Tax Compliance Form Templates

Documents:

727

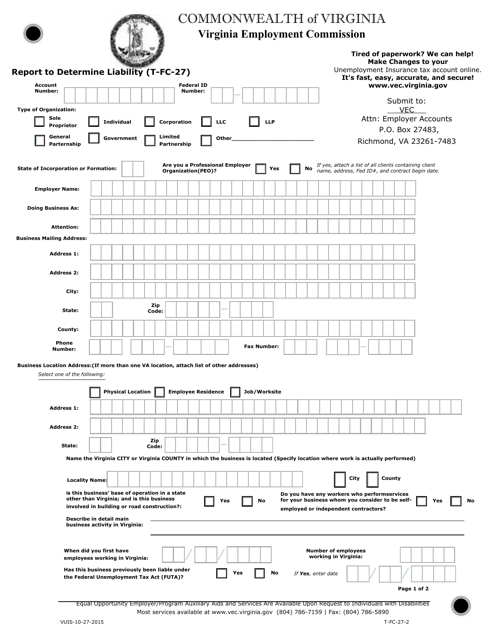

This form is used for reporting and determining liability in the state of Virginia. It is specifically for tax purposes and helps individuals or businesses report their financial obligations accurately.

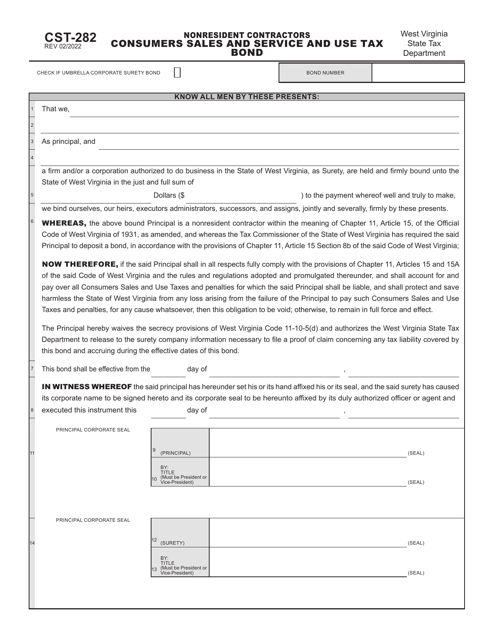

This form is used for contractors who are nonresidents of West Virginia and need to post a bond for Consumers Sales and Service and Use Tax.

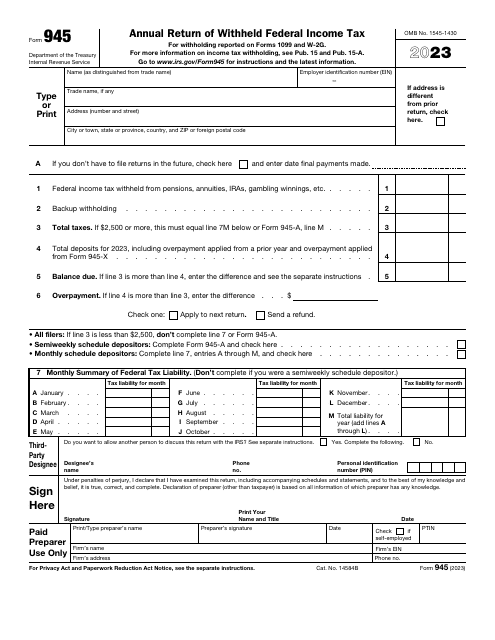

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.

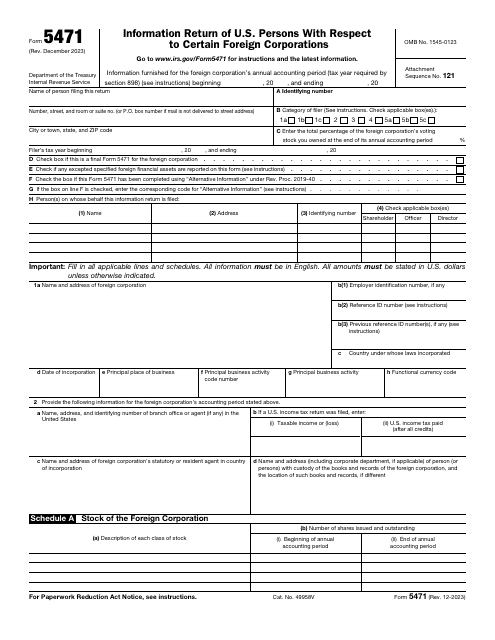

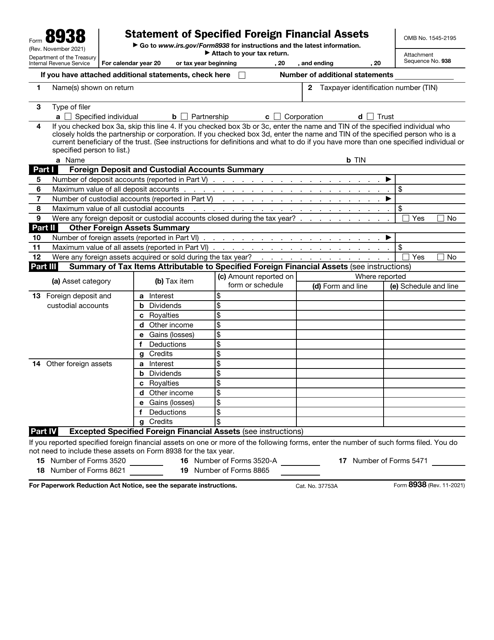

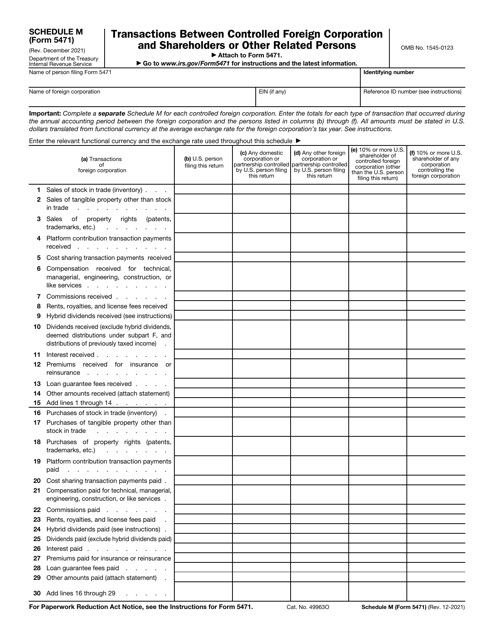

Fill in this document if you are a U.S. citizen that had control of a foreign corporation during the yearly accounting period of a foreign corporation

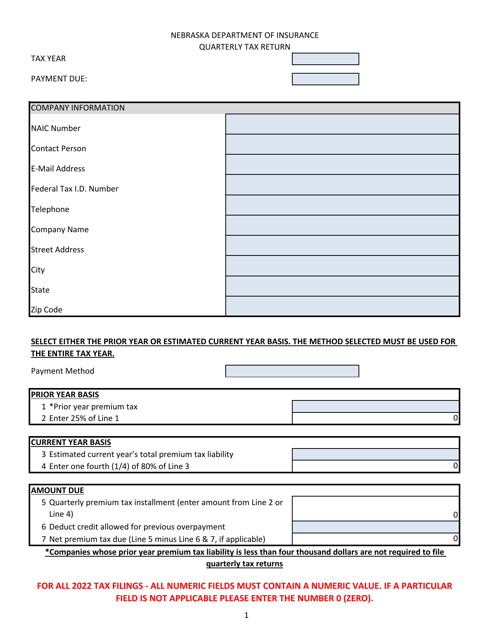

This form is used for reporting and paying quarterly premium taxes in the state of Nebraska.

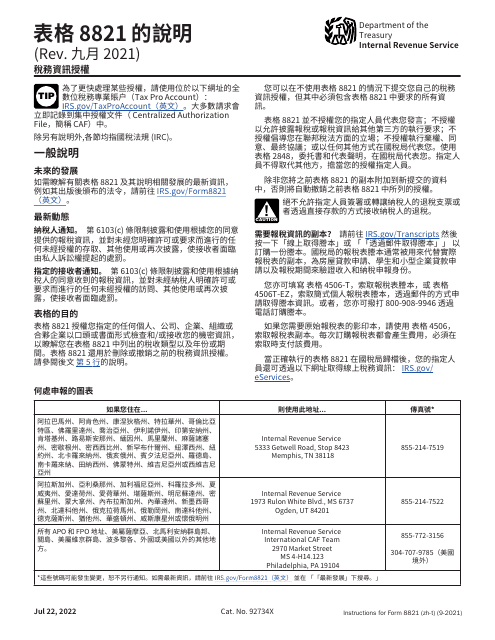

This document provides instructions for completing the IRS Form 8821 Tax Information Authorization in Chinese. It explains how to authorize someone to access your tax information and guide you through the form filling process.

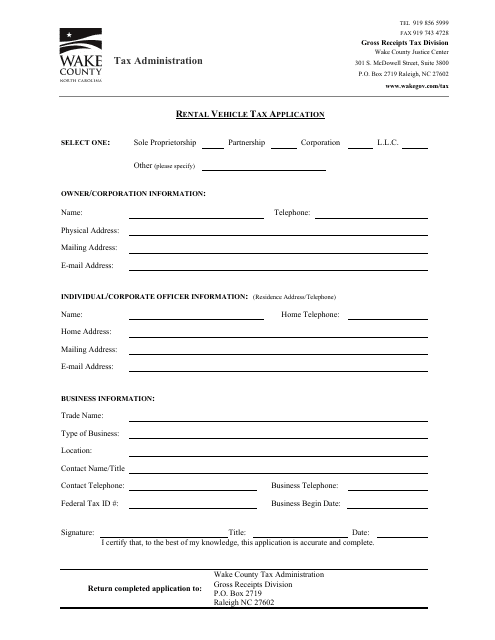

This document is for applying for rental vehicle tax in Wake County, North Carolina. It is used to report and pay taxes related to renting vehicles in the county.

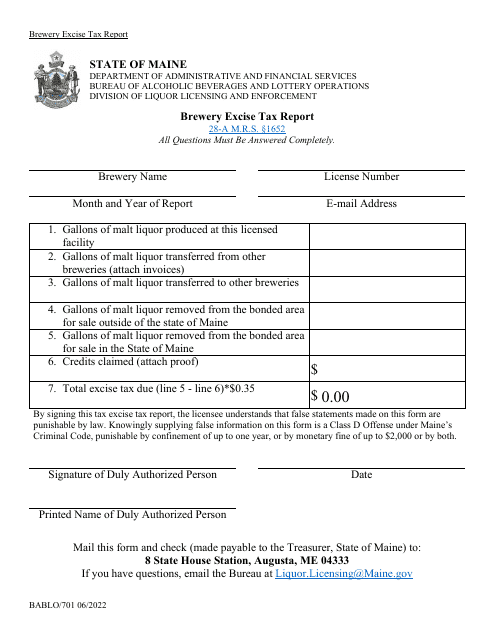

This Form is used for reporting brewery excise taxes in the state of Maine. It is required for breweries to accurately report and pay their excise tax obligations.