Independent Contractor Templates

Related Articles

Documents:

131

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

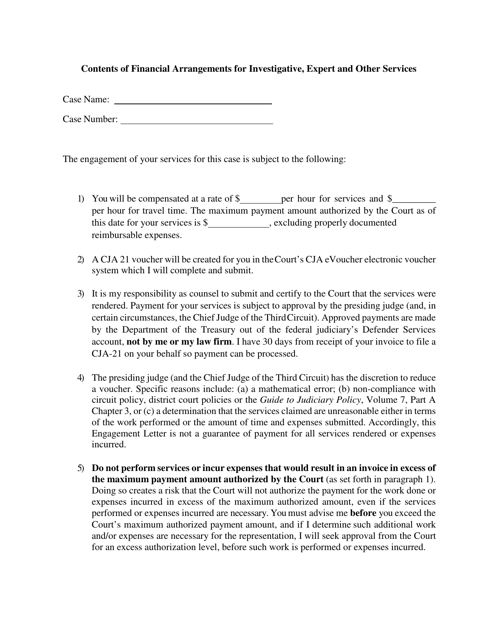

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

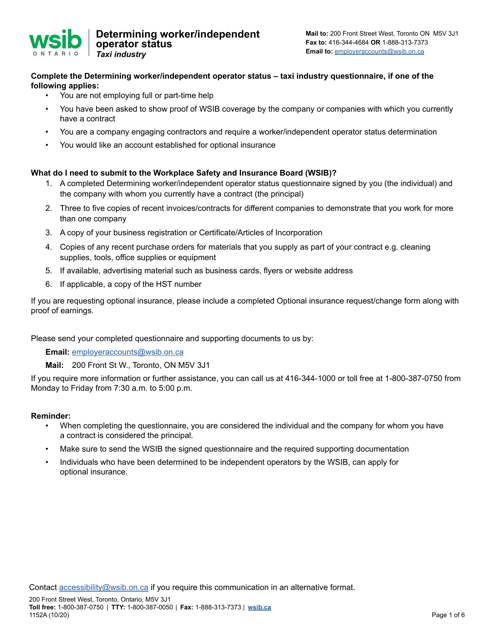

This form is used for determining the worker/independent operator status in the taxi industry in Ontario, Canada.

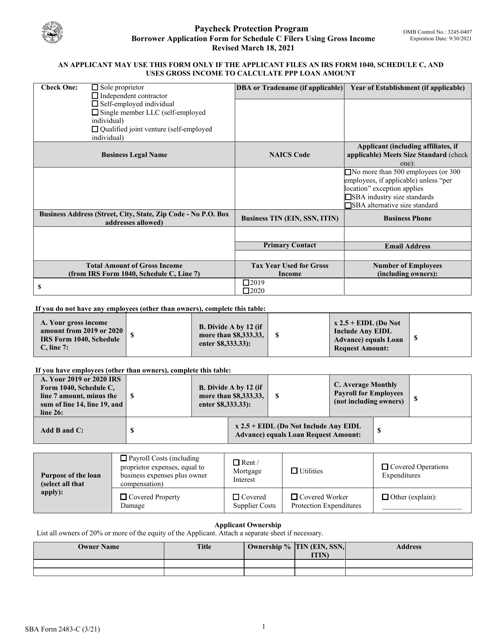

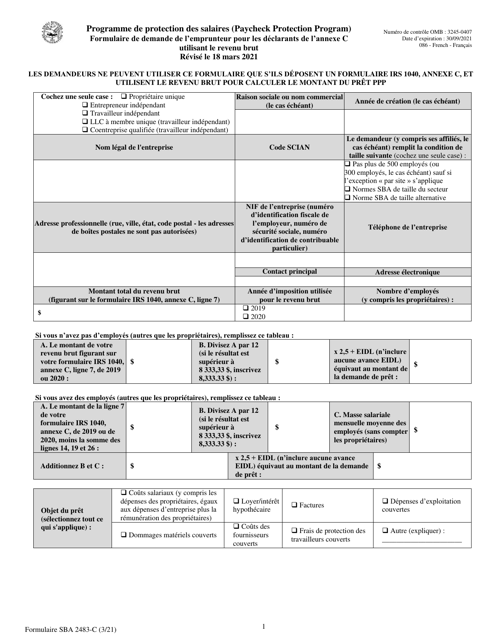

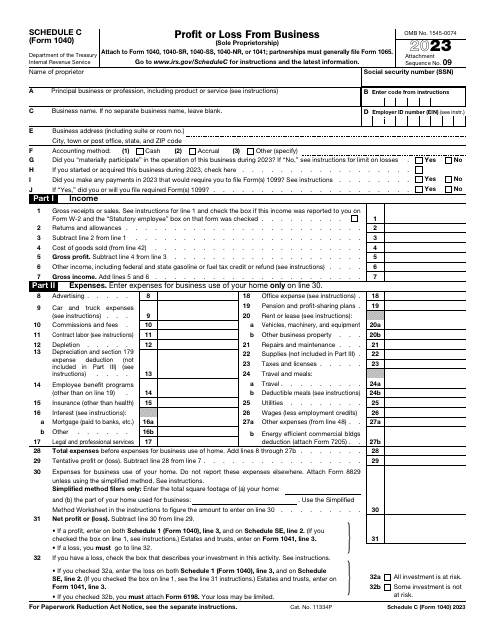

This Form is used for Schedule C filers who are applying for a loan with the Small Business Administration (SBA) and are using gross income as their method of calculation.

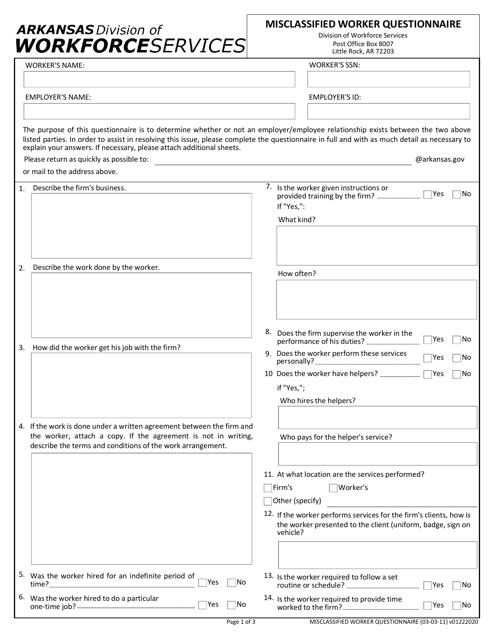

This Form is used for determining the classification of workers in Arkansas to ensure compliance with state employment laws.

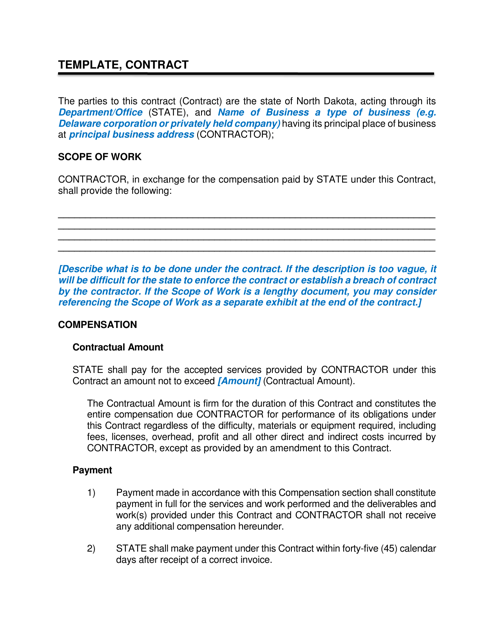

This document is a template for creating a personal service contract in North Dakota. It outlines the terms and conditions of a contract for services between two parties. It can be used for various personal services such as tutoring, gardening, or personal training.

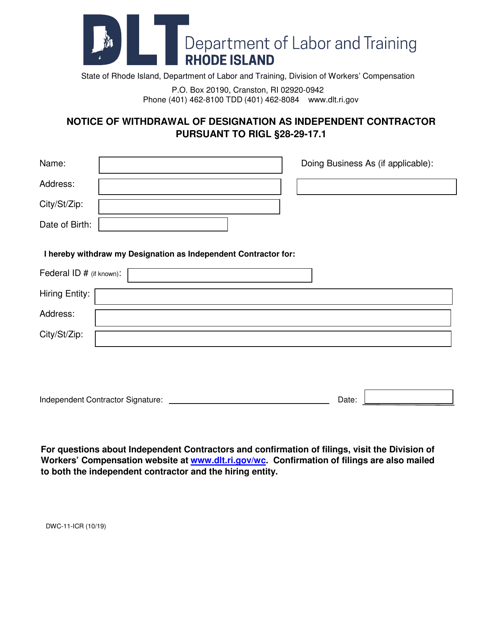

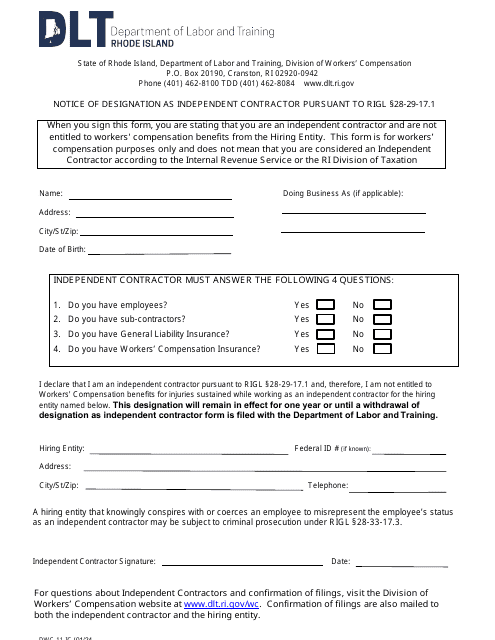

This Form is used for notifying the Rhode Island Department of Labor and Training about the withdrawal of designation as an independent contractor according to Rhode Island state law.

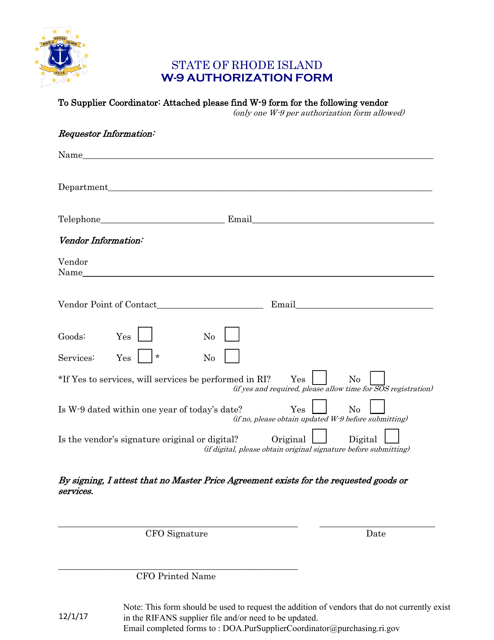

This document authorizes the withholding of taxes in Rhode Island.

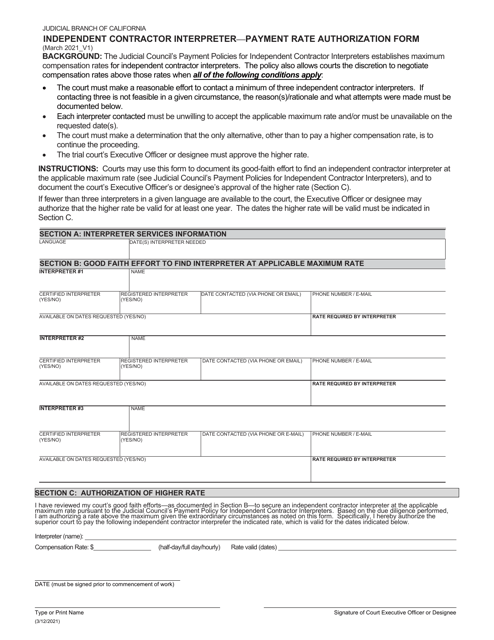

This form is used for authorizing the payment rate for independent contractor interpreters in California.

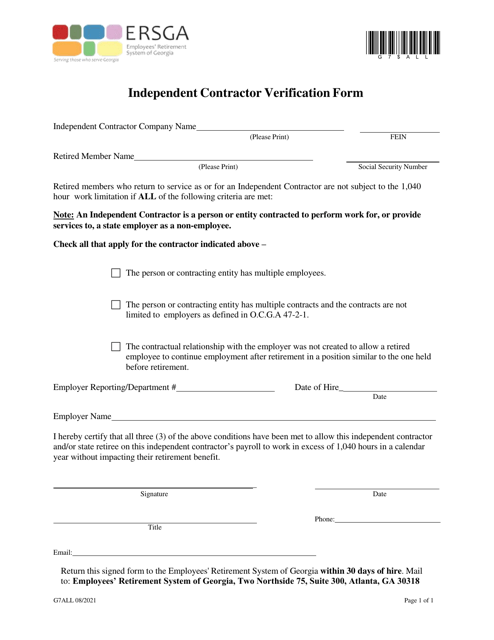

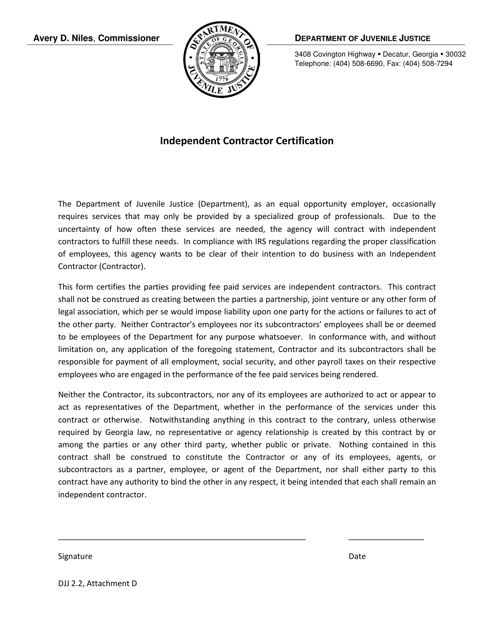

This form is used for verifying the status of an independent contractor in the state of Georgia, United States.

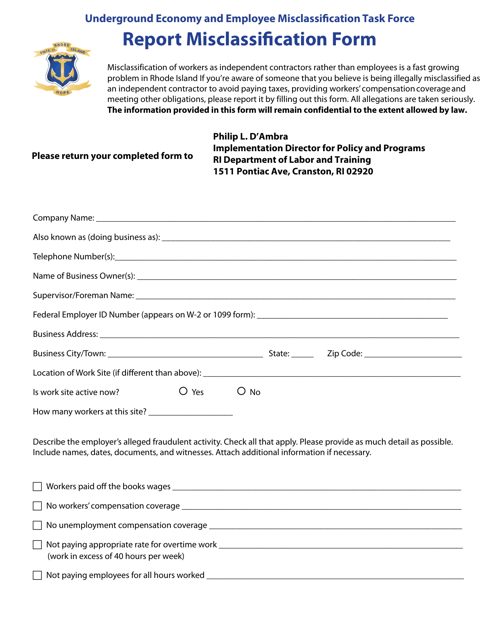

This Form is used for reporting misclassification of workers in Rhode Island.

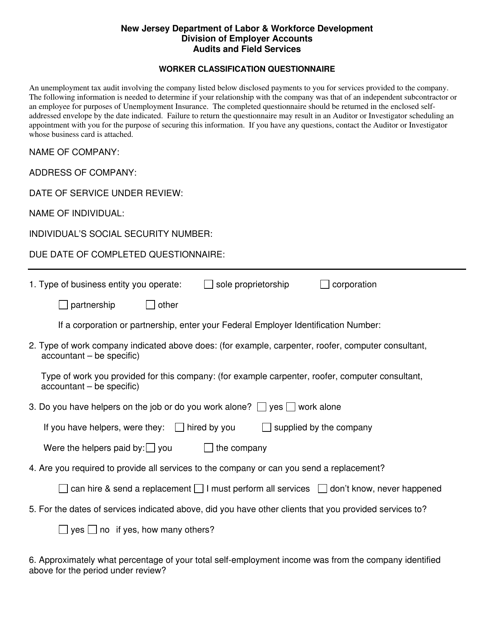

This document is used for determining the proper classification of workers in New Jersey. It helps employers determine if workers should be classified as employees or independent contractors.

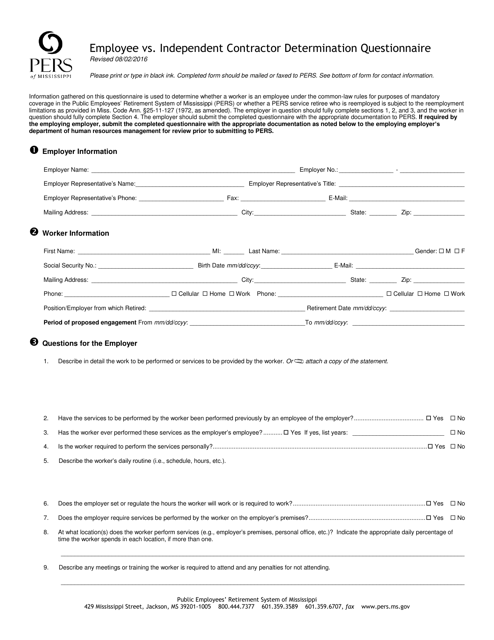

This Form is used for determining whether a worker should be classified as an employee or an independent contractor in the state of Mississippi. It helps in distinguishing the employment relationship between the worker and the employer.

This document is a certification form used in the state of Georgia (United States) for independent contractors. It verifies the status of a contractor and their eligibility for certain tax benefits and exemptions.

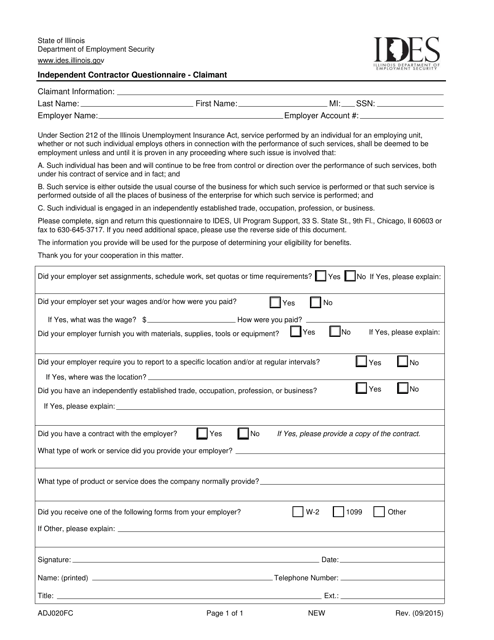

This form is used for independent contractors in Illinois to complete a questionnaire related to their claim.

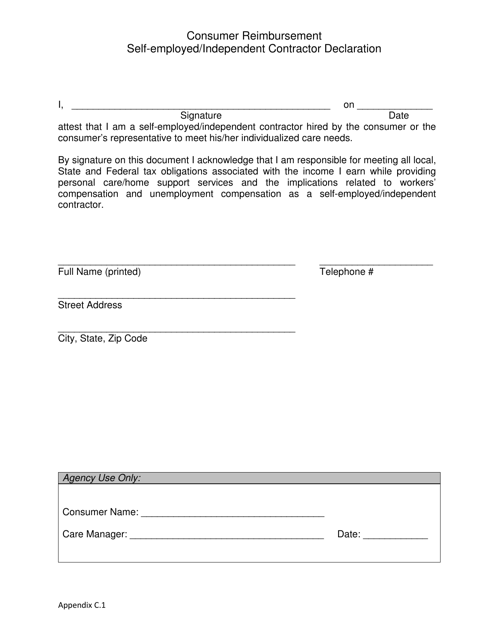

This document is used for self-employed individuals or independent contractors in Pennsylvania to declare their reimbursement options under the Consumer Reimbursement: Self-employed/Independent Contractor Declaration for the Options Program.

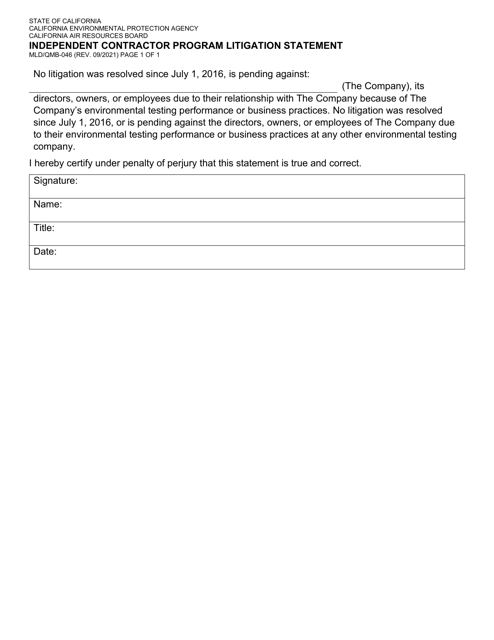

This Form is used for providing a litigation statement regarding independent contractor programs in California.

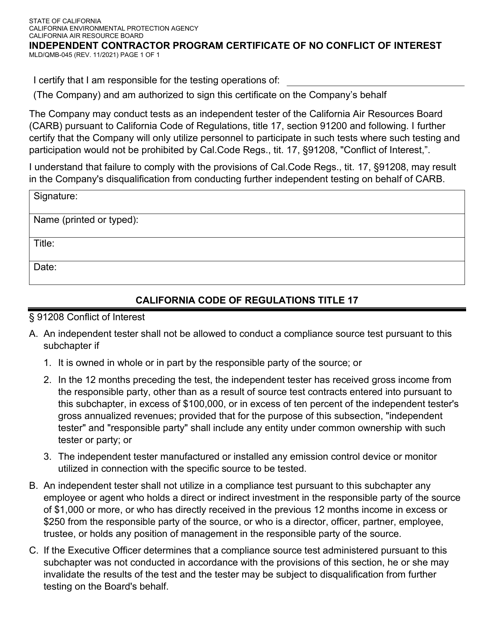

This form is used for the Independent Contractor Program in California to certify that there is no conflict of interest.

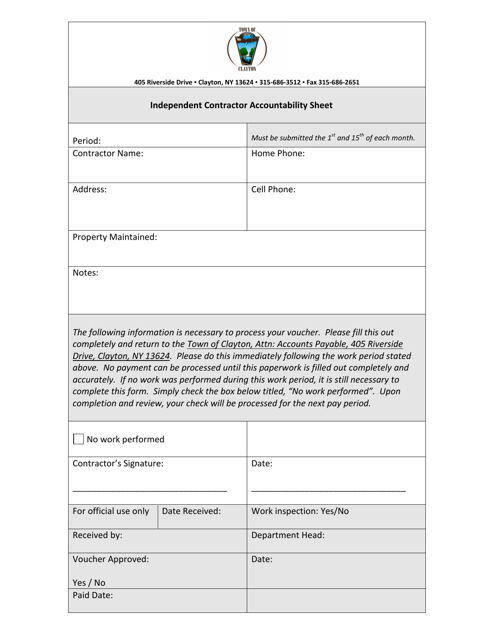

This document is used to track the accountability of independent contractors working for the Town of Clayton, New York. It helps ensure transparency and proper management of contractor activities.

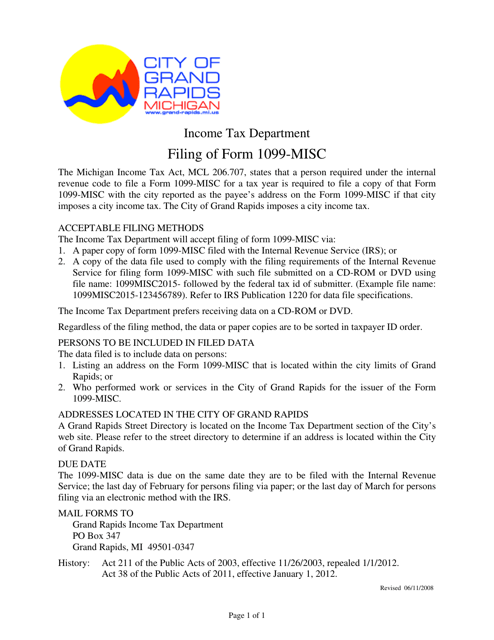

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

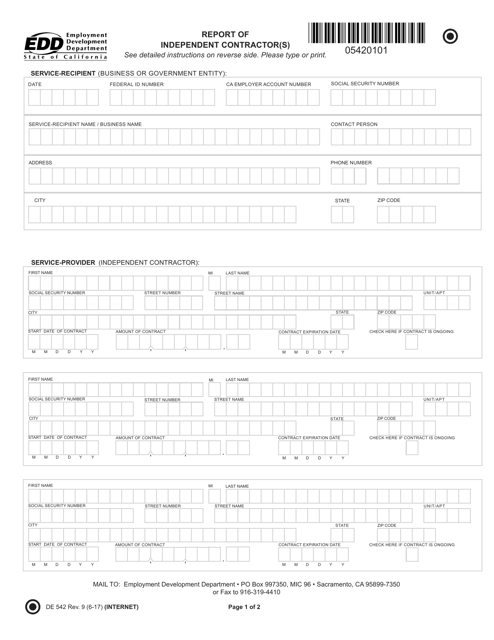

This Form is used for reporting independent contractor(s) in California. It helps businesses comply with state laws related to independent contractor classification.

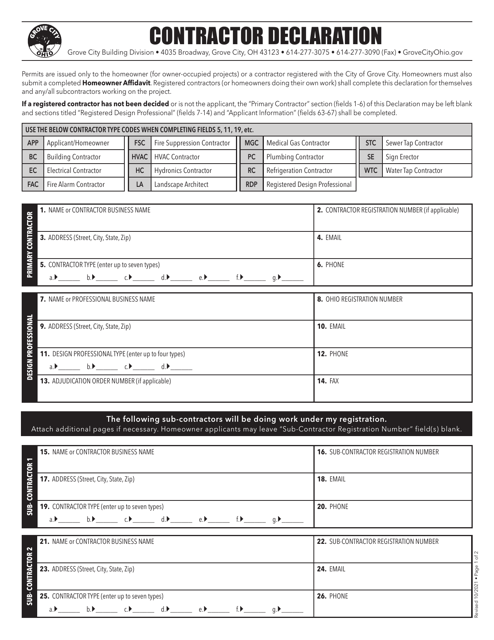

This document is used for contractors in Grove City, Ohio to make a formal declaration or statement related to their business activities.

If you are an Alabama resident, this type of agreement is a critical document for those individuals wanting to establish and outline in writing certain terms that are agreed upon by a customer and an independent contractor.

This is an agreement used in Alaska that outlines the terms and conditions of the working relationship between a customer and a contractor.

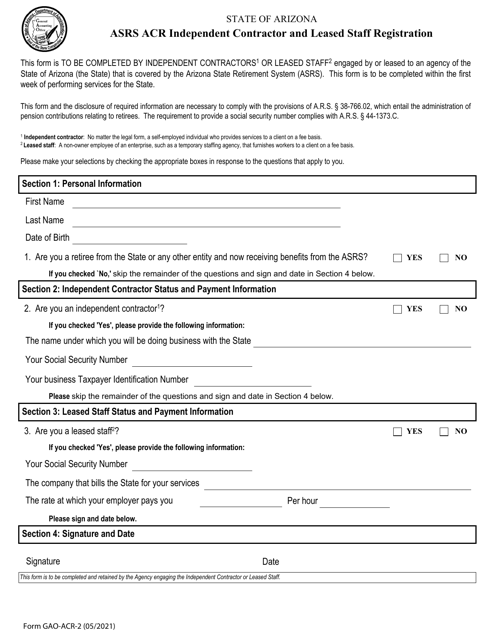

This type of template can be used in Arizona to detail the specific conditions and agreements between a contractor and a client.

When signing this type of agreement in Arkansas, the main function of the document ensures a guarantee that the contractor will complete a specific job and will stick to the terms stipulated in the agreement.

Using this type of agreement in California is useful for those wanting to clearly set in writing the responsibilities that a contractor promises to comply with and successfully complete for a specific task.

Residents of Colorado may use this type of agreement to detail the business relationship between an independent contractor and a customer.

If you are a Connecticut resident, this type of agreement can be an important document if you want to establish and officially document specific conditions and agreements between two parties.