U.S. Department of the Treasury Forms

The U.S. Department of the Treasury is responsible for managing the country's finances. It plays a critical role in promoting economic growth and stability, ensuring the financial security of the United States, and collecting taxes. The department oversees the production of currency, enforces federal finance and tax laws, manages the public debt, and administers various programs related to economic and financial policy. It also works to combat financial crimes, enforce trade sanctions, and provide financial assistance to individuals and businesses during specific economic situations.

Related Articles

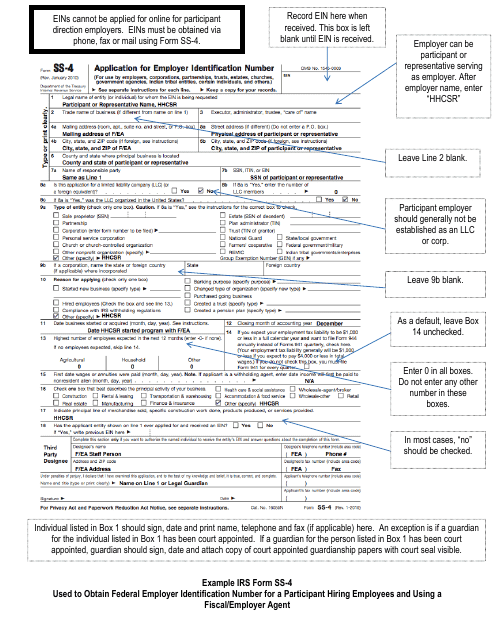

Documents:

2369

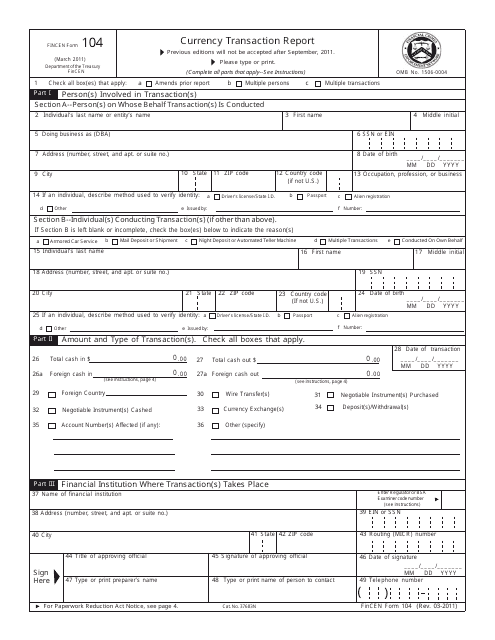

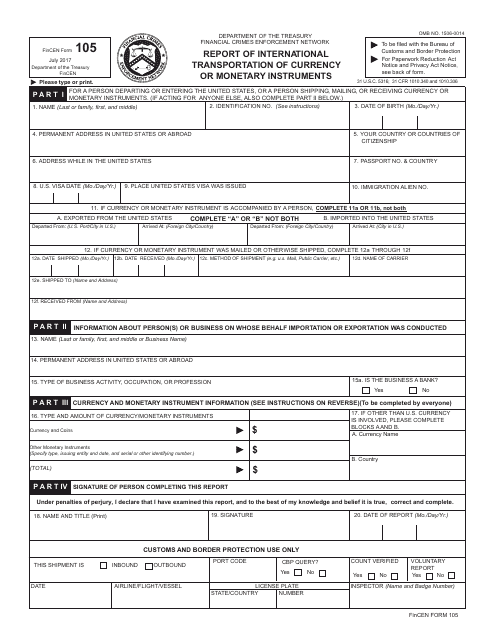

This Form is used for reporting large cash transactions to the Financial Crimes Enforcement Network (FinCEN).

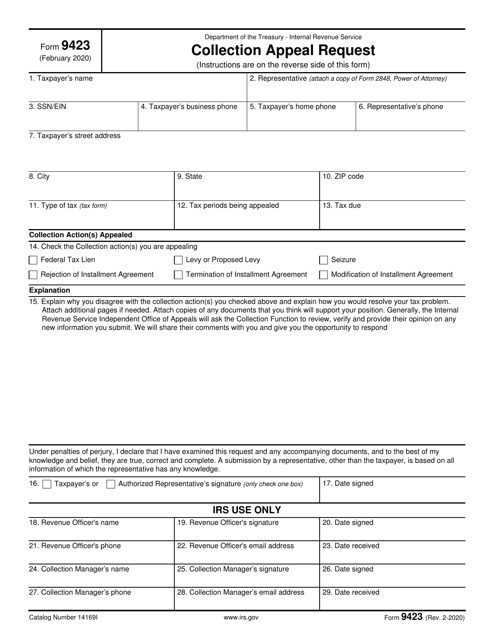

This is a written document prepared by a taxpayer with a tax debt, if they want to prevent or stop certain fiscal enforcement actions against them due to their failure to pay tax on time.

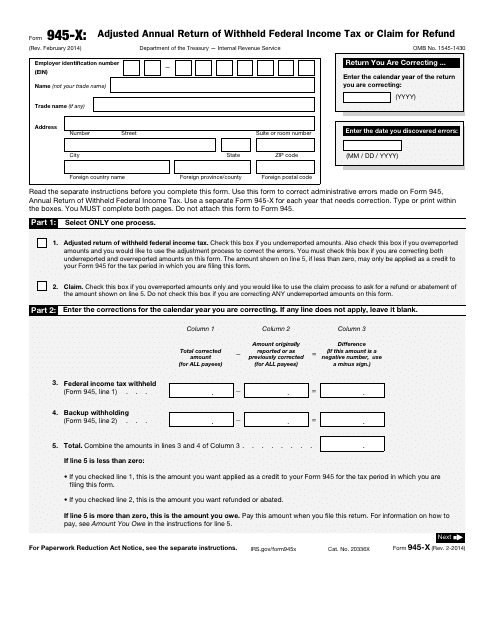

This is a fiscal form used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

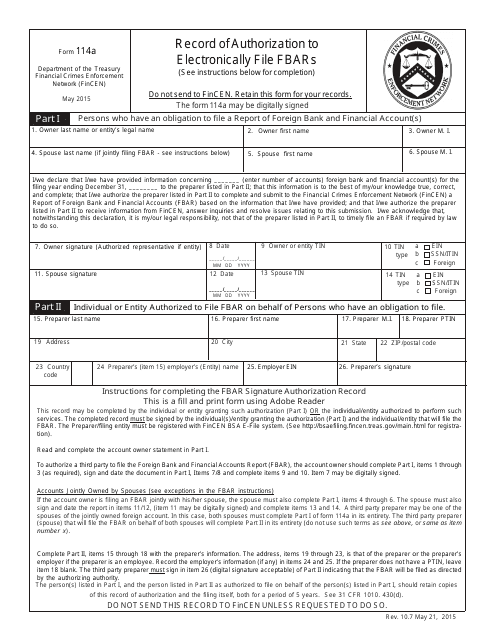

Use this document for releasing your authorization to an individual or organization to complete and file the FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). You can file using a third-party preparer.

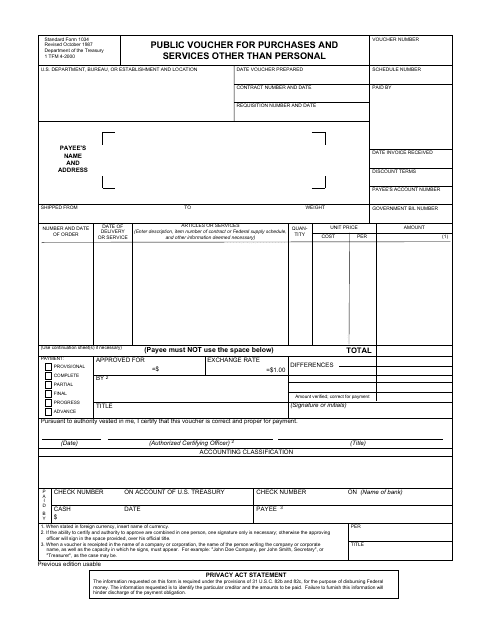

This form is used for reimbursing purchases and services made on behalf of the government that are not personal in nature.

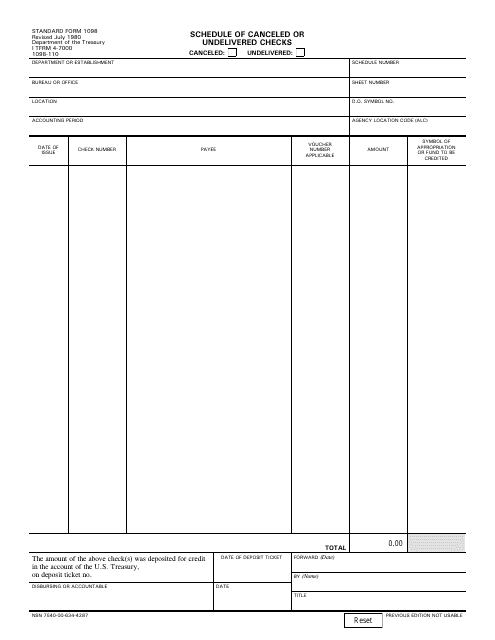

This form is used for reporting canceled or undelivered checks. It is used to document check payments that were not received by the intended recipient or were canceled by the payer.

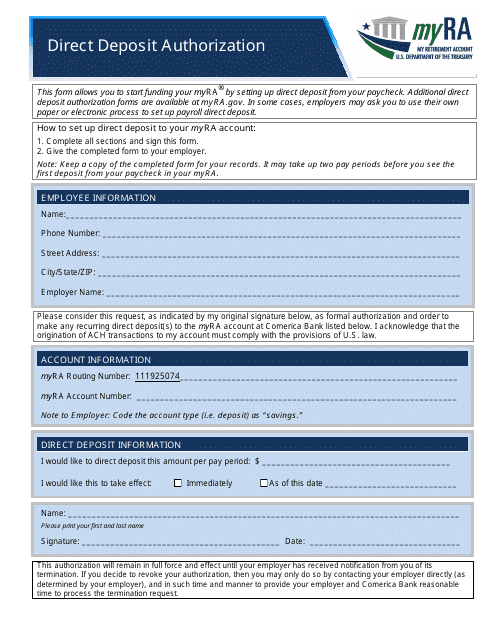

This Form is used for authorizing direct deposit of funds into your Myra account.

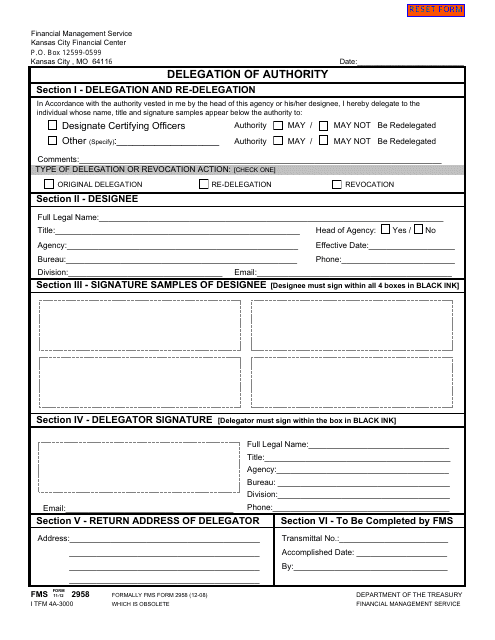

This form is used for delegation of authority. It is a document that grants someone the power to make decisions or take actions on behalf of another person or organization.

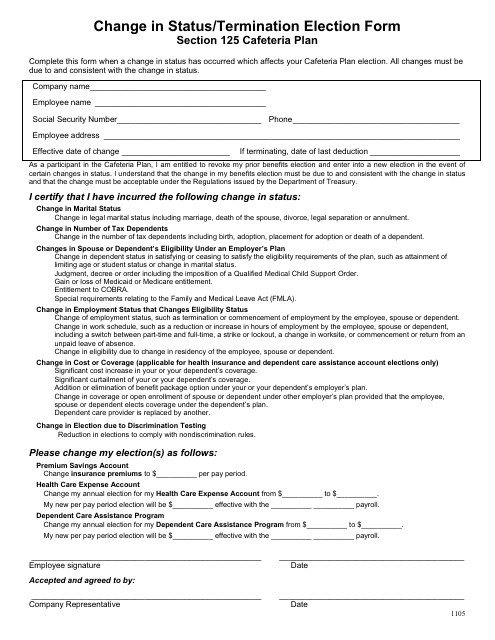

This document is used for making changes to your Section 125 Cafeteria Plan, such as updating your benefits or terminating the plan.

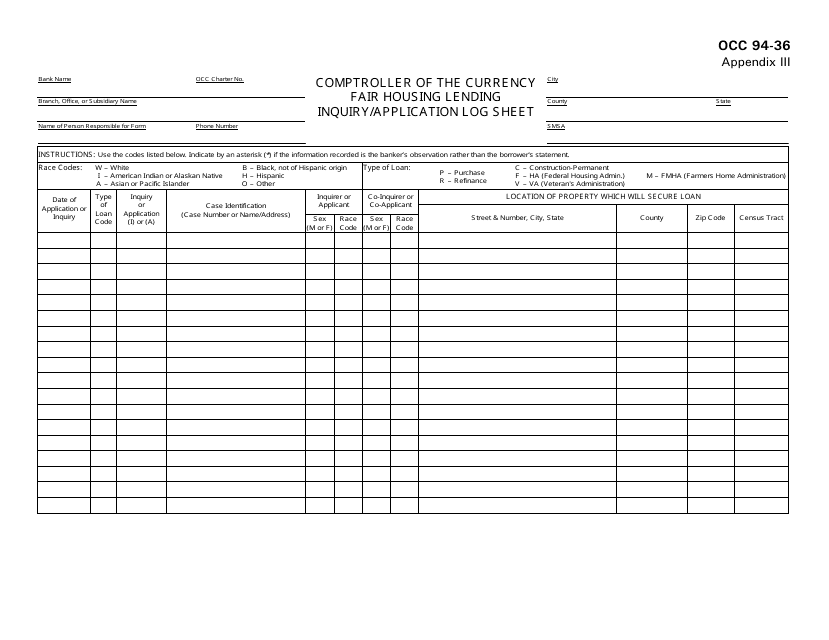

This form is used for tracking and recording inquiries and applications related to fair housing lending. It helps to ensure compliance with fair housing laws and regulations.

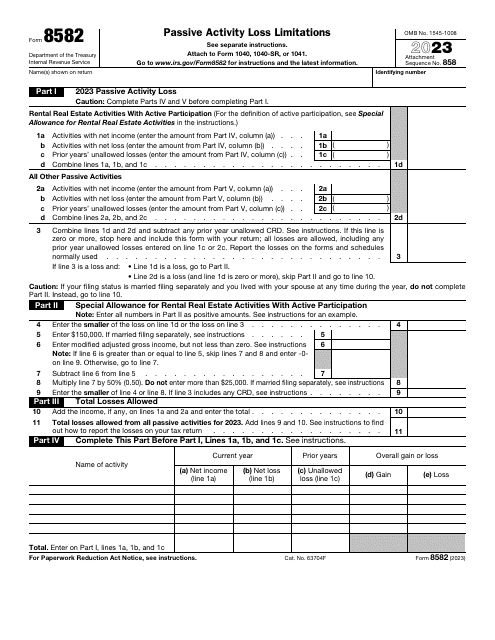

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This form is used for reporting the transportation of currency or monetary instruments during international travel.

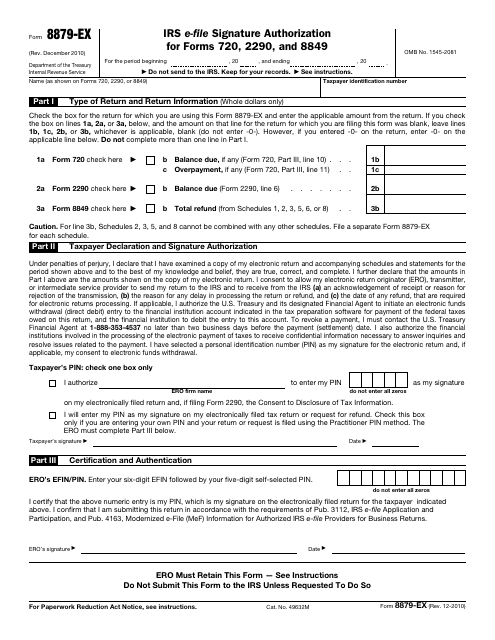

This form is used for IRS e-file signature authorization for Forms 720, 2290, and 8849. It allows taxpayers to authorize the electronic filing of these specific forms with the IRS.

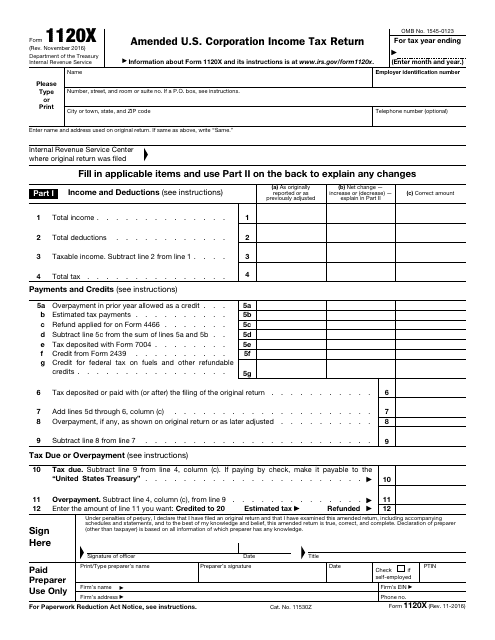

This document is filled out by corporations in order to correct Form 1120 (or Form 1120-A), a claim for a refund, or an examination, as well as to make certain elections after the prescribed deadline.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

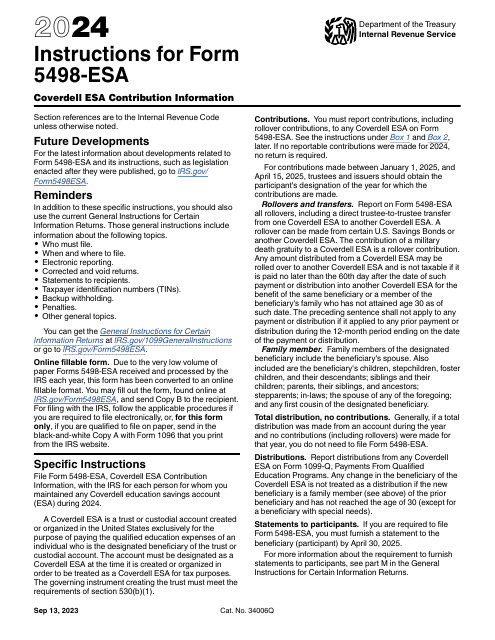

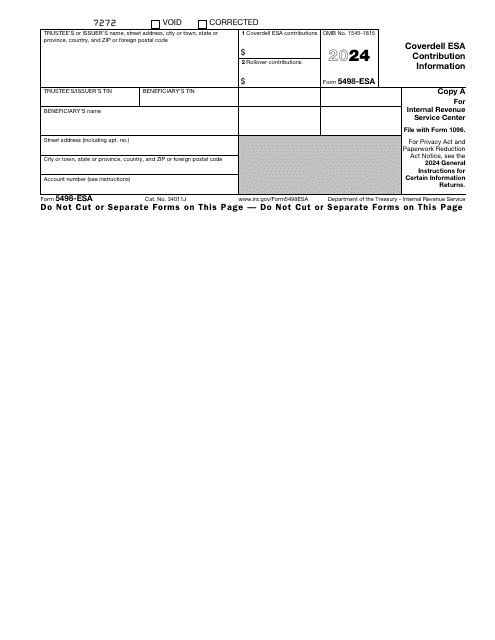

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

This is an IRS form that includes the details of an installment sale.

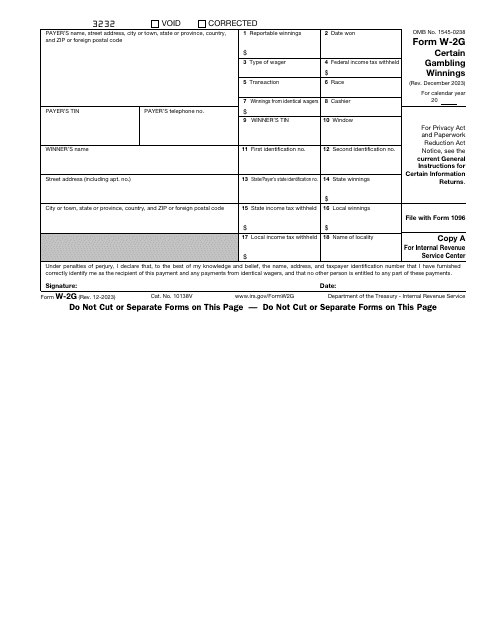

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

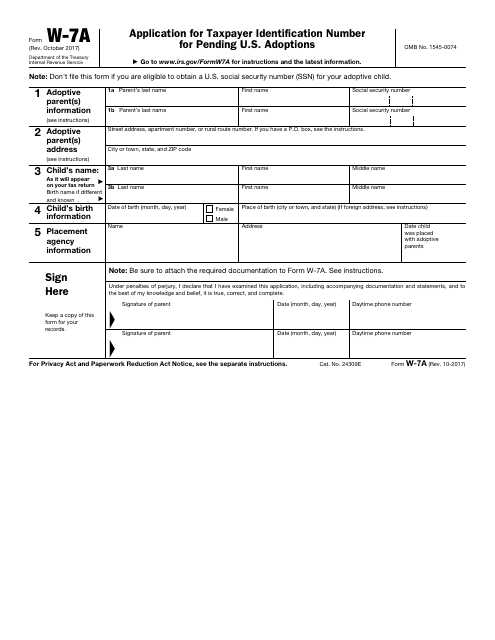

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.

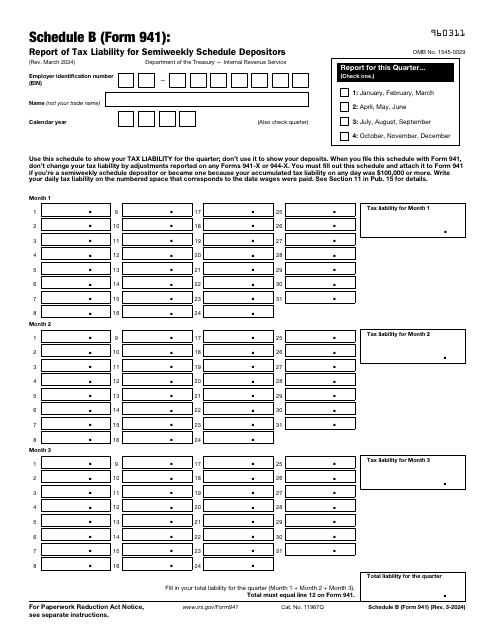

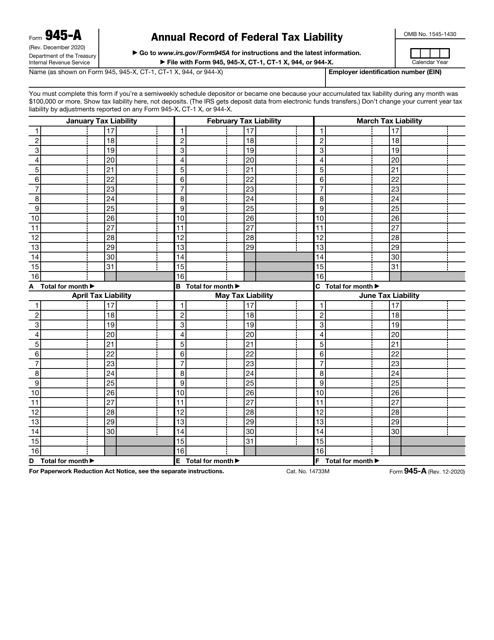

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a formal IRS document that outlines the details of a property foreclosure.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

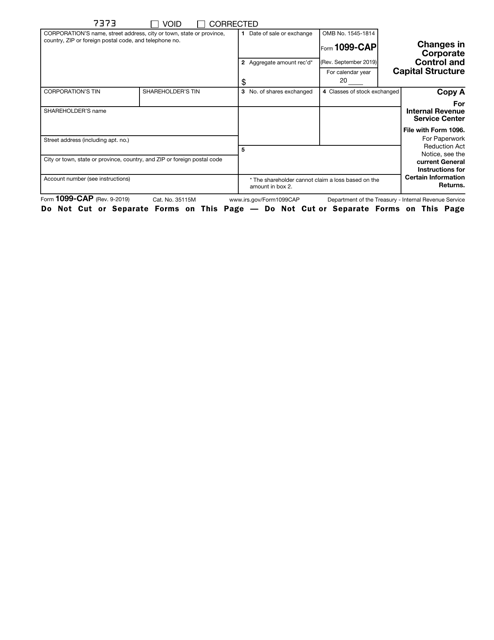

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

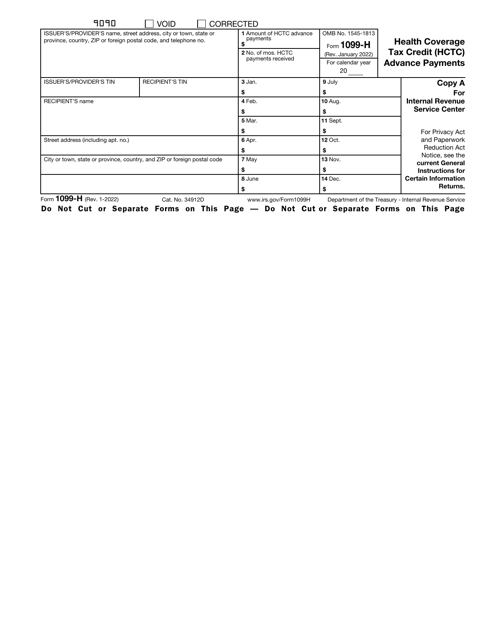

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.