Tax Assessment Form Templates

Documents:

197

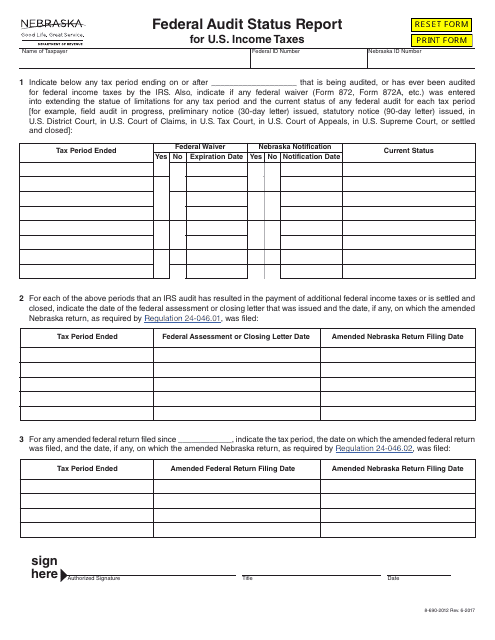

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

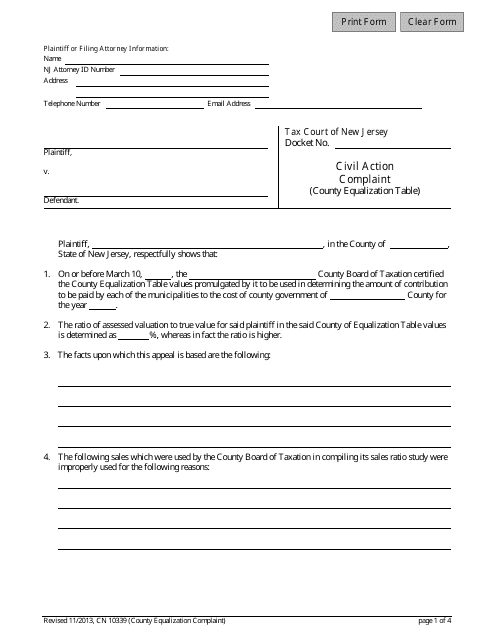

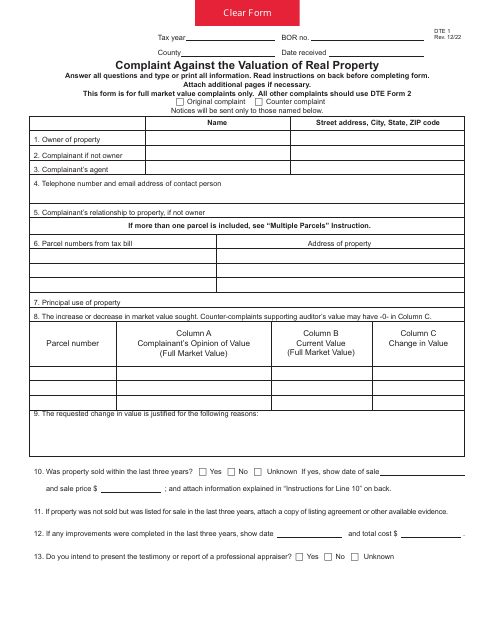

This form is used for filing a complaint regarding property value assessment with the County Equalization Board in New Jersey.

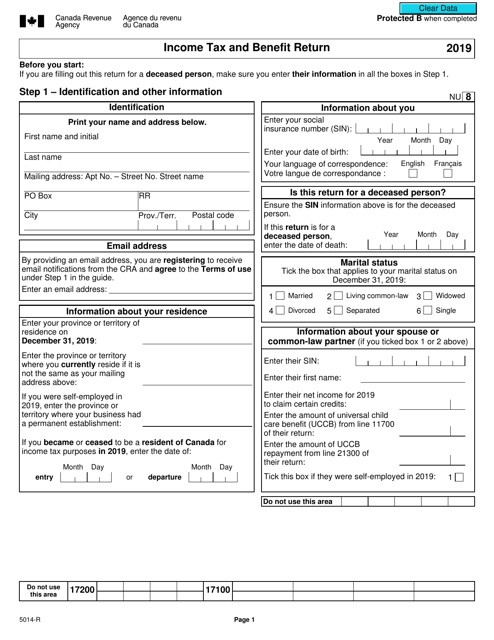

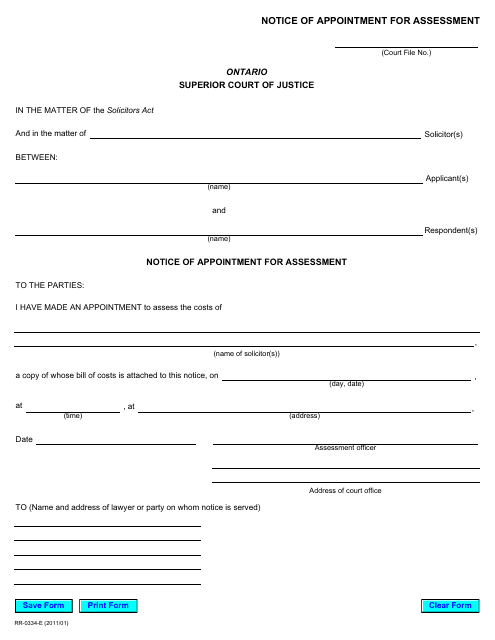

This Form is used for notifying individuals of their appointment for assessment in Ontario, Canada.

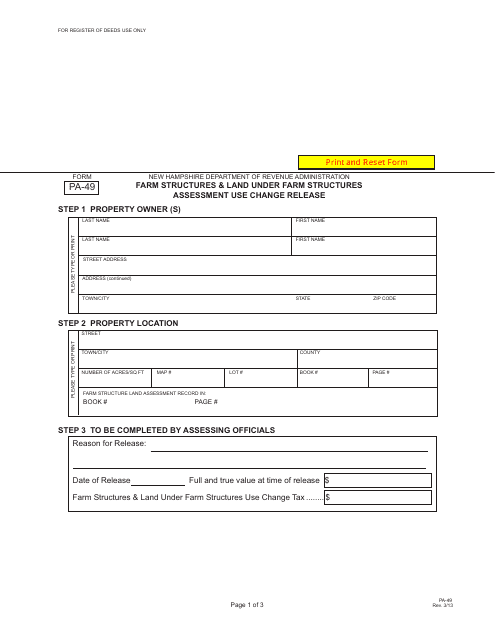

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

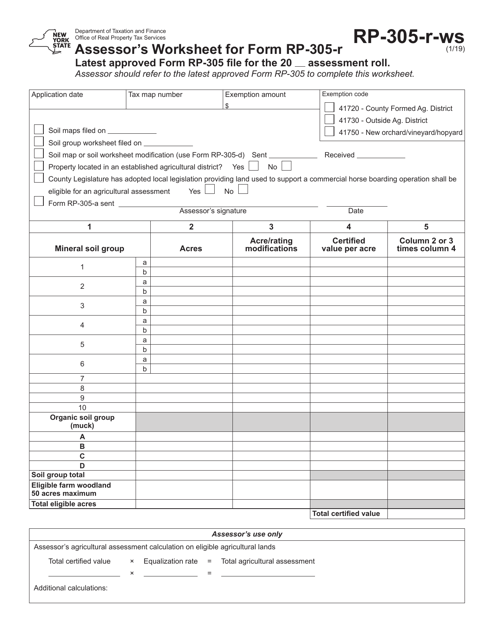

This Form is used by assessors in New York to complete the worksheet for Form RP-305-R. It helps in assessing property values in the state.

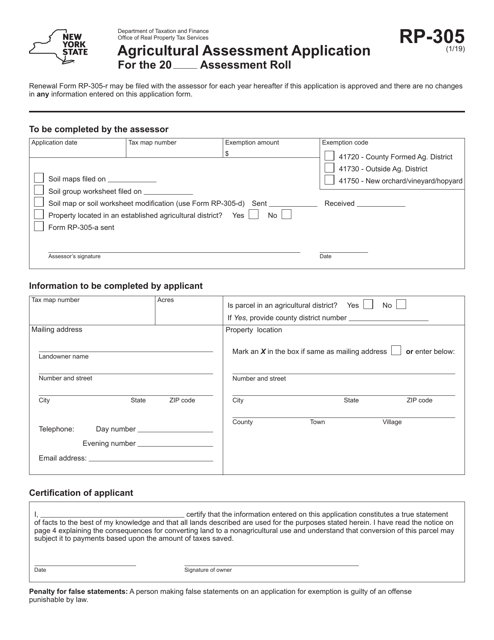

This form is used for applying for agricultural assessment in New York. It helps property owners receive tax benefits for qualifying agricultural land.

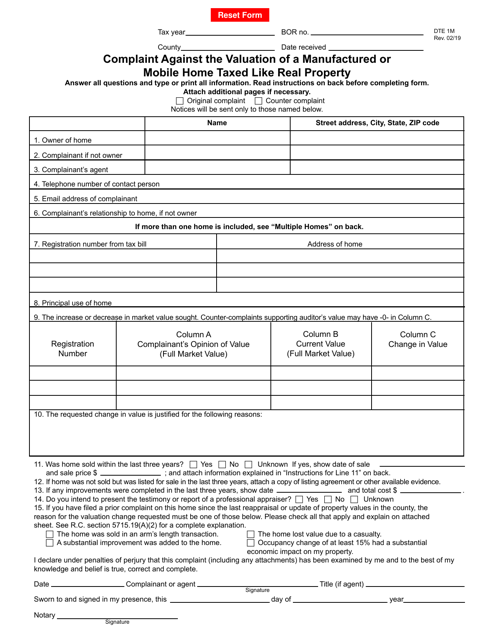

This form is used for filing a complaint against the valuation of a manufactured or mobile home that is taxed like real property in the state of Ohio.

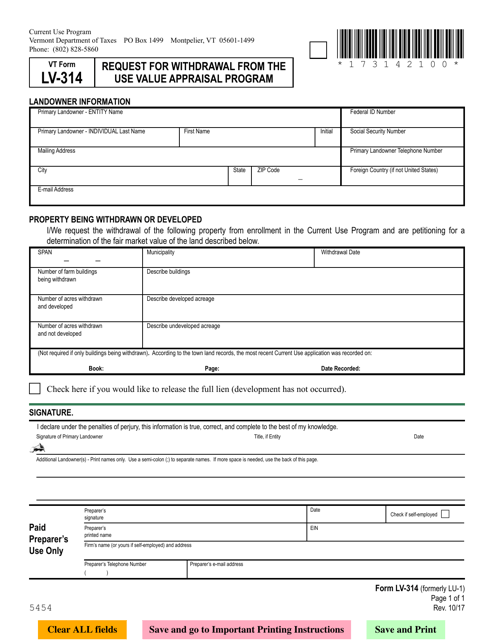

This form is used for requesting withdrawal from the Use Value Appraisal Program in Vermont.

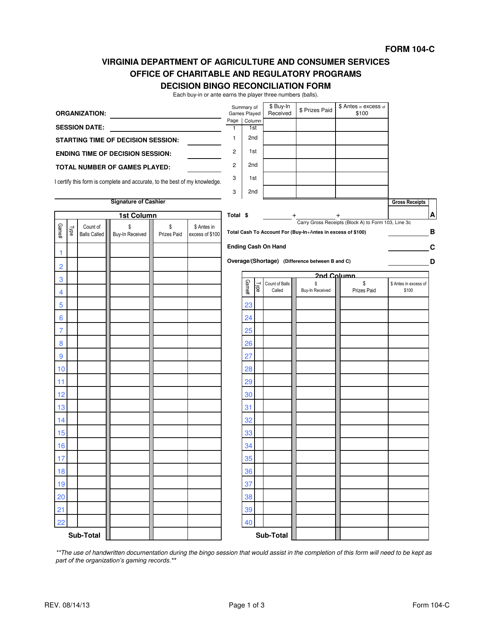

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

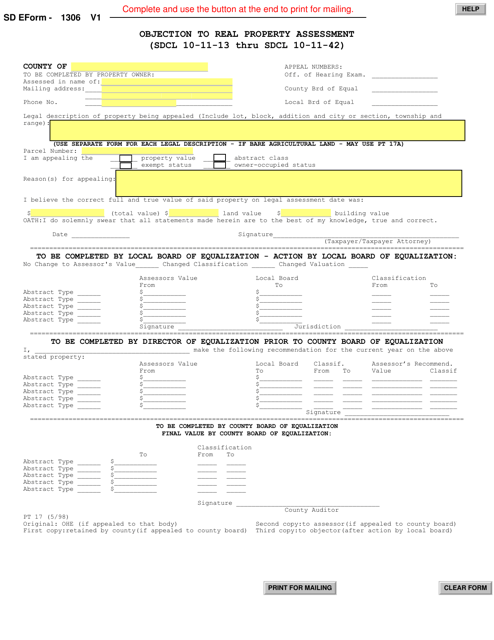

This form is used for filing an objection to the assessment of real property in South Dakota. It allows property owners to dispute the assessed value of their property for tax purposes.

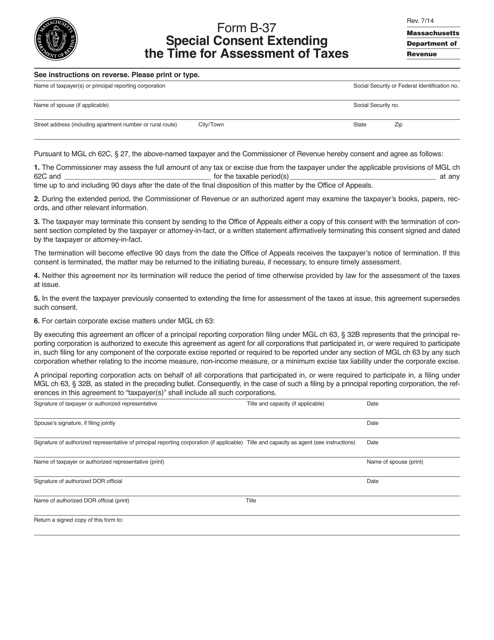

This Form is used for requesting a special consent to extend the time for assessment of taxes in the state of Massachusetts.

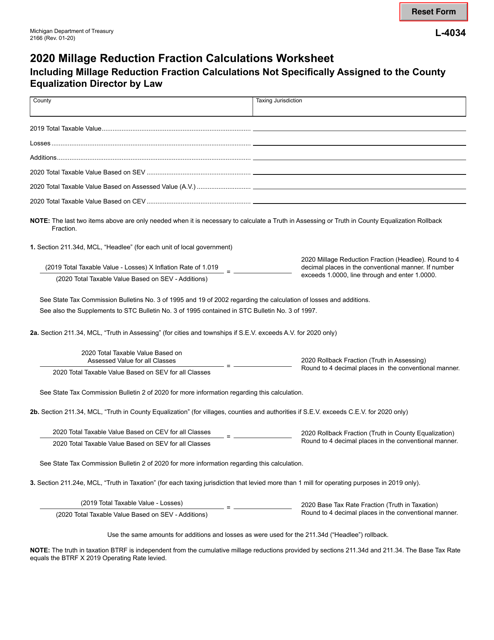

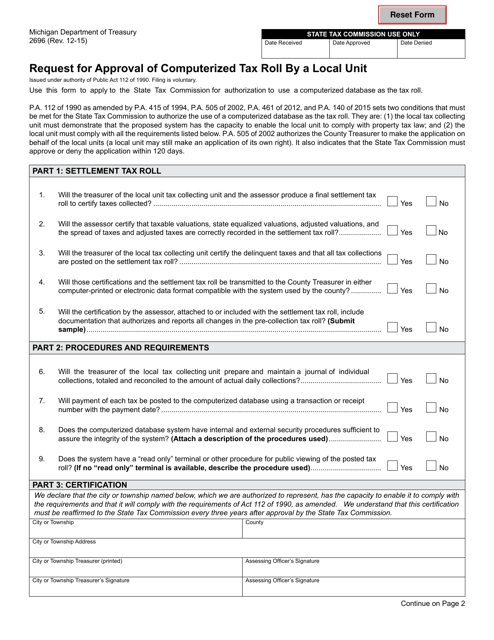

This form is used for a local unit in Michigan to request approval for a computerized tax roll. It helps streamline the tax collection process.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

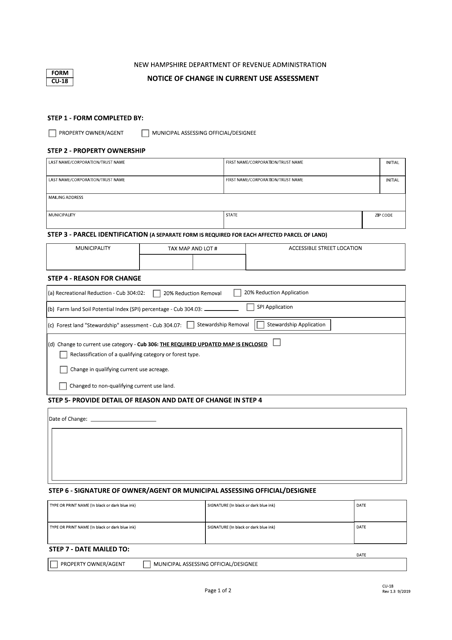

This form is used for notifying a change in the current use assessment in New Hampshire. It is used by property owners to inform the authorities about any changes in the use of their land for tax assessment purposes.

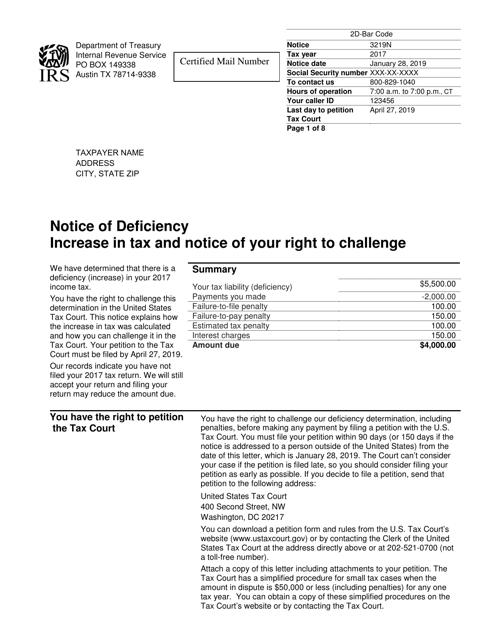

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

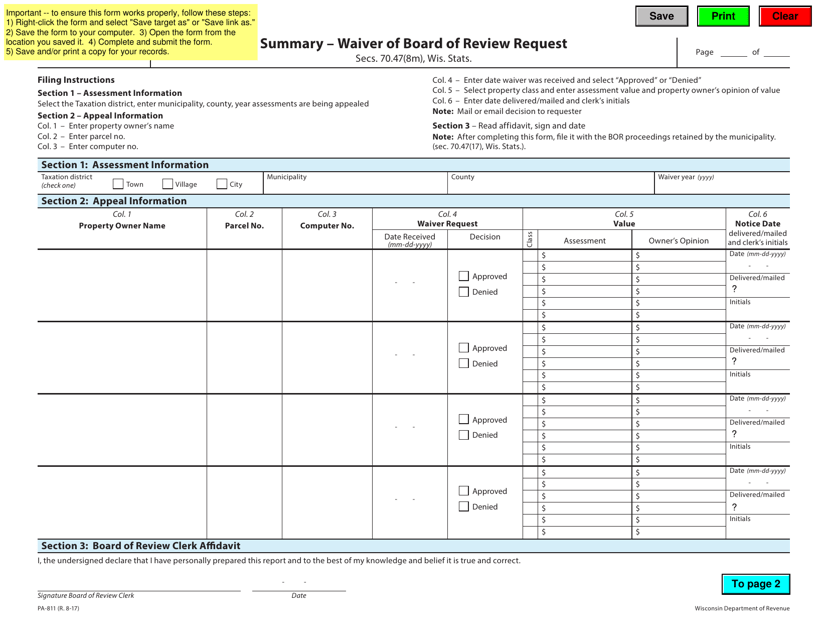

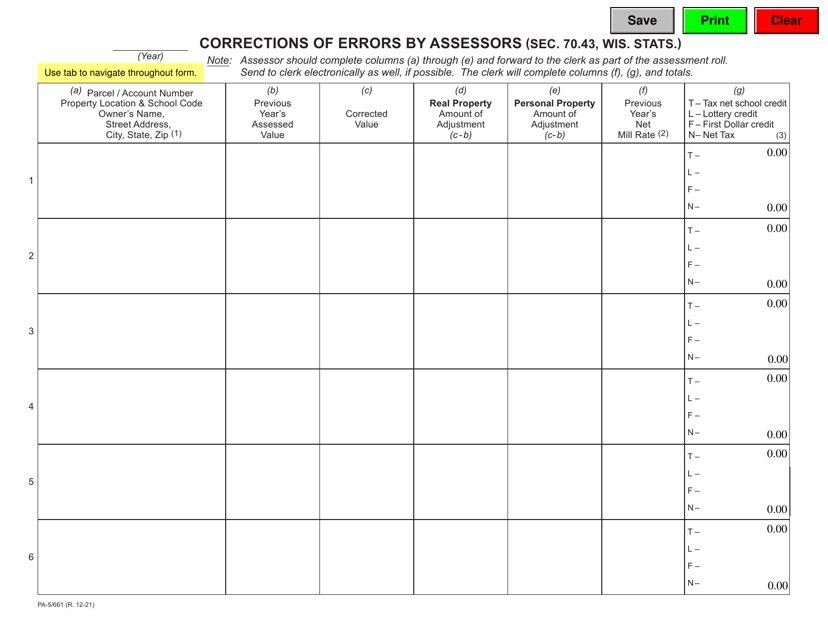

This form is used for requesting a waiver of the Board of Review in Wisconsin.

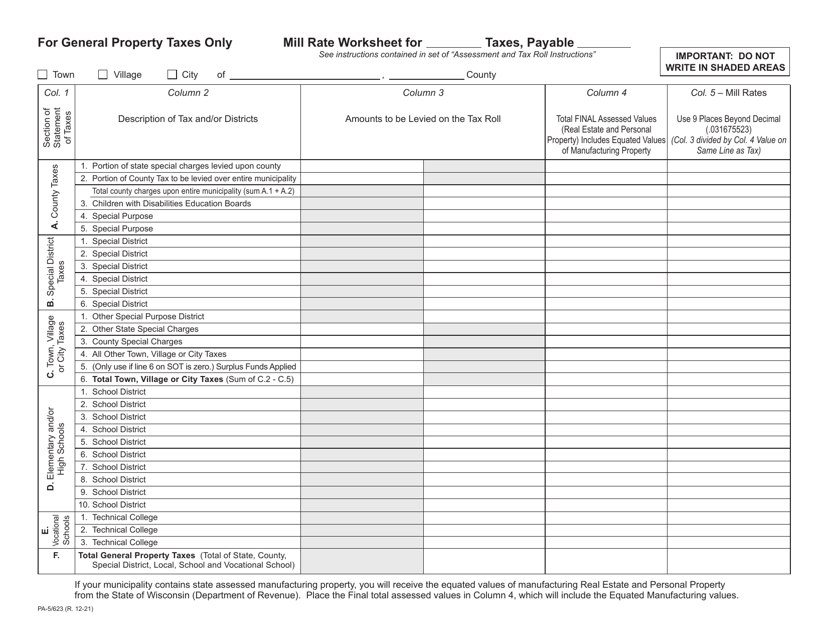

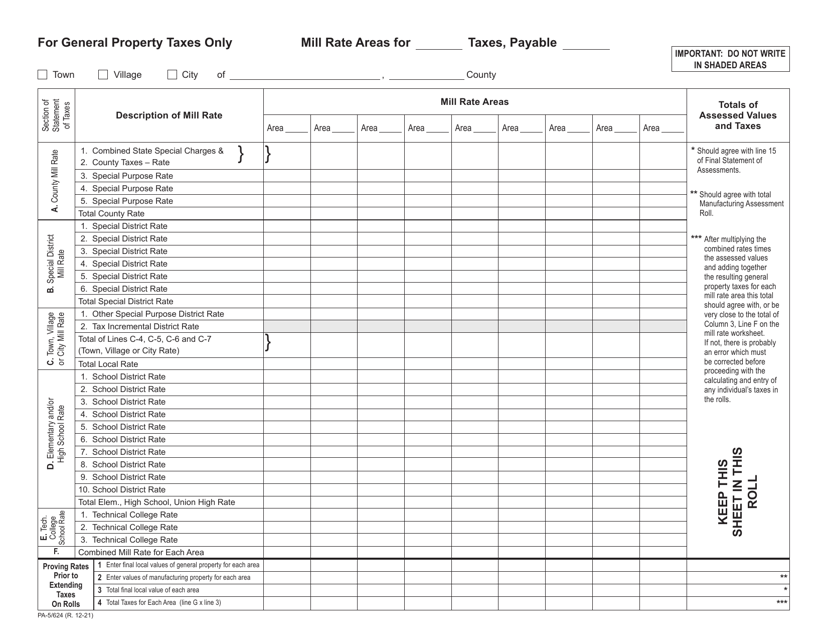

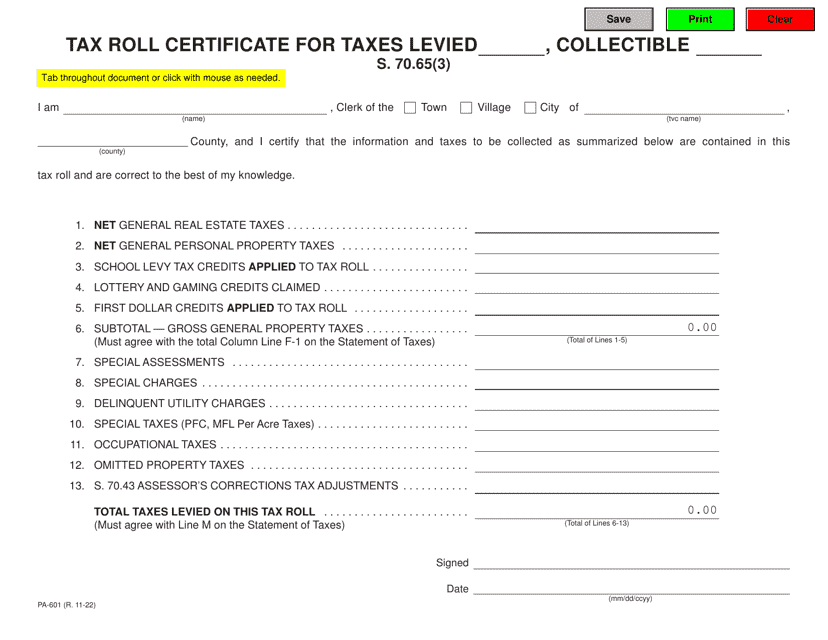

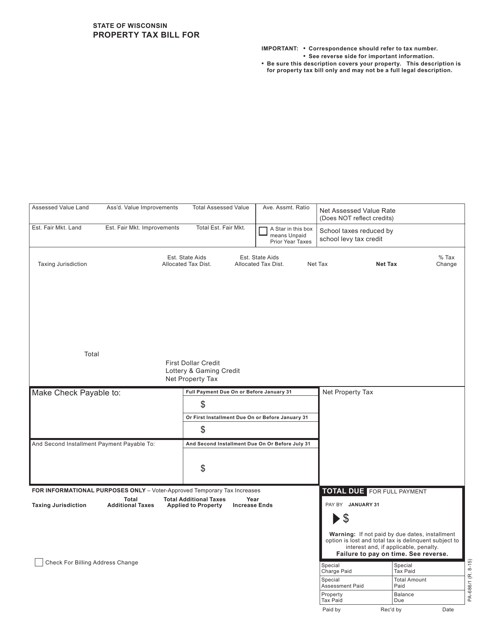

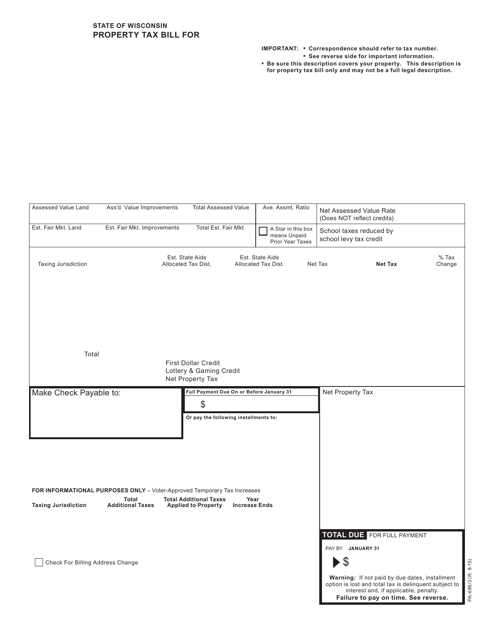

This form is used to send property tax bills to residents in Wisconsin.

This form is used for paying property tax bills in the state of Wisconsin.