Tax Report Templates

Documents:

943

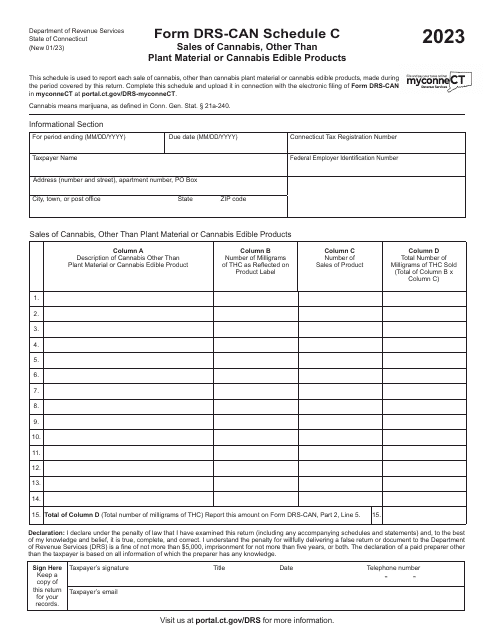

This form is used for reporting sales of cannabis in Connecticut, excluding plant material or cannabis edible products.

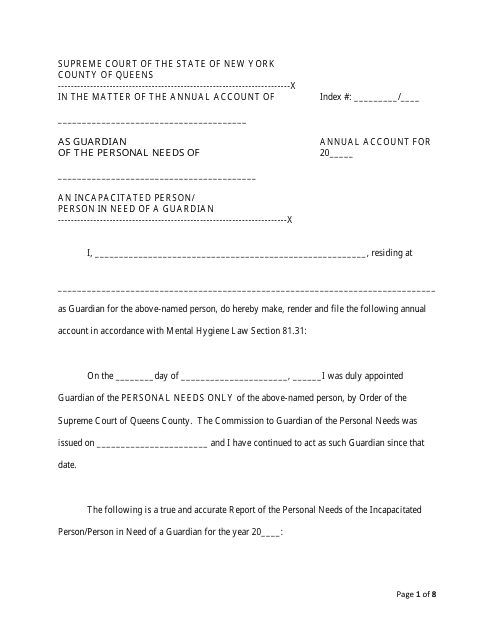

This document is used for filing annual accounts in New York. It provides a summary of a company's financial activities for the year.

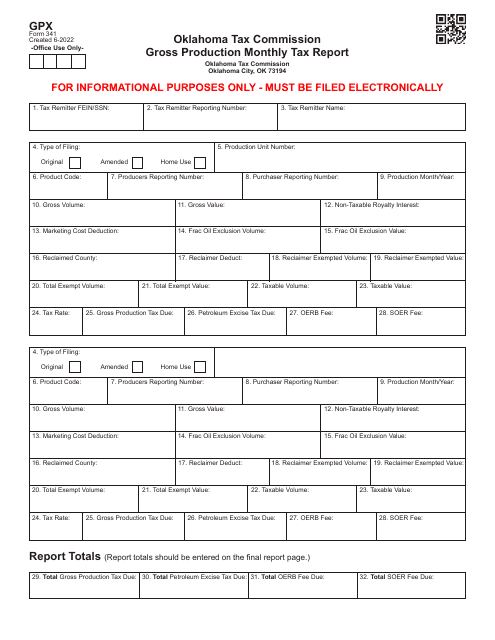

This form is used for reporting monthly gross production tax in Oklahoma.

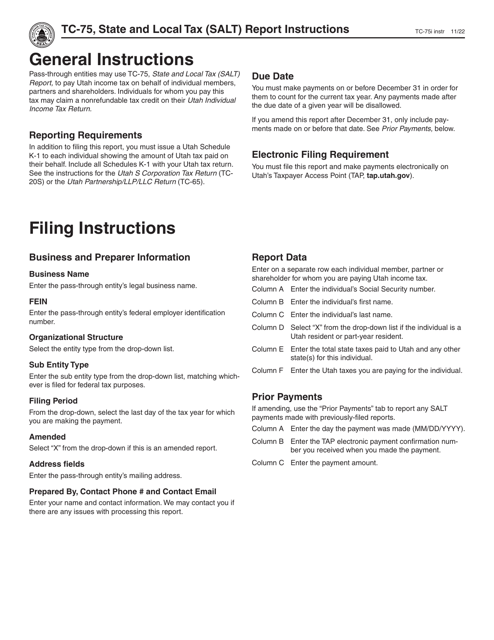

This Form is used for reporting state and local taxes in Utah. It provides instructions on how to accurately complete the TC-75 State and Local Tax Report.

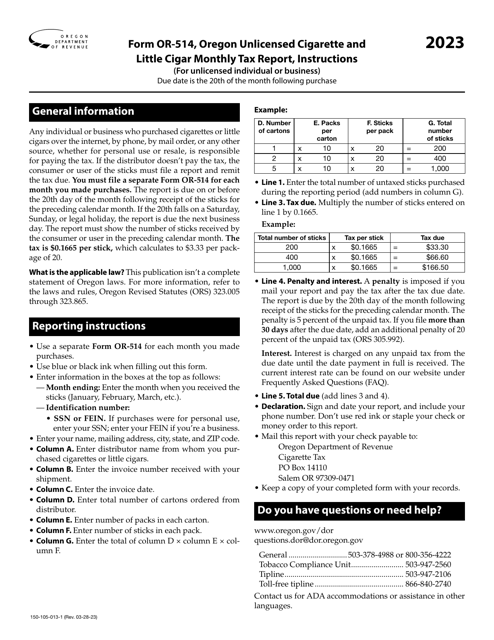

This Form is used for reporting monthly taxes on unlicensed cigarettes and little cigars in Oregon by unlicensed individuals or businesses.

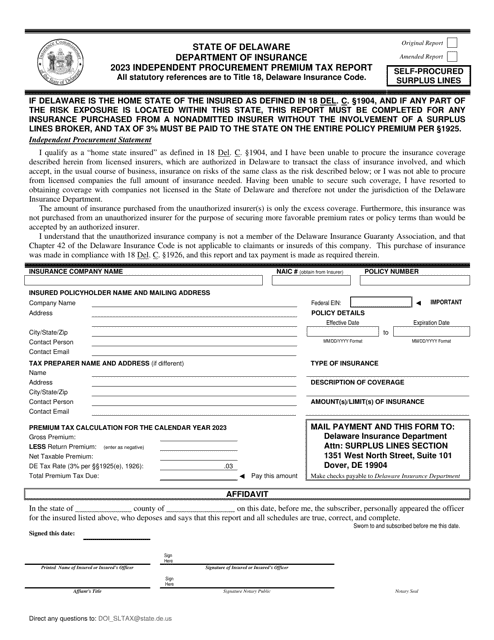

This document is a tax report used for self-procured surplus lines in the state of Delaware. It pertains to independent procurement premium taxes.

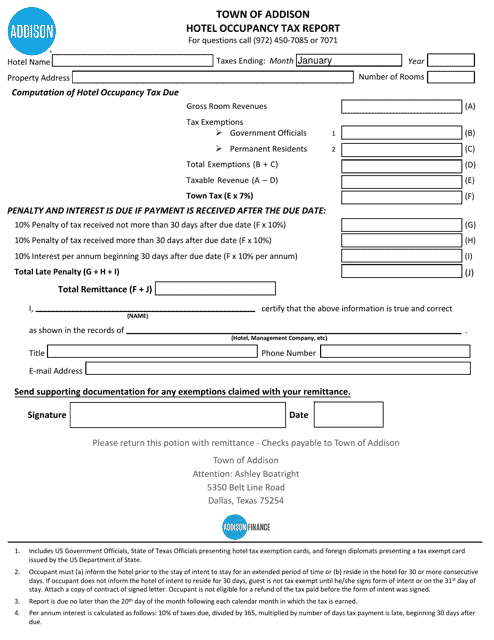

This document is for reporting hotel occupancy taxes in the Town of Addison, Texas.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

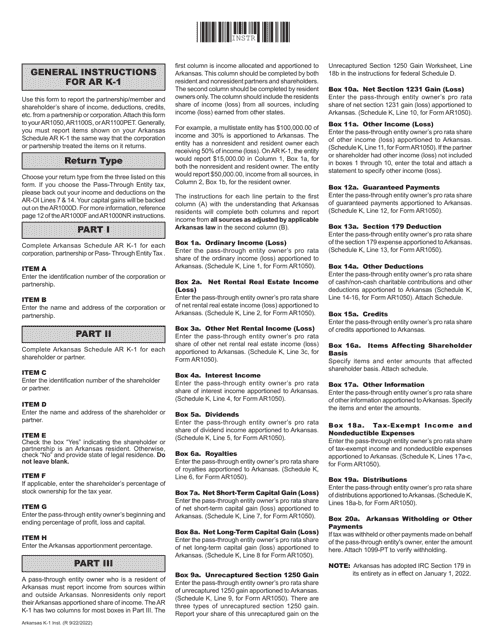

This form is used for reporting an individual's share of income, deductions, credits, and other financial information for tax purposes in the state of Arkansas.

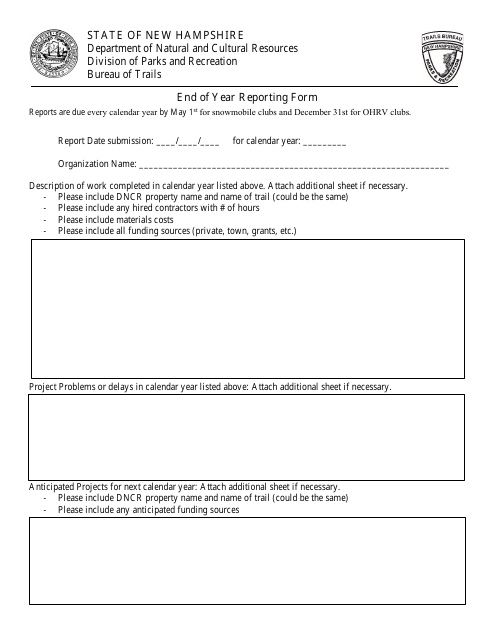

This Form is used for reporting financial information at the end of the year in the state of New Hampshire. It is required for businesses and individuals to submit this form to the appropriate authorities.

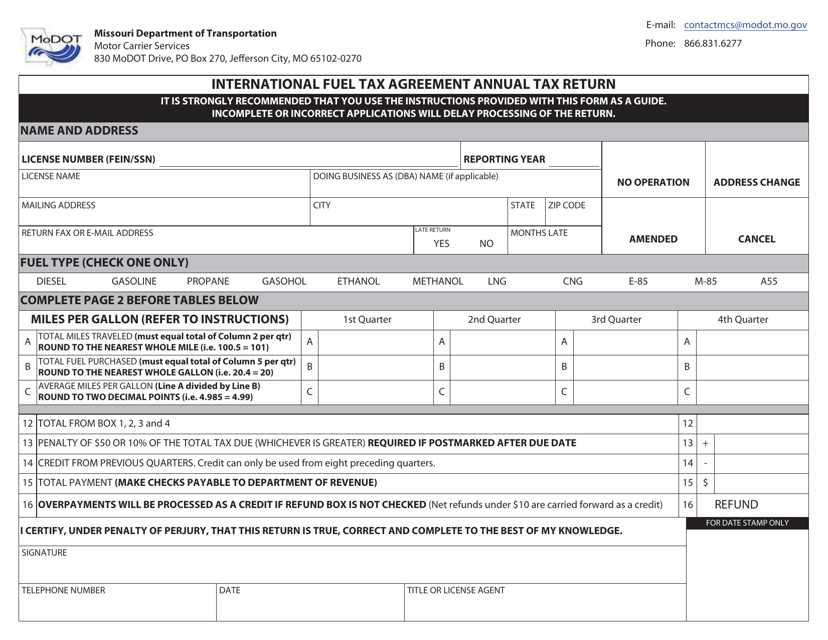

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.

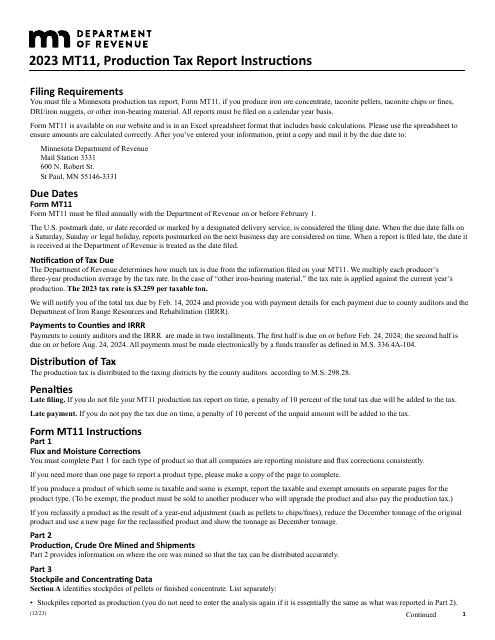

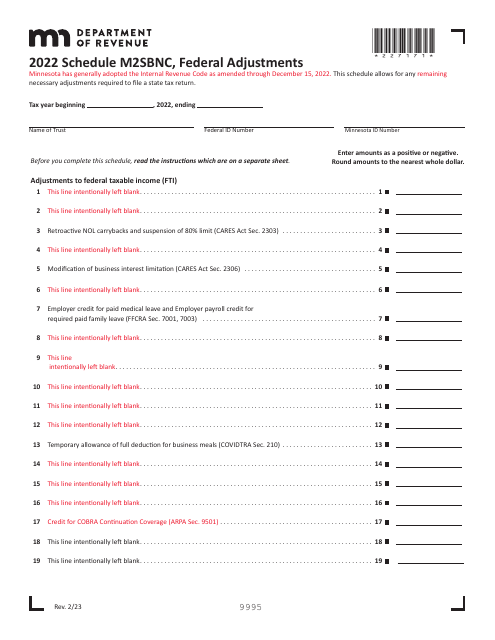

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.

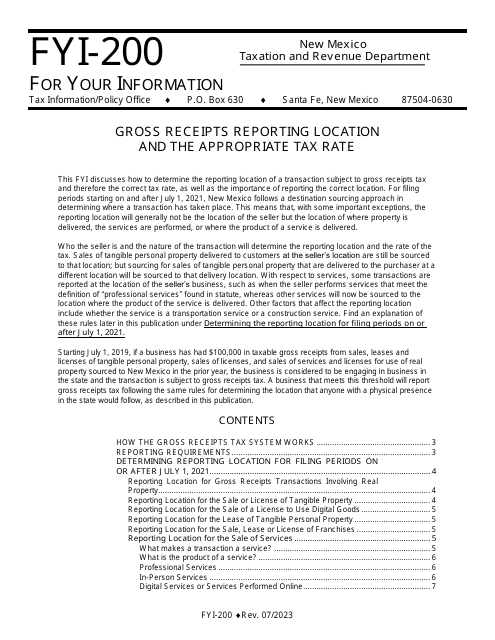

This document provides instructions on where to report gross receipts for taxation purposes in New Mexico, as well as guidance on the appropriate tax rate to use.

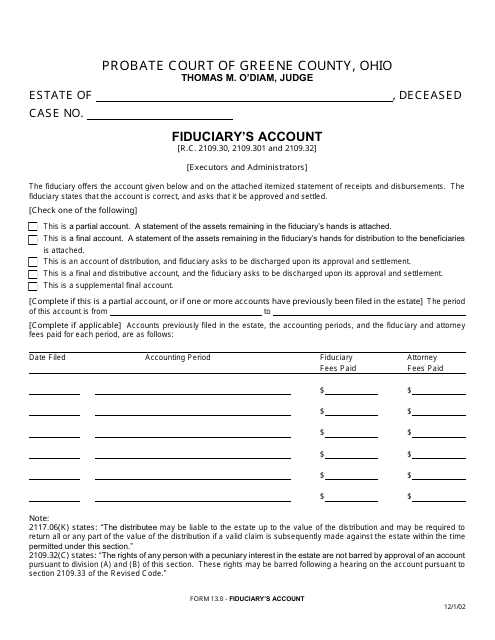

This form is used for filing a fiduciary's account in Greene County, Ohio.