Fill and Sign United States Legal Forms

Documents:

235709

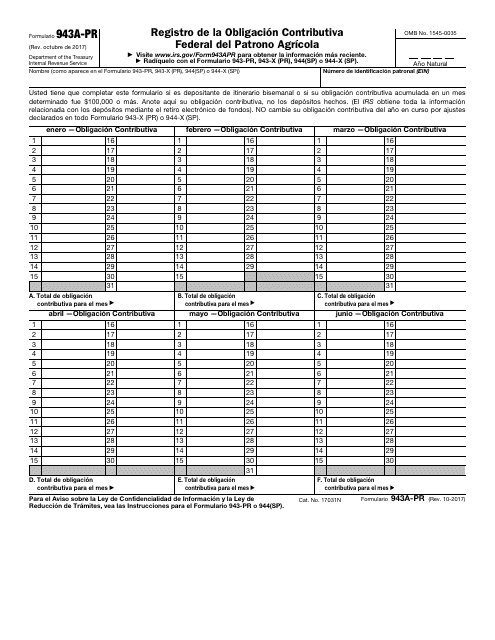

This document is for Puerto Rican farmers to report their federal employment taxes.

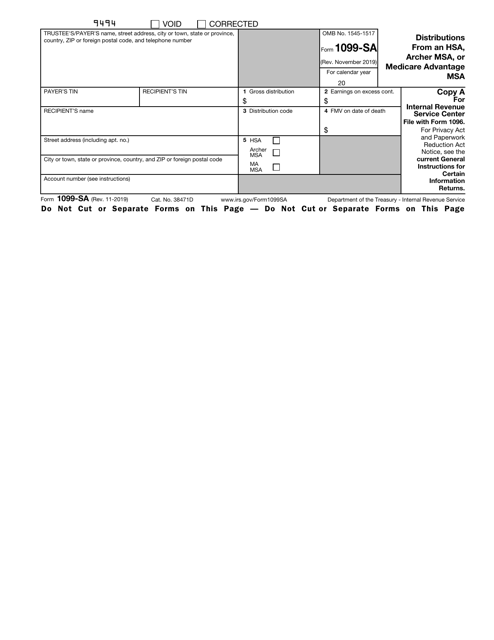

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

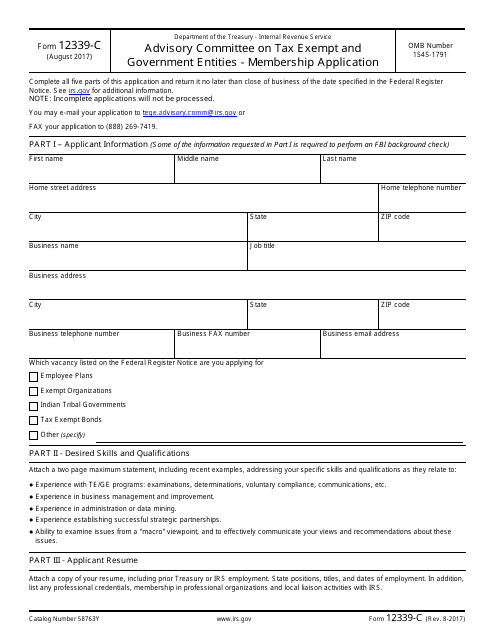

This form is used for applying to become a member of the Advisory Committee on Tax Exempt and Government Entities.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

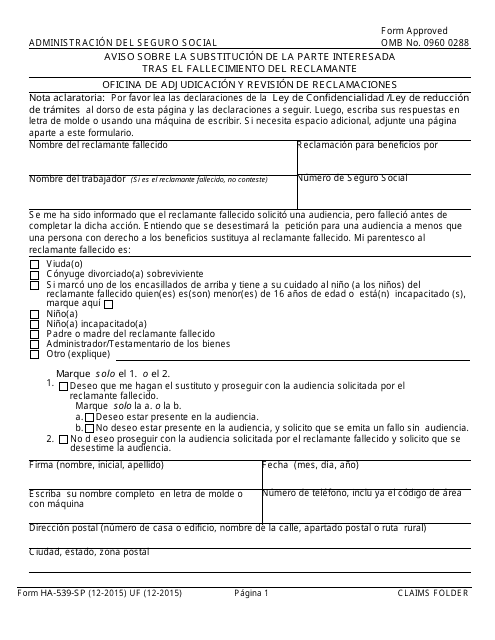

This form is used for notifying about the substitution of the interested party after the death of the claimant.

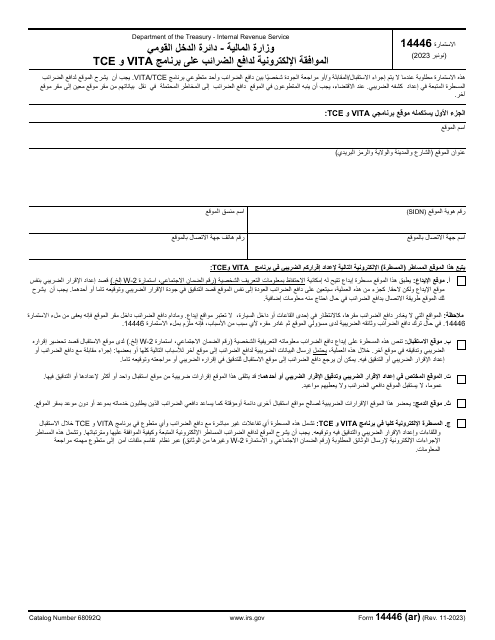

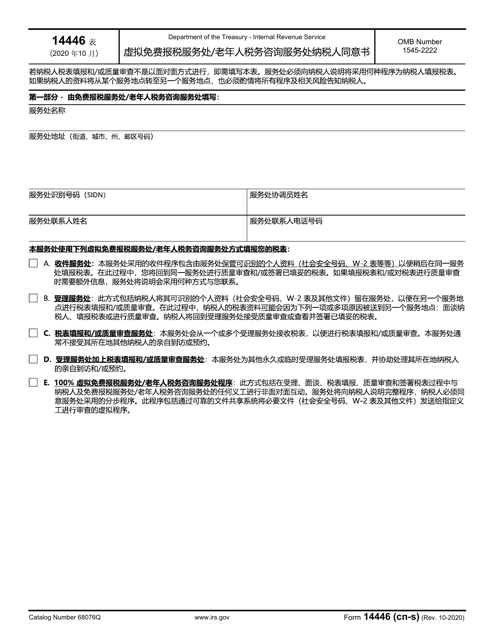

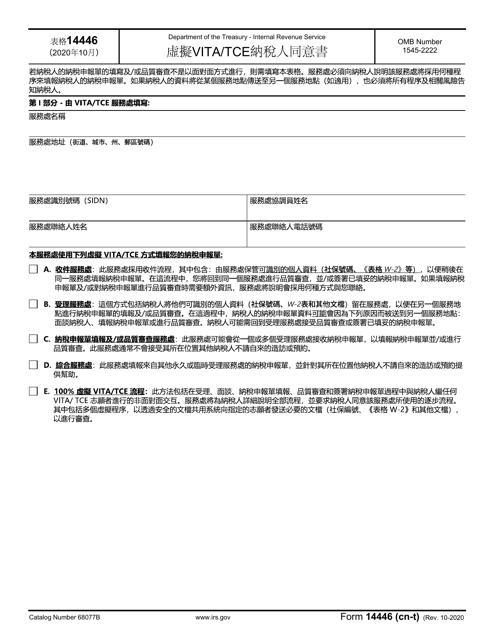

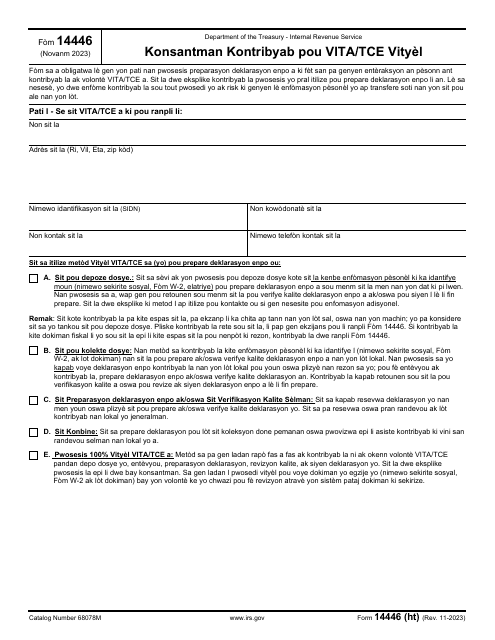

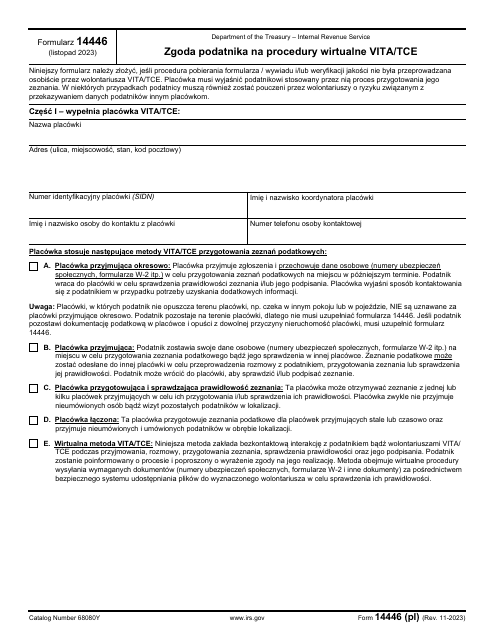

This document is used for obtaining the taxpayer's consent in the Virtual Vita/TCE program, specifically for Vietnamese-speaking taxpayers.

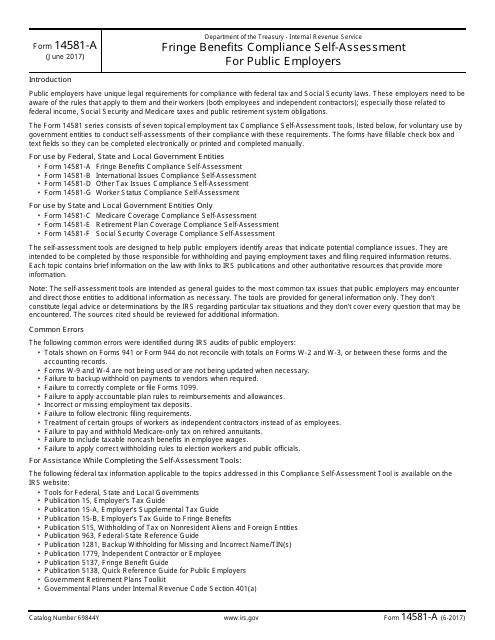

This Form is used for public employers to self-assess their compliance with fringe benefits regulations set by the IRS.

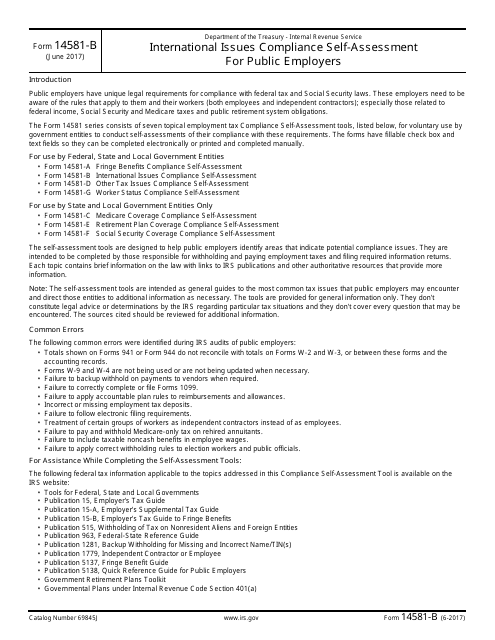

This form is used for public employers to self-assess their compliance with international issues related to taxation.

This document is used for conducting a Medicare coverage compliance self-assessment by state and local government employers.

This Form is used for public employers to assess their compliance with other tax issues for the purpose of tax compliance.

This Form is used for state and local government entities to assess their retirement plan coverage compliance.

This form is used for state and local government entities to complete a self-assessment of their compliance with social security coverage requirements.

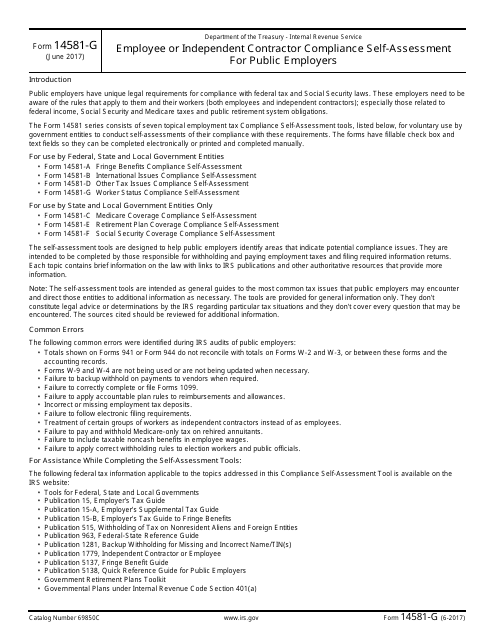

This document is used for public employers to assess compliance with employee or independent contractor classification rules.

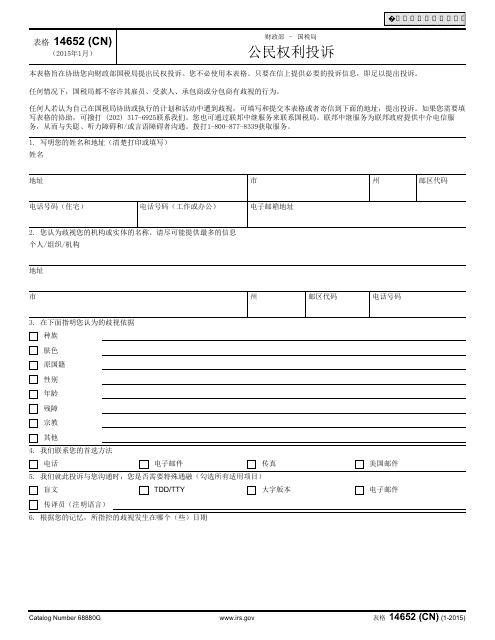

This document is used for filing a civil rights complaint in the Chinese language with the IRS.

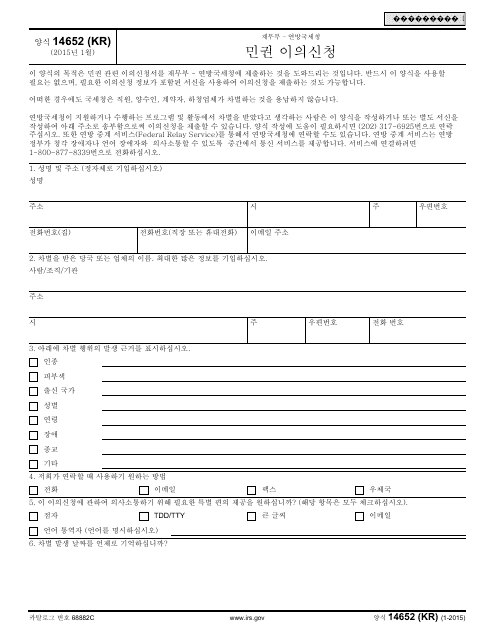

This form is used for filing a civil rights complaint with the IRS, specifically for individuals who prefer to fill it out in Korean.

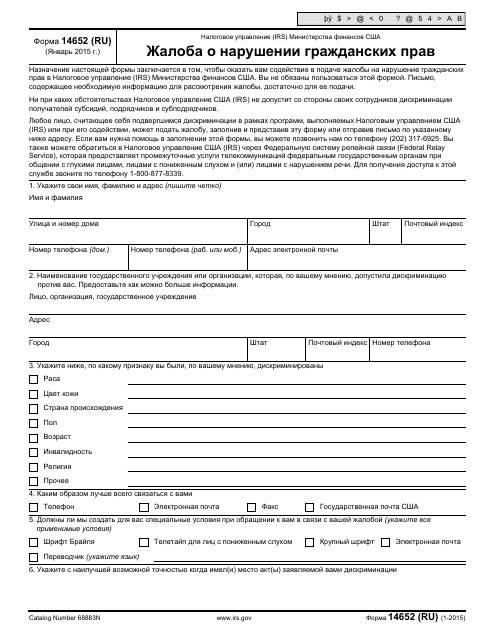

This document is used for filing a civil rights complaint in Russian with the Internal Revenue Service (IRS).

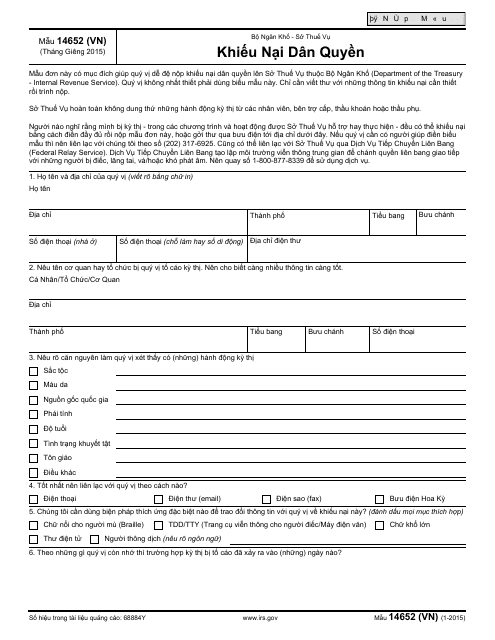

This document is a civil rights complaint form in Vietnamese for the IRS. It is used to file a discrimination complaint related to civil rights violations.

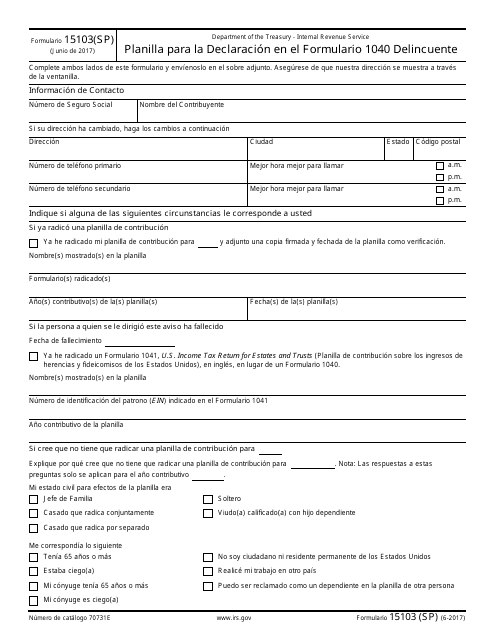

This Form is used for filing a tax return for individuals who have committed a crime and need to declare their income on Form 1040. (Spanish)

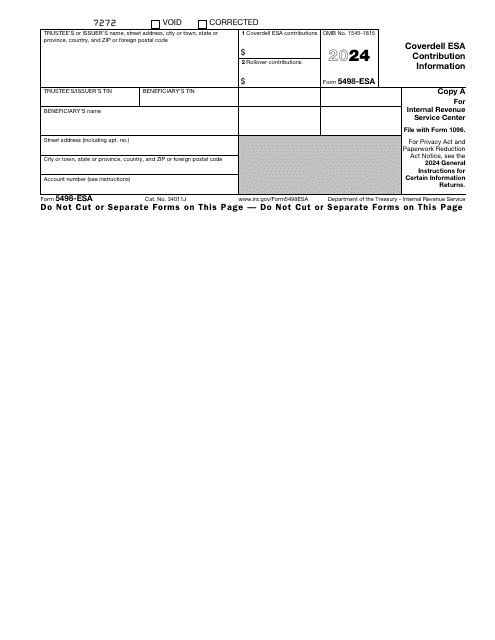

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

This is an IRS form that includes the details of an installment sale.

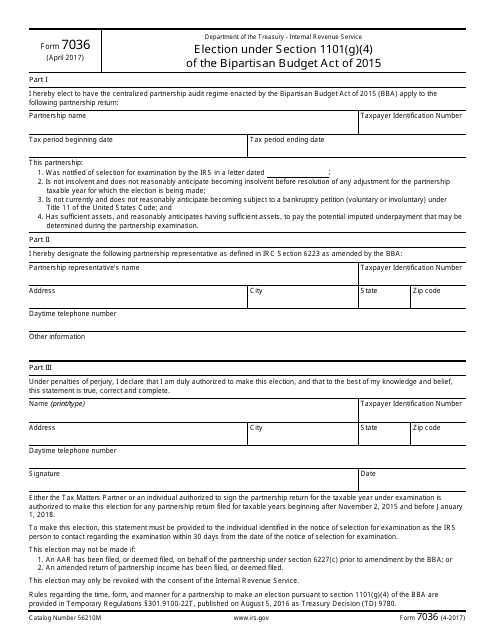

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.