Tax Deductions Templates

Documents:

1801

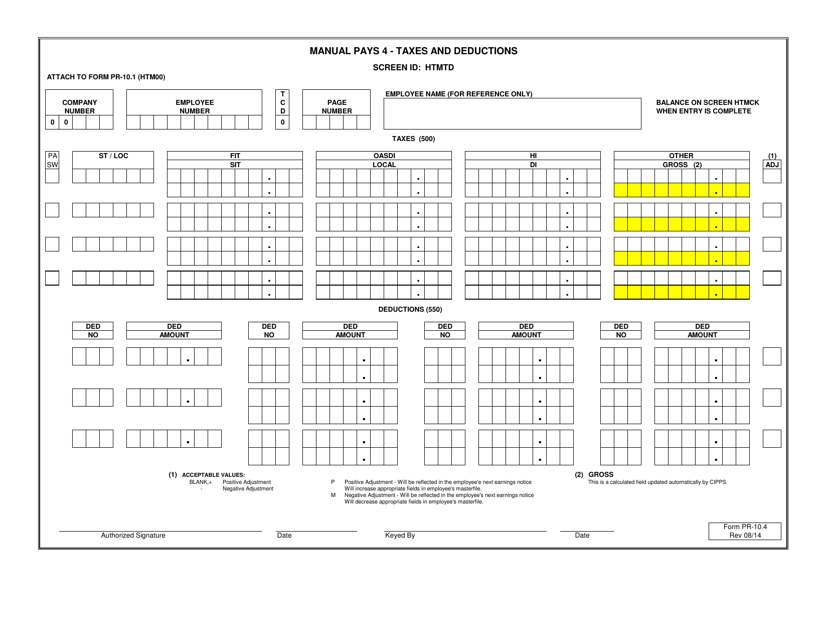

This document is used for reporting and calculating taxes and deductions for residents of Virginia. It provides guidelines and instructions for filling out the PR-10.4 form, ensuring accurate reporting of income and deductions.

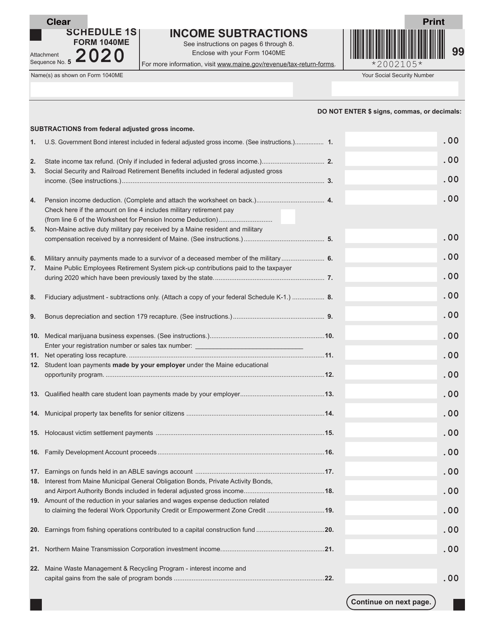

This form is used for reporting income subtractions specific to the state of Maine on your Form 1040ME tax return.

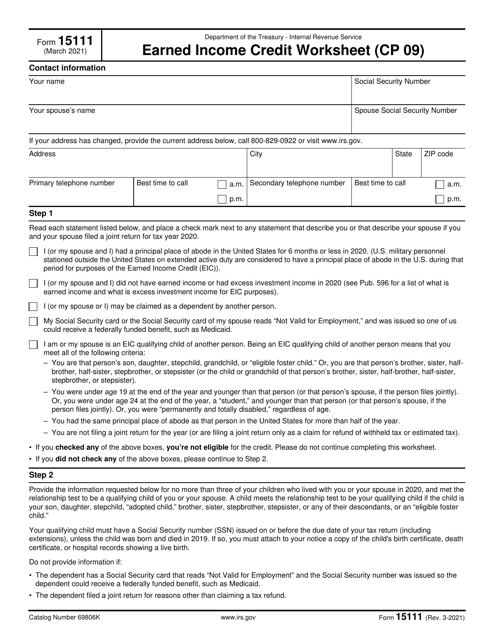

This form is used to calculate the Earned Income Credit for eligible taxpayers.

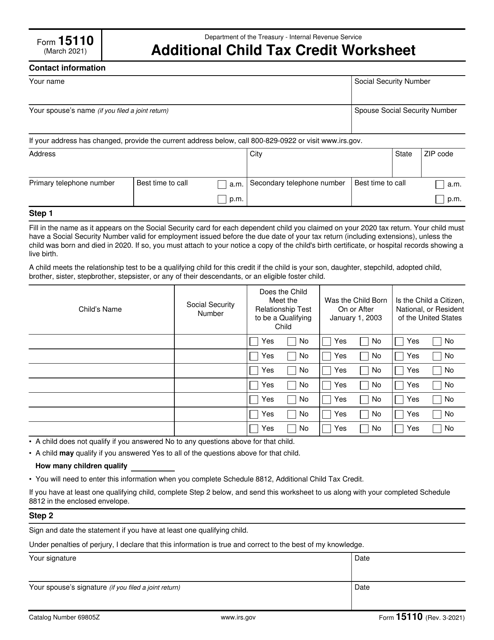

This form is used for calculating the additional child tax credit.

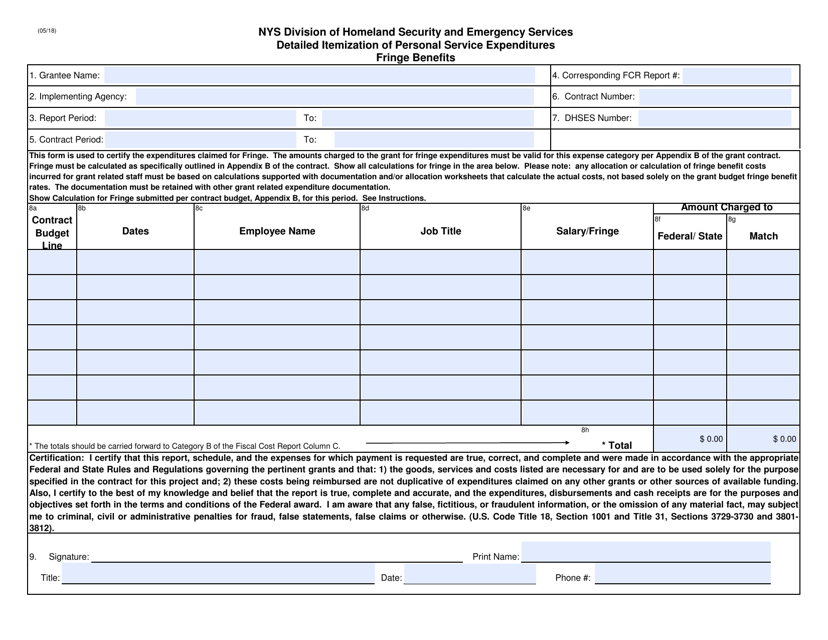

This document provides a detailed breakdown of personal service expenditures, including fringe benefits, specifically for individuals residing in New York.

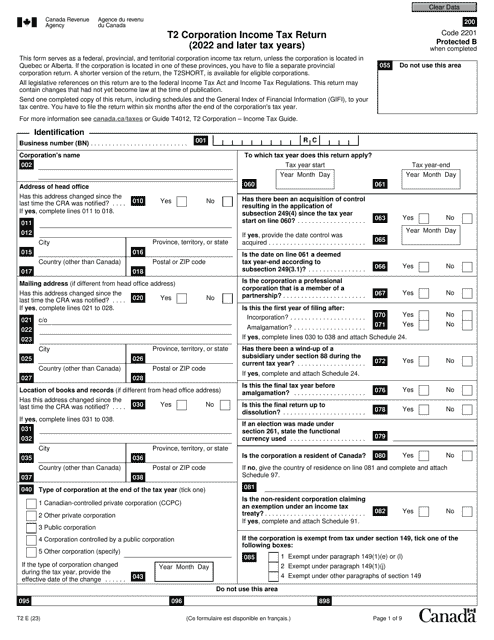

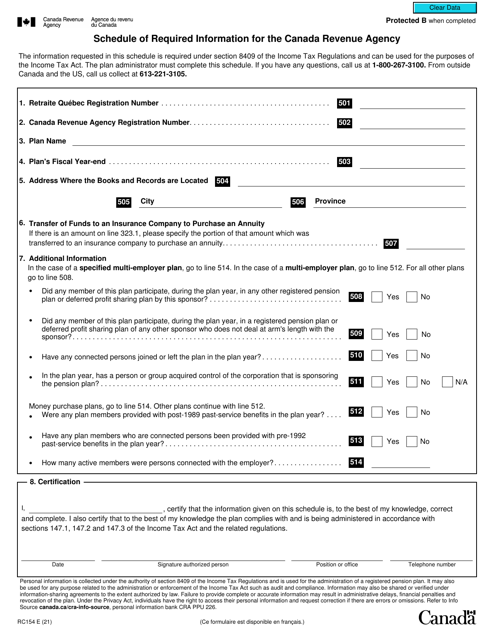

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

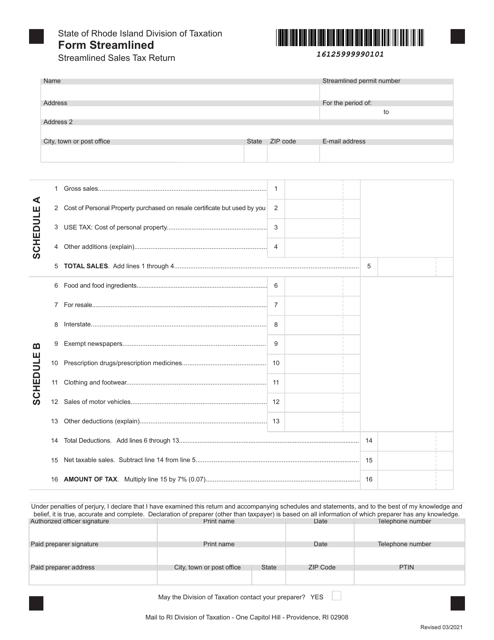

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

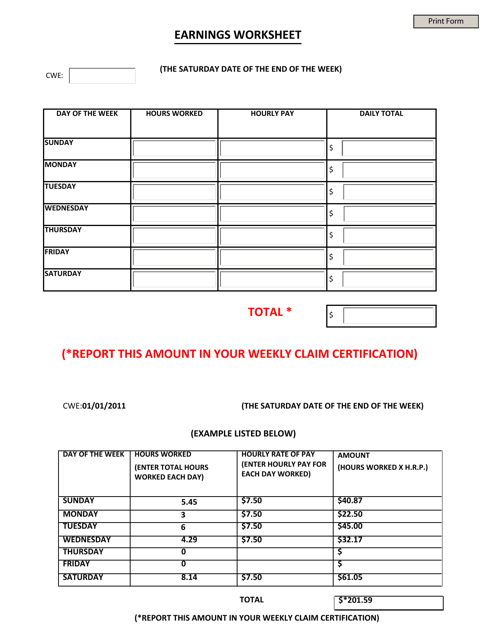

This document is used to calculate and track earnings in the state of South Carolina.

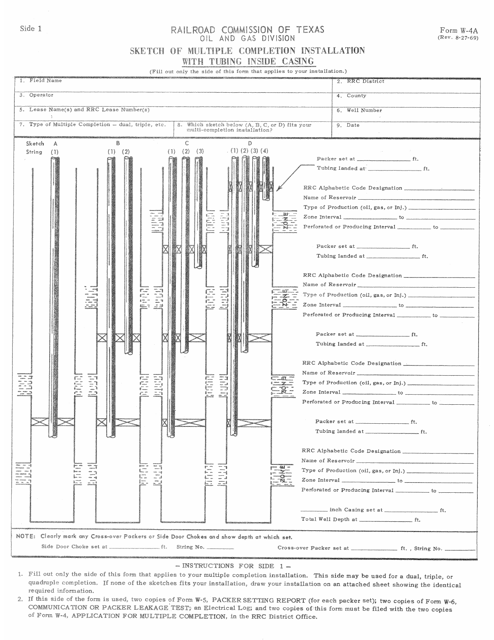

This form is used for sketching out the multiple completion installation of a project in Texas.

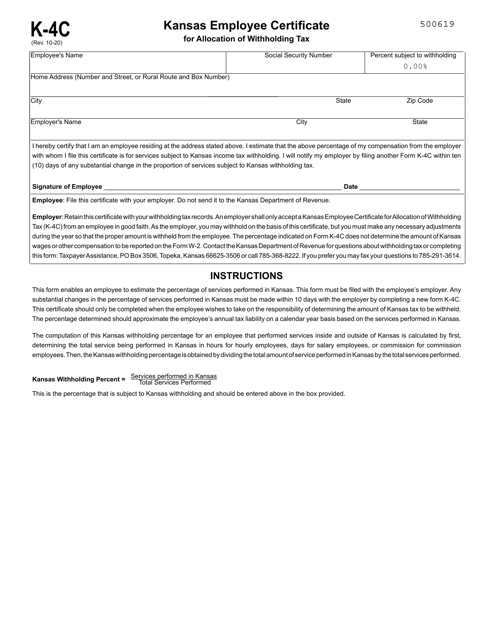

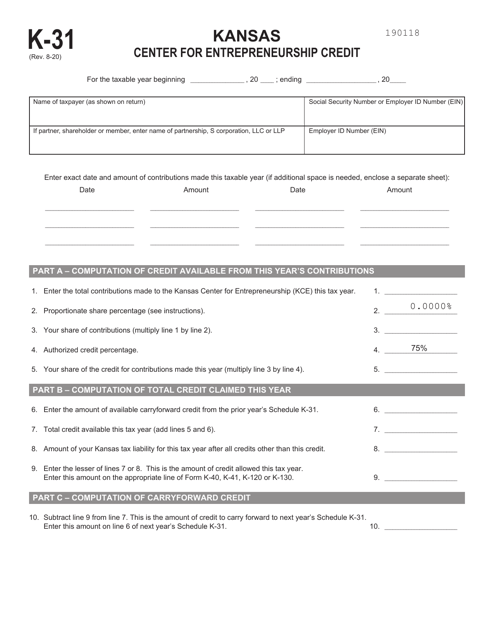

This form is used for Kansas employees to allocate their withholding tax.

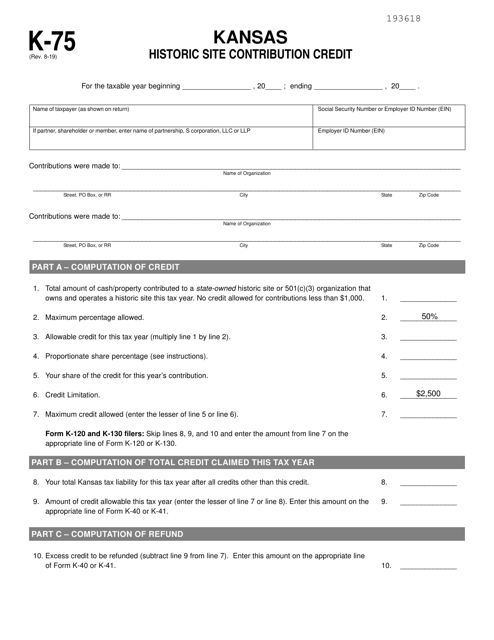

This document is used for claiming the Kansas Historic Site Contribution Credit in the state of Kansas. This credit is available for taxpayers who make contributions to qualified historic sites in Kansas.

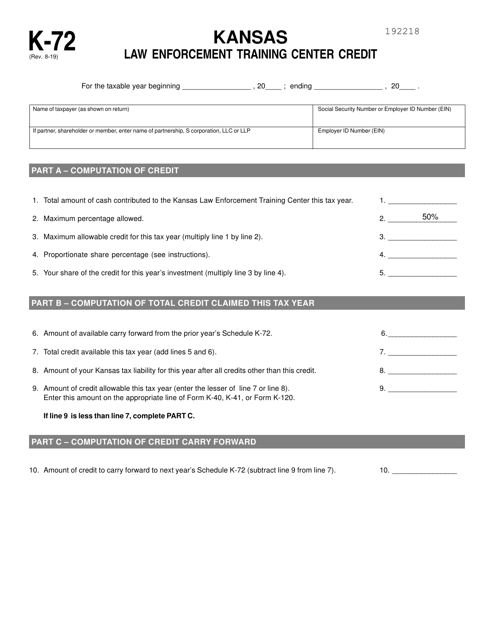

This form is used for claiming the Kansas Law Enforcement Training Center Credit in Kansas. This credit is available to individuals who have completed law enforcement training at the Kansas Law Enforcement Training Center.

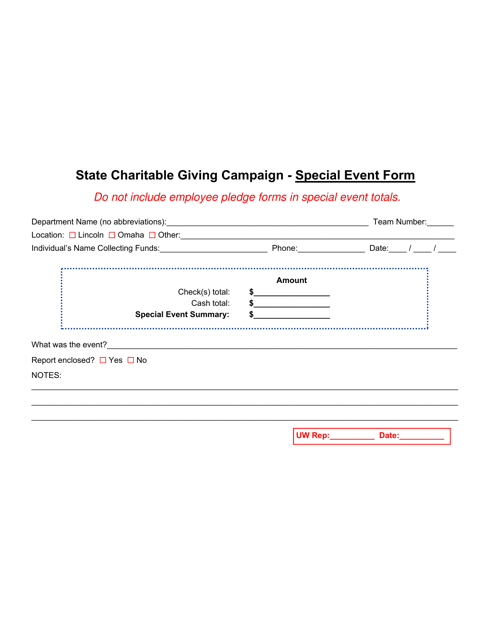

This document is used for reporting special events organized as part of the State Charitable Giving Campaign in Nebraska.

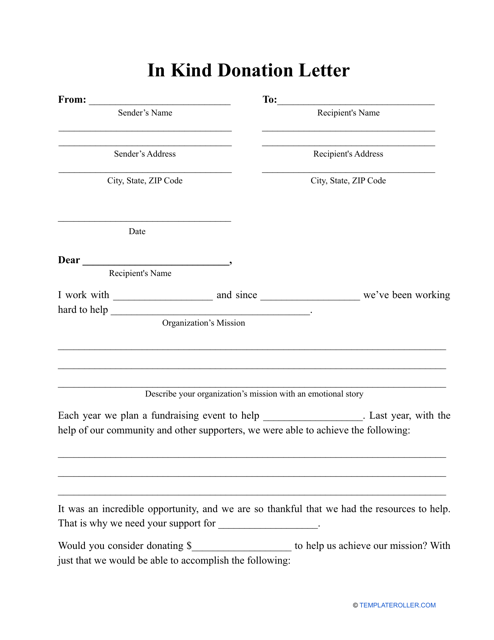

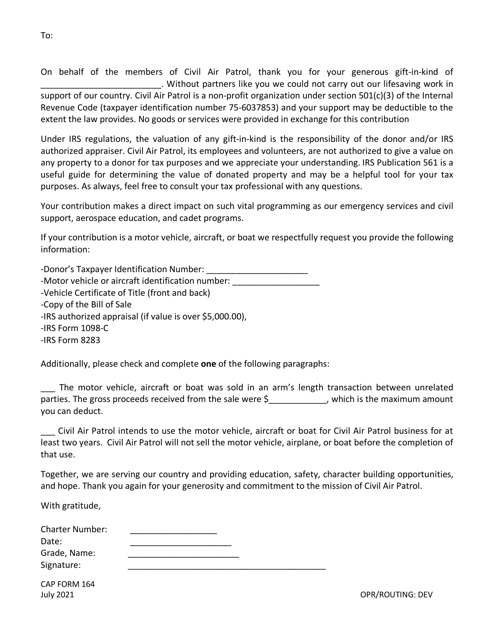

The purpose of this document is to notify donors that a charitable organization is in need of a certain service or good, and it will be thankful for a contribution that may be provided.

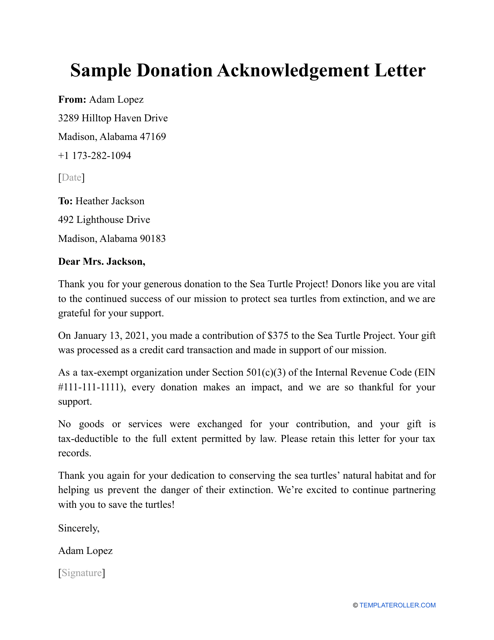

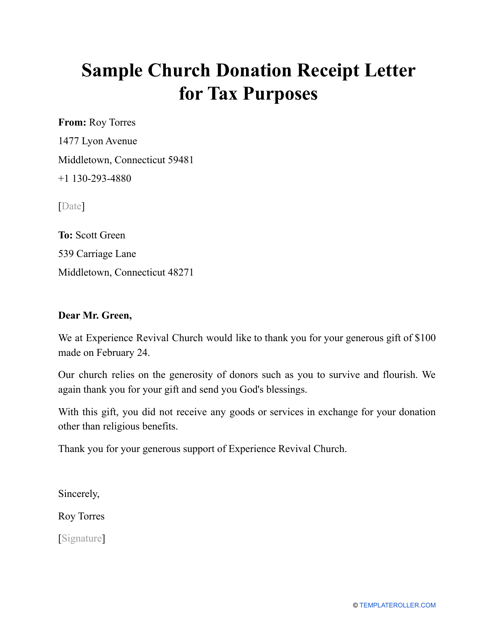

Individuals may use this type of letter as a reference when a charitable organization has received a contribution from a donor and they would like to acknowledge the donation.

This is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax deduction on their tax return.

This document is used for recording and acknowledging in-kind donations received by an organization. It helps to keep a record of the donated items and their value for tax purposes.