U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

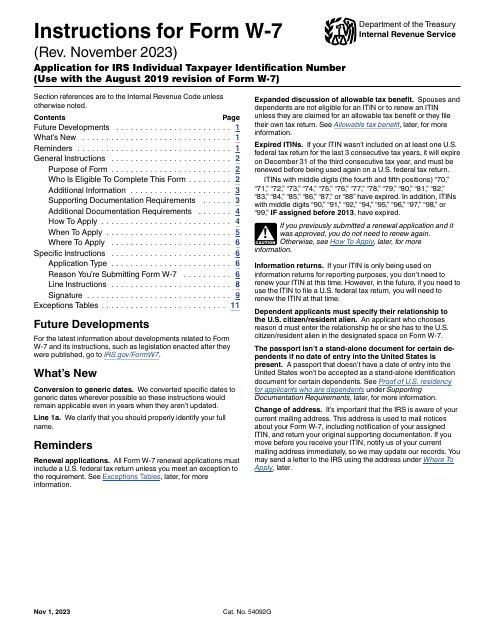

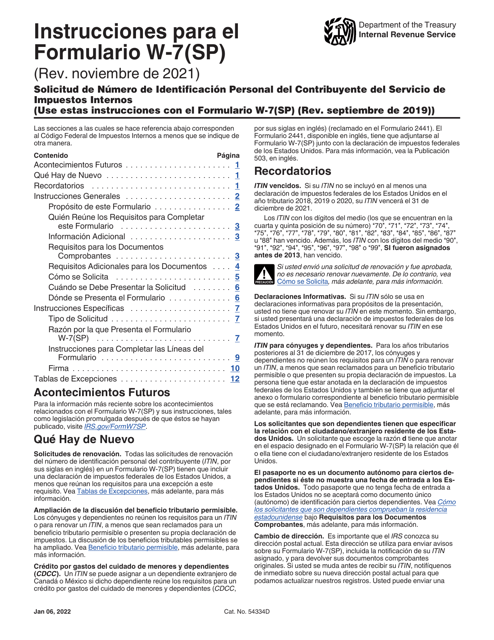

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

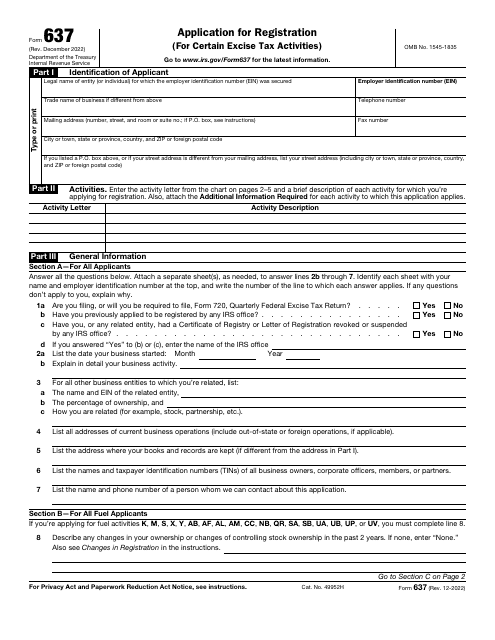

The purpose of this form is to provide filers with a Certificate of Registry or a Letter of Registration issued by the Internal Revenue Service (IRS), which they will then receive after the IRS processes and approves their application.

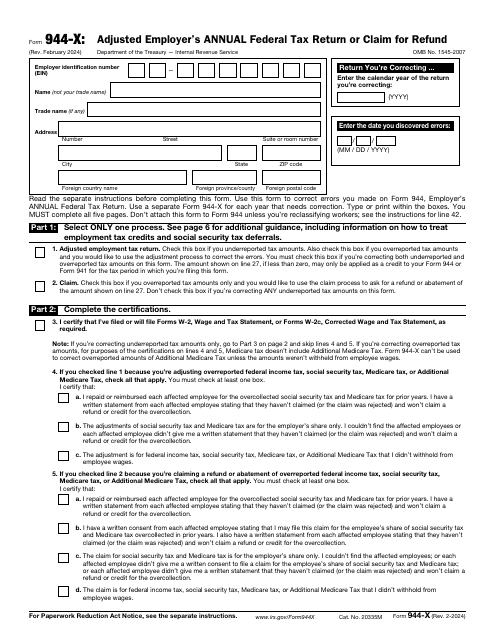

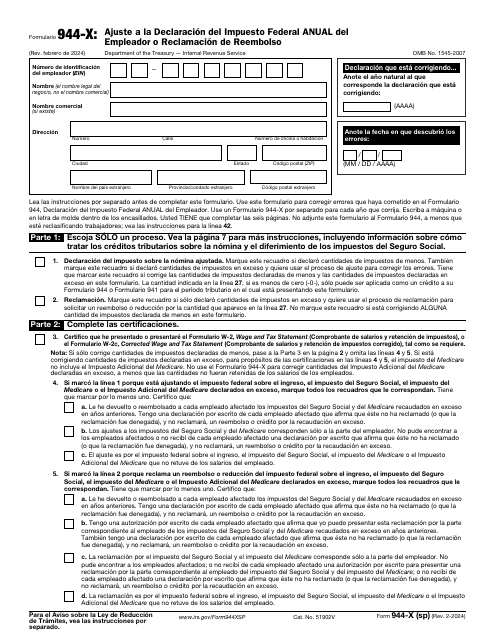

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.