of Maryland.

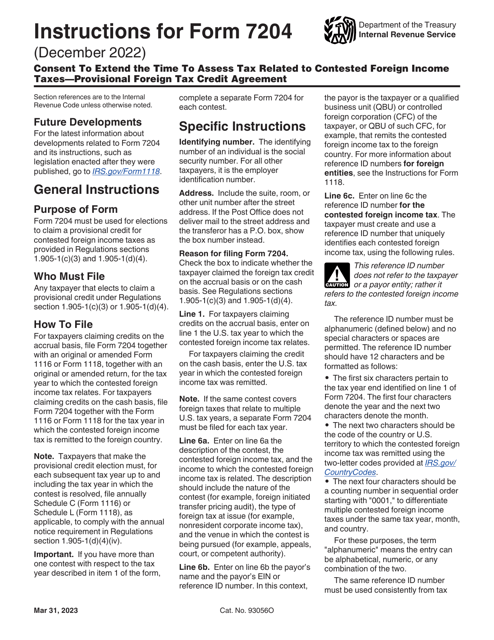

This Form is used to request an extension of time for assessing tax related to contested foreign income taxes. It involves a provisional foreign tax credit agreement.

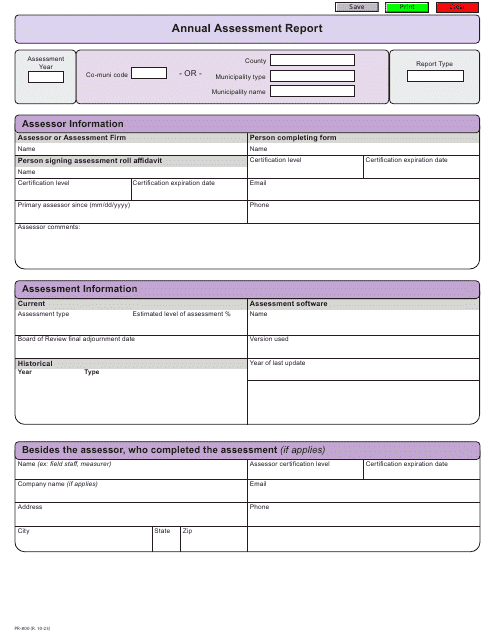

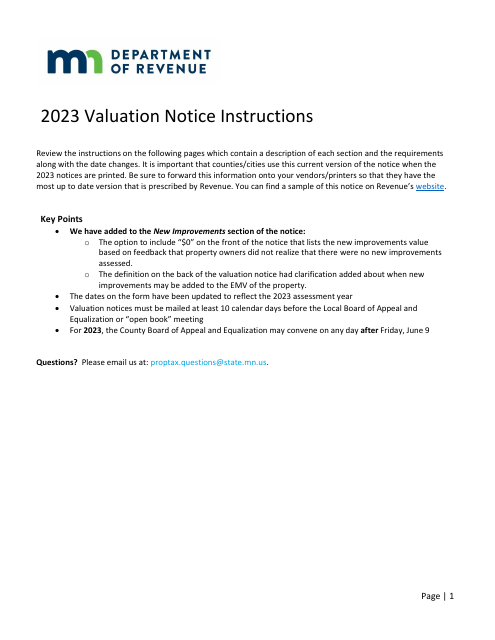

This document provides instructions for completing the Local Board of Appeal and Equalization Meeting and Certification Form in Minnesota. It outlines the steps to follow and the information required to ensure accurate completion of the form.

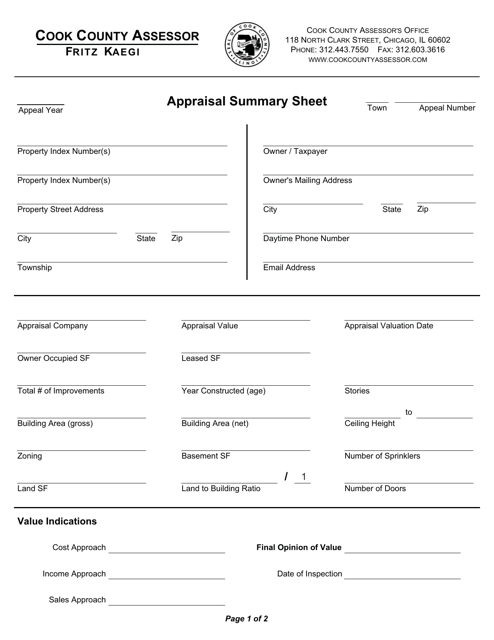

This document provides a summary of the appraisal for properties in Cook County, Illinois. It includes important information such as property value and assessment details.

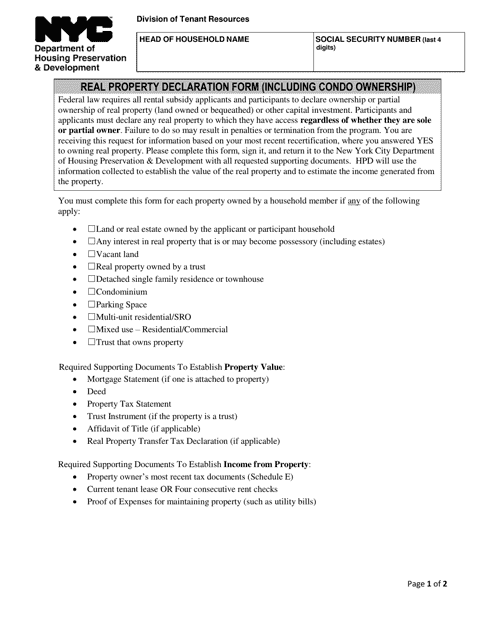

This Form is used for declaring real property ownership in New York City, including condos.

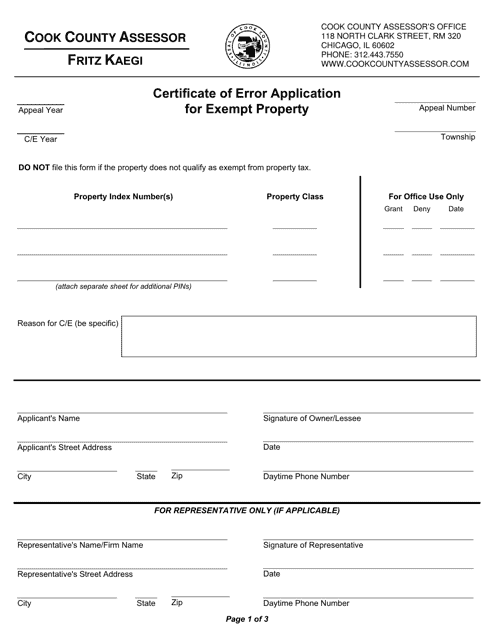

This document is used to apply for a Certificate of Error for exempt property in Cook County, Illinois. It is used when there is an error in the assessment of a property that has been designated as exempt, such as a nonprofit organization or government entity. The application is filed with the Cook County Assessor's Office to request a correction in the property's assessment value for tax purposes.

This document provides instructions for understanding and responding to a Valuation Notice in the state of Minnesota. It guides property owners on how to interpret the notice and how to take appropriate action, such as filing an appeal if necessary.