Independent Contractor Templates

Related Articles

Documents:

131

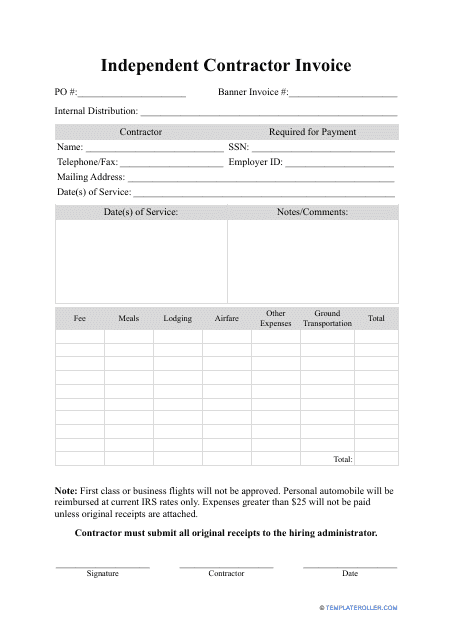

A contractor can use this type of template to present the charges for the services or goods they have provided, either to an individual or to an organization.

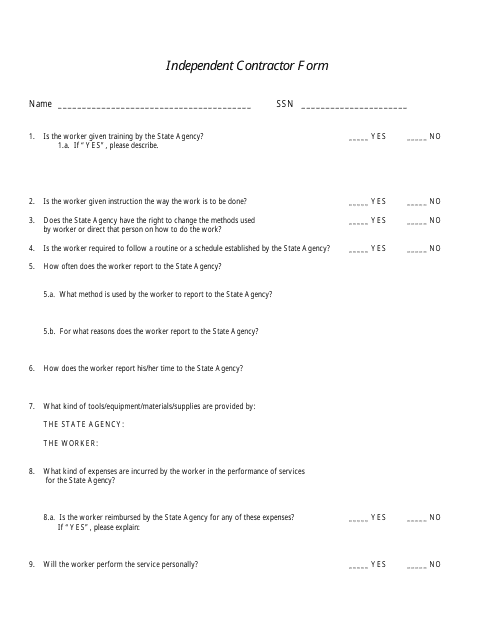

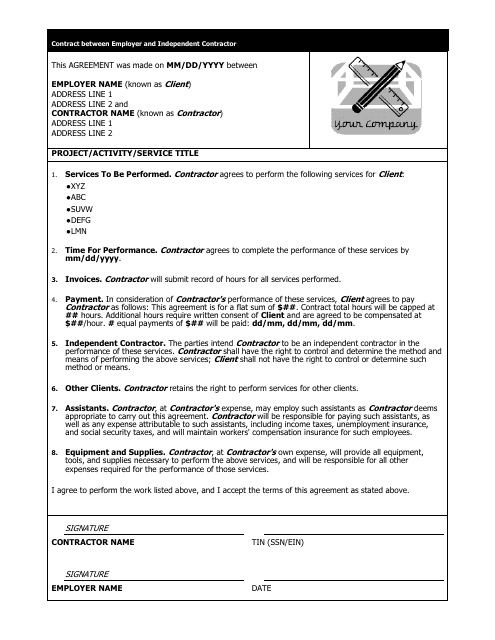

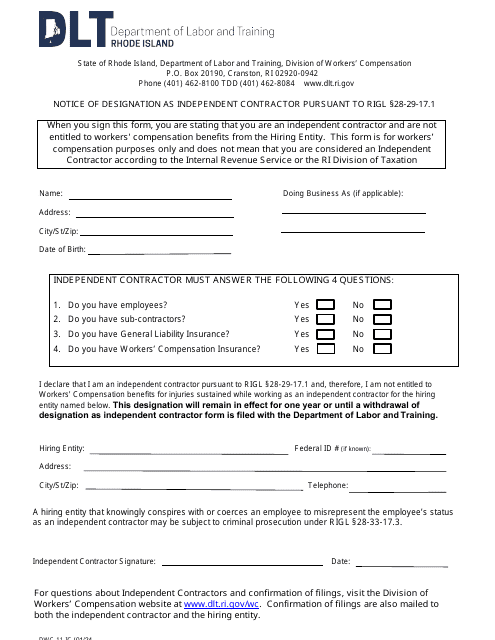

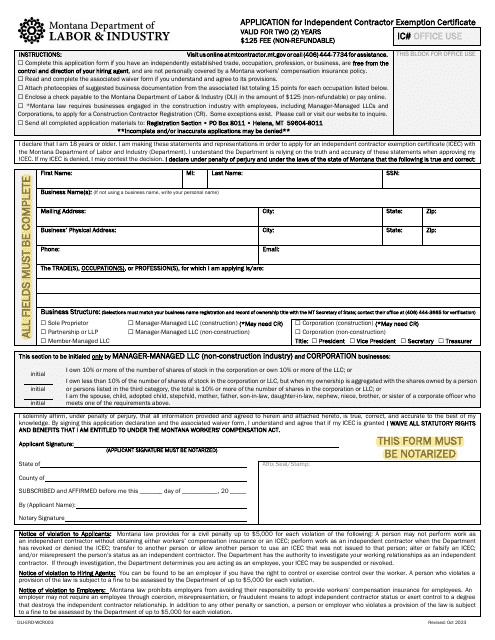

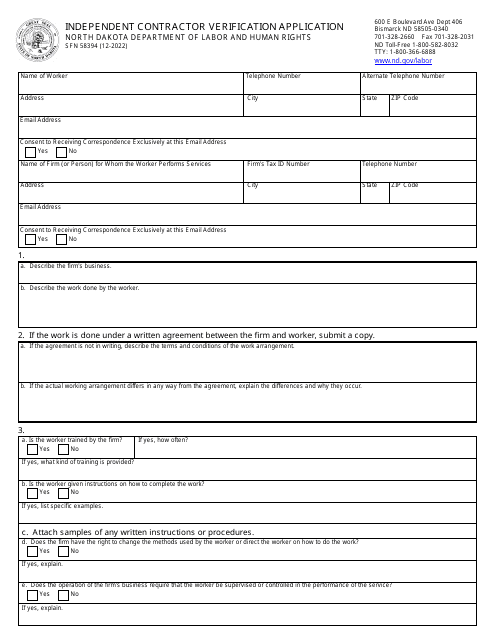

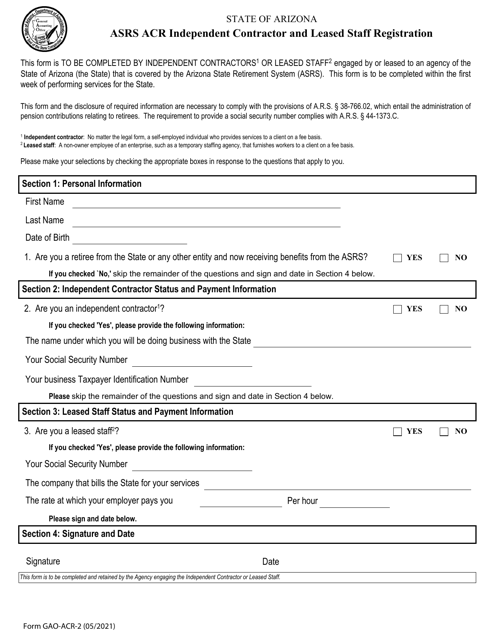

This Form is used for contractors who work independently and are not considered employees. It helps establish the working relationship between the contractor and the hiring company.

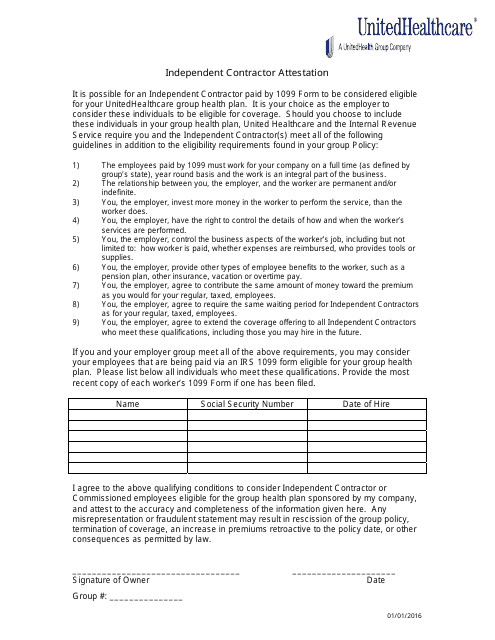

This form is used for independent contractors working as brokers for UnitedHealthcare to confirm their status.

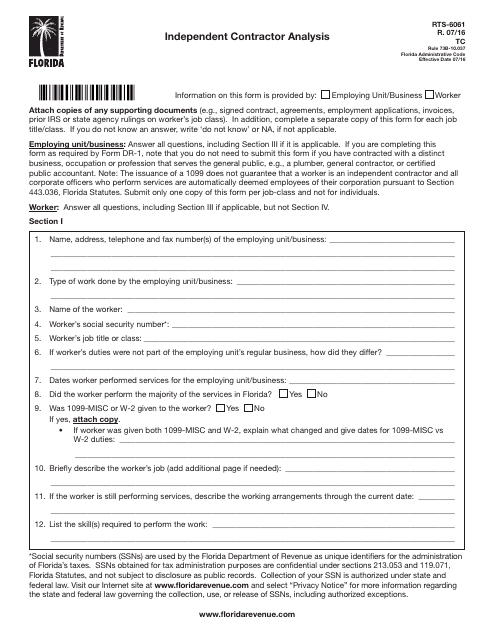

This form is used for conducting an independent contractor analysis in the state of Florida.

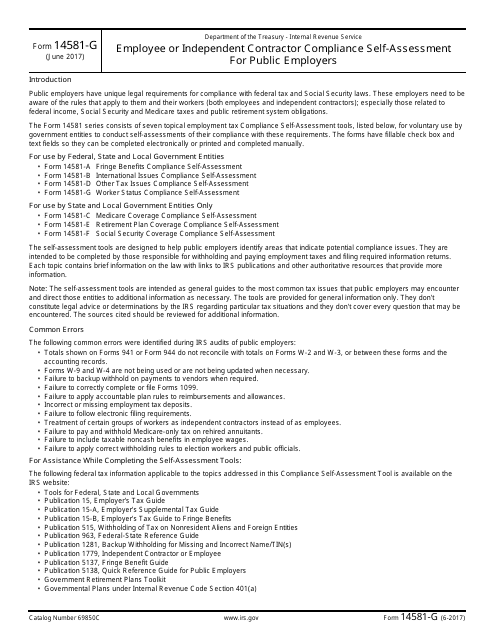

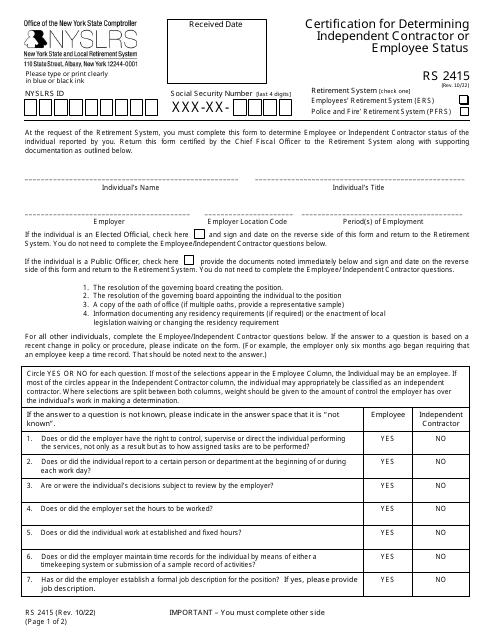

This document is used for public employers to assess compliance with employee or independent contractor classification rules.

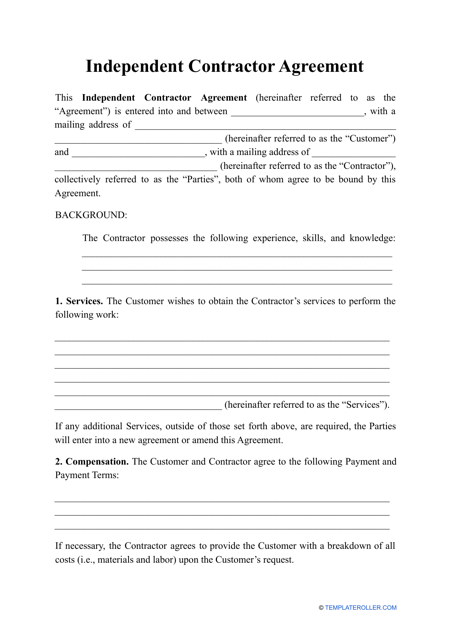

This document outlines the terms and conditions of a working relationship between an employer and an independent contractor. It covers important details such as payment terms, project scope, and responsibilities of both parties.

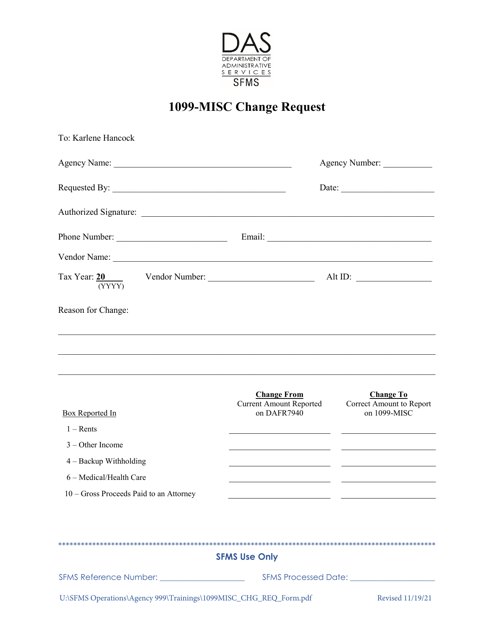

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

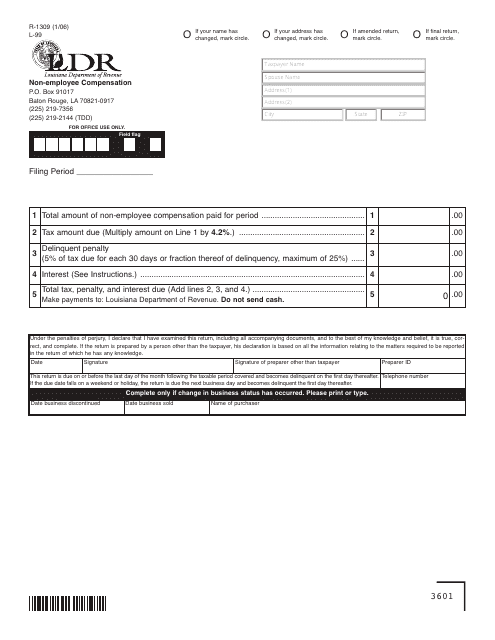

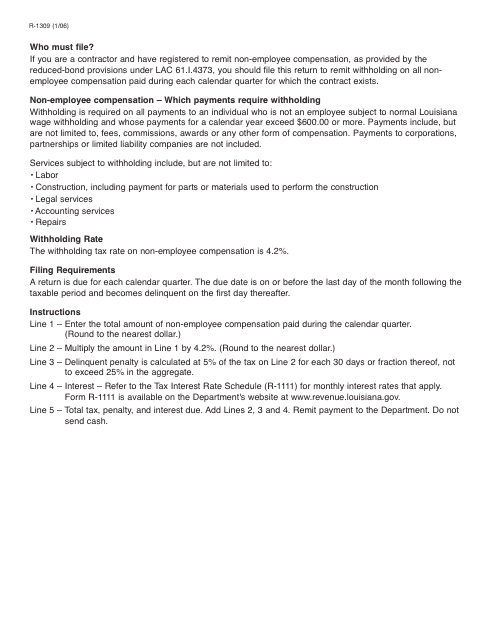

This form is used for reporting non-employee compensation in the state of Louisiana.

This document is used for reporting non-employee compensation in the state of Louisiana.

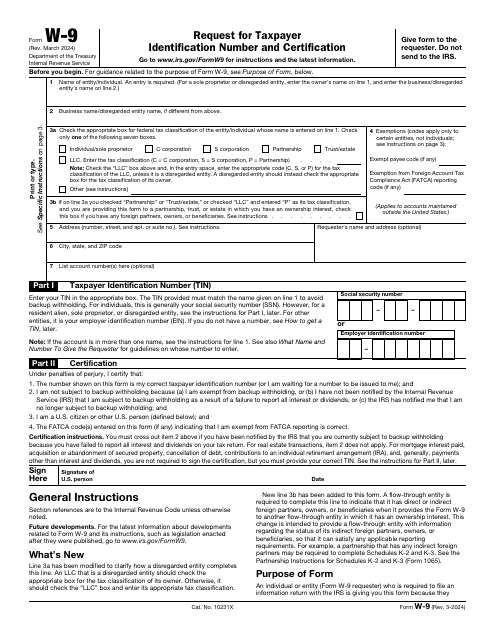

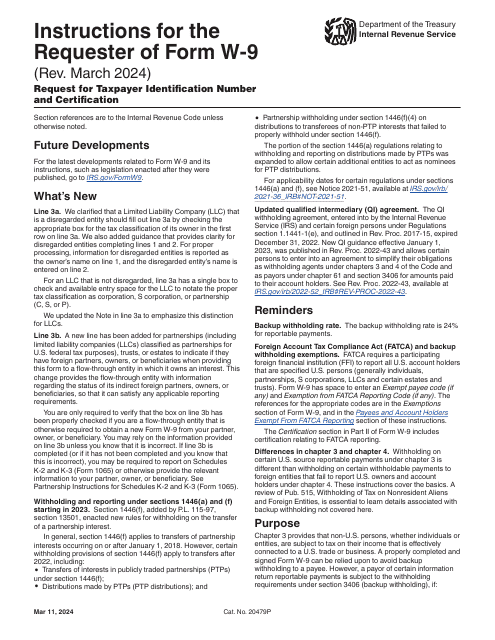

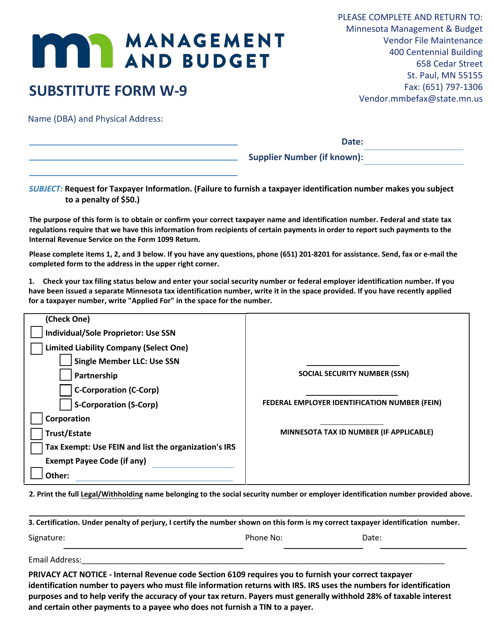

This is a formal instrument completed by a taxpayer to list their full name, contact details, and taxpayer identification number when requested by a party they worked with.

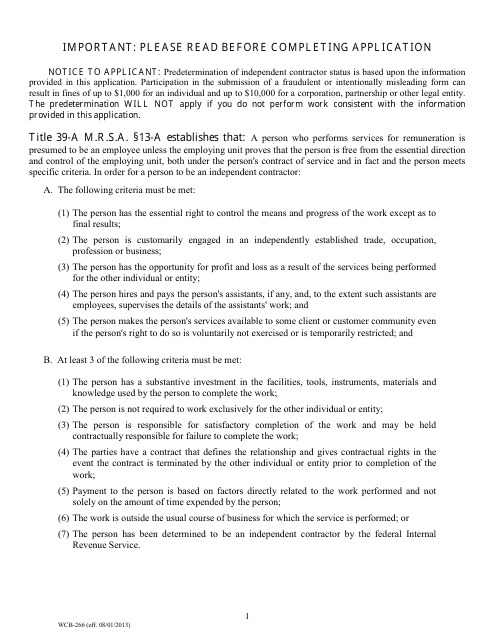

This form is used for applying for predetermination of independent contractor status in Maine. It helps establish a rebuttable presumption for independent contractors.

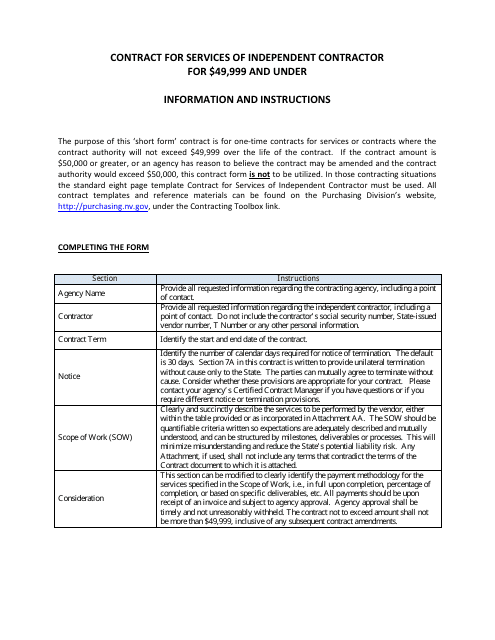

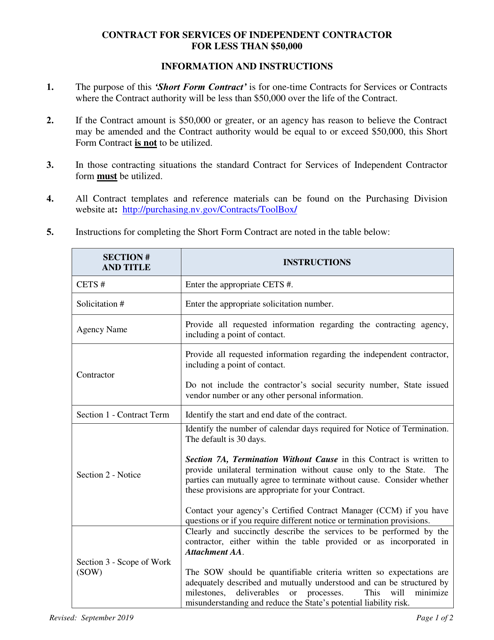

This document provides instructions for a contract that is used when hiring an independent contractor in Nevada for a service project that is valued at $49,999 or under. It outlines the terms and conditions of the agreement between the hiring party and the contractor.

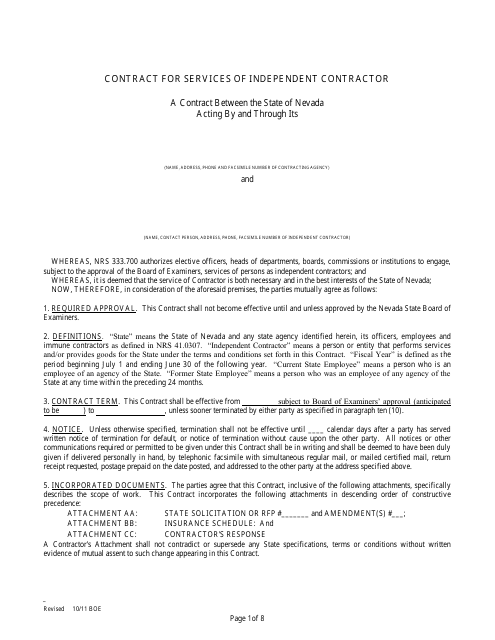

This document is for hiring and outlining the terms of an independent contractor in the state of Nevada. It clearly defines the responsibilities, payment terms, and legal relationship between the contractor and the hiring party.

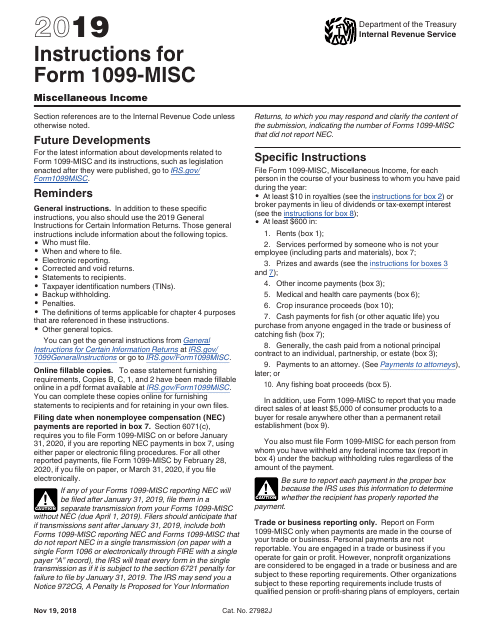

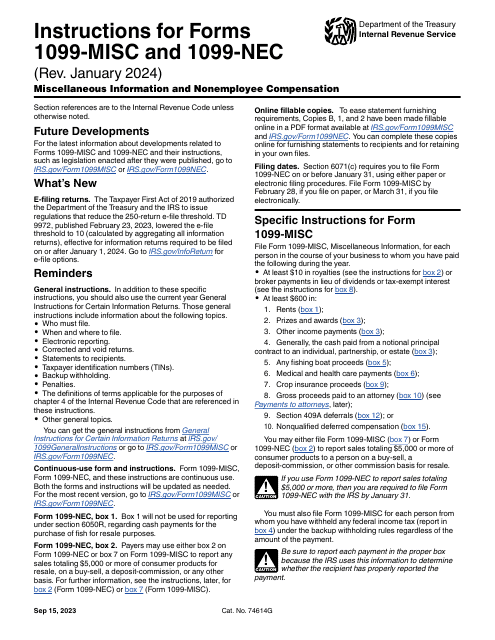

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

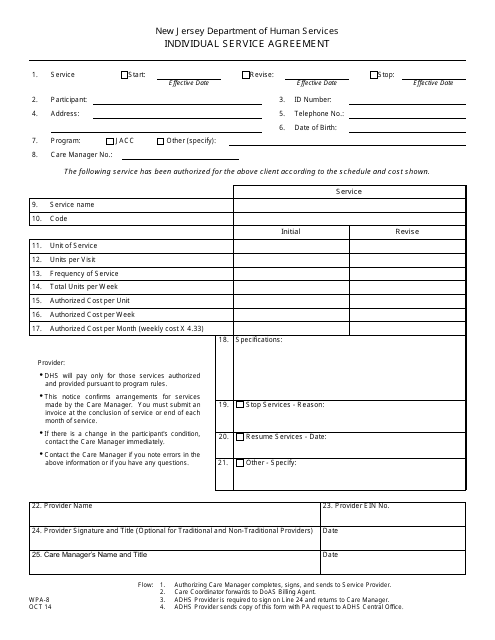

This form is used for an Individual Service Agreement in the state of New Jersey. It outlines the terms and conditions for specific services provided to an individual.

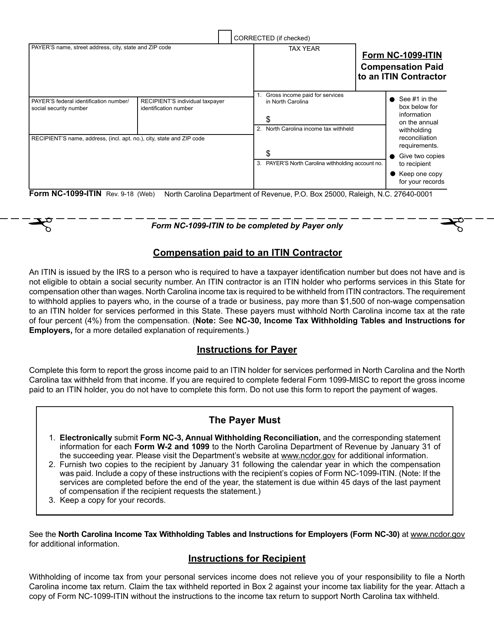

This Form is used for reporting compensation paid to an ITIN contractor in North Carolina.

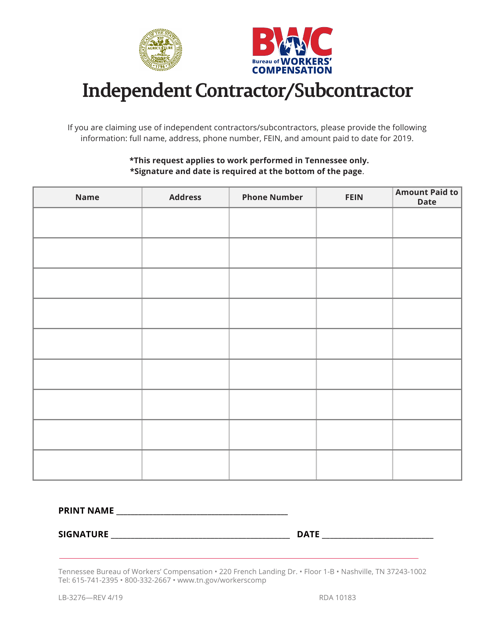

This form is used for reporting independent contractors or subcontractors in the state of Tennessee.

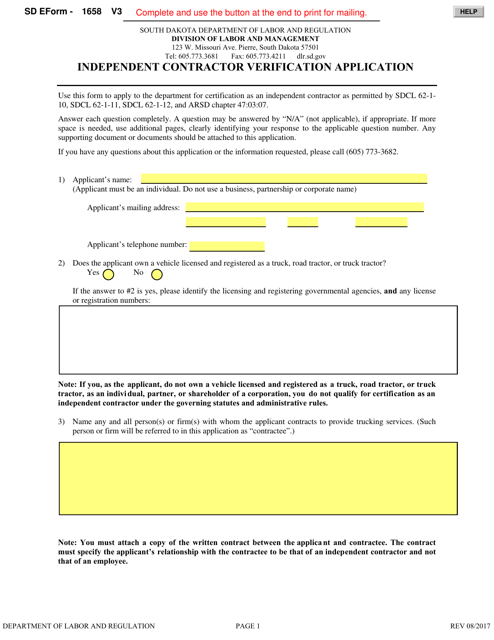

This Form is used for independent contractors to apply for verification in South Dakota.

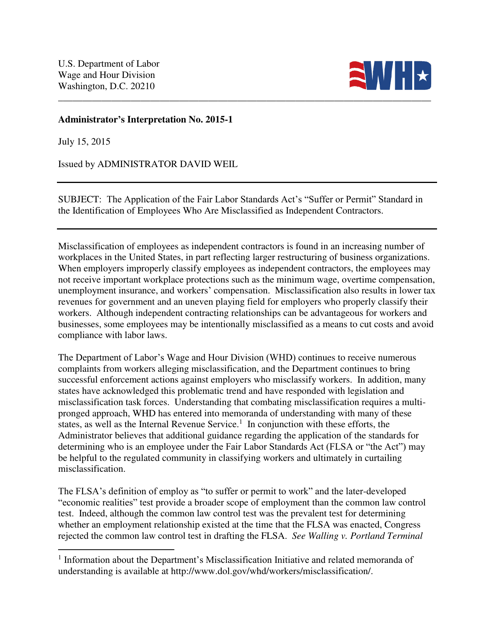

This document provides guidance on how to determine if workers should be classified as employees or independent contractors under the Fair Labor Standards Act.

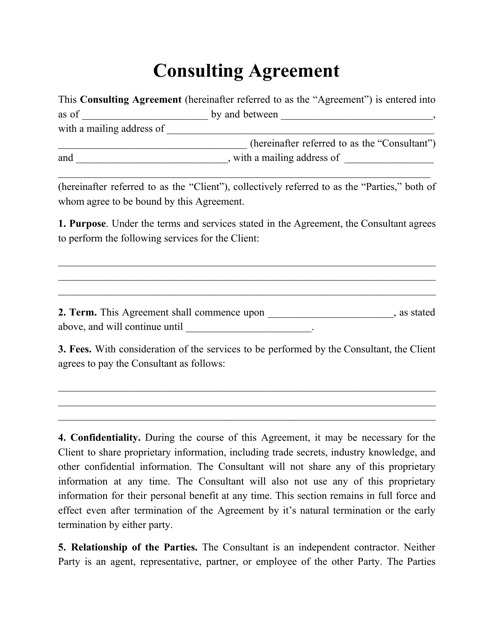

Are you knowledgeable about a particular sphere or industry? You may use this document to market your consulting services without any misunderstandings between you and your potential client.

This agreement sets out the terms and conditions of an arrangement agreed upon by a contractor and a customer, client, or business.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

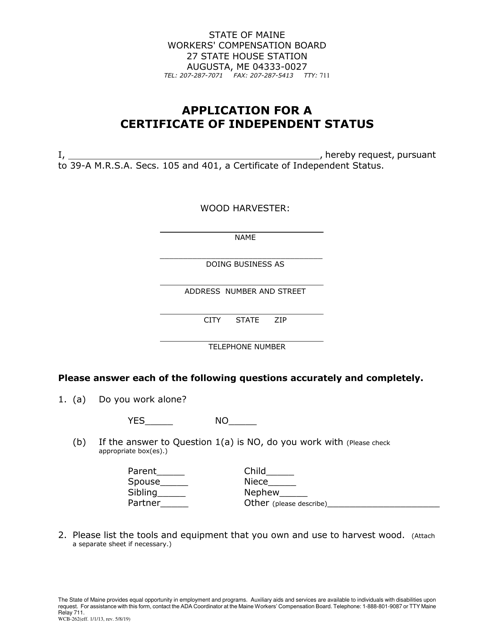

This Form is used for applying for a Certificate of Independent Status in Maine. It is used to determine if a worker is an independent contractor or an employee for workers' compensation purposes.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

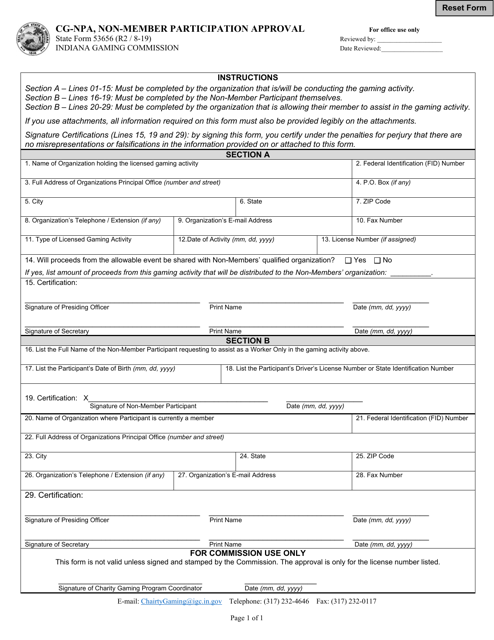

This form is used for non-members in Indiana to request approval for participation.

This Form is used for reporting taxpayer information for individuals or businesses in Minnesota. It is used to request the taxpayer identification number (TIN) and certification of the individual/business for tax purposes.

This type of document provides instructions for creating a contract with an independent contractor for services worth less than $50,000 in the state of Nevada. It outlines the necessary details and terms for the agreement.

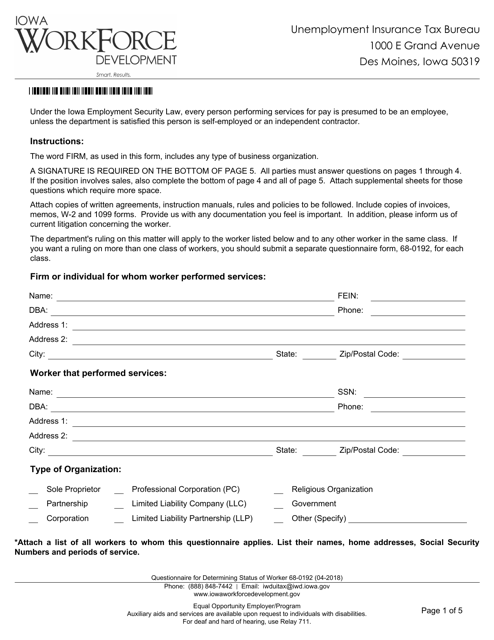

This form is used for determining the employment status of a worker in the state of Iowa. It is a questionnaire that helps employers determine whether a worker should be classified as an employee or an independent contractor.

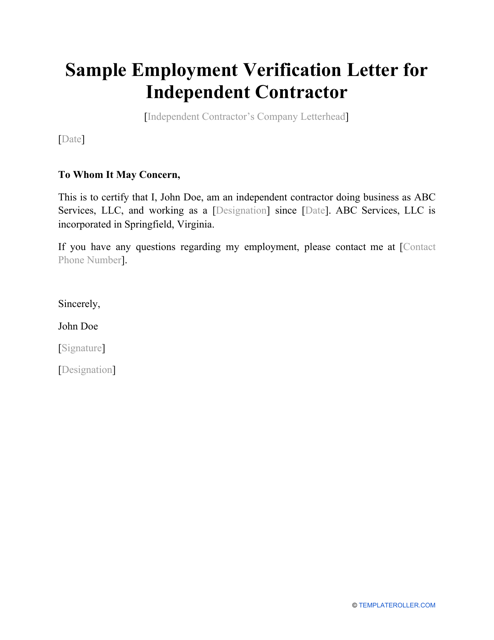

Independent contractors may use a letter such as this when they would like to verify their employment status.