Tax Exempt Form Templates

Documents:

1303

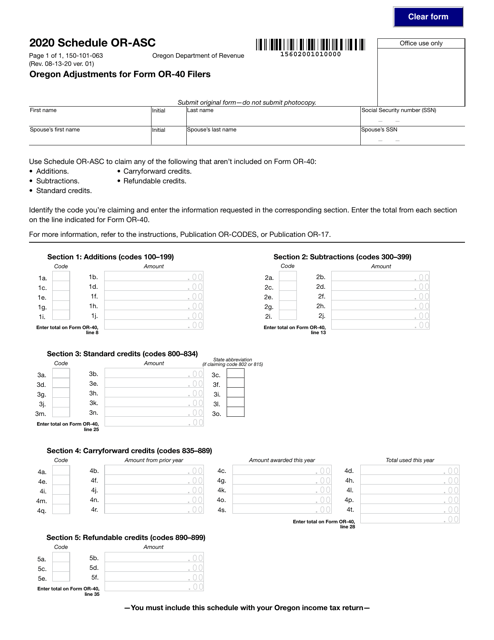

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

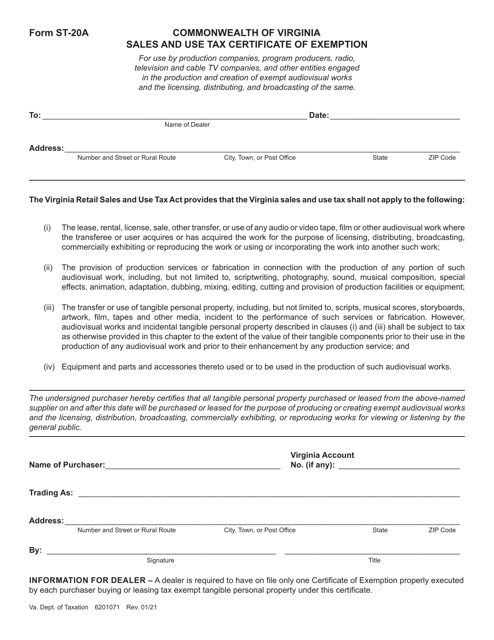

This form is used for claiming exemption from sales and use tax in the state of Virginia.

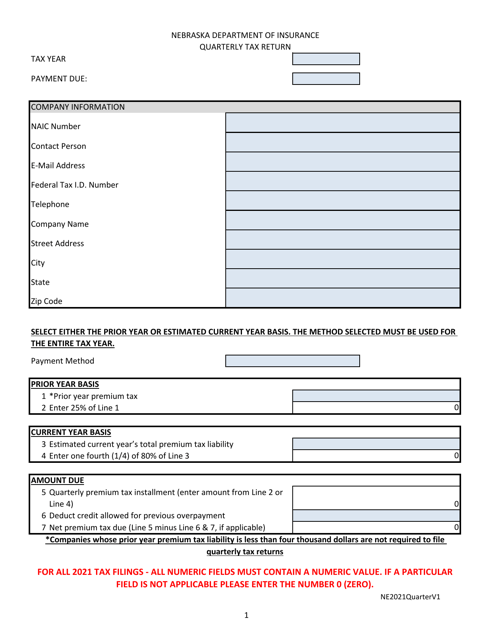

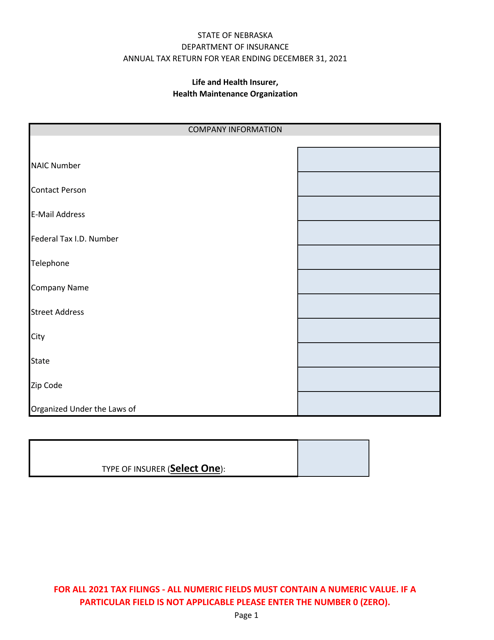

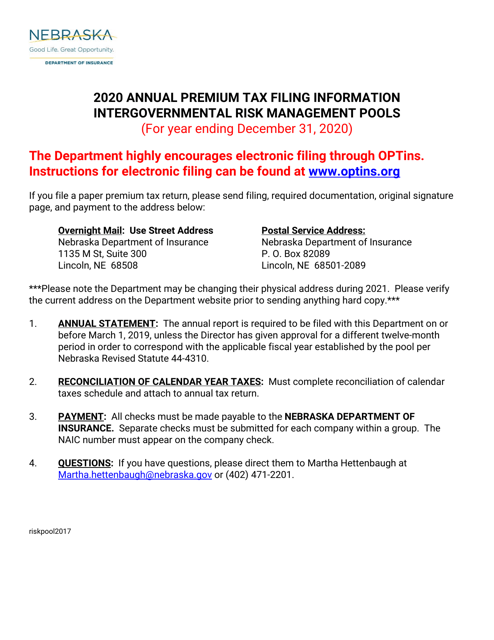

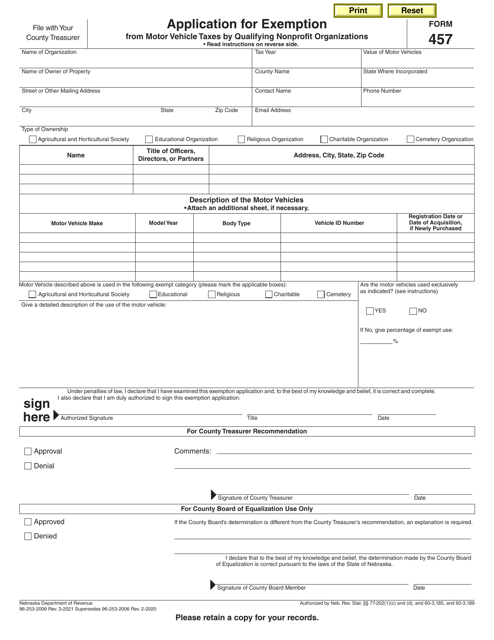

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

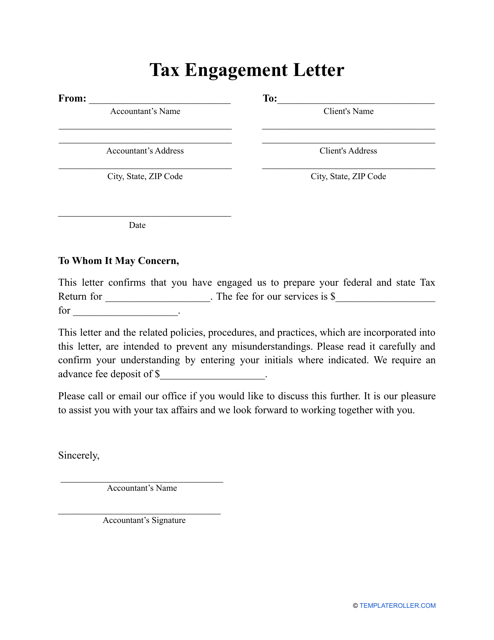

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

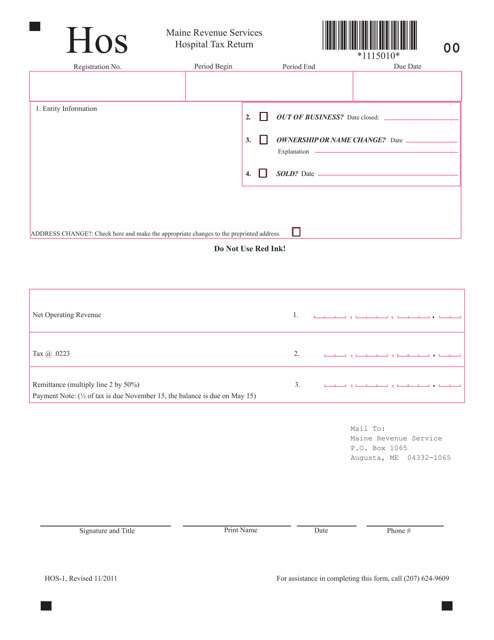

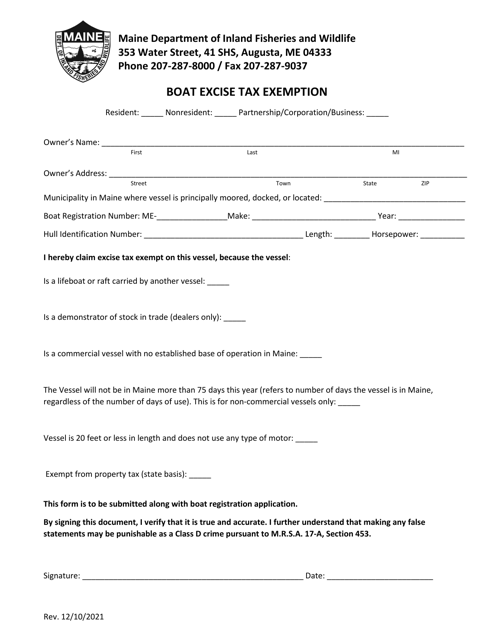

This Form is used for filing hospital tax returns in the state of Maine. It is used by hospitals to report and pay their taxes to the state revenue department.

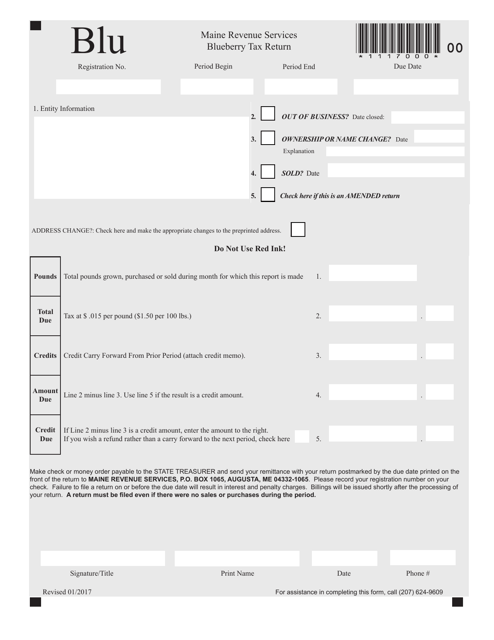

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

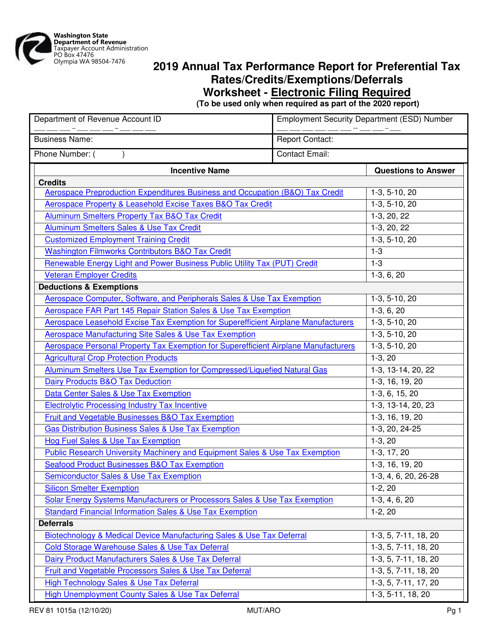

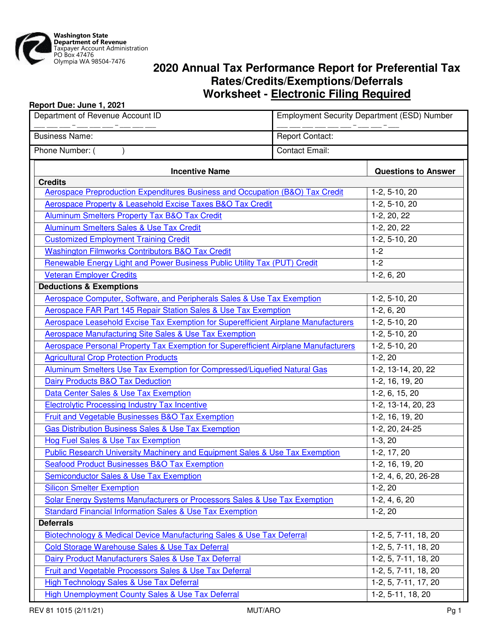

This Form is used for reporting annual tax performance for preferential tax rates, credits, exemptions, and deferrals in Washington state.

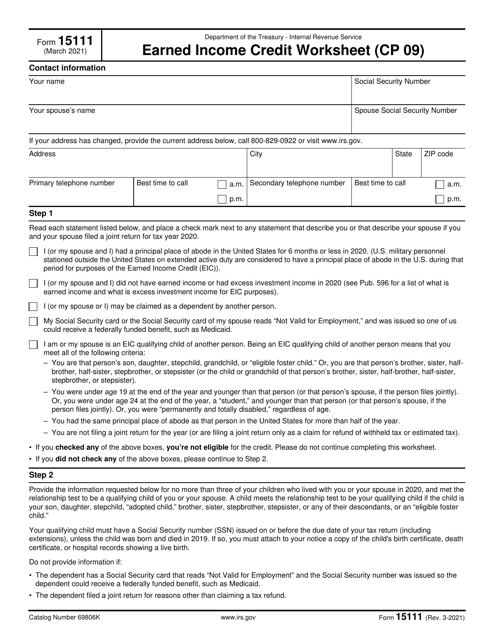

This form is used to calculate the Earned Income Credit for eligible taxpayers.

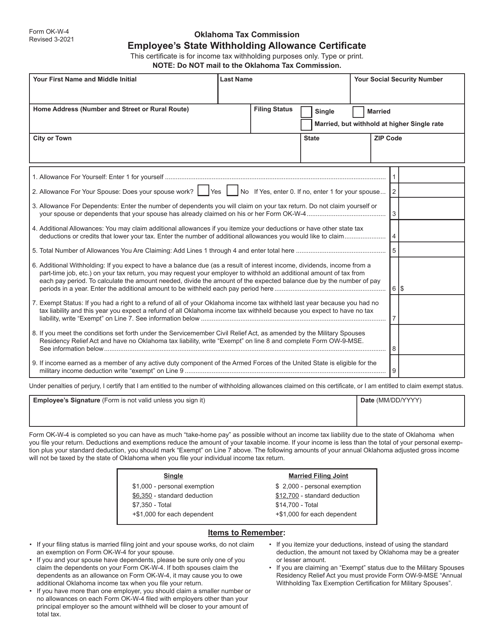

This form is used for employees in Oklahoma to declare their state withholding allowances for income tax purposes. It helps determine how much state income tax to withhold from an employee's paycheck.

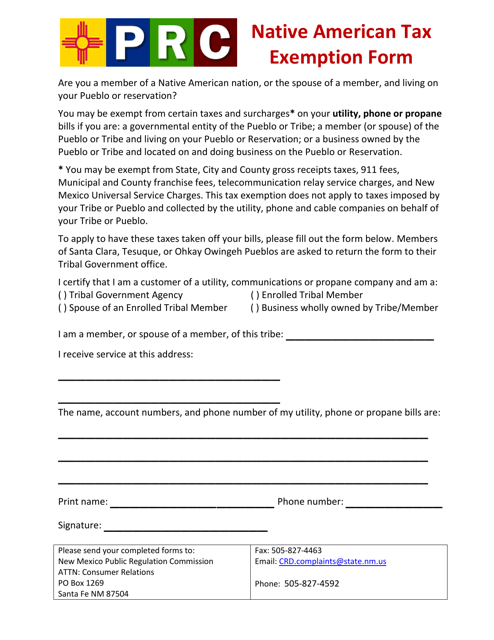

This form is used for Native Americans in New Mexico to claim tax exemption on certain purchases. It allows them to save money by not paying state sales tax on eligible goods and services.

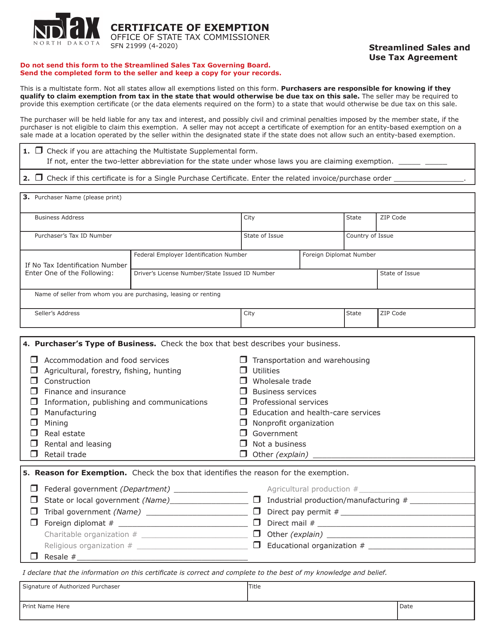

This form is used for claiming exemption from sales and use taxes in North Dakota as part of the Streamlined Sales and Use Tax Agreement.

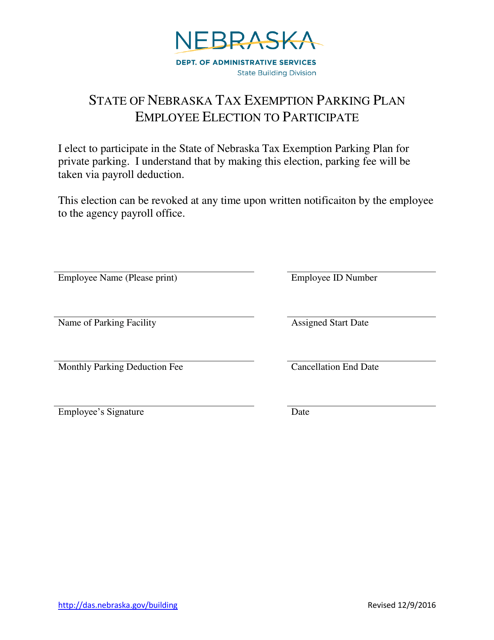

This document is for employees in Nebraska to elect to participate in a tax exemption parking plan.

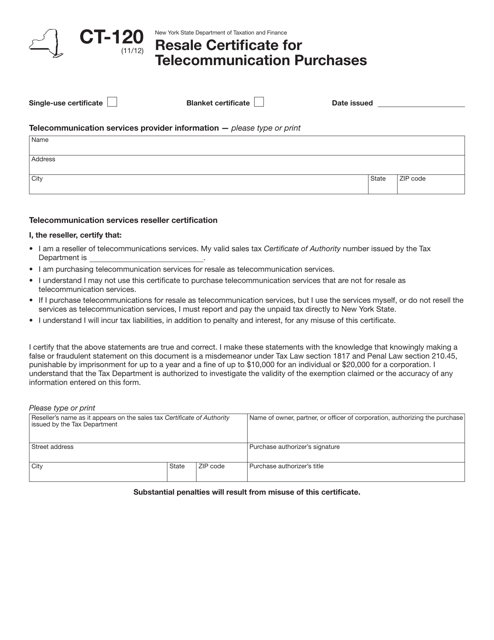

This form is used for applying for a resale certificate in New York for tax-exempt telecommunication purchases.

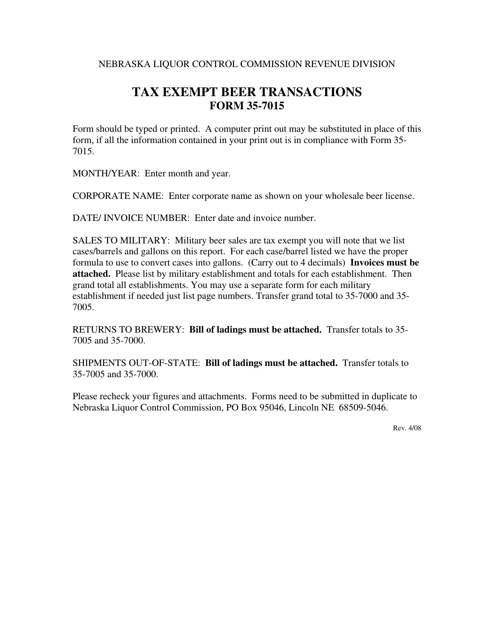

This form is used for reporting tax-exempt beer transactions in Nebraska.

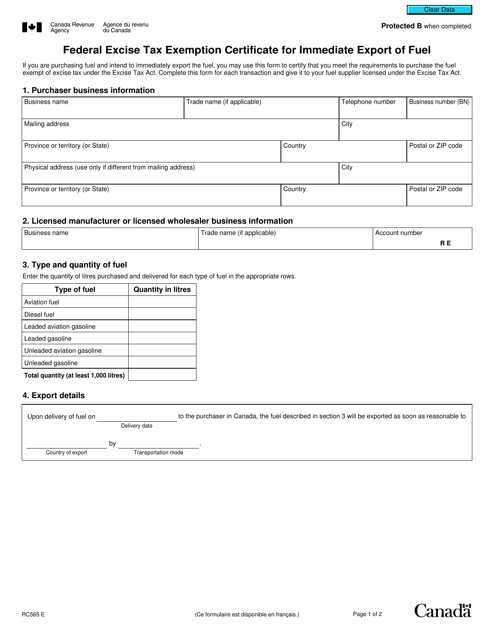

This form is used for applying for a federal excise tax exemption certificate in Canada, specifically for the immediate export of fuel.

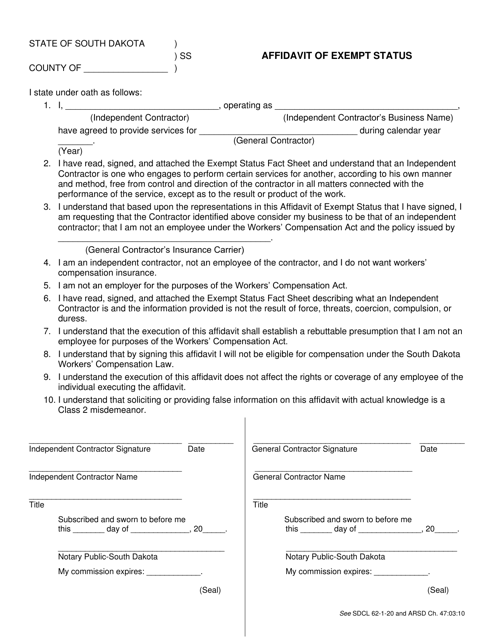

This form is used to declare exempt status for tax purposes in South Dakota.