Tax Deductions Templates

Documents:

1801

This is a document you may use to figure out how to properly complete IRS Form 6765

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

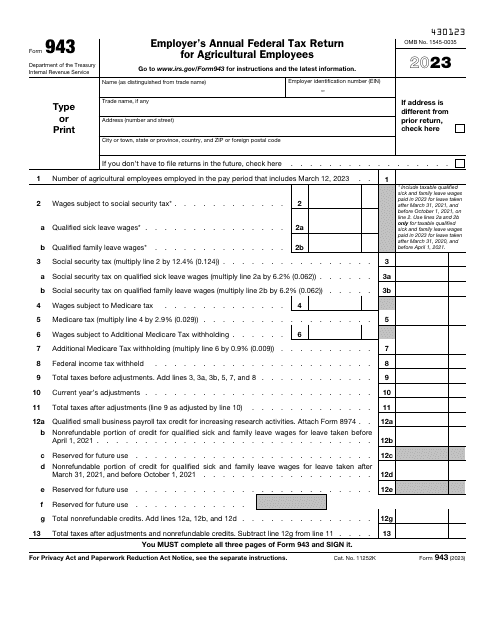

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

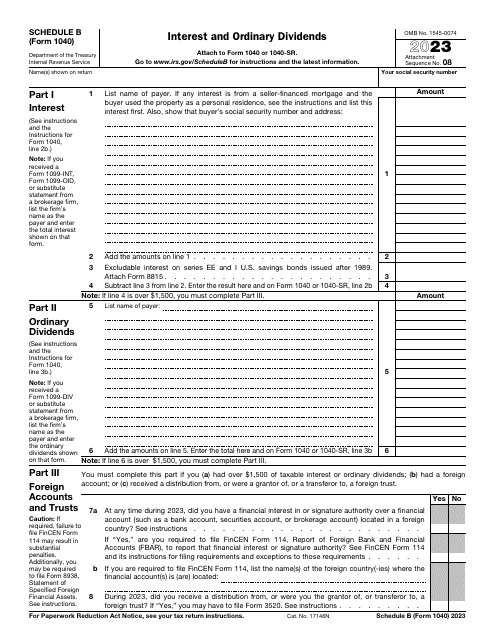

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

This is an IRS form that includes the details of an installment sale.

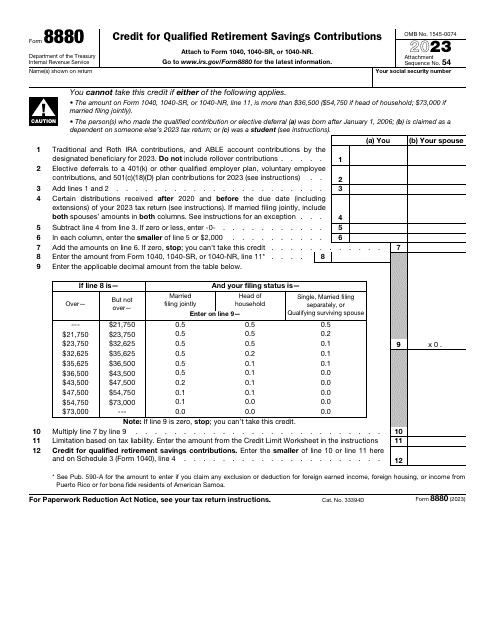

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

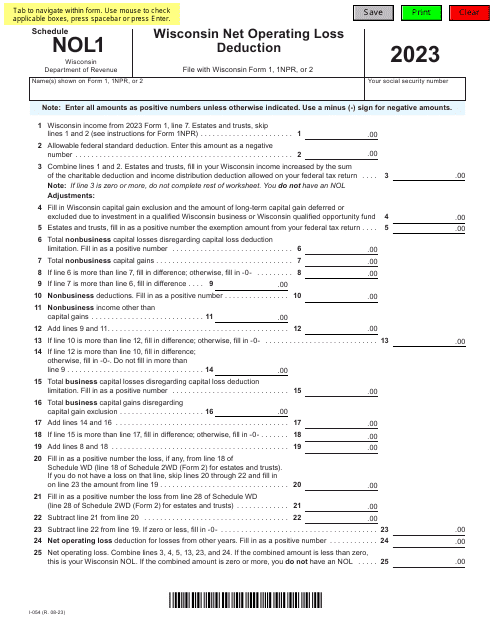

This Form is used for claiming the Wisconsin Net Operating Loss Deduction on your state tax return. It provides instructions on how to calculate and report your net operating loss.

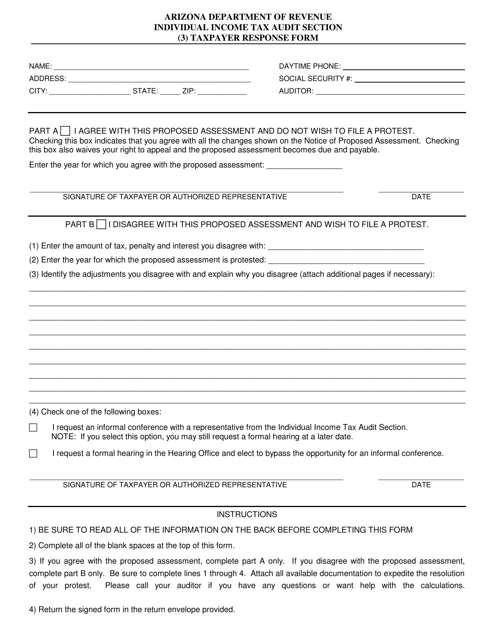

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

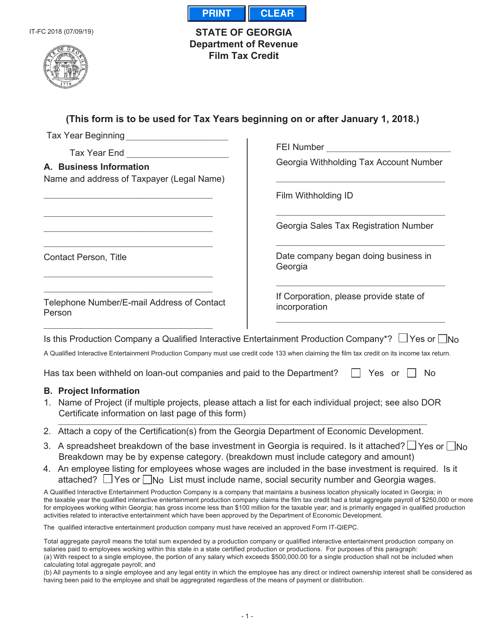

This Form is used for claiming film tax credits in Georgia, United States.

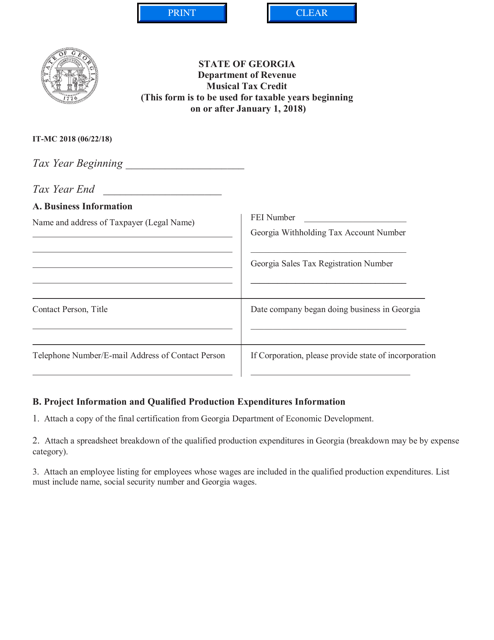

This document is a form used in Georgia (United States) for claiming the Musical Tax Credit.

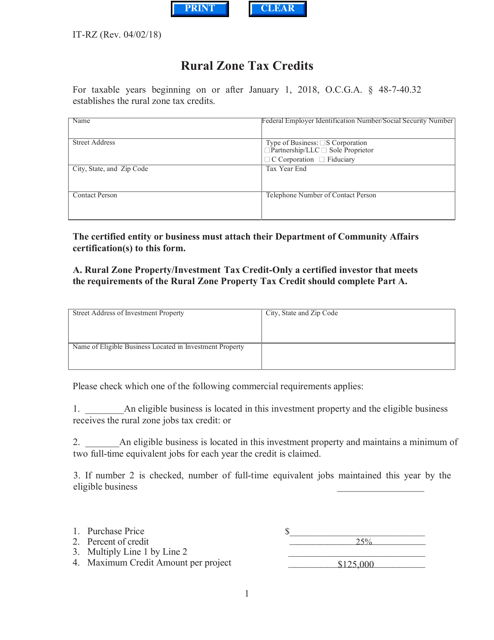

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

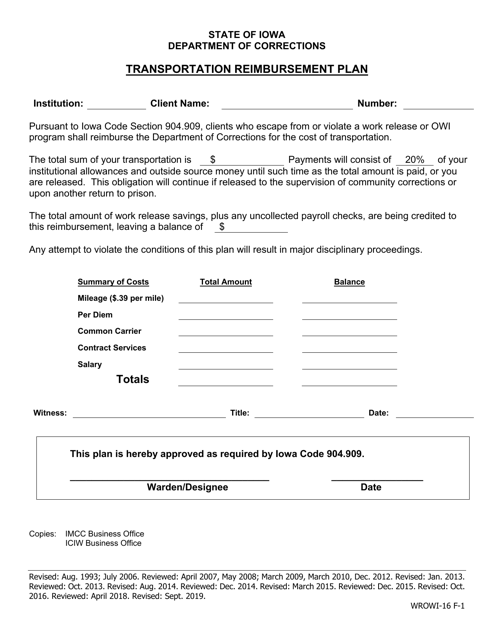

This type of document outlines the reimbursement process for transportation expenses in Iowa. It provides information on how individuals can be reimbursed for costs incurred while using different modes of transportation for work-related purposes.

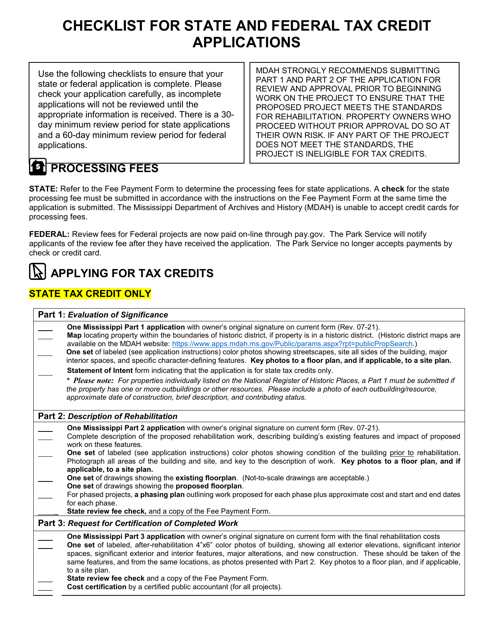

This document is a checklist for individuals in Mississippi who are applying for state and federal tax credits. It helps ensure that all necessary information and documentation are included in the application to receive tax credits.