Tax Exempt Form Templates

Documents:

1303

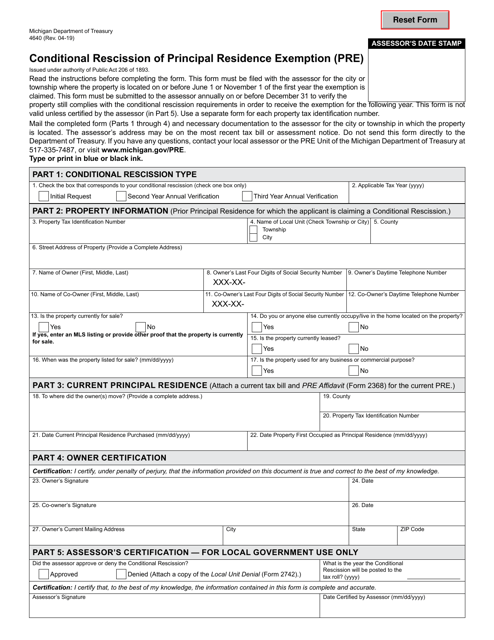

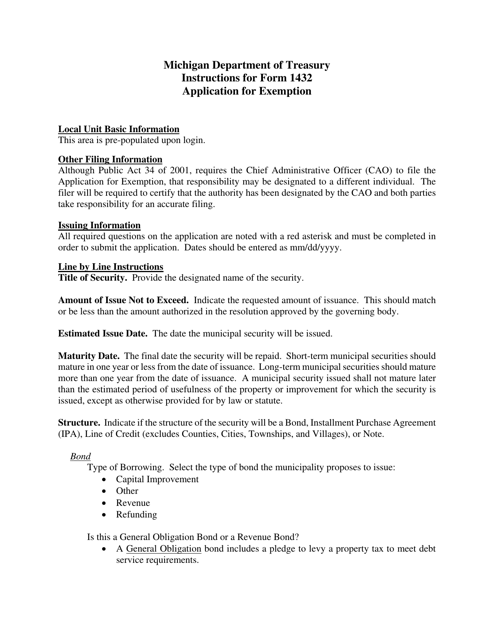

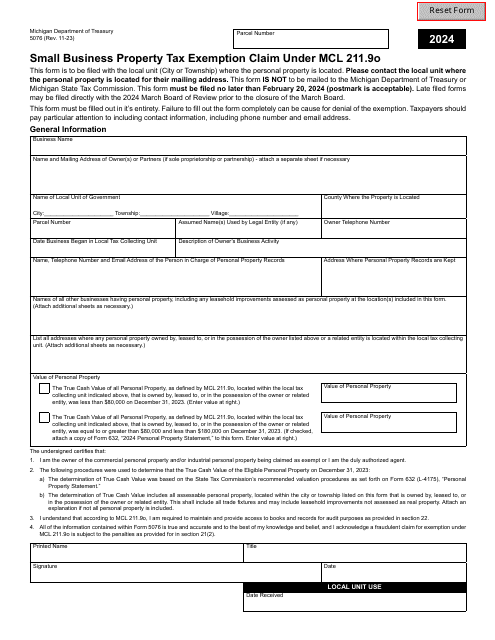

This Form is used for applying for an exemption in the state of Michigan. It provides instructions on how to complete and submit Form 1432.

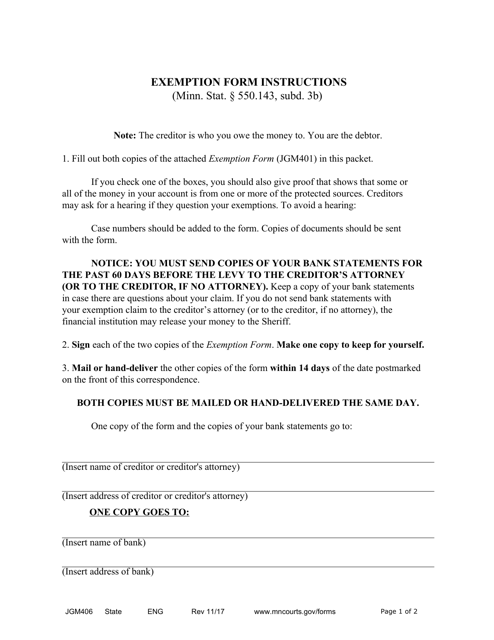

This Form is used for claiming an exemption from certain taxes in Minnesota. It provides instructions on how to complete and file the JGM401 Exemption Form.

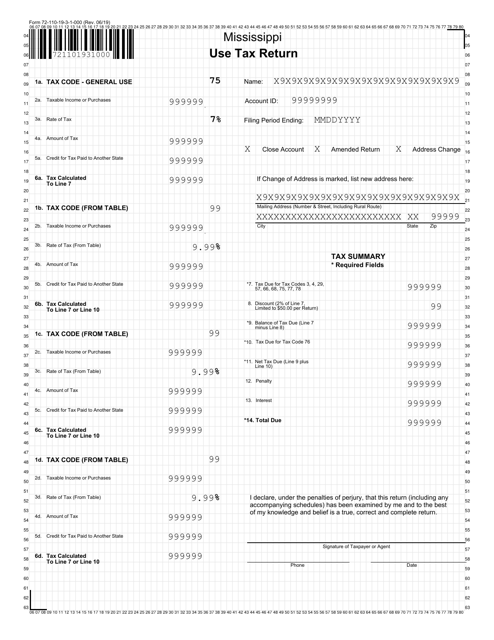

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

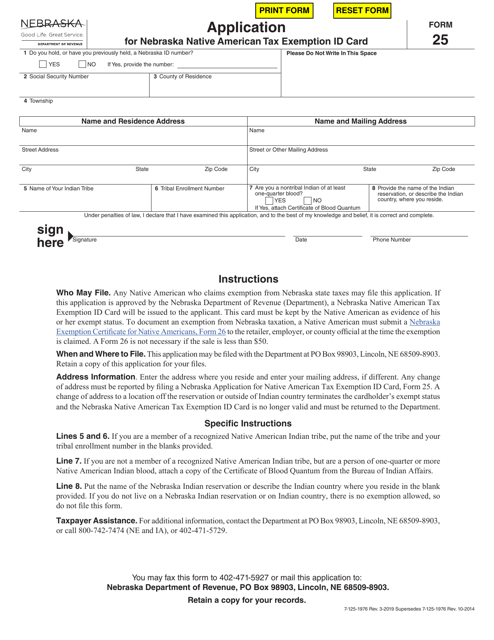

This form is used for applying for a Native American tax exemption ID card in Nebraska.

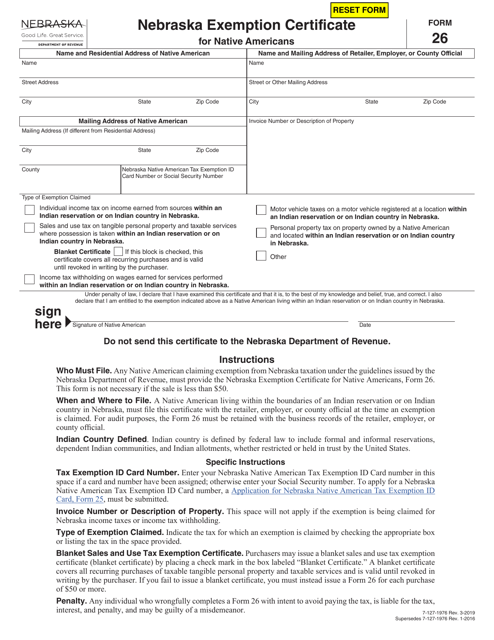

This Form is used for Native Americans in Nebraska to apply for exemption from certain taxes. It allows them to certify their tribal membership and claim tax benefits.

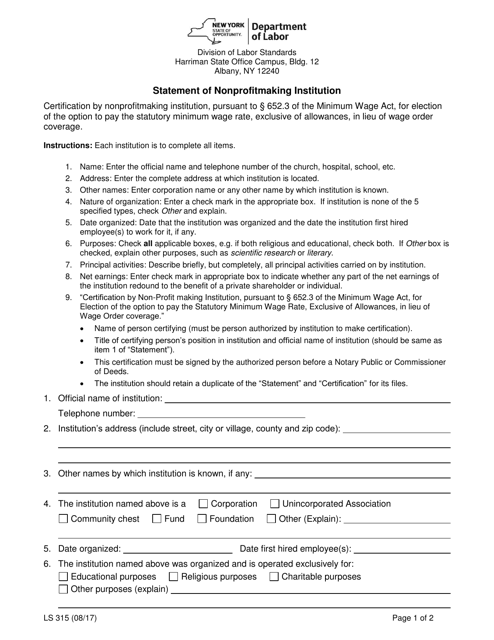

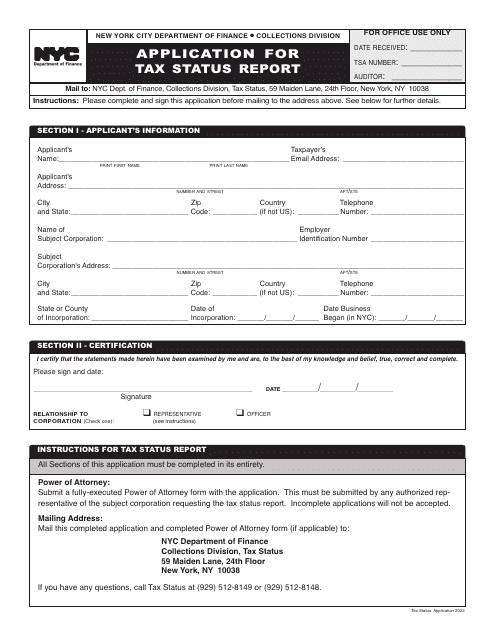

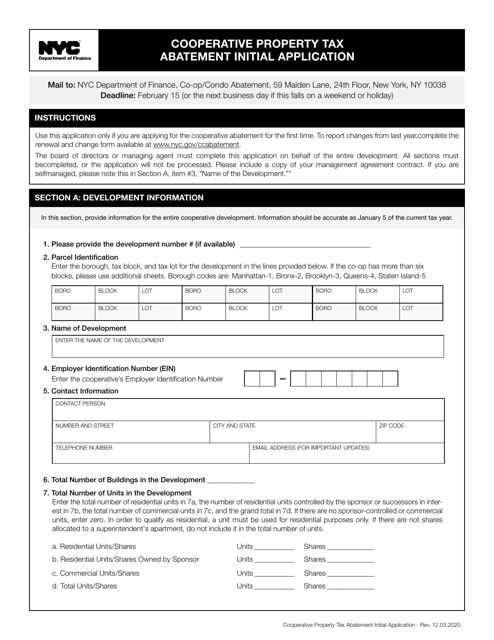

This form is used for reporting the financial status of a nonprofit organization in New York that does not make a profit. It provides information about the institution's revenues, expenses, and assets.

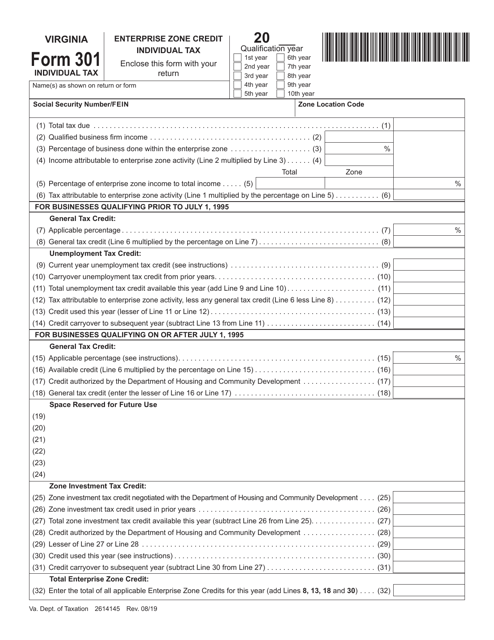

This Form is used for claiming the Enterprise Zone Credit on individual income tax returns in Virginia.

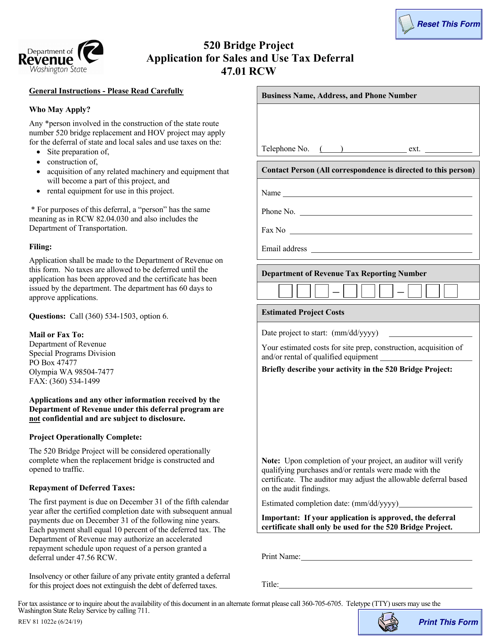

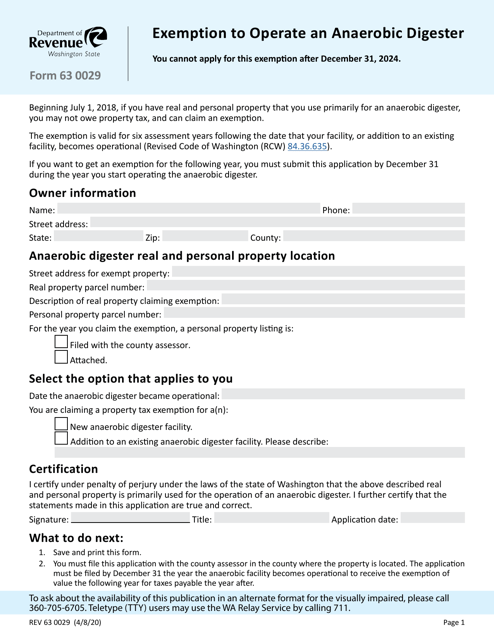

This document is an application form for the Sales and Use Tax Deferral program for the 520 Bridge Project in Washington state. It is used to request a deferral of sales and use tax for eligible construction and improvement projects related to the 520 bridge.

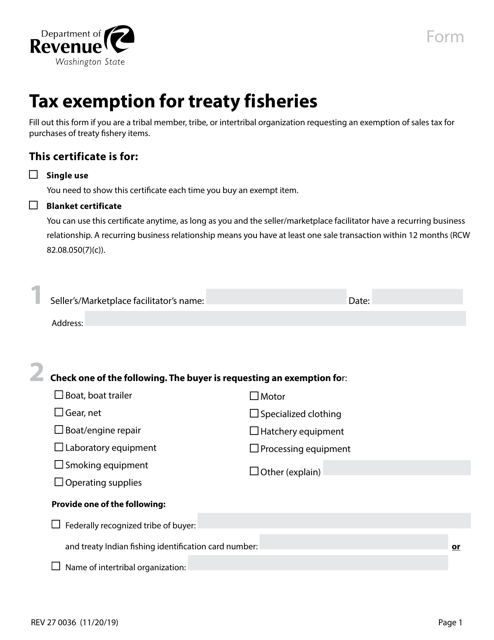

This form is used for requesting tax exemption for treaty fisheries in the state of Washington.

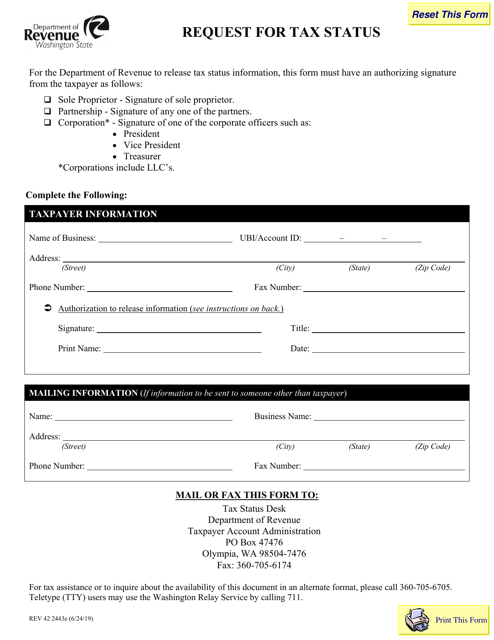

This form is used for requesting tax status in the state of Washington.

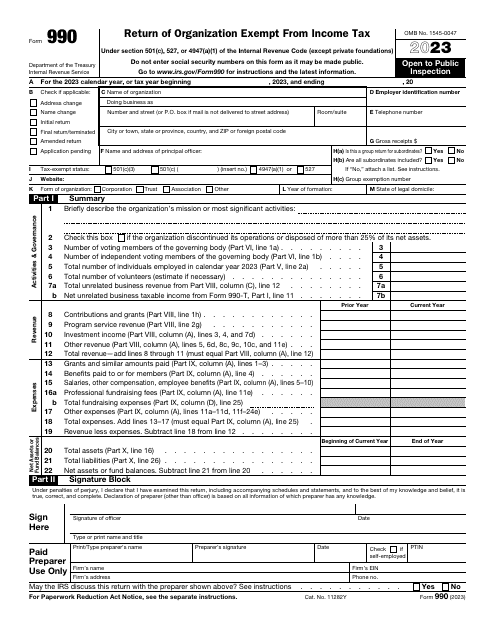

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

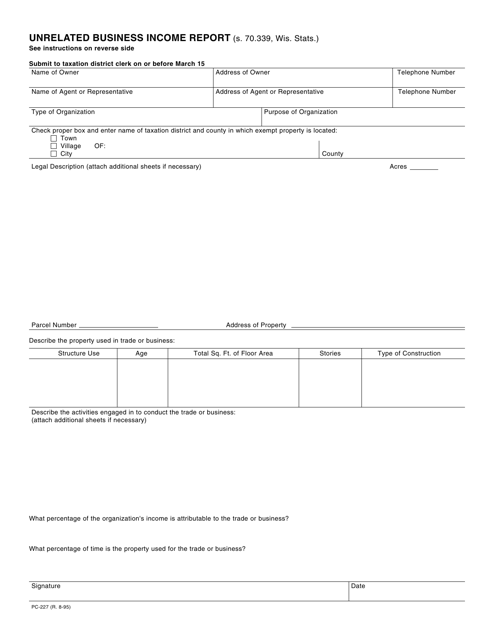

This Form is used for reporting unrelated business income in the state of Wisconsin.

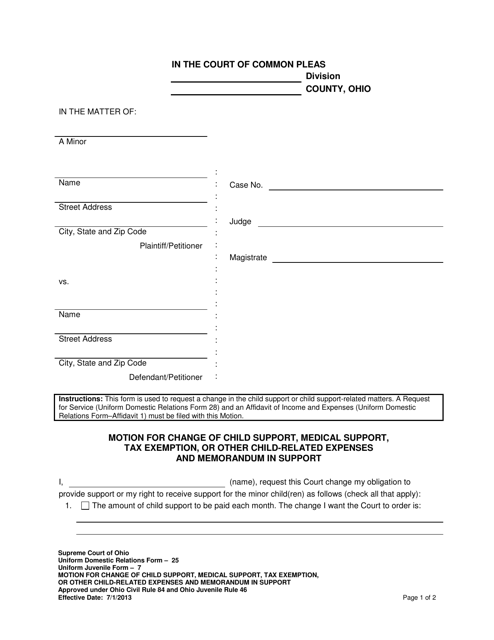

This document is used in Ohio for filing a motion to change child support, medical support, tax exemption, or other child-related expenses. It also includes a memorandum explaining the reasons for the requested changes.

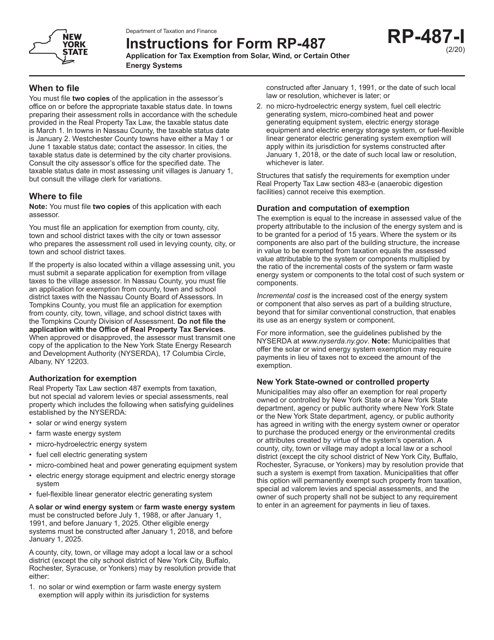

This Form is used for applying for tax exemption from solar, wind, or certain other energy systems in New York. It provides instructions on how to complete the application and qualify for the exemption.