Tax Preparer Templates

Documents:

1288

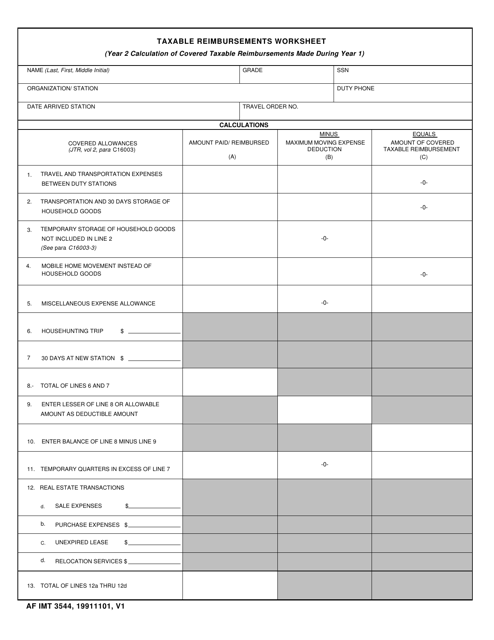

This form is used for calculating taxable reimbursements for expenses incurred during official Air Force duties.

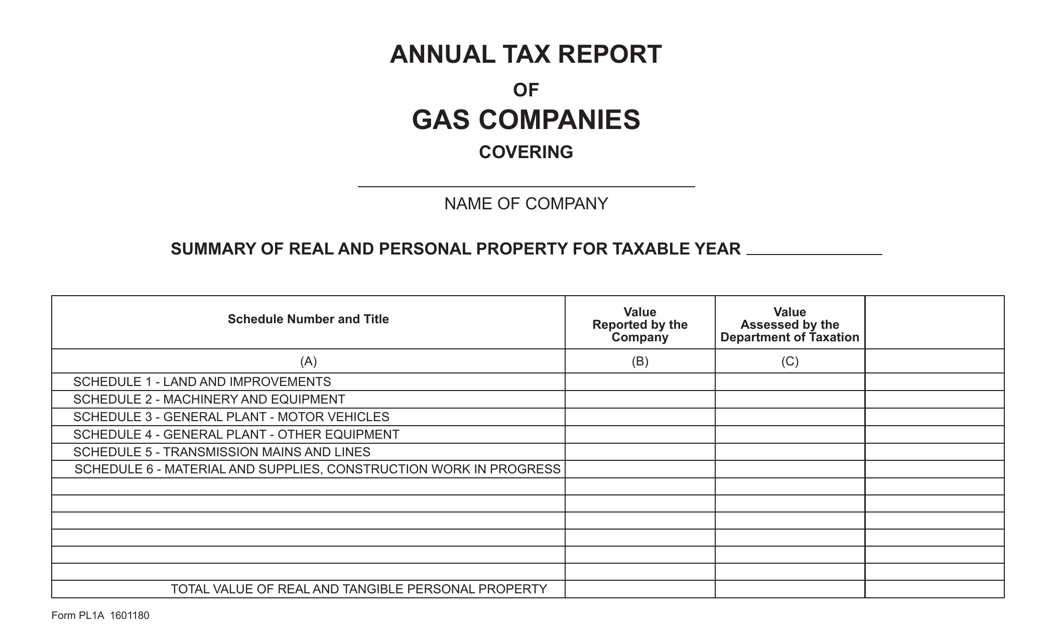

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

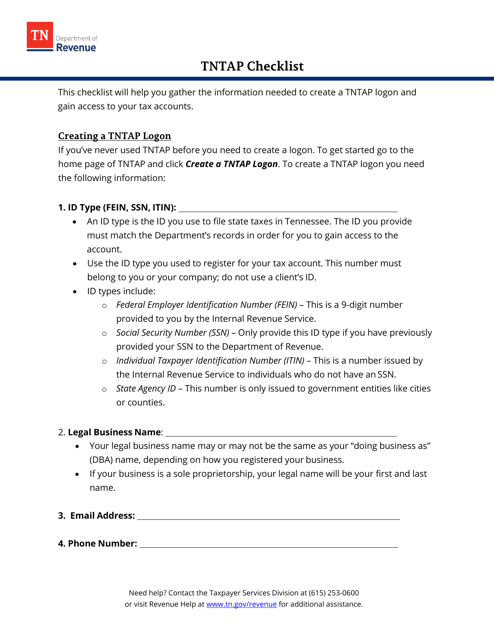

This document provides a checklist for individuals or businesses in Tennessee who need to use the TNTAP (Tennessee Taxpayer Access Point) system for various tax-related activities. The checklist helps ensure that all necessary information and requirements are met when using the TNTAP system.

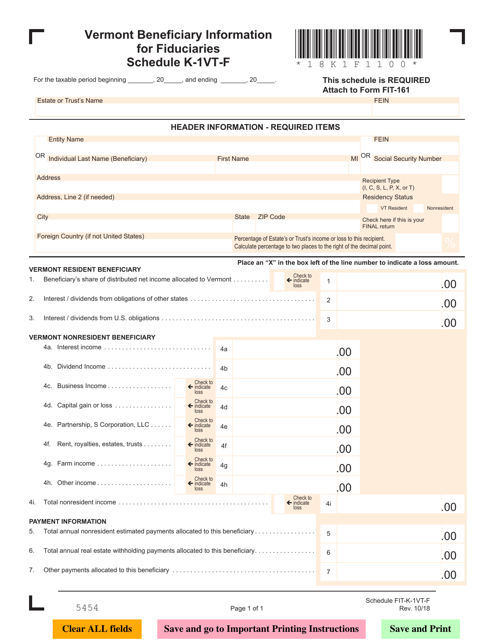

This document provides beneficiary information for fiduciaries in Vermont. It is used for reporting income from trusts or estates to individual beneficiaries.

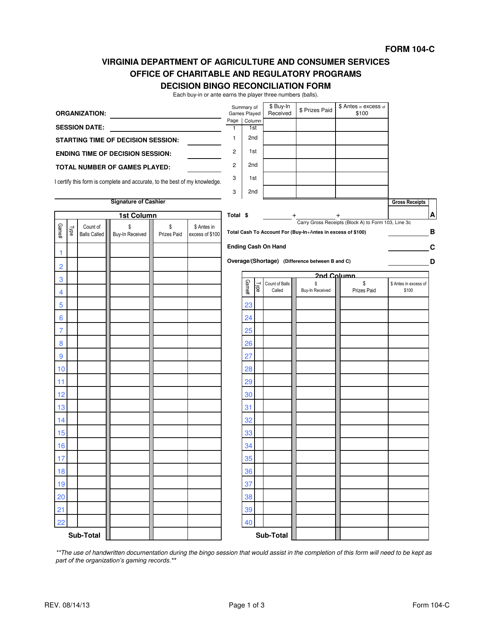

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

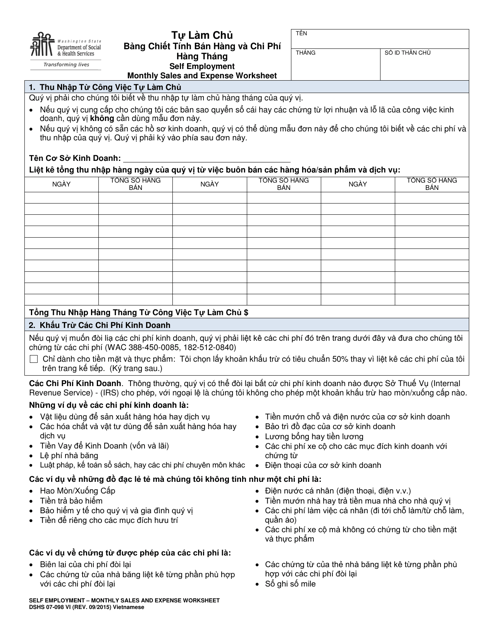

This form is used for recording monthly sales and expenses for self-employed individuals in Washington.

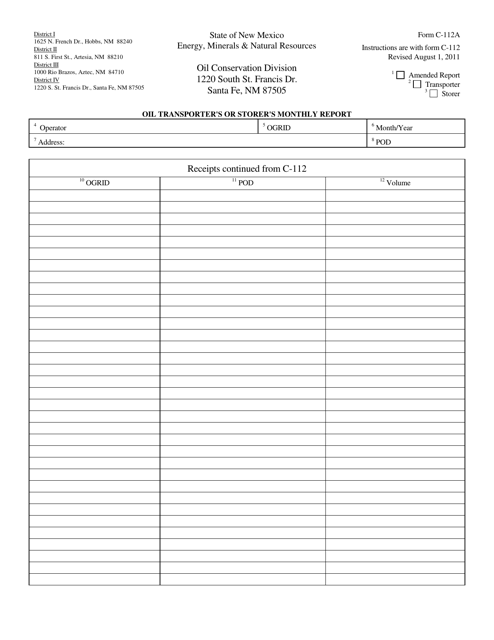

This form is used for providing a continuation of receipts information in the state of New Mexico.

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

This type of document provides instructions for filling out various IRS forms including 1096, 1097, 1098, 1099, 3921, 3922, 5948, W-2G. It outlines the reporting requirements and guidelines for different types of income and transactions.

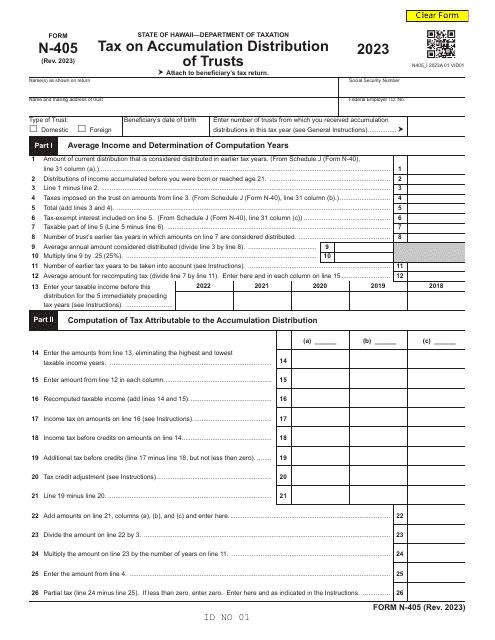

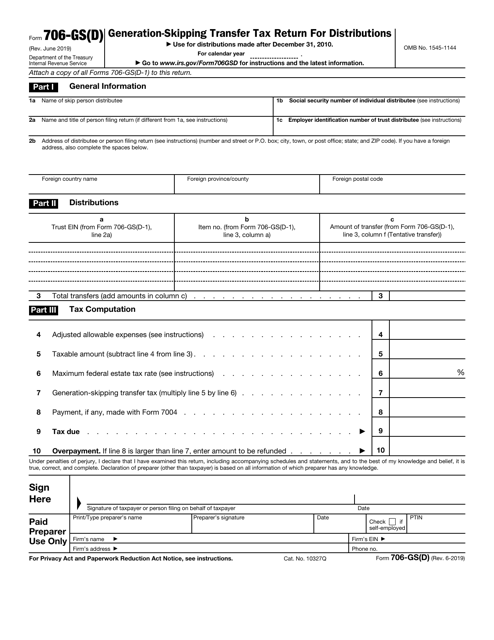

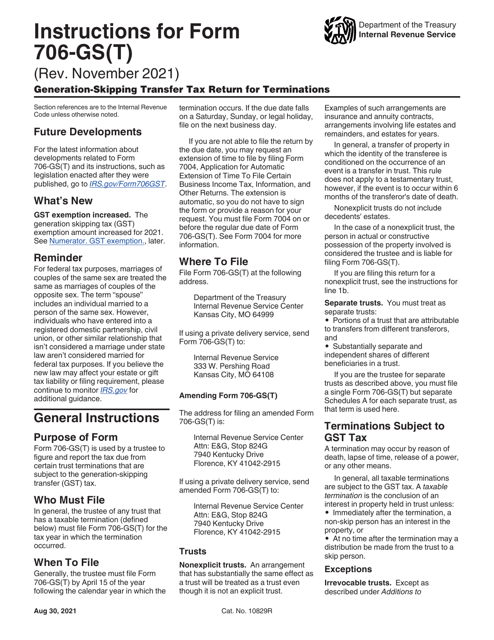

This form is used for reporting and paying the generation-skipping transfer tax on distributions from certain trusts.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

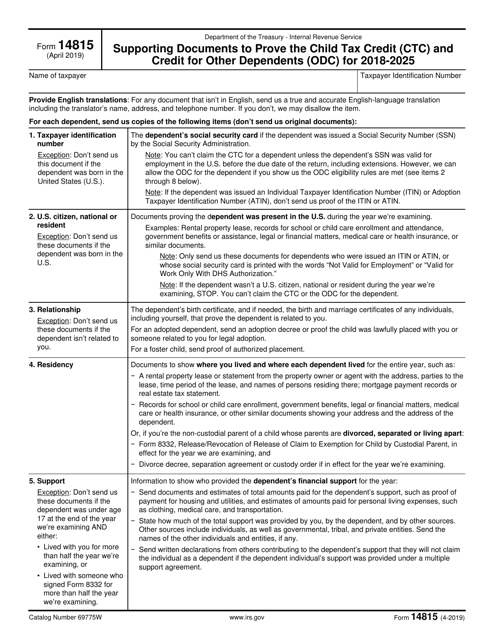

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

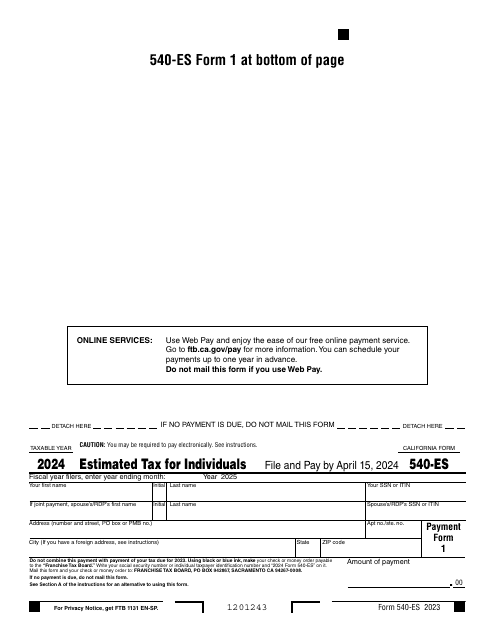

Fill out this form over the course of a year to pay your taxes in the state of California.

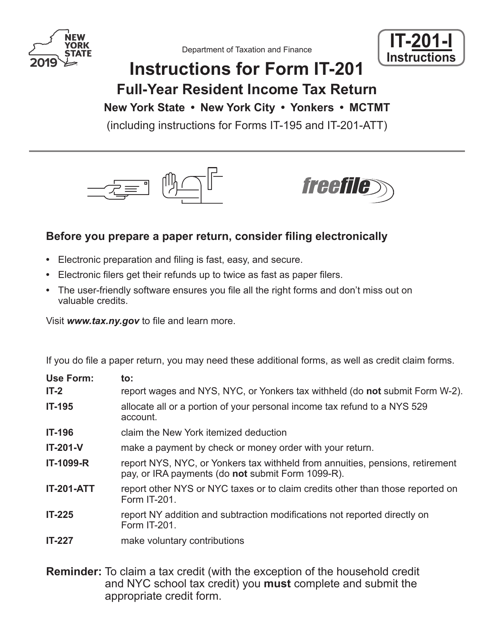

This form contains official instructions for Form IT-201, along with Forms IT-195 and IT-201-ATT.

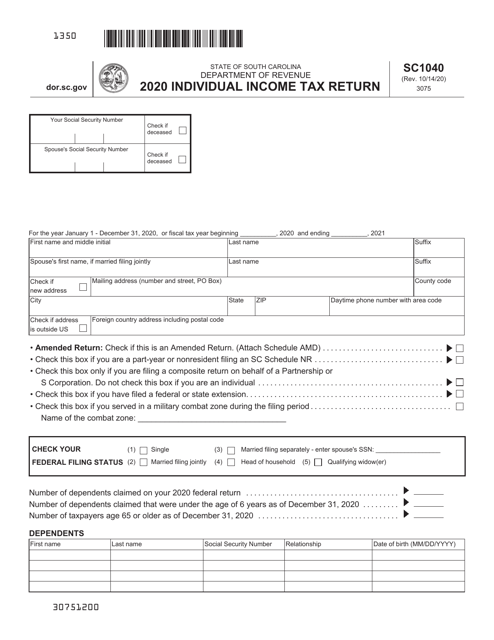

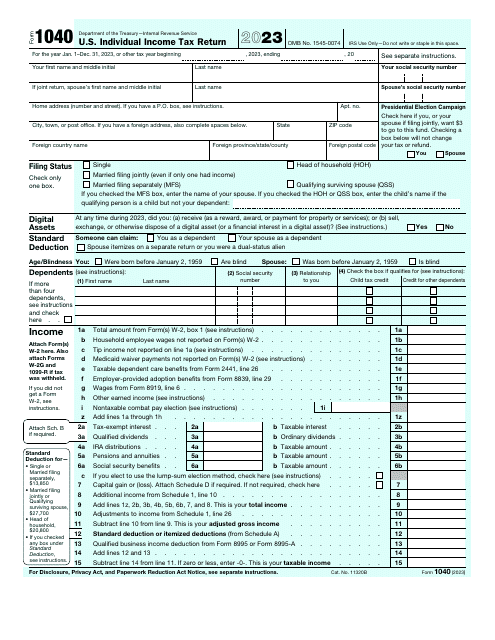

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

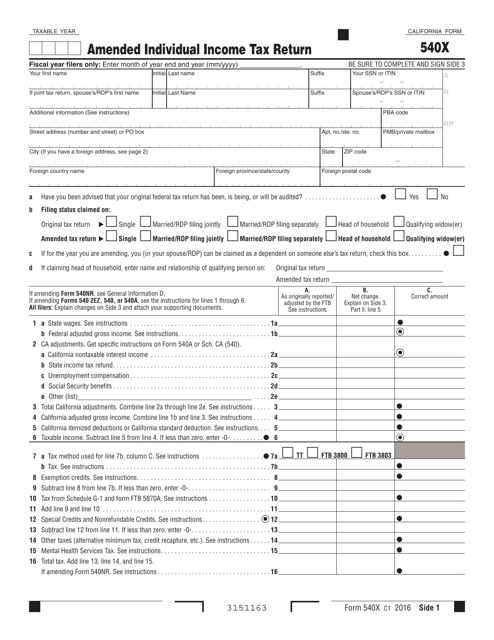

This form is used for making amendments to your individual income tax return in California.

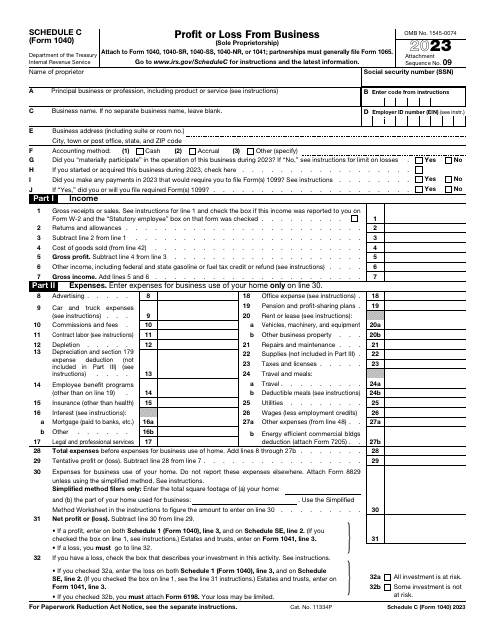

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.