Tax Assessment Form Templates

Documents:

197

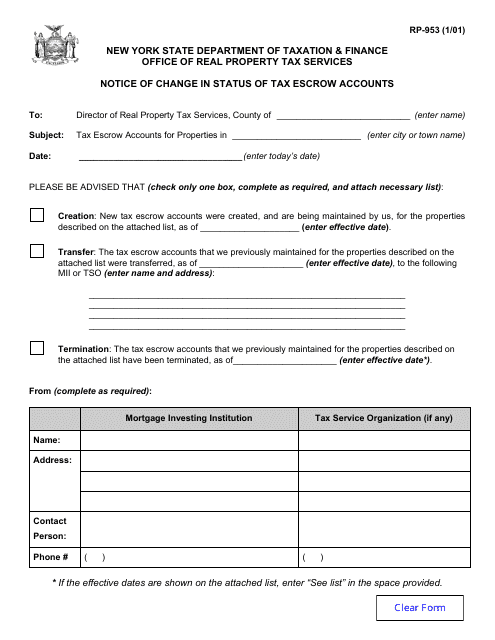

This form is used for notifying the change in status of tax escrow accounts in New York.

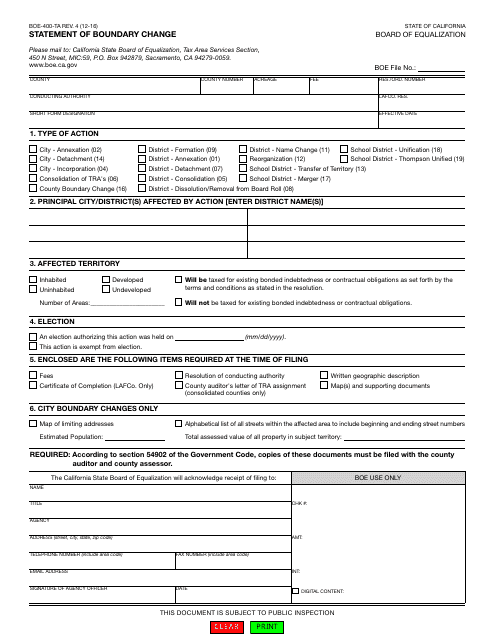

This form is used for reporting boundary changes in California.

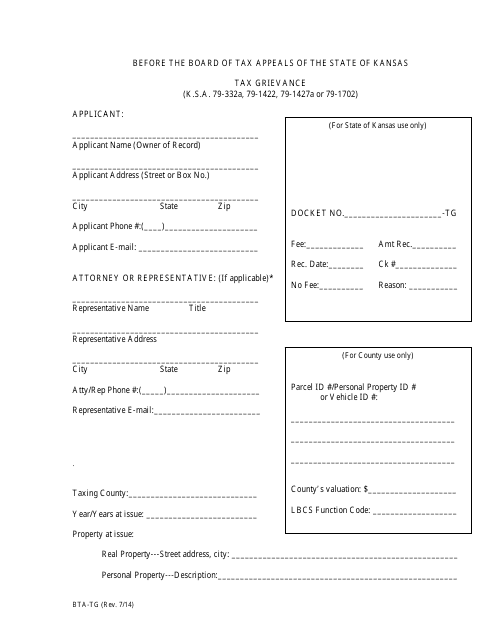

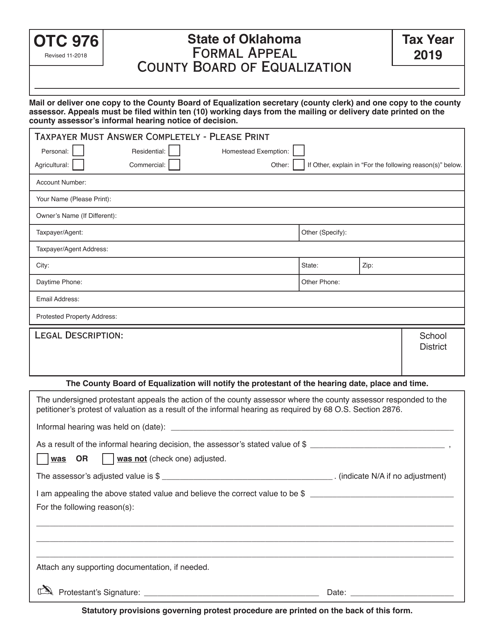

This document is used for filing a tax grievance in the state of Kansas.

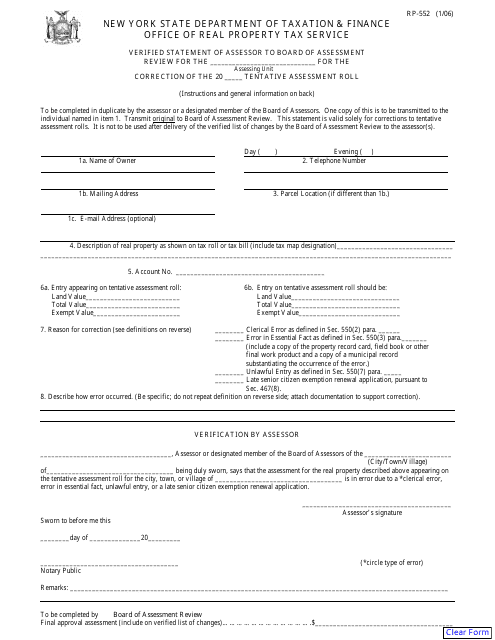

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

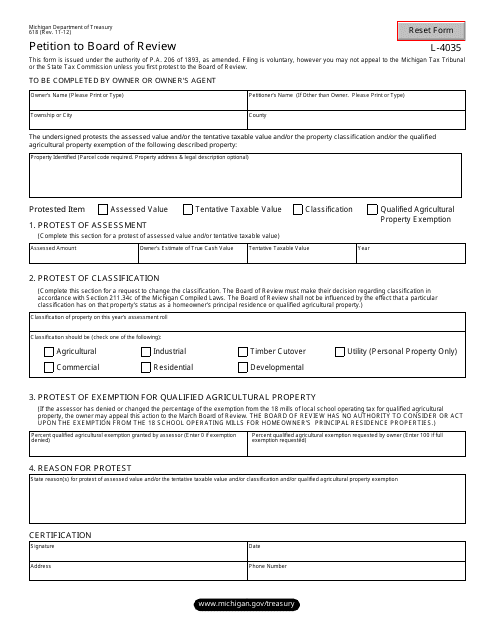

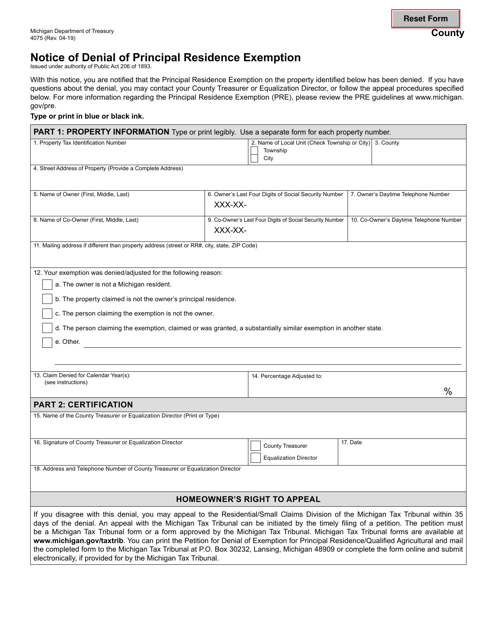

This form is used for filing a petition to the Board of Review in the state of Michigan.

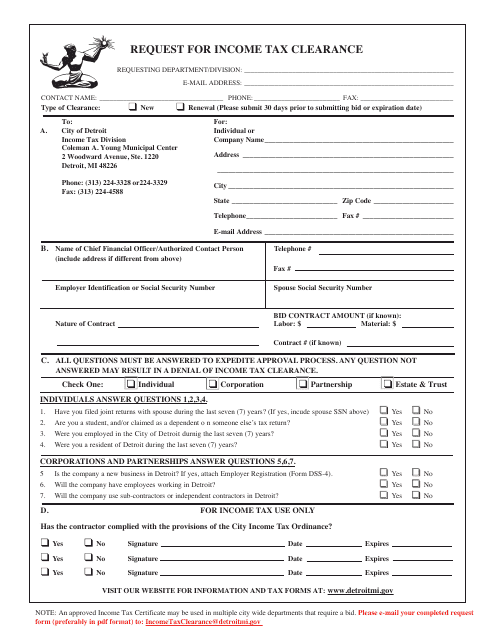

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

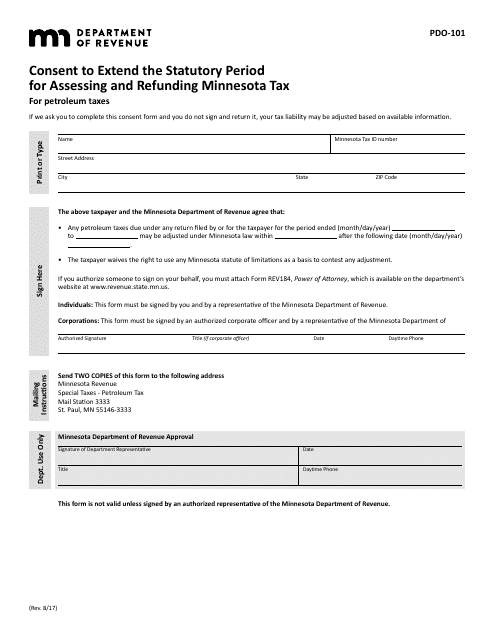

This form is used for requesting to extend the statutory period for assessing and refunding Minnesota tax for petroleum taxes in the state of Minnesota.

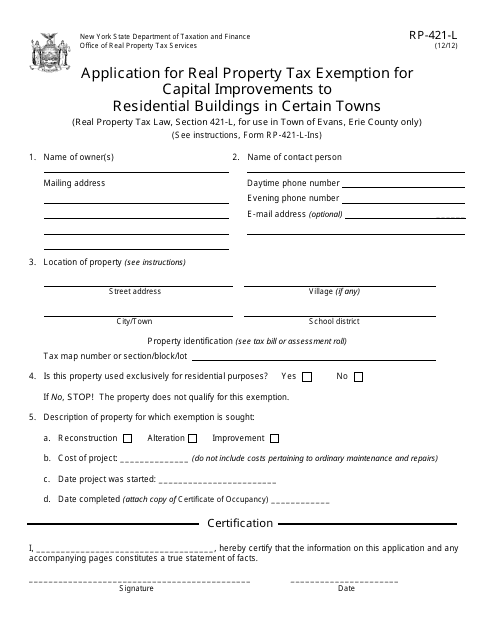

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

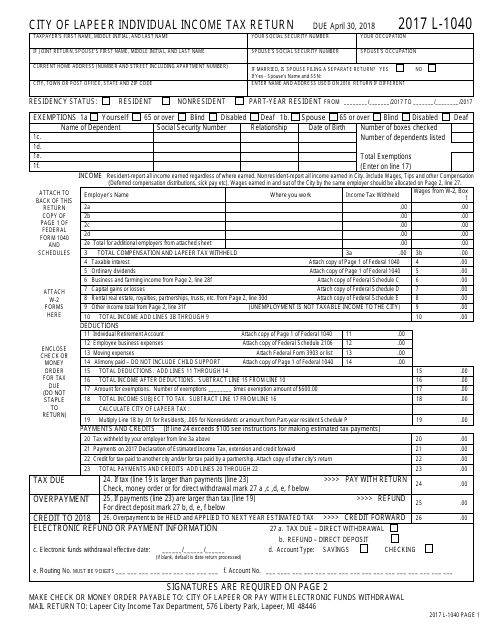

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

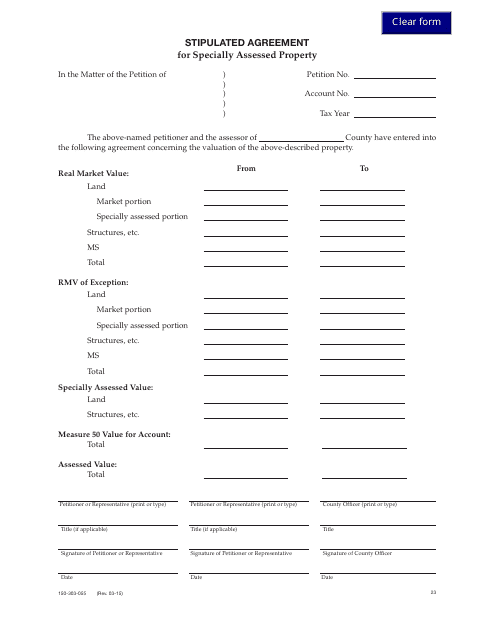

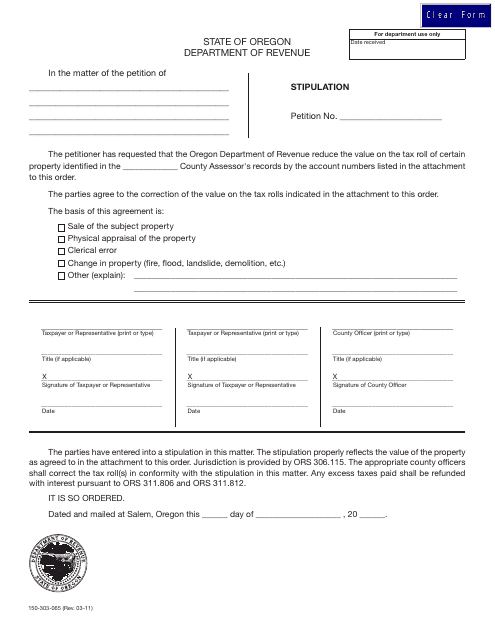

This form is used for entering into a stipulated agreement for specially assessed property in the state of Oregon.

This Form is used for stipulating agreements with the County Assessor in Oregon.

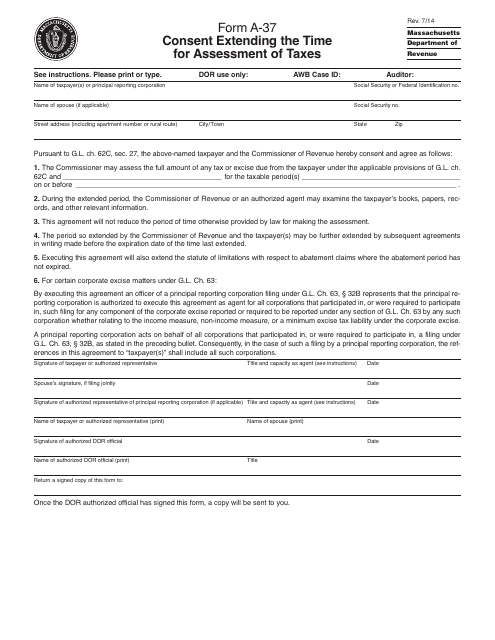

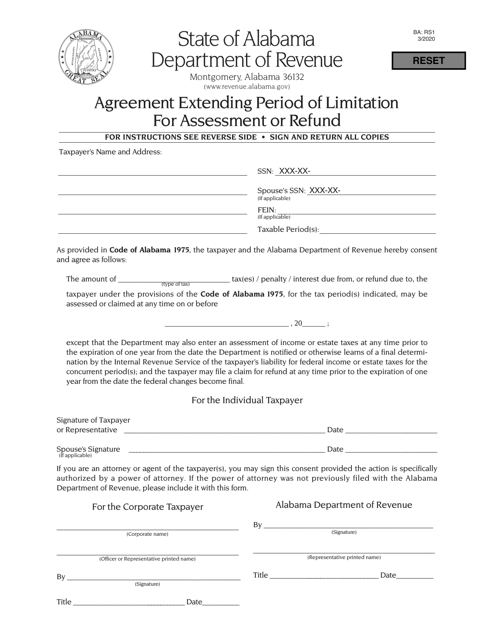

This form is used for requesting an extension of the time for assessment of taxes in Massachusetts.

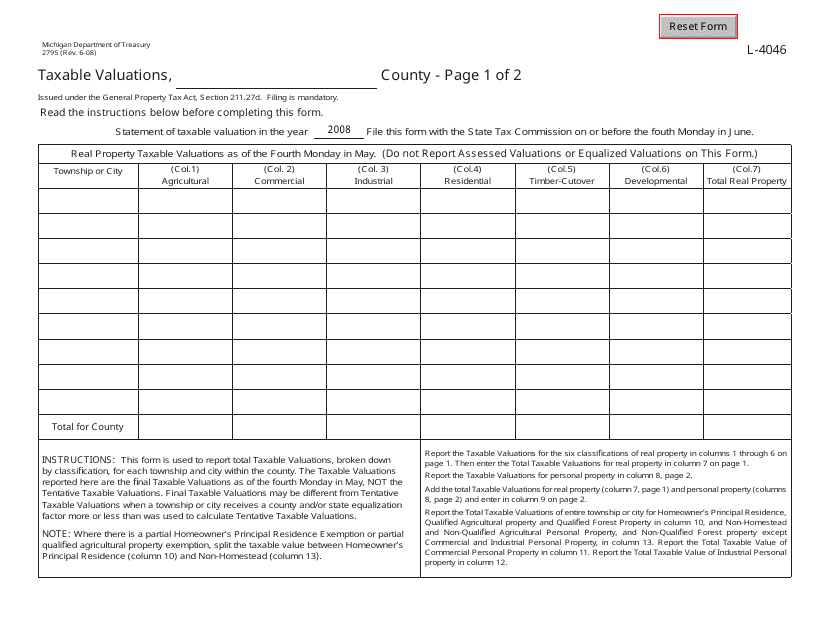

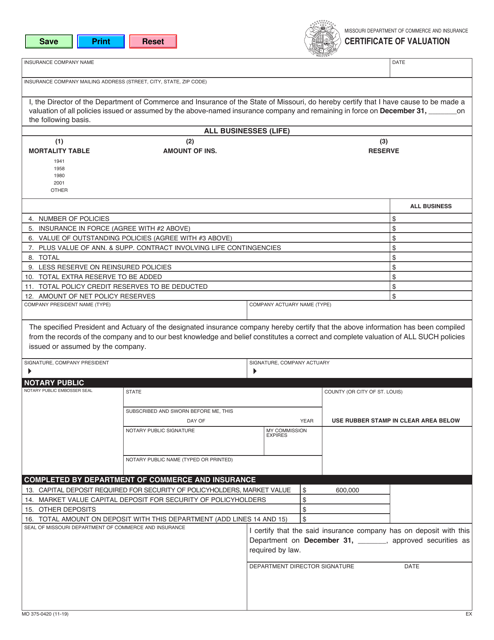

This form is used for reporting taxable valuations in the state of Michigan. It is used by property owners to determine the value of their property for tax purposes. The form must be filed annually with the local tax assessor's office.

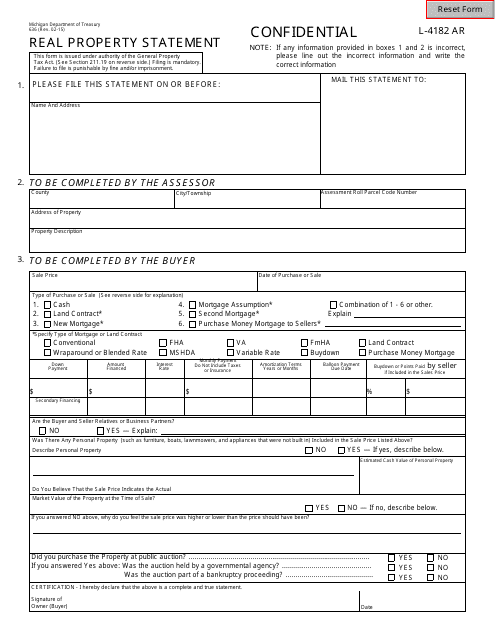

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

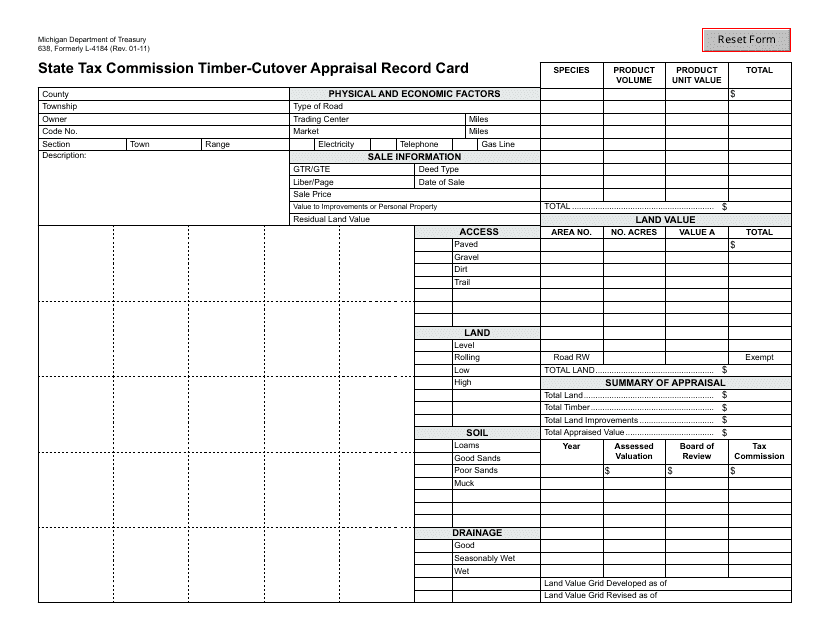

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

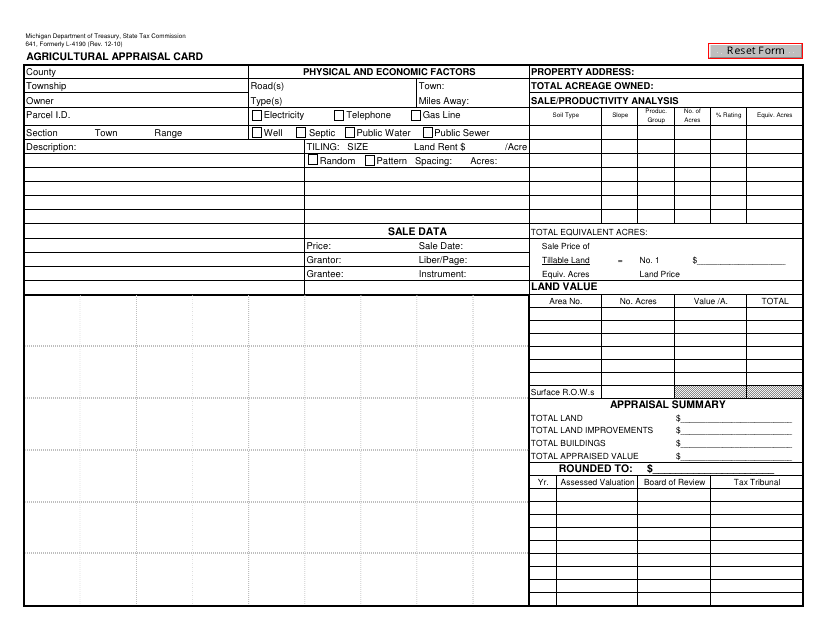

This form is used for agricultural property owners in Michigan to apply for a property tax assessment based on the agricultural use of their land.

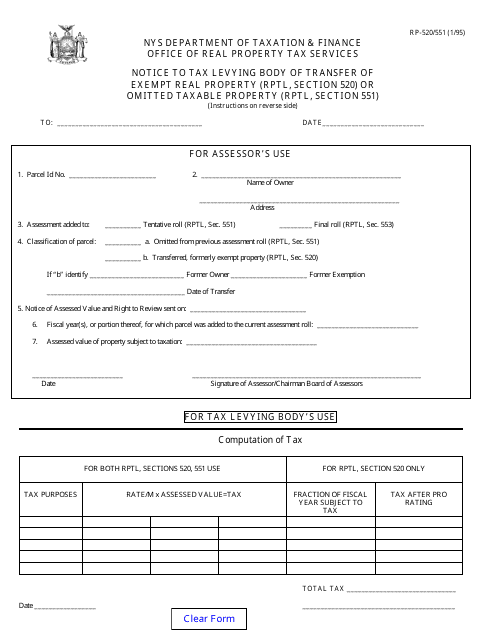

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.

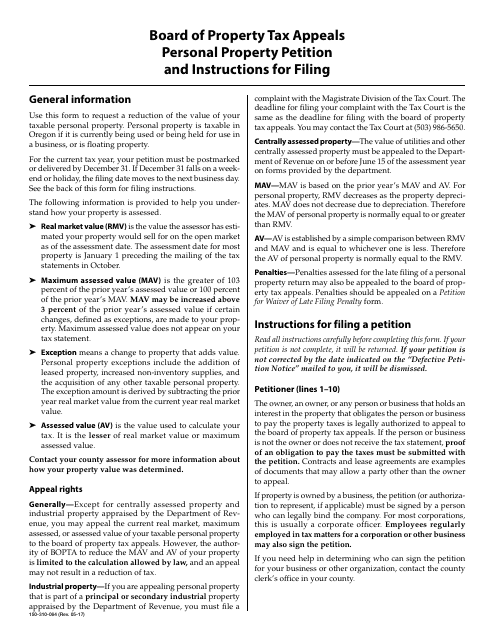

This form is used for filing a personal property petition with the Board of Property Tax Appeals in Oregon. It is used to request a review of the assessed value of personal property for tax purposes.

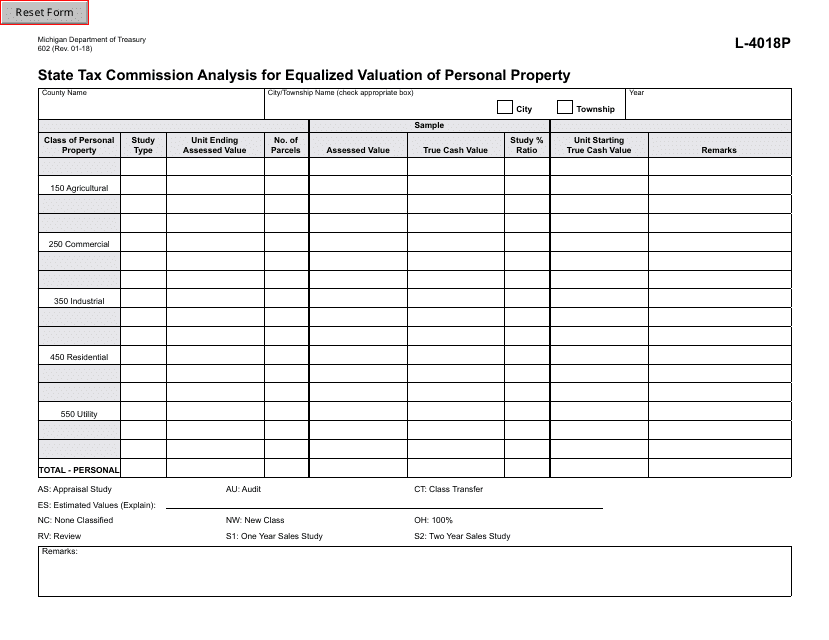

This form is used by the State Tax Commission in Michigan to analyze the equalized valuation of personal property for tax purposes. It helps determine the value of personal property owned by individuals and businesses in Michigan.

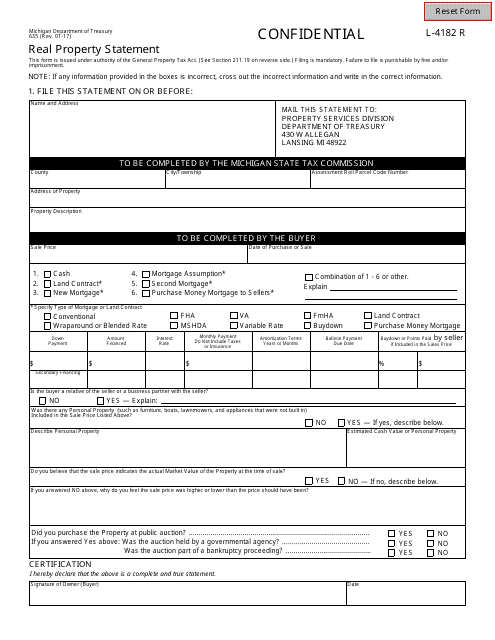

This document is used for providing a statement of real property in the state of Michigan. It is used to report the value of real property for tax assessment purposes.

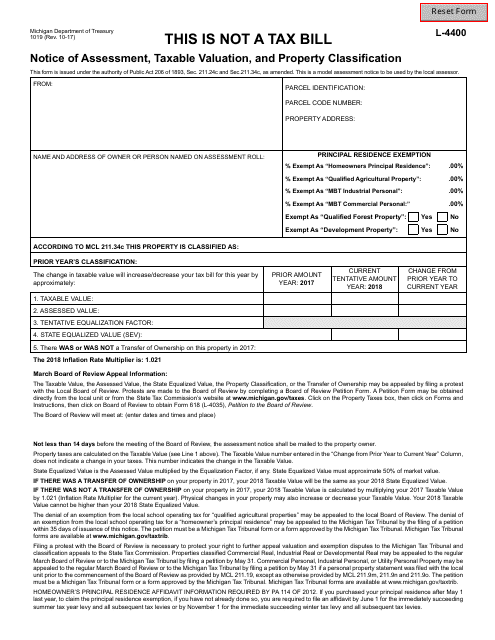

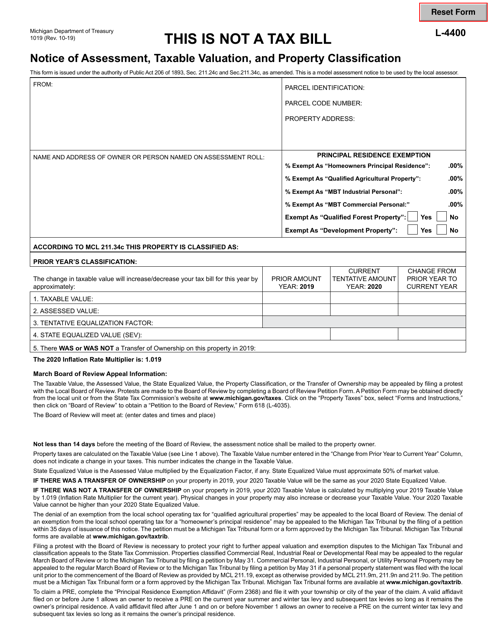

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

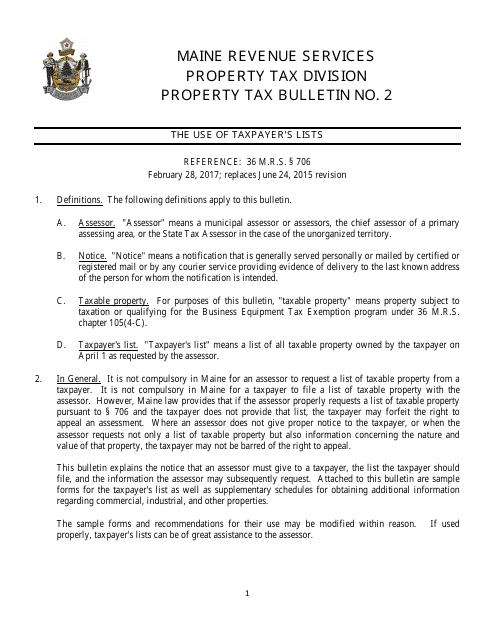

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

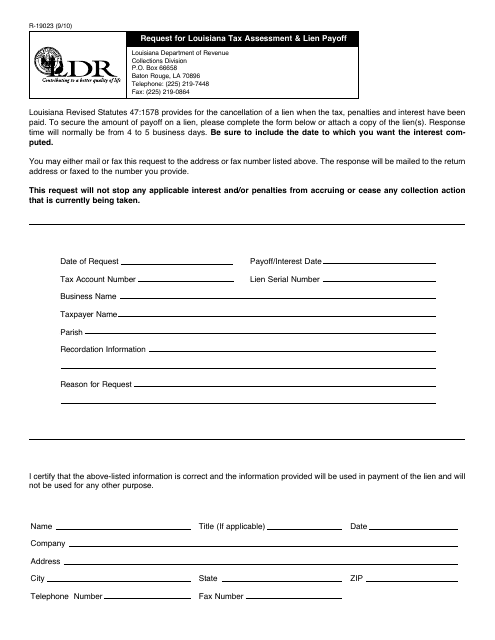

This form is used for requesting a tax assessment and lien payoff in the state of Louisiana.

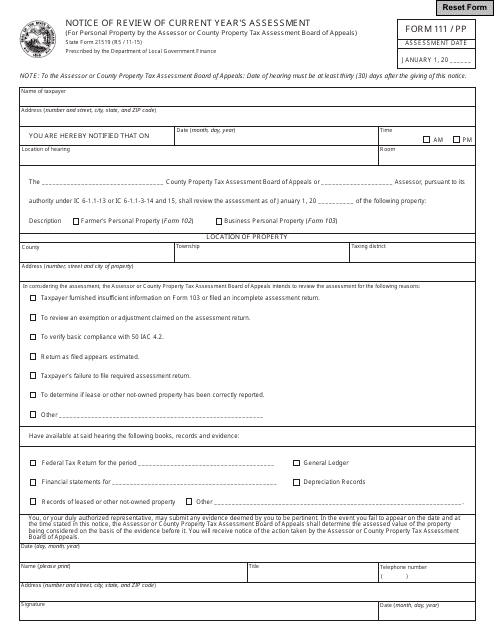

This form is used for notifying Indiana residents about the review of their current year's assessment.

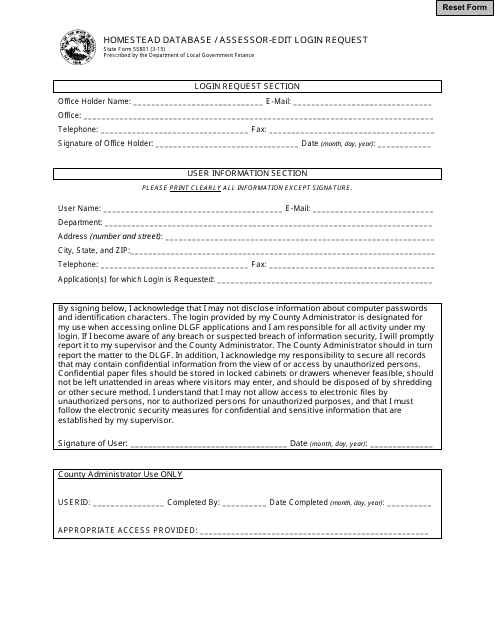

This document is used for requesting to edit login information in the Homestead Database for assessors in the state of Indiana.

This Form is used for notifying the Municipal Tax Assessors in Connecticut about corrections or changes required in the tax assessment records.

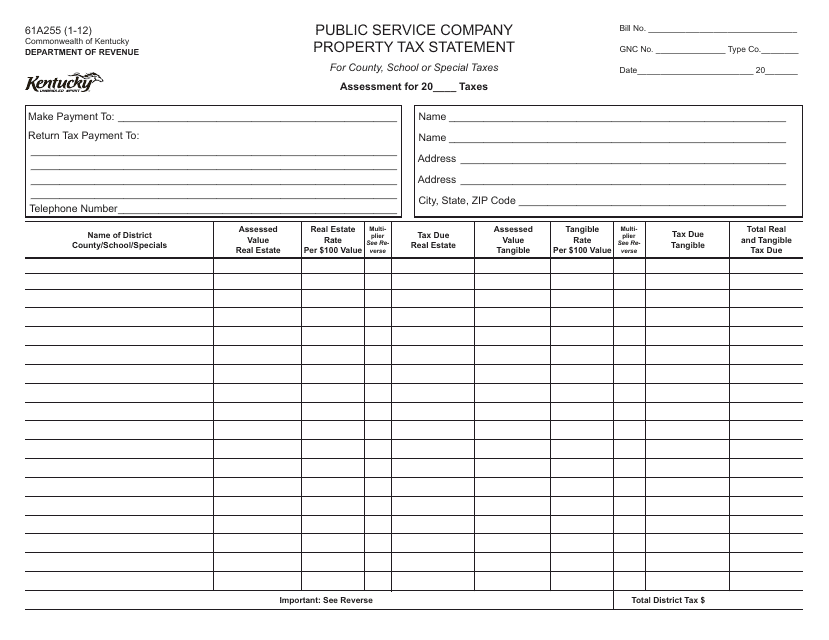

This form is used for filing the Public Service Company Property Tax Statement in Kentucky. It provides information related to the property owned by public service companies for tax purposes.

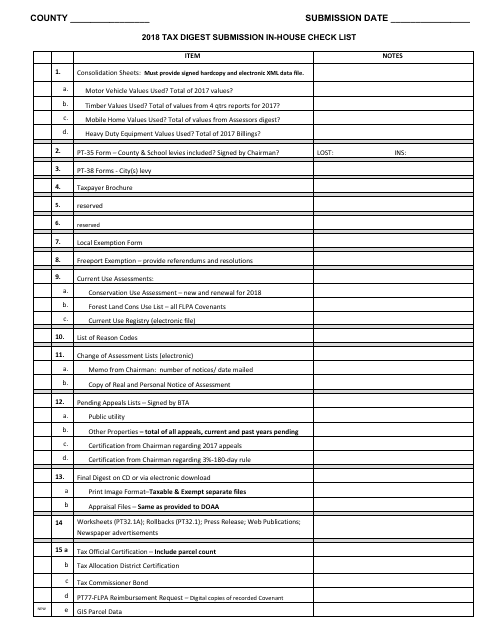

This checklist is used for submitting the tax digest in-house in the state of Georgia, United States. It provides a comprehensive list of items to be reviewed and included when submitting the tax digest.

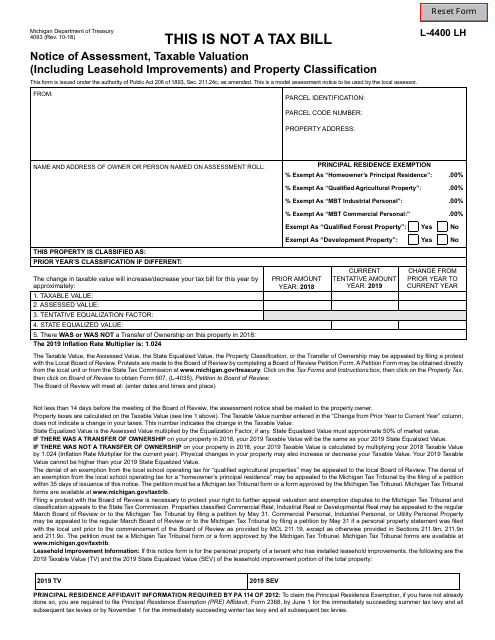

This Form is used for the Notice of Assessment, Taxable Valuation and Property Classification in Michigan, including leasehold improvements. It provides information about the assessment, taxes, and property classification for a specific property in Michigan.

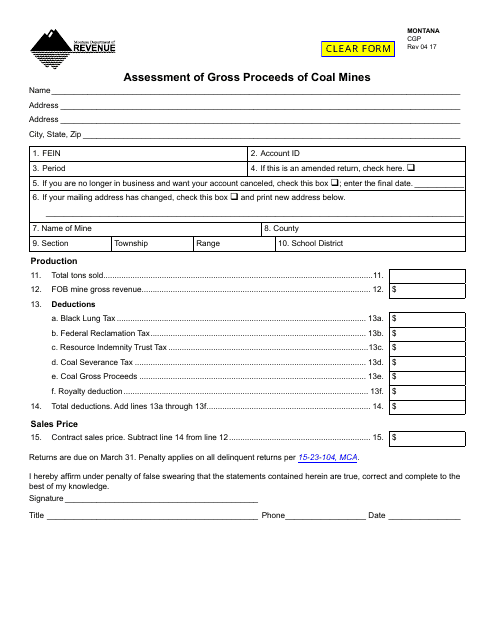

This form is used for assessing the gross proceeds of coal mines in Montana. It provides a way for mining companies to report their earnings from coal mining operations in the state. The assessment of these gross proceeds is important for determining tax liabilities and ensuring compliance with state regulations.