Tax Deductions Templates

Documents:

1801

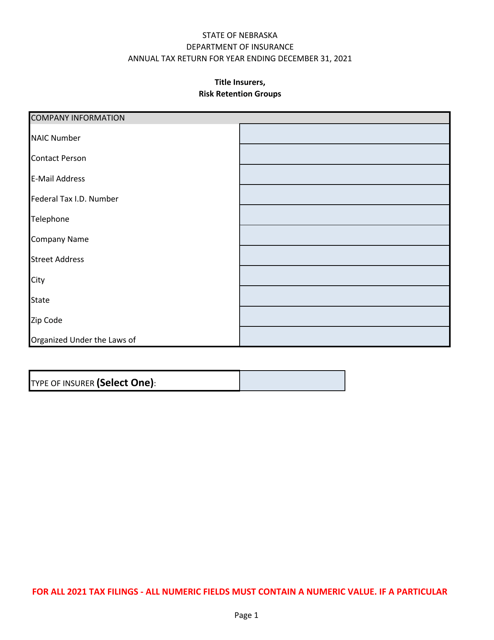

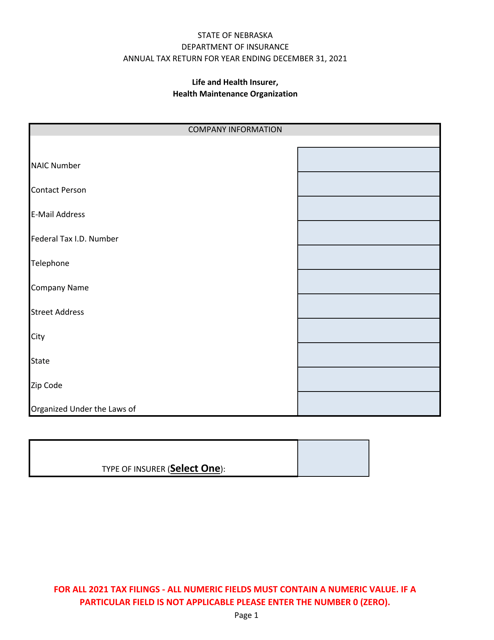

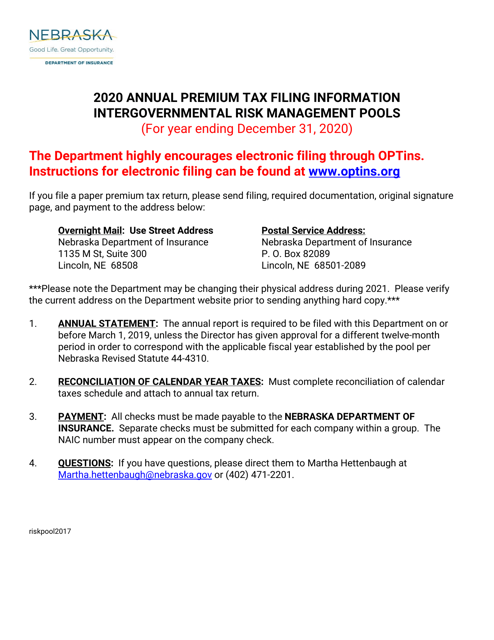

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

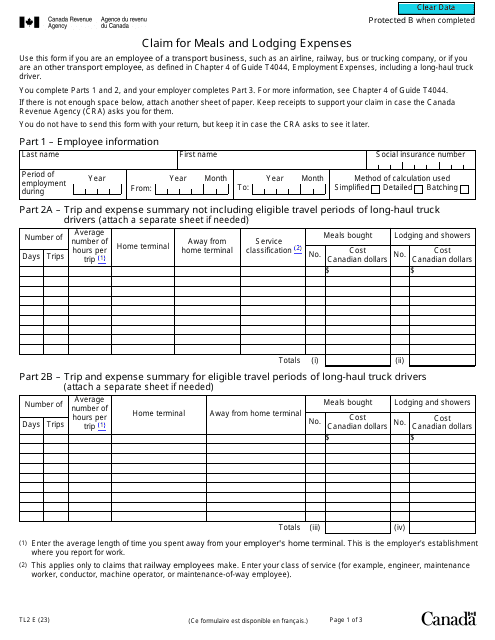

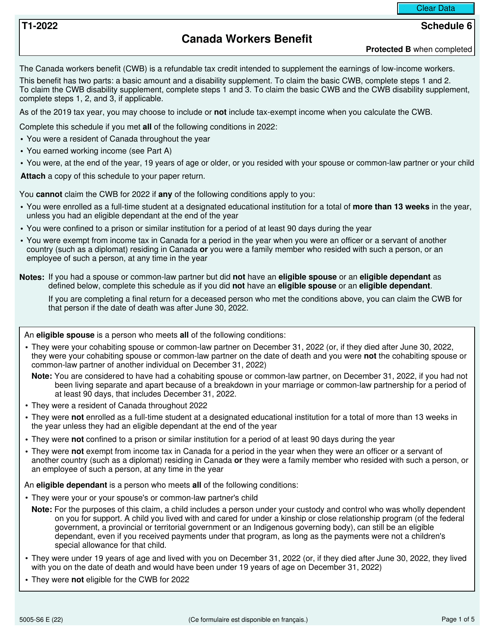

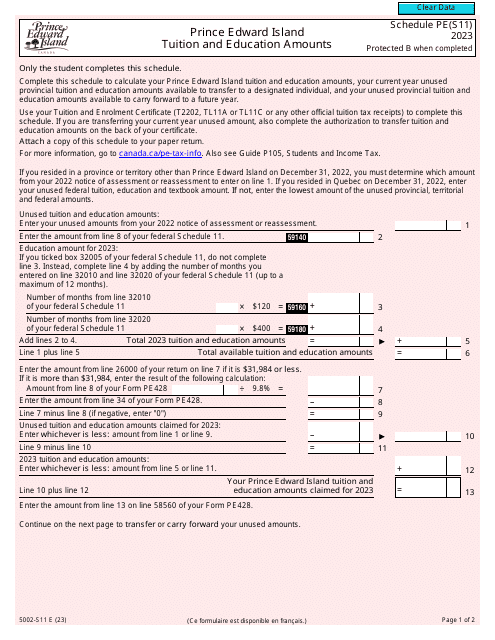

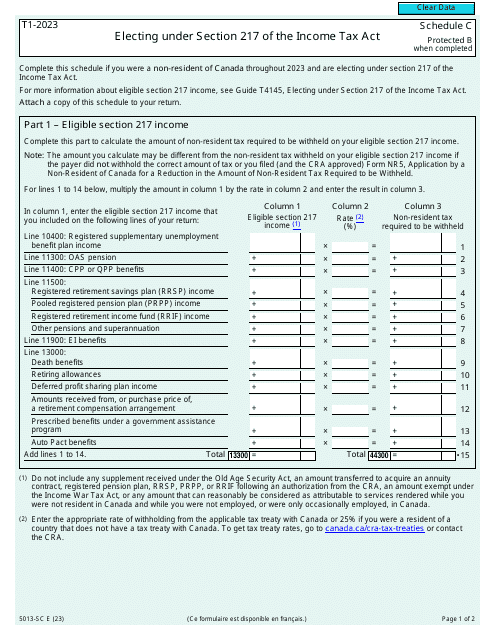

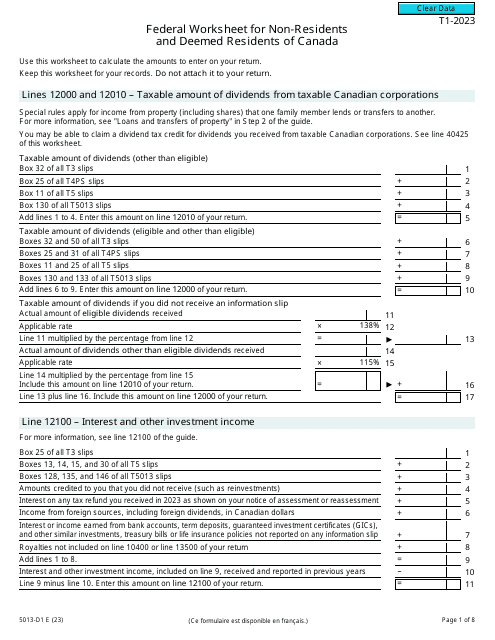

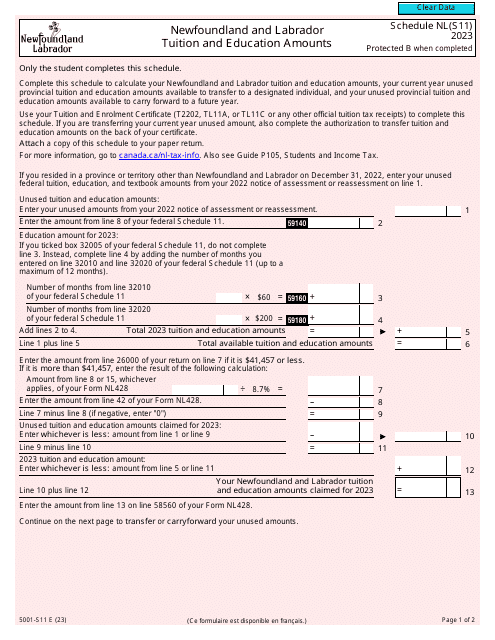

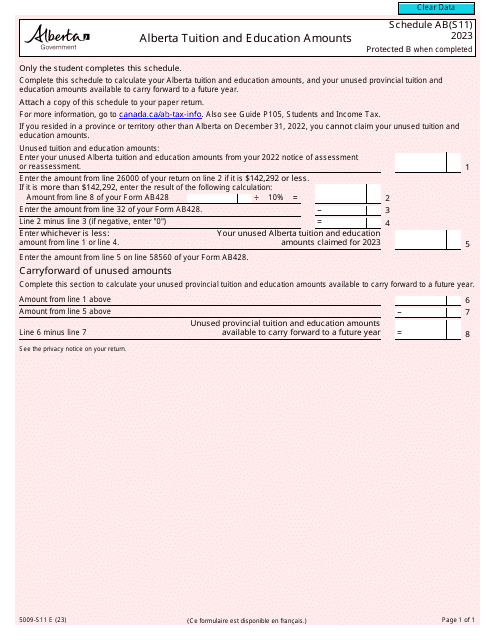

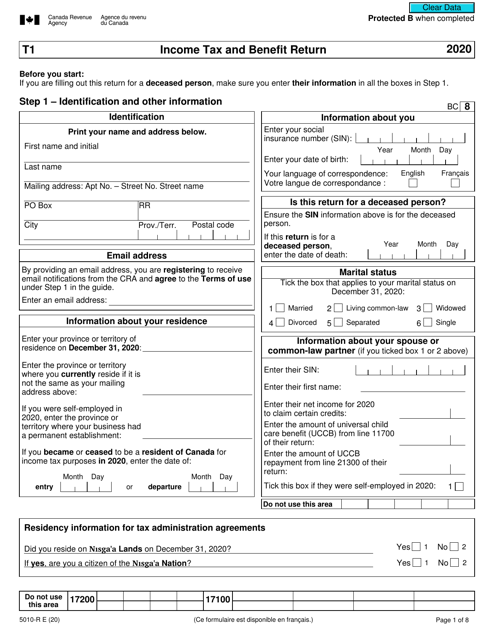

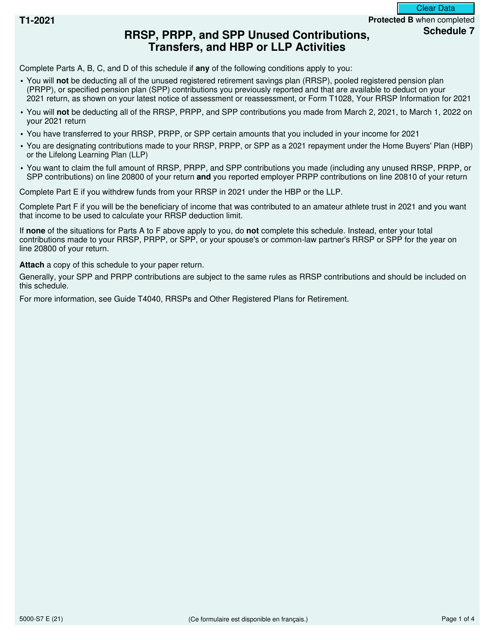

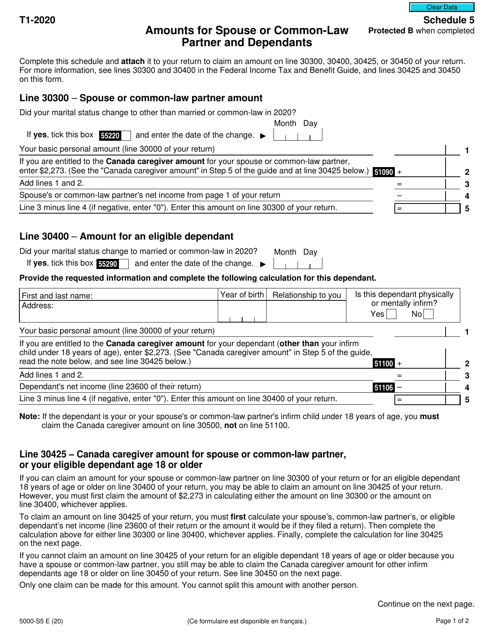

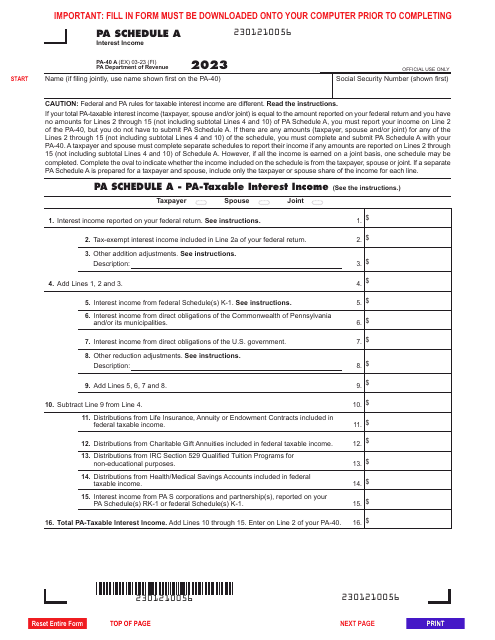

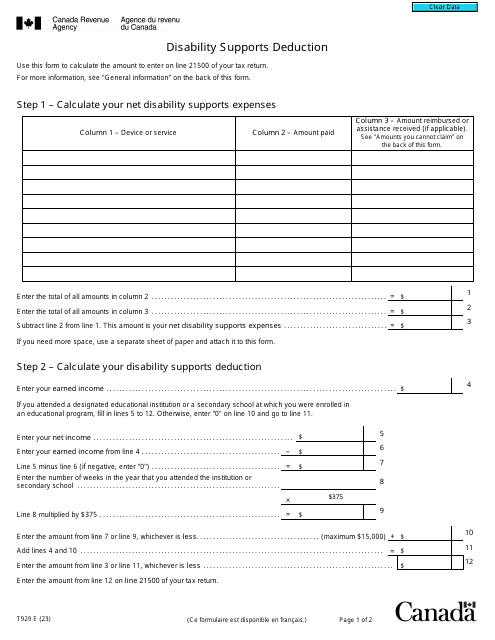

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.

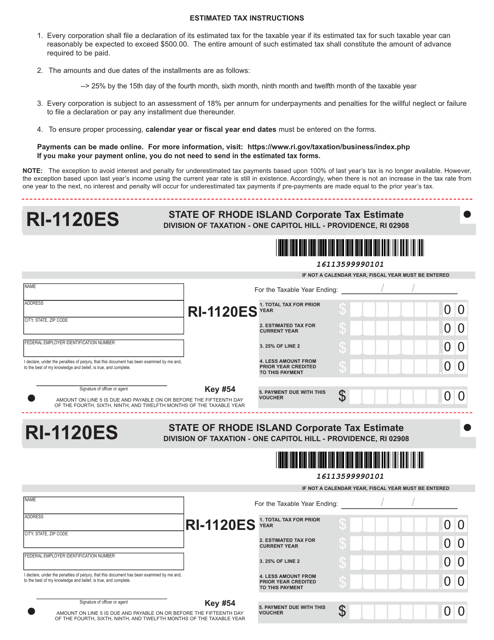

This Form is used for businesses in Rhode Island to estimate and pay their corporate taxes.

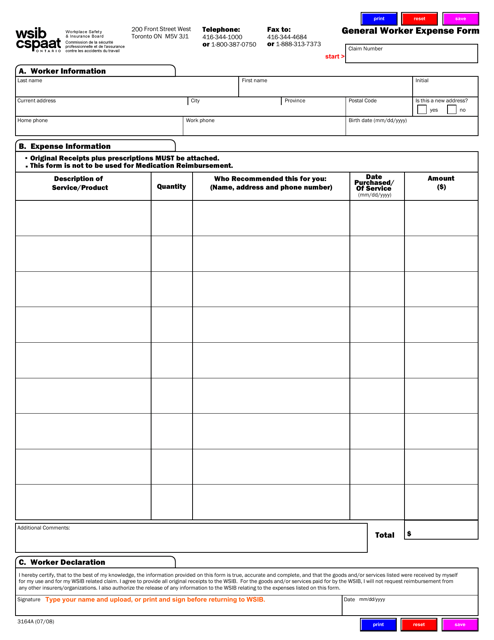

This form is used for reporting general worker expenses in Ontario, Canada. It allows workers to record and claim expenses incurred during their job.

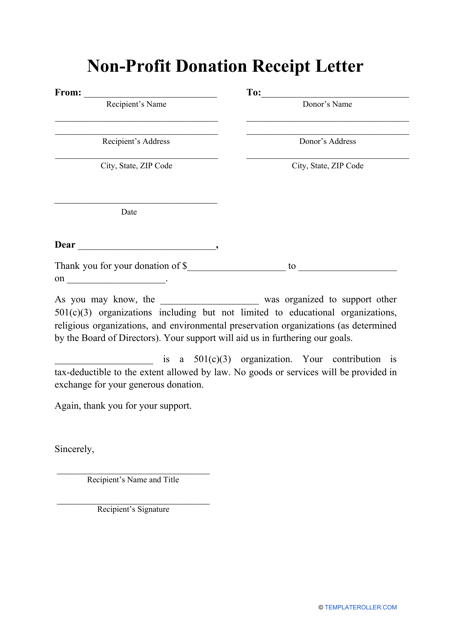

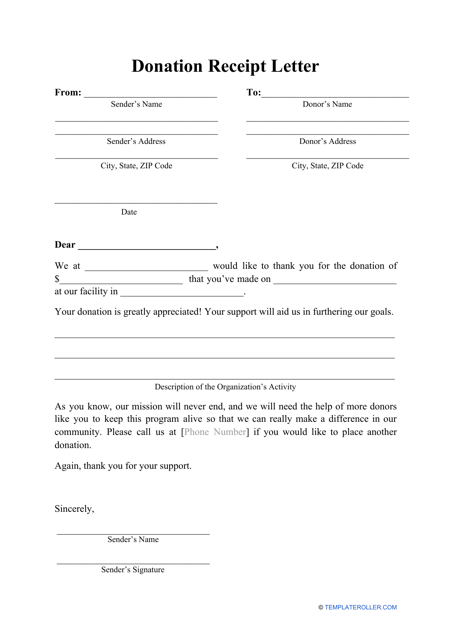

A non-profit organization may prepare and send this letter to a donor to confirm that a donation or a gift was received and to thank the donor or sponsor for their financial support or tangible property they have donated.

This letter notifies an individual that their donation was received and thanks them for their support of the charity in question.

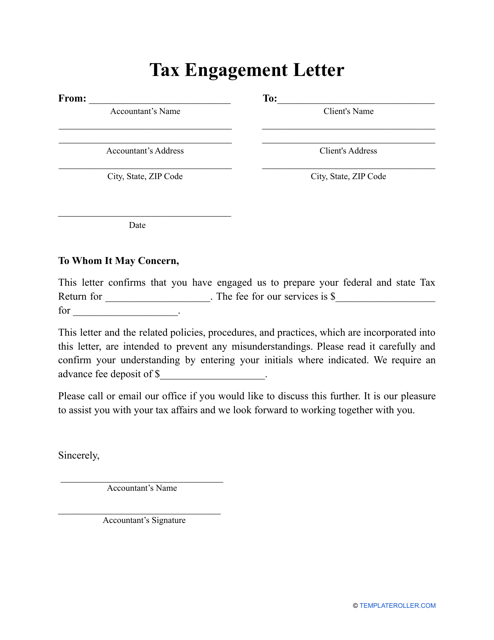

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

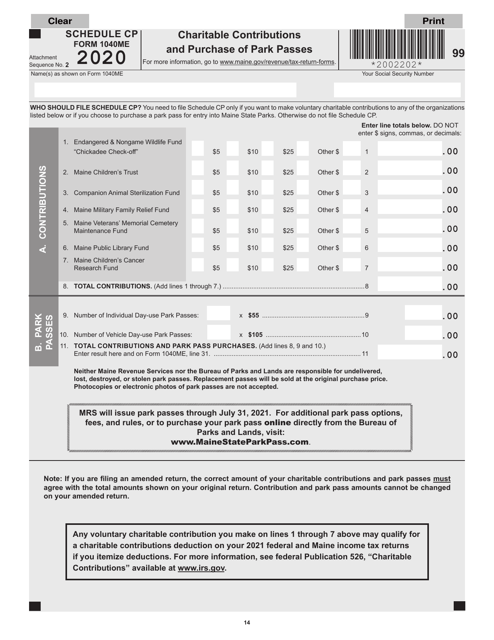

This form is used for reporting charitable contributions and the purchase of park passes in the state of Maine on the Maine tax return.

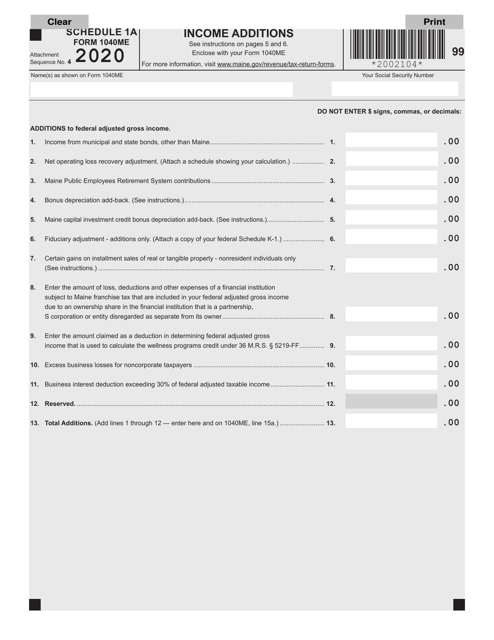

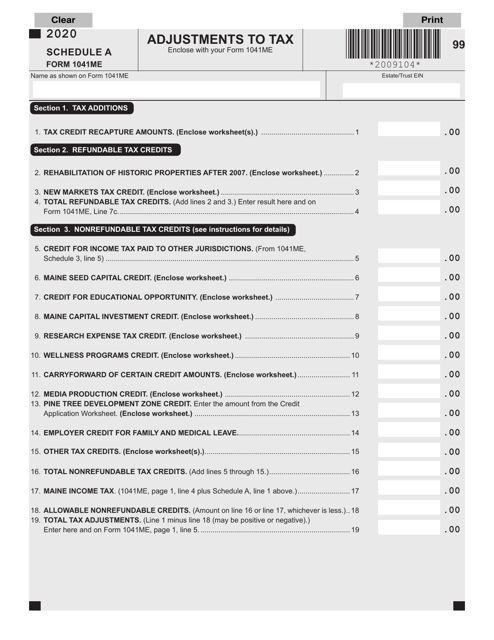

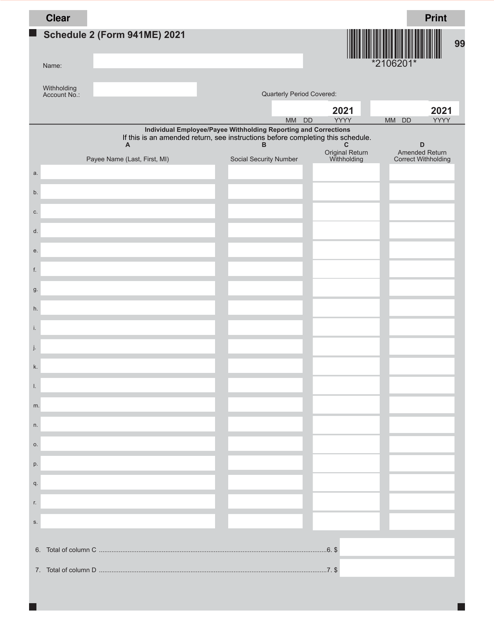

This form is used for reporting additional income additions for Maine residents filing the Form 1040ME. It helps taxpayers accurately include any income sources that need to be added to their overall income calculations.

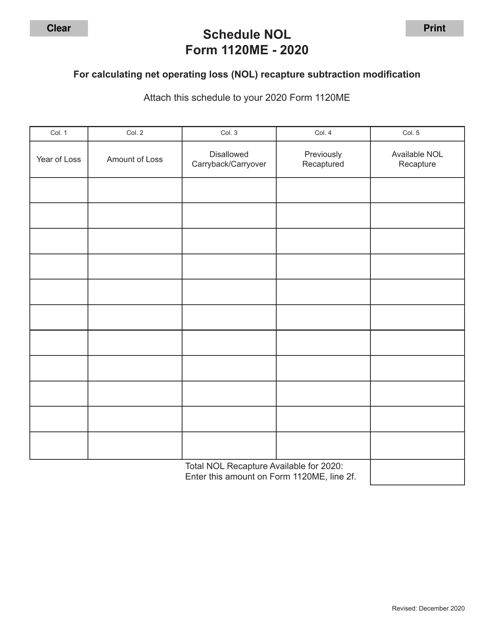

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

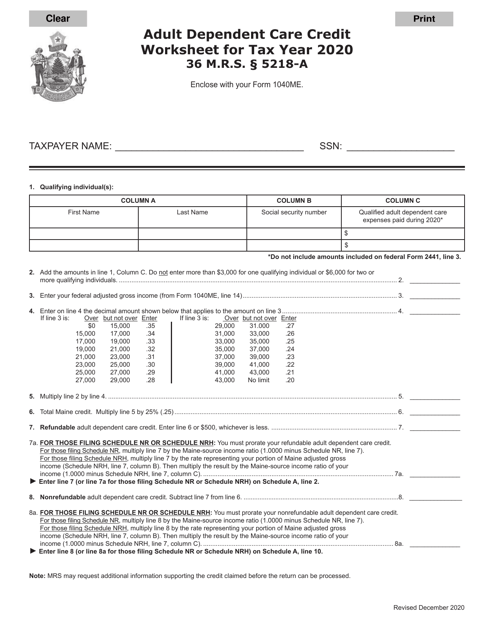

This document is used for calculating the Adult Dependent Care Credit in the state of Maine.

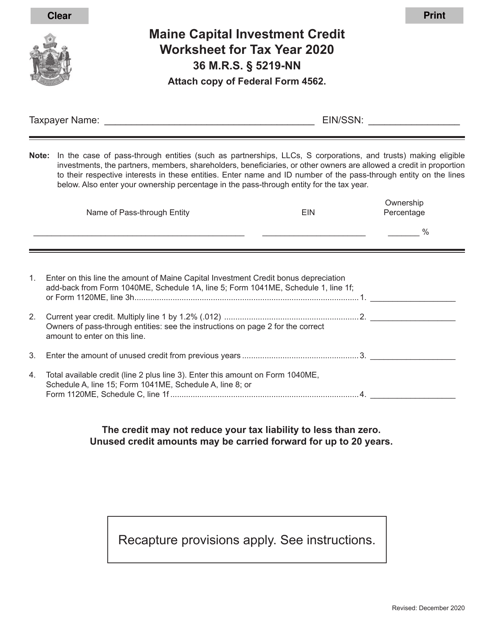

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

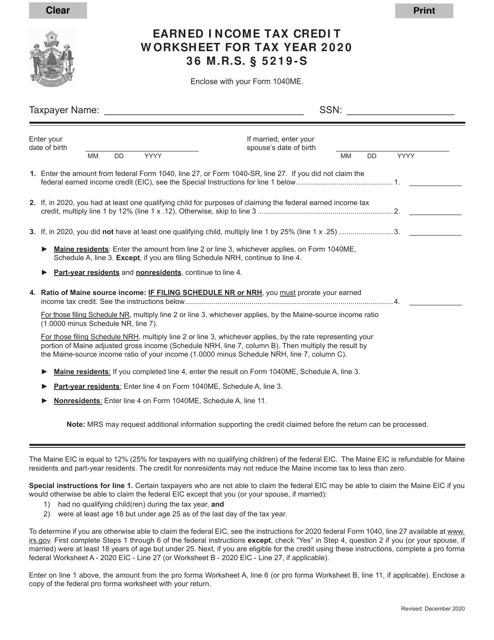

This document is used for calculating the Earned Income Tax Credit in the state of Maine. It provides a worksheet to help residents determine their eligibility and calculate the amount of credit they may qualify for.

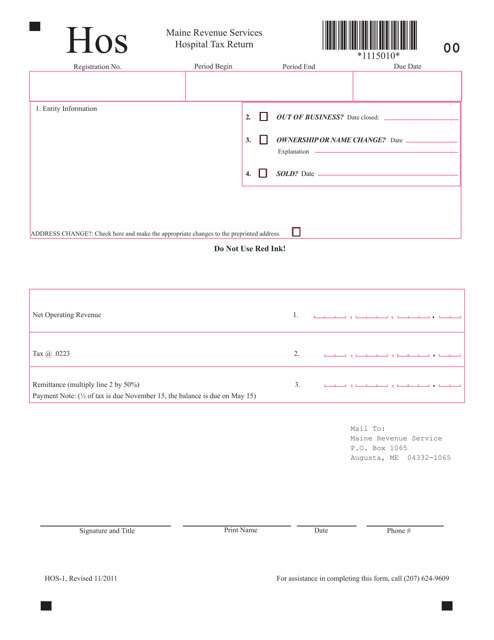

This Form is used for filing hospital tax returns in the state of Maine. It is used by hospitals to report and pay their taxes to the state revenue department.

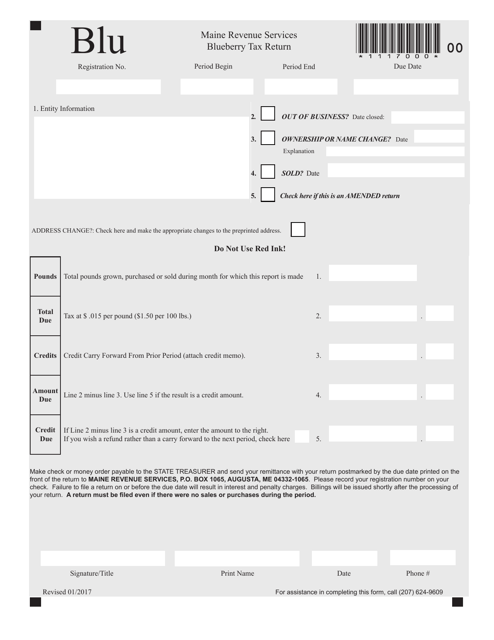

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.