Tax Regulations Templates

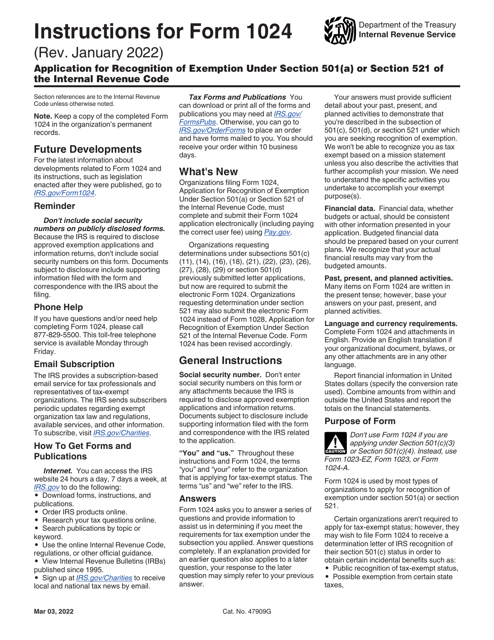

Are you facing confusion and uncertainty regarding tax regulations? Look no further! Our comprehensive collection of tax regulations, also known as tax regulation or tax requirements, is here to help. With a vast range of documents, we cover everything from Instructions for IRS Form 1024 Application for Recognition of Exemption Under Section 501(A) to Form SFU-1 Special Fuel Users Tax Report - Maine and IRS Form 8554 Application for Renewal of Enrollment to Practice Before the Internal Revenue Service. Whether you're a taxpayer or a tax professional, our assortment of documents, including Form I-338 Composite Return Affidavit - South Carolina and Voluntary Disclosure Agreement - Arkansas, will provide you with the guidance and information you need. Don't waste any more time searching for answers; explore our collection of tax regulations today and gain a clearer understanding of your tax obligations.

Documents:

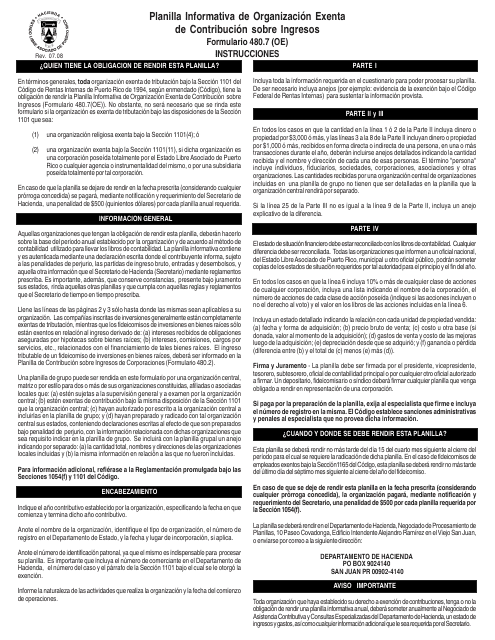

480

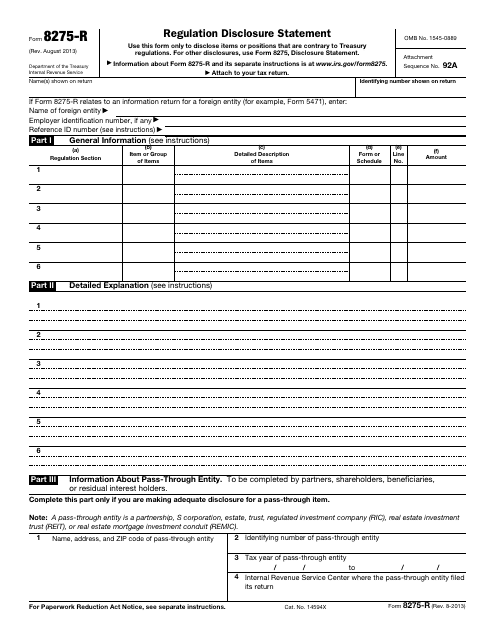

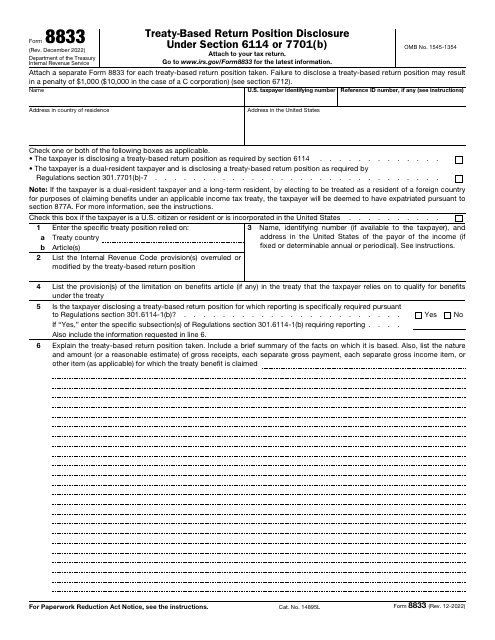

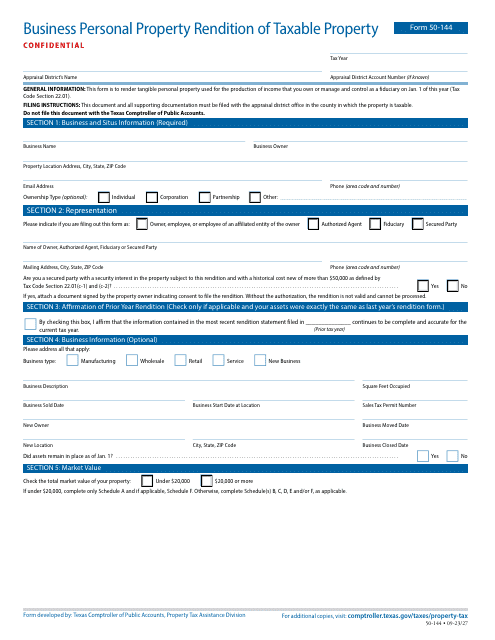

This document is used to disclose information about the regulations that apply to a tax return.

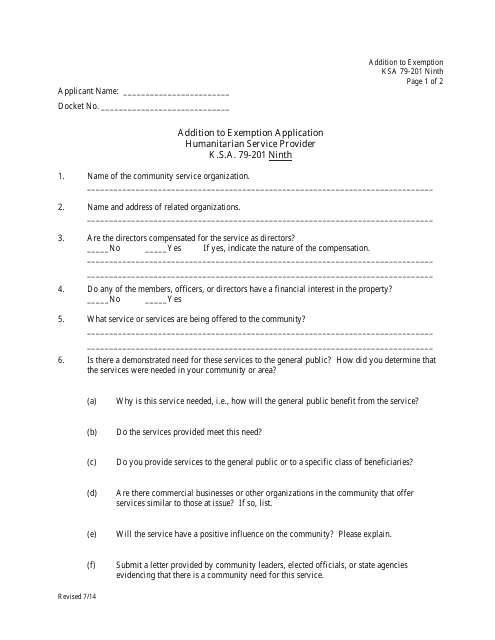

This document is an addition to the exemption application for Humanitarian Service Provider K.s.a. 79-201 Ninth in Kansas. It provides additional information or updates to the original application.

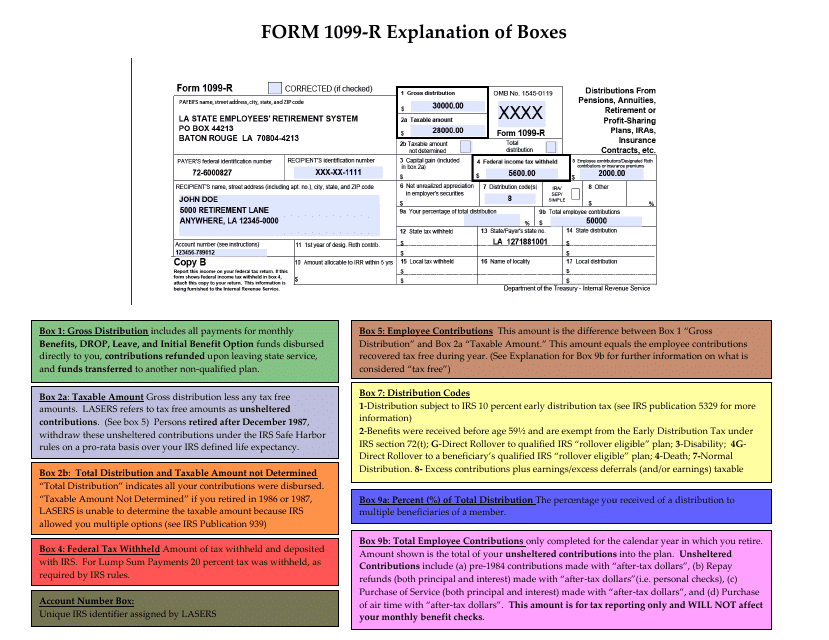

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

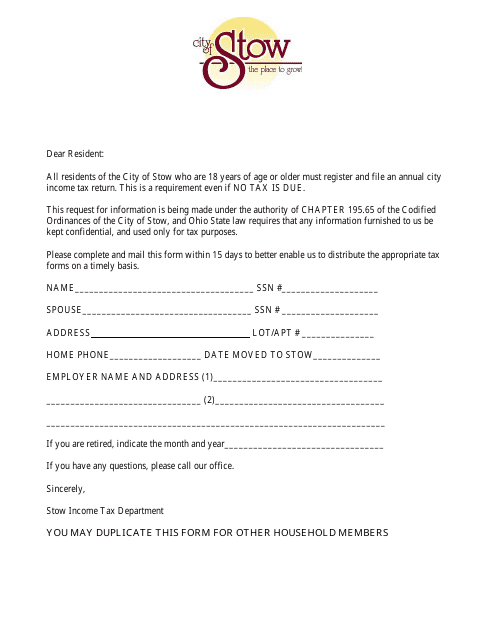

This Form is used for filing your income tax return in the City of Stow, Ohio.

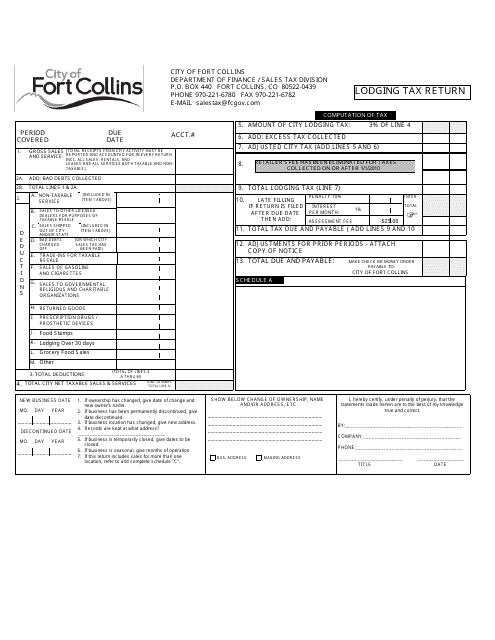

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

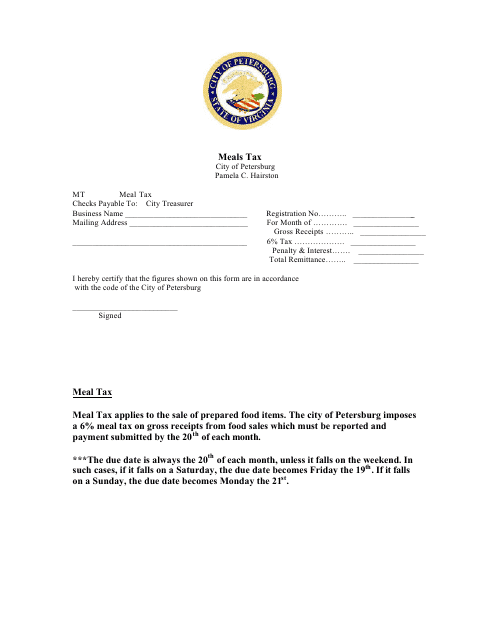

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

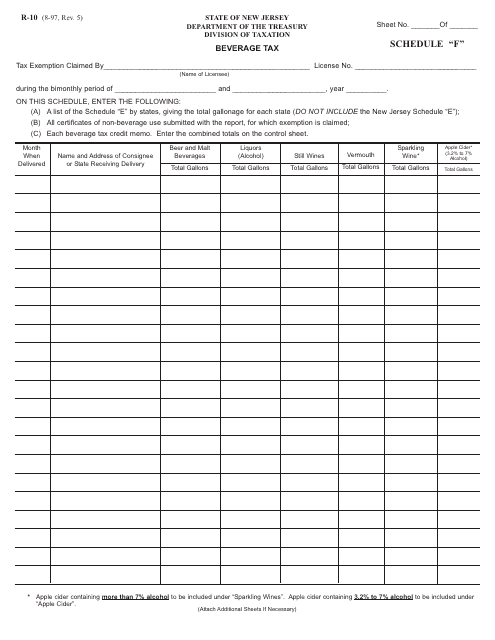

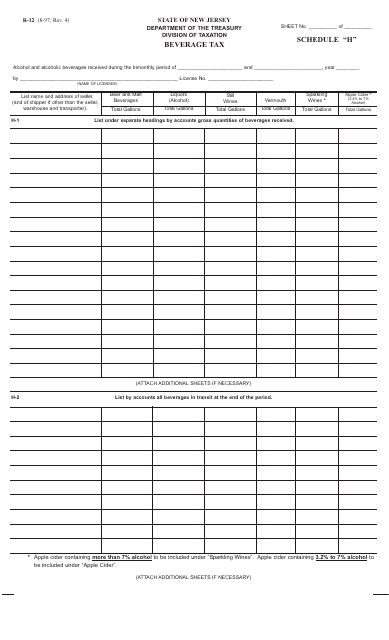

This form is used for reporting beverage taxes in New Jersey

This form is used for reporting and paying beverage taxes in the state of New Jersey.

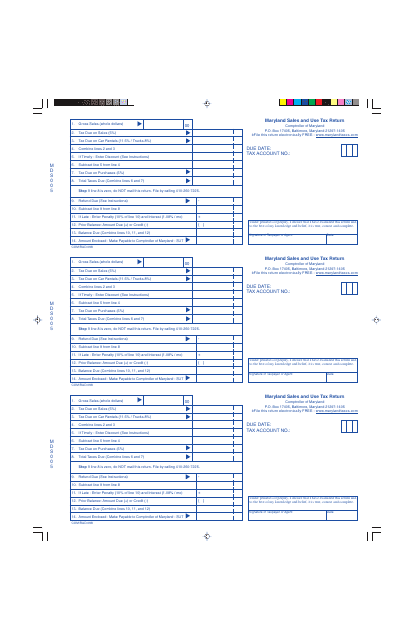

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

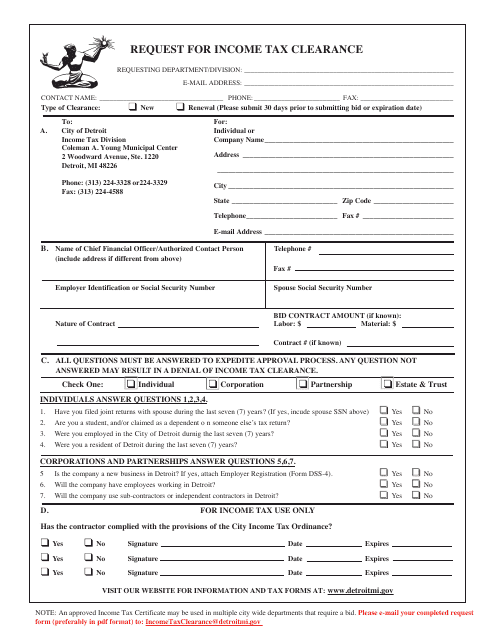

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

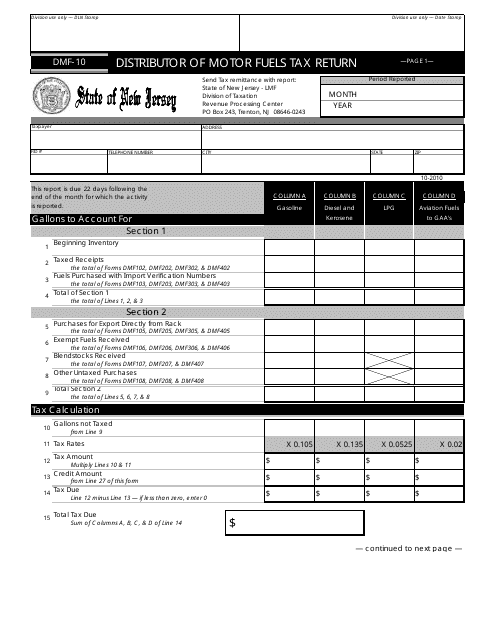

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

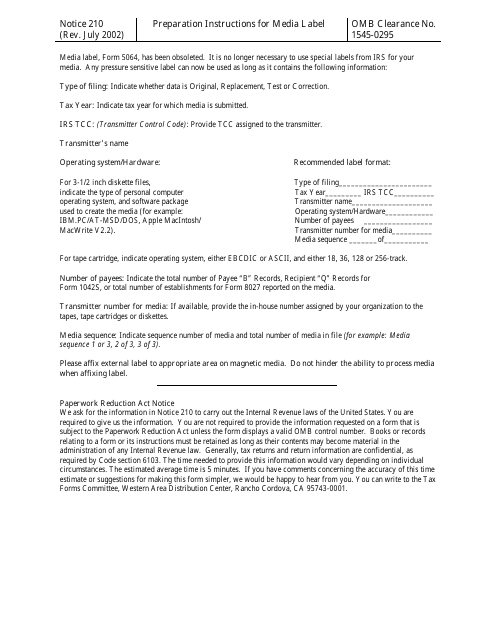

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

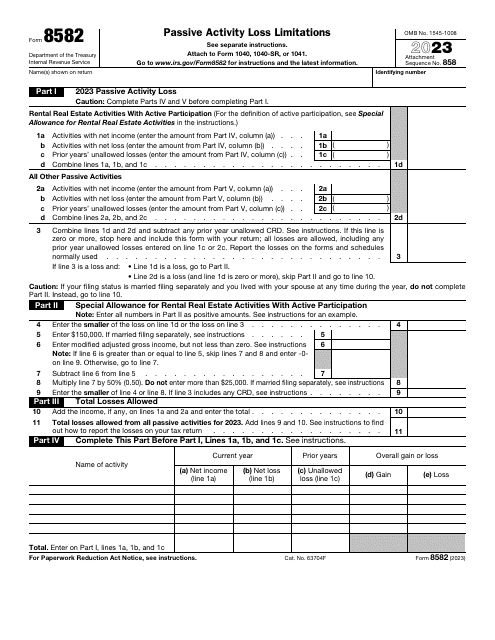

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

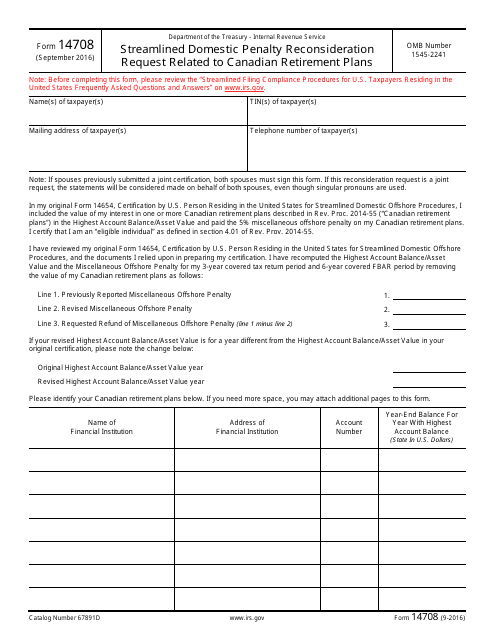

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

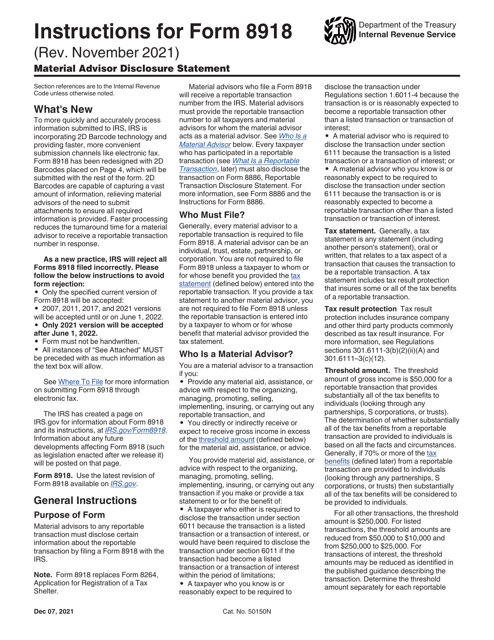

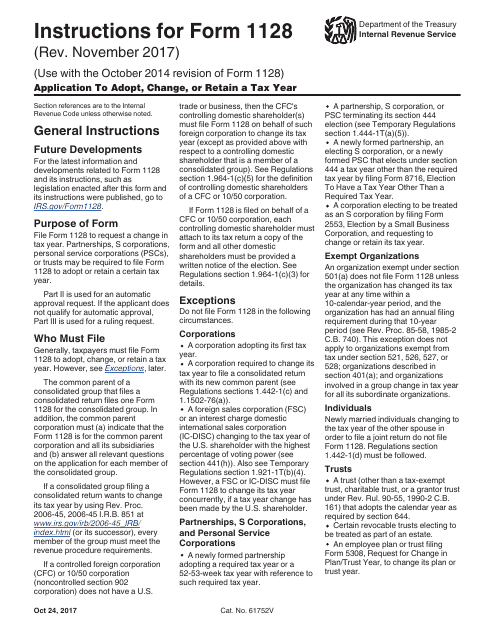

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

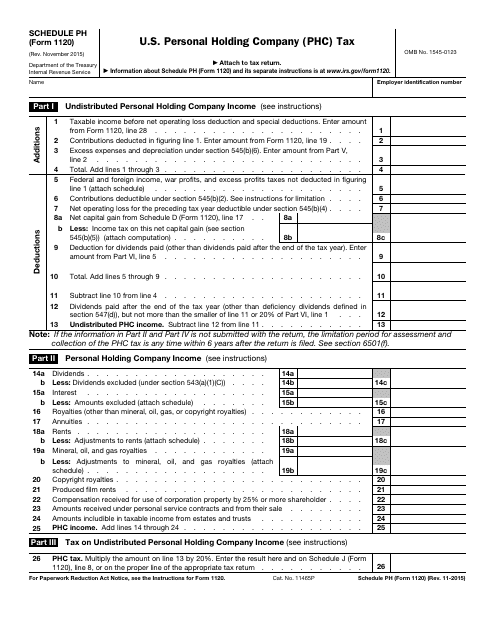

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

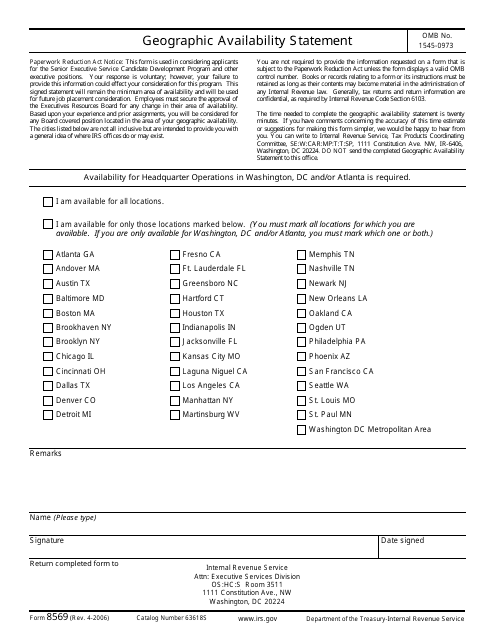

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

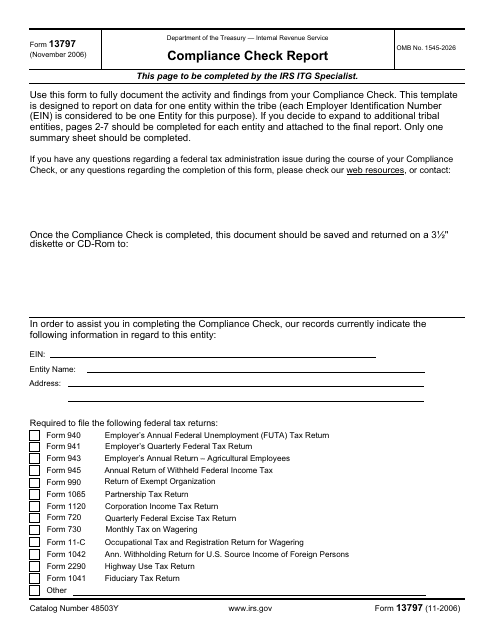

This document is used for reporting compliance checks to the IRS. It helps ensure that individuals and businesses are meeting their tax obligations.

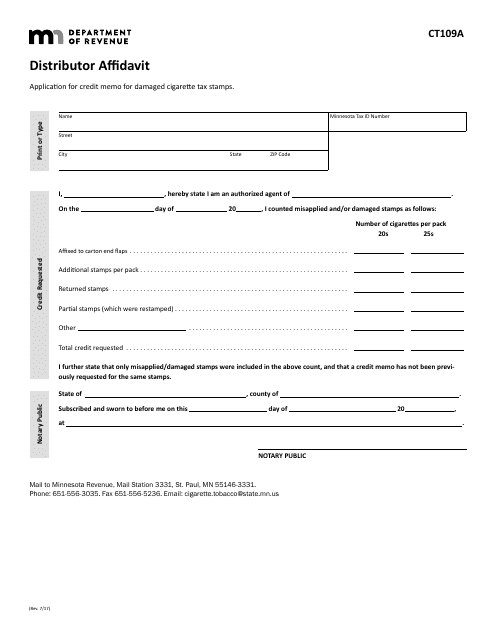

This Form is used for distributors in Minnesota to provide an affidavit.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

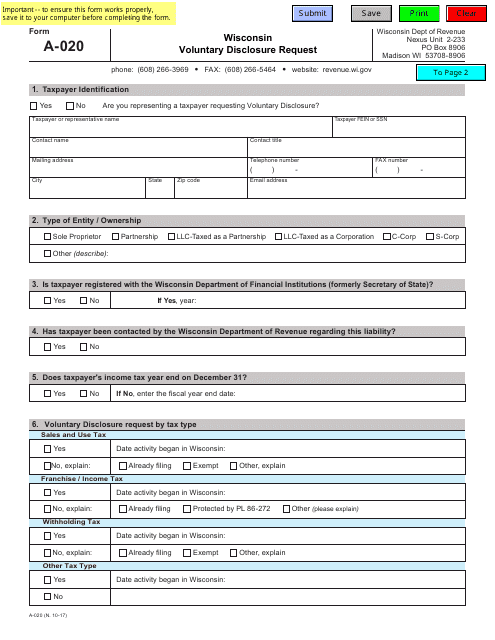

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

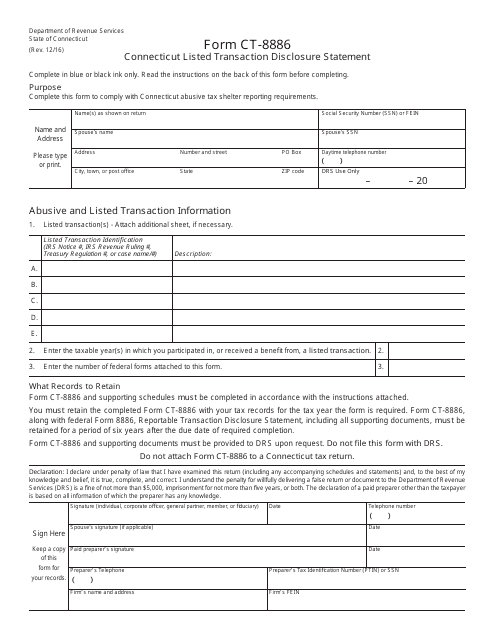

This Form is used for disclosing listed transactions in Connecticut.

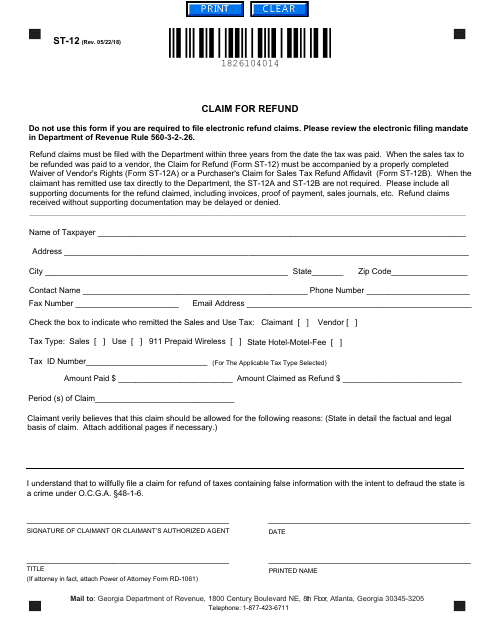

This Form is used for claiming a refund in the state of Georgia, United States.

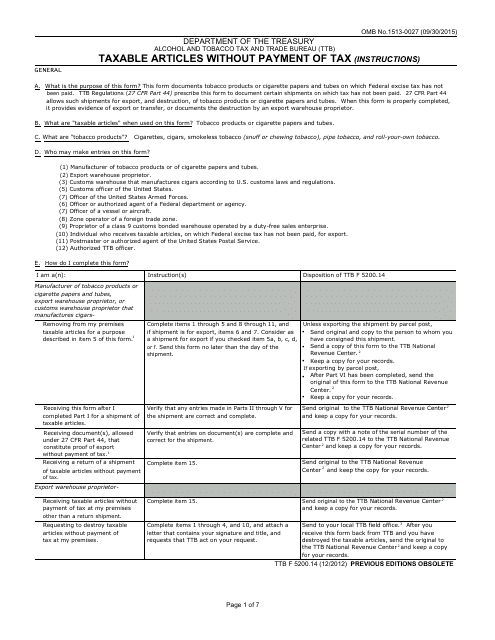

This document is used for reporting the taxable articles that are not paid for with tax.

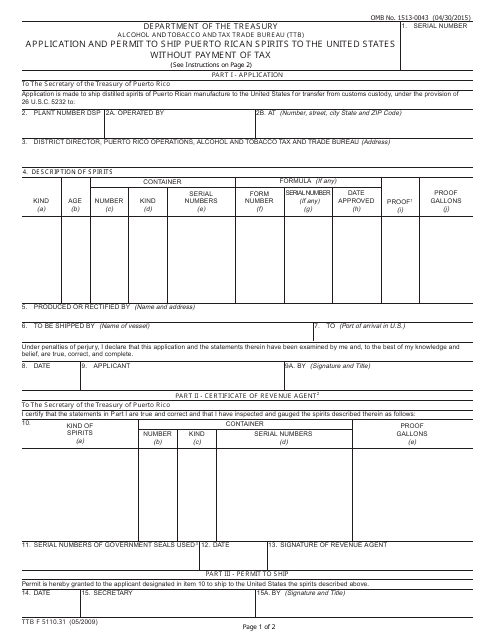

This Form is used for applying and obtaining a permit to ship Puerto Rican spirits to the United States without payment of tax.

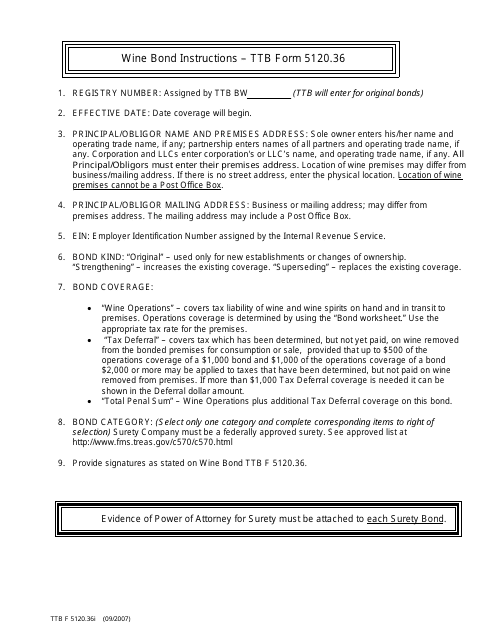

This document provides instructions for completing the TTB Form 5120.36I Wine Bond. This form is used for wine manufacturers or importers to post a bond with the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with applicable laws and regulations. The bond serves as a financial guarantee that any taxes owed on the wine will be paid in a timely manner.