U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

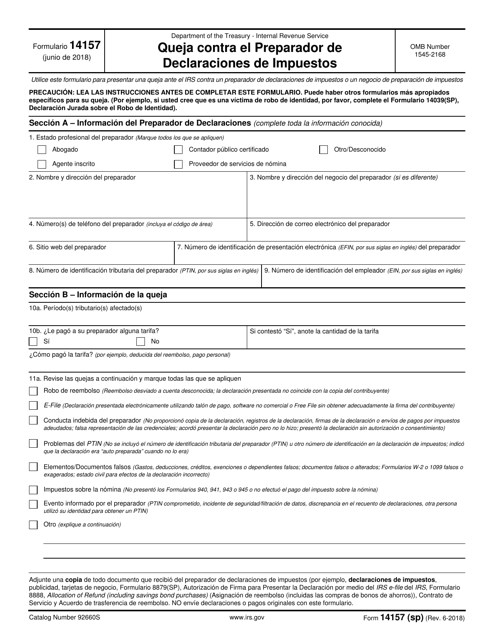

This type of document is a Spanish version of IRS Form 14157. It is used for filing a complaint against a tax preparer.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

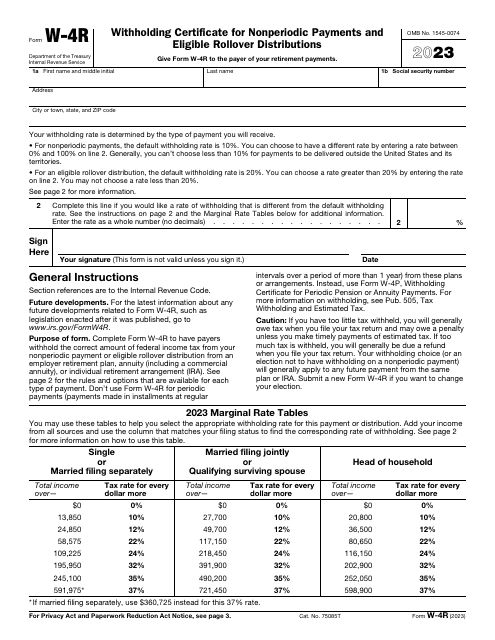

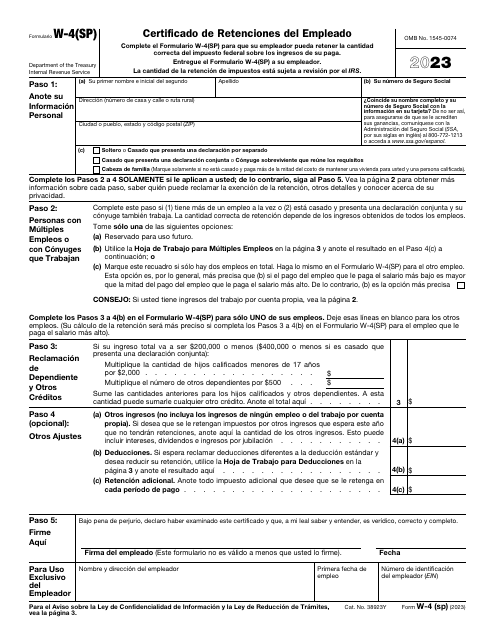

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

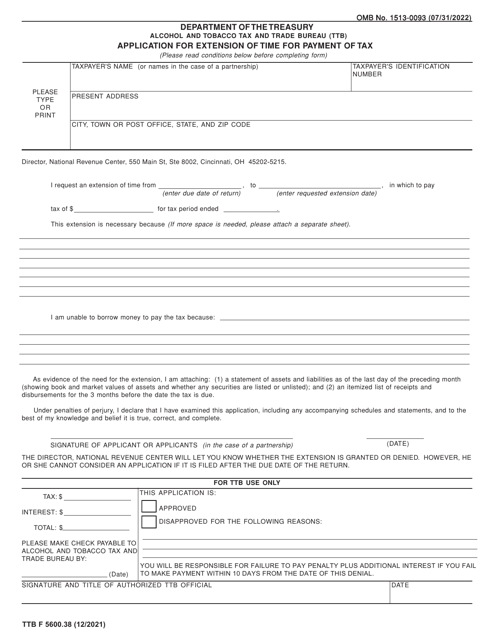

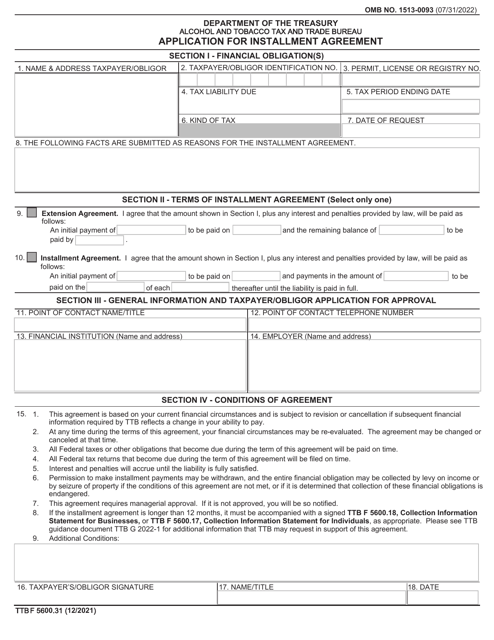

This Form is used for applying for an installment agreement with the Alcohol and Tobacco Tax and Trade Bureau (TTB). It is for businesses that owe excise taxes on alcohol, tobacco, and firearms and need to make payments in smaller, manageable installments.

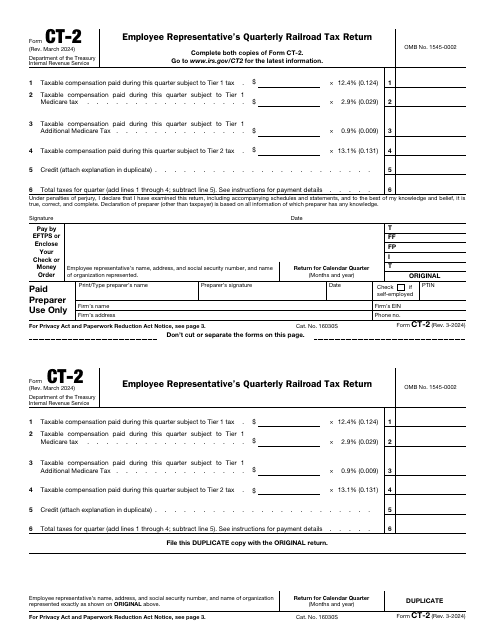

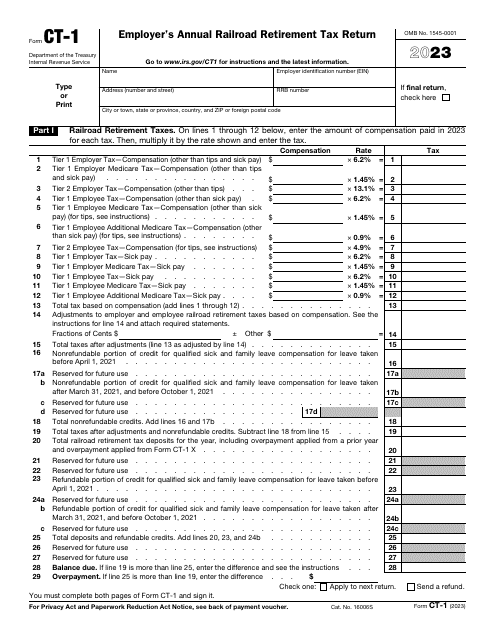

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

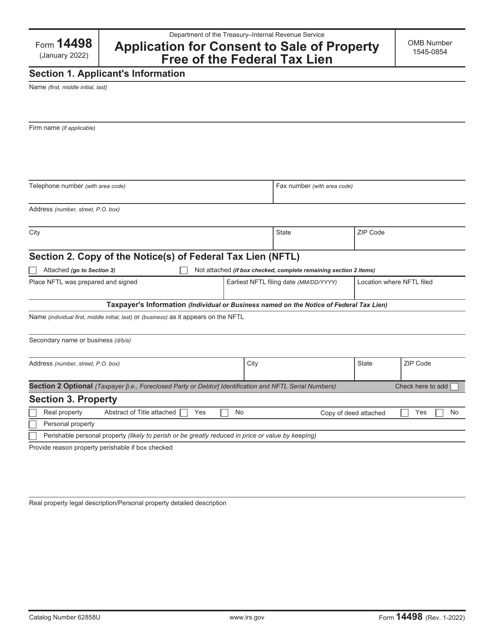

This is a formal IRS document that outlines the details of a property foreclosure.

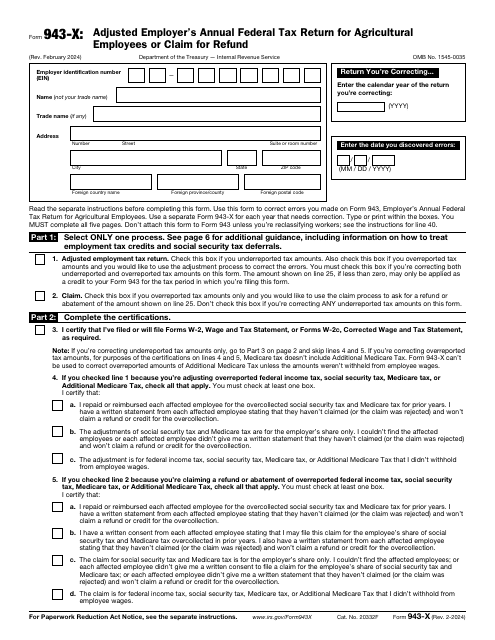

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

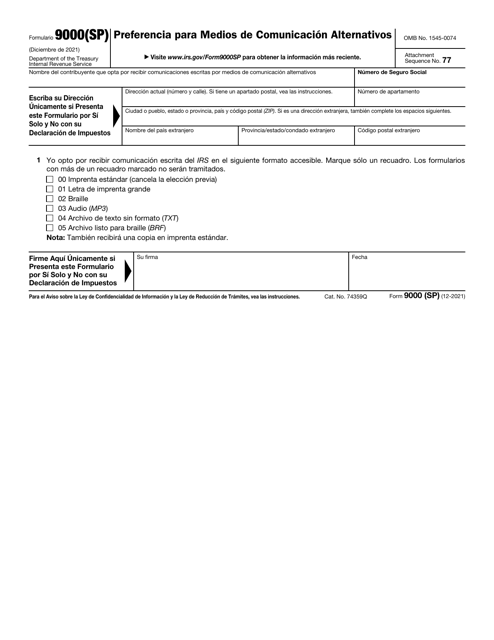

This document is for requesting preference for alternative communication methods with the IRS. (in Spanish)

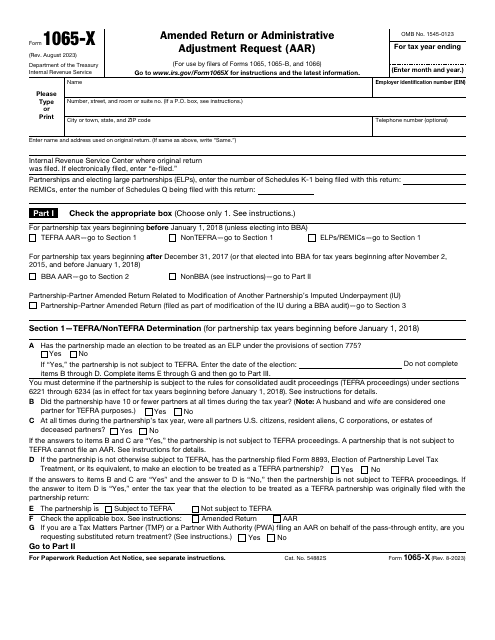

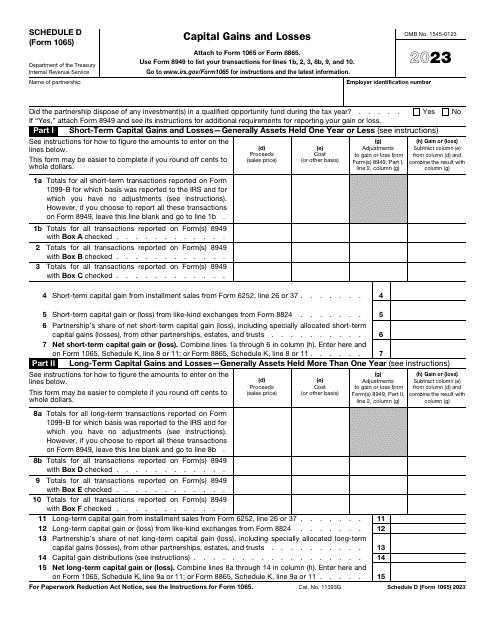

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

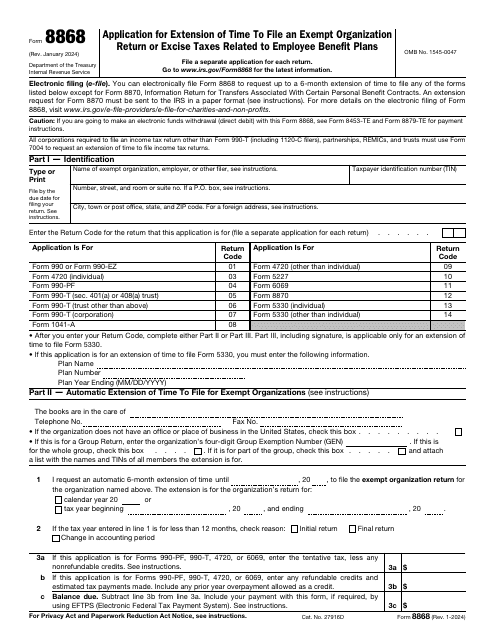

This is a formal IRS form that exempt organizations have to use to inform the fiscal authorities about late filing of a return.

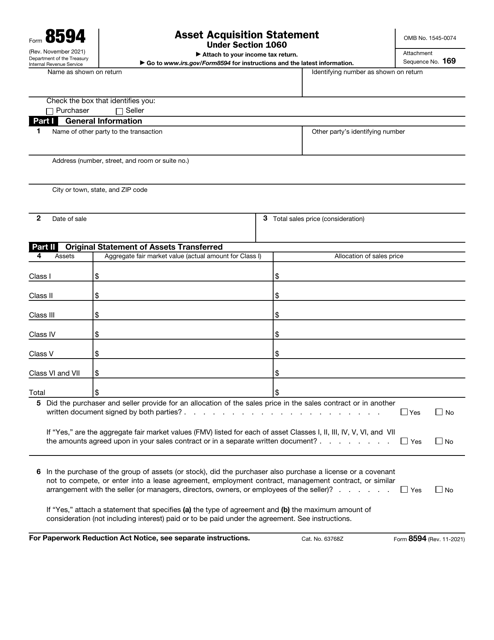

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

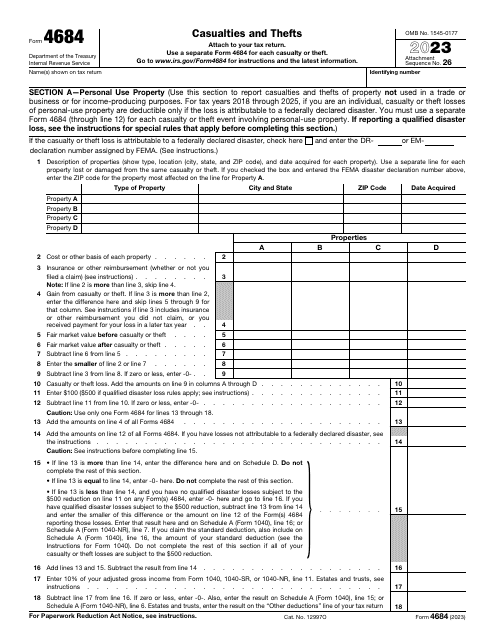

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.