Tax Deductions Templates

Documents:

1801

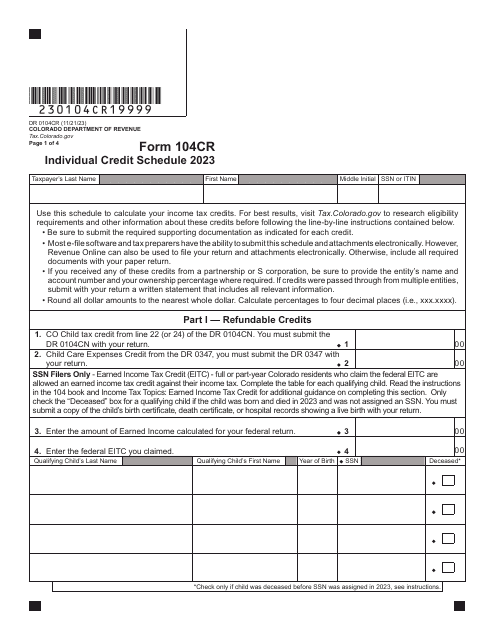

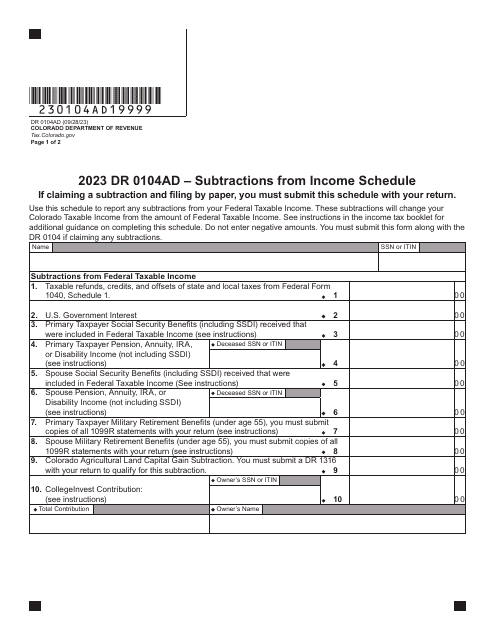

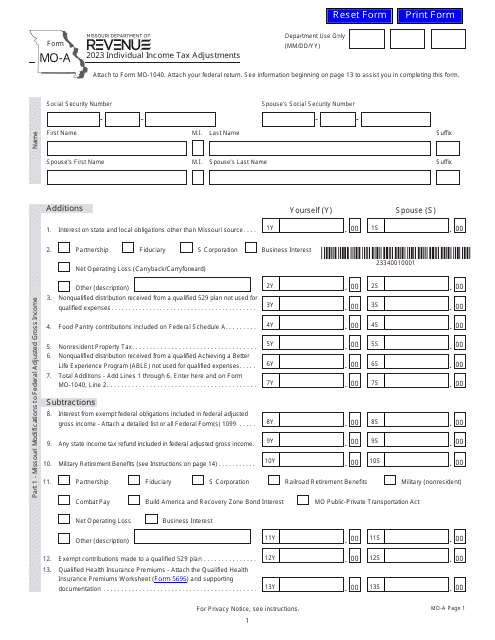

This is an application developed by the Colorado Department of Revenue. The form is used to report subtractions from Federal Taxable Income.

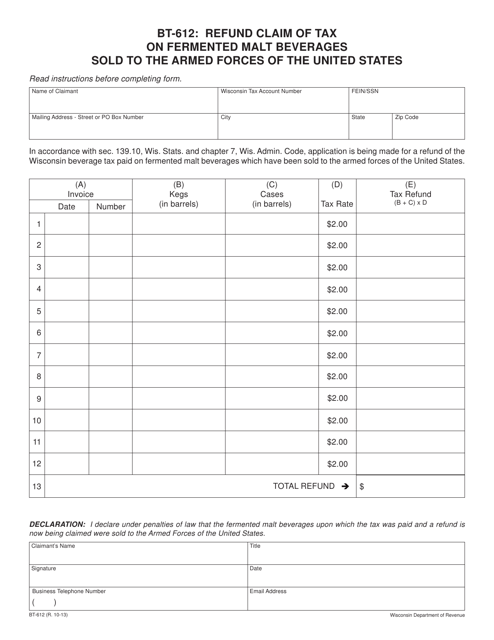

This Form is used for claiming a refund of tax on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

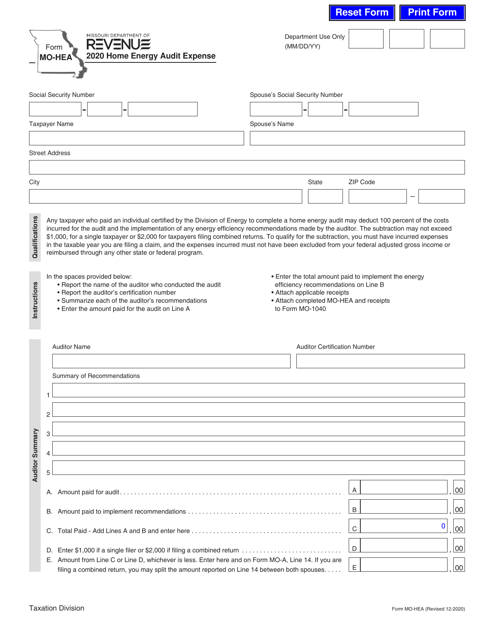

This form is used for reporting expenses related to a home energy audit in Missouri.

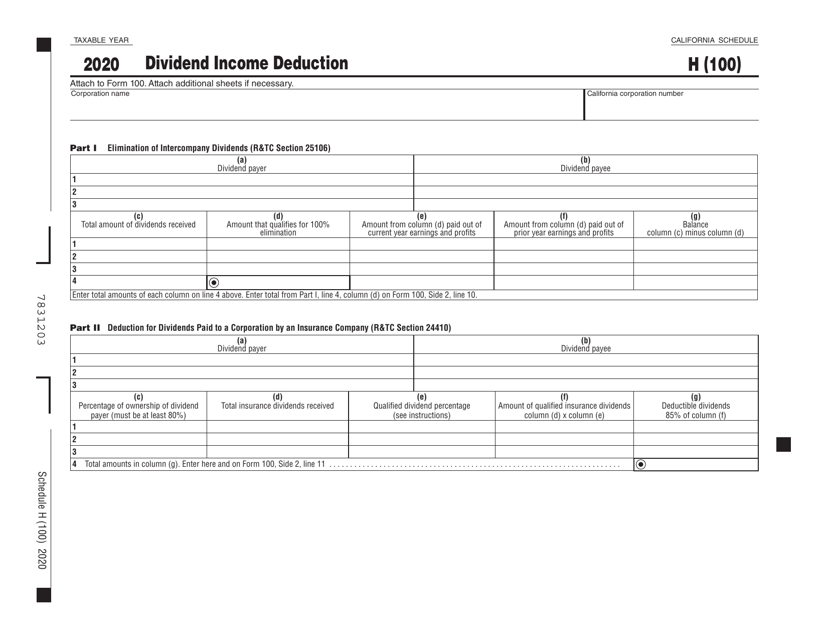

This form is used for claiming a deduction on dividend income in the state of California.

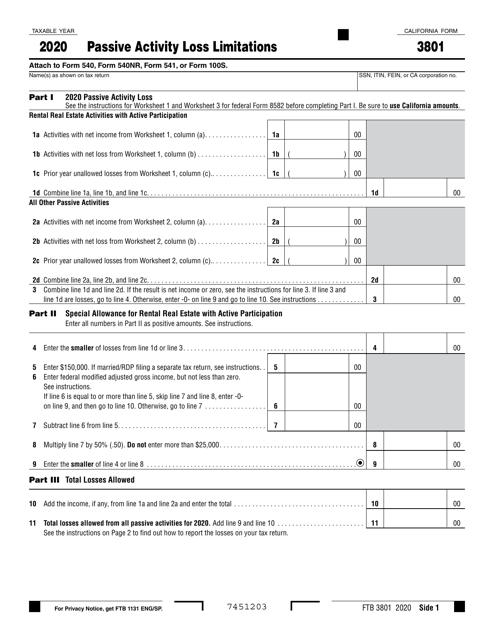

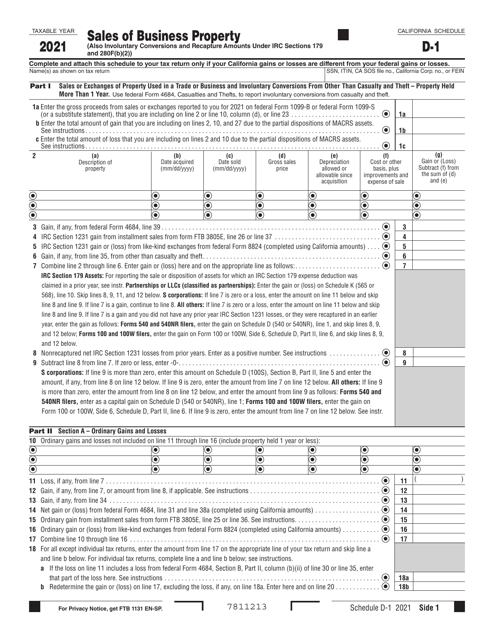

This form is used for reporting passive activity loss limitations in California.

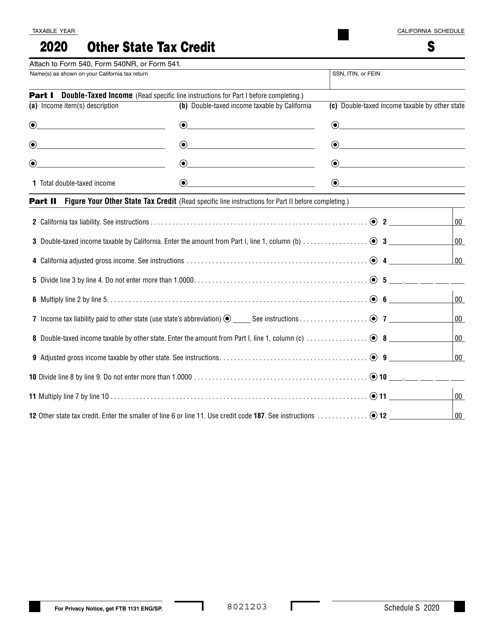

This document is used for claiming a tax credit for taxes paid to another state while being a resident of California.

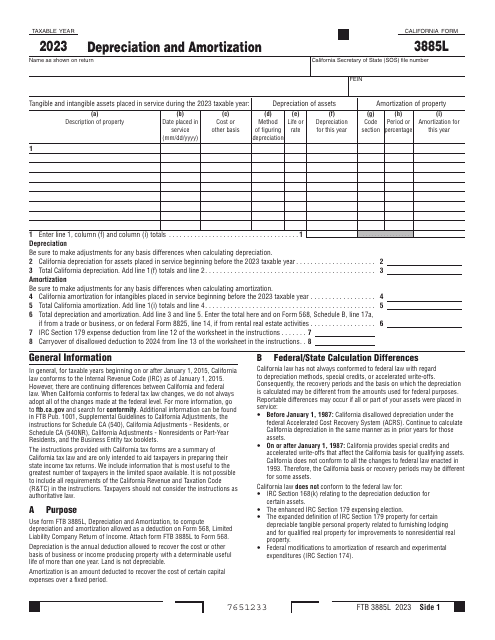

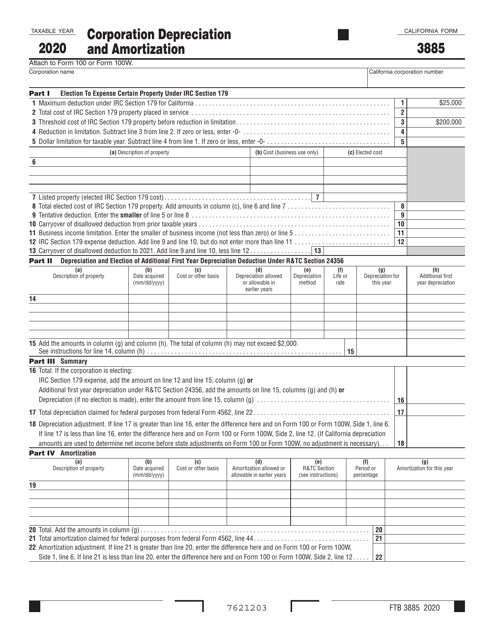

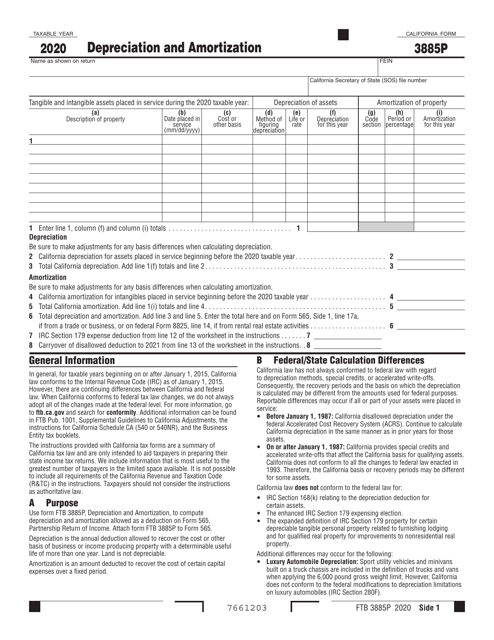

This Form is used for reporting depreciation and amortization expenses for California state tax purposes.

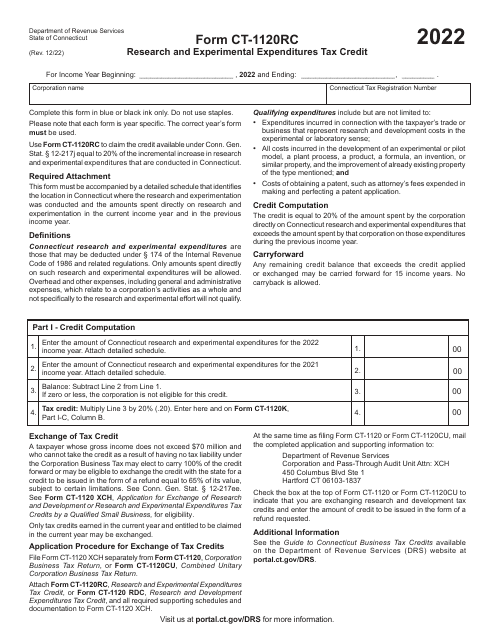

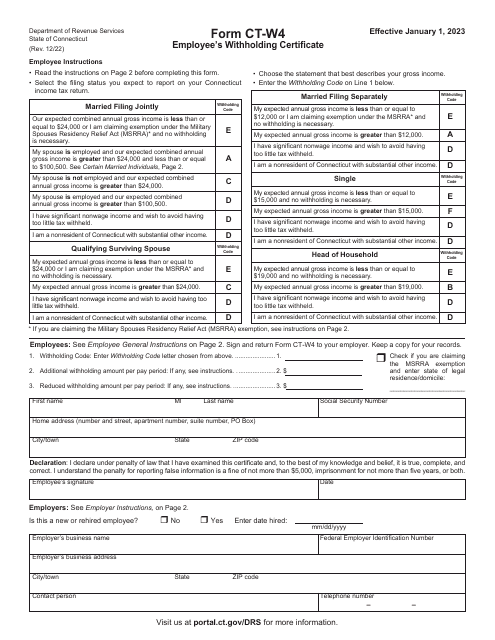

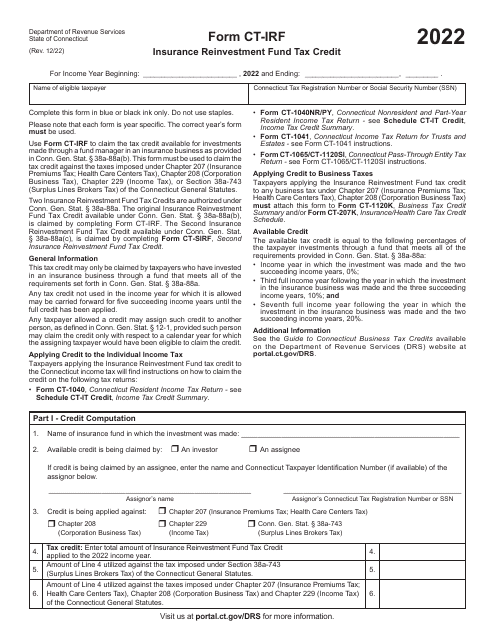

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

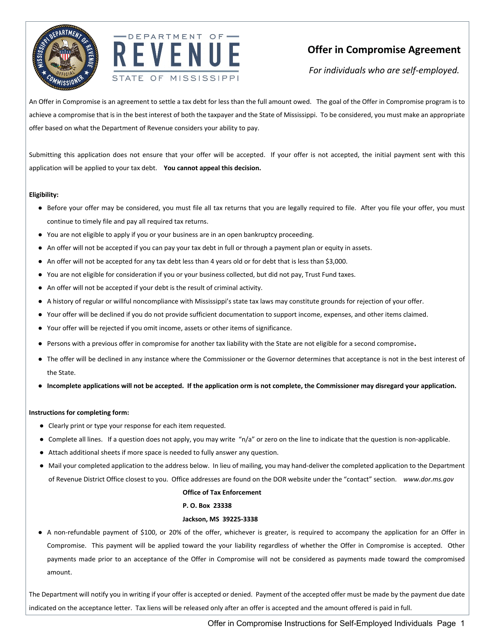

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

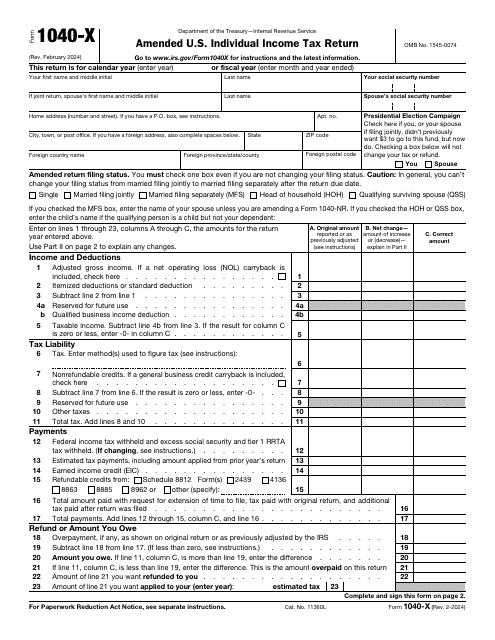

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

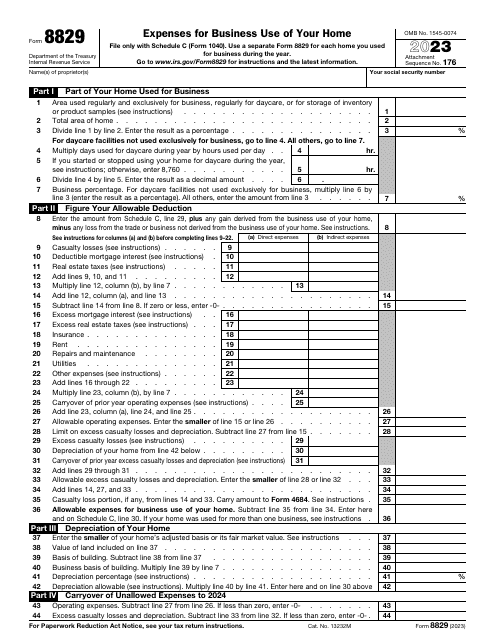

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.