Tax Compliance Form Templates

Documents:

727

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

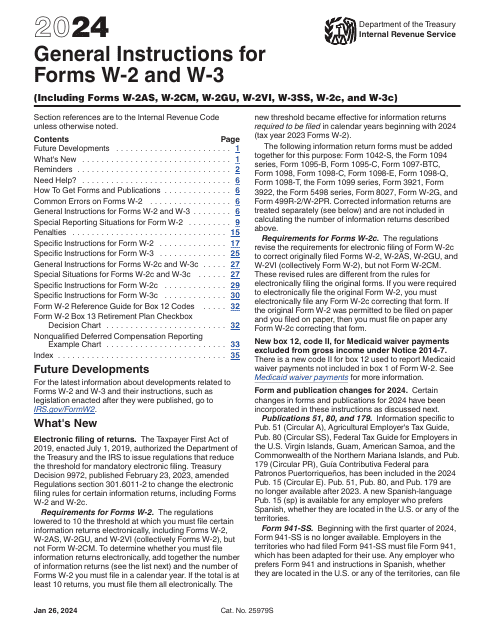

This document provides instructions for various IRS forms including 1096, 1097, 1098, 1099, 3821, 3822, 5498, and W-2G. The instructions guide individuals or organizations on how to fill out these specific information returns required by the IRS.

This form is used for reporting the compensation of corporate officers for tax purposes. It provides instructions on how to fill out IRS Form 1125-E.

This form is used for reporting any international boycott activities conducted by a taxpayer. It provides instructions for filling out IRS Form 5713, which helps the IRS monitor compliance with laws related to international boycotts.

This Form is used for reporting information related to tax credit bonds and specified tax credit bonds to the IRS. It provides instructions for completing the IRS Form 8038-TC.

This document provides instructions for completing IRS Form 8621-A, which is used by shareholders who are making certain late elections to end their treatment as a Passive Foreign Investment Company.

This document provides instructions on how to calculate interest using the look-back method for property depreciated under the income forecast method. It is used for IRS Form 8866.

This Form is used for reporting the agreement between a Certified Professional Employer Organization (CPEO) and their customer to the Internal Revenue Service (IRS).

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

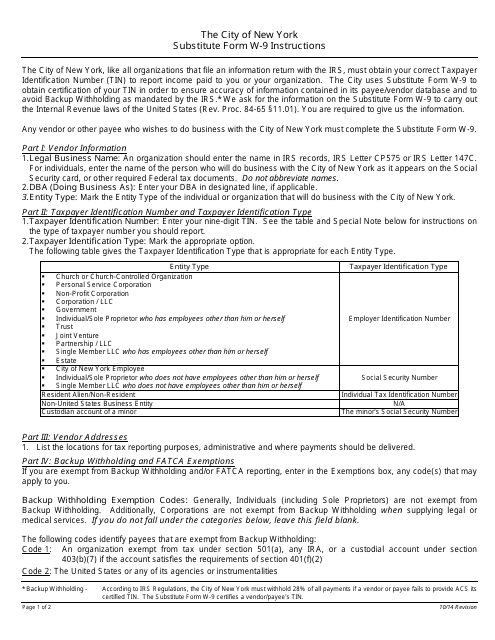

This document is for requesting taxpayer identification number and certification in New York City. It provides instructions for completing the Substitute Form W-9.

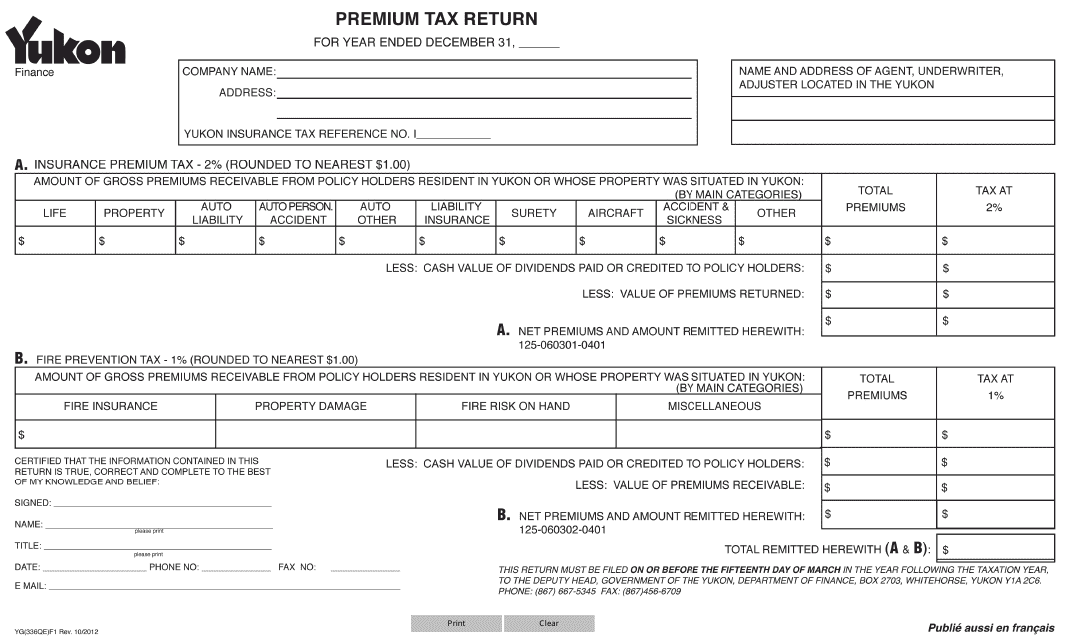

This form is used for filing premium tax returns in Yukon, Canada.

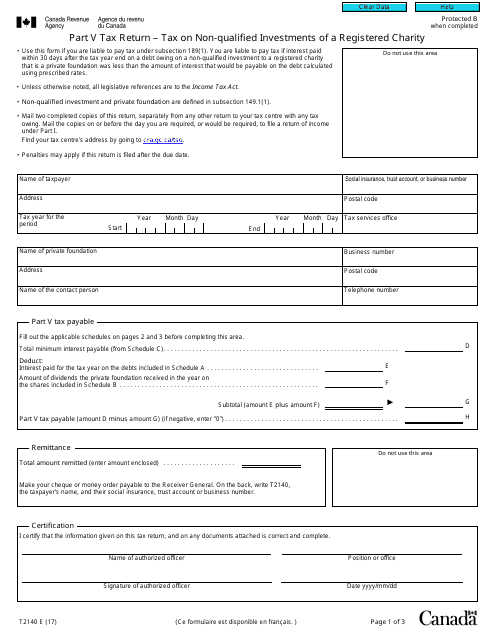

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

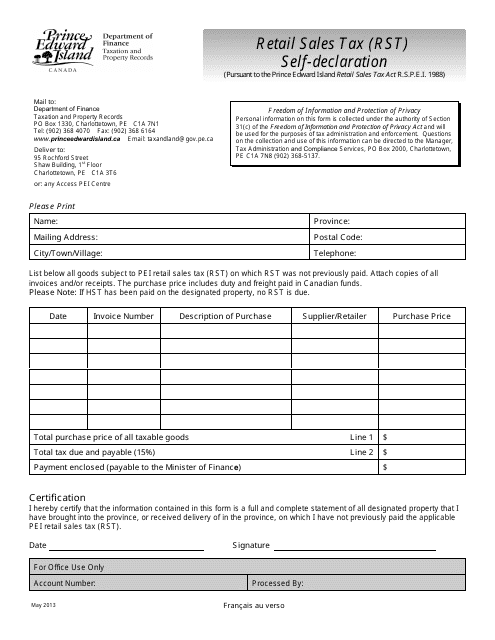

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

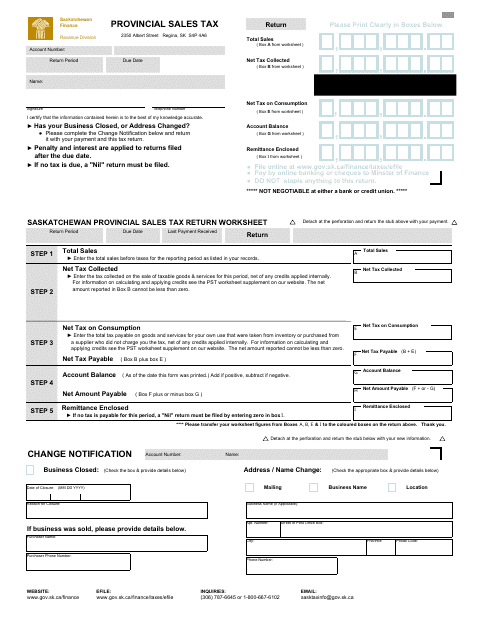

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

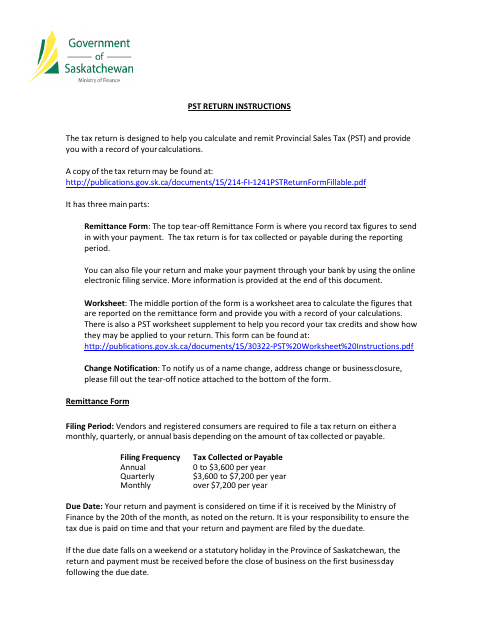

This document provides instructions for completing and filing the Provincial Sales Tax Return in Saskatchewan, Canada. It guides taxpayers on how to report and pay their sales tax obligations to the provincial government.