Tax Compliance Form Templates

Documents:

727

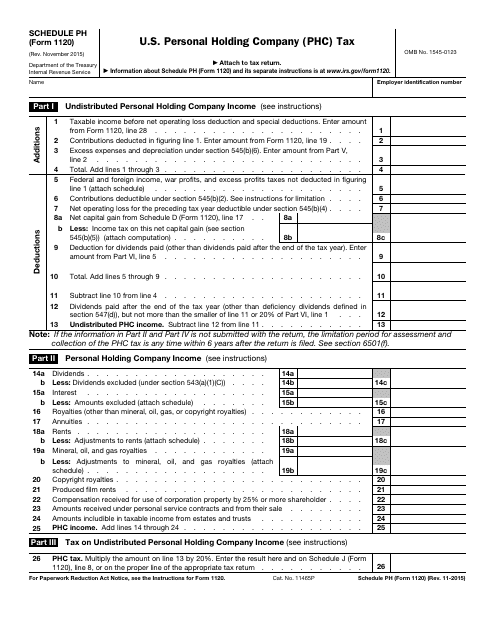

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

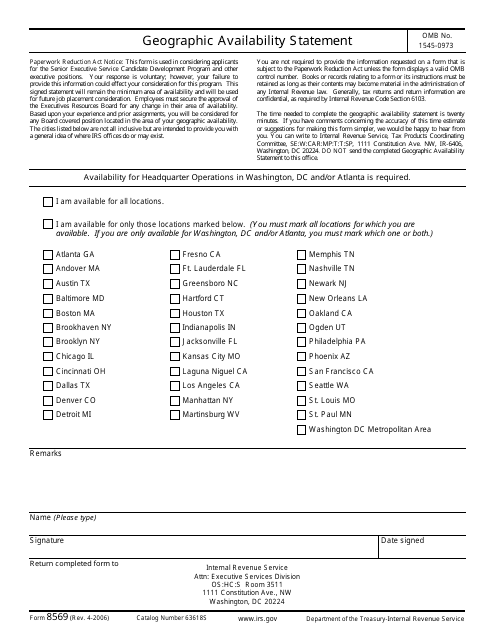

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

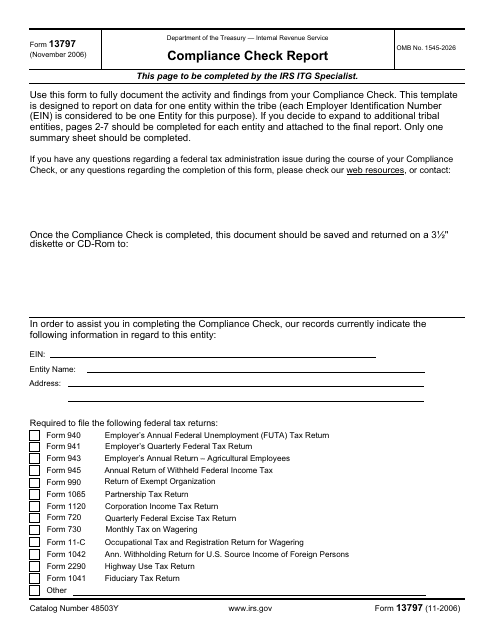

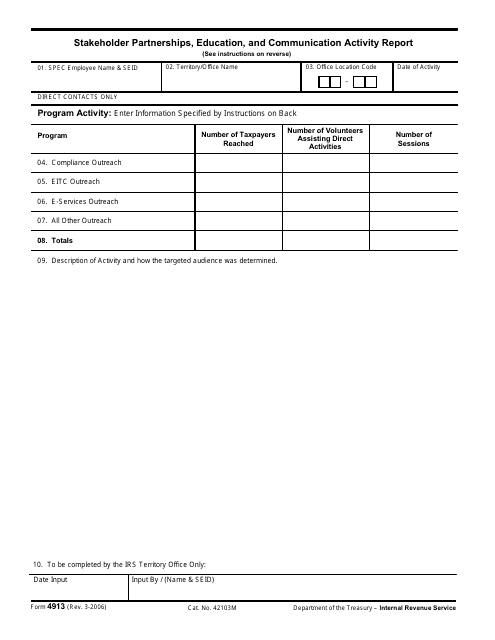

This document is used for reporting compliance checks to the IRS. It helps ensure that individuals and businesses are meeting their tax obligations.

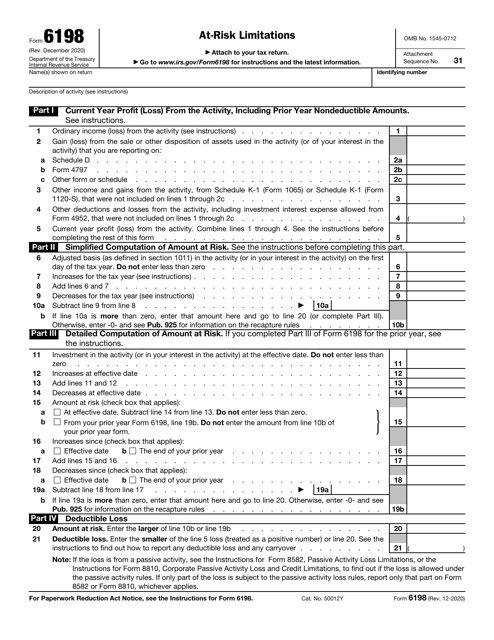

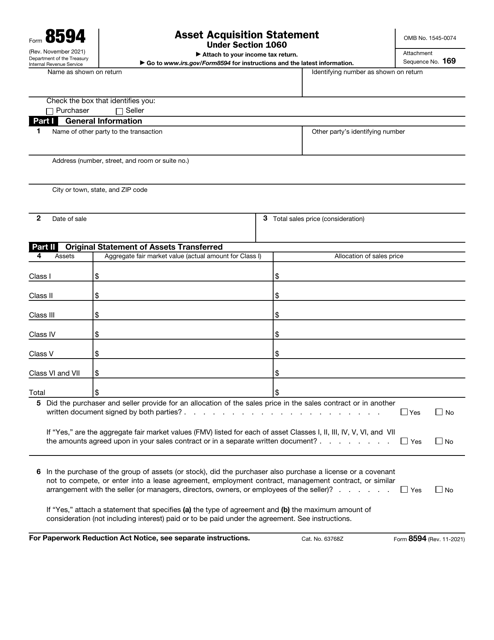

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

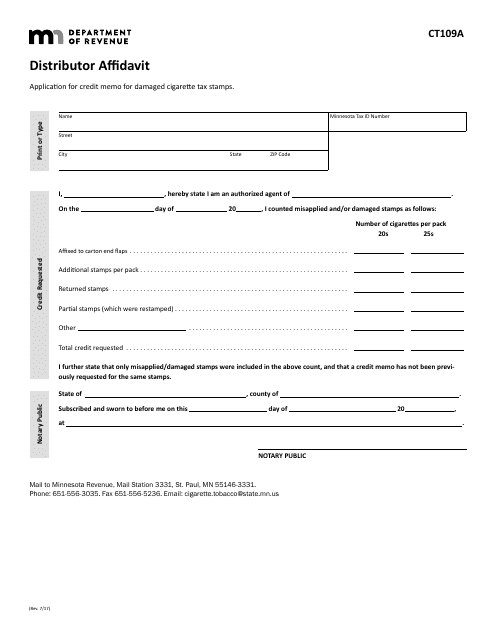

This Form is used for distributors in Minnesota to provide an affidavit.

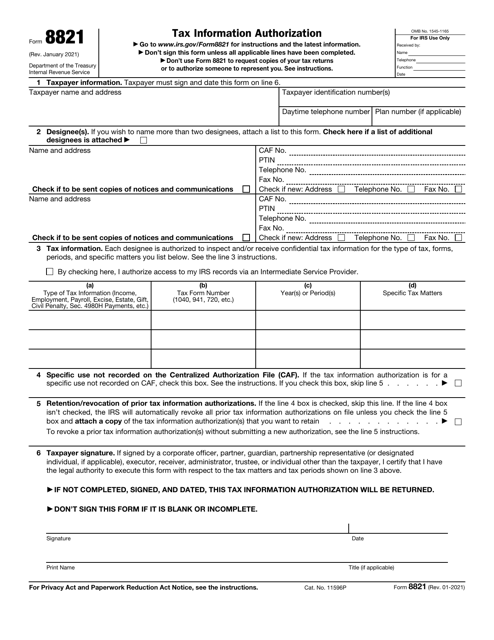

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

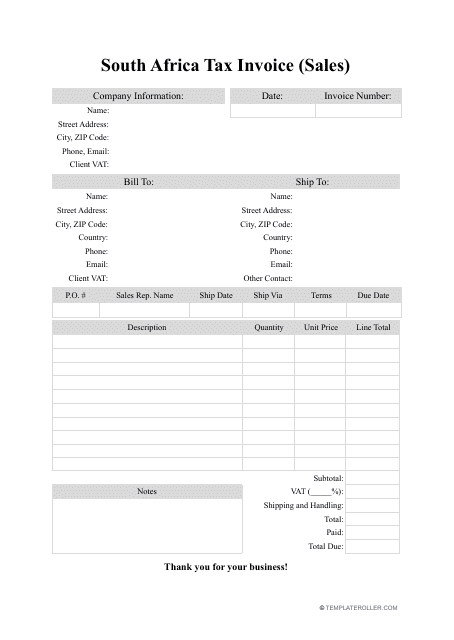

This type of document is a template for creating a sales tax invoice in South Africa.

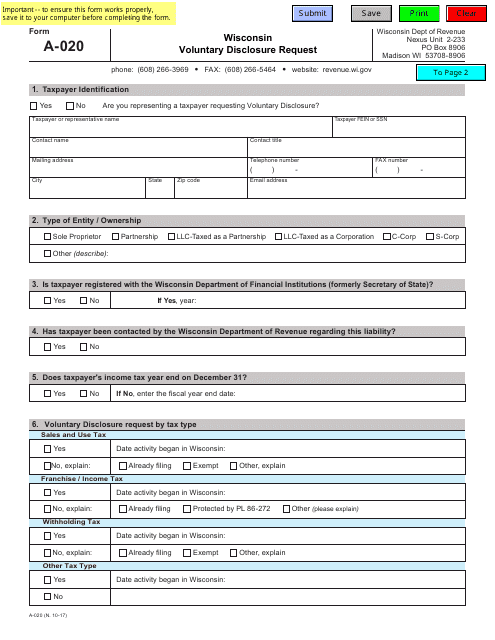

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

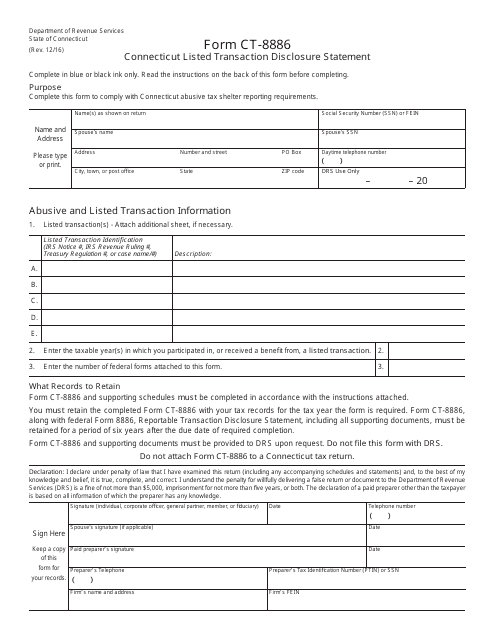

This Form is used for disclosing listed transactions in Connecticut.

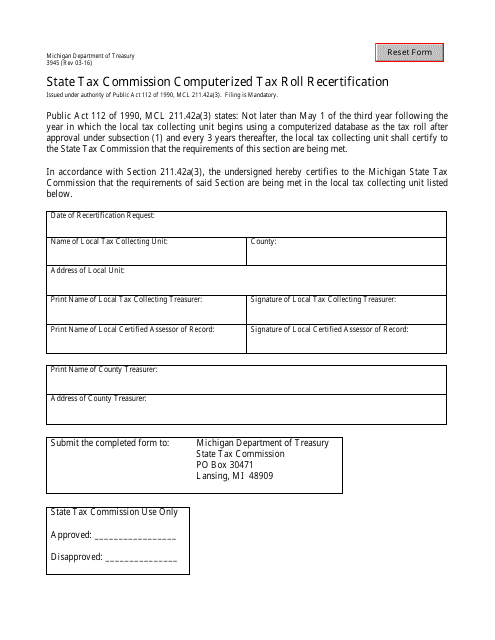

This document is used for recertifying the computerized tax roll with the State Tax Commission in Michigan.

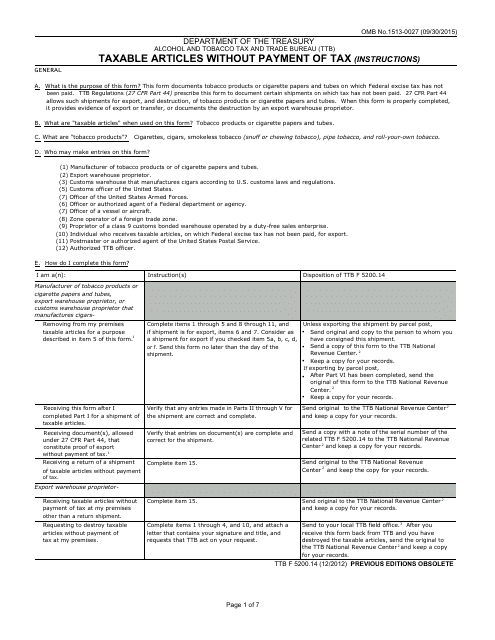

This document is used for reporting the taxable articles that are not paid for with tax.

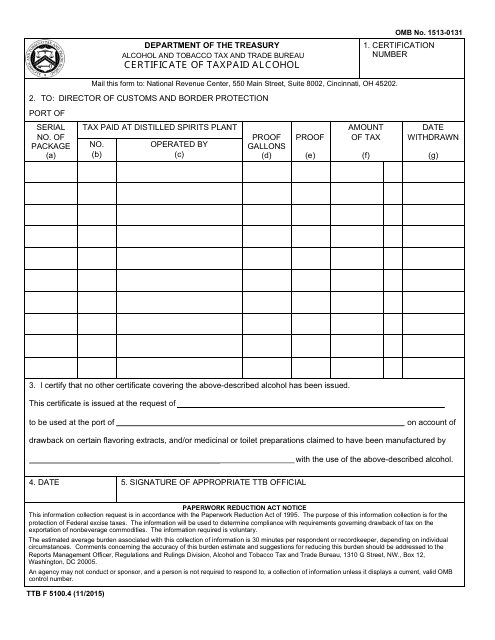

This form is used for obtaining a certificate for alcohol on which taxes have been paid.

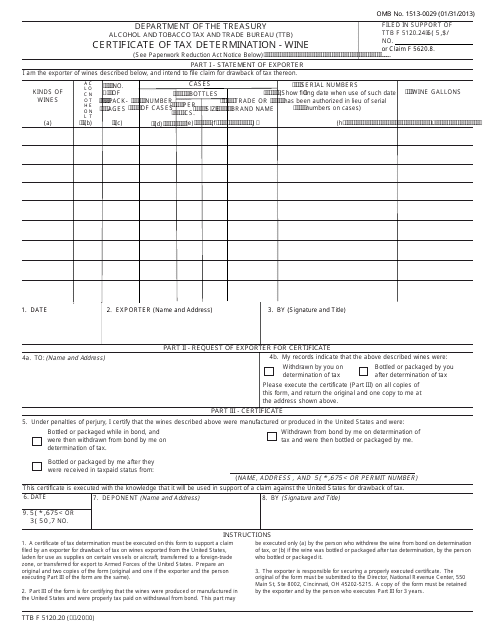

This TTB Form is used for obtaining a Certificate of Tax Determination for wine. It helps to determine the tax liability for wine producers and importers.

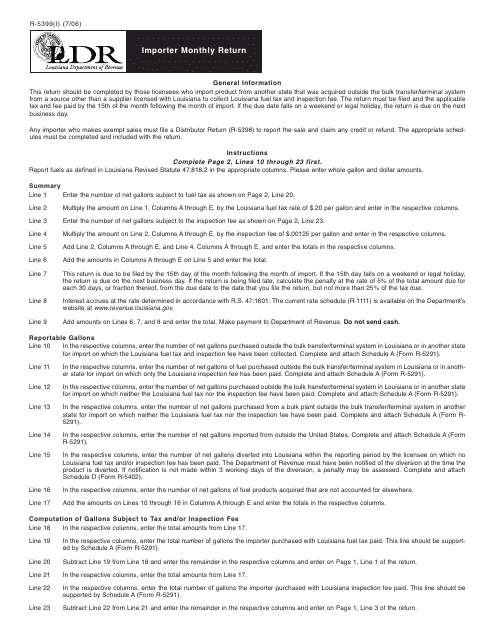

This Form is used for reporting monthly imports to the state of Louisiana.

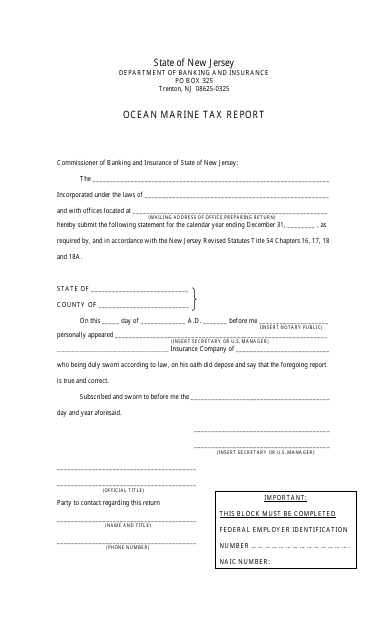

This document is used for reporting taxes related to ocean marine activities in the state of New Jersey.

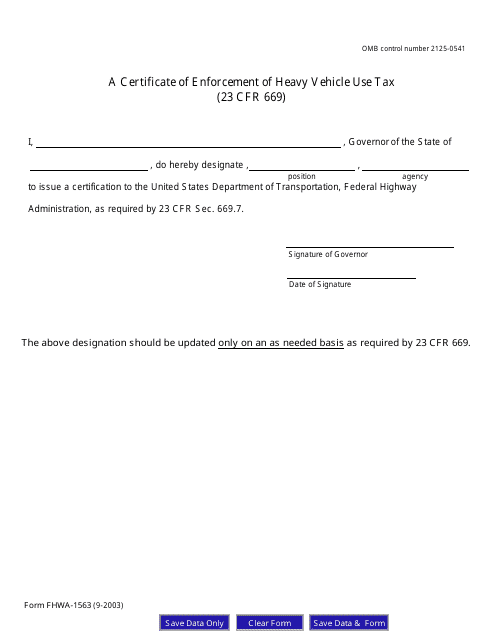

This form is used for certifying the enforcement of heavy vehicle use tax.

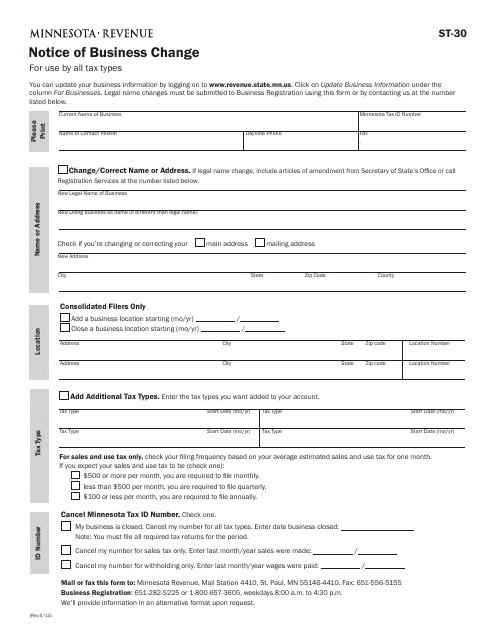

This Form is used for notifying the state of Minnesota about changes in business information. It helps businesses update their records with the state.

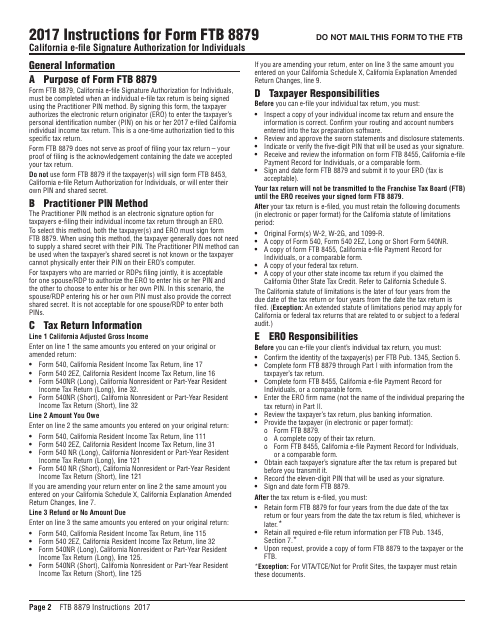

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

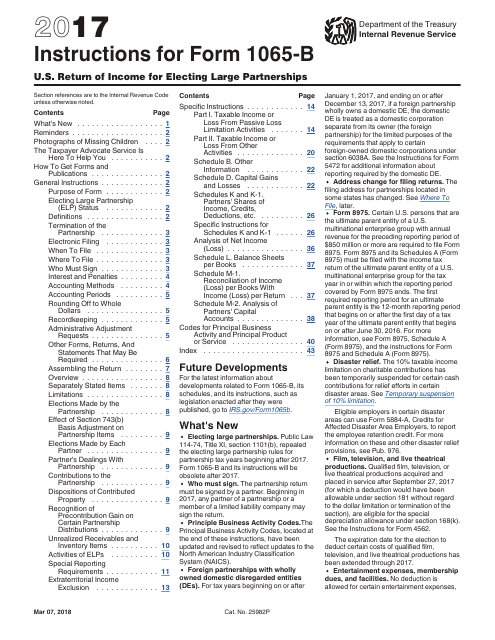

This Form is used for reporting income and expenses of electing large partnerships in the United States.

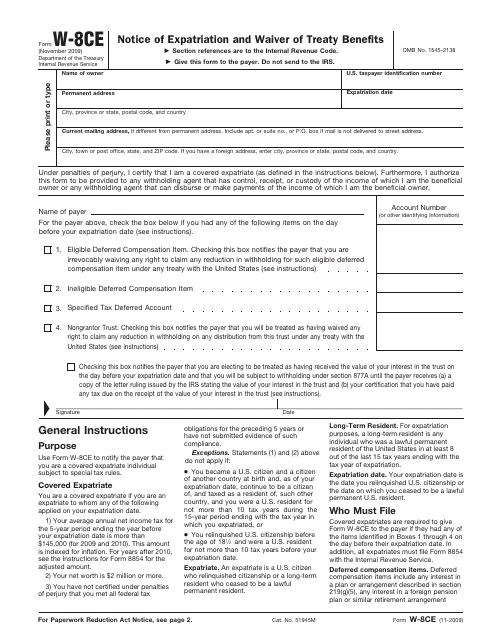

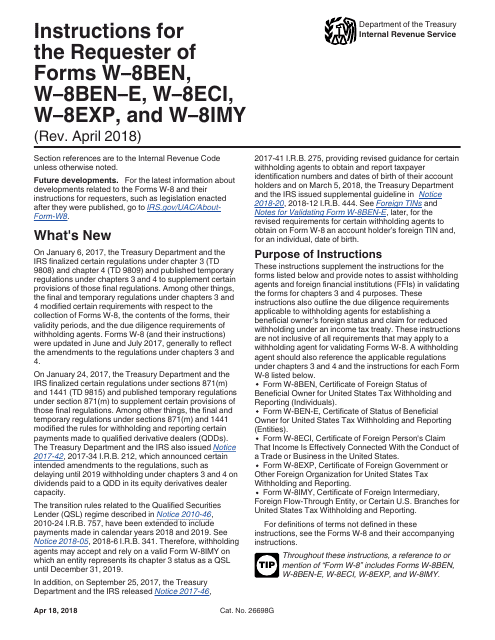

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

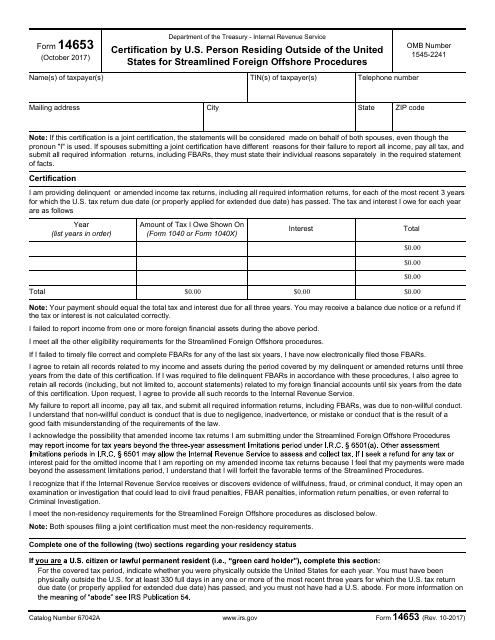

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.