Tax Compliance Form Templates

Documents:

727

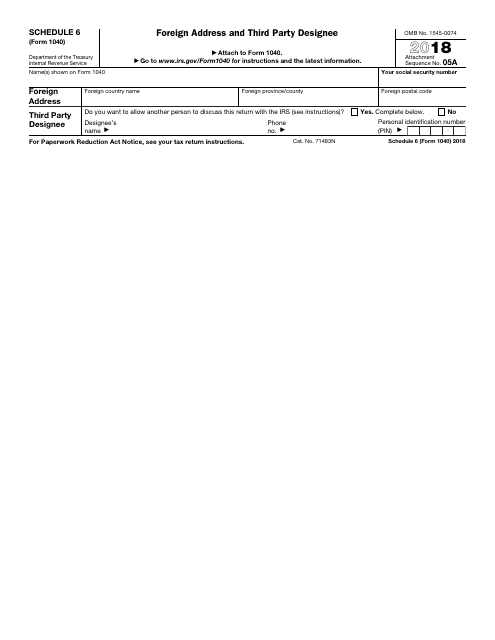

This form is used for providing a foreign address and designating a third party for tax purposes on IRS Form 1040.

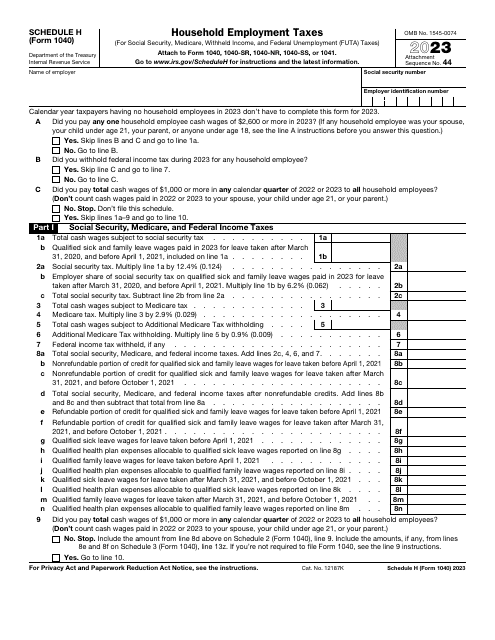

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

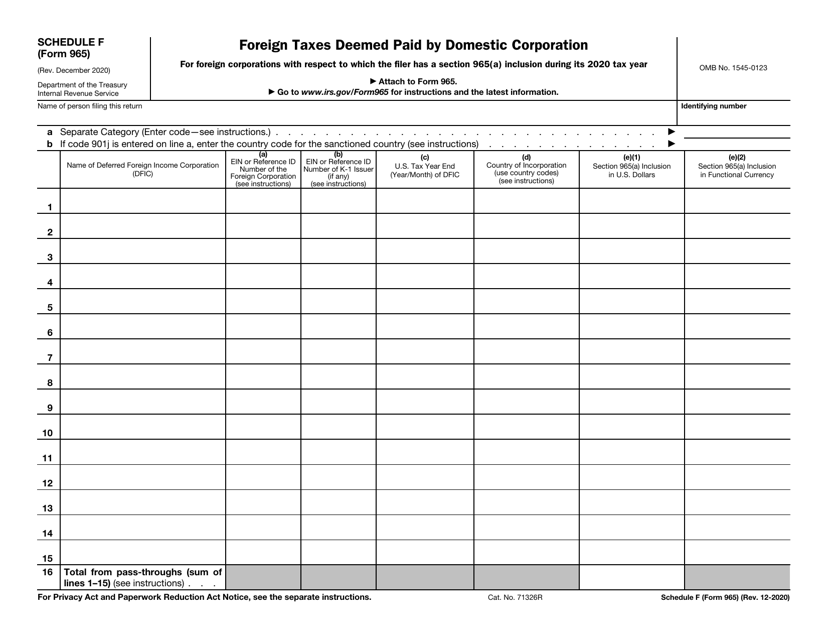

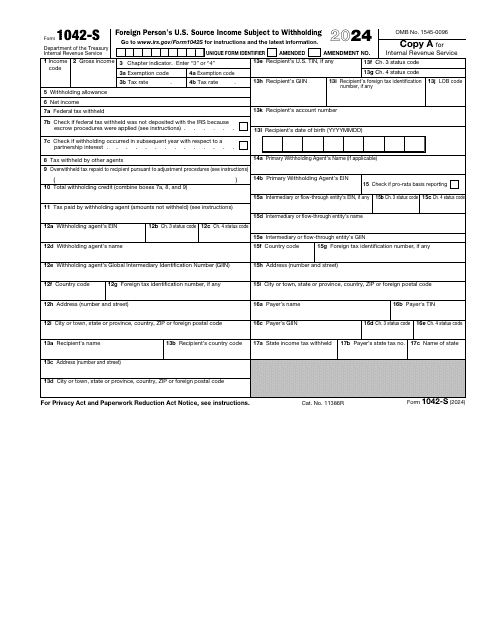

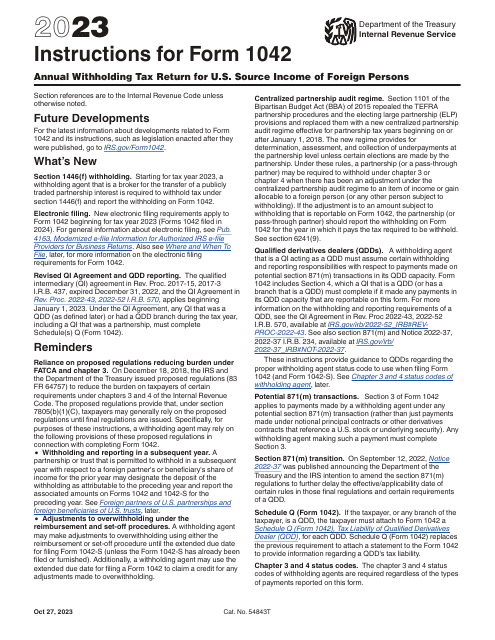

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

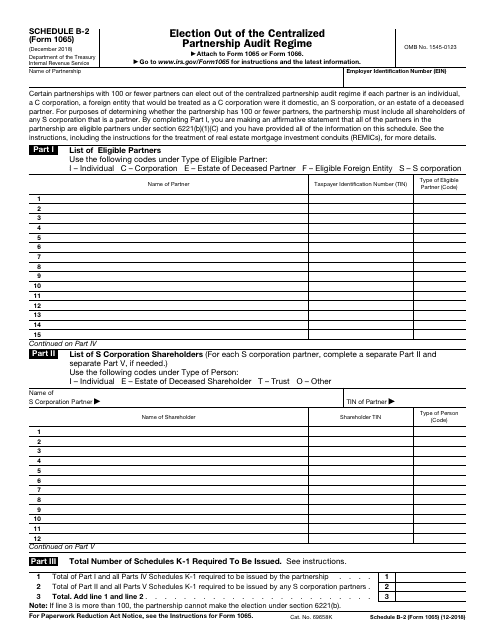

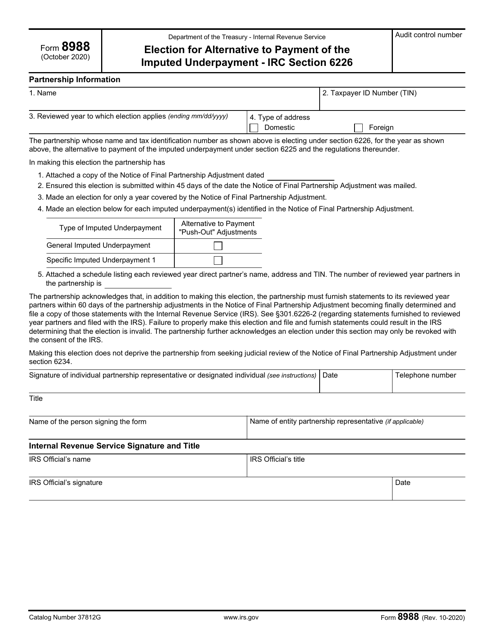

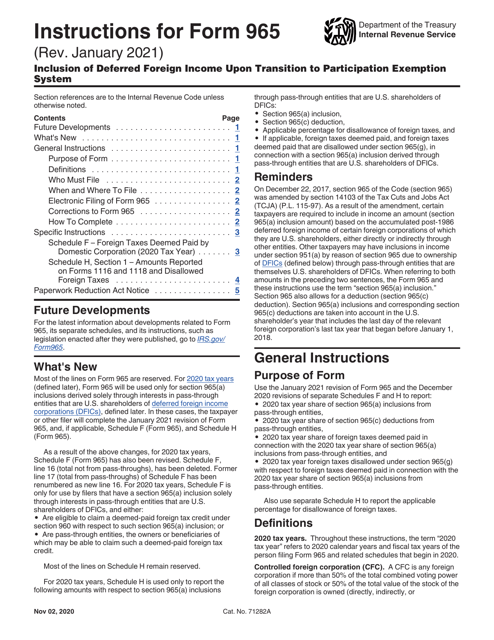

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

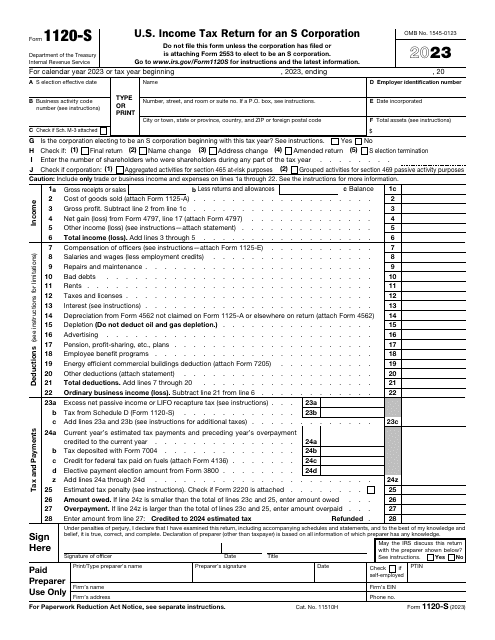

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

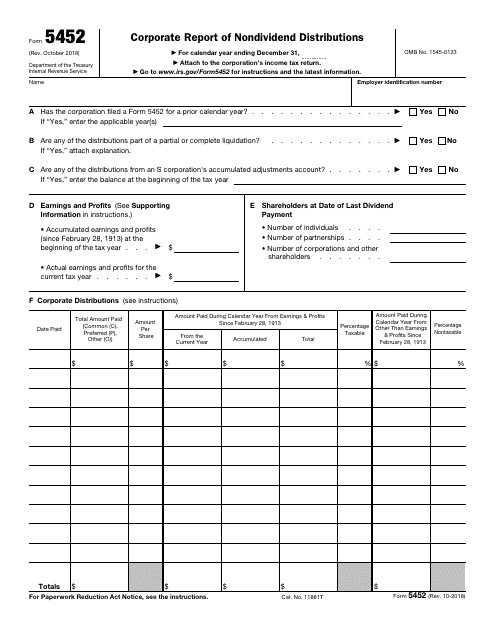

This type of document is used by corporations to report nondividend distributions to the IRS.

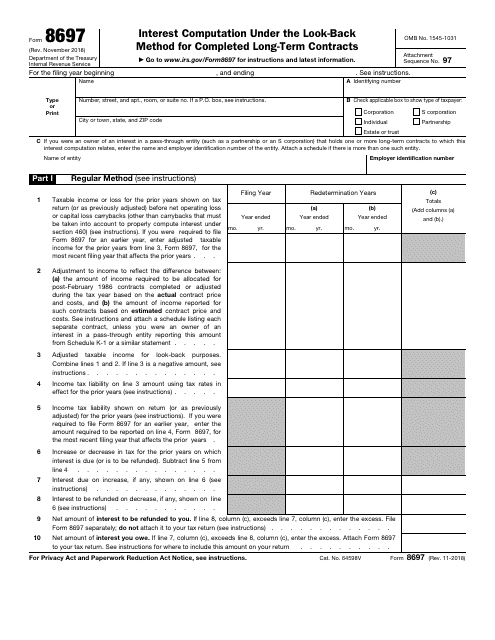

This form is used for calculating interest using the look-back method for completed long-term contracts.

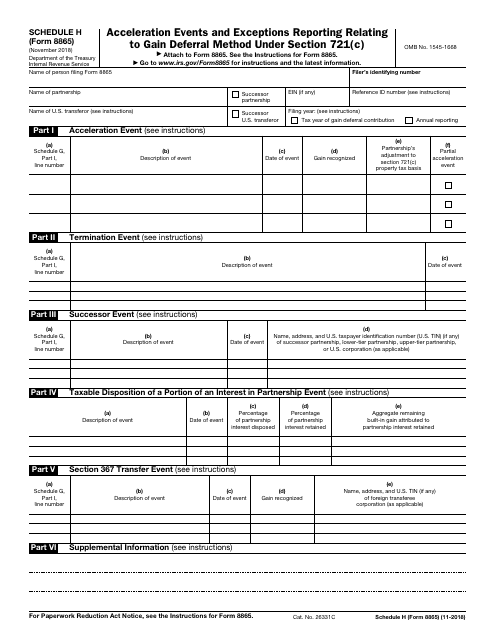

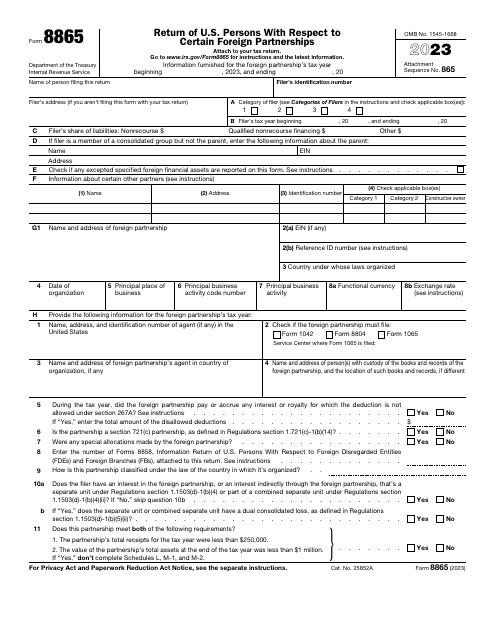

This document is used for reporting acceleration events and exceptions related to the gain deferral method under Section 721(c) on IRS Form 8865 Schedule H.

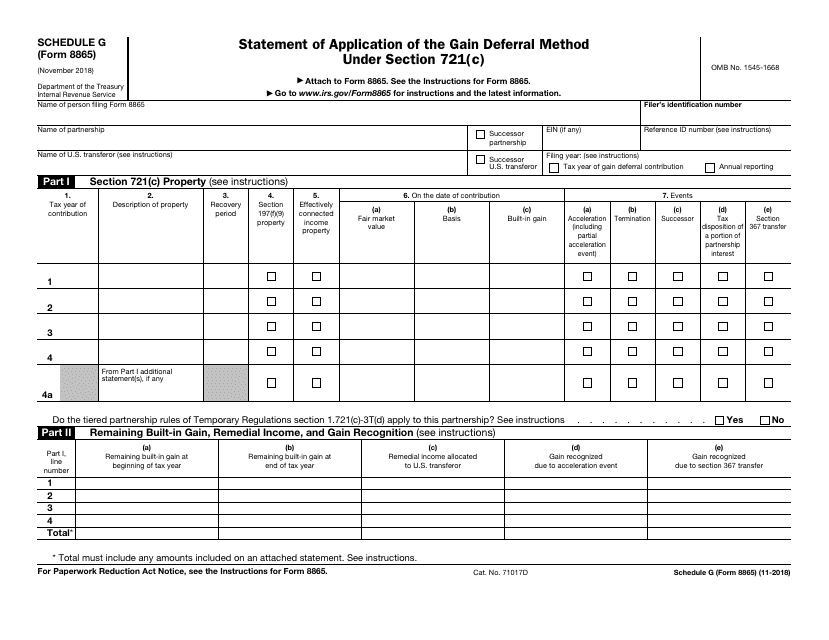

This Form is used for reporting the application of the gain deferral method under Section 721(c) on IRS Form 8865 Schedule G.

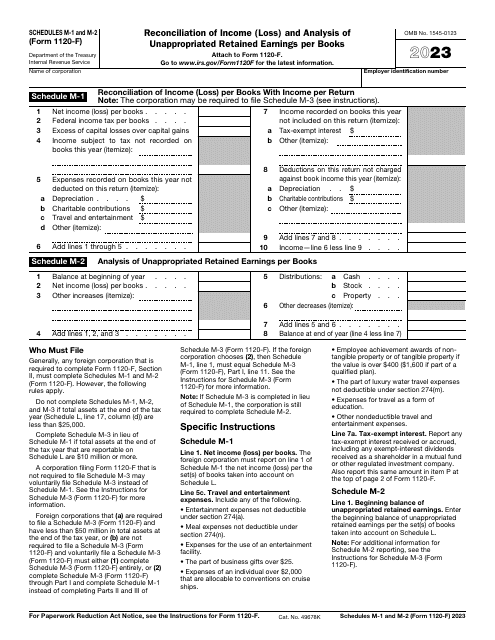

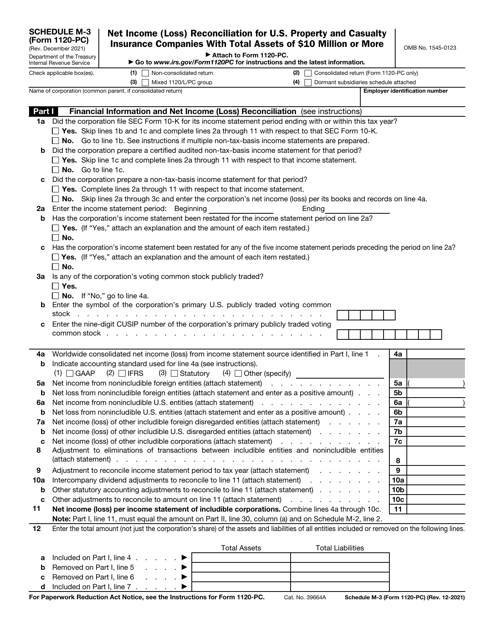

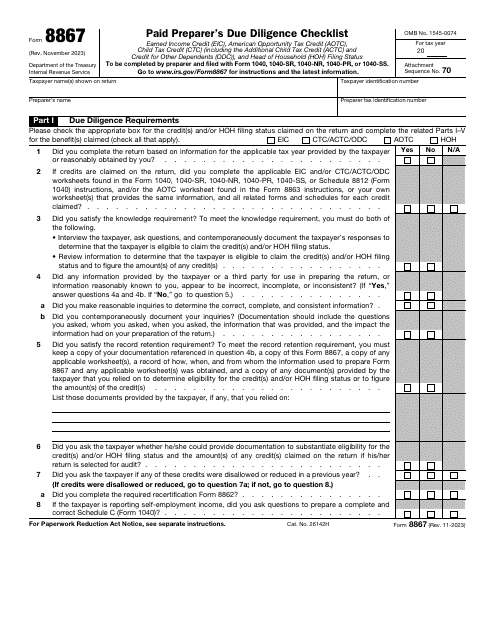

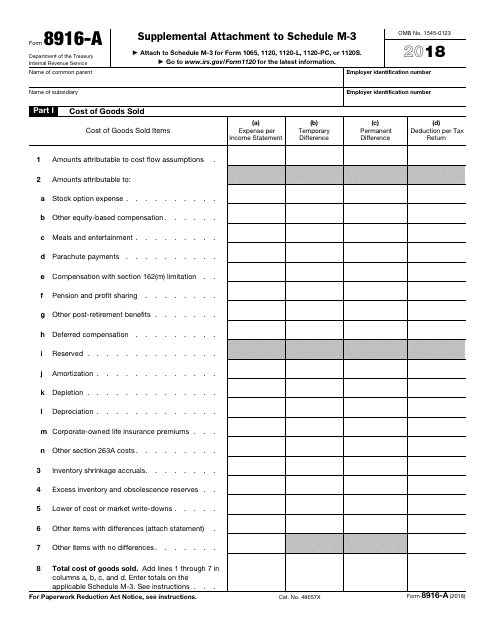

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

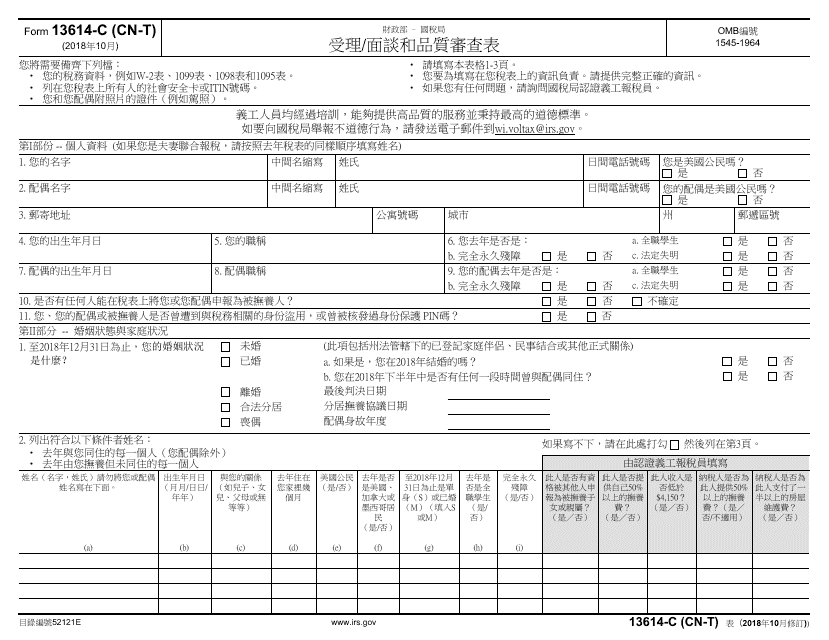

This form is used for the intake, interview, and quality review process conducted by the IRS. It is specifically designed for Chinese individuals or those who prefer to use Chinese language.

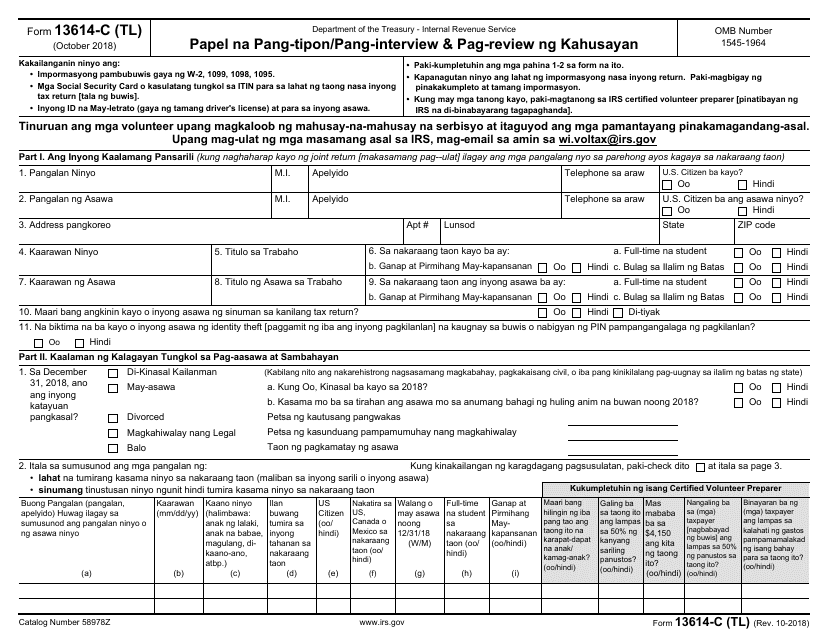

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

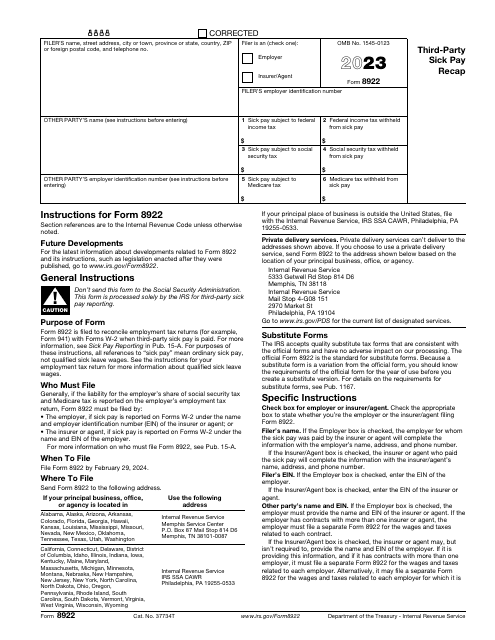

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

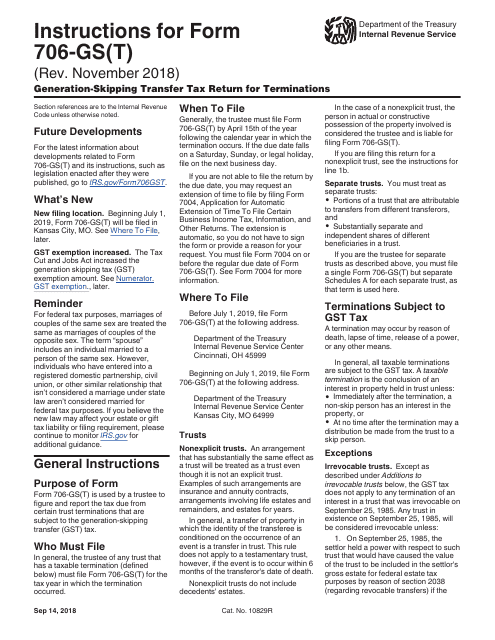

This Form is used for reporting the Generation-Skipping Transfer Tax for terminations on the IRS Form 706-GS (T). It provides instructions on how to fill out the form and report any transfers subject to the tax.

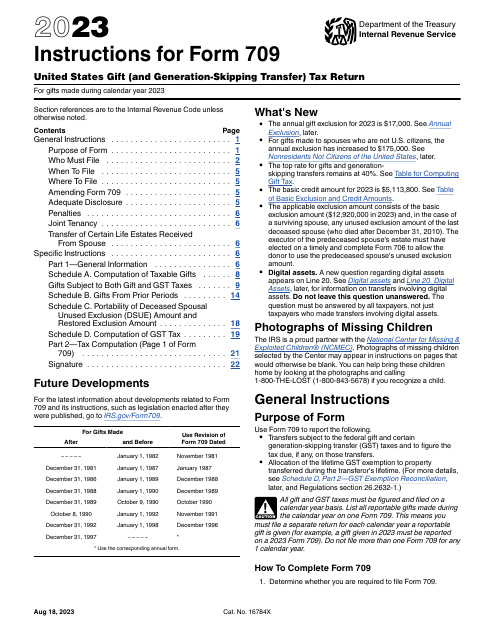

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023