Tax Compliance Form Templates

Documents:

727

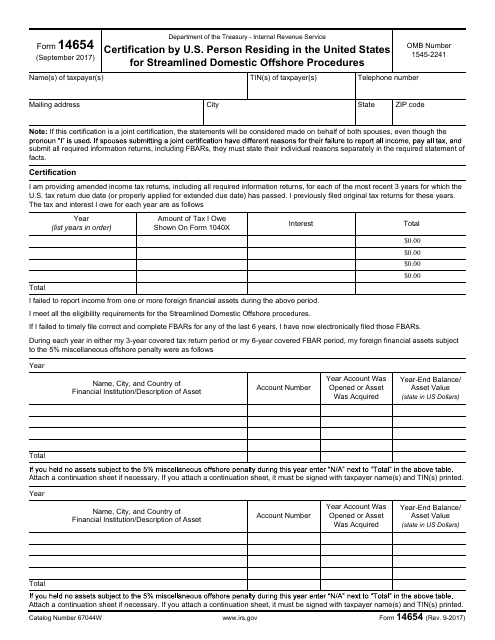

This form is used for U.S. persons who reside in the United States and want to certify their compliance with the streamlined domestic offshore procedures for reporting offshore income and assets to the IRS.

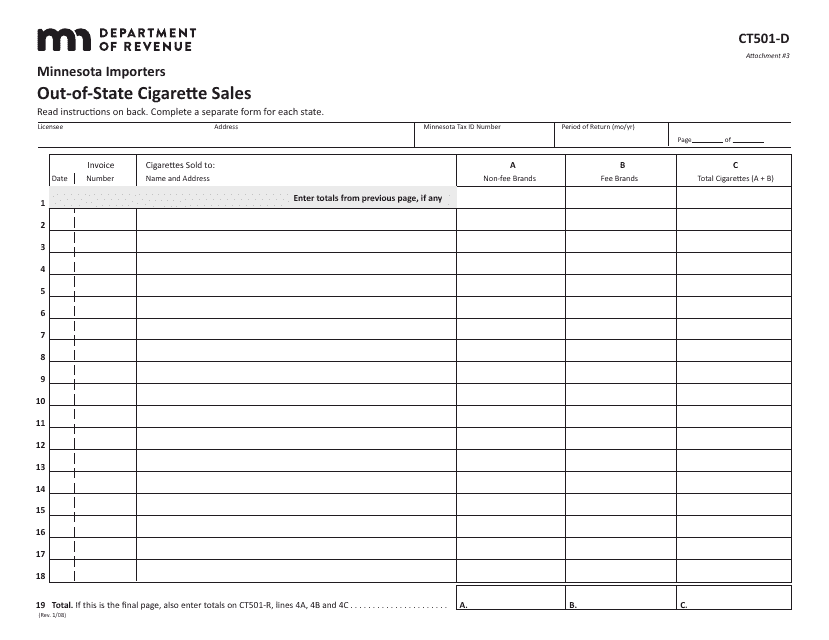

This Form is used for reporting out-of-state cigarette sales in Minnesota.

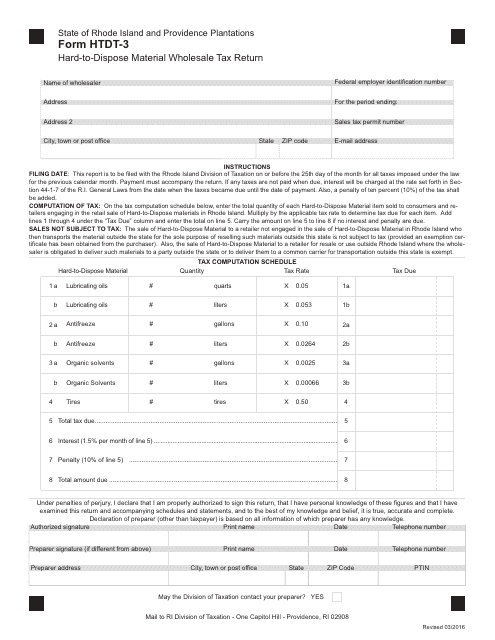

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

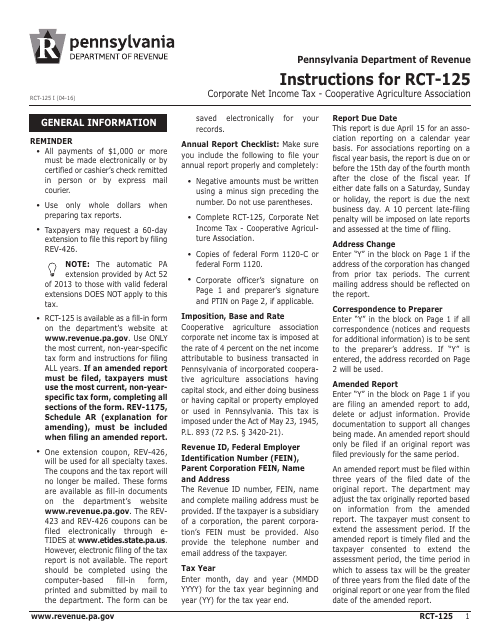

This Form is used for filing corporate net income tax for Cooperative Agriculture Associations in Pennsylvania. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

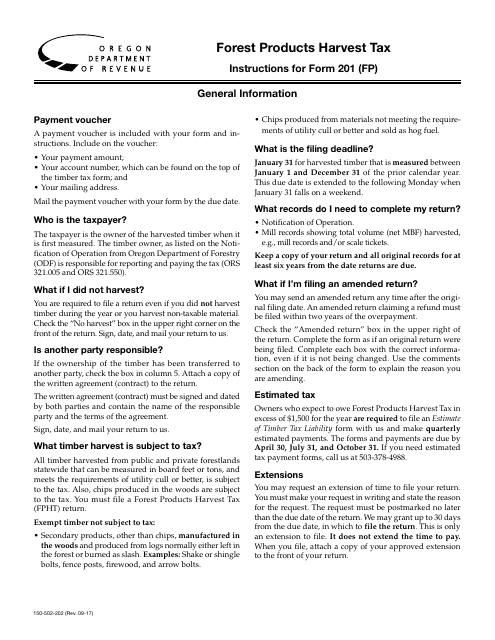

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

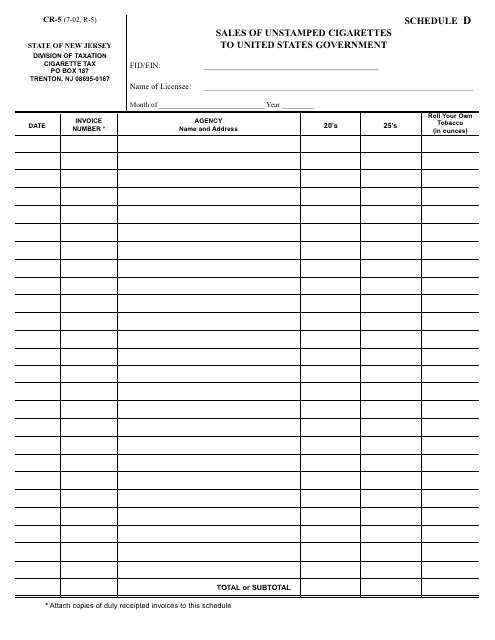

This form is used for reporting sales of unstamped cigarettes to the United States Government in New Jersey.

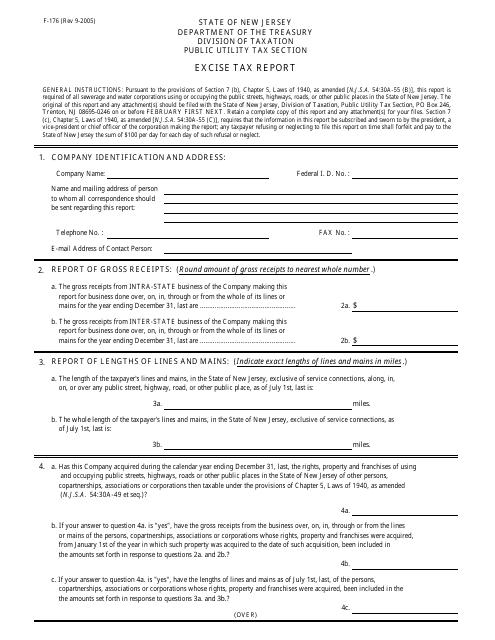

This form is used for reporting excise tax in the state of New Jersey.

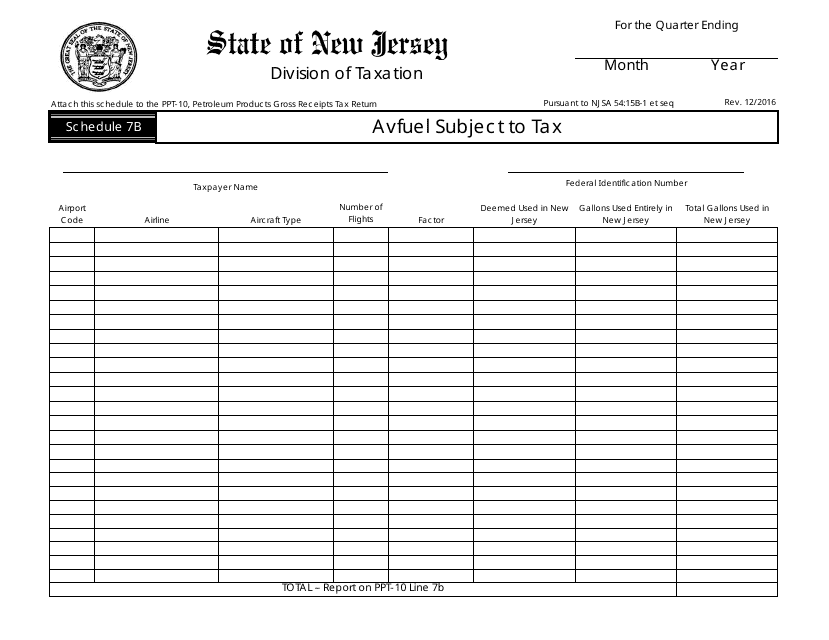

This Form is used for reporting Avfuel subject to tax in New Jersey.

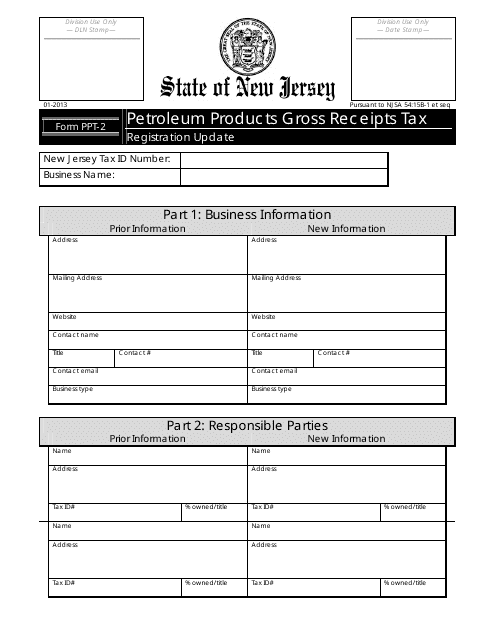

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

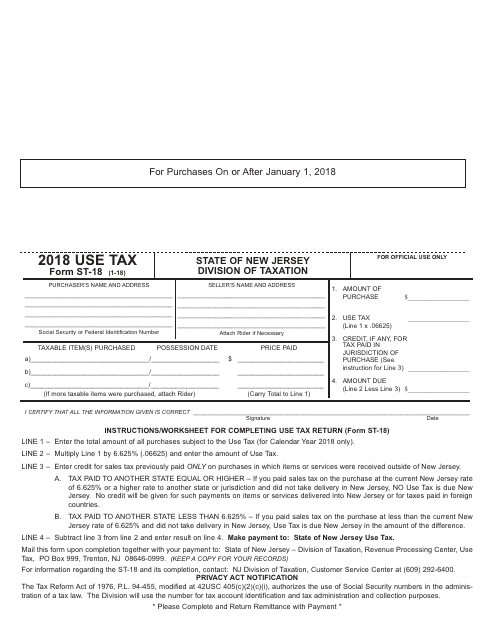

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on goods purchased out-of-state and used within New Jersey. Use this form to calculate and remit the appropriate tax amount.

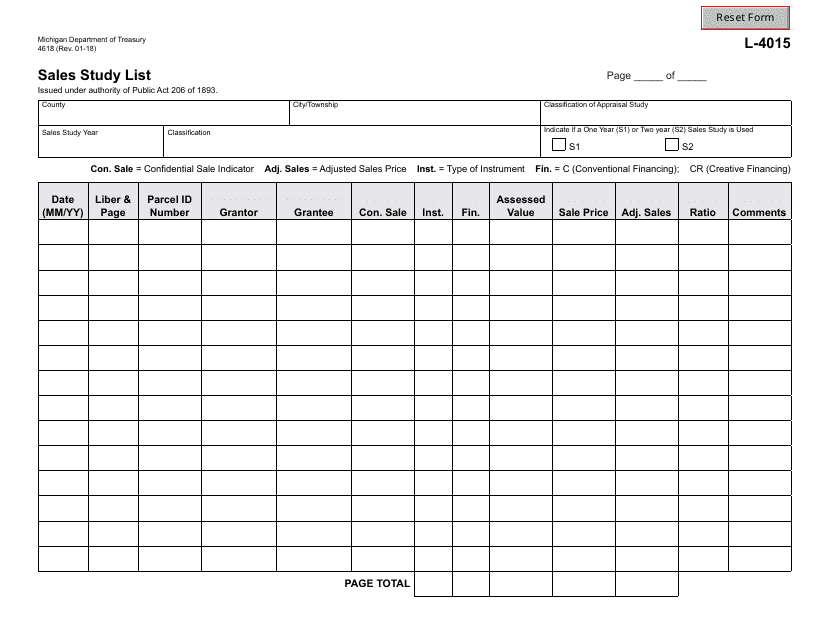

This form is used for submitting a sales study list in the state of Michigan.

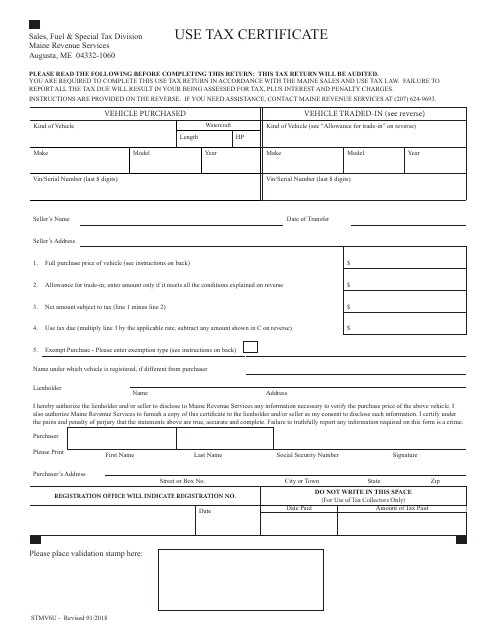

This form is used for certifying use tax payments in the state of Maine.

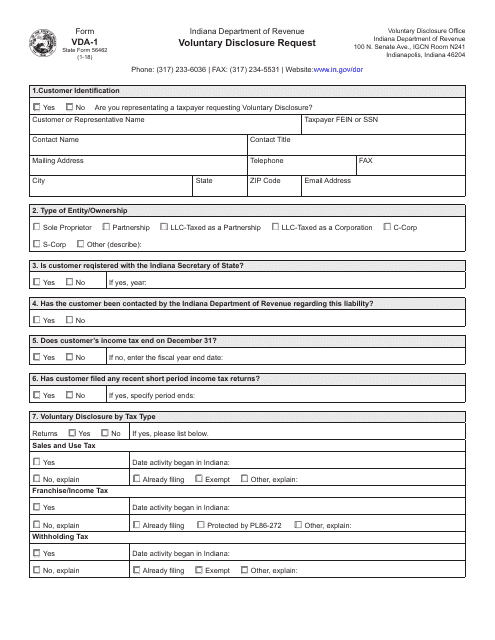

This form is used for requesting a voluntary disclosure in Indiana. It is known as the State Form 56462 (VDA-1) and is used to report any undisclosed tax liabilities.

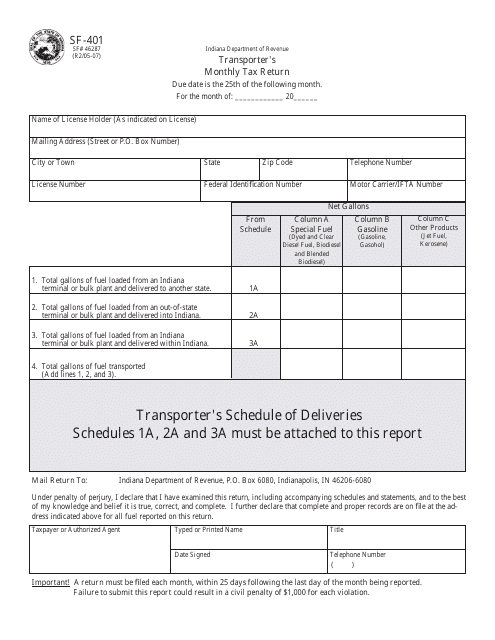

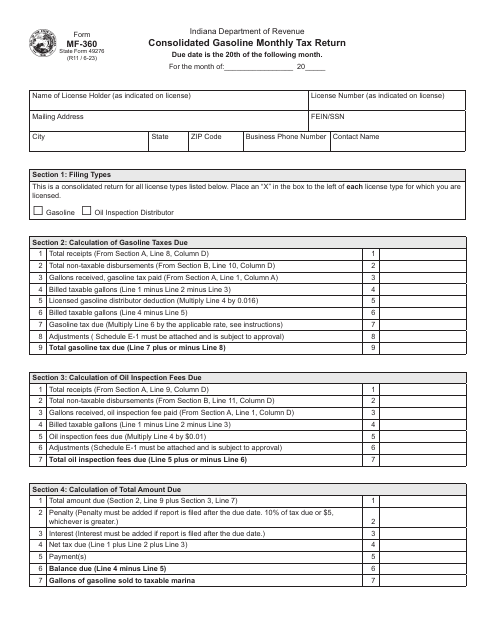

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

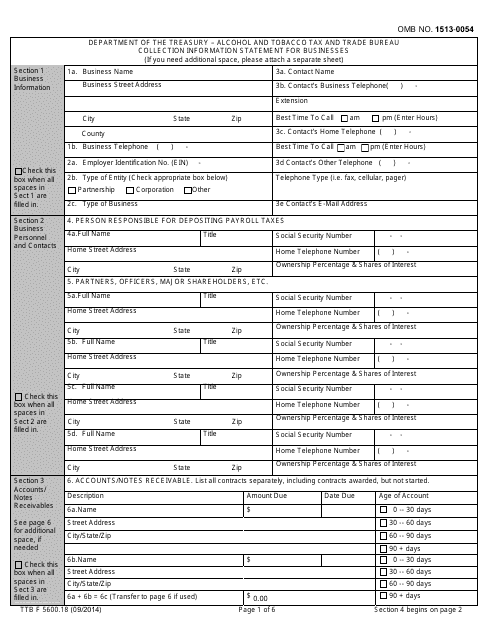

This document is used for obtaining collection information from businesses. It is required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for businesses engaged in alcohol and tobacco-related activities.

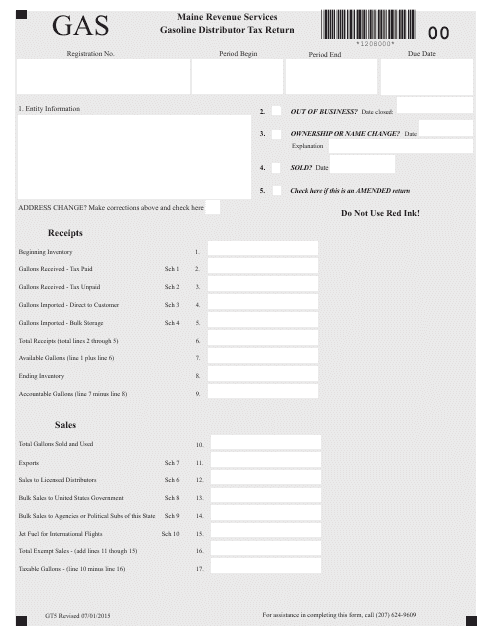

This form is used for filing the gasoline distributor tax return in the state of Maine. It is used by businesses that distribute gasoline in the state and must report and remit taxes owed.

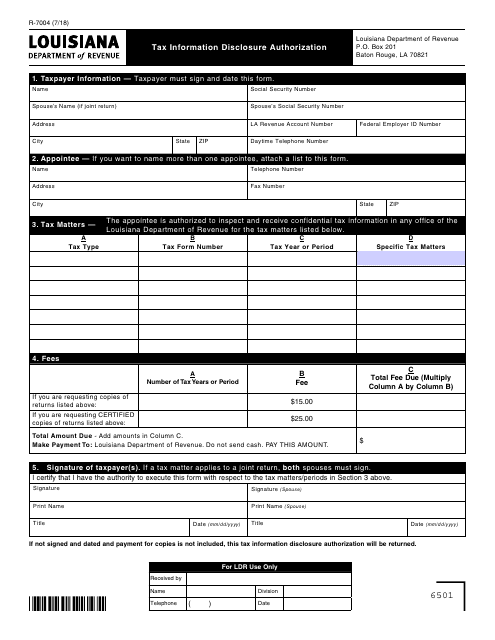

This form is used for authorizing the disclosure of tax information in the state of Louisiana.

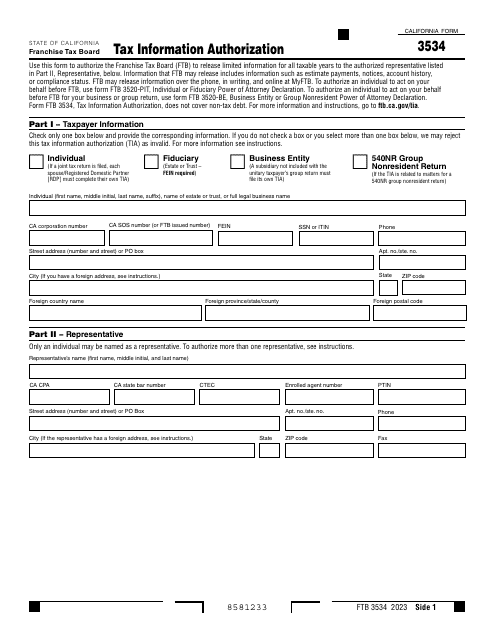

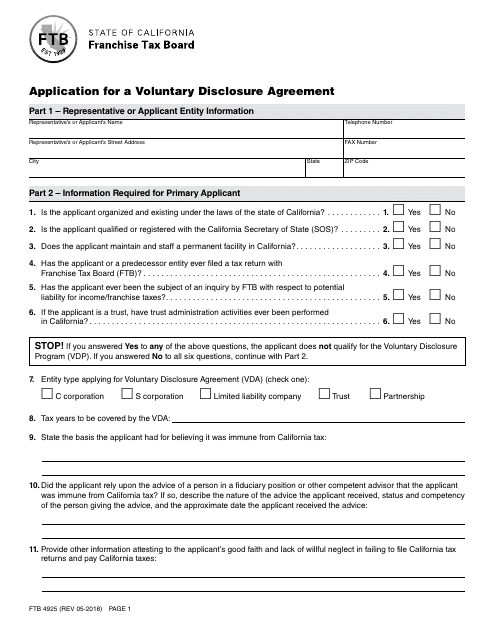

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

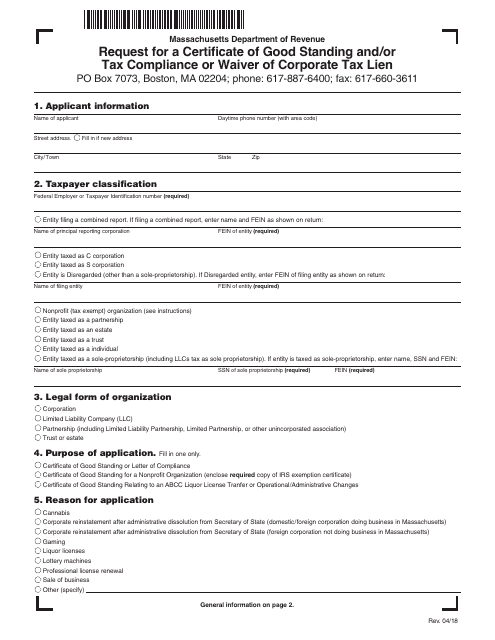

This Form is used for requesting a Certificate of Good Standing and/or Tax Compliance or Waiver of Corporate Tax Lien in the state of Massachusetts. It certifies that a business is compliant with its tax obligations or requests a waiver for any corporate tax liens.

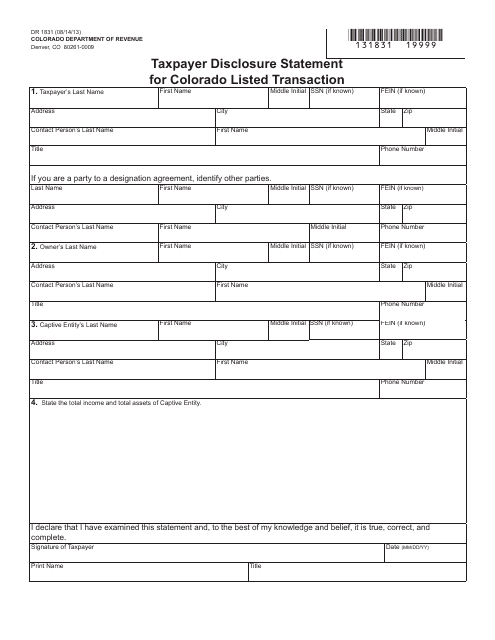

This form is used for taxpayers in Colorado to provide disclosure statements for listed transactions related to taxes.

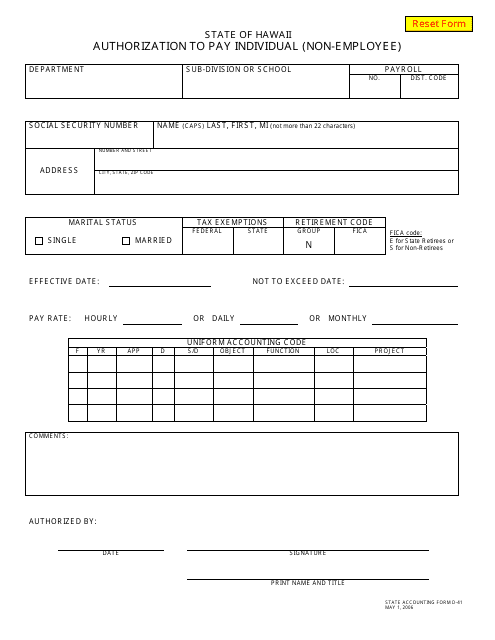

This Form is used for authorizing payment to an individual who is not an employee in the state of Hawaii.

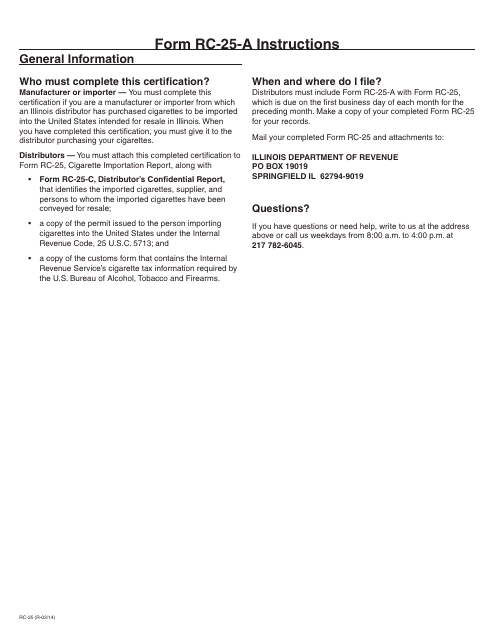

This form is used for cigarette manufacturers and importers in Illinois to certify compliance with state regulations. It provides instructions for completing and submitting Form RC-25-A.

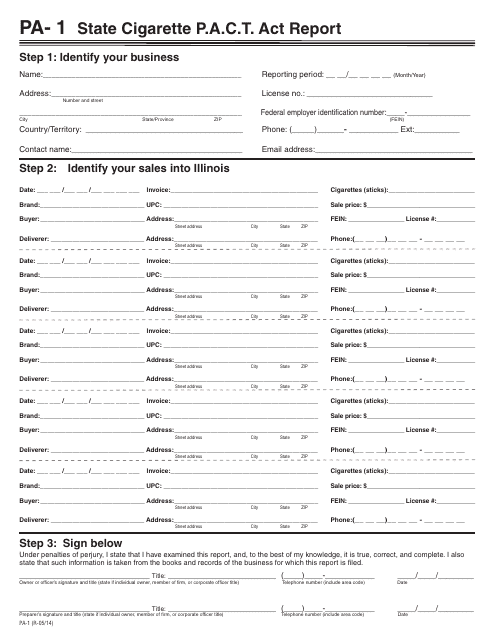

This form is used for reporting information related to the P.A.C.T. Act (Prevent All Cigarette Trafficking Act) for cigarette sales in the state of Illinois.

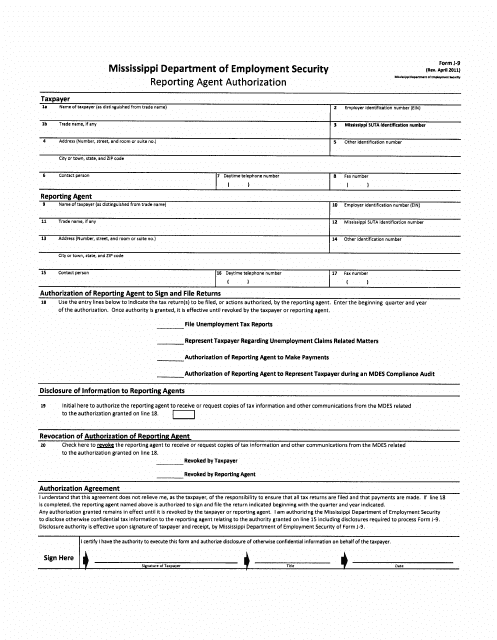

This form is used for authorizing a reporting agent to file tax returns on behalf of a taxpayer in the state of Mississippi.

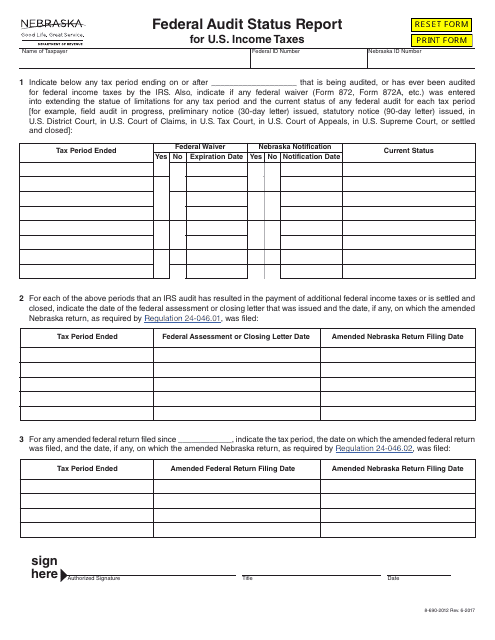

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

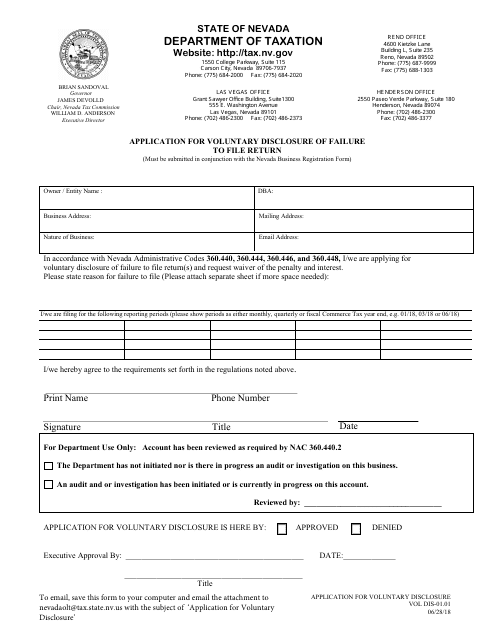

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

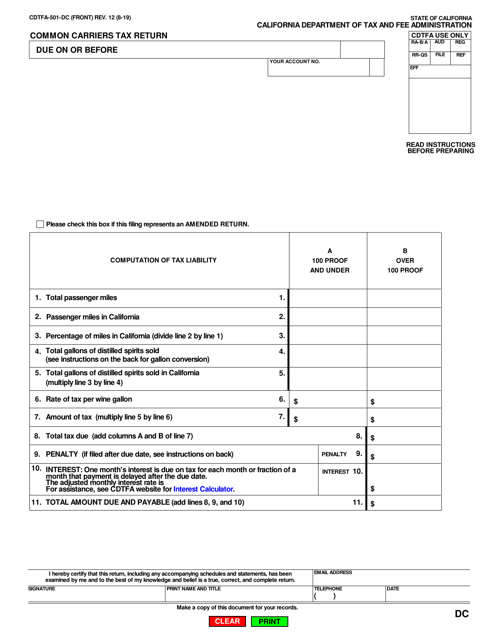

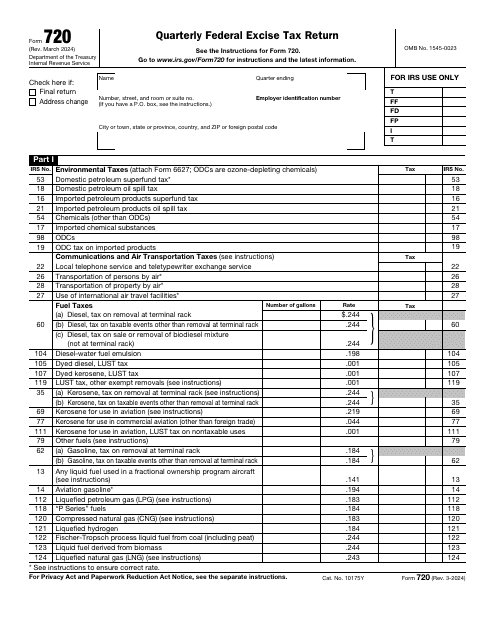

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

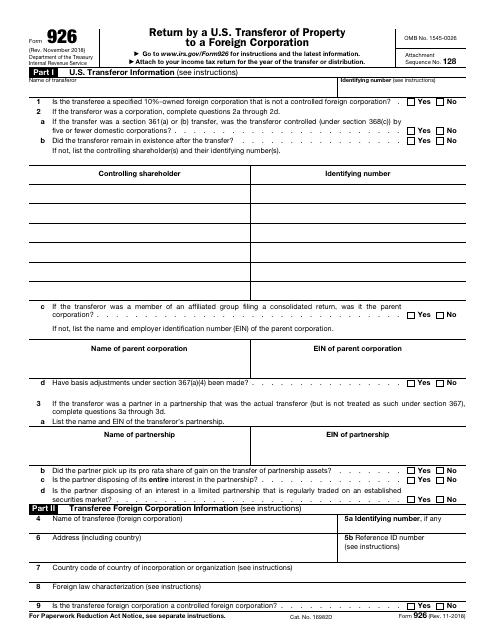

Fill in this form developed for U.S. citizens and residents, domestic corporations, and domestic estate or trusts, to report certain transfers of property to a foreign corporation.

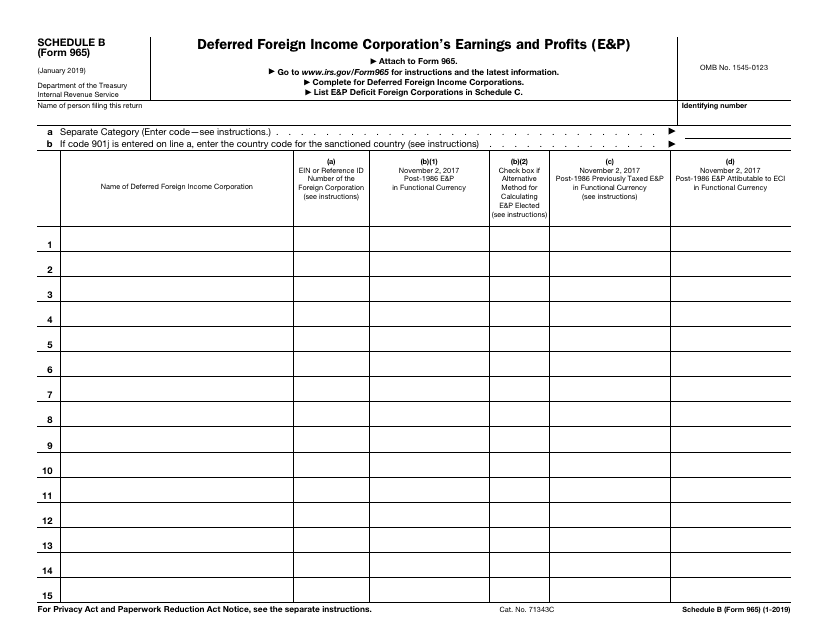

This Form is used for reporting the deferred foreign income and the earnings and profits of a foreign corporation.