Fill and Sign United States Legal Forms

Documents:

235709

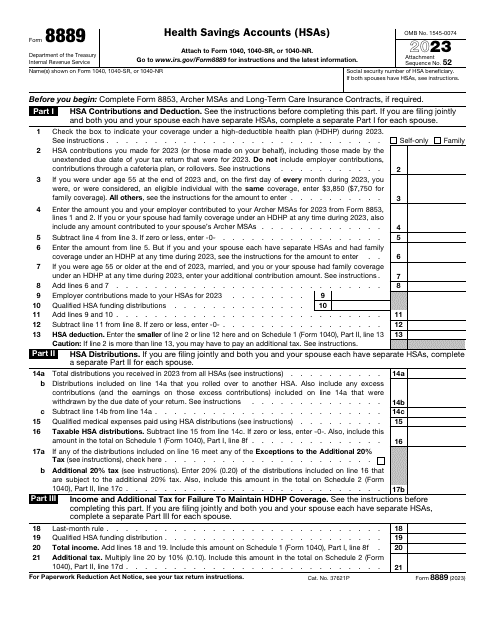

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

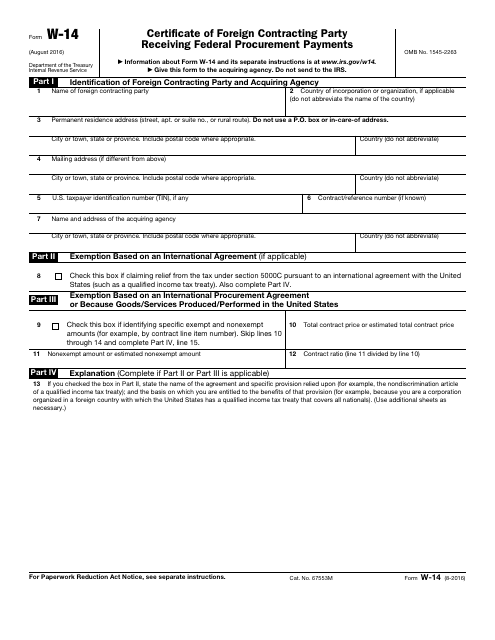

This document is used for reporting information about a foreign contracting party that receives payment for federal procurement contracts.

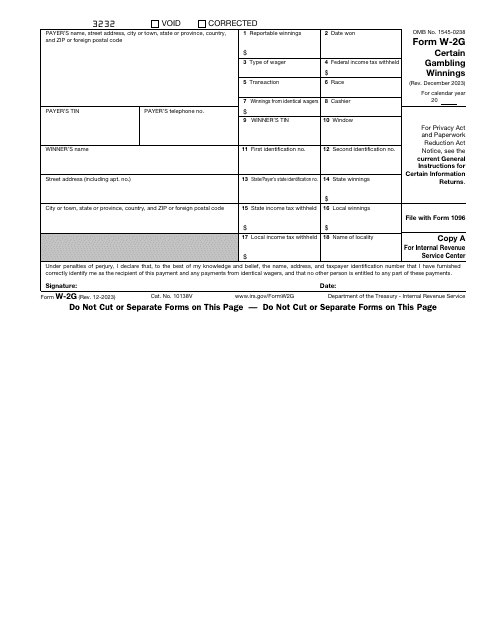

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

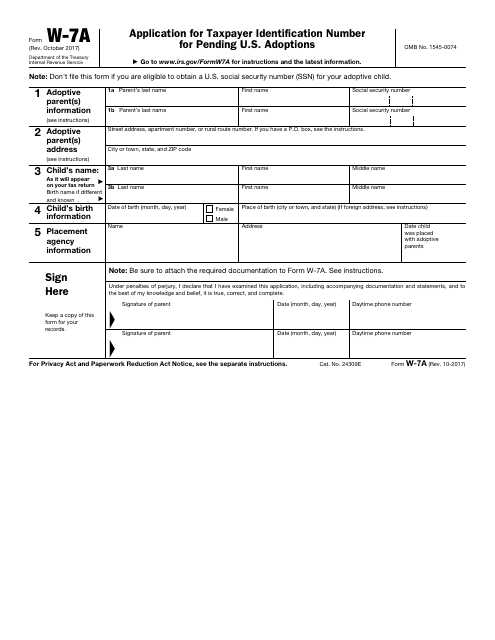

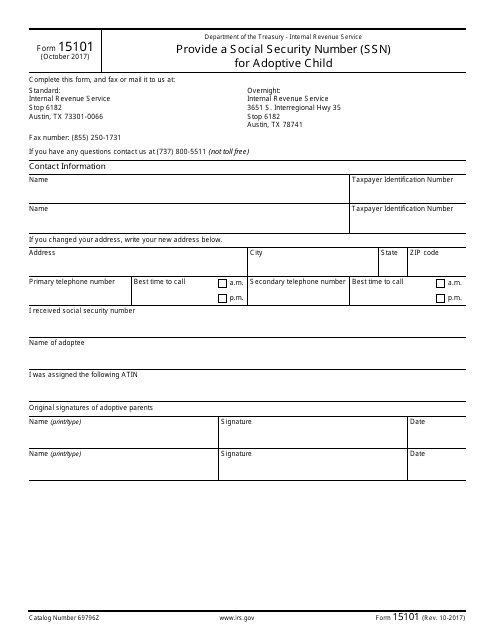

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.

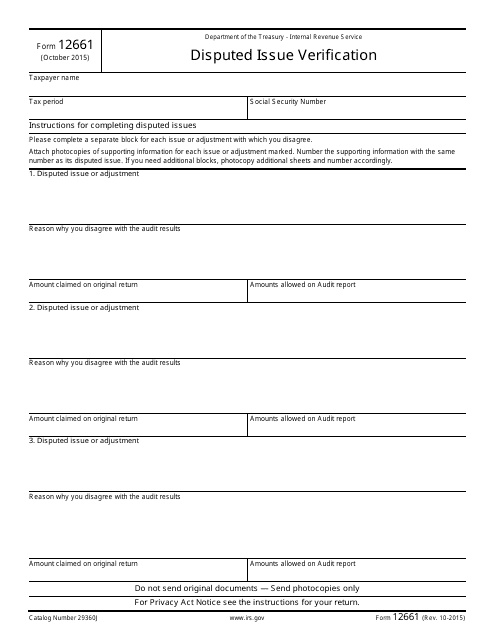

This document is used for verifying disputed issues with the Internal Revenue Service (IRS). It helps individuals and businesses provide evidence and documentation to support their claims and resolve disputes with the IRS.

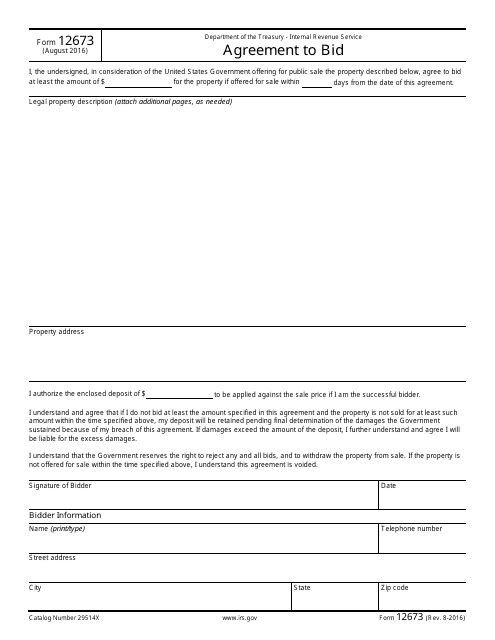

This form is used for taxpayers who want to enter into an agreement with the Internal Revenue Service (IRS) to participate in an auction or bidding process.

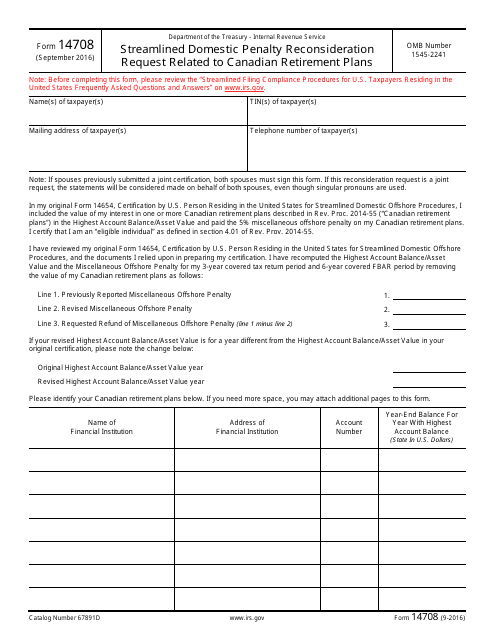

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

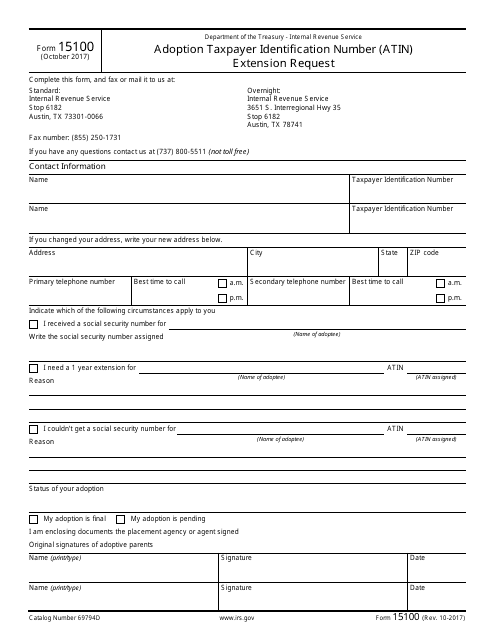

This form is used for requesting an extension of an Adoption Taxpayer Identification Number (ATIN) from the IRS.

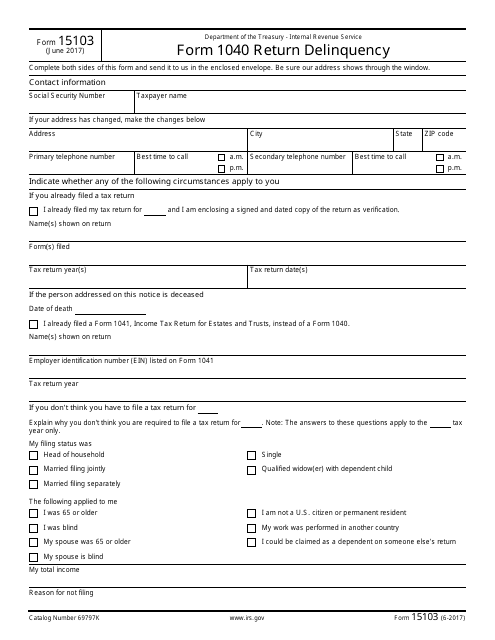

This Form is used for reporting delinquent tax returns to the IRS.

This form is used for providing a summary report of carriers to the Internal Revenue Service (IRS). It includes information such as carrier name, address, and total taxable amounts for various services.

This document is for reporting activities of terminal operators to the IRS.

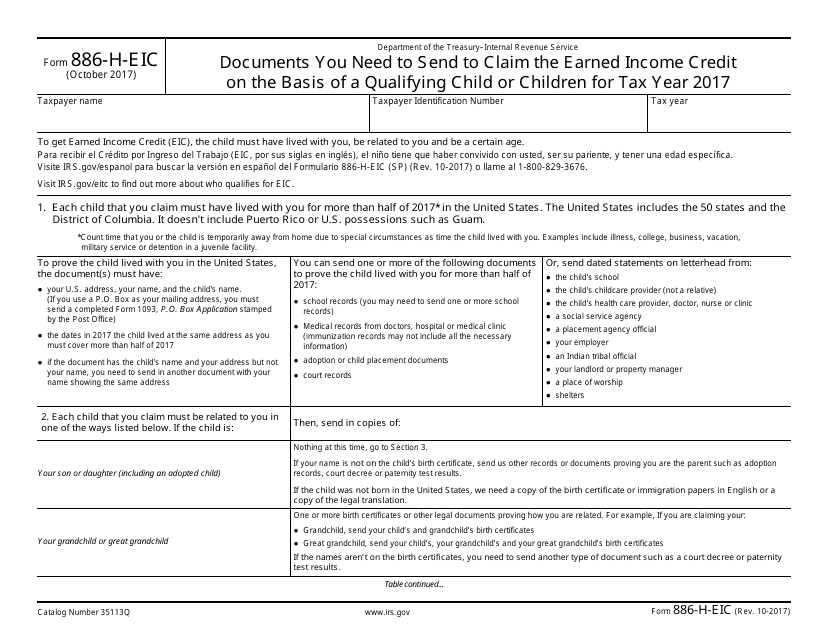

This form is used to provide the necessary documentation required to claim the Earned Income Credit (EIC) based on having a qualifying child or children. It outlines the specific documents that need to be submitted to the IRS in order to support your claim.

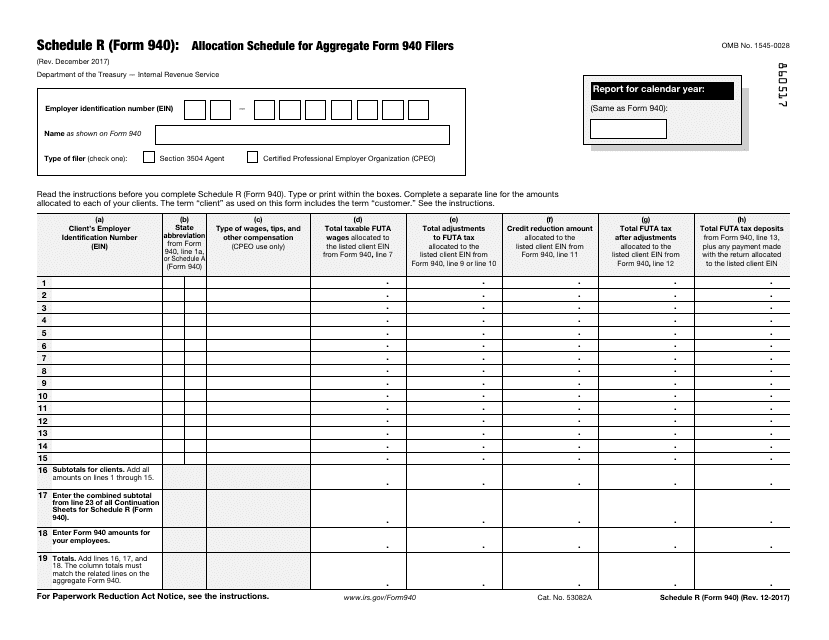

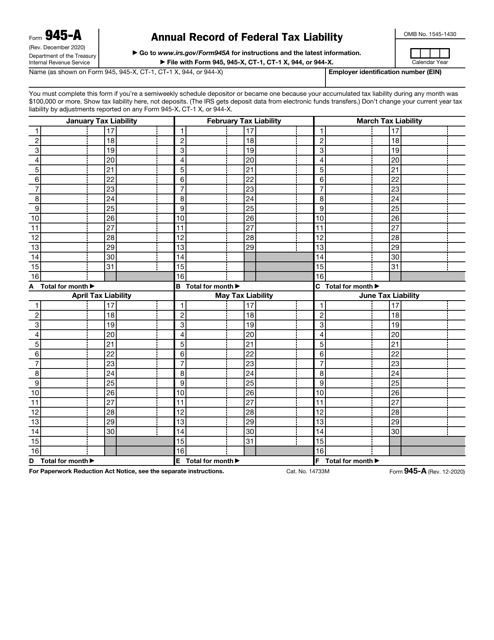

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a formal IRS document that outlines the details of a property foreclosure.