Tax Obligation Templates

Documents:

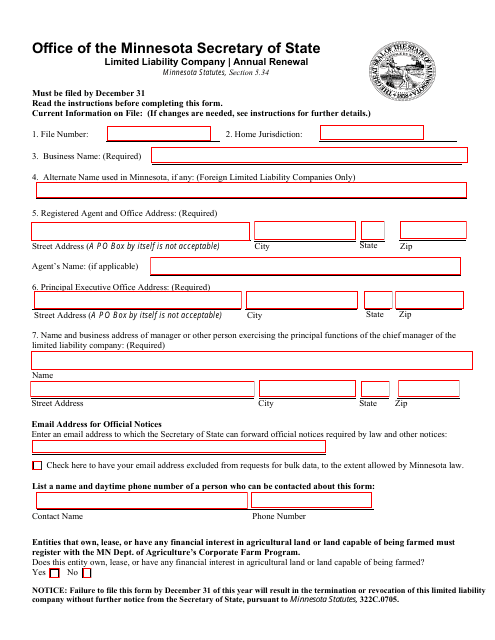

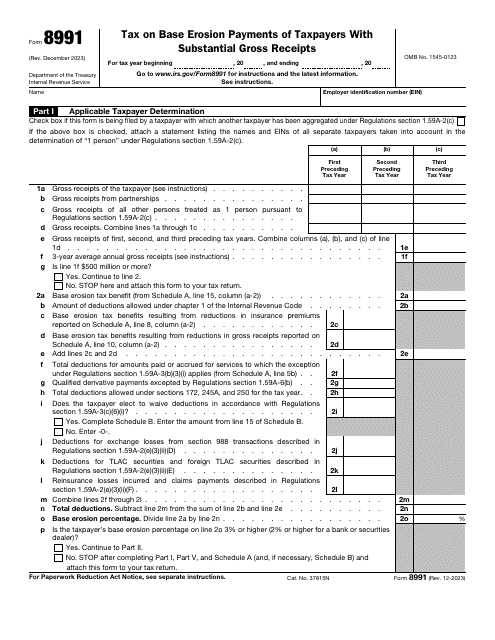

442

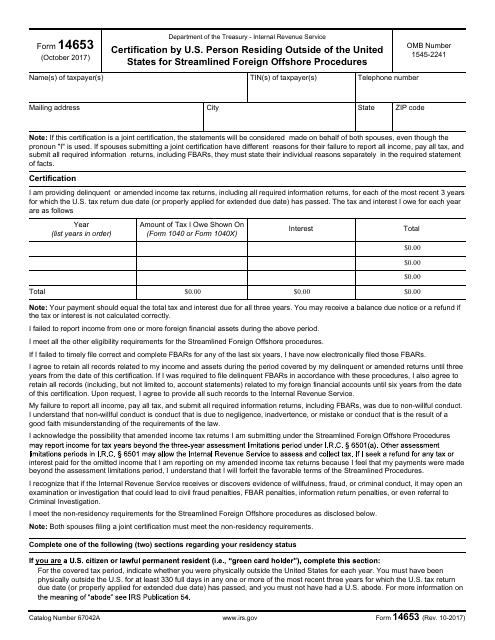

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

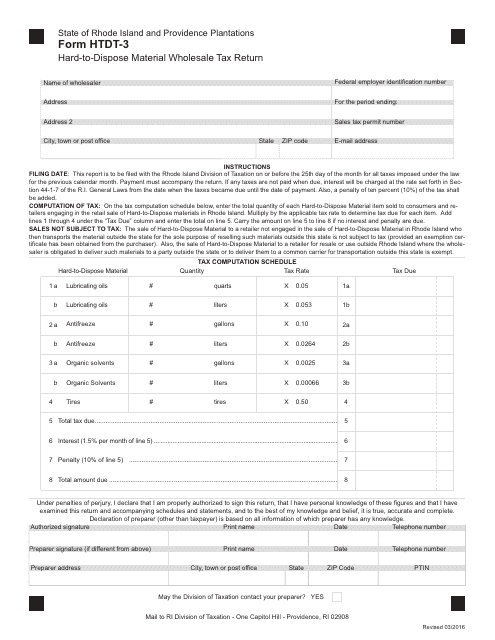

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

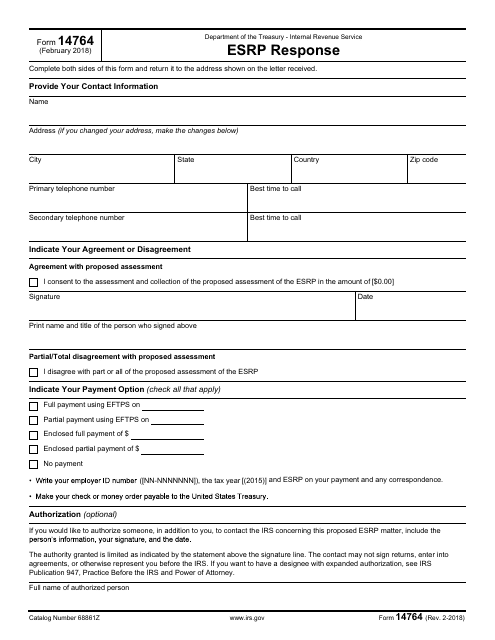

This form is used to respond to an IRS notice regarding the Employer Shared Responsibility Payment (ESRP). It is used to provide an explanation or dispute the proposed penalty.

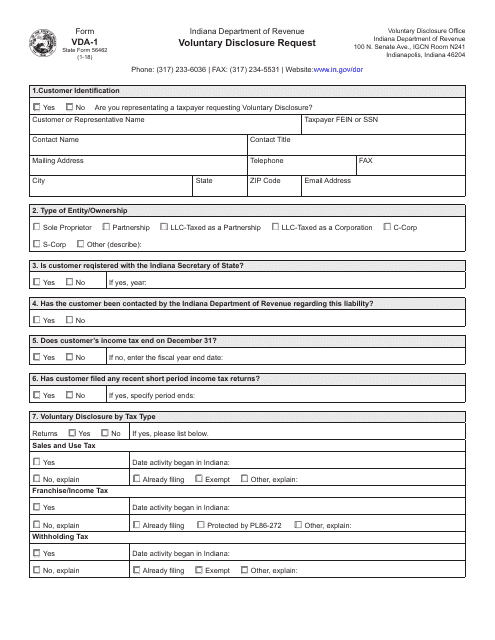

This form is used for requesting a voluntary disclosure in Indiana. It is known as the State Form 56462 (VDA-1) and is used to report any undisclosed tax liabilities.

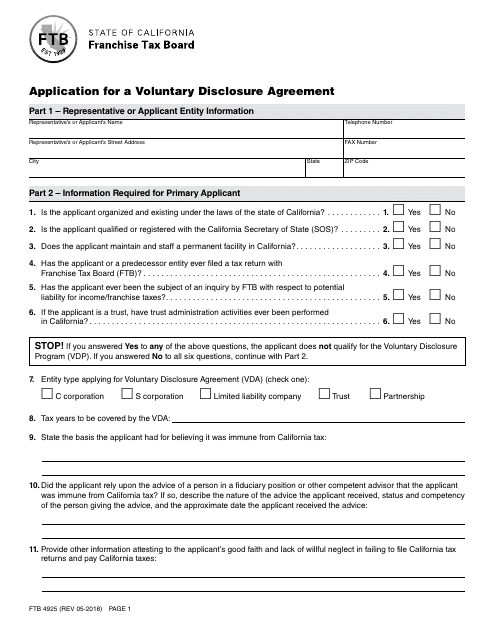

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

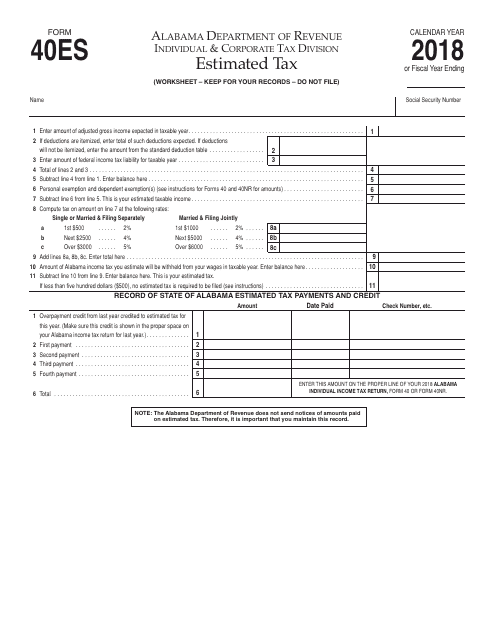

This form is used for individuals in Alabama to report and pay estimated taxes.

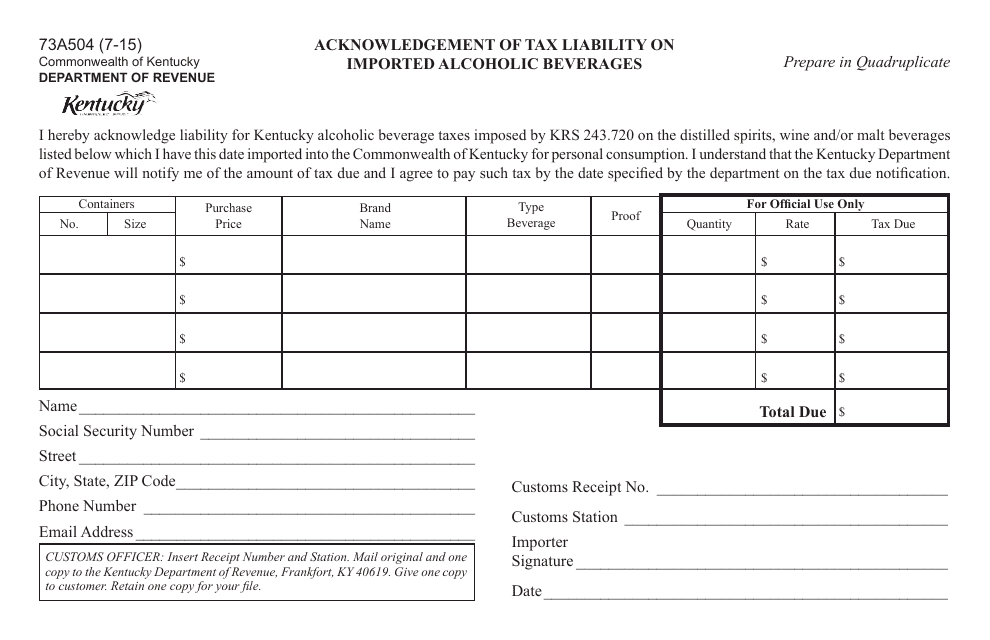

This form is used for acknowledging tax liability on imported alcoholic beverages in the state of Kentucky.

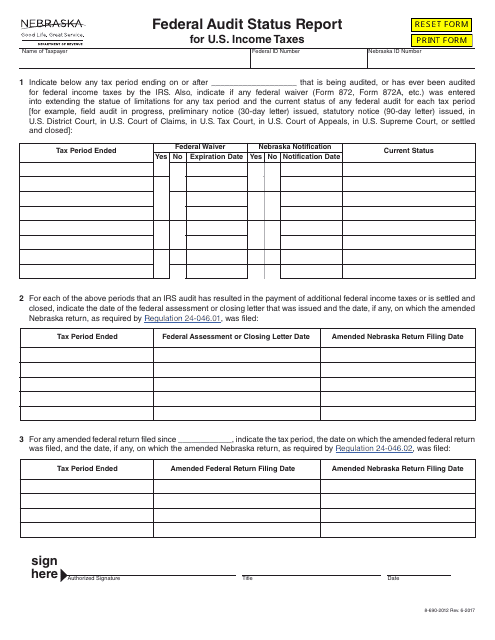

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

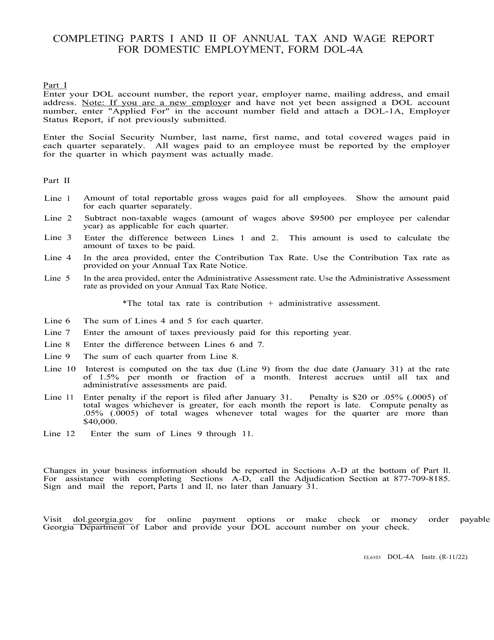

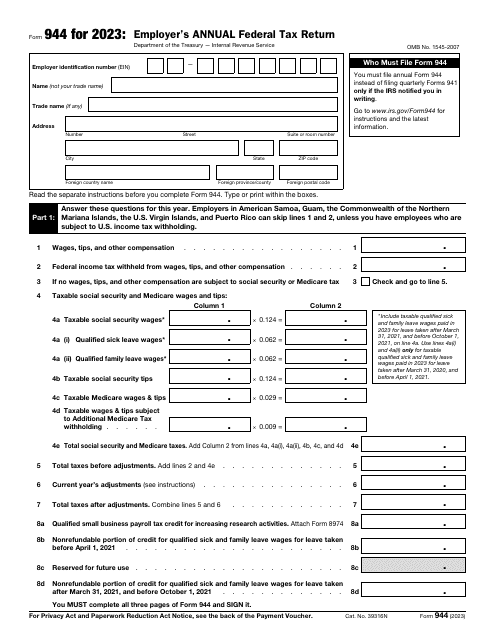

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

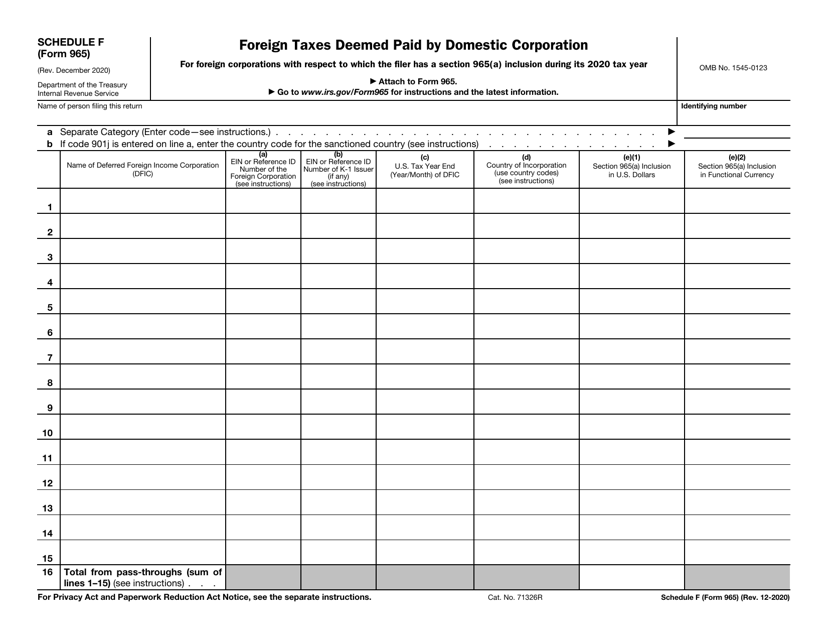

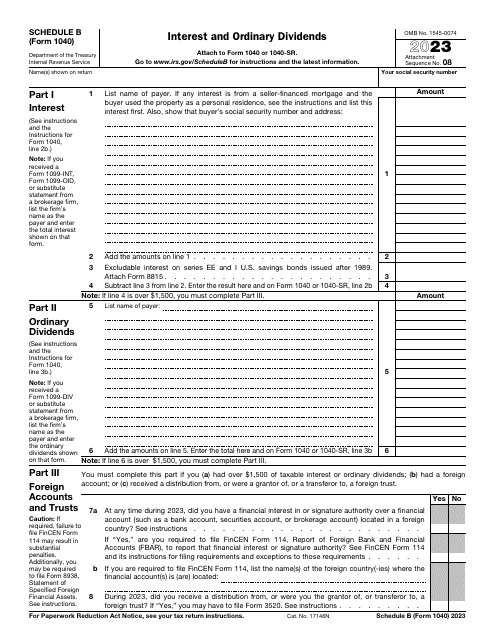

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

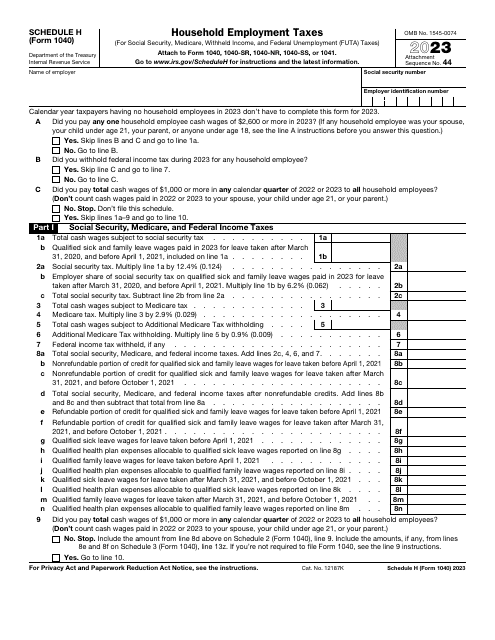

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

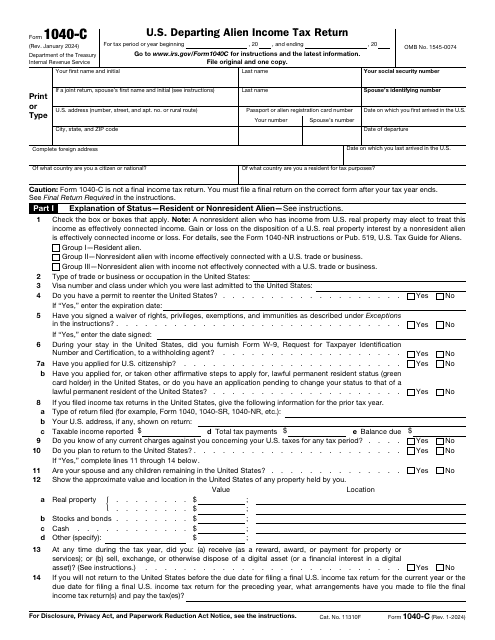

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

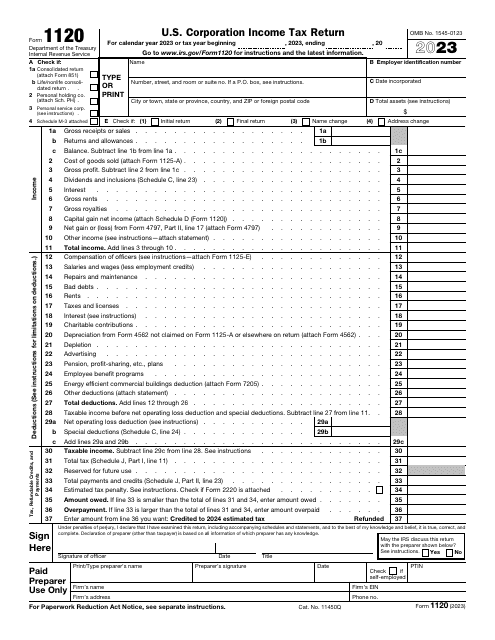

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

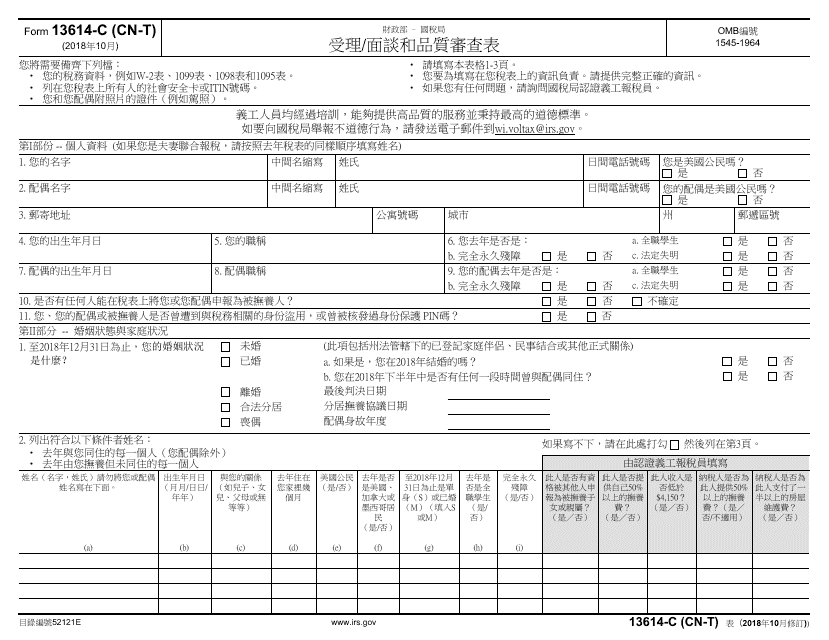

This form is used for the intake, interview, and quality review process conducted by the IRS. It is specifically designed for Chinese individuals or those who prefer to use Chinese language.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

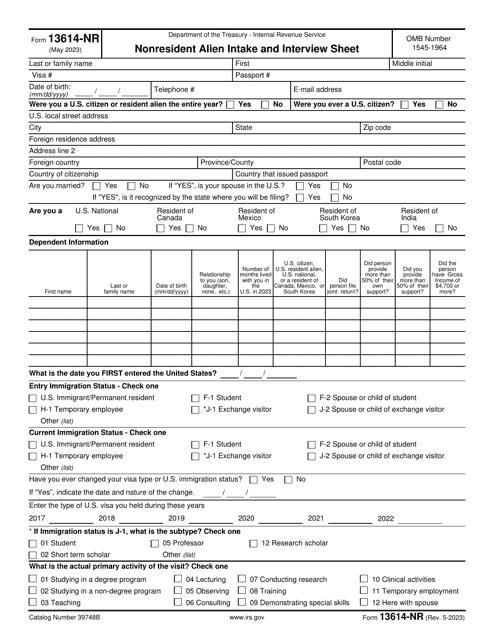

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.