Fill and Sign United States Legal Forms

Documents:

235709

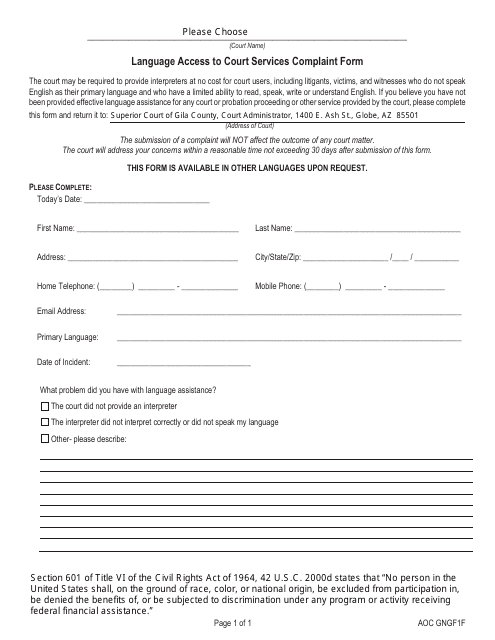

This form is used for filing a complaint regarding language access to court services in Gila County, Arizona.

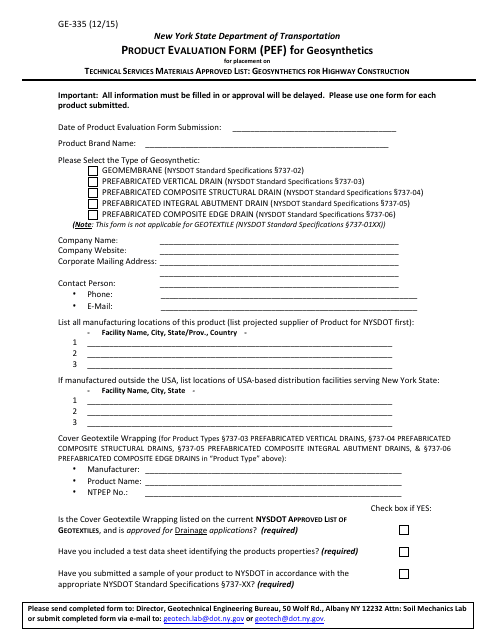

This form is used for evaluating geosynthetic products in New York.

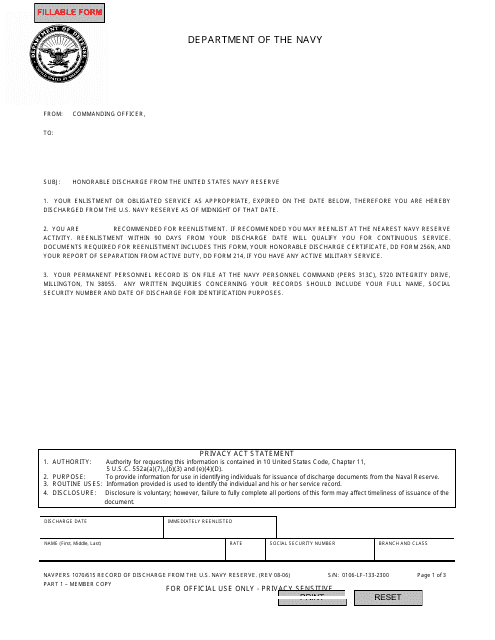

This form is used to record the discharge from the U.S. Navy Reserve and includes a health record.

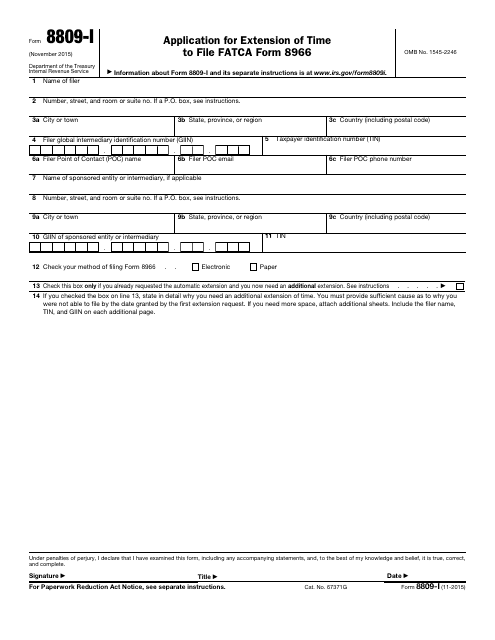

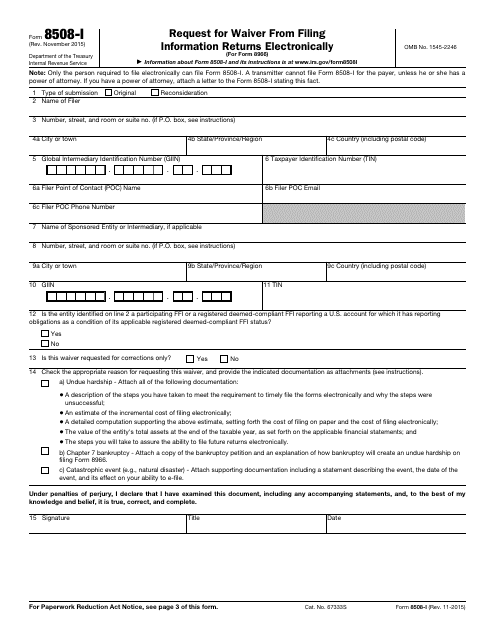

This Form is used for requesting an extension of time to file the Fatca Form 8966 to the IRS.

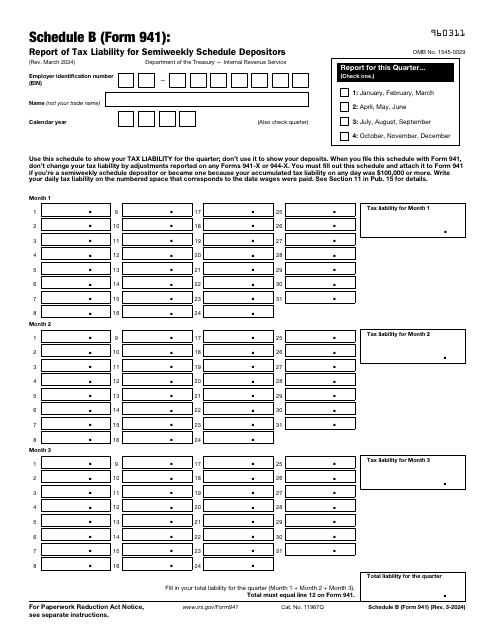

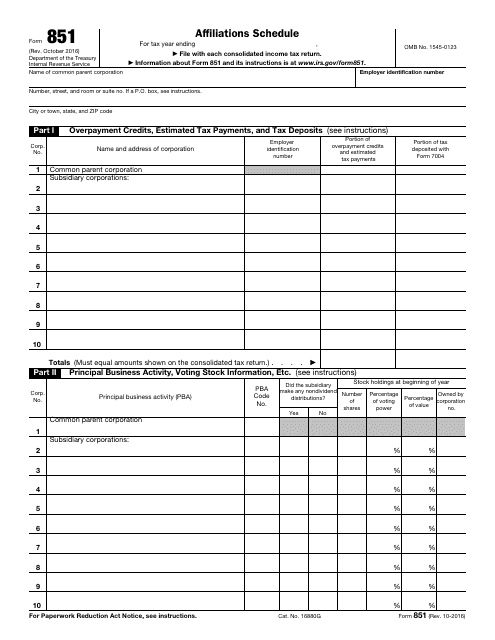

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations.

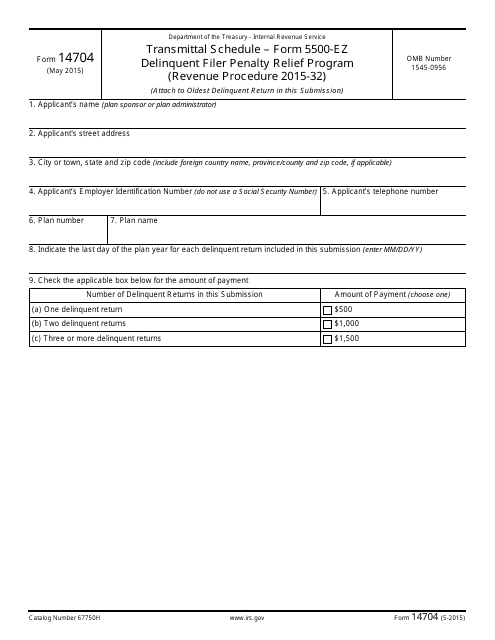

This form is used for the Transmittal Schedule Form 5500-EZ Delinquent Filer Penalty Relief Program provided by the IRS. It outlines the guidelines and procedures for penalty relief for late filers of Form 5500-EZ.

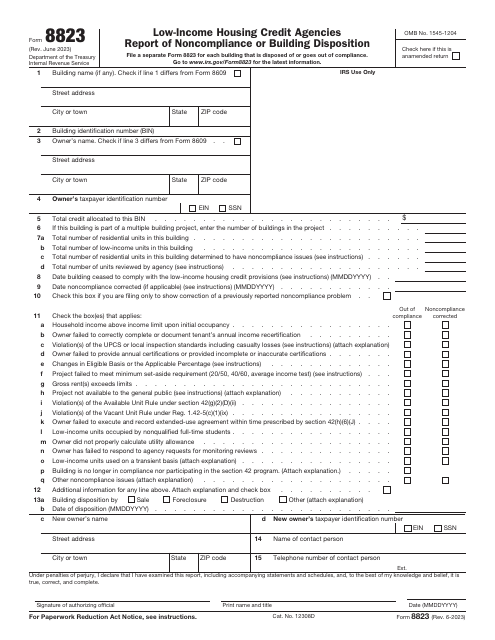

This is a formal document a housing credit agency is supposed to use to inform the tax authorities about certain noncompliance issues discovered during the inspection of a building and its units or specific instances of building disposition

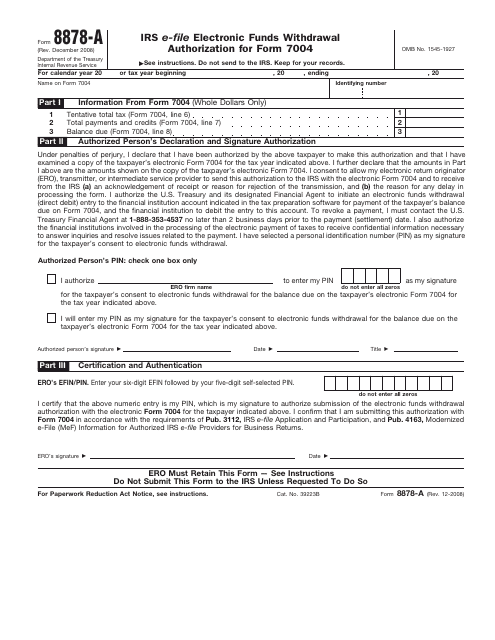

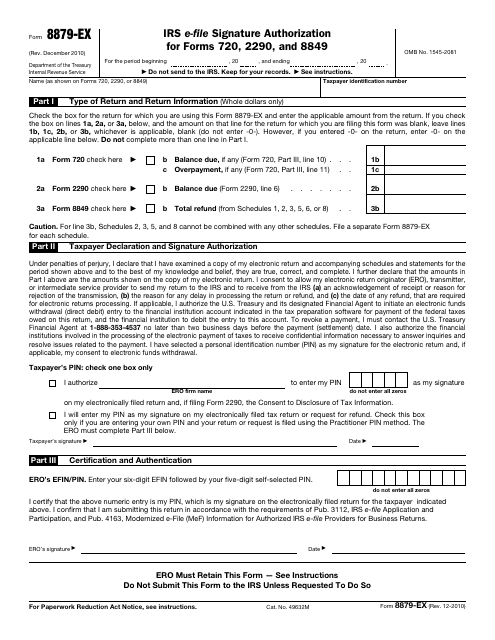

This form is used for IRS e-file signature authorization for Forms 720, 2290, and 8849. It allows taxpayers to authorize the electronic filing of these specific forms with the IRS.

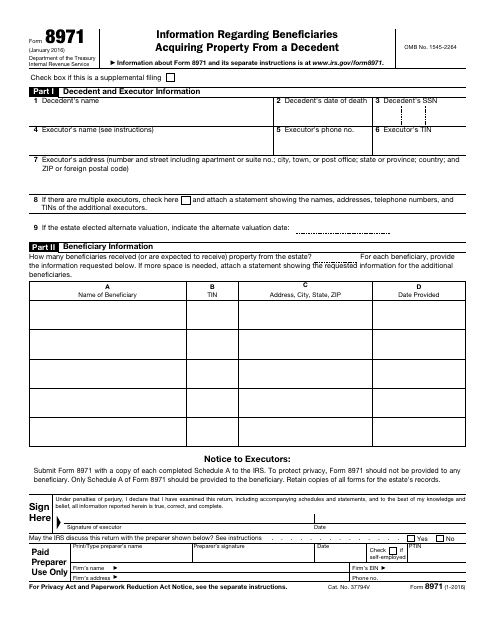

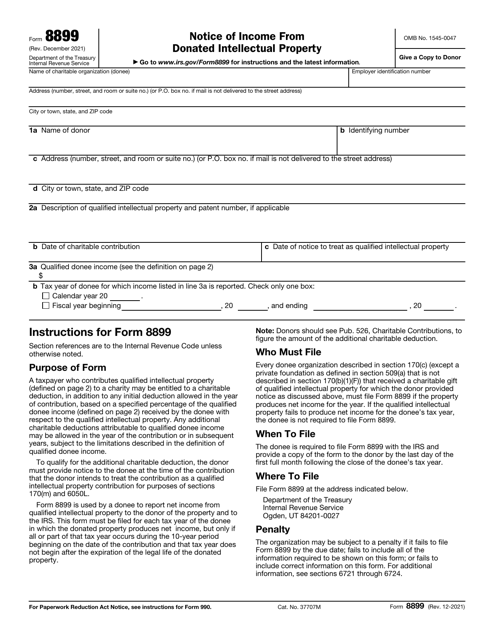

This form is used for providing information about beneficiaries who acquire property from a deceased person.

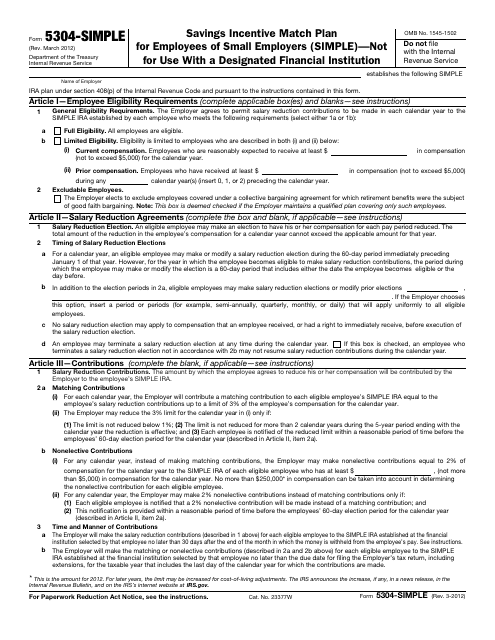

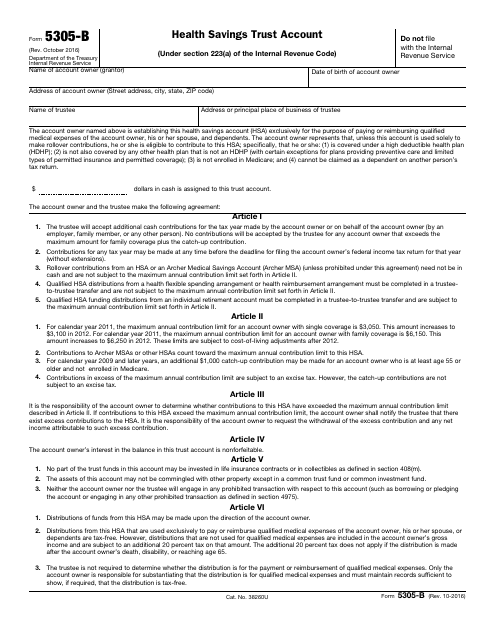

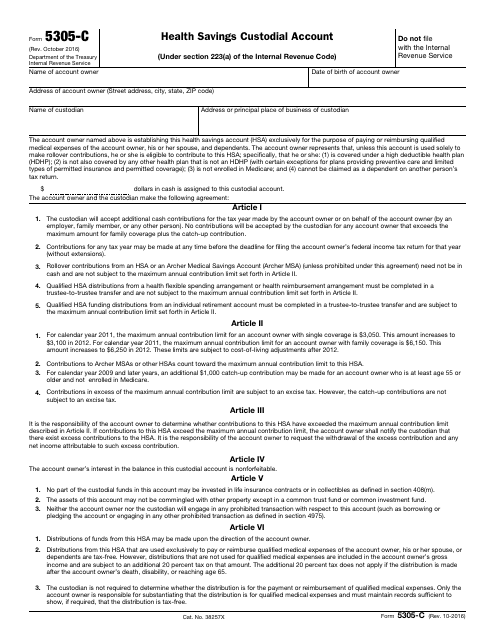

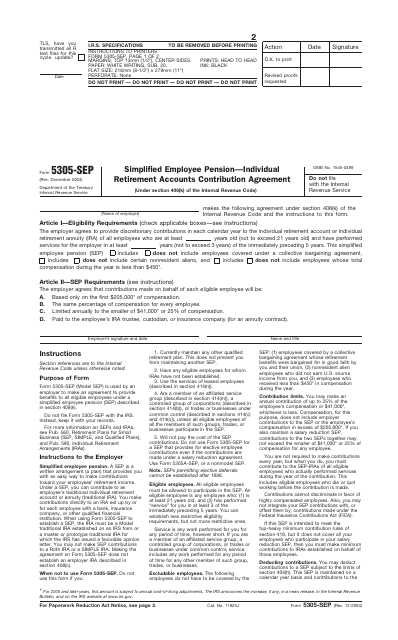

This is a fiscal document that outlines the details of a retirement plan established with the agreement of the company and its employees.

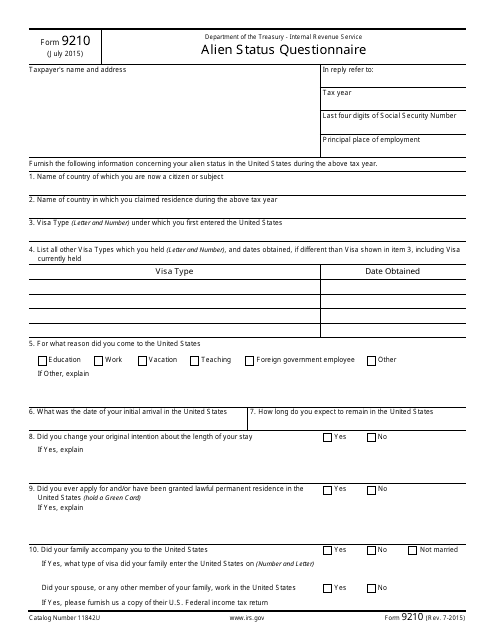

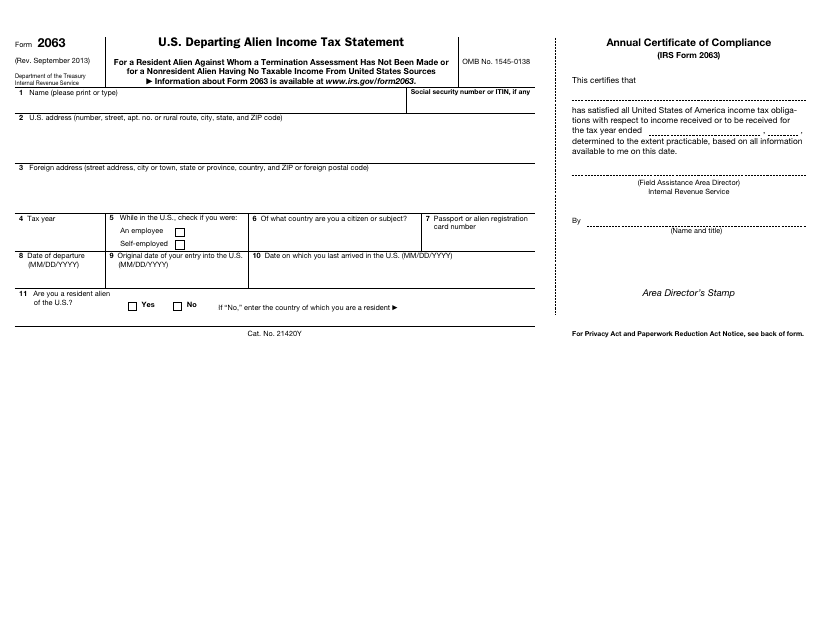

This document is used for determining the alien status of an individual for tax purposes.

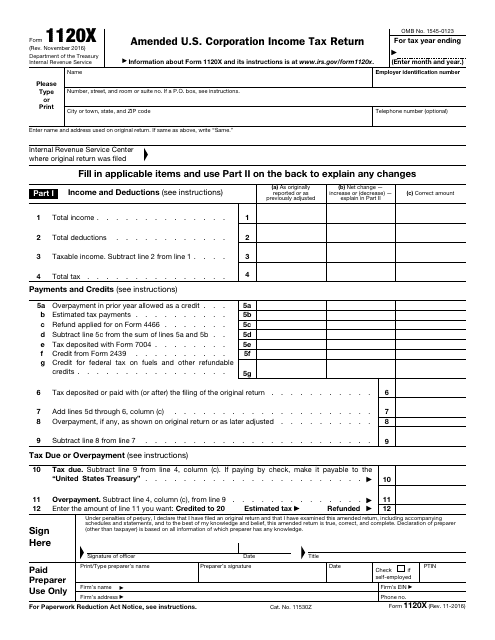

This document is filled out by corporations in order to correct Form 1120 (or Form 1120-A), a claim for a refund, or an examination, as well as to make certain elections after the prescribed deadline.

This form is used for reporting income earned by non-resident aliens who are leaving the United States.

This is a formal agreement signed by an employer to arrange a simplified employee pension.

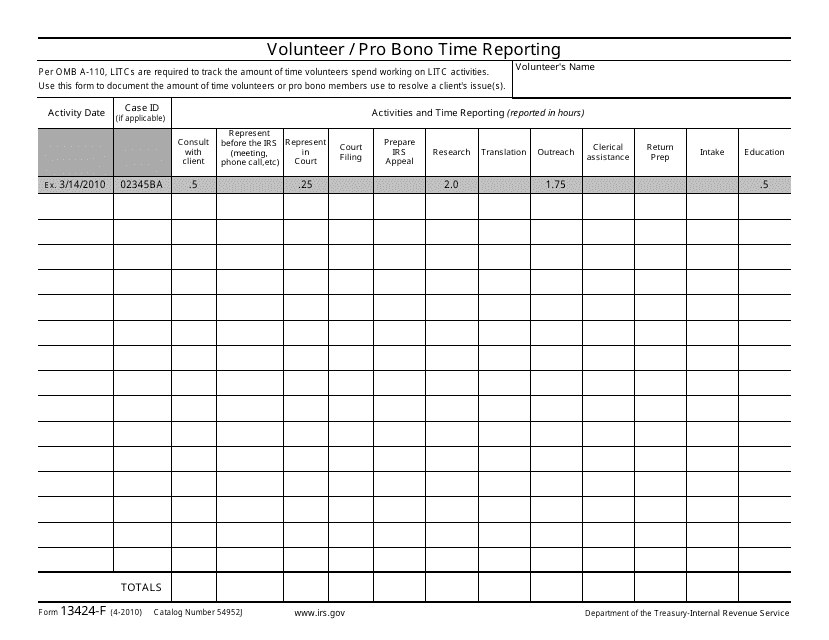

This form is used for reporting volunteer or pro bono time to the IRS. It helps individuals or organizations document the time they have devoted to providing free services to the community.

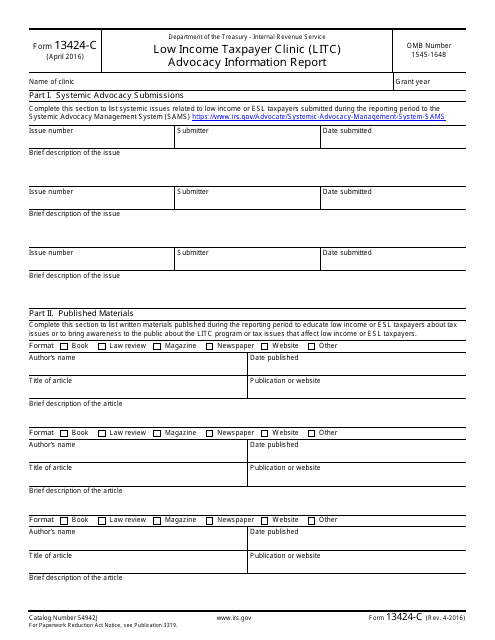

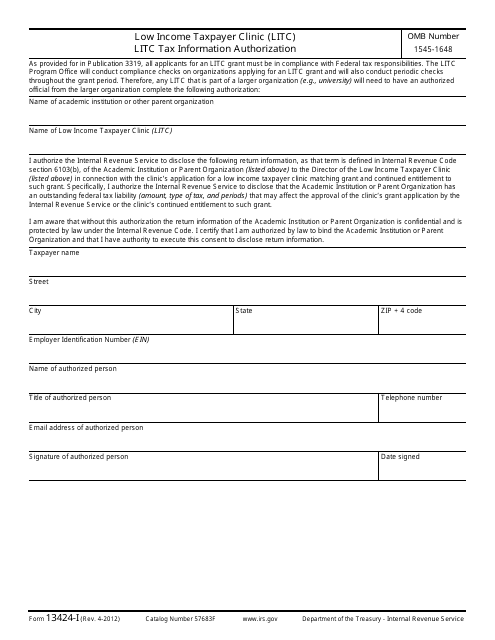

This document is for a Low Income Taxpayer Clinic (LITC) to authorize the tax information for LITC tax purposes.

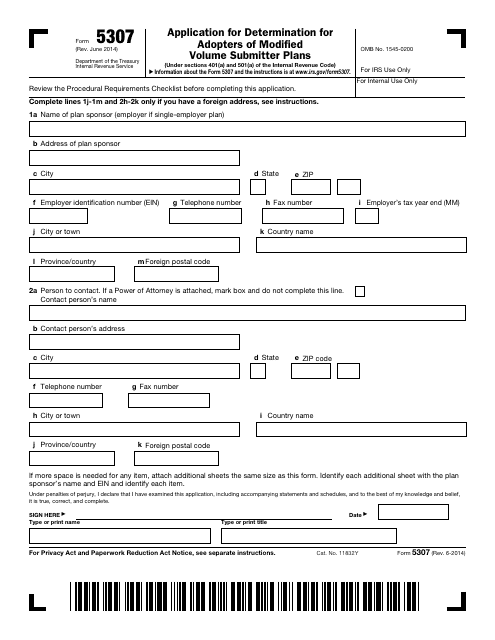

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.