U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

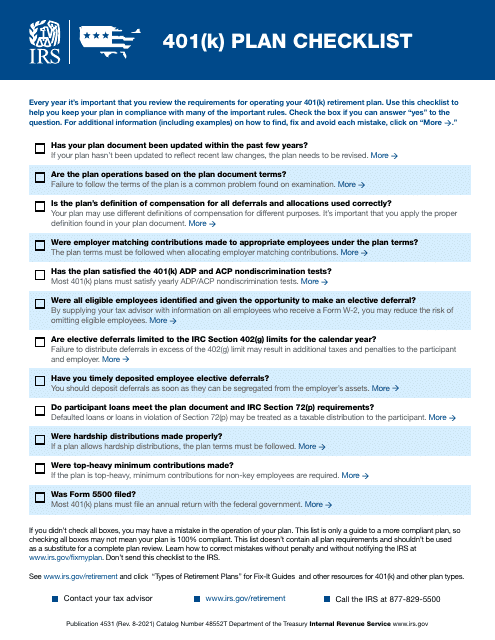

This document is a checklist that outlines the key steps and considerations for setting up and managing a 401(k) retirement plan. It provides guidance on eligibility, contribution limits, investment options, and other important factors to consider when establishing a 401(k) plan for your employees. Use this checklist to ensure compliance and maximize the benefits of your company's retirement plan.

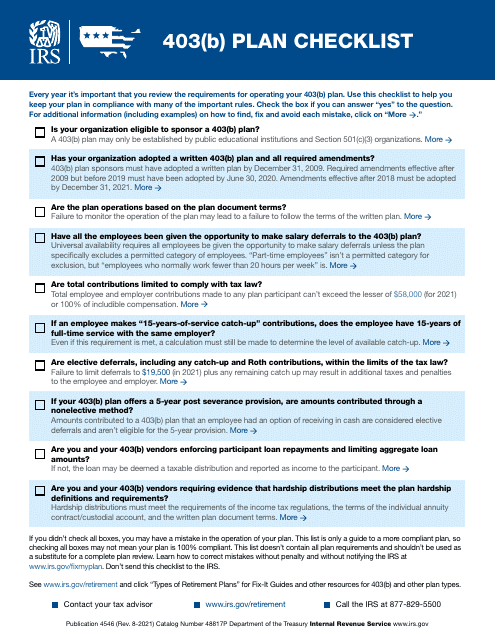

This document is a checklist for individuals who have or are interested in a 403(b) retirement plan. It provides a list of important items to consider and actions to take when managing a 403(b) plan.

This form is used for partnership to request modification of imputed underpayments under IRC Section 6225(C).

This document is used for requesting a refund from the Internal Revenue Service (IRS) for a settlement or government concession.

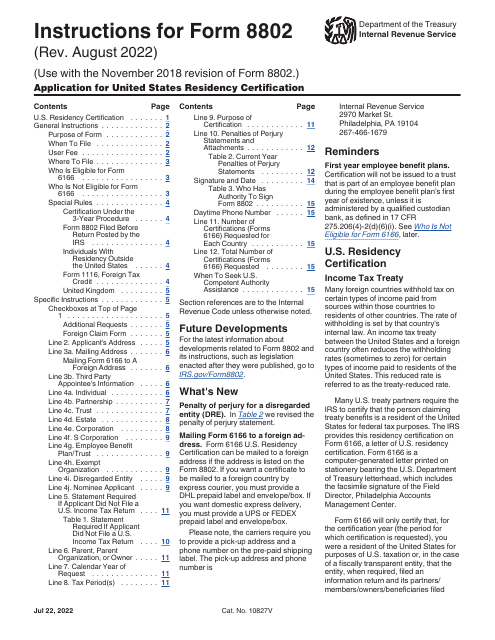

These are the official instructions for IRS Form 8802 and is used to help certify an applicant's United States residency.

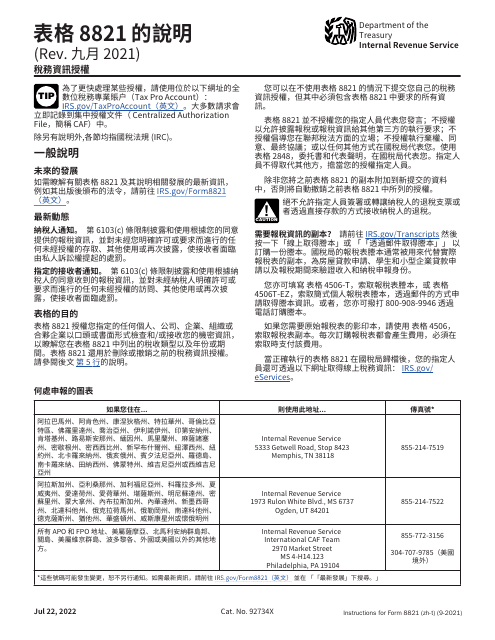

This document provides instructions for completing the IRS Form 8821 Tax Information Authorization in Chinese. It explains how to authorize someone to access your tax information and guide you through the form filling process.

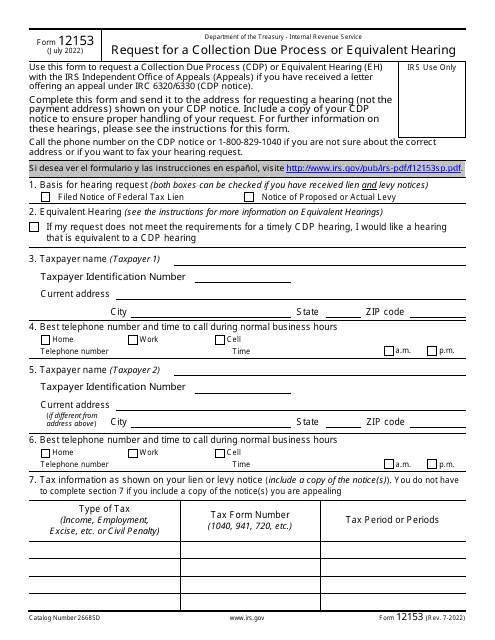

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

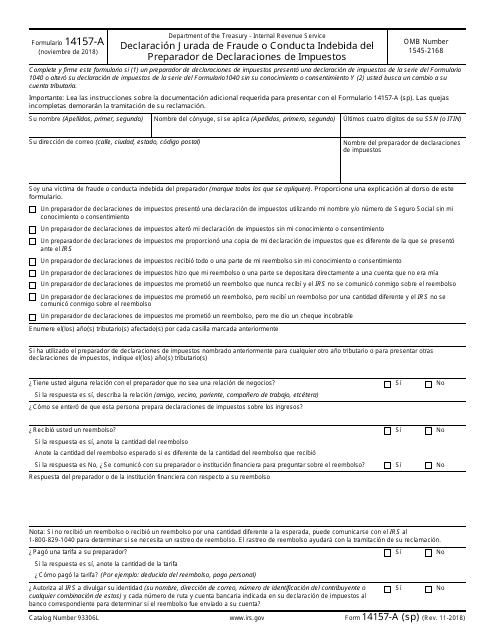

This type of document is a Spanish version of IRS Form 14157-A used for reporting fraud or misconduct by tax preparers.

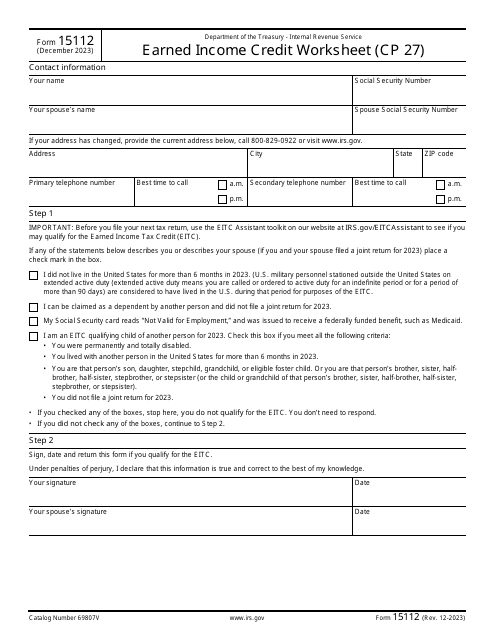

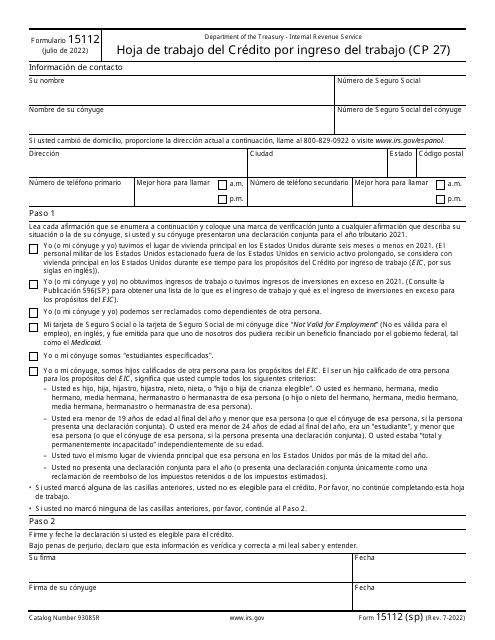

This Form is used for calculating the Earned Income Credit on your tax return.

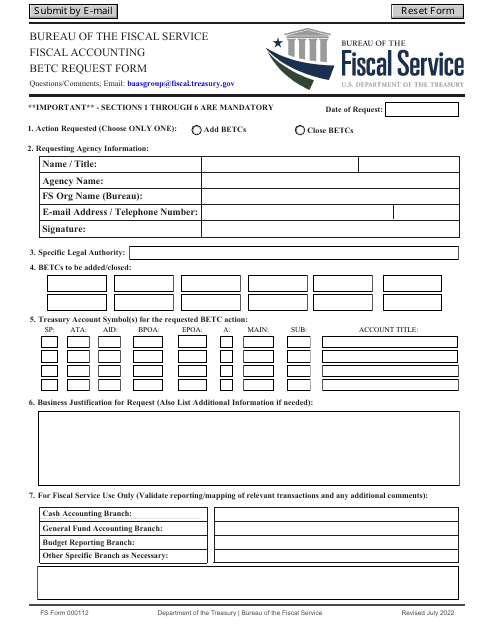

This form is used for requesting a betc (business expense tax credit) from the Federal Student Aid office.

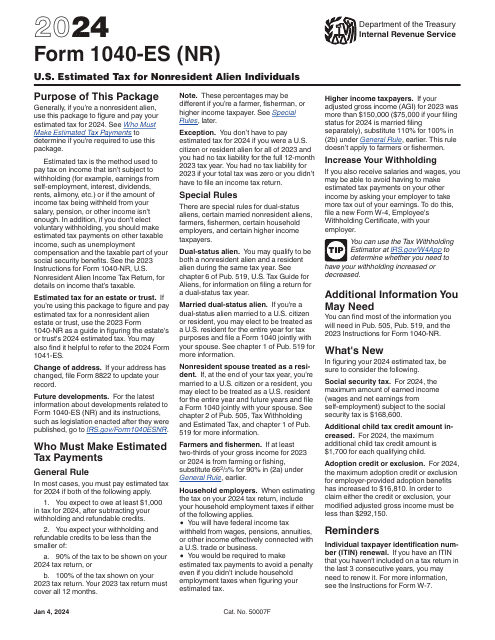

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

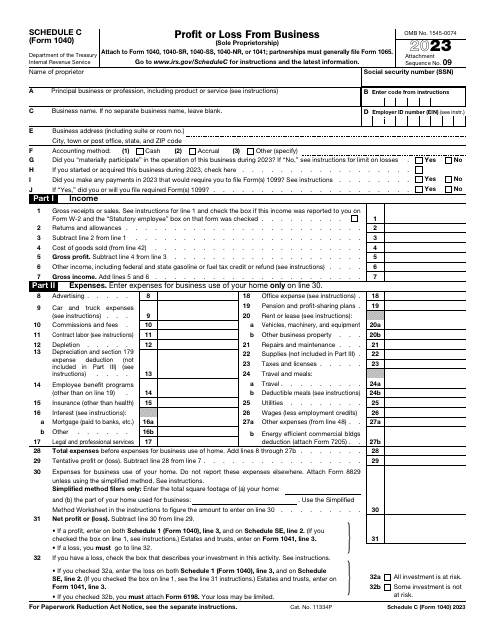

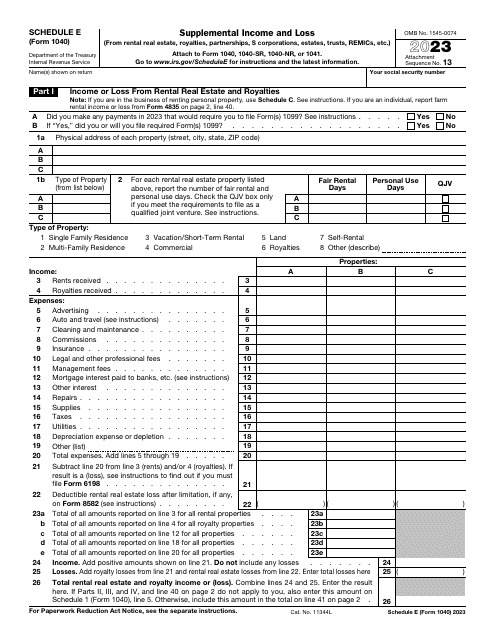

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

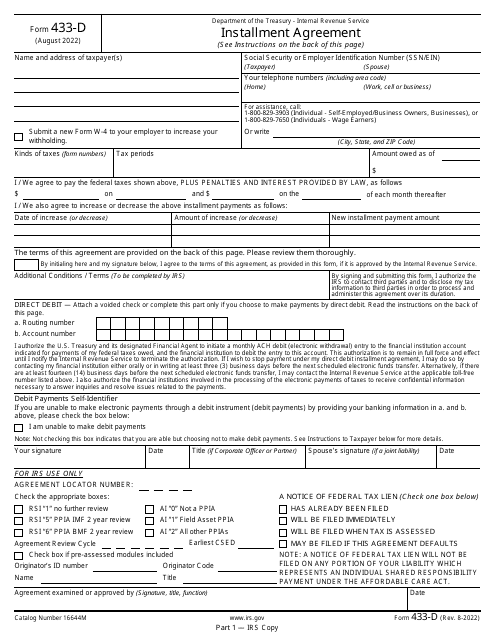

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

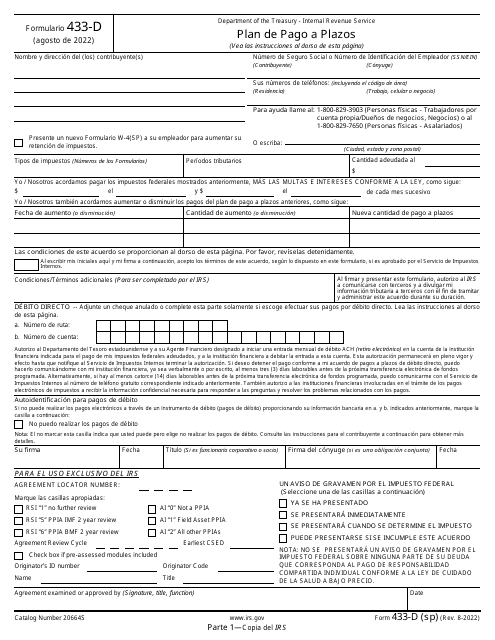

This Spanish document is used for setting up a installment payment plan with the IRS. It is known as IRS Form 433-D.