U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

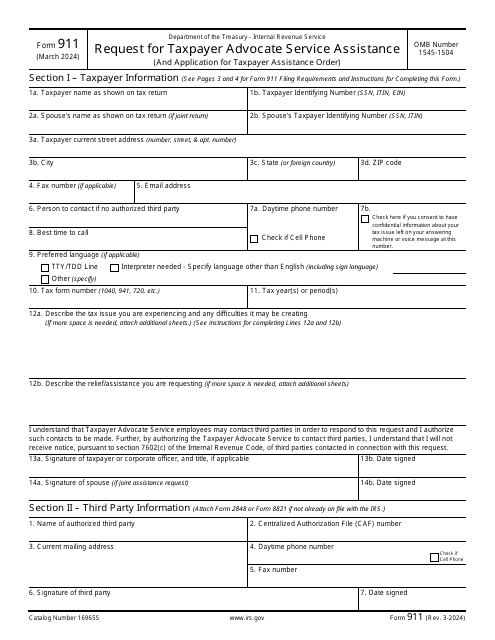

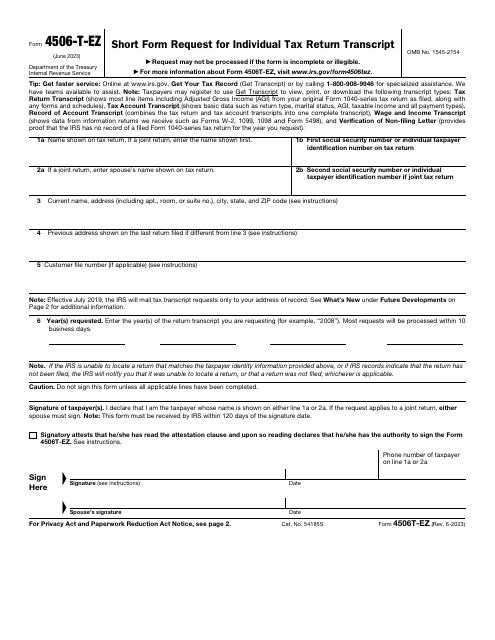

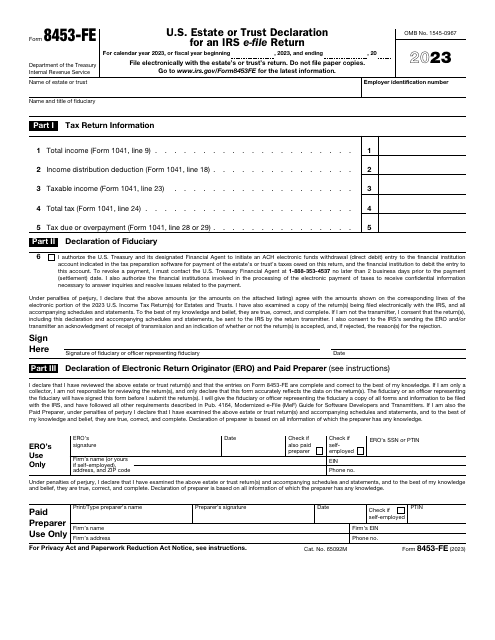

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

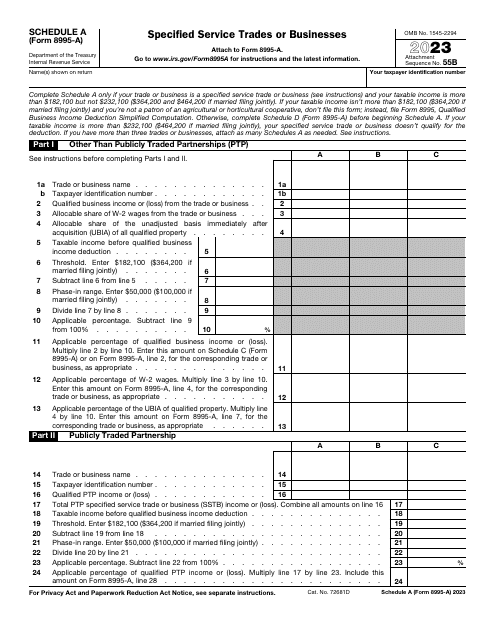

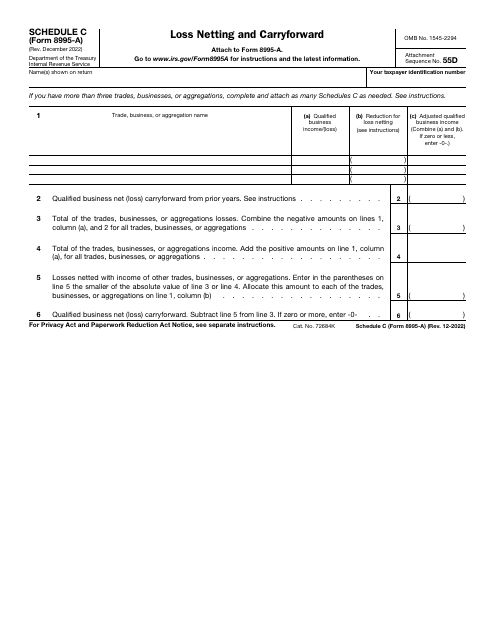

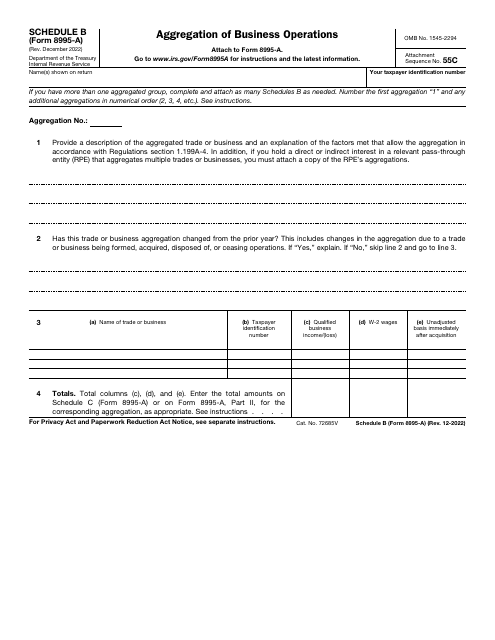

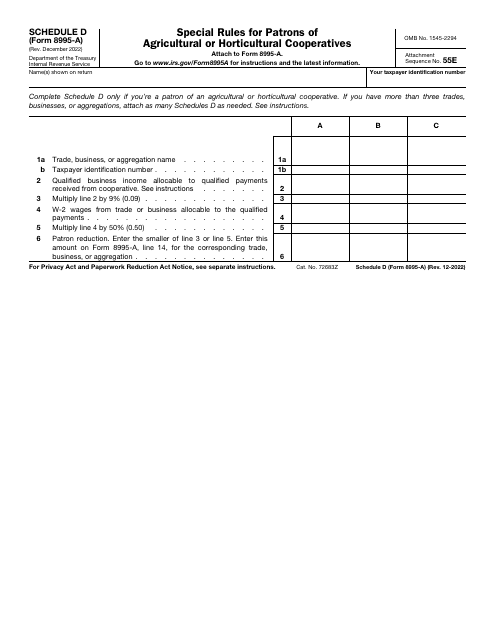

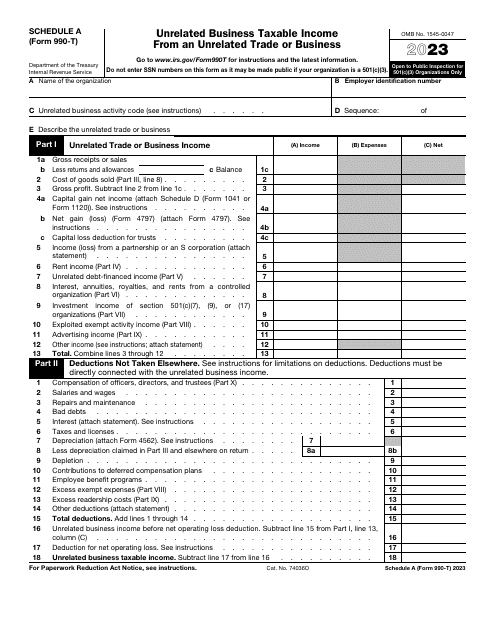

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

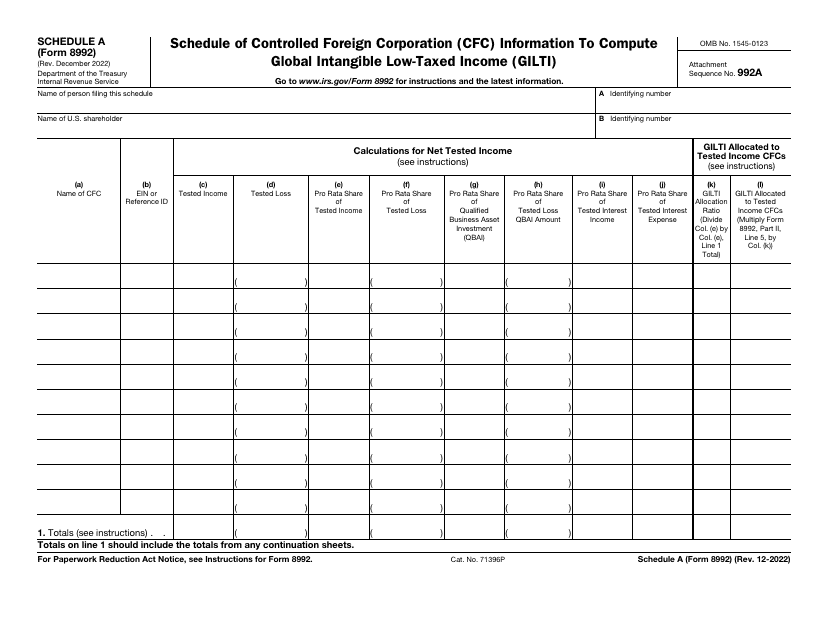

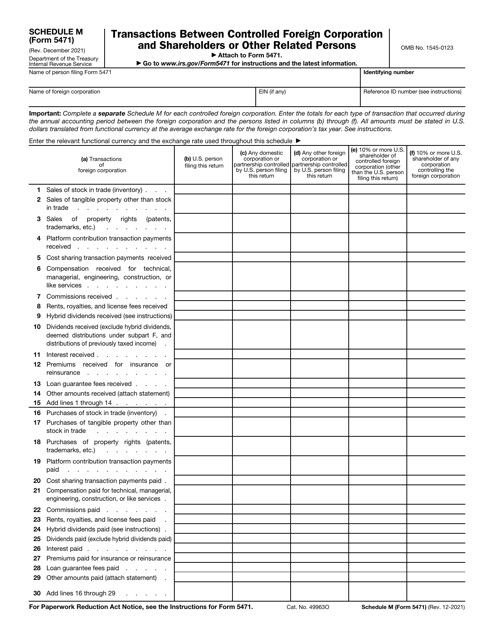

Fill in this document if you are a U.S. citizen that had control of a foreign corporation during the yearly accounting period of a foreign corporation

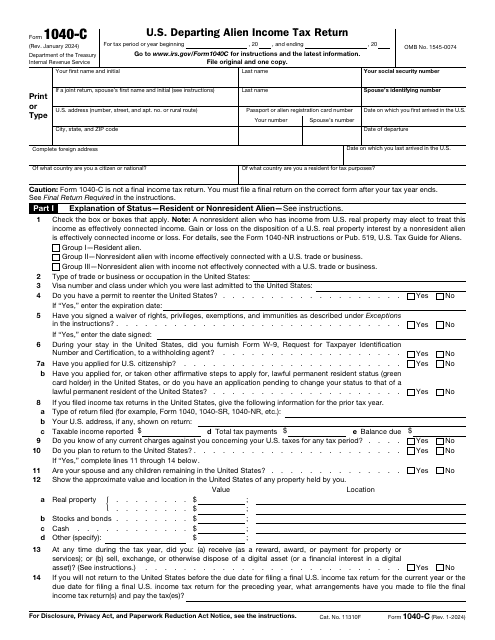

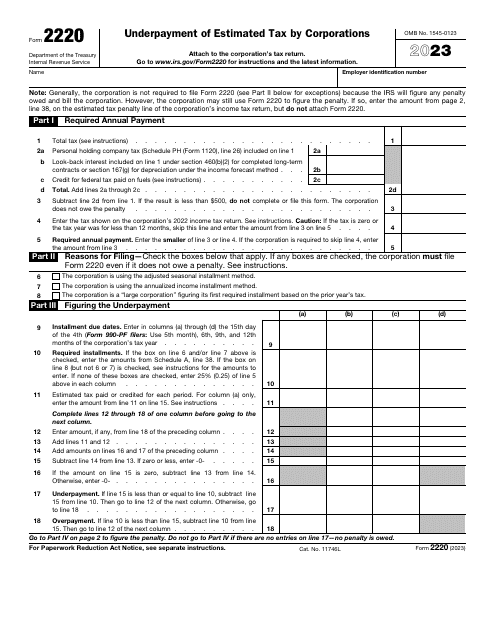

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

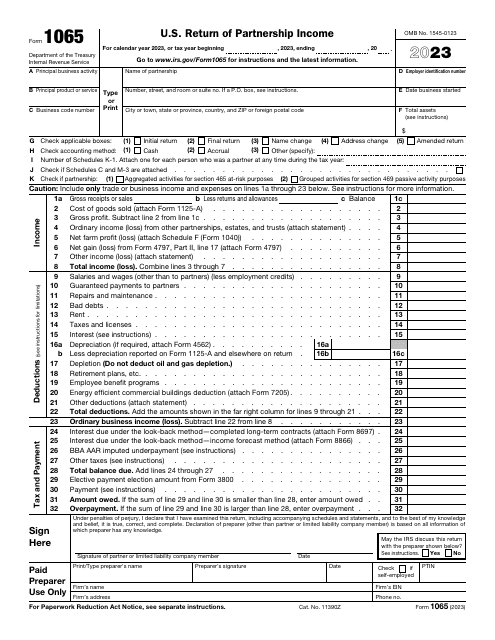

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

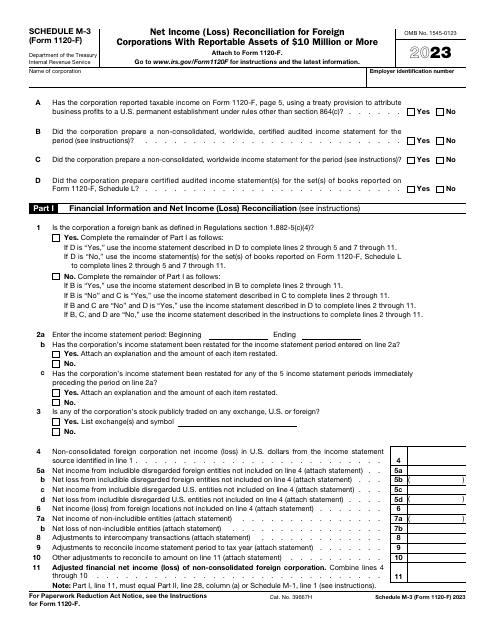

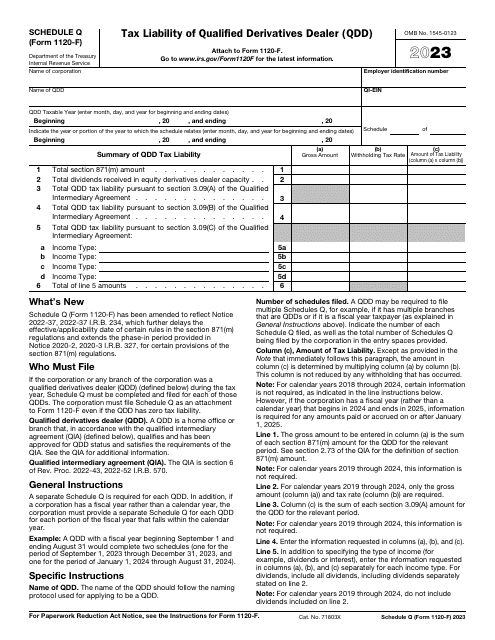

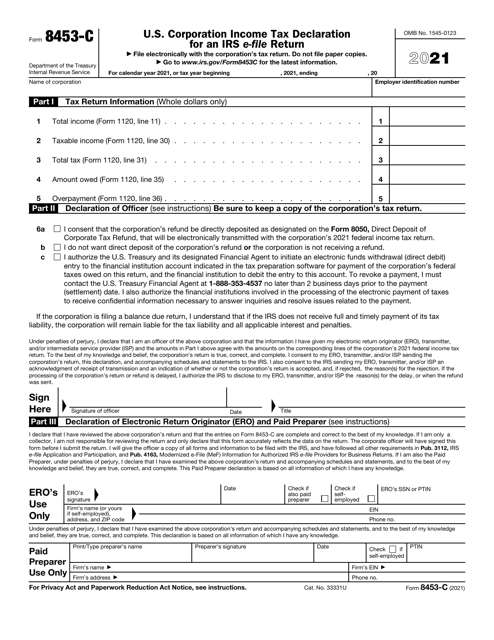

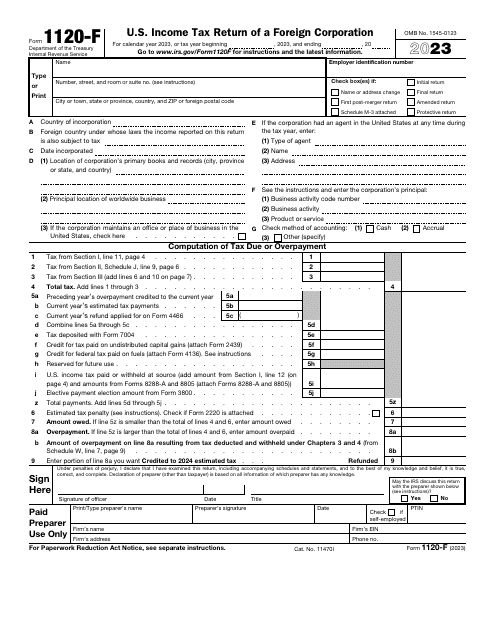

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

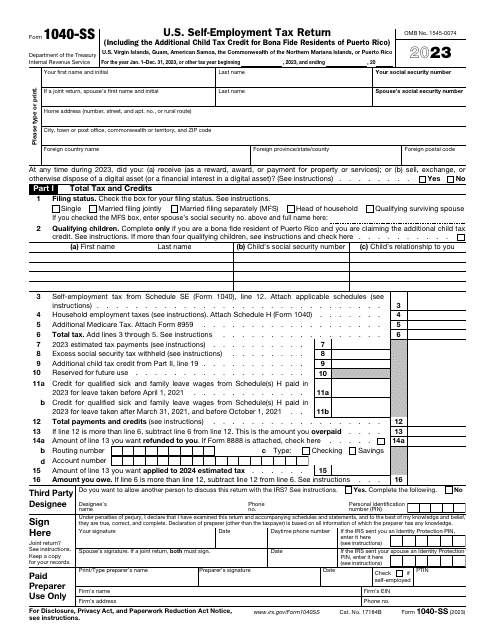

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

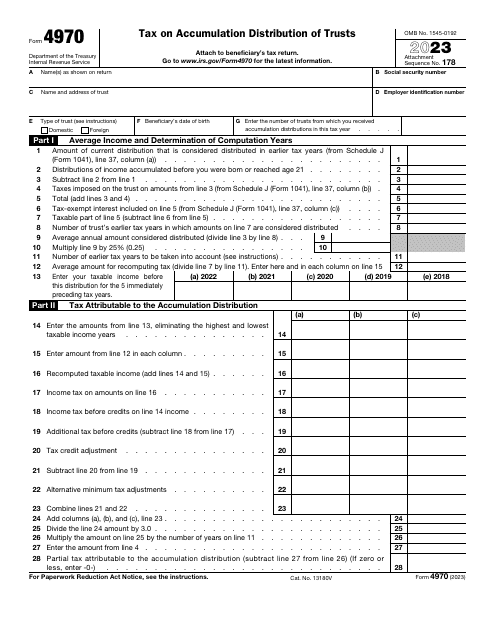

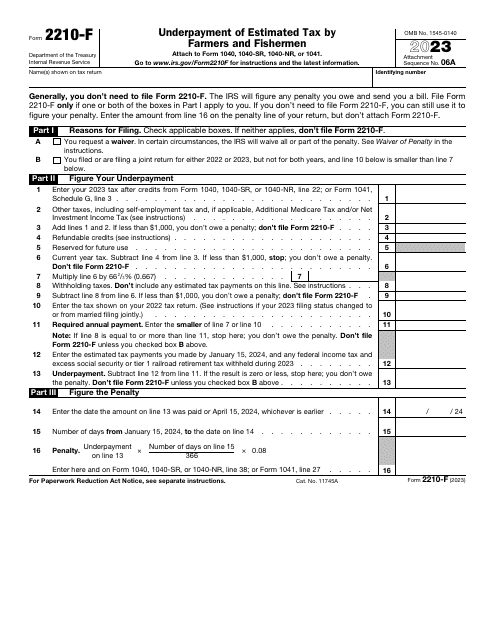

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.