Fill and Sign United States Legal Forms

Documents:

235709

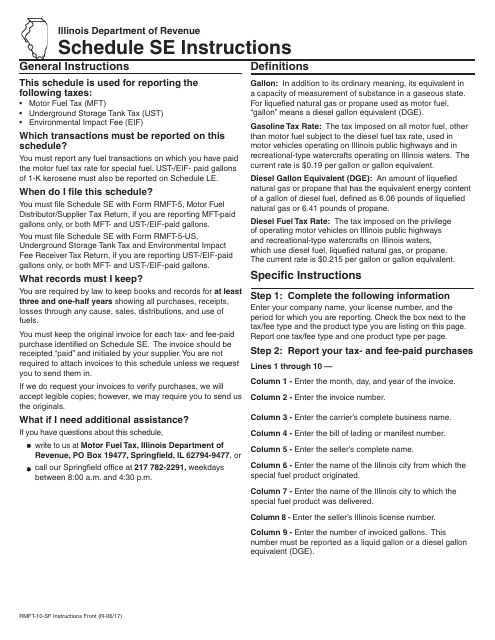

This document provides instructions for Form RMFT-10-SF Schedule SE. It pertains to tax and fee-paid purchases of undyed fuels at the diesel fuel tax rate in Illinois.

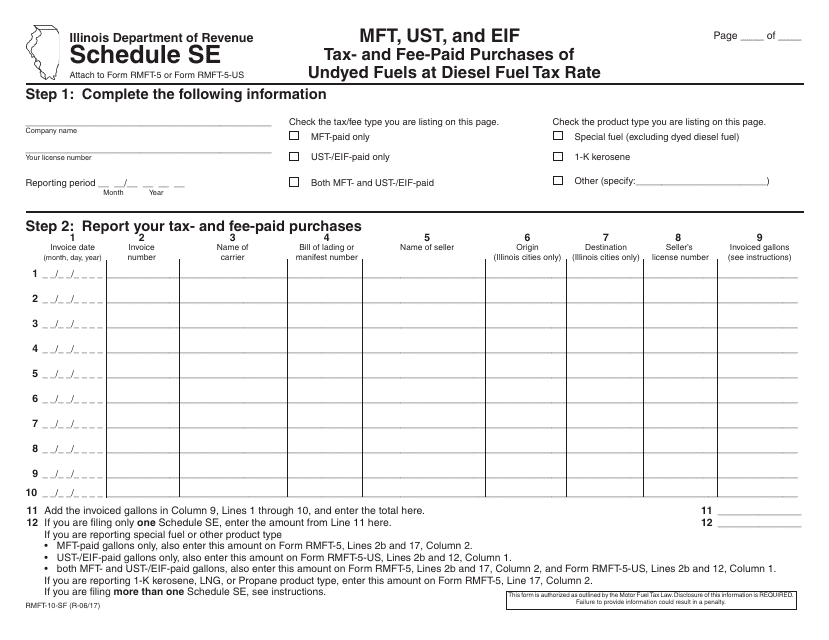

This form is used for reporting tax- and fee-paid purchases of undyed fuels at the diesel fuel tax rate in Illinois.

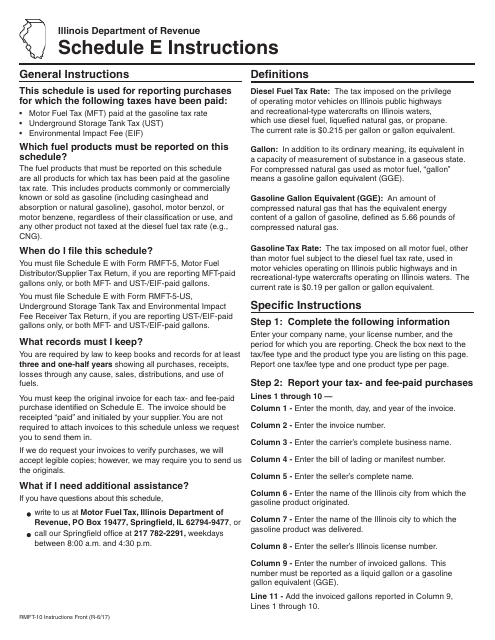

This Form is used for reporting and calculating the tax and fee-paid purchases of fuels, specifically gasoline, in Illinois.

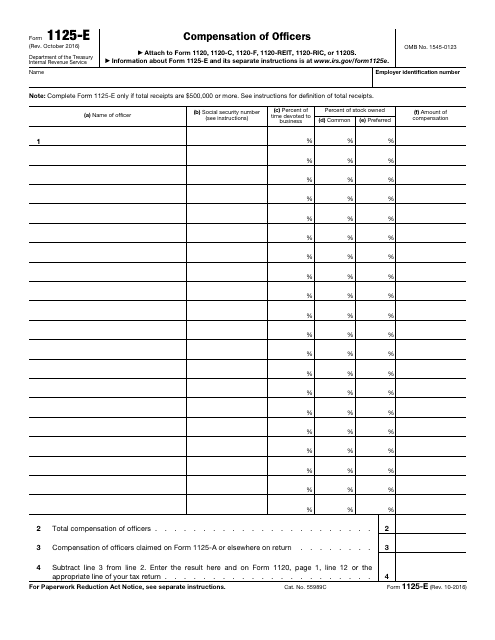

This IRS form is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.

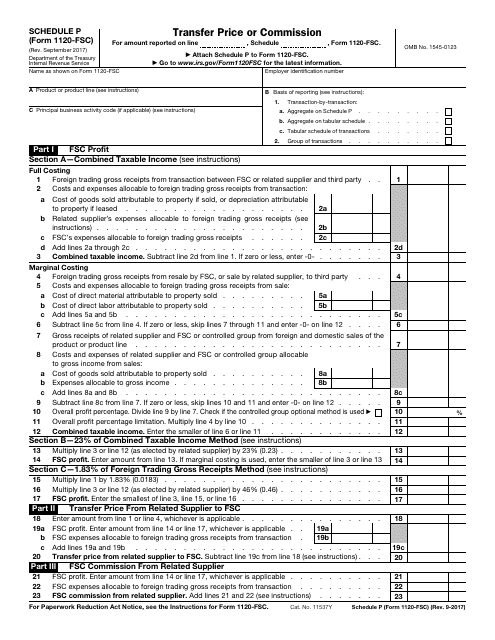

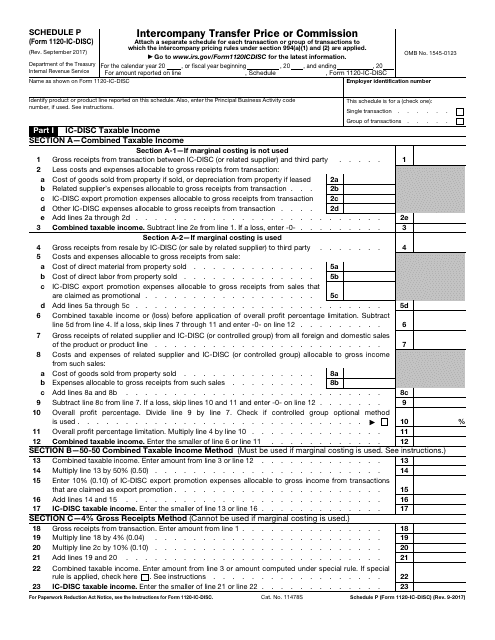

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

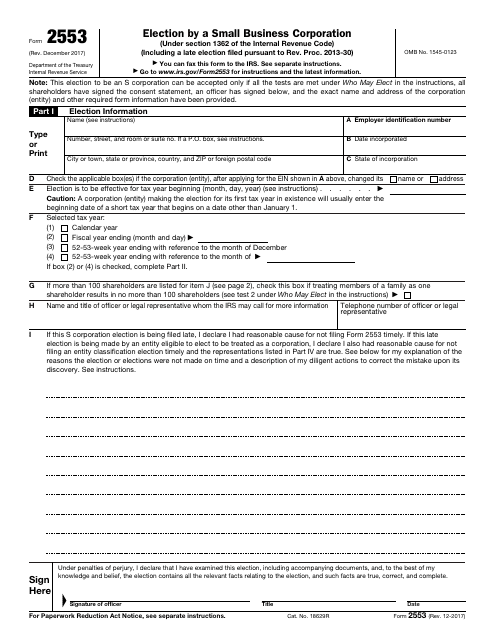

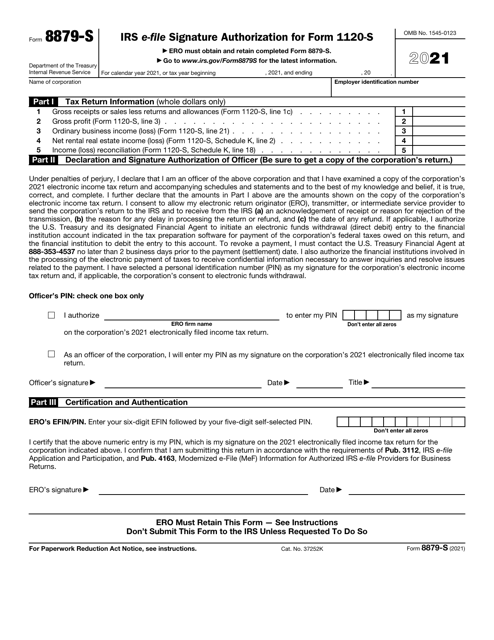

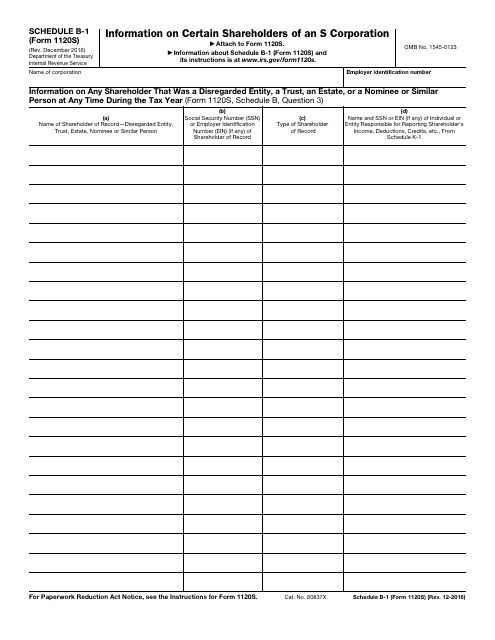

This is a fiscal statement filed by companies that want to be recognized as S corporations.

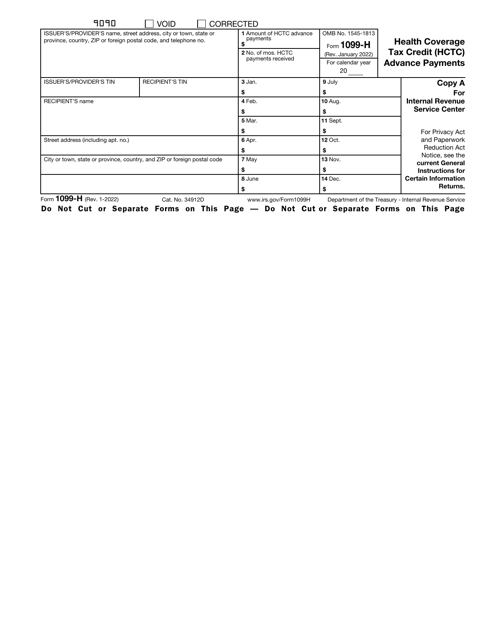

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

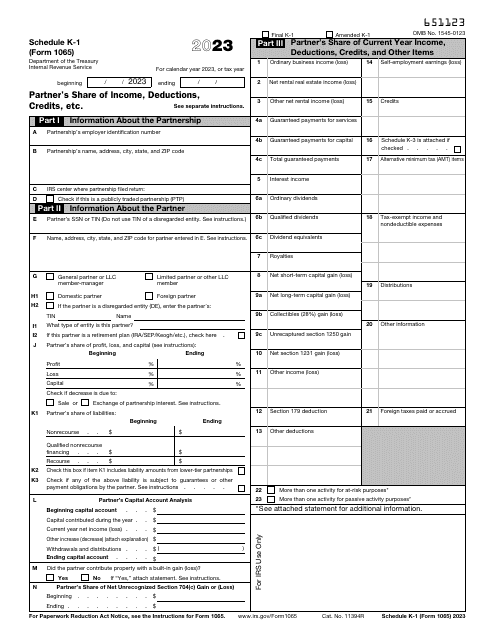

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

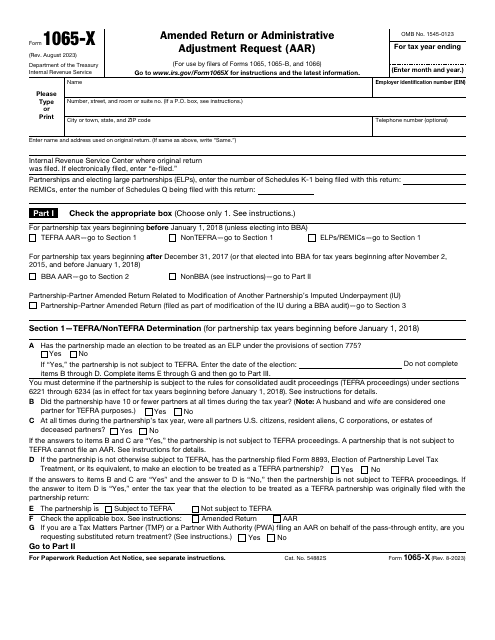

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

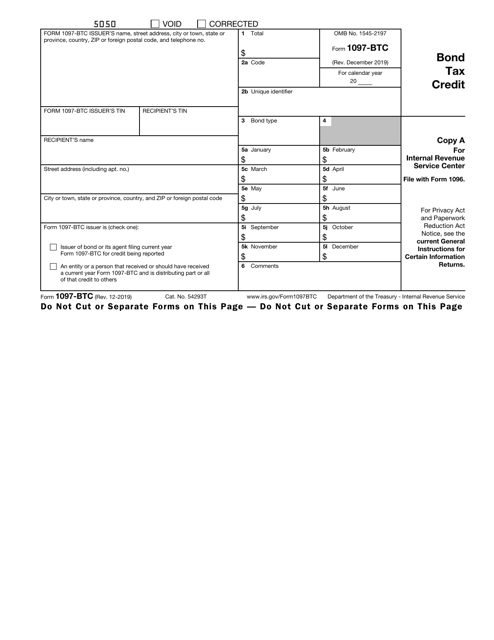

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Submit this form to the Internal Revenue Service (IRS) if you are a corporation that offers their employees an incentive stock option (ISO) to report to the IRS about your transfers of stock made to any transferee when that transferee exercises an ISO under Section 422(b).

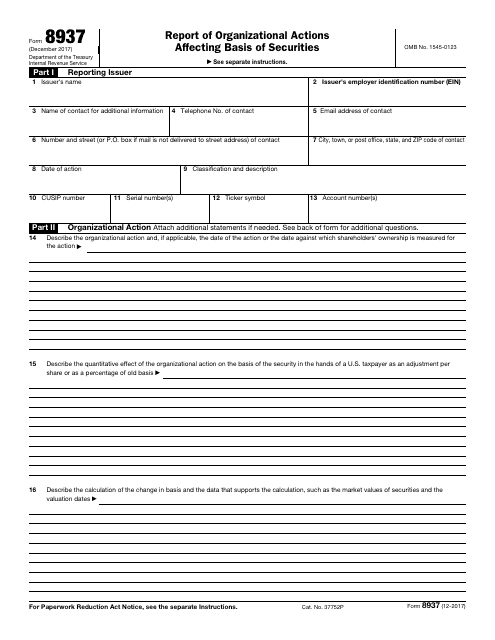

This Form is used for reporting any organizational actions that may have an impact on the basis of your securities for tax purposes. It is required by the Internal Revenue Service (IRS) to ensure accurate reporting of capital gains or losses.

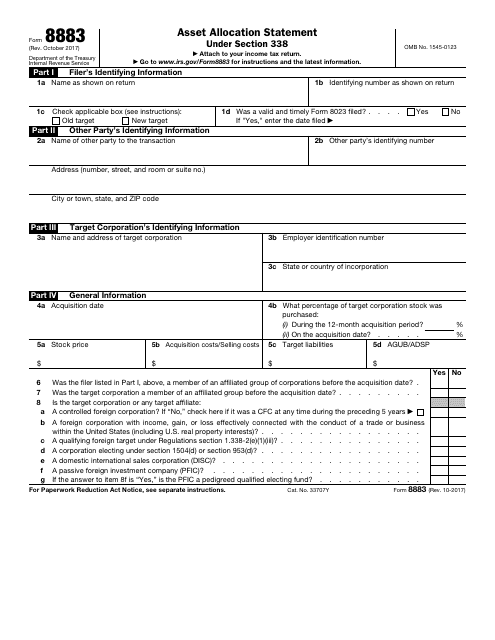

This form is used for reporting asset allocation statement under Section 338 to the IRS.

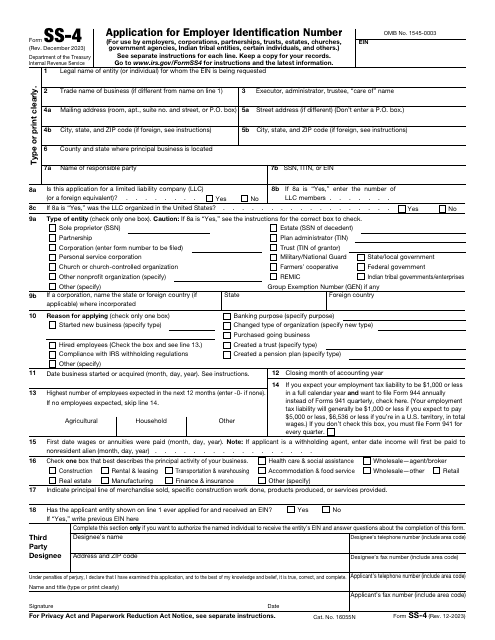

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.