Fill and Sign United States Legal Forms

Documents:

235709

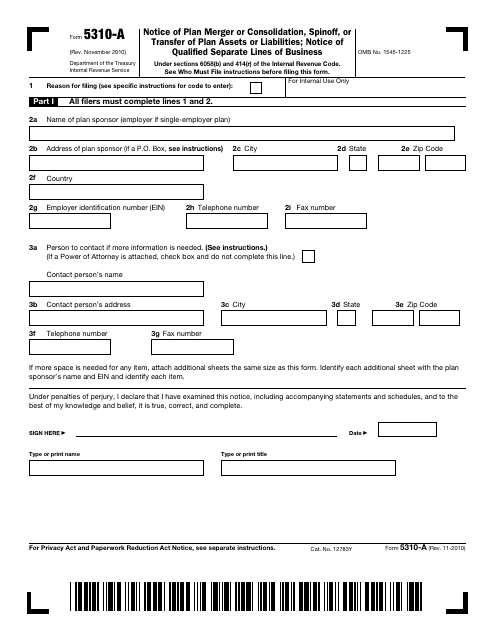

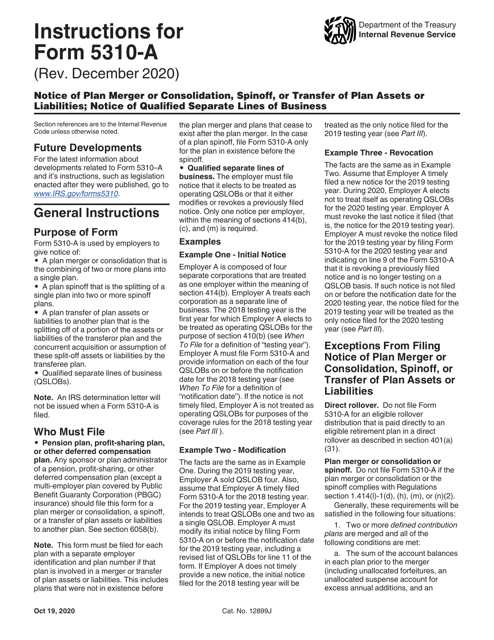

This Form is used for reporting a plan merger or consolidation, spinoff, transfer of plan assets or liabilities, or qualified separate lines of business.

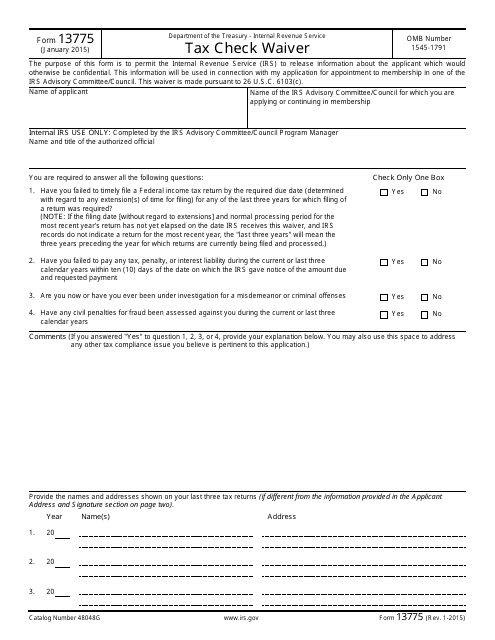

This form is used for requesting a waiver for tax checks from the IRS.

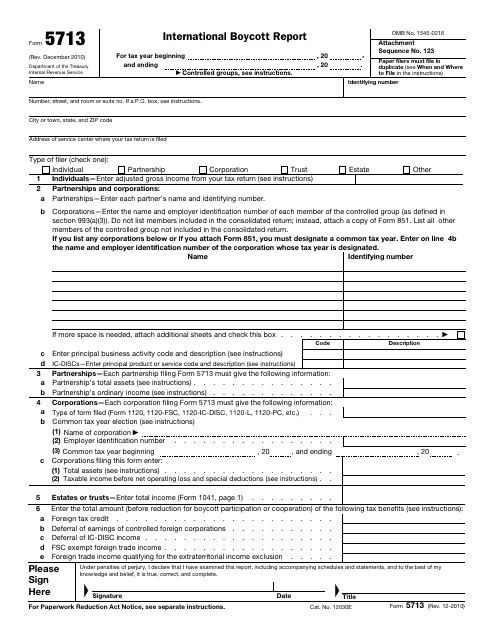

This Form is used for reporting international boycott activities to the Internal Revenue Service (IRS). Businesses may be required to complete this form to comply with U.S. tax laws.

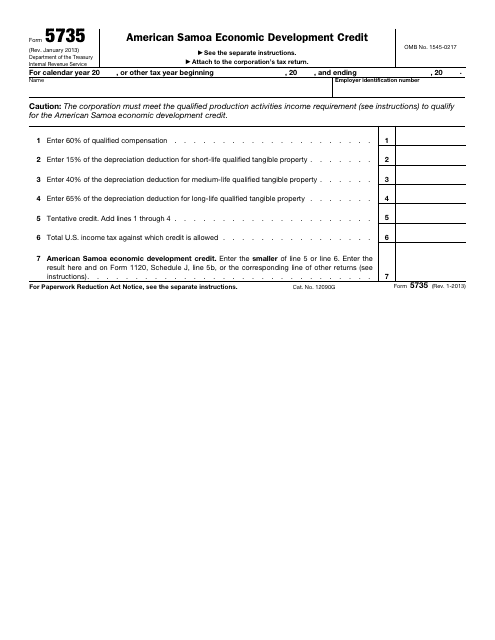

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

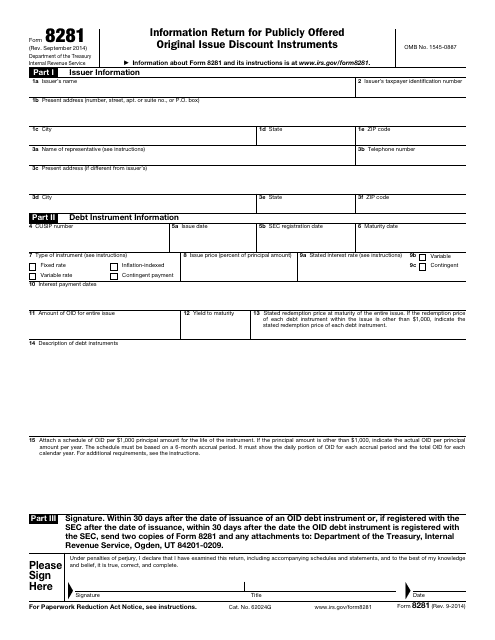

This is a written form filled out and filed by the taxpayers that issued publicly offered debt instruments with an original issue discount.

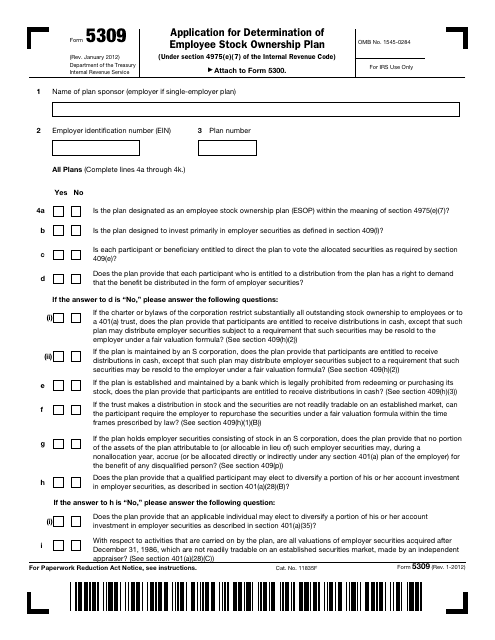

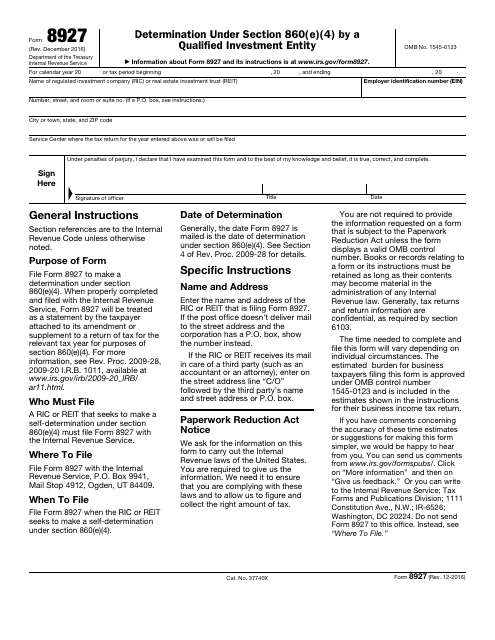

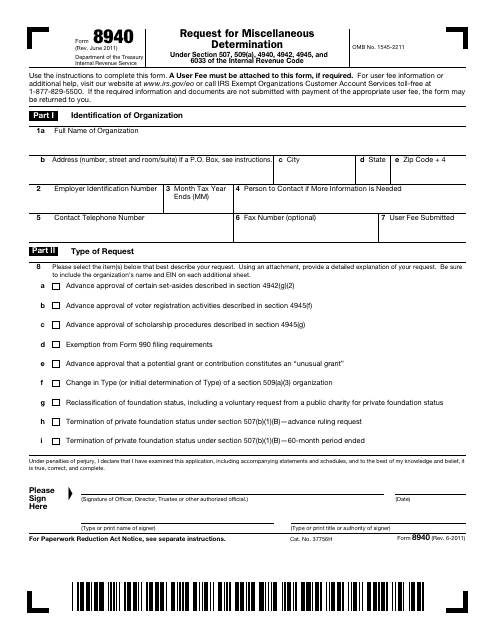

This form is used for requesting miscellaneous determinations from the IRS.

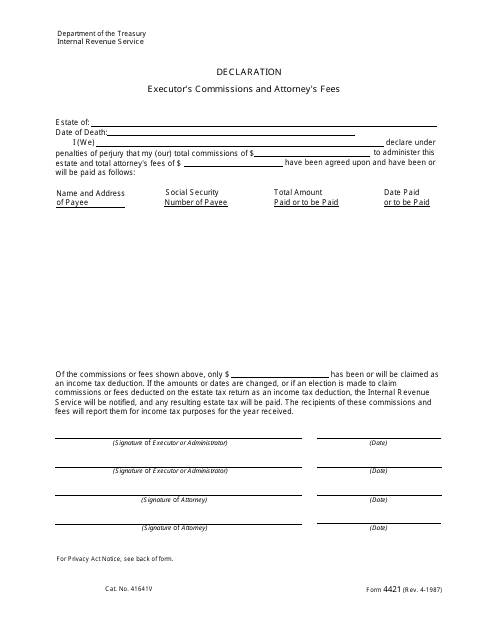

This is a form that should be filled in by an executor and an attorney, hired to manage the probate estate of a deceased person.

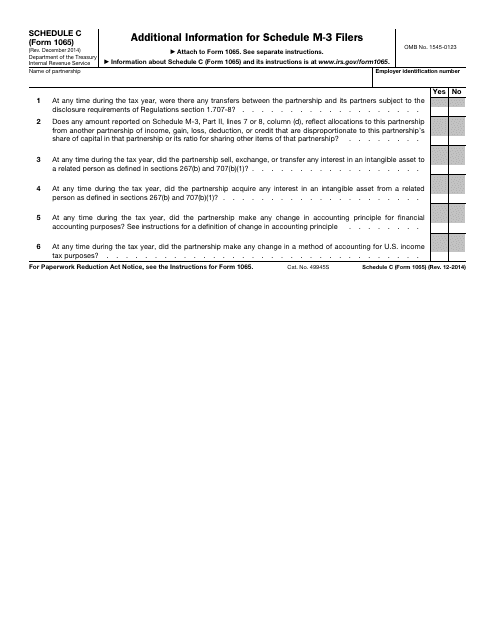

This form is used for providing additional information specifically for filers of Form 1065 Schedule C who also need to complete Schedule M-3.

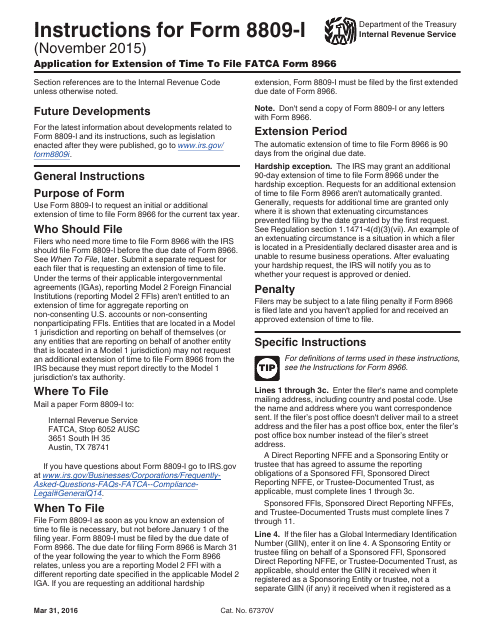

This Form is used for requesting an extension of time to file the Fatca Form 8966 with the IRS.

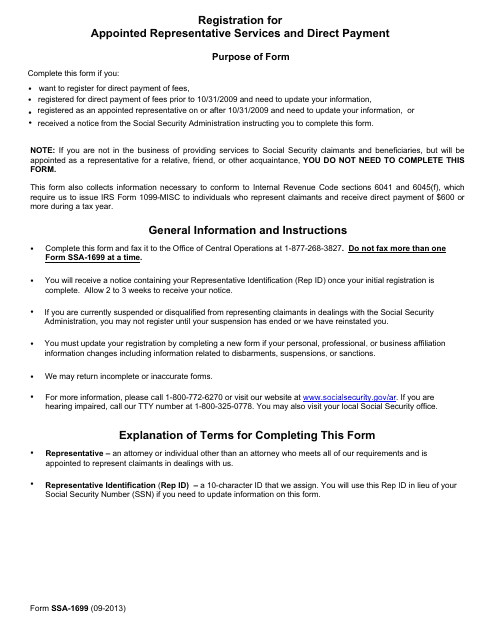

This is a document that individuals may use when they would like to register for the direct payment of fees or if they have registered as an appointed representative before but now want to change some of the information they have submitted in the past.

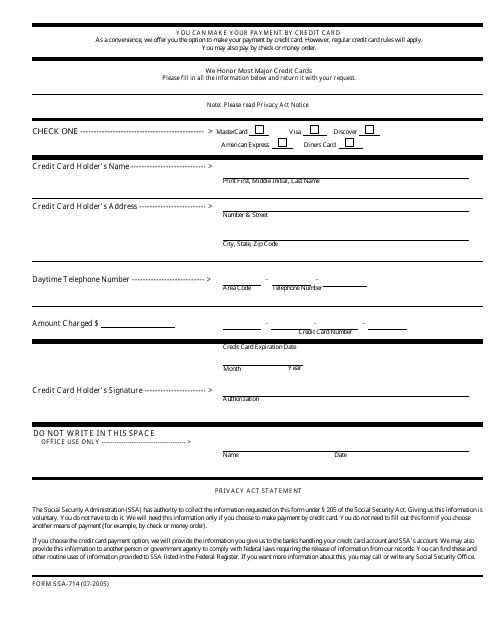

This form is used for applying to make credit card payments for services provided by the Social Security Administration.

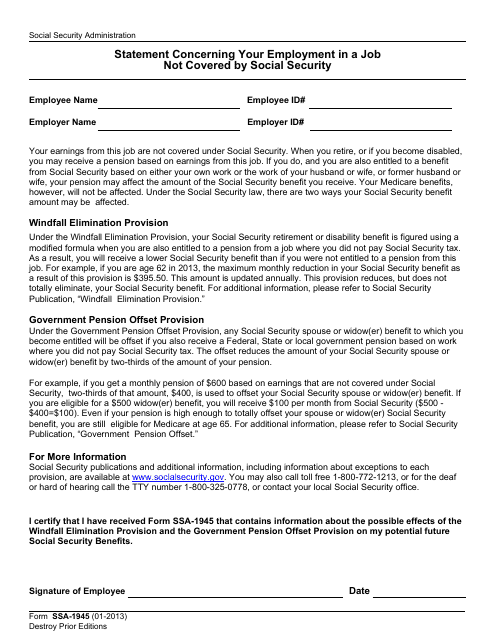

Use this form if you have a job and do not pay Social Security tax, in order to provide an explanation as to how your present job can affect your Social Security benefits.

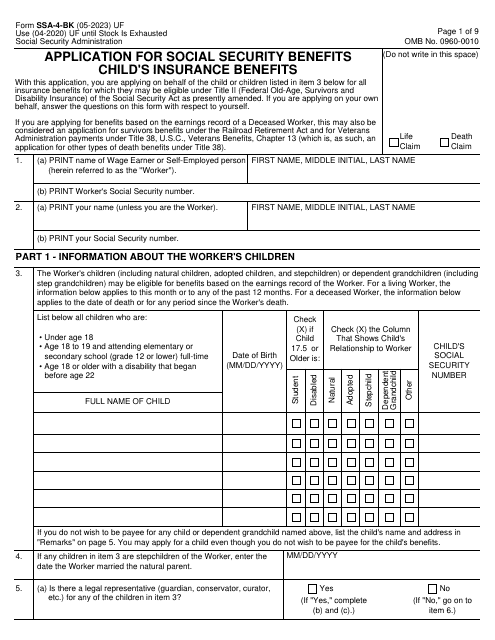

Use this form to apply for Child's Insurance Benefits with the Social Security Administration on behalf of children of eligible workers.

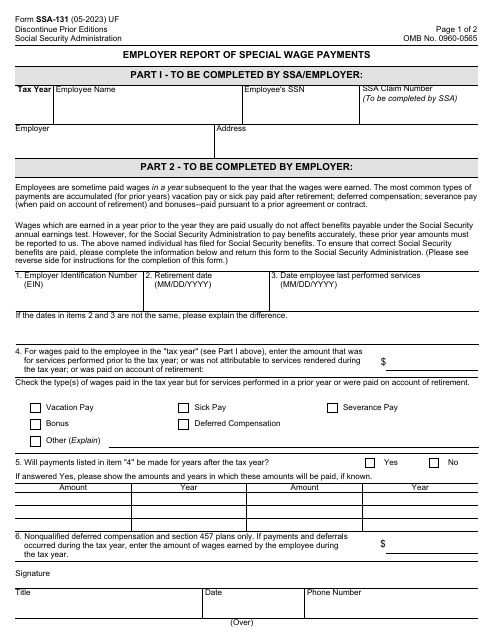

Download this form if you are an employer and need to report the special wages you pay to an employee.

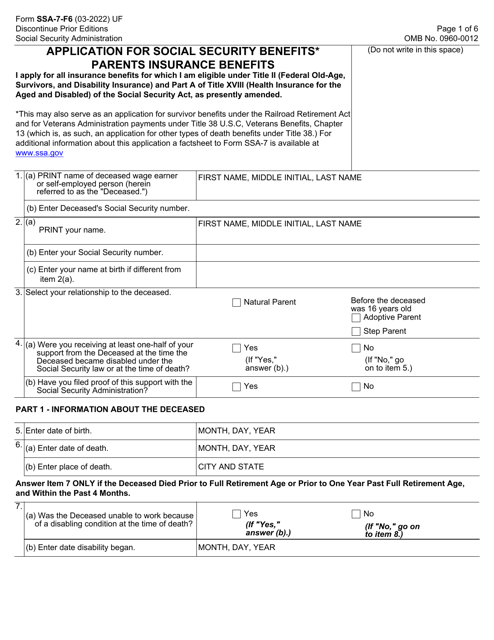

This application is filed by dependent parents of deceased workers with enough Social Security credits to confirm eligibility for SSA benefits.

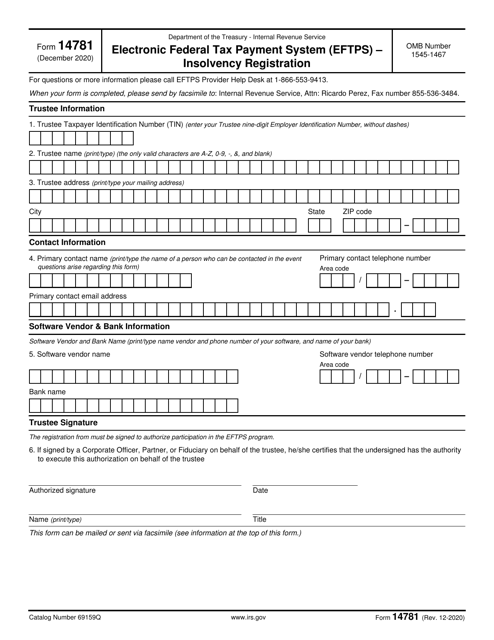

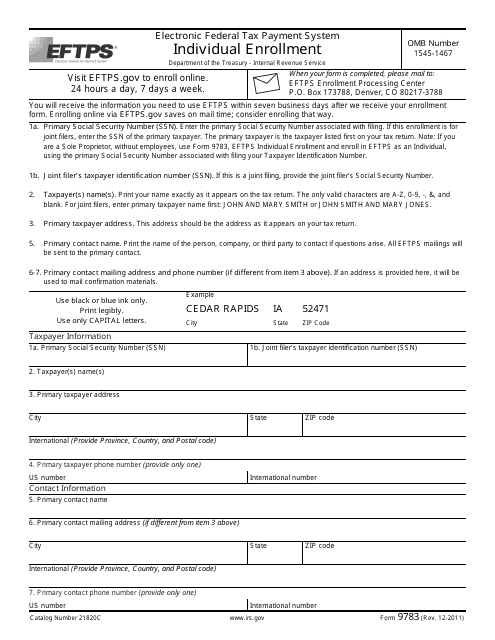

This Form is used for enrolling individuals in the Electronic Federal Tax Payment System (EFTPS). EFTPS allows individuals to make electronic tax payments to the IRS.

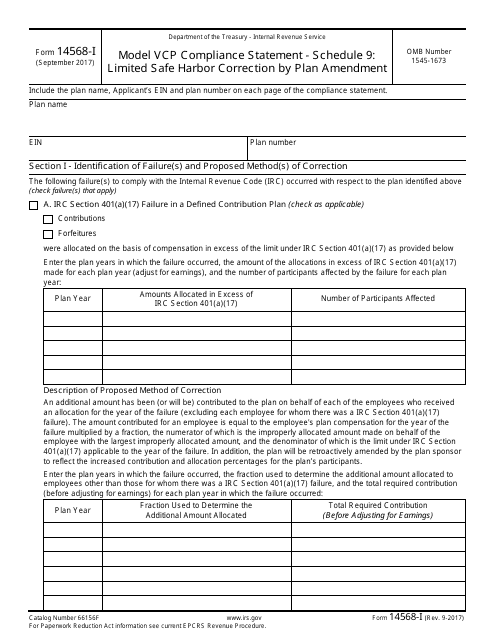

This form is used for making limited safe harbor corrections by plan amendment for IRS Form 14568-I Schedule 9.

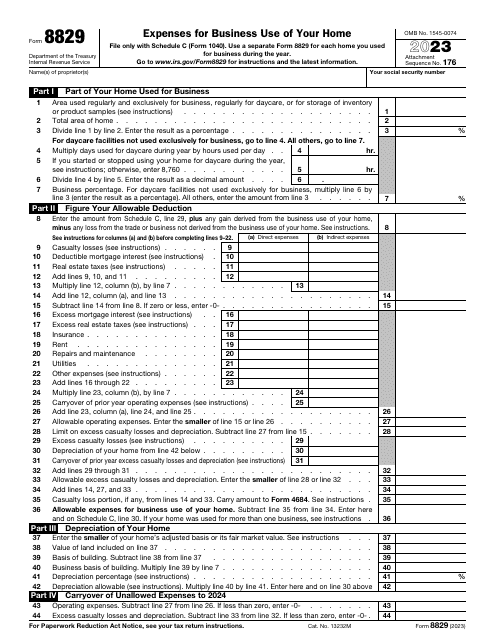

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

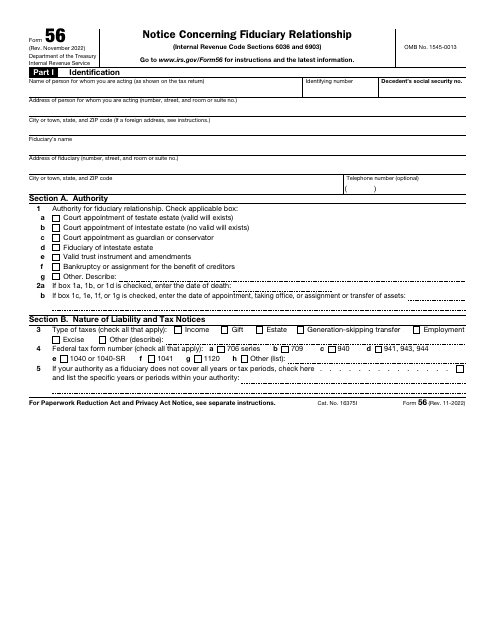

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

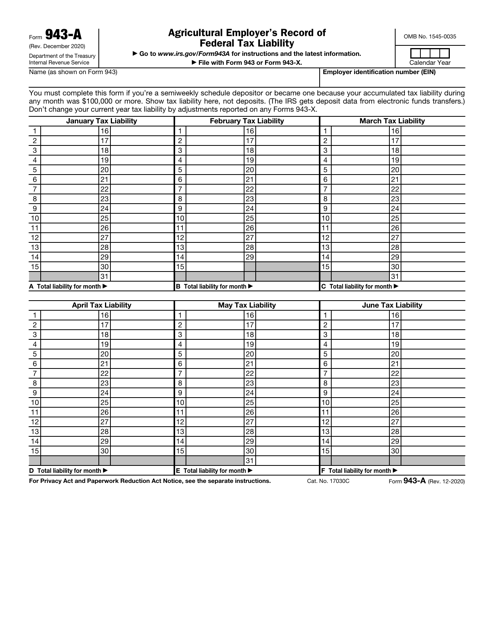

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.